Developed directly by Coinbase, Base App has quickly become one of the most worthwhile places for users to invest their time onchain. If Farcaster users previously received the DEGEN airdrop worth several thousand dollars at its peak, there is a high chance that using Base App may bring similar mini airdrops in the future.

Not only that, Base App is the central application that connects Base and Coinbase. Beyond the airdrop opportunity, there are several other reasons that make Base App worth experiencing today.

What is Base App?

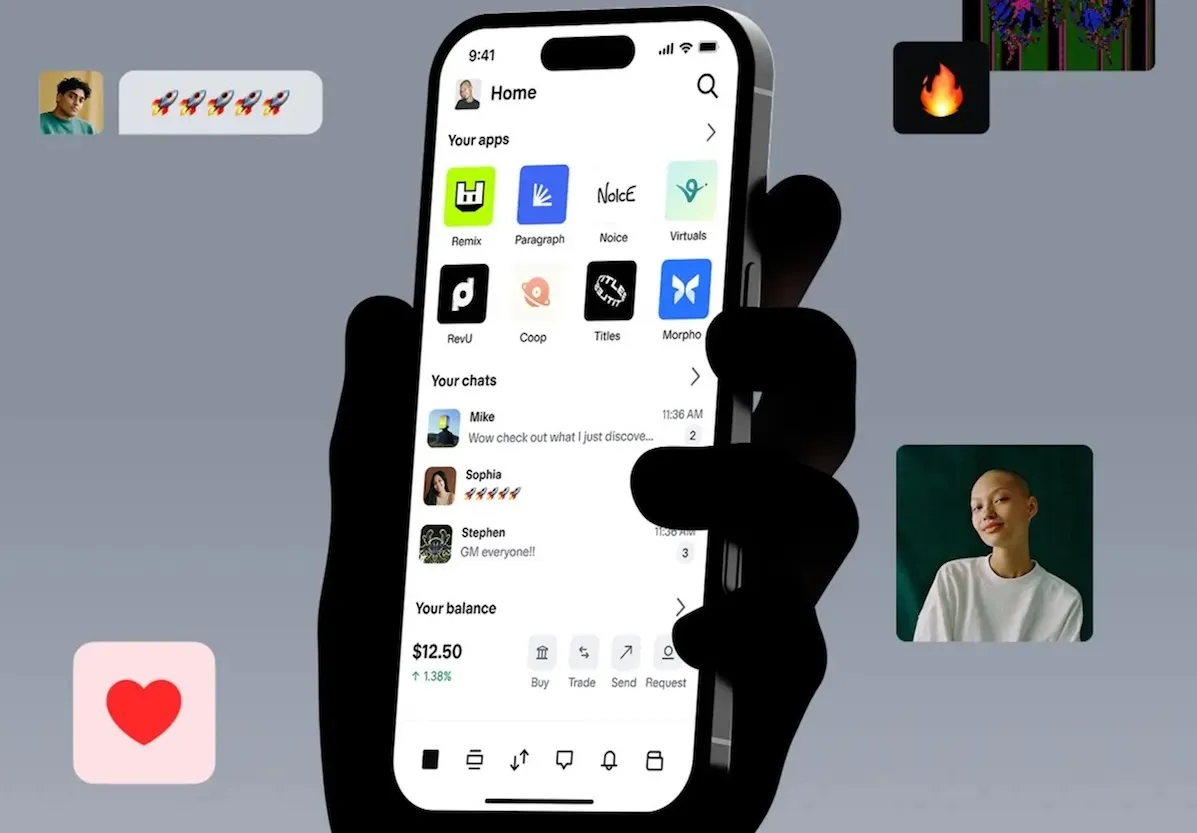

Base App is the next evolution of Coinbase Wallet, reintroduced by Coinbase in July 2025 with a new name and vision. Rather than acting only as a crypto wallet, it is designed as an all-in-one application, bringing multiple on-chain features into a single place so users do not have to juggle different apps.

Base App is built as a unified Web3 application that brings together key features like trading, simple payments, social interaction, and exploration of new dApps in one place.

Some of the notable highlights include:

- Get paid when people engage with content.

- A feed to discover apps, coins, videos, communities, and more.

- Buy, sell, and trade onchain assets without leaving the app.

- Send money to anyone around the world for free.

- Get up to 3.85% APY in rewards by holding USDC in the app.

- Embedded mini dApps that plug in DeFi functions such as trading, yield strategies, and lending/borrowing directly inside the app.

On top of that, Base App uses smart wallet infrastructure with account abstraction. Users can create a wallet using just an email address, enjoy automatic gas sponsorship, and experience faster confirmations thanks to features like Flashblocks, which cut block times to around 200 milliseconds for near-instant settlement.

Overall, Base App tackles many of the friction points that have held Web3 back, making it easier for people to move from Web2 services or Coinbase’s centralized exchange into the onchain world.

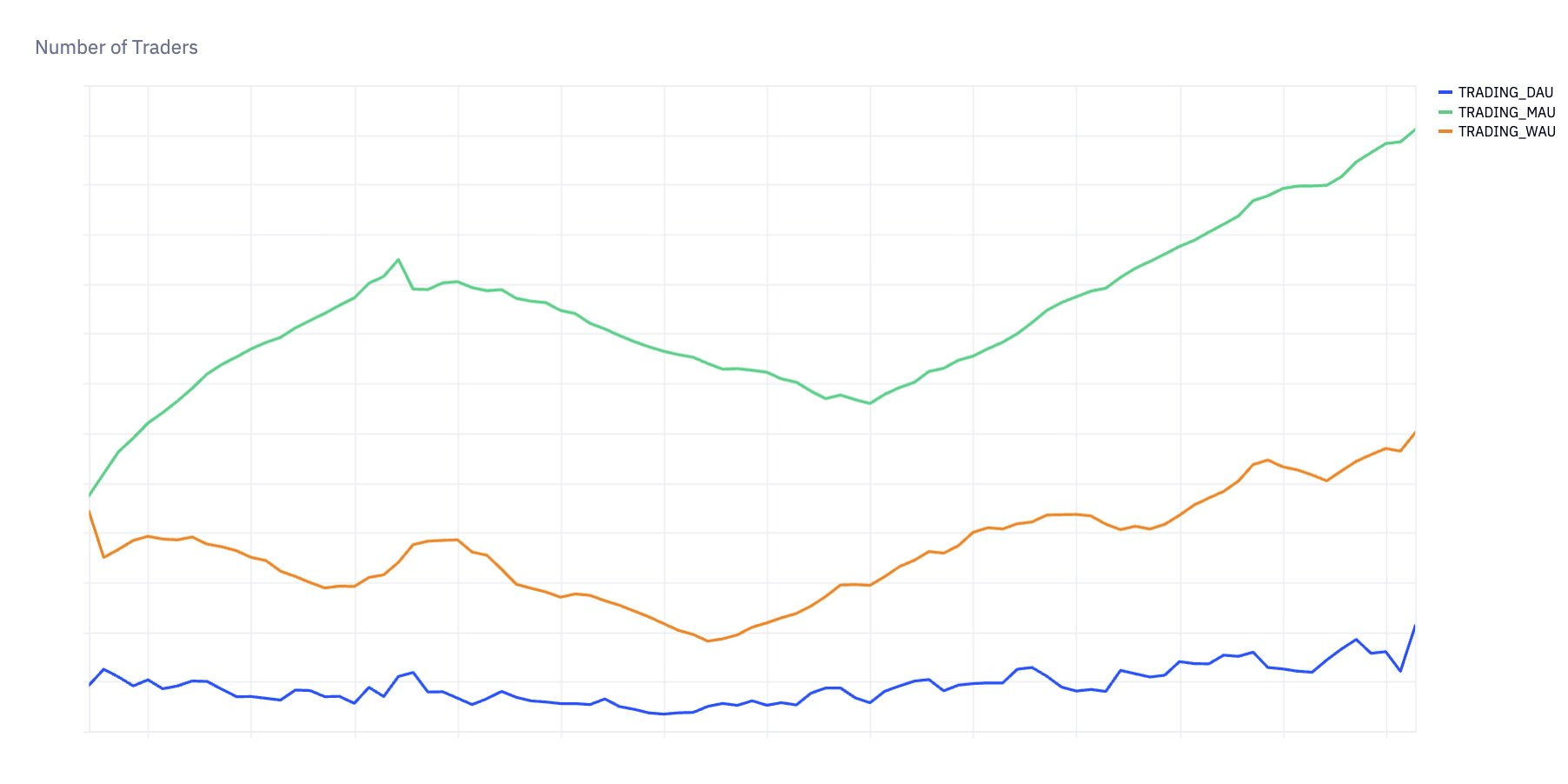

As of now, Base App has already reached several notable milestones:

- Over 1M users have joined the waitlist.

- Creators have earned more than $500K in total payouts.

- A meaningful portion of active content posters are now generating real income from their work.

To further support builders, Base has also introduced Base Build, a toolkit that helps teams analyze user behavior, measure which marketing channels perform best, and unlock $500 in free gas credits to kickstart development of their own mini apps.

Why does Coinbase need Base App to succeed?

The shift from offchain to onchain

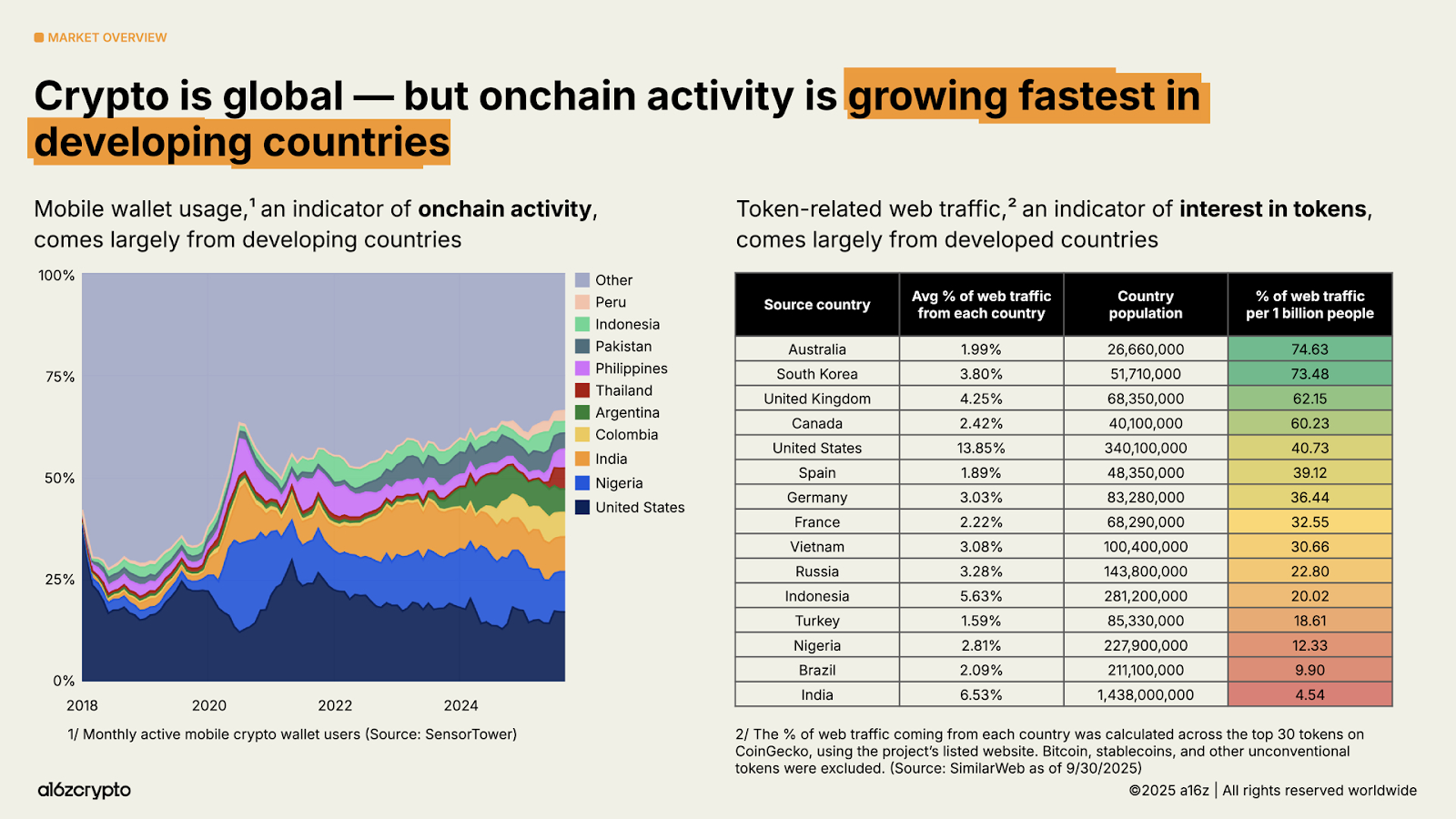

Market trends show a clear shift:

- 2021, investors mostly traded on centralized exchanges. By 2024 and 2025, attention and capital shifted heavily to the onchain space through platforms like pump.fun, AI agents, and new memecoin variants such as ICM, x402, and ERC 8004.

- The rise of Hyperliquid signaled to centralized exchanges that onchain activity will dominate over the next five to ten years. This is why CZ has actively promoted Aster, a direct competitor to Hyperliquid.

- Research from a16z paints a similar picture. Mobile crypto wallet usage, a key indicator of onchain activity, is rising fastest in emerging markets like Argentina, Colombia, India, and Nigeria. In Argentina alone, mobile crypto wallet usage increased sixteen times in three years.

- More products are now launching directly onchain instead of following the old path of launching on CEX first and moving to onchain later. This trend accelerated as launchpads and billion dollar memecoins like GOAT, AI16Z, PNUT, and SPX6900 began to appear.

Opportunities now lie onchain, and user behavior has changed significantly. Users have become familiar with Web3 wallets, rely less on centralized exchanges, prefer self custody, and spend more time on onchain applications.

If major players like Binance, Bybit, OKX, or Coinbase do not quickly capture this growing onchain market and instead rely only on traditional CEX models, their revenue may decrease significantly in the coming years.

From a business model perspective, Binance, Coinbase, and Robinhood fundamentally share the same revenue model, which is earning percentage based fees on trading volume. The problem is that the traditional CEX structure cannot expand fast enough to match the explosive growth of onchain tokens and user activity.

If they remain only as intermediaries, their growth potential becomes limited. The next step is to transition from an offchain service to a full onchain ecosystem.

This creates a common pressure. Major exchanges must move onchain to play the long term game. They are not stopping at launching Layer 2. They are expanding or acquiring other components like DEXs, their own blockchains, and launchpads to keep users inside their ecosystems.

Coinbase is the clearest example, having built Base, a Layer 2 on Ethereum. Other exchanges have taken their own paths:

- Kraken launched INK, a Layer 2 focused on DeFi.

- Robinhood deployed a Layer 2 based on Arbitrum Orbit centered on asset tokenization.

- Bybit strengthened ties with Mantle with two C-level executives becoming strategic advisors.

- Binance is heavily educating users about the Binance Web3 Wallet through Binance Alpha, Binance Meme Rush, and CZ’s promotion of Aster.

Base App as the key piece for Coinbase

Base App is not just an all in one application. It is the main entry point connecting more than 100M Coinbase users with the Base ecosystem.

Coinbase has repeatedly stated in earnings calls and interviews that its long term strategy is the onchain economy, not depending solely on centralized exchange trading fees.

When a global company chooses Base App as its central product:

- The product will receive long term investment.

- It will be tightly integrated with Coinbase CEX, USDC, and Base chain.

- It will attract builders through grants, incentive programs, and Base Build.

- It will serve as the main onboarding gateway for new users.

In simple terms, if Base App succeeds, Coinbase succeeds. This forces Coinbase to push the product aggressively.

However, despite Web3’s potential, the biggest barrier remains user experience

- Seed phrases are difficult to remember.

- Gas fees vary across chains.

- Users must switch between many wallets, apps, and chains.

- There is fear of scams or pressing the wrong button.

Base App solves this by acting as a bridge for Web2 users entering Web3. The top layer looks like a familiar social feed with interaction and following functions, while the bottom layer is powered entirely by onchain infrastructure.

In reality, no matter how good an onchain product is, if it requires too much knowledge and too many steps, it will struggle to reach large mainstream audiences. The real market lies in that mainstream group, not in the noisy community of experienced traders on Crypto Twitter.

As of Q4 2025, Coinbase is almost the only company that has built a serious Web2 to Web3 bridge at scale. Competitors are either not ready or still experimenting without offering a complete end to end experience for regular users.

If Coinbase leads Base App to success early, it will gain a major advantage. It can build a closed ecosystem where users move from CEX to onchain fully inside the Coinbase environment without needing multiple apps.

This early stage is also an opportunity for investors who act early. While Coinbase is still heavily using incentives, mini airdrops, and fee discounts to attract users to Base App, early adopters will benefit the most.

New in the Base app: Trading just got even easier.

— Base App (@baseapp) November 5, 2025

See what people are buying, and trade right from your feed with a new card that shows all the important details. pic.twitter.com/4qH4oD9WlQ

Base App introduces in-feed trading, allowing users to monitor activity and execute trades directly from the feed.

Why should users start using Base App today?

Opportunities to receive BASE token airdrop

Base App acts as a bridge bringing Web2 users into the Base ecosystem. Every action in the app, from posting and using mini apps to trading, happens directly on Base. It is therefore reasonable to expect that being active on Base App can become a key criterion for receiving future rewards.

Beyond potential rewards from Base itself, users can also expect ecosystem mini airdrops similar to Farcaster’s DEGEN distribution, where early users and active creators received tokens.

However, there is also another possibility. Base might not launch an airdrop.

- Base already has a large, diverse user base with nearly three years of mainnet history. Distributing tokens fairly across the entire ecosystem would be difficult.

- If the distribution is poorly received, it could harm the reputation of both Base and Coinbase, especially given the thousands of builders and creators who have supported Base for years.

In that case, an ICO model like Monad’s launch could be a better approach. If this happens, regular activity on Base App may become a requirement to purchase $BASE during early allocation rounds instead of receiving tokens for free.

Opportunities from Base incentives

Although Coinbase is one of the largest exchanges in the United States, that reputation alone is not enough to pull users into Base. Traditional CEX habits and KYC barriers lead users to enter and exit quickly without staying long enough on the onchain side.

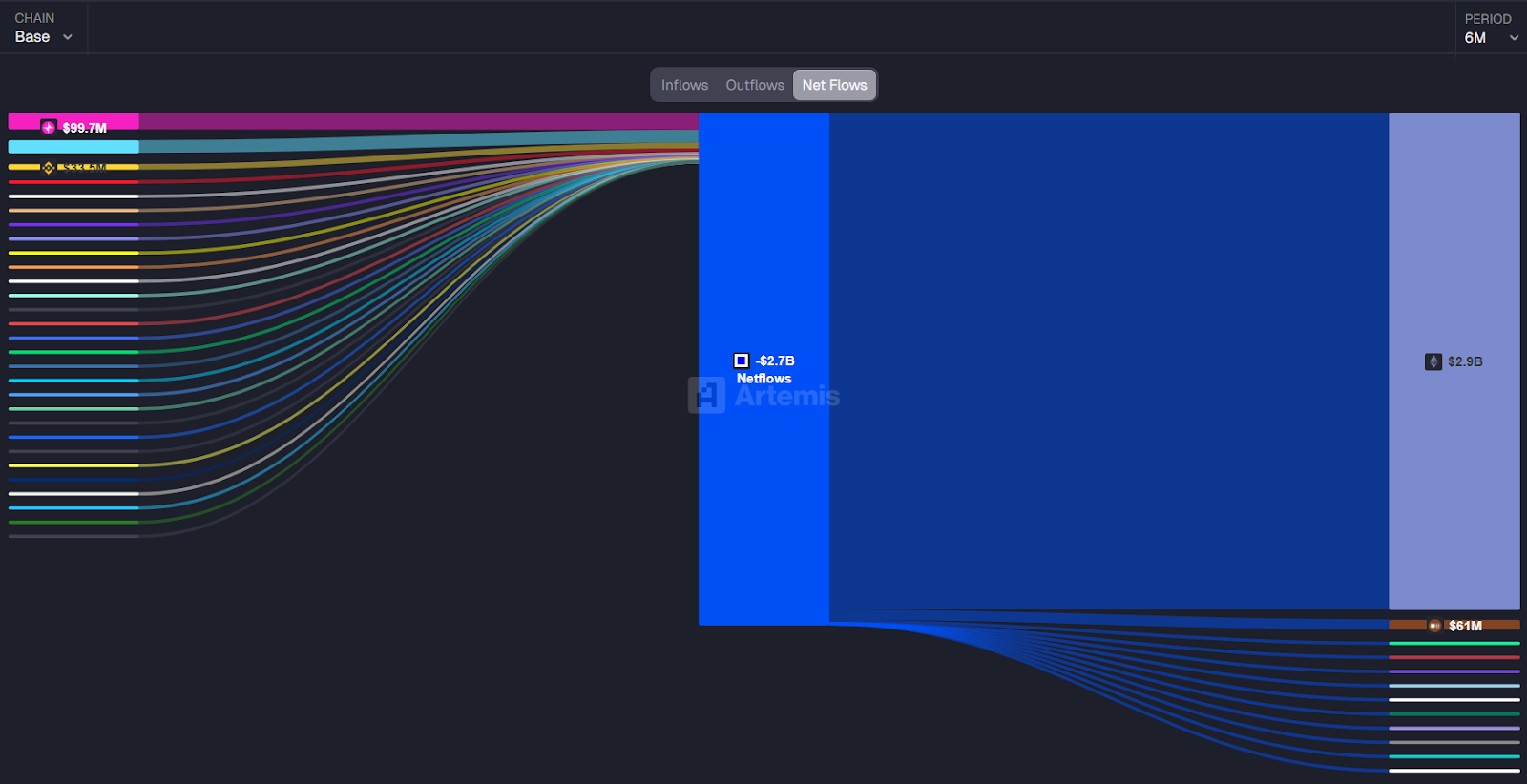

During the past six months, Base recorded around $2.7B outflows from the network, among the highest across all chains.

Base App is therefore designed as a new gateway to attract and retain users on Base. It offers a friendlier interface and more social and financial activities.

In return, Coinbase will likely provide incentives and run promotions to encourage Base App usage, especially as the open version for all users is about to launch.

Incentives may come in various forms:

- Rewards for providing liquidity through DeFi mini apps to deepen Base network liquidity.

- Rewards for creators and traders who trade directly inside the app.

- Reduced or zero fees for selected actions.

- High APY for holding stablecoins in Base App.

- Airdrops based on assets held in the app. Many Base users previously received the VVV airdrop for holding CLANKER tokens.

These incentives provide passive and low risk earnings during bear markets, and users do not need to move across many dApps to access them.

Overall, Base App is becoming the center that creates a seamless experience, supports high retention, and builds a closed ecosystem where all incentives cycle back into Coinbase’s system.

- High rewards for creators lead to higher quality content, which attracts more users.

- Incentives for DeFi draw liquidity providers, which improves liquidity and attracts traders.

- More traders and users pull in more builders and higher quality dApps.

This creates a positive flywheel for both Base and Coinbase. To start this flywheel, incentives are necessary and users are the ones who benefit.

Opportunities for researchers, degens, and KOLs

Not only builders but also researchers and active degens can use Base App to share insights, opinions, or even calls.

- Creators receive exactly 50% of trading fees when users trade coins or content under their ticker or post.

- Base is extremely active with memecoins, second only to Solana. This means people who hunt trends or write narratives can post directly on Base App and immediately tap into a large liquidity pool and community.

This creates an attractive loop where creators, researchers, and degens can share insights, validate them with onchain data, and earn fees or airdrops at the same time.

A @baseapp notif hits different pic.twitter.com/cQ9aNelrkS

— aneri.base.eth (@0xAneri) October 17, 2025

Creators receive 50% of trading fees

Conclusion

Base App offers a practical way for users to access onchain features within a familiar, Coinbase connected environment. It reduces friction by combining wallet, trading, payments, DeFi, and social activity in a single app, while still allowing users to keep control of their assets.

For those who expect Coinbase to continue investing in its onchain strategy, using Base App early is a reasonable way to explore the ecosystem, understand how it works in practice, and potentially benefit from any future incentive programs tied to real usage.

FAQs

Q1. How is Base App different from a typical crypto wallet?

Base App goes beyond basic storage and transfers. It combines wallet functions with trading, simple payments, DeFi mini apps, and a social feed, so most onchain actions can be done inside one application instead of juggling multiple tools.

Q2. Who is Base App mainly designed for?

Base App targets users who are familiar with Coinbase or CEX trading but have limited experience with Web3. It is also suitable for more advanced users who want a cleaner way to manage onchain trading, DeFi, and content in a single place.

Q3. How does Base App connect to the broader Coinbase ecosystem?

Base App is tightly linked with Coinbase CEX, USDC, and the Base chain. Users can move from centralized trading to onchain activity while staying inside the Coinbase environment, which reduces the number of separate apps and services they need to manage.

Q4. What can users actually do inside Base App day to day?

Users can trade onchain assets, send and receive payments, interact with DeFi strategies through mini apps, and post or consume content in the social feed. Many of these actions are tied directly to the Base network rather than staying offchain.

Q5. Are incentives and airdrops the only reason to consider Base App?

No. Incentives and possible airdrops are one part of the story, but the core value is smoother access to onchain activity. Even if reward programs change over time, users still gain experience with an app that simplifies Web3 usage.

Q6. Why might some users want to try Base App early?

Early usage helps people understand how onchain products work in practice in a lower friction setup. It also positions them to qualify for any future incentive schemes that may use real in-app activity as a reference, whether that is an airdrop, sale allocation, or fee benefit.