Over the past few months, Base has turned into one of the most closely watched projects in the crypto community.. It is not only a chance to change positioning through an airdrop, but also a source of hope for a true blue-chip project in a crowded and increasingly saturated Layer 2 landscape.

However, the opportunity is not just for airdrop hunters. Investors can also make money from their own knowledge and views about this event through prediction markets.

Let’s break down what could be the most optimal strategy.

What is Base?

Base is a Layer 2 solution developed by Coinbase to make Ethereum more accessible and cost-efficient. Built on the OP Stack, it functions as an optimistic rollup, bundling transactions to reduce fees while preserving decentralization.

Following its release in August 2023, the network has grown rapidly, recording over 20M monthly active addresses and integrating cross-chain features like a bridge to Solana. This development represents a core component of Coinbase’s broader on-chain strategy.

Within the ecosystem, protocols such as Aerodrome act as central liquidity hubs, while Zora drives NFT activity and secondary sales. Community events like Onchain Summer have further established Base as a hub for user engagement and content creation.

Base Ecosystem Context

Launching a token for a project has never been a trivial matter. When that project is Base, one of the most prominent names in the Layer 2 narrative, expectations become even stricter.

With its position and backing from Coinbase, Base cannot afford to make mistakes. A casual fair-launch style or a rollout without a tightly designed tokenomics plan would be very difficult to justify. More than anyone else, the Base team understands they need a perfect market timing point, where liquidity and investor sentiment are excited enough to properly price the project.

Another key factor is the maturity of the ecosystem. Base needs to ensure that its infrastructure has enough depth and appeal to retain capital and users. The ultimate goal is to turn liquidity from airdrops or ICOs into long-term capital, instead of letting it immediately flow out once the event ends.

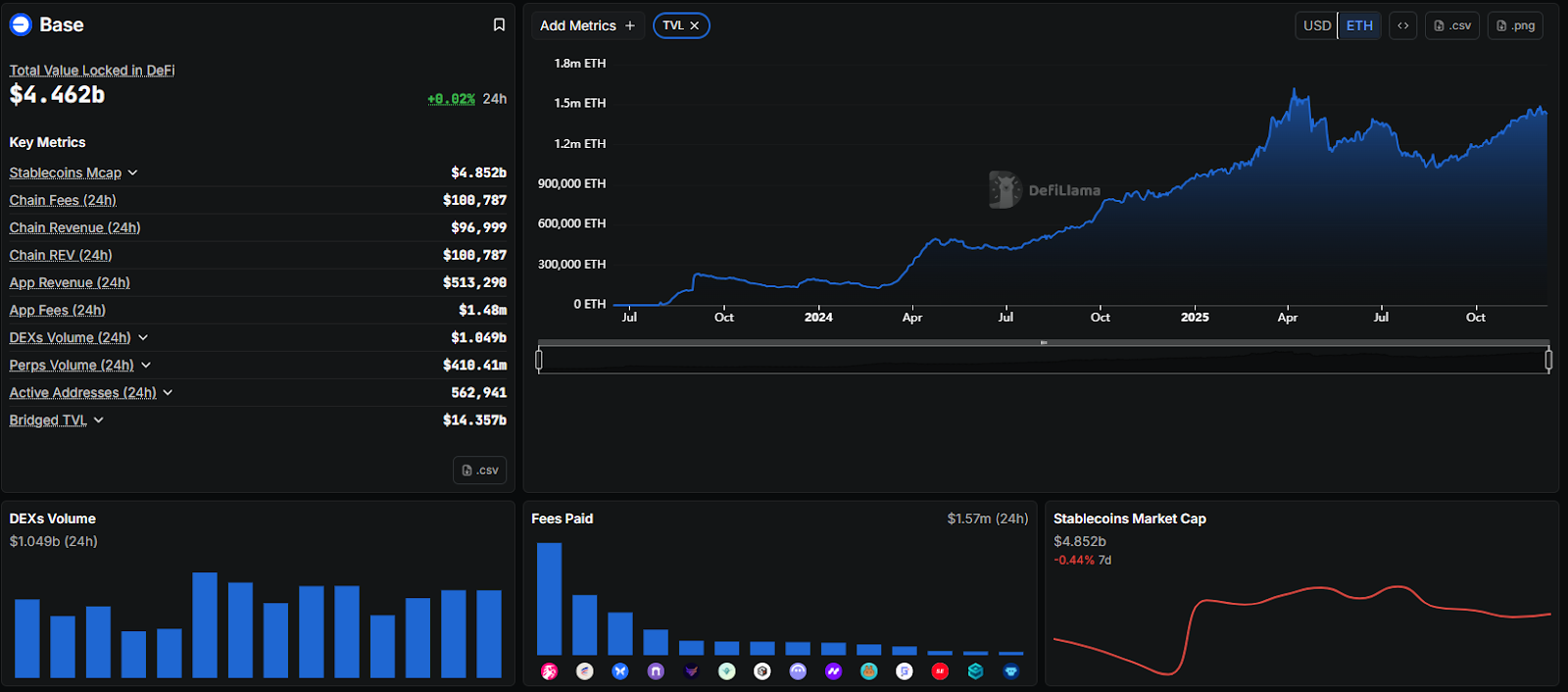

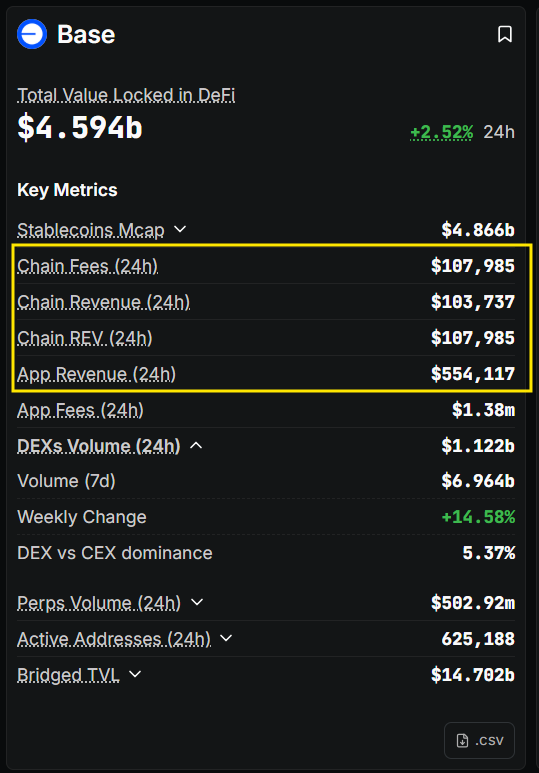

After more than 2 years of development, Base has become one of the most active networks among Layer 2s:

- TVL on Base has increased about 39%, from around $3.21B (1/1/2025) to $4.46B (9/12/2025).

- DEX trading volume averages $1.5B to $3B daily. Aerodrome and Uniswap are the two DEXs with relatively large and balanced TVL at the moment (around $450M as of 12/9), creating a sufficiently thick liquidity layer for degens and memecoin traders.

- Stablecoin market cap stands at around $4.8B (with USDC at about $4.38B), with consistent upward growth. In particular, moving USDC between Base and Coinbase is free and extremely fast.

- For lending protocols, Morpho, Aave, and Spark rank first, second, and third in TVL, ensuring robust liquidity for users.

- The consumer app ecosystem is also diverse with Base App, Farcaster, Zora, Limitless, Footballfun and others.

- Memecoins on Base are also a factor that will likely continue to be used to retain users. Although simple, they are extremely effective.

Read more: Why should start using Base App today?

Besides the internal factors of the project, another element that can be considered is the spotlight that Base can capture at TGE. This spotlight can be decided by factors such as:

- Whether other ecosystems are running strong incentive programs. If they are, launching the token could cause liquidity in the Base ecosystem to flow out to wherever incentives are higher.

- Whether major competing projects have already done their TGE. This is more about sentiment, but it is still very important. MegaETH already has a specific launch date, Monad has mainnet, and Flying Tulip and Stable may be the next projects that investors need to watch to make decisions.

Overall, the Base ecosystem can be considered relatively mature and ready to welcome a large wave of liquidity from airdrop programs initiated by Base itself.

However, the team may want to further optimize timing around secondary factors such as:

- Base App needing to be more complete.

- The infrastructure needs to become faster and cheaper.

- The chain’s culture needs to be further deepened, or simply to “test” the loyalty of dApps and users when a bear market comes.

In short, from the way Base has been built and shaped over the past years, investors can expect that any Base token launch will come with a lot of careful calculations and planning to optimize every opportunity created by the TGE.

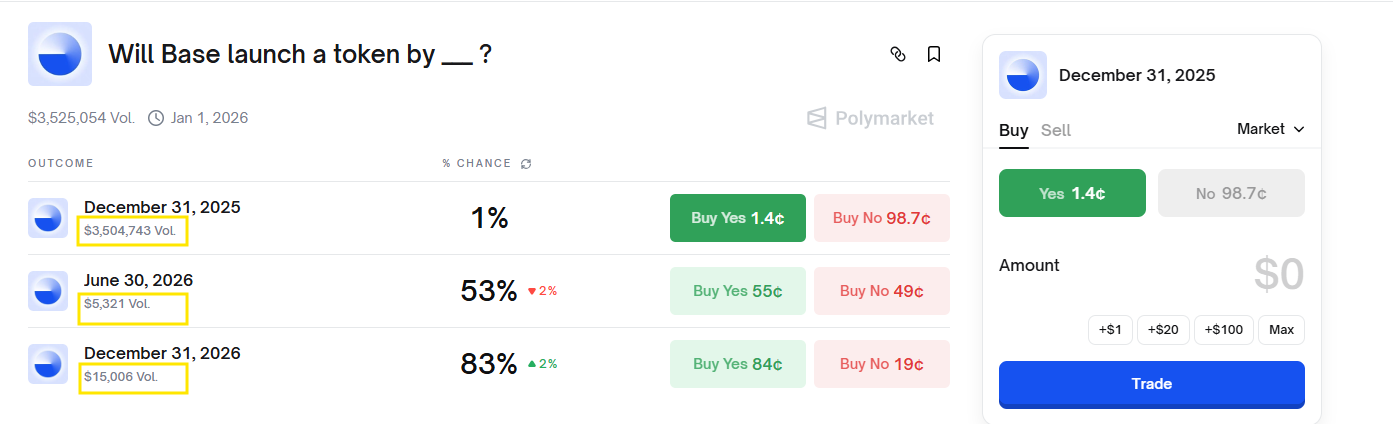

Will Base launch a token by?

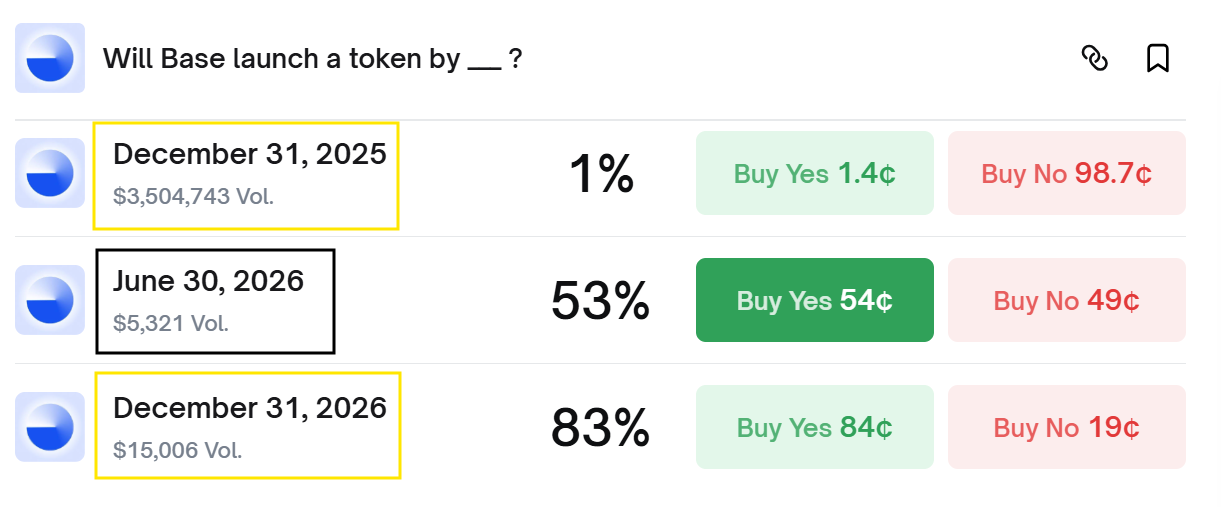

There is an active market on Polymarket tracking the timeline for the Base token TGE. Where do the opportunities lie within this prediction market? Below is an analysis of the probabilities for each scenario.

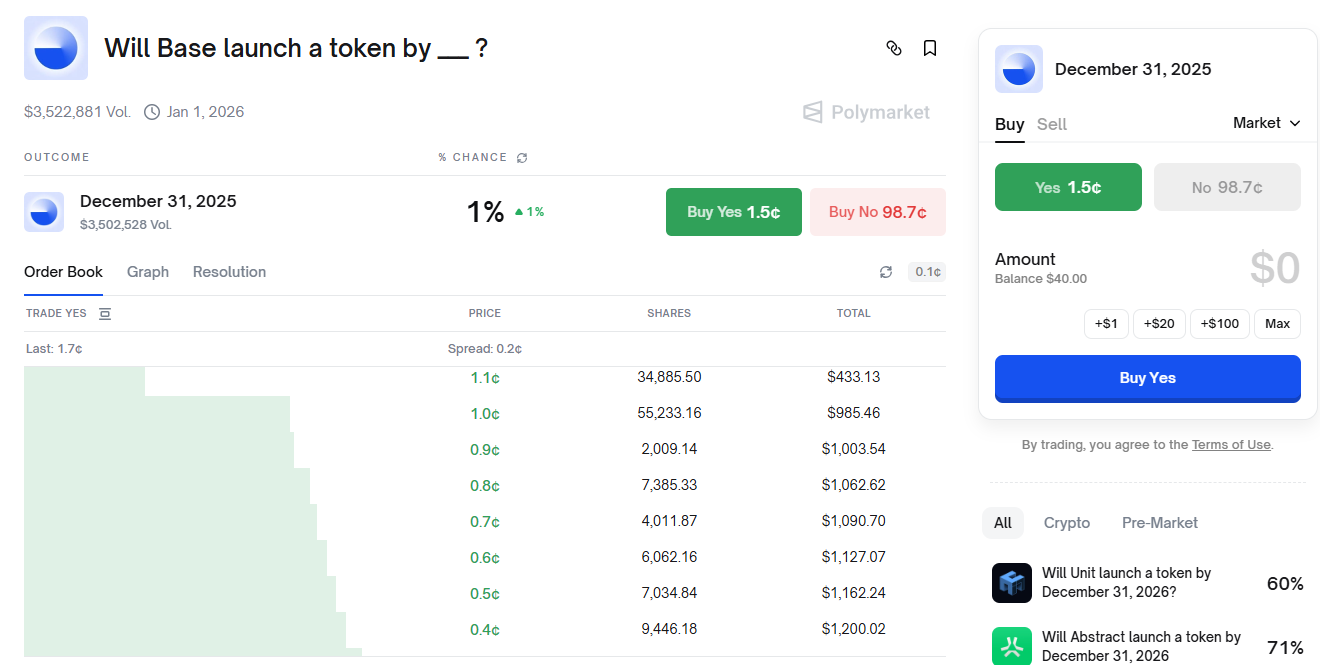

Scenario 1: Base launches $BASE by December 31, 2025

There is only about a 1% probability that Base will launch a token before 31/12/2025. This clearly reflects that traders are almost certain this event is nearly impossible. Some reasons that can be mentioned in this case include:

- The black swan event on 10/10 almost wiped out many investors. There are even rumors that many small and mid-size market makers went bankrupt. This pushed the market into a severe liquidity shortage, and even a moderate selling force could cause BTC to break down, dragging altcoins with it.

- Base App is currently still in a limited access version, even though it is the product that will connect Base (Web3) and Coinbase (Web2). Without being fully ready to welcome a large user base, launching the token would lack a strong connection between the two sides. That could cause Base to lose a large number of potential users, while Coinbase could lose liquidity and trading volume that might otherwise flow from Base into this CEX.

- BTC is entering a downtrend, pushing overall market sentiment to very low levels. Monad’s TGE was not particularly successful, with an FDV at merely an “acceptable” level for a project that raised over $400M. This is likely a case study that makes Base more cautious.

- Also, because Base is developed directly by Coinbase, they are unlikely to be pressured by VCs or investors to rush a token launch before the bear market fully hits. They can completely keep building through the bear and wait for a more favorable time to issue a token.

There are also several legal uncertainties that may affect the timing of a token launch:

- Legal risks with Coinbase: Although in February 2025 the SEC agreed to drop its lawsuit against Coinbase, Coinbase is still a publicly listed company in the US and thus subject to much stricter oversight than any typical crypto project. Launching a token for Base (a Layer 2 backed by Coinbase) carries a high risk of being classified as a security if not handled carefully.

- Pressure from existing regulations: SEC warnings that Layer 2s using a centralized sequencer (like Base currently) could be seen as unregistered exchanges pose a real regulatory barrier.

- The GENIUS and CLARITY bills: The US Congress has passed the GENIUS Act (focused mainly on stablecoins) and is pushing forward the CLARITY Act (classification of digital assets). However, these laws primarily clarify which assets are commodities and which are securities; they do not remove registration requirements if a token is deemed a security.

Therefore, taking the risk of launching a token while Base is already operating very well is something Coinbase likely does not want to get involved in. This is reflected in the 1% odds.

Overall, this is a “free money” opportunity for those who bet “No” on Polymarket, because the odds are highly skewed, and the high volume shows strong conviction from whales. If there are updates around the 17–18/12 announcement, the odds may shift, but for now, the market is heavily betting on a delay.

Wrist-check, 12.18.25 pic.twitter.com/H256hfH8HH

— Base (@base) December 1, 2025

Base’s “Wrist-check” teaser that fuels token rumors

Scenario 2: Base launches $BASE by June 30, 2026

In the second scenario, the market is currently pricing this outcome at about 53%, a number that reflects balance and uncertainty from traders. This figure can be broken down into different lines of reasoning.

Side betting YES:

This side currently holds about 53% odds on Polymarket, showing that they believe Base has strong incentives to accelerate its TGE in the first half of 2026. Some main reasons that could support this view include:

- Base’s current development momentum: Base is already a top Layer 2 even without a governance token. This could be an ideal time to launch a token to capitalize on hype, increase decentralization, and attract more liquidity and incentives.

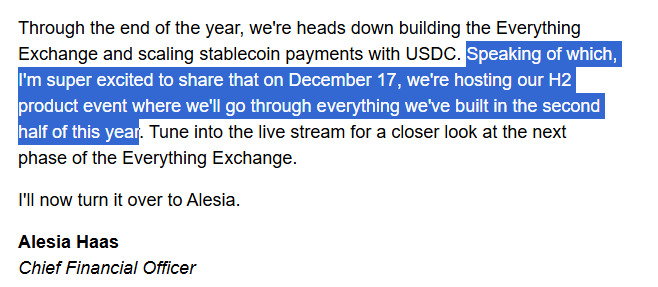

- Signals from the upcoming announcement: The Yes side is betting on the event on 17–18/12/2025 (the “Wrist-check, 12.18.25” teaser from @base). The market thinks launching the token directly from this announcement is unlikely, but it could reveal the token roadmap, tokenomics, or new features (such as RWA tokenization or AI agents) that lead to an earlier TGE, or at least leak the token launch timeline.

- Base App going public: If this happens, the probability of Base launching a token will move to a new level. This belief is not baseless, since in Coinbase’s latest article, the CFO said they would launch a product that has been built for more than half a year. If that product is Base App, it would force the market to reprice all token launch possibilities across upcoming timeframes, with the most affected windows likely being in 2026, because the app will need additional time to operate under heavy usage.

Side betting NO:

This side holds 47% odds, reflecting skepticism about an early launch. However, in this case it does not say too much about the market’s conviction.

The volume for both YES and NO is only just over $5K, an extremely modest figure compared with the contracts expiring on 31/12/2025 or 31/12/2026.

So we can conclude that this timeframe is affected by:

- The date being somewhat in the middle, not as near-term as 12/2025 and not as far out as 31/12/2026. Being in the middle makes the market less enthusiastic about this window.

- Current information is mostly focused on 2025, making it harder for the market to price opportunities around this period. Unless they are insiders, very few traders dare to bet on this kind of timeframe.

- According to the 4-year cycle, 2026 will be a downtrend year. Macro policies and tariffs are still extremely complex, especially with a US president who “does whatever he wants”, so his policies may affect the broader market and therefore the timing of any token launch. The mid-year period is often when markets become particularly depressed.

Scenario 3: Base launches $BASE by December 31, 2026

In the third scenario, the volume for this timeframe is higher, and the market is pricing an 83% probability that Base will launch a token.

- In 2022, Aptos also conducted an airdrop and TGE in a bearish market. All sentiment and attention were focused on the project. The notable point is that Aptos did not have a detailed plan to retain liquidity, which caused it to be left behind. Base can fully learn from this strategy.

- In addition, a major reason many people may choose to buy YES right now is that they are betting Base will need more than the next 6 months to complete its entire ecosystem, or at least waiting until the Fed has a new chair who leans more toward Trump’s views. This could very likely create a favorable macro environment in Q4/2026.

However, if you want to participate in this scenario, there are still some variables that investors need to consider:

- The event’s end date is still very far away. Entering now as a conviction trade and holding with little information can both lock up capital and fail to guarantee a high probability of winning.

- Instead, trading the odds based on information from now until the event ends (more than 1 year) will be more reasonable. Even though there is currently only 17% probability priced in for NO, if BTC performs poorly and a wave of FUD hits, the market could immediately reprice the token launch, and sentiment could worsen, causing NO odds to rise. This is also a strategy.

- Finally, $15K in volume is still very small, so in these last two scenarios, users need to play carefully and with a clear strategy, instead of acting hastily at this stage when the displayed % does not yet truly reflect crowd belief.

Conclusion

Betting on when Base will launch its token depends on a wide range of variables. Users can absolutely earn profits without waiting for the event to finish, based on:

- Analyzing how the market prices the timeline and which factors Base needs before launching a token, including regulation, broader market conditions, ecosystem products, and competitors.

- Tracking product updates, which will likely be the biggest driver of changes in the market’s % view on the token launch timeline.

- Paying attention to major ecosystem events such as Base Camp and hackathons, because sometimes just one statement can shift sentiment and the market’s thinking about the token launch timing accordingly.

FAQs

Q1. How do prediction markets help investors around the Base token event?

Prediction markets like Polymarket let traders express views on when a token might launch. Instead of simply “hoping for an airdrop”, investors can monetize their timing views by buying or selling YES/NO outcomes.

Q2. What are the main scenarios the market is pricing in?

Markets currently split Base’s token timing into different windows (end of 2025, mid-2026, end of 2026), each with its own implied probability based on liquidity, macro conditions, and progress of Base’s products such as Base App.

Q3. How does macro policy affect the Base token timeline?

Interest rates, liquidity conditions, and US regulatory moves can all change risk appetite. A more supportive macro backdrop in 2026, or a new Fed chair, could encourage Base to time its token launch for stronger demand.

Q4. What role does ecosystem growth play in token timing?

High TVL, active DEX volume, strong stablecoin flows, and a vibrant consumer app layer give Base a better foundation to absorb a token launch. The more “sticky” the ecosystem, the easier it is to turn airdrop liquidity into long-term capital.

Q5. What are the main risks for traders in these prediction markets?

Key risks include low liquidity in some contracts, sudden sentiment shifts after major announcements, and the opportunity cost of locking capital in long-dated outcomes where information may change slowly.

Q6. Can traders profit even if they never hold the future Base token?

Yes. The article emphasizes that traders can focus purely on odds. By entering and exiting positions as probabilities move, they can capture PnL from changing market expectations without ever owning the eventual token.