If blockchain platforms act as the foundation, then DApps are the houses and infrastructure built on that foundation. DApps play an important role in the market because they are the applications that users directly interact with and use.

So, what is a DApp? Let's explore it through this article!

What is DApp?

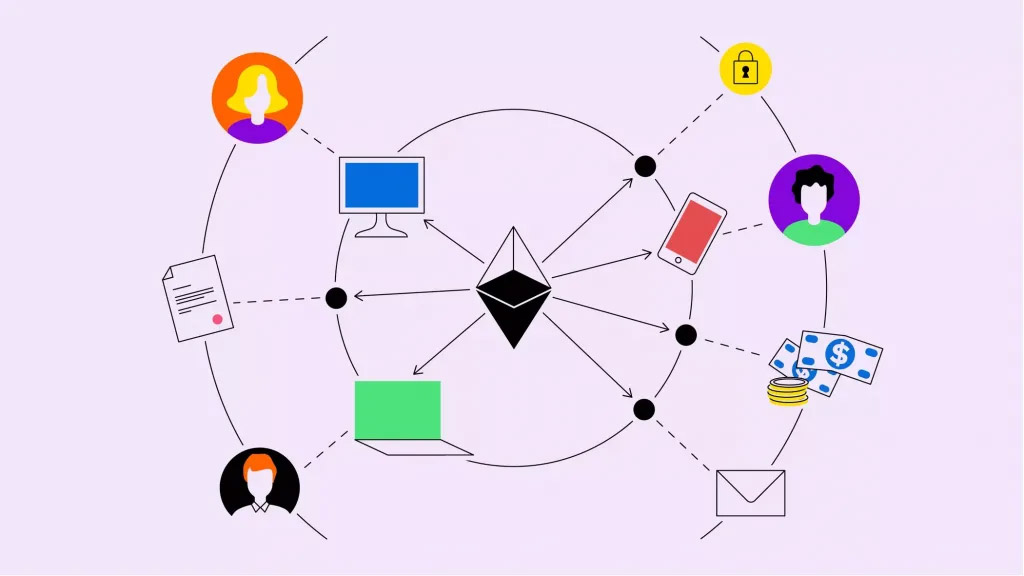

A DApp is a decentralized application built on Layer 1/Layer 2 blockchains that support smart contracts and have a front-end interface for users. Each application solves different problems, such as bridging, lending, gaming, or SocialFi.

Since decentralized applications are built directly on blockchain platforms, the characteristics of these decentralized applications will depend on those blockchain platforms.

- If built on Ethereum, a DApp will inherit the security and decentralization from Layer 1.

- If built on Solana/Sui, a DApp will inherit scalability, low costs, and high speed.

- Conversely, although Bitcoin is also considered a Layer 1, the network does not support smart contract integration, leading to no DApps being built on Bitcoin.

The first decentralized application appeared on Ethereum on April 22, 2016.

Features of DApps

DApps stand out with some core characteristics that differentiate them from regular applications. Here are the main features:

- Decentralization: No central entity controls it; data is stored and processed on multiple network nodes, avoiding a single point of failure and increasing resilience.

- Transparency and Open-Source: The source code is often public, allowing anyone to inspect and verify operations, building trust from the community.

- Cryptographic Security: Uses blockchain encryption technology to protect data, prevent fraud, and ensure transactions cannot be altered after being recorded.

- Autonomy and User Control: Users own their personal data and digital assets (such as crypto wallets), without needing intermediaries like banks or companies.

- Immutability: Once data is recorded on the blockchain, it cannot be edited, enhancing integrity and reliability.

These features make DApps attractive in environments requiring high trust, but they also require users to manage their private keys themselves to avoid losses.

Classification of DApps

DApps can be classified into three groups as follows:

- Type I (Fully Independent DApp):Operates on its own blockchain, maximizing control over security, consensus, and performance. Best for simple, mission-critical functions where independence matters more than feature richness. Heavy lift to launch/maintain (validators, tooling, ecosystem). Example: Bitcoin for peer-to-peer currency without complex smart contracts.

- Type II (DApp Based on Existing Blockchain): Deploys smart contracts on platforms like Ethereum, Solana, Base, inheriting their security and tooling. Enables faster, cheaper go-to-market and broad wallet/liquidity access, but may face gas spikes or congestion. Fits most use cases (DEXs, lending, NFTs). Example: Uniswap on Ethereum enabling trustless token swaps.

- Type III (Expanded and Integrated DApp): Builds atop Type II, combining multiple protocols, tokens, and data into a higher-level product. Delivers richer UX and features (game economies, social + DeFi mashups) but adds operational complexity (dependencies, upgrades, liquidity routing). Common in large ecosystems with many Lego-like components. Example: Axie Infinity leveraging NFTs/tokens across Ethereum-based infrastructure.

In addition to technical classification, DApps are also classified by their intended use, making it easier to visualize real-world applications.

This classification is more flexible and reflects recent development trends, such as the explosion of DeFi or NFTs. Here are some main types:

- DeFi: Focuses on financial services like lending, trading, or investing without banks.

- Gaming and Metaverse: DApps in the gaming field, where players own virtual assets (NFTs) and can earn real money.

- NFT and Content Markets: Allows creation and trading of exclusive digital assets. Example: OpenSea is a decentralized NFT marketplace.

- SocialFi: Platforms for sharing without censorship, where users earn rewards from content. Example: Farcaster on Base.

- Governance and DAO: Voting systems with decisions based on community votes.

Applications of DApps on Blockchain

DApps can be deployed in diverse ways to address various market and real-life needs. Specifically:

- To solve token exchange issues, having applications like Uniswap, Aerodrome, and PancakeSwap.

- To solve lending issues on blockchain, having applications like Aave, Morpho, and Spark.

- To solve leveraged trading issues, having applications like Hyperliquid, Aster, and Lighter.

Some DApps have also expanded applications into various aspects of daily life, such as shopping and receiving cashback in tokens, decentralized internet networks with DePIN projects, or sharing computing power from GPUs/CPUs for designers, developers...

Conclusion

Hopefully, through this article, readers have a clearer view of what a DApp is, as well as its classification and a better understanding of the applications of DApps.

With immutable characteristics, 24/7 availability, and elimination of cumbersome procedures due to no intermediaries, DApps promise to open up a promising future for many applications in traditional markets, in both financial and daily consumer sectors.

FAQs

Q1. Do DApps need their own token to work?

No. Tokens can incentivize users or governance, but many DApps operate purely with the base chain’s currency and fees.

Q2. How should a team choose which chain to build on?

Match the app’s needs to chain traits: security/finality requirements, throughput, typical gas costs, dev tooling, and where your target users already keep funds.

Q3. If code is “immutable,” how do DApps upgrade?

Common patterns use proxy contracts, timelocks, and DAO votes. Check if upgrades are possible and who controls them (multisig vs. community).

Q4. Can a DApp be “taken down”?

Smart contracts are hard to kill once deployed, but websites, APIs, and indexers can be censored. Robust DApps provide multiple front-ends or IPFS/ENS access.

Q5. What does it actually cost to use a DApp?

Gas fees (vary by chain/L2), potential slippage on trades, and protocol-specific fees. Some actions also require approval transactions that add extra gas.