Bitcoin was the first cryptocurrency, launched in 2009. Since then, many other cryptocurrencies have emerged, commonly called altcoins. When Bitcoin’s price runs higher and becomes less accessible to small retail investors, they look for new opportunities in altcoins.

According to TradingView, as of Nov 2025, altcoins collectively reach about $260B in market capitalization. So, what is an altcoin, what types of altcoins are there, and how do you invest in them?

Altcoin Definition: What is an Altcoin?

Altcoin is short for alternative coin, referring to all cryptocurrencies other than Bitcoin, essentially the alternative to Bitcoin. Put simply, any coin that is not Bitcoin is an altcoin (or “alt” for short).

Altcoins were often created to address perceived limitations of Bitcoin such as throughput, programmability, or energy consumption, and to enable new features. The first two altcoins on the market were both forks* of the Bitcoin blockchain: Namecoin (NMC) was created in April 2011 and Litecoin (LTC) was created October 2011.

*The term “fork” refers to the copying of the open source code of an existing blockchain or project, then modifying it to create a new blockchain or project.

Bitcoin vs. Altcoin: Why the Distinction Matters

Altcoins emerged because Bitcoin was the first cryptocurrency. Everything that came later was framed as an alternative to Bitcoin, which made sense at the time since many early projects explicitly set out to offer different design choices.

Some critics argue that calling everything else an alternative overemphasizes Bitcoin’s primacy and that, given Bitcoin’s older technology stack, one could just as well call Bitcoin an alternative to newer designs. Regardless of the label, the distinction is useful because Bitcoin and altcoins often differ in both technical features and intended use cases.

In technical features:

- Consensus and architecture: Bitcoin uses Proof-of-Work consensus mechanism and a largely monolithic architecture. Altcoins may adopt the same approach or experiment with alternatives such as Proof-of-Stake, Proof-of-Authority, Delegated Proof-of-Stake… and modular designs that separate execution, settlement, data availability, consensus.

- Throughput and functionality: Many altcoins target faster confirmation times or different security assumptions, and they typically enable programmable smart contracts that support decentralized applications. Examples include general purpose smart contract platforms, application specific chains, and networks optimized for high throughput or specialized privacy.

- Ecosystem capabilities: Altcoin ecosystems often add native features such as account abstraction, on-chain governance, or built in interoperability, which can lower the barrier for developers and users.

In use cases:

- Bitcoin: Primarily positioned as digital money and a store of value with a conservative feature set and strong emphasis on credibility, simplicity, and security.

- Altcoins: Often address specific needs or push the frontier of functionality, such as decentralized finance, stablecoins, payments, non-fungible tokens, gaming, privacy preserving transfers…

Last but not least, altcoins are generally more volatile than Bitcoin because liquidity and attention are dispersed across numerous smaller markets. This greater volatility offers larger potential gains but also sharper losses, which investors pursuing upside knowingly accept.

These differences underscore why the Bitcoin versus altcoin distinction still matters, and reflect the diversity as well as innovation in the crypto sector.

Types of Altcoins

According to CoinGecko, one of the leading independent cryptocurrency data aggregators, there are over 18,000 altcoins existing as of November 2025. They span multiple categories by technology, purpose, and economics. Here are main types of altcoins:

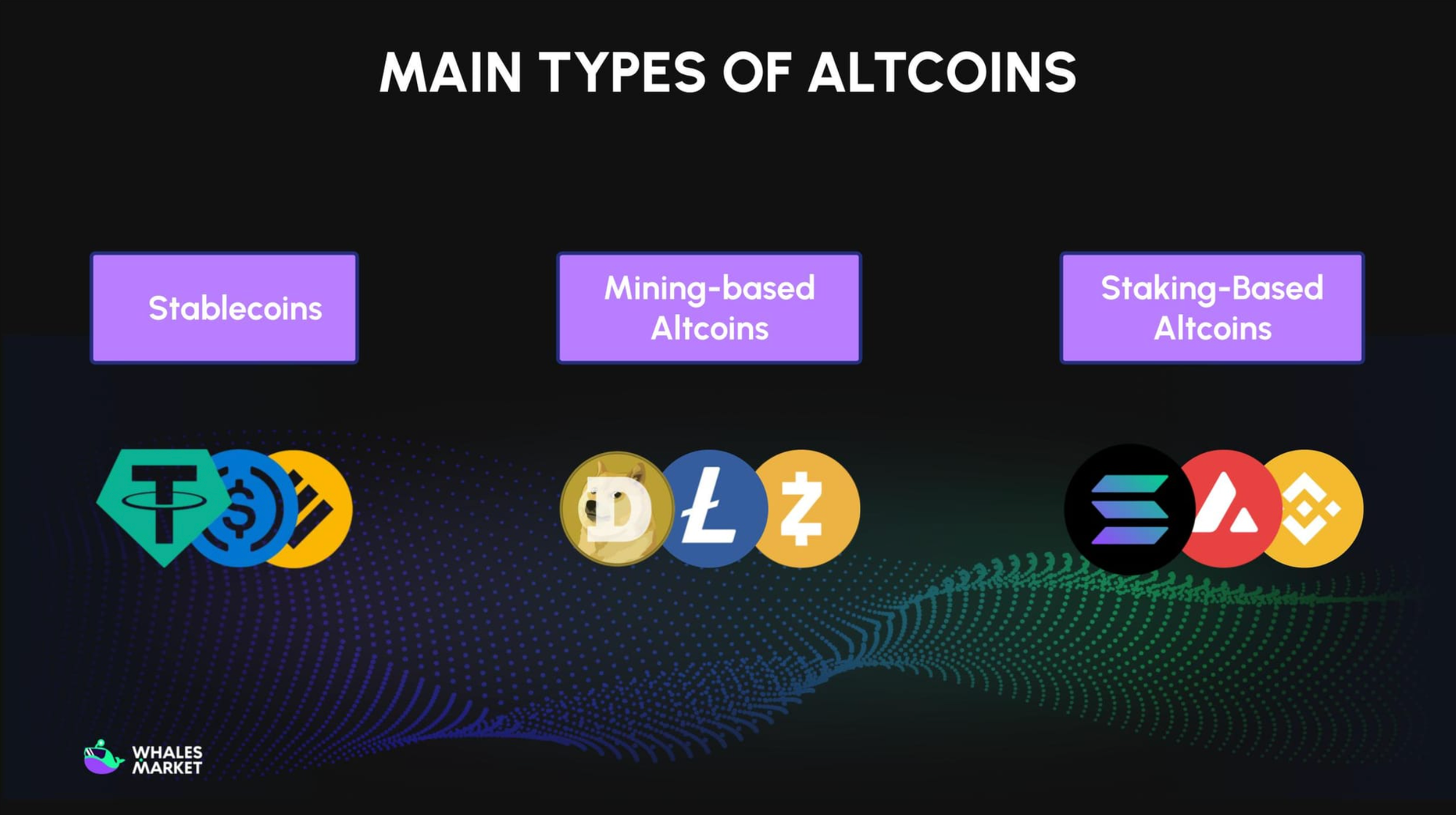

- Stablecoins: Altcoins designed to maintain a stable value and dampen crypto volatility by pegging to a more stable asset such as fiat currencies, gold, other commodities, or even other crypto assets. Popular examples include Tether (USDT), USD Coin (USDC), Sky (USDS), Paxos Gold (PAXG)...

- Mining-based Altcoins: Altcoins that rely on mining to validate and settle transactions, typically using Proof-of-Work (PoW). Examples include the pre-Merge version of Ethereum, Dogecoin (DOGE), Litecoin (LTC)...

- Staking-based Altcoins: Altcoins that use staking by validators to secure the network and process transactions, variants of Proof-of-Stake (PoS). Peercoin (PPC) was among the first to introduce PoS, which later gained popularity because it generally consumes less energy than PoW. Other examples: Solana (SOL), BNB Chain (BNB), Avalanche (AVAX)...

These are often categorized based on their underlying technology, primary purpose, and economic characteristics. While the main technology-based types are mining-based and staking-based, investors generally focus more on these functional utility types within a project's ecosystem:

- Payment Token: The purest form of digital currency, created solely to serve as a medium of exchange and value transfer for everyday transactions. Examples: XRP Ledger (XRP), Monero (XMR), Hedera (HBAR)...

- Governance Token: Tokens that grant token holders the right to participate in the protocol's governance, including proposing, voting on, and implementing decisions related to new features or system changes. Examples: Compound (COMP), Ekubo (EKUBO), Uniswap (UNI)...

- Utility Token: Tokens that are designed to provide users with access to a specific product, service, or function within the token-issuing project's ecosystem. Examples: Whales Market (WHALES), ZRX (0x), REP (Augur)...

- Security Token: Tokenized representations of traditional securities such as equities, bonds, or fund shares. These are typically issued via a Security Token Offering (STO) and must comply with securities regulations. Examples: INX Token (INX), Overstock Token (OSTKO)...

- Memecoins: Tokens inspired by internet memes or pop culture. Initially launched for fun and speculation, they have grown into a segment sometimes called “MemeFi.” Examples: Pepe Coin (PEPE), Floki (FLOKI), Shiba Inu (SHIB)...

Investors usually tend to prioritize a token's functional role, particularly Governance and Utility tokens, to maximize benefits from holding. Conversely, tokens like Payment and Security tokens currently represent a smaller, less dominant segment of the broader crypto landscape.

Pros and Cons of Altcoins

Pros

Here are the key advantages many people see in altcoins compared with Bitcoin:

- Lower barriers to entry: Both Bitcoin and altcoins enable borderless transfers without traditional banks. Many altcoins further reduce friction with reduced fees, quicker confirmations, and strong community participation in governance and ecosystem growth. This accessibility helps attract newcomers and supports broader adoption.

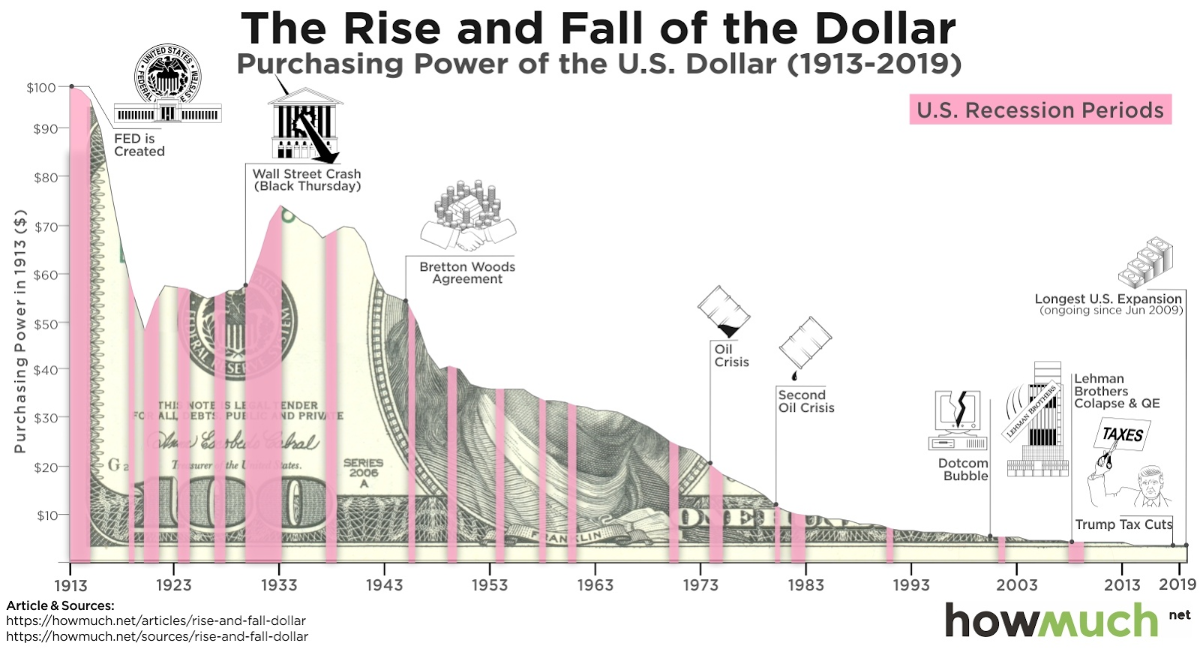

- Reduce inflation: Unlike fiat currencies, which face unlimited supply and inflationary risk from Central Bank money printing, most altcoins have a predetermined, finite total supply. This creates a predictable and generally deflationary emission schedule, where inflation naturally declines toward zero, offering a strong hedge against the devaluation and loss of purchasing power inherent in fiat systems.

- Diversification: With thousands of altcoins in the market, it provides essential portfolio diversification opportunities, allowing investors to spread risk across different technologies and market sectors. Beyond simple price speculation, holding altcoins offers unique benefits such as governance voting rights, early product access, and potential airdrops, maximizing the utility derived from investment.

- Innovation engine: While Bitcoin established the foundational technology, altcoins are the catalysts for innovation, specifically targeting Bitcoin’s limitations (scalability, transaction speed, and cost). Altcoin projects (excluding meme coins) implement novel solutions such as:

- Smart contracts (innovated by Ethereum): Allowing for automated, trustless execution of agreements without third-party reliance, reducing fraud.

- Cross-chain communication (innovated by IBC, Polkadot, LayerZero): Enabling fast, native token transfers between blockchains without relying on insecure wrapped assets.

This drive introduces capabilities that neither fiat nor Bitcoin can offer, opening new potential in decentralized finance (DeFi) and global payments (e.g., stablecoins enabling stable value and DeFi yields).

Cons

While altcoins offer distinct advantages in innovation and diversification, they are inherently complex assets that introduce several specific risks.

- Price volatility: Altcoins, due to their significantly lower market capitalization compared to Bitcoin, exhibit highly volatile and often unpredictable price swings. Prices can easily double or be halved within hours or days, making them inherently high-risk investments. The effect is amplified in memecoins, where price can double and then halve within a single hour. The OST token below is a representative example, showing a rapid surge followed by a sharp decline within two hours.

- Thin liquidity: Compared to Bitcoin, altcoins generally feature lower liquidity depth. This thin liquidity can lead to substantial slippage when executing large buy or sell orders, thereby increasing the effective transaction cost and risk for traders.

- Security/protocol risk: New code and complex integrations expose altcoins to smart contract, wallet, dApp, and especially bridge vulnerabilities. In fact, the industry has seen multi-billion-dollar losses from hacks, the Ronin bridge exploit in March 2022 (~615M USD) is a notable case. Even if users are reimbursed, trust can suffer.

- Regulatory risk: The legal status of cryptocurrencies remains a significant global hurdle. While some nations have adopted crypto as a legitimate asset (e.g, El Salvador), many others impose partial or total bans (e.g, China, Algeria…). This patchwork creates compliance uncertainty for investors and forces projects to innovate within evolving legal frameworks.

Things to know when investing in Altcoins

Before investing in altcoins, you must thoroughly research the respective crypto projects to realistically assess the opportunity versus the risk. Key factors for a robust evaluation include:

- Evaluate the underlying technology: Assess the project’s technology based on three critical pillars: scalability, security, and adaptability. These factors determine the long-term viability, capacity to handle growth, ability to maintain user trust, and resilience to future market developments. This evaluation is crucial for judging the project's potential for sustained existence and long-term success.

- Experience and vision of the development team: The team’s credibility is a vital success indicator. Look for a qualified and committed development team that demonstrates a clear vision, extensive experience, and a solid track record. It is highly recommended to investigate the professional backgrounds of core members, including their history of participation and contribution within the broader crypto community.

- Recognise market trends: Investing in altcoin also requires a basic understanding of broader market trends. Altcoin prices frequently follow Bitcoin’s movements, so monitor BTC forecasts and trends in addition to the altcoin’s specific metrics. Furthermore, be aware of the "altcoin season," a unique phase where altcoins significantly outperform Bitcoin, which can dramatically impact investment timing.

- Properly assess the risks of an altcoin project: Altcoin investments are inherently volatile and risky. Beyond reviewing technical innovation and security, it is essential to understand that even promising projects can lose value. Always conduct a thorough, two-sided review to weigh both the potential returns and the significant downside risks of the new platform.

- Only invest capital you can afford to lose: Due to the high volatility and unpredictable nature of the market, never invest all your available capital into a single asset class (especially altcoins). Adhere strictly to the principle of only investing disposable income, money that you can afford to lose entirely without impacting your financial stability.

Conclusion

Altcoins are no longer a side note to Bitcoin, they are the primary engine of crypto’s innovation. Accounting for a substantial share of the market's total value and developer activity, altcoins drive the essential technological and functional diversity that keeps the ecosystem dynamic.

Investing in altcoins is fundamentally investing in the evolution of blockchain technology itself, offering unmatched potential for utility beyond Bitcoin's foundational role. However, this potential carries inherent complexity and elevated risk. Therefore, always conduct your own research (DYOR) before committing capital to any altcoin project.

FAQs

What does Altcoin mean?

An altcoin is any cryptocurrency other than Bitcoin. Altcoins were created to offer new features, address perceived limitations of Bitcoin (such as speed or scalability), or serve specialized functions (e.g., smart contracts, governance, utility).

How do altcoins differ from Bitcoin?

Altcoins often differ from Bitcoin in several key aspects:

- Consensus mechanism: Many altcoins use Proof-of-Stake (PoS) or other mechanisms, unlike Bitcoin’s Proof-of-Work (PoW).

- Functionality: Altcoins offer features like smart contracts, stable value, or governance rights.

- Supply: Altcoins often have different total supply caps and inflation schedules.

Is Ethereum an altcoin?

Yes. By definition, anything that isn’t Bitcoin is an altcoin. Ethereum is the largest altcoin and the leading smart contract platform.

When is Altcoin season?

Altcoin season refers to periods when many altcoins outperform Bitcoin, often alongside falling BTC dominance and rising liquidity/risk appetite. Timing varies by cycle and is not guaranteed.

Are altcoins riskier than Bitcoin?

Generally yes. Most altcoins have smaller market caps and thinner liquidity, leading to higher volatility and larger drawdowns, plus added smart-contract, governance, and regulatory risks.