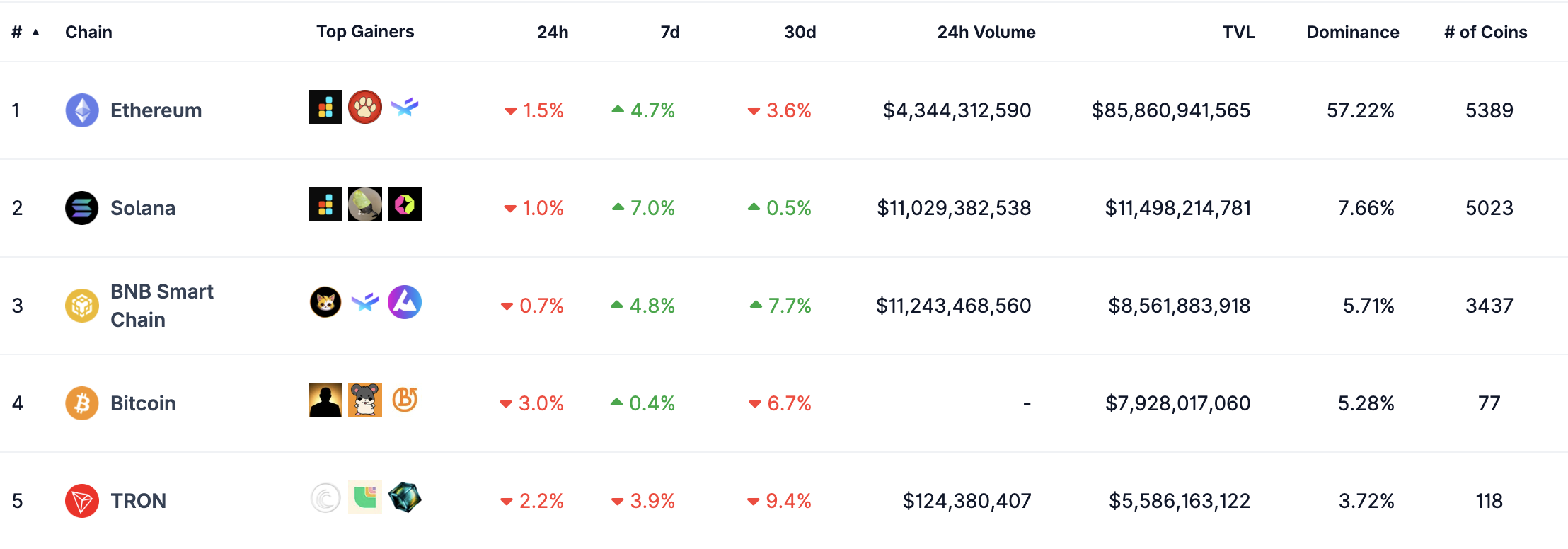

Solana has emerged as one of the fastest-growing blockchains in Web3, known for its high speed, low fees, and ability to support consumer-scale applications. So what makes Solana different, and how did it become one of the most influential networks in crypto?

What is Solana?

Solana is an open-source, high-performance Layer-1 blockchain launched in 2020, designed with Rust program language to maximize transaction throughput and minimize fees. It uses a hybrid architecture combining Proof-of-Stake (PoS), Proof-of-History (PoH), and Tower BFT to achieve fast block confirmation and low-cost transactions.

Beyond being a base layer, Solana functions as a full smart-contract platform (like Ethereum), enabling developers to build and deploy decentralized applications across DeFi, NFTs, gaming, and consumer-focused Web3 products. The network emphasizes speed and seamless user experience, making it attractive for applications requiring real-time performance.

When Solana entered the market, most major blockchains still relied on Proof-of-Work and struggled with slow transactions and high gas fees. Solana introduced a new performance-focused design aimed at scaling on-chain computation.

In early testing, the network demonstrated the ability to handle over 50,000 transactions per second (TPS), positioning it as one of the fastest blockchains in the industry.

The History of Solana

2017–2020: Solana’s Origins and Its Mainnet Beta Launch

Solana began in 2017 when Anatoly Yakovenko published the Proof-of-History (PoH) whitepaper, introducing a cryptographic timekeeping mechanism designed to improve blockchain throughput. Alongside co-founders Greg Fitzgerald and Raj Gokal, the team built a new high-performance architecture combining PoH, Proof-of-Stake, and Tower BFT.

During this early phase, Solana secured multiple investment rounds to accelerate development:

- Seed round (2018): $3.17M led by Multicoin Capital

- Series A (2019): $20M funding led by Multicoin Capital, Blocktower, & others

- Public sale on CoinList (March 2020): $1.76M for 8M SOL (~$0.22 per token)

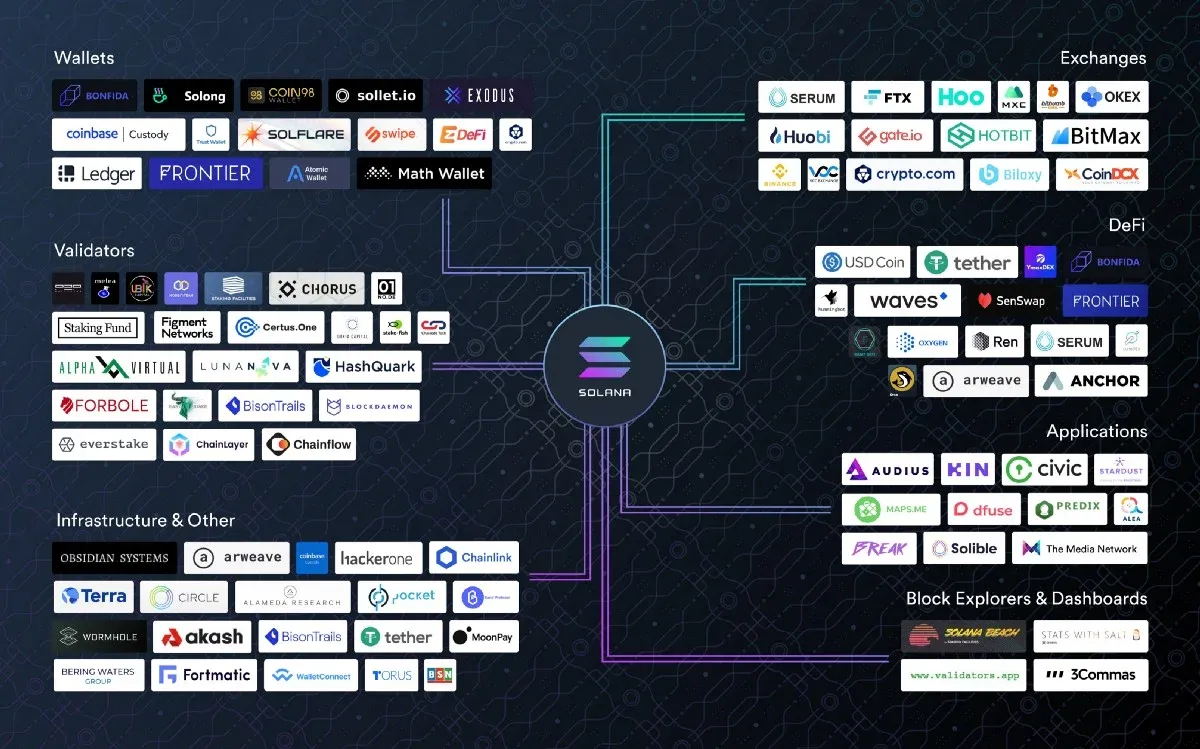

The Solana mainnet beta officially launched on March 16, 2020, introducing a scalable smart-contract platform capable of processing tens of thousands of transactions per second in internal tests. By the end of 2020, more than 100 projects were built on Solana, with 8.3B transactions on-chain, laying the groundwork for its ecosystem expansion.

2021–2022: Breakout growth, then reliability shocks and the FTX crisis

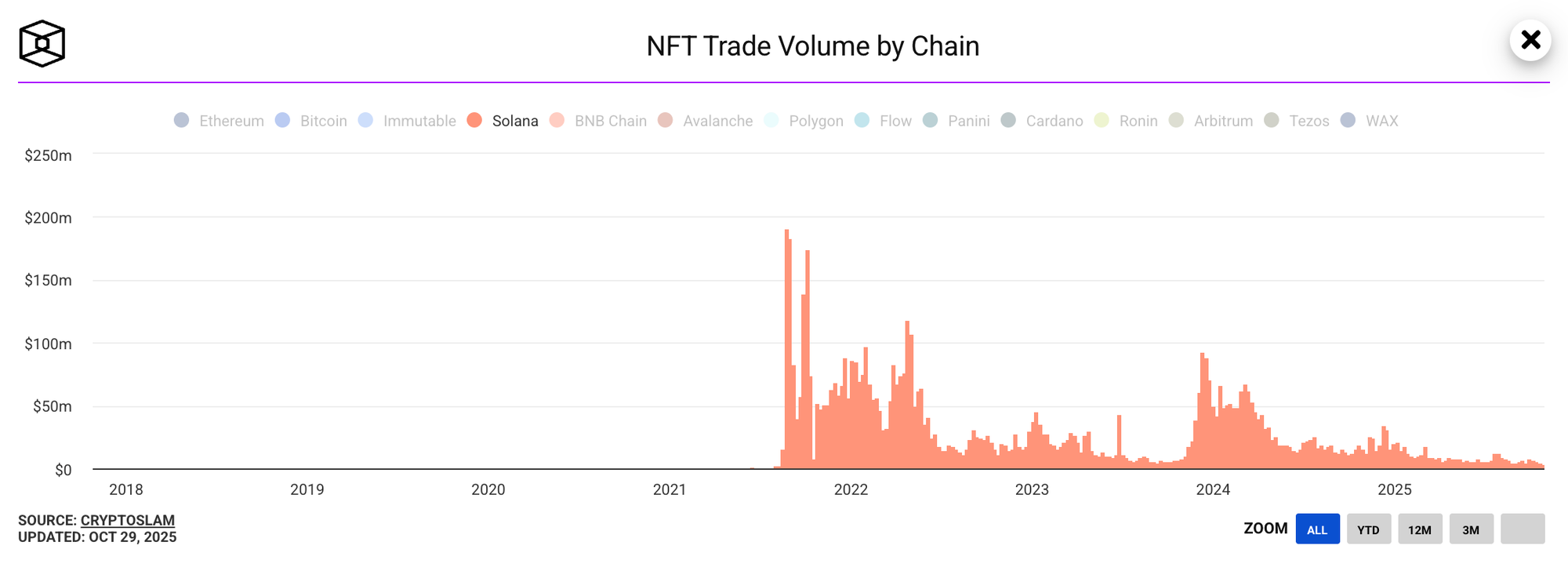

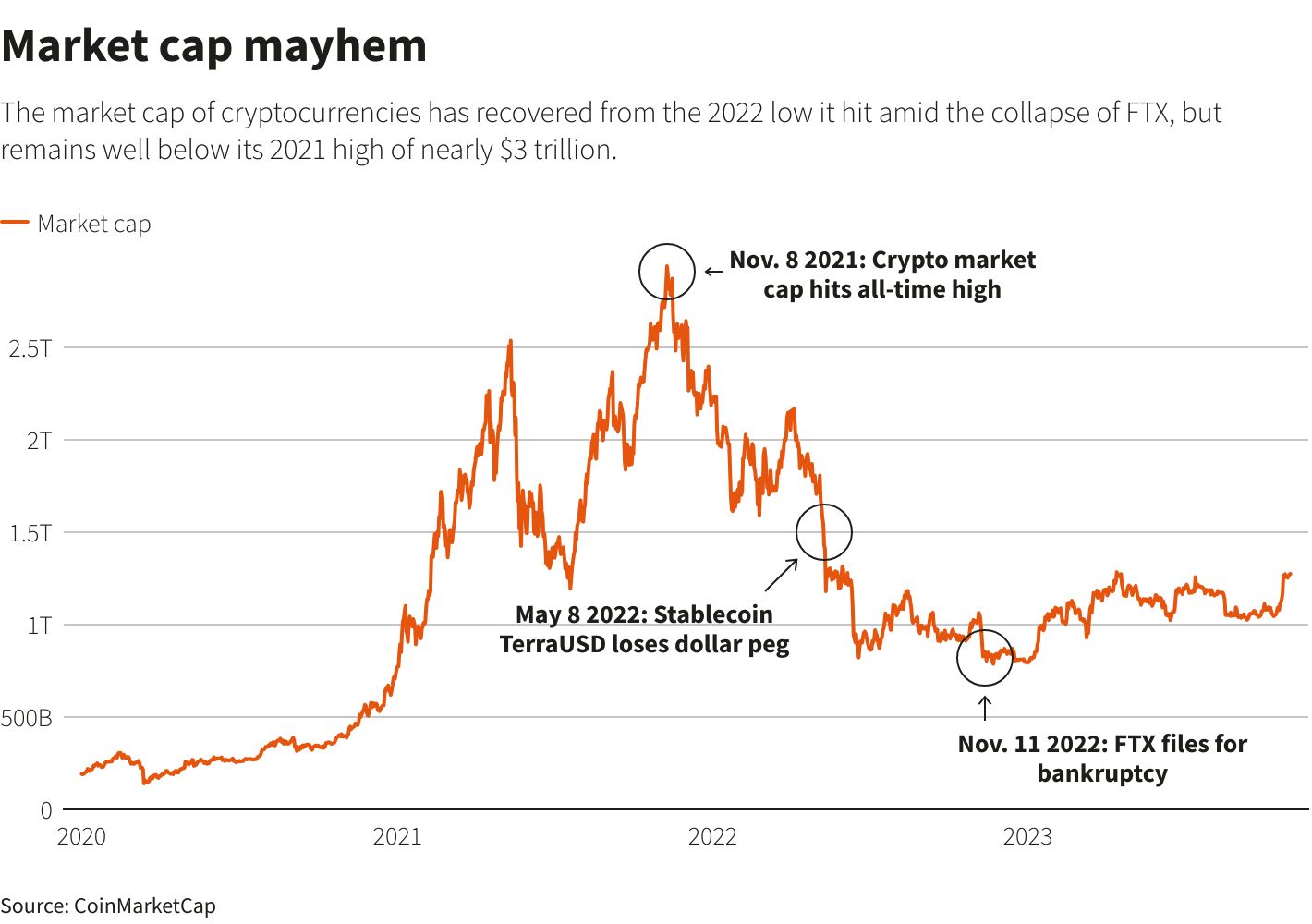

In 2021, Solana experienced rapid adoption across DeFi, NFTs, and Web3 apps. SOL reached its first all-time high of ~$260 (Nov 2021), and TVL climbed to ~$15B. Solana also became a major NFT hub with early collections like Degenerate Ape Academy and Solana Monkey Business, helping establish a vibrant creator ecosystem.

Academic analysis found that Solana NFT trading surpassed $2B in cumulative volume with more than 1.6M traders by early stages of adoption.

However, Solana’s rapid growth exposed stability issues. On September 14, 2021, bot spam during the Grape Protocol IDO caused a ~17-hour outage, followed by additional disruptions throughout 2022 due to network load.

The situation worsened in late 2022 after the FTX collapse, which triggered a severe downturn in the crypto market. FTX and Alameda Research were major early Solana investors and held significant SOL and Solana-ecosystem assets. Their bankruptcy led to forced liquidations and panic, causing SOL to fall over 94% in 2022, one of the steepest declines among major crypto assets.

2023–2025: Resilience, client diversity, and renewed adoption

Following the 2022 downturn, Solana shifted focus toward reliability, network upgrades, and client diversity. Key developments included:

- Firedancer/Frankendancer client: A next-gen validator client designed to improve performance and resilience.

- Ecosystem expansion: Projects like Jupiter, Marinade, and Tensor helped increase liquidity and usage.

Momentum returned in late 2023–2024 as Solana became the center of a viral memecoin boom led by tokens like BONK and WIF. At peak, Solana accounted for ~30% of memecoin trading volume and ~15% of memecoin market cap.

By 2025, Solana had re-established itself as one of the most active blockchains in users, transactions, and on-chain liquidity.

How Solana Works

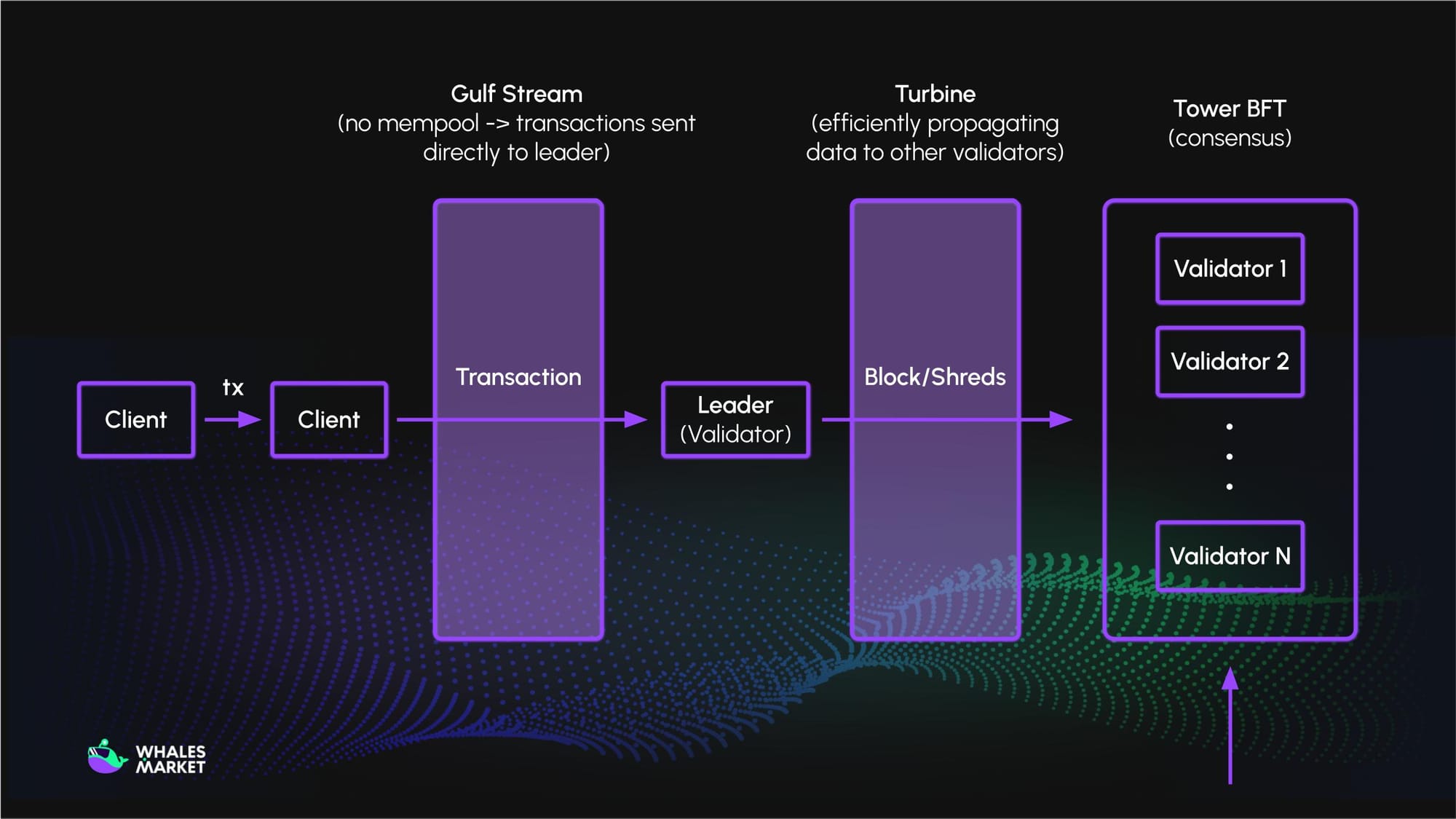

Solana is often misunderstood as using Proof-of-History (PoH) as its consensus mechanism. In reality, Solana uses Proof-of-Stake for consensus. PoH is a cryptographic timestamping system that enhances PoS, not a replacement for it.

PoH acts as a decentralized clock, creating a verifiable sequence of events before consensus. This allows validators to agree on transaction order without waiting to sync timestamps, reducing communication overhead and accelerating block finalization.

Once ordering is set, Tower BFT (Solana’s optimized BFT mechanism) finalizes blocks. Validators stake SOL to secure the network and vote on blocks.

To scale execution, Solana introduces Sealevel and Gulf Stream:

- Sealevel: A parallel smart-contract engine that runs thousands of contract instructions at once across GPUs and SSDs, unlike most blockchains that process one transaction at a time.

- Gulf Stream: Removes the mempool by pushing transactions directly to validators before previous blocks finalize, reducing latency and boosting throughput.

These components allow Solana to process tens of thousands of TPS under optimal conditions while keeping fees extremely low.

Solana’s Key Features

Solana combines novel architecture with performance-first design, making it one of the fastest and most scalable blockchains in the market.

- Proof of History (PoH): A completely new concept that makes Solana a truly irreplaceable blockchain. Proof of History drastically reduces the communication required between validators, allowing the network to process far more transactions in parallel and boosting throughput to an entirely new level.

- Scalability & High Speed: Engineered for high throughput, Solana can reach tens of thousands of TPS (tested up to ~50,000 TPS), supporting real-time financial and consumer applications.

- Low transaction costs: Fees typically remain below $0.01, making Solana ideal for high-frequency use cases such as DeFi trading, on-chain gaming, and social apps.

- Developer-friendly ecosystem: Supports high-performance languages like Rust and provides modern tooling, making it attractive for advanced Web3 builders.

- Scalability without sharding: Solana scales on-chain without sharding or Layer-2s, keeping apps and users in one unified execution environment.

- High-performance validator hardware requirement: Requires stronger hardware for validators, but remains energy-efficient and carbon-neutral compared to PoW systems (such as Bitcoin).

$SOL Information

$SOL Key Metrics

- Token Name: Solana

- Ticker: $SOL

- Token Type: Native Token

- Total Supply: 612,987,176 SOL

- Circulating Supply: 549,823,696 SOL

$SOL Tokenomics

$SOL Allocation:

- Community Reserve: 38%

- Seed Sale: 15.86%

- Founding Sale: 12.63%

- Team Allocation: 12.5%

- Solana Foundation: 12.5%

- Validator Sale: 5.07%

- Strategic Round: 1.84%

- Public Sale: 1.6%

$SOL Use Case

- Paying transaction fees: SOL is used for all network fees, including transfers, smart-contract execution, NFT minting, and interactions across dApps.

- Staking for network security: Validators and delegators stake SOL to secure the chain, validate blocks, and earn staking rewards.

- Collateral in DeFi: SOL is widely used as collateral for lending, borrowing, LP positions, yield farming, and liquid-staking derivatives (mSOL, jSOL, bSOL, etc.).

- Payments & Micro-transactions: With ultra-low fees, SOL enables fast P2P transfers, merchant payments, gaming payments, and SocialFi tipping.

- NFT & creator economy: SOL powers NFT minting, trading, royalties, and creator monetization across Solana marketplaces and apps.

- Gas for program execution: All smart-contract execution on Solana consumes SOL, making it essential for computation across the ecosystem.

- Future governance asset: SOL is expected to play an increasing role in protocol governance as Solana transitions toward more decentralized decision-making.

How to get SOL

There are two main ways to obtain Solana (SOL): buying it with money or earning it through activities. Both methods give users access to the token that powers transactions, staking, and applications across Web3.

How to buy SOL coin

SOL can be purchased through major cryptocurrency platforms. Users can:

- Buy on centralized exchanges (CEXs) such as Binance, Coinbase, Kraken, Bybit, OKX, or KuCoin, using fiat (USD, EUR, VND, etc.) via bank transfer, credit/debit card, or P2P trading.

- Swap on decentralized exchanges (DEXs) like Jupiter or Raydium by exchanging other tokens for SOL directly on the Solana network.

- Purchase through wallet providers supporting fiat on-ramp (e.g., Phantom, Coinbase Wallet, MoonPay, Ramp), then transfer SOL to a self-custody wallet.

Once purchased, users can store SOL in wallets such as Phantom, Solflare, Backpack, or Ledger for on-chain use.

How to earn from SOL

Users can earn SOL through on-chain and ecosystem activities:

- Staking rewards: Delegate SOL to validators or use liquid staking platforms (e.g., Marinade, Jito, Lido) to earn rewards.

- Validator rewards: Run a Solana validator node and receive incentives for helping secure the network.

- Work and contributions: Earn SOL by contributing to Solana-based projects, DAOs, or bounties in the ecosystem.

- Participating in on-chain programs: Some apps and protocols provide SOL rewards for liquidity provision, participation, or ecosystem incentives (depending on market conditions).

The team behind Solana

Solana was created by engineers with deep backgrounds in distributed systems, cryptography, and high-performance computing.

- Anatoly Yakovenko - Co-Founder & CEO: Former Qualcomm engineer specializing in distributed systems and compression. Anatoly introduced Proof of History (PoH) in 2017, the core innovation behind Solana’s high-speed architecture.

- Raj Gokal - Co-Founder & COO: Entrepreneur with experience in venture investing and consumer tech. Raj focuses on ecosystem growth, operations, and partnerships that help drive global adoption of Solana.

- Greg Fitzgerald - Co-Founder & CTO: Former Qualcomm senior engineer. Greg helped build the Solana protocol from the ground up and led the development of the first Solana validator client.

- Stephen Akridge - Co-Founder & Core Engineer: Contributed key ideas for offloading transaction signature verification to GPUs, a major factor enabling Solana’s parallel execution capabilities.

- Eric Williams - Co-Founder & Chief Scientist: PhD in physics and data scientist. Eric contributed to Solana’s economic and cryptographic design, helping structure the network’s incentive model and validator economics.

Conclusion

From early experiments to powering millions of transactions daily, Solana has evolved into a core pillar of the crypto landscape. Despite early challenges, the network has matured, strengthened reliability, and built one of the most active user ecosystems in Web3.

FAQs

What is the native token of the Solana blockchain?

The native token of Solana is $SOL. It is used to pay transaction fees, secure the network through staking, and power applications in the Solana ecosystem.

Is Solana an altcoin?

Yes. Solana (SOL) is considered an altcoin because it was launched after Bitcoin and is an alternative blockchain with its own network and token.

Is Solana open source?

Yes. Solana is an open-source blockchain, meaning its codebase is publicly accessible and community developers can contribute to the ecosystem.

How many Solana coins are there?

Solana has a non-fixed supply with controlled inflation.

- Current total supply: ~612M SOL

- Circulating supply: ~550M SOL (as of Oct 30, 2025)

What does Solana do?

Solana is a high-performance blockchain designed to support scalable decentralized applications (dApps), including DeFi protocols, NFTs, gaming, payments, and consumer-focused apps.

Is Solana a good investment? Should I buy $SOL?

Solana has emerged as one of the strongest Layer-1 blockchains, backed by fast transaction speeds, low fees, a rapidly growing developer ecosystem, and rising user adoption across DeFi, NFTs, gaming, and consumer applications. Its performance-oriented architecture has allowed it to capture market share from both Ethereum Layer-1 and Layer-2 ecosystems, especially during periods of high on-chain activity.

However, investing in SOL comes with risks. Solana has historically faced network outages, strong competition from other high-performance blockchains, and broader crypto-market volatility. While the network has significantly improved stability and infrastructure since 2023, future performance is not guaranteed.

Disclaimer: This is not financial advice. Always DYOR (Do Your Own Research)!

Is Solana better than Bitcoin?

They serve different purposes:

- Bitcoin is primarily a decentralized store of value.

- Solana is a high-speed platform for running decentralized applications.

One is not universally “better”, they address different goals in the crypto ecosystem.

How to mine Solana

You cannot mine Solana. Solana uses Proof-of-Stake (PoS), not mining. Users earn SOL through staking, not mining hardware.

Who is the Solana founder and when was Solana launched?

Solana was founded by Anatoly Yakovenko along with Greg Fitzgerald, Raj Gokal, Stephen Akridge, and Eric Williams.

- Concept introduced: 2017

- Mainnet beta launched: March 2020

How does Solana work?

Solana uses Proof-of-Stake enhanced by Proof-of-History (PoH), a cryptographic time-ordering system. This allows fast block processing and high throughput. It also uses Sealevel for parallel execution and Gulf Stream for fast transaction forwarding.

What is $SOL used for?

SOL is used to:

- Pay transaction & smart-contract fees

- Stake to secure the network

- Earn rewards as a delegator or validator

- Provide liquidity & collateral in DeFi

- Power NFT and Web3 applications