BNB serves as the native coin and foundational fuel for the entire BNB Chain, powering its high-performance blockchain and sprawling decentralized economy.

What is BNB Coin?

BNB coin is the cryptocurrency created by Binance, one of the world’s largest crypto exchanges founded by Changpeng Zhao (CZ). Launched in 2017, BNB (originally known as Binance Coin) was designed to offer trading fee discounts, exclusive access, and other utilities within the Binance exchange ecosystem.

Following the launch of the BNB Chain (formerly Binance Smart Chain) in 2020, BNB’s role expanded dramatically. Since then, BNB has functioned as both a utility token (for fees) and governance token, granting holders the right to participate in on-chain governance and the overall direction of the BNB Chain.

What is BNB Chain?

BNB Chain is a layer-1 blockchain that is compatible with Ethereum Virtual Machine (EVM), offering faster transactions and lower fees compared to Ethereum.

From the start, the network consisted of two main blockchains:

- Binance Chain (BC): Optimized for ultra-fast trading and asset transfers.

- BNB Smart Chain (BSC): Designed to support smart contracts and decentralized applications (dApps).

In 2022, these networks were unified under the single BNB Chain brand (short for “Build ’N Build”). This move was aimed to strengthen its identity as an independent ecosystem. However, the term BSC is still widely used in reference to its smart contract functionality

BNB Coin History

Early History (2017-2019)

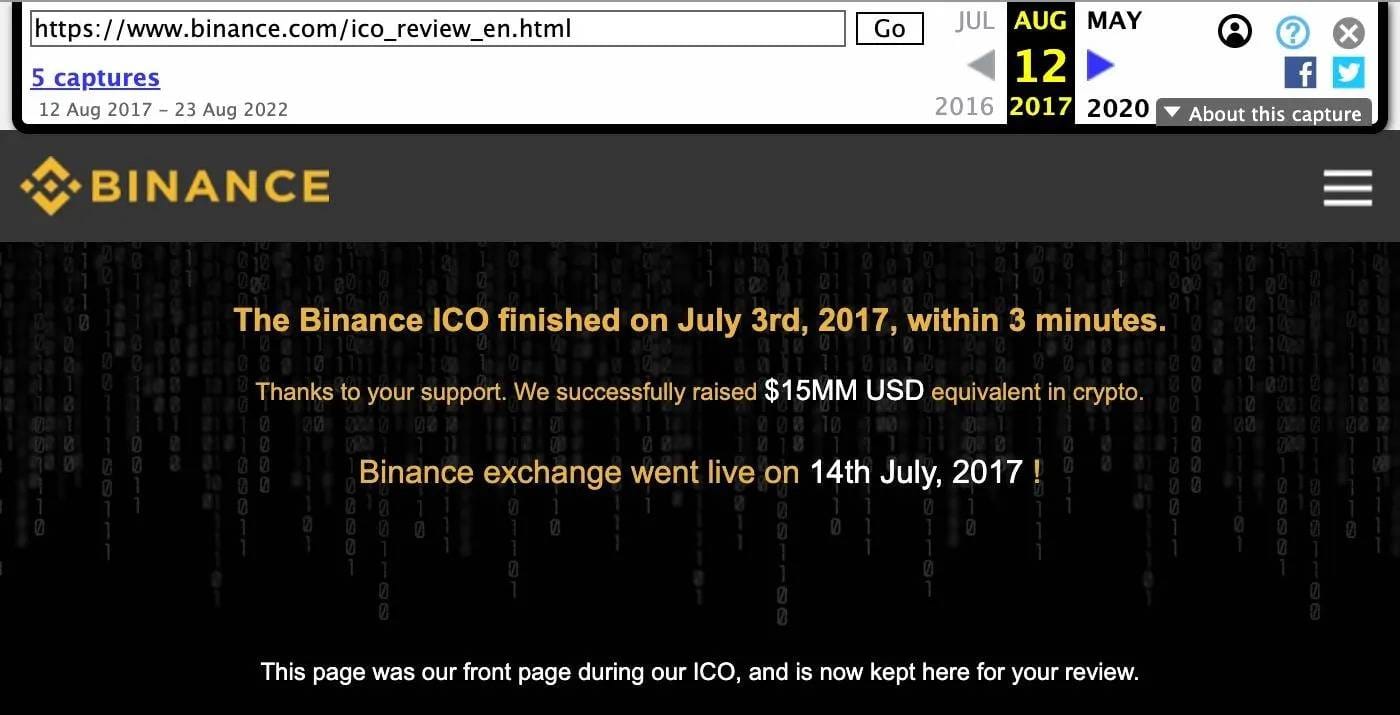

BNB’s journey began in July 2017, when Binance conducted its Initial Coin Offering (ICO) on the Ethereum network. The sale raised about $15M, with 100 million BNB sold at an average price between $0.10 and $0.15 per token.

At the time, BNB existed as an ERC-20 token, serving two simple purposes:

- To raise fund for the launch of the Binance exchange.

- To provide trading fee discounts for early users.

In 2019, Binance introduced its own mainnet, the Binance Chain, marking BNB’s first major transformation. All ERC-20 tokens were migrated to the BEP-20 standard, converting BNB into a native coin on its proprietary blockchain.

BNB Chain Expansion (2020-2022)

A year later, in September 2020, Binance launched the BNB Smart Chain (BSC) with EVM compatibility, enabling developers to easily port Ethereum-based dApps. This milestone triggered a DeFi (decentralized finance) and NFT boom, establishing BNB Chain as a major player in the smart contract ecosystem.

By 2021, BNB had entered the top 10 cryptocurrencies by market capitalization, reaching its first all-time high (ATH) of $690. This surge reflected speculative demand and growing utility across DeFi, staking, and governance use cases.

The transformation continued in 2022, when CZ unified the dual-chain architecture under the singular BNB Chain brand. This rebranding represented a clear strategic pivot, positioning BNB not as Binance’s chain, but as a community-driven, decentralized ecosystem.

“People always think of BSC as part of Binance because it carries the company’s name. We’ve done a lot of work to decentralize it and hope to make BNB go beyond Binance,” said Binance CEO Changpeng Zhao.

As of October 2025, BNB has reached a new all-time high of approximately $1,374, driven by ecosystem growth, institutional adoption, and positive market sentiment. Thus solidifying its role as both a utility and investment asset.

How BNB Chain Works

BNB Chain Consensus Mechanism

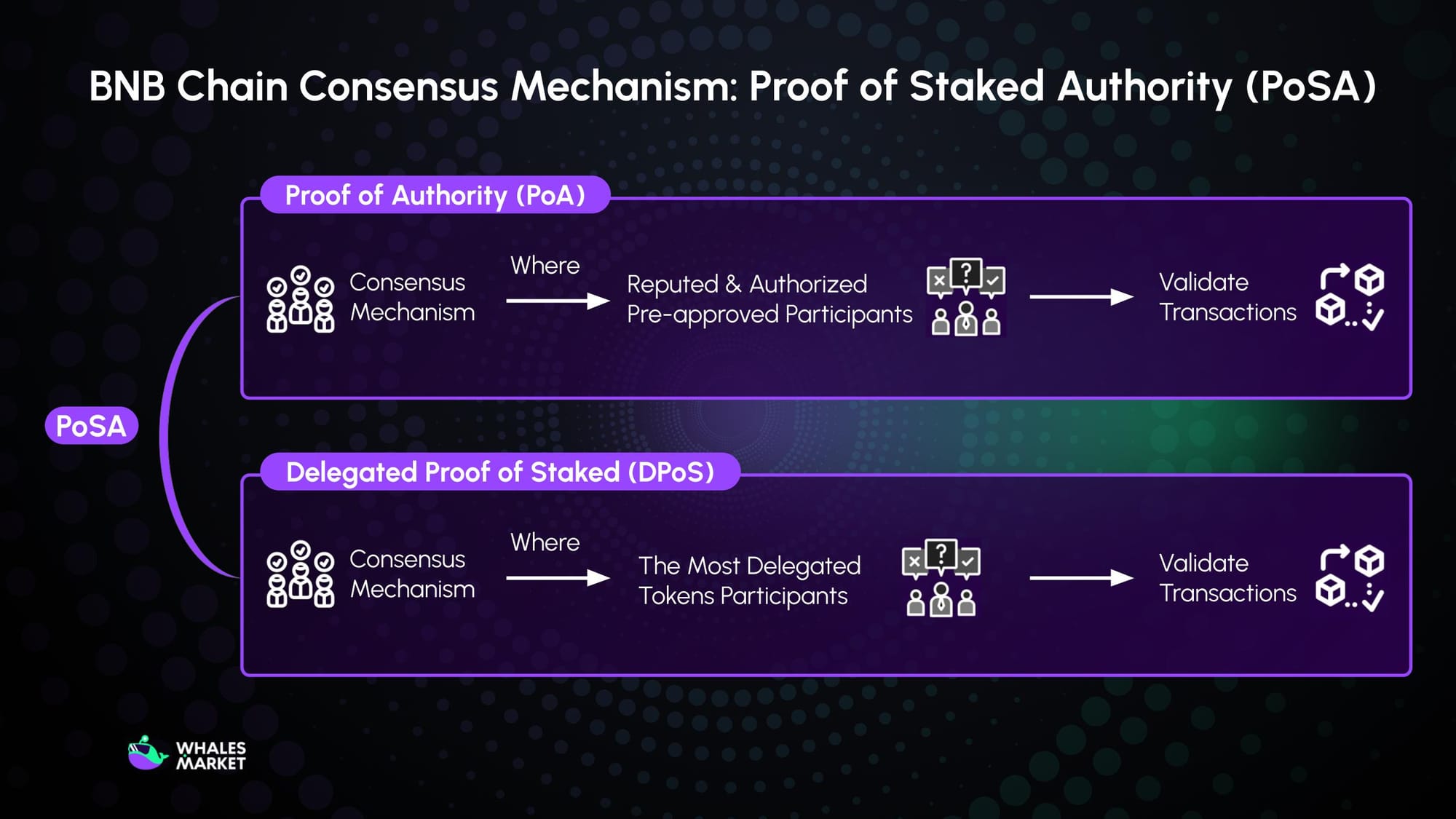

BNB Chain operates on a consensus model called Proof of Staked Authority (PoSA). This is a hybrid mechanism combining elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA).

Here’s how it works:

- PoSA relies on a limited number of trusted participants, known as validators, who must stake a significant amount of BNB to qualify (at least 10,000 BNB).

- There are 21 validators who are chosen every 24 hours and take turns producing blocks. Note that the selection criteria correspond with the stake they have in the network, but it also requires validation of reputation and authority criteria.

- Then the validators will be rewarded with transaction fees from the blocks they confirm.

This combining consensus structure encourages community participation and rewards those who support the network, while helping BNB Chain achieve faster finality than pure Proof of Work systems. In contrast, it has to face the centralization problem, representing a deliberate trade-off in the blockchain trilemma.

BNB Auto-Burn Mechanism

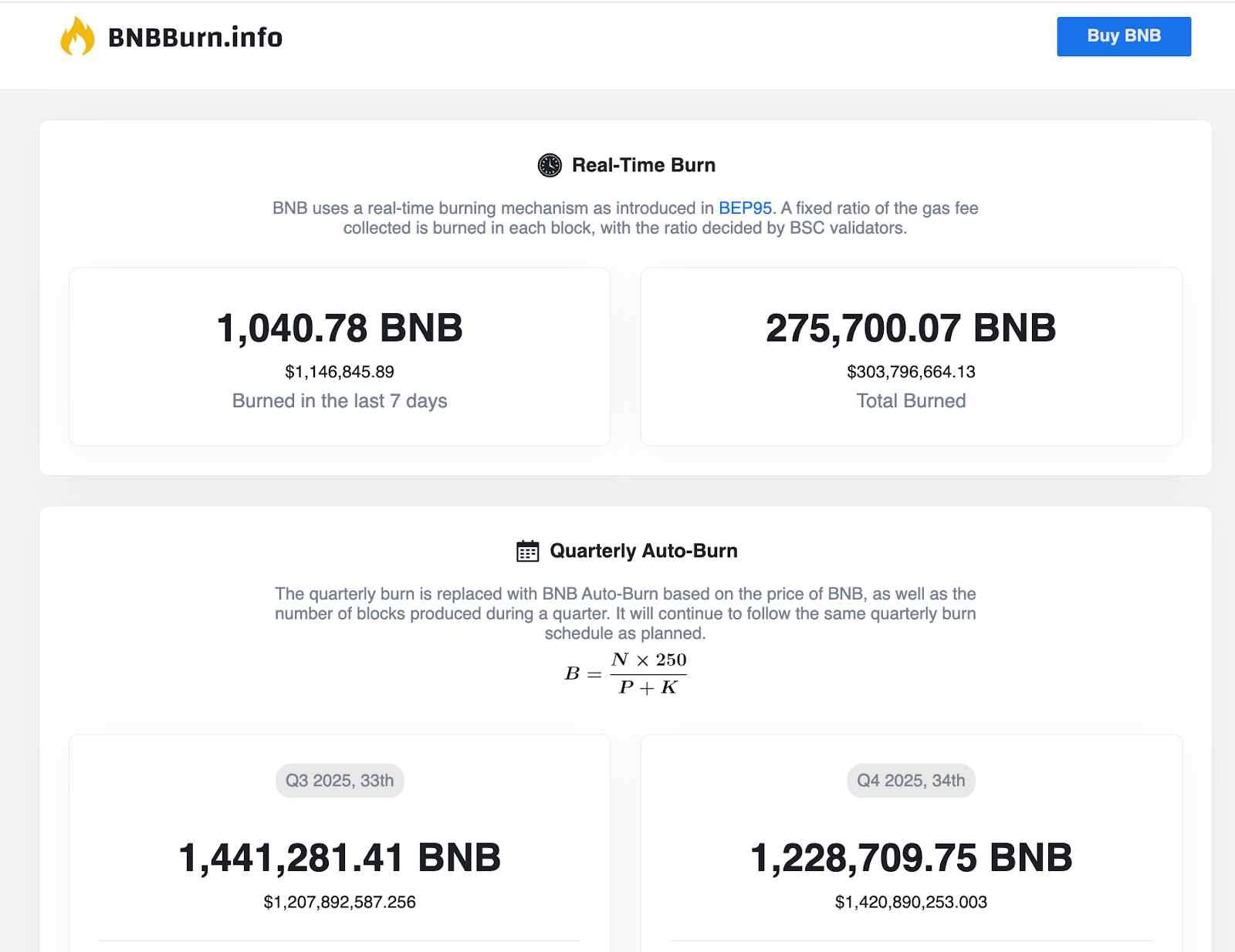

To maintain scarcity and long-term value, BNB Chain implements an Auto-Burn mechanism designed to reduce the total BNB supply to 100M $BNB, creating a deflationary effect over time.

BNB utilizes two burning mechanisms aimed at cutting its total supply by 50%, from 200M to 100M $BNB:

- The first is the real-time burning mechanism. A portion of the BNB used as gas fees on the network is burned automatically. As blockchain activity grows, more BNB is consumed, accelerating the burn rate.

- The second is the BNB Auto-Burn mechanism. Conducted every quarter, this mechanism automatically adjusts the amount of BNB to be burned based on market price and the number of blocks produced during that period. When the BNB price decreases, the burn quantity increases proportionally.

To monitor the real-time burning data, users can check BNBBurn.info, an independent analytics platform built by the BNB Chain community.

BNB Coin Details

$BNB Key Metrics

Here is the information of BNB token:

- Token Name: BNB

- Ticker: $BNB

- Token Type: Native Token

- Initial Total Supply: 200M $BNB

- Target Total Supply: 100M $BNB

- Circulating Supply: 139,180,048 BNB (as of Oct 2025, continuously reduced by the burning mechanism)

$BNB Tokenomics

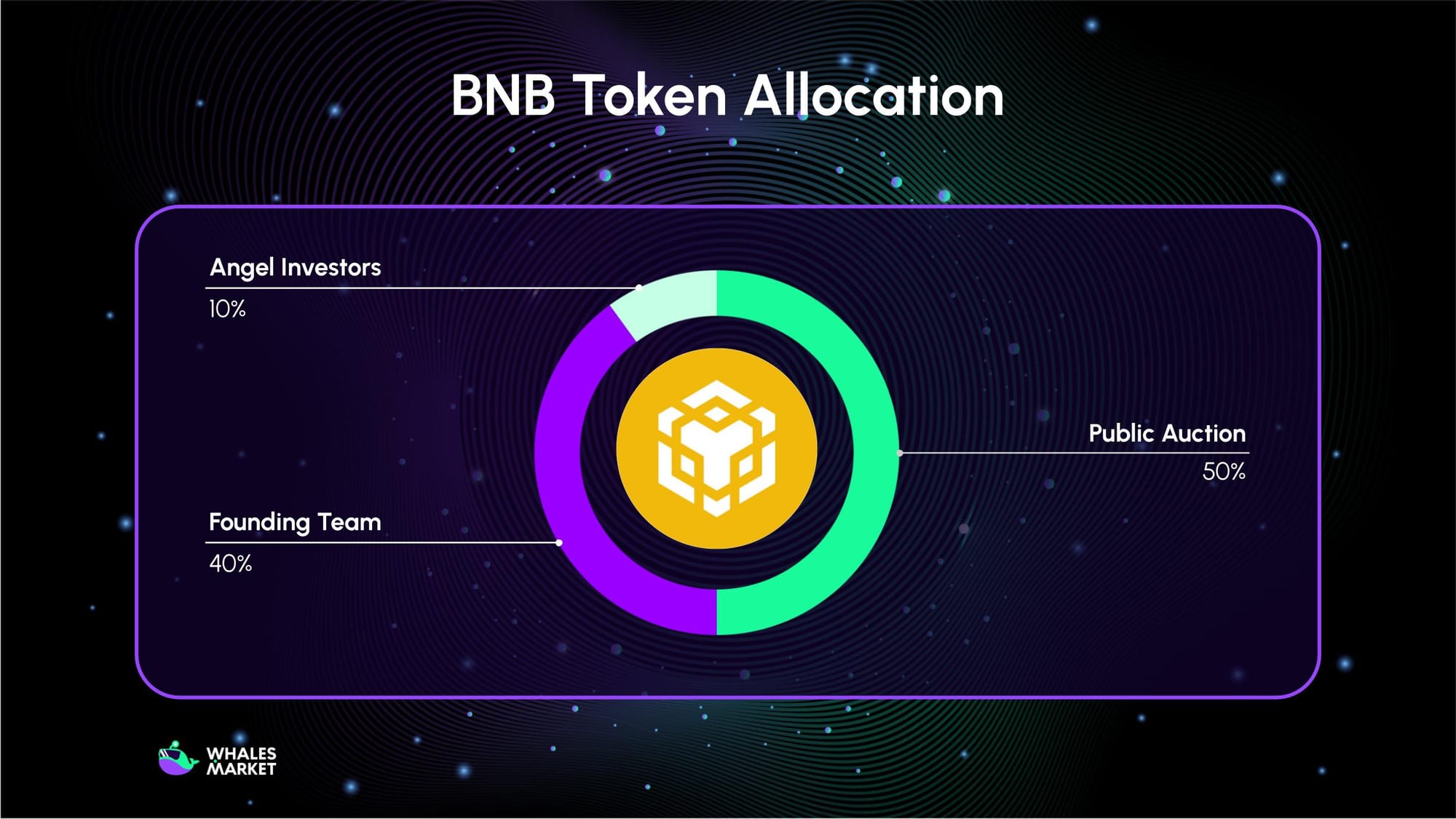

Initial Total Supply: 202 million $BNB

Final Target Supply: 100 million $BNB

$BNB Token Allocation:

- Public Auction: 50%

- The Founding Team: 40%

- Angel Investors: 10%

$BNB Use Case

BNB token gives holders exclusive access to a potent array of use cases, including CeFi, DeFi, and PayFi.

CeFi: Within the Binance Exchange, BNB provides users with:

- Trading fee discounts.

- Exclusive access to Launchpad and Megadrop events.

- Earning opportunities via liquidity provision, lending, and the BNB Vault.

- Participation in staking programs and HODLer Airdrops.

DeFi: BNB acts as the core utility and governance token, enabling users to:

- Pay transaction fees on BNB Chain.

- Access and interact with dApps.

- Earn yield through staking, liquid staking, and restaking.

- Participate in on-chain governance.

PayFi: BNB facilitates secure, fast, and low-cost transactions across Binance’s partner network, covering shopping, travel, entertainment, and financial services.

*PayFi, or Payment Finance, is where blockchain technology integrates into real-world payment solutions, offering real-time settlement for transactions.

For an in-depth breakdown of BNB’s use cases, refer here.

How to get BNB

BNB coins can be obtained through two primary methods: Buy and Earn.

Where to buy BNB coin

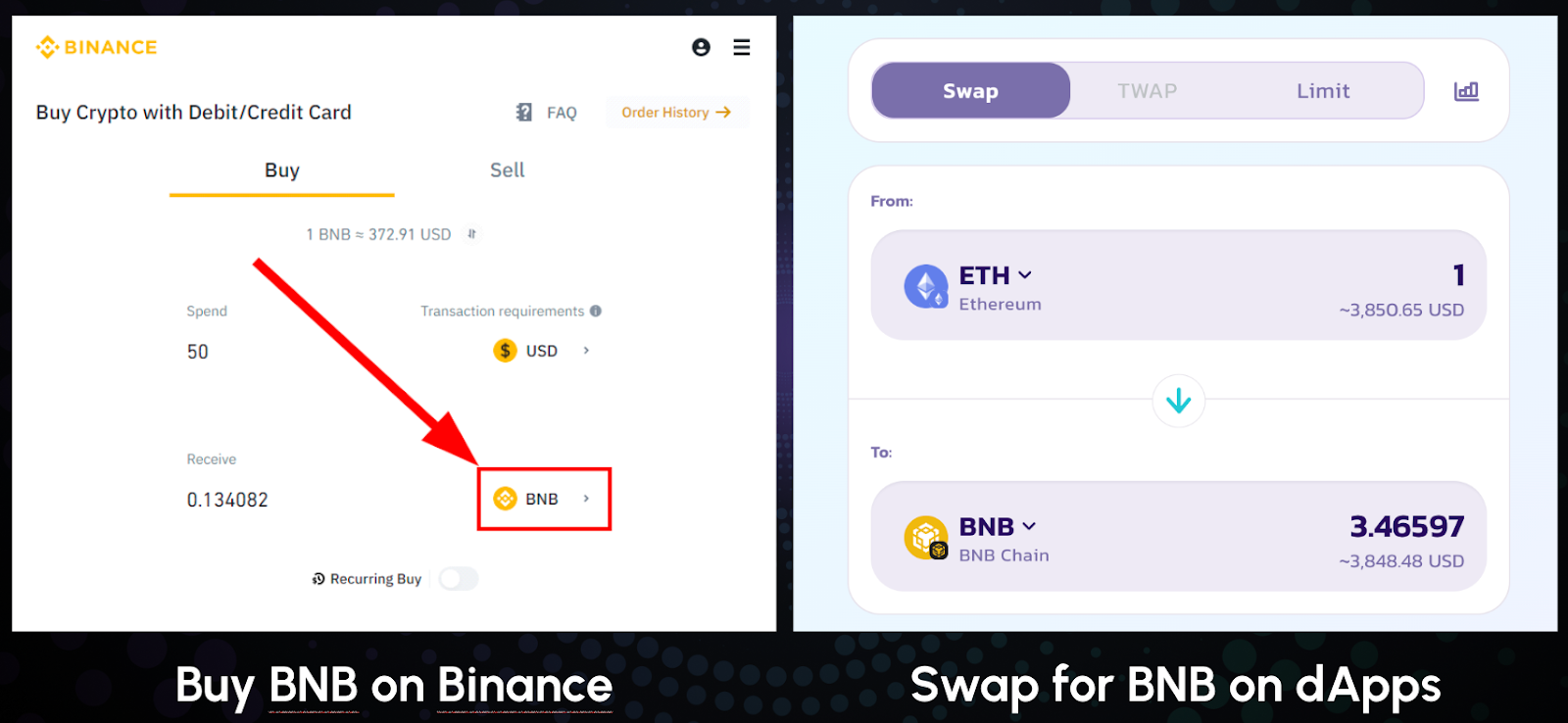

To buy BNB coins, users can:

- Purchase on centralized exchanges (e.g., Binance) using fiat currencies, then transfer the tokens to their wallet address.

- Trade crypto across multiple chains (e.g., swap ETH for BNB on PancakeSwap). In this case, ensure you have sufficient tokens to pay for gas fees during the transaction.

How to earn BNB token

To earn BNB coins, users can:

- Work or Earn bounties: Contribute to DAOs, crypto-paying companies, or participate in bug bounty programs.

- Stake and Validate: Stake BNB to earn passive rewards or run a validator node to support network security while earning transaction fees.

The team behind BNB Token & BNB Chain

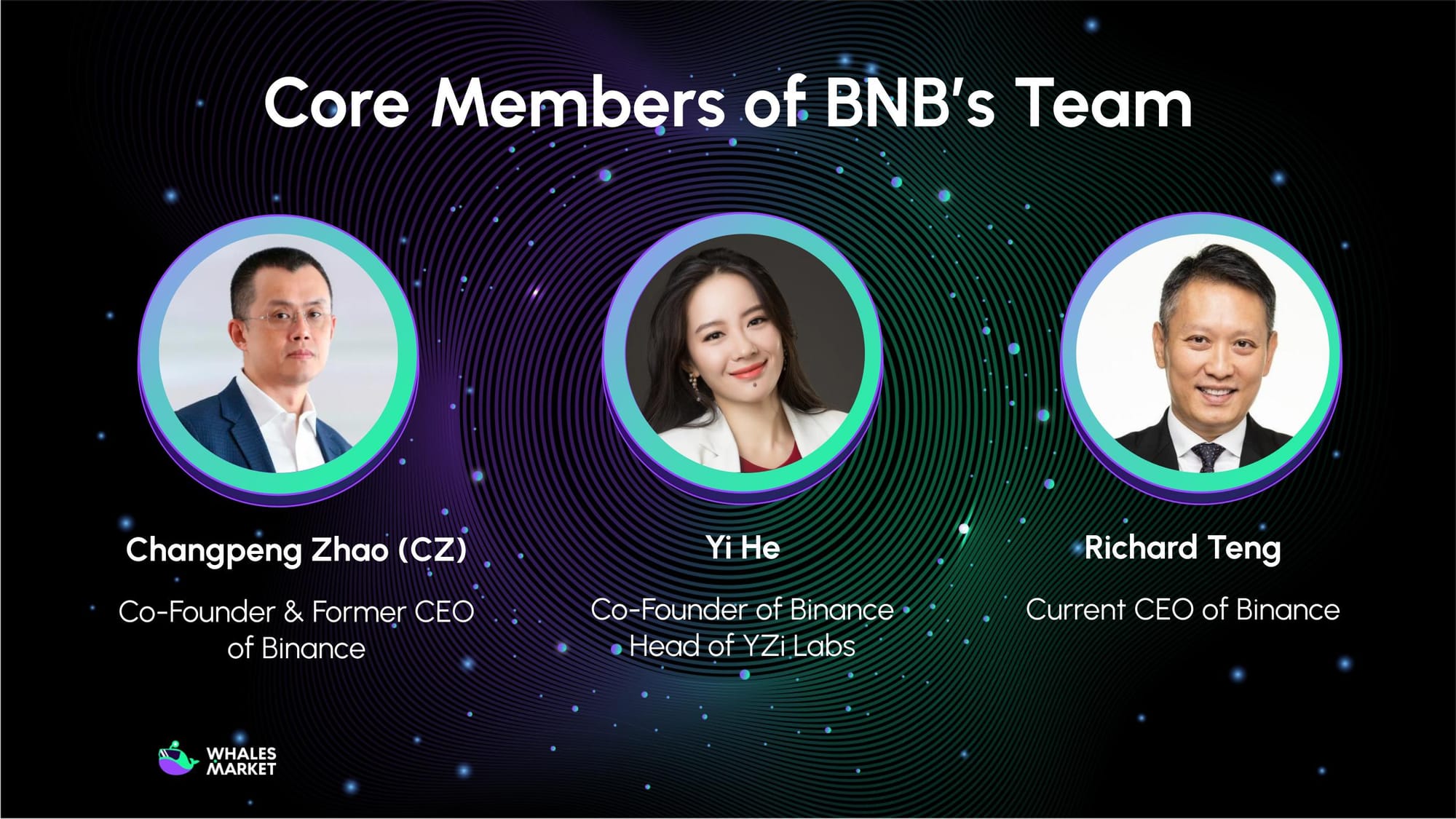

BNB Chain was developed by Binance team, with core members:

- Changpeng Zhao (CZ): Co-founder and former CEO of Binance. CZ has a background in high-frequency trading systems, having founded Fusion Systems in 2005. Before creating Binance, he held early blockchain roles at Blockchain.info and OKCoin. In November 2023, CZ stepped down as Binance CEO following U.S. regulatory settlements but remains an influential figure in the broader BNB Chain ecosystem.

- Yi He: Co-founder of Binance and Head of YZi Labs (Binance's venture arm, formerly Binance Labs). Yi He brings extensive experience in marketing, operations, and Web3 investments. She also helped establish core initiatives such as Binance Launchpad, Binance Smart Chain (now BNB Chain), Binance Academy, and the Binance Charity Foundation.

- Richard Teng: CEO of Binance. Teng has over 30 years of experience in financial services and regulation. As CEO, Teng oversees Binance's support for BNB Chain, including investments via YZi Labs and ecosystem programs like the Most Valuable Builder (MVB) accelerator.

Conclusion

From a simple utility token to the backbone of a thriving blockchain, BNB’s evolution mirrors Binance’s ongoing pursuit of decentralization and innovation.

After eight years in operation, Binance remains a dominant force in the global crypto landscape, and BNB coin will continue to serve as the key fuel and driving force behind the next phase of Web3 growth.

FAQs

Is BNB a coin or token?

BNB began as an ERC-20 token on the Ethereum network. In 2019, it migrated to its own mainnet (Binance Chain) and became the native coin of the ecosystem. As a coin, it is now used to pay for transaction fees and secure the BNB Chain.

Is BNB Coin a good investment?

The investment potential of BNB is based on its deep utility (paying gas fees, Launchpad access) and its deflationary auto-burn mechanism. However, its value is also closely tied to the success of the BNB Chain ecosystem and the regulatory landscape affecting the Binance exchange.

Disclaimer: This is not financial advice!

When was BNB Coin launched?

BNB was launched in July 2017 through an Initial Coin Offering (ICO). This ICO raised $15 million, which was used to fund the development and launch of the Binance exchange.

Who Created BNB?

BNB was created by the Binance exchange and its founding team. The key figures behind its creation are Changpeng Zhao (CZ), the co-founder and former CEO of Binance, and Yi He, co-founder and current head of YZi Labs (Binance's venture arm).

How does BNB Chain work?

BNB Chain uses a Proof of Staked Authority (PoSA) consensus mechanism. A limited set of 21 active validators stake their BNB to approve transactions and create new blocks. This model allows for very fast transaction speeds and low fees, but it is less decentralized than other blockchains.

What is BNB used for?

BNB's primary use case is to pay for gas fees (transaction costs) on the BNB Chain. It is also used on the Binance exchange for trading fee discounts, as a "ticket" to participate in token sales on Launchpad, and for earning yield via staking and DeFi protocols.

Does Binance own or control the BNB Chain?

Officially, BNB Chain is an open-source, community-driven project, and Binance is just one of many contributors. In practice, Binance created the chain, is the largest stakeholder, and its venture arm (YZi Labs) is the primary funder for the ecosystem, giving it exceptionally strong influence.