MicroStrategy has long been seen as one of the biggest diamond hands in BTC, and a representative name in the DATs wave. Even after buying in the $60K range and surviving the 2022 bear market with major shocks like Luna and FTX, the company has never sold any BTC.

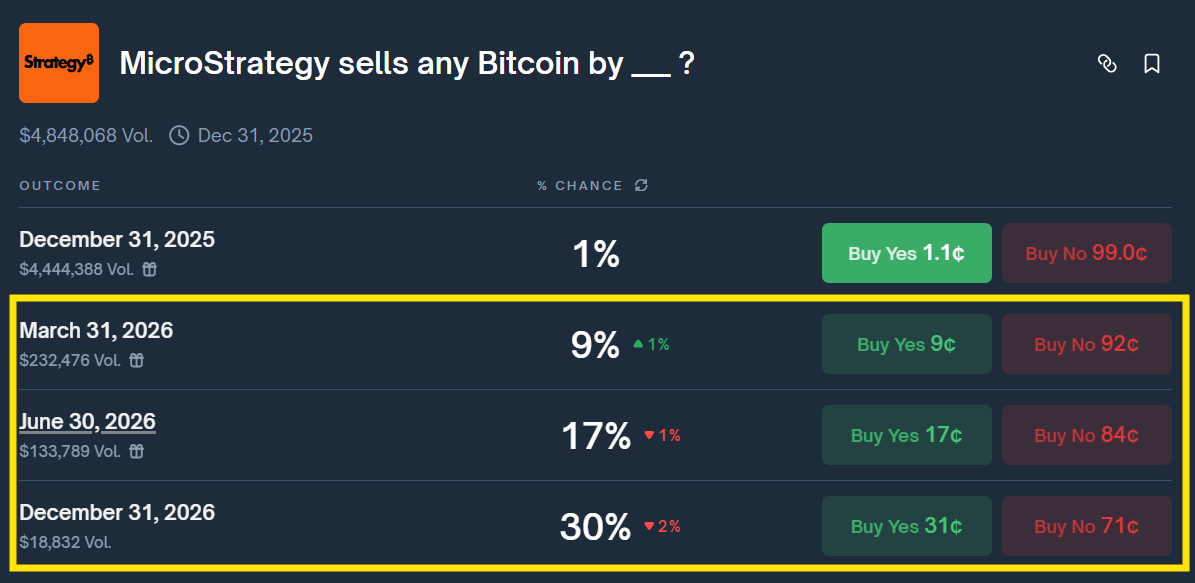

Today, MicroStrategy holds about 671,268 BTC, roughly 3.197% of the 21M total supply. However, CEO Phong Le recently said the company could sell BTC if it truly needs to meet its debt obligations. Polymarket quickly turned this into a time based market.

In this article, we will break down the scenarios the market is pricing in.

MicroStrategy Overview

For many years, MicroStrategy was known as an enterprise data analytics software company. However, since 2020, the company shifted its focus toward a “Bitcoin Treasury” strategy, treating Bitcoin as a treasury reserve asset and continuously expanding its holdings through capital raising activities in the market (equity, bonds, and other capital products), while still maintaining the software business.

By 2025, the company pushed this positioning further by changing its legal name to Strategy Inc and using “Strategy” as the main brand, while “MicroStrategy” became the former name. In press releases, Strategy often describes itself as a “Bitcoin Treasury Company”, while still developing an enterprise analytics platform that integrates AI.

As its Bitcoin holdings have grown, Strategy’s stock has increasingly been viewed as a proxy for Bitcoin exposure, which makes BTC price movements strongly influence how investors value the company.

Where does Strategy get the money to buy BTC?

Strategy is not only known for holding BTC, but also for how large each purchase can be. Each purchase is often hundreds of millions to over $1B. So where does that money come from?

If we ignore BTC price gains and losses for a moment, and look at the software business:

- Total revenue: $128.7M, up 10.9% year over year.

- Subscription: up 65.4% to $46.0M.

- Gross profit: $90.7M with a 70.5% gross margin.

It is clear the software business generates revenue that is very small compared to the amount of BTC the company holds. This also suggests the capital used to buy BTC does not come from the software business.

The main source of funding is issuing equity and debt over a long period, when borrowing costs were low.

- From 2024 to the end of 2025, Strategy issued a total of about $8.035B in convertible senior notes, treated as debt raised between 2024 and 2025.

- In addition, it raised about $5.557B (including converting €620M into USD on Dec 16, 2025, equivalent to $729M) via perpetual preferred stock. This is a hybrid between debt and equity, with perpetual dividends.

- The total capital raised from these sources is about $13.59B, mainly used to buy BTC without needing to sell BTC to repay debt.

This is the main funding source Strategy uses to build its BTC treasury position.

When does Strategy sell any Bitcoin?

Borrowing always comes with repayment obligations. It is clear that income from selling software is almost not enough for the company to meet its debt related obligations. Typically, Strategy will raise new debt to refinance old debt, and this has been the approach in recent years.

So what happens if, in a bear market, the company cannot raise more capital to refinance old debt?

Selling BTC becomes the most viable option, and CEO Phong Le said they would only sell BTC if two conditions occur:

- Strategy may sell BTC if it needs cash to pay preferred dividends when mNAV is below 1.

- The company cannot raise more capital through equity issuance or borrowing.

Let’s analyze each scenario so traders can make a more informed decision on the Polymarket market.

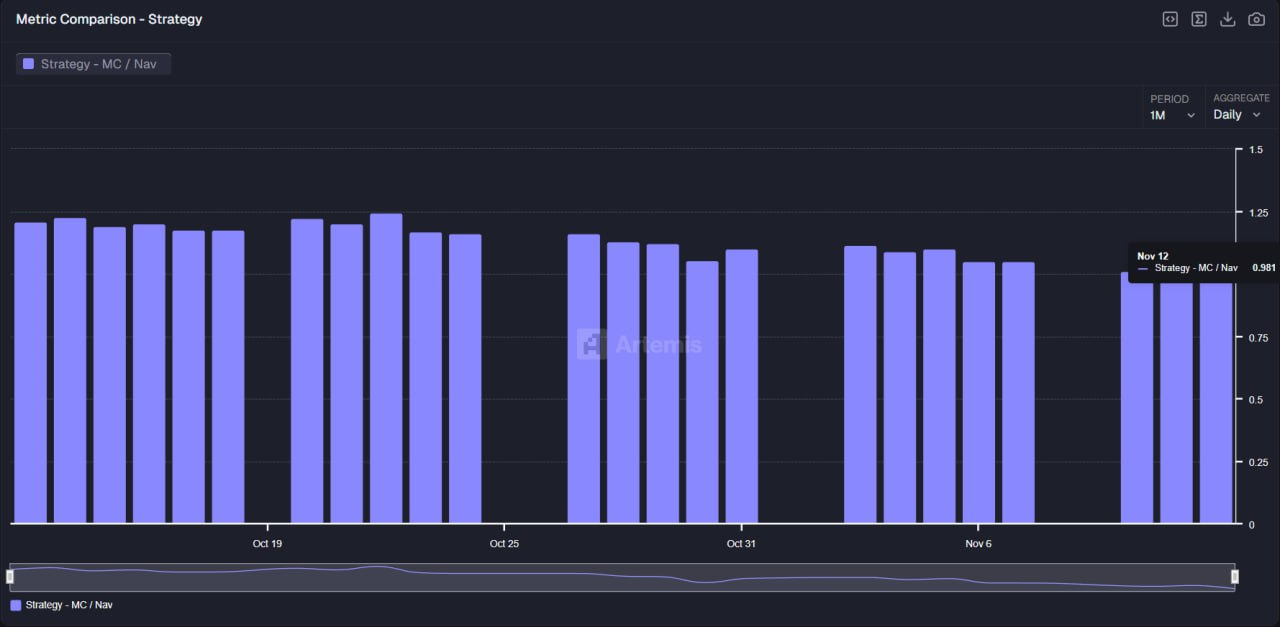

Case 1: mNAV below 1

mNAV is a way to compare the company’s market value to the value of its BTC holdings. When mNAV drops below 1, raising new capital can become less attractive because dilution can hurt per share value.

Right now, Strategy pays about $750M to $800M in preferred dividends each year. In the past, it used issuing new shares to cover older obligations, but the stock price has fallen sharply, which makes this path harder to execute.

If mNAV < 1, raising new capital (through equity or debt) becomes less attractive because dilution would reduce per share value even further. In that situation, selling a portion of BTC to pay preferred dividends (obligations) can be mathematically reasonable.

- However, what traders should pay attention to is Strategy’s ability to meet its obligations, not the assumption that “if mNAV is below 1, Strategy will automatically sell BTC.” In mid November 2025, Strategy did not sell BTC even when mNAV was below 1.

- Also, selling BTC is not meant to “make mNAV look better.” It serves one purpose: paying obligations. In addition, this metric is very short term because it is heavily affected by BTC price. This factor should be treated as a reference, not something to bet on 100% whenever mNAV is below 1.

Case 2: The company cannot raise more capital

The second case is when Strategy cannot raise more capital to refinance old debt. This can happen even when mNAV is above 1.

To address this risk, Strategy created a reserve fund worth $1.44B to ensure it can pay preferred dividends and interest for at least 12 months, and it plans to increase this reserve to cover 24 months.

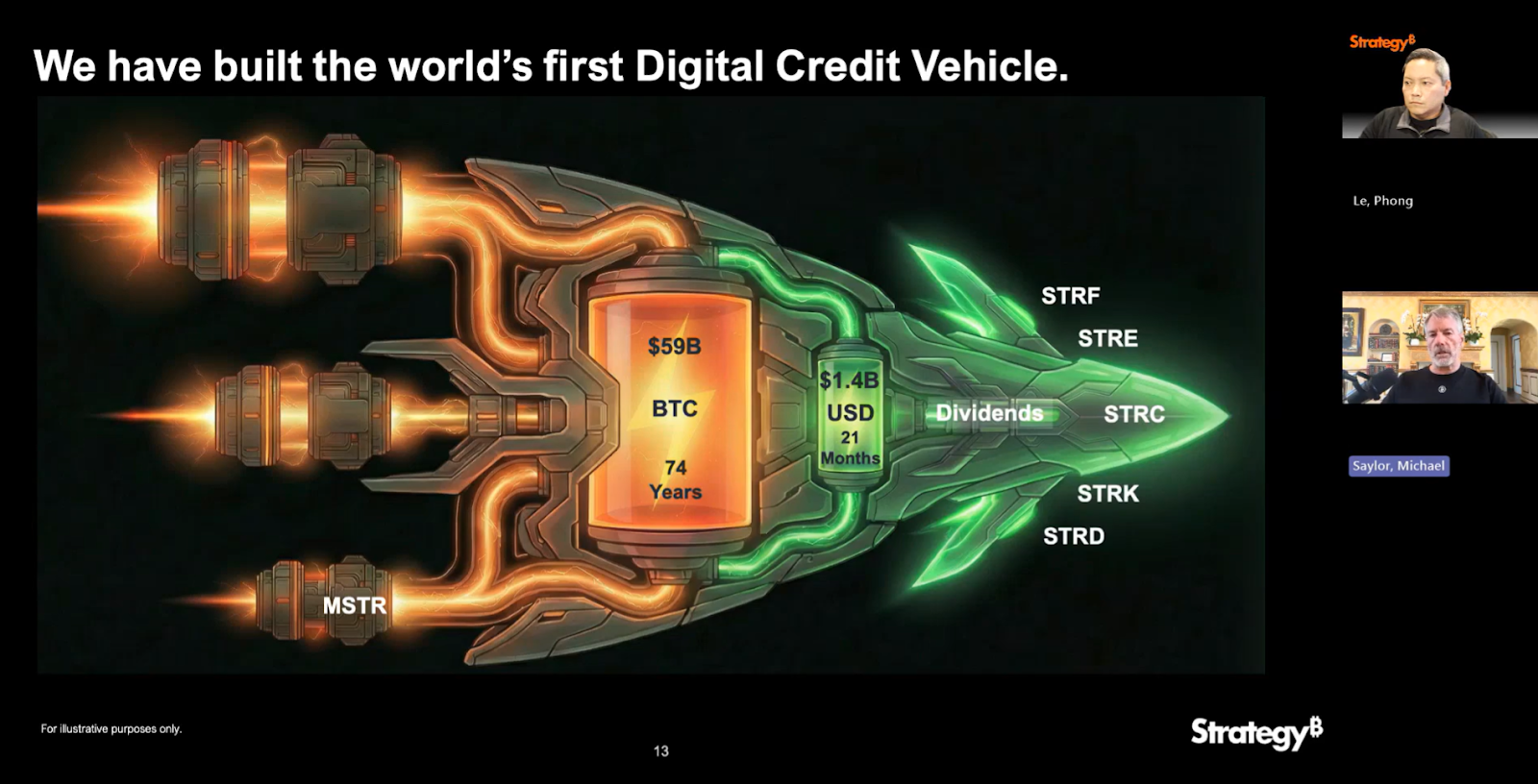

The image below is from Strategy’s most recent community update meeting (Dec 1, 2025). In that meeting, they disclosed the following:

- STRF, STRE, STRC, STRK, SRTD are the obligations they must service, with interest of about $800M per year.

- The green section is the cash reserve to cover interest for the next 21 months.

- The orange section is the “last resort” to repay obligations. If the green reserve is depleted and the company cannot raise more capital, then selling BTC to meet debt obligations becomes mandatory.

In short, selling BTC ultimately happens only to pay obligations, and Strategy’s current obligations are about $800M per year. With about $1.4B in cash, it is very likely there will not be any selling from Strategy in 2026, because it has more than enough capacity to meet its obligations in 2026.

On paper, the odds look attractive, though it is far from guaranteed. However, traders still face some risks:

- Capital can be locked for a long time, because the deadline for the most attractive risk reward odds right now is more than 1 year away (Dec 31, 2026).

- Odds can move with FUD or statements from Saylor or Phong Le, which can leave users stuck in temporary losses for a long period.

Conclusion

Strategy selling BTC could become an event that creates major market impact. At the same time, it creates a betting market around it, and users can potentially make money from that event.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What is Strategy Inc and how is it related to Strategy?

Strategy Inc is the rebranded entity, while Strategy is the former company name used historically. Many people still use Strategy out of habit, but recent guidance and branding use Strategy as the main name.

Q2: How much Bitcoin does Strategy hold and why does it matter for the market?

Strategy holds hundreds of thousands of BTC, making it one of the largest corporate Bitcoin holders. That scale means any BTC sale headline can move sentiment quickly, even if the actual probability is low.

Q3. Why do preferred dividends matter in a Bitcoin treasury strategy?

Preferred dividends are recurring cash obligations that must be serviced regardless of BTC price. If funding conditions tighten, those payments can become a pressure point in the BTC sale narrative.

Q4. How do convertible notes affect the risk of a Bitcoin sale?

Convertible senior notes are a major funding tool used to expand BTC holdings. If refinancing becomes difficult in a bear market, the fallback options become more limited and traders may price a higher sale risk.

Q5. What does mNAV < 1 actually imply, and does it automatically mean Strategy will sell BTC?

When mNAV drops below 1, issuing new equity or raising new capital can become less attractive because dilution may further reduce value per share. However, mNAV < 1 does not automatically trigger BTC selling. A sale would still depend on whether the company needs cash to meet obligations and cannot fund them through other means.