Decentralized perpetual trading currently faces significant friction due to fragmented liquidity and the complexity of managing native assets across multiple blockchain networks. VOOI has emerged as a specialized solution to solve this challenge. So what is VOOI, and what products does it offer?

What is VOOI Network?

VOOI is a cross-chain perpetual DEX aggregator, designed for flexibility across both EVM (Ethereum Virtual Machine) and non-EVM networks. It simplifies perpetual trading by leveraging chain and account abstraction. This technology provides users with gas-efficient access to aggregated liquidity and a seamless, unified interaction experience regardless of the underlying network.

VOOI’s Product

VOOI offers two product variants for decentralized perpetual trading: VOOI Light and VOOI Pro (Unified Trading Terminal). In both products, users retain sole custody of assets and private keys, and must authorize all interactions with external protocols.

Trading fees on VOOI are determined by the respective DEX or trading protocol and are subject to change.

VOOI Light

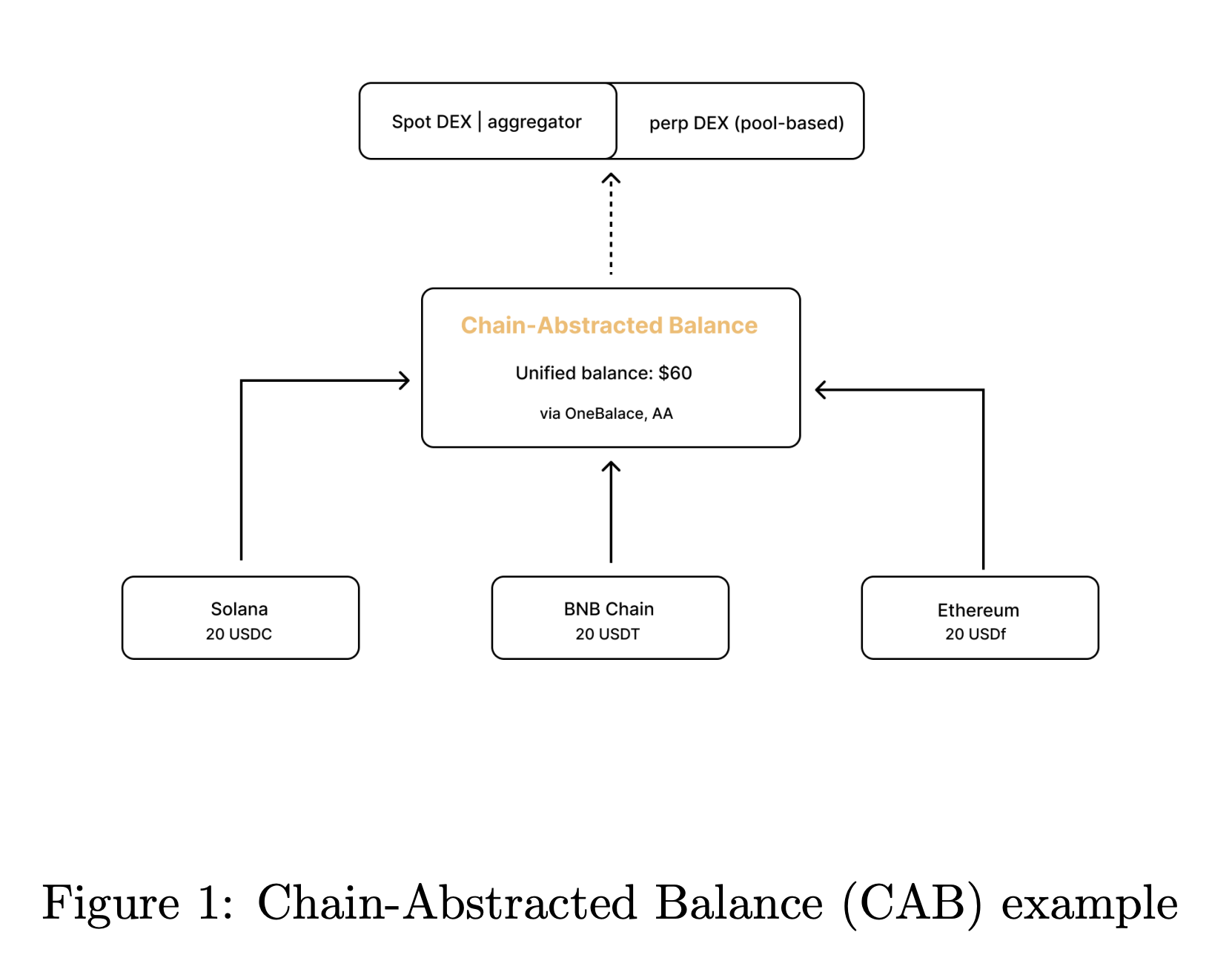

VOOI Light is a chain-abstracted interface for spot and perpetual trading across multiple blockchains and venues. It introduces a single Chain Abstracted Balance (CAB) used to settle execution costs and fund movements after user confirmation, removing the need to manage gas per chain.

Through the Chain Abstracted Balance (CAB):

- Orders and fund routes are coordinated by VOOI Light.

- Execution fees and transfers are settled from the user’s CAB once approved.

- Only users can initiate actions on integrated protocols; VOOI cannot move funds without user signatures.

In short, VOOI Light simplifies user interaction by abstracting away the complexities of managing native assets on multiple chains for transaction fees and fund movements.

As of Nov 17th, 2025, VOOI Light is in its Beta phase.

VOOI Light Beta supports trading via KiloEx, GMX, and Ostium:

- Spot trading networks: Arbitrum, Base, BNB Smart Chain, OP Mainnet, Polygon, Linea, Ethereum, Solana.

- Perpetual trading networks: Arbitrum, Base, BNB Smart Chain.

VOOI Pro

VOOI Pro (or VOOI Unified Trading Terminal) is a consolidated terminal for trading across multiple perpetual DEXs (e.g., Orderly, HyperLiquid) and trading marketplaces across several networks. It focuses on providing consistent order entry, portfolio visibility, and optional automation hooks.

The terminal serves to centralize access to diverse markets, thereby enhancing execution efficiency. Critically, VOOI Pro supports a full suite of professional trading operations (Market, Limit, Stop Limit, Stop Loss, and Take Profit Orders), which are essential for effective risk and position management.

VOOI Pro integrates Ostium marketplace on Arbitrum, and some following Perp DEXs:

- Aster on BNB Chain, Arbitrum One, Ethereum

- Hyperliquid on Arbitrum

- Orderly on Arbitrum, Optimism, Base, Mantle, Sei, Ethereum, Avalanche, Morph, Sonic, Bearchain, Story, Solana

In addition, the VOOI Pro incorporates an AI Copilot to assist with navigation and provide contextual suggestions, alongside features that facilitate automated trading via signal bots. Though, it is important to note that it is not a financial advisor.

VOOI’s Key Features

- Gas-efficient trading via abstraction: VOOI Light uses a Chain Abstracted Balance (CAB) and account abstraction so users do not manage per-chain gas. This removes the common friction of managing native assets and gas fees across multiple chains by utilizing a single cross-chain balance for all execution costs.

- Advanced professional order suite: The VOOI Pro Terminal supports advanced trading strategies through a full suite of professional order types, including crucial risk management features such as Stop Loss, Take Profit, and Limit Orders, optimizing execution precision.

- Unified multi-chain aggregation: The platform centralizes access by aggregating multiple perpetual DEXs and trading marketplaces across a wide array of EVM and non-EVM networks. This integration provides users with one unified interface for broad market access, reducing interface switching and standardizing order entry.

$VOOI Information

$VOOI Key Metrics

Here is the information of $VOOI

- Token Name: VOOI

- Ticker: $VOOI

- Token Type: Governance & Utility.

- Total Supply: 1,000,000,000 $VOOI

- Blockchain: TBA

- Contract address (CA): TBA

$VOOI Use Case

$VOOI’s primary utilities are designed to work together across the VOOI ecosystem while preserving the protocol’s decentralization.

- VOOI Governance: $VOOI holders gain the ability to propose, vote, delegate, and help shape parameters and roadmap priorities.

- Maximise and Boost VOOI Yield Products: Staking or locking $VOOI can unlock defined yield boosts on eligible products with transparent caps and criteria.

- Discount VOOI Trading Fees: Qualified holders may receive fee discounts that scale by balance, stake, lock duration, or activity tier.

- Reward Contribution to VOOI: Contributors can earn programmatic rewards for verifiable actions that improve execution quality, liquidity depth, and platform reliability.

- Pre-Access to VOOI Products: Governance-aligned users may receive priority access to pre-release features and modules in the Trading SuperApp.

$VOOI Listing Details

- Listing Date: TBA

- Confirmed CEX Listings: TBA

- Pre-Market Price (Whales Market): TBA

VOOI Tokenomics & Fundraising

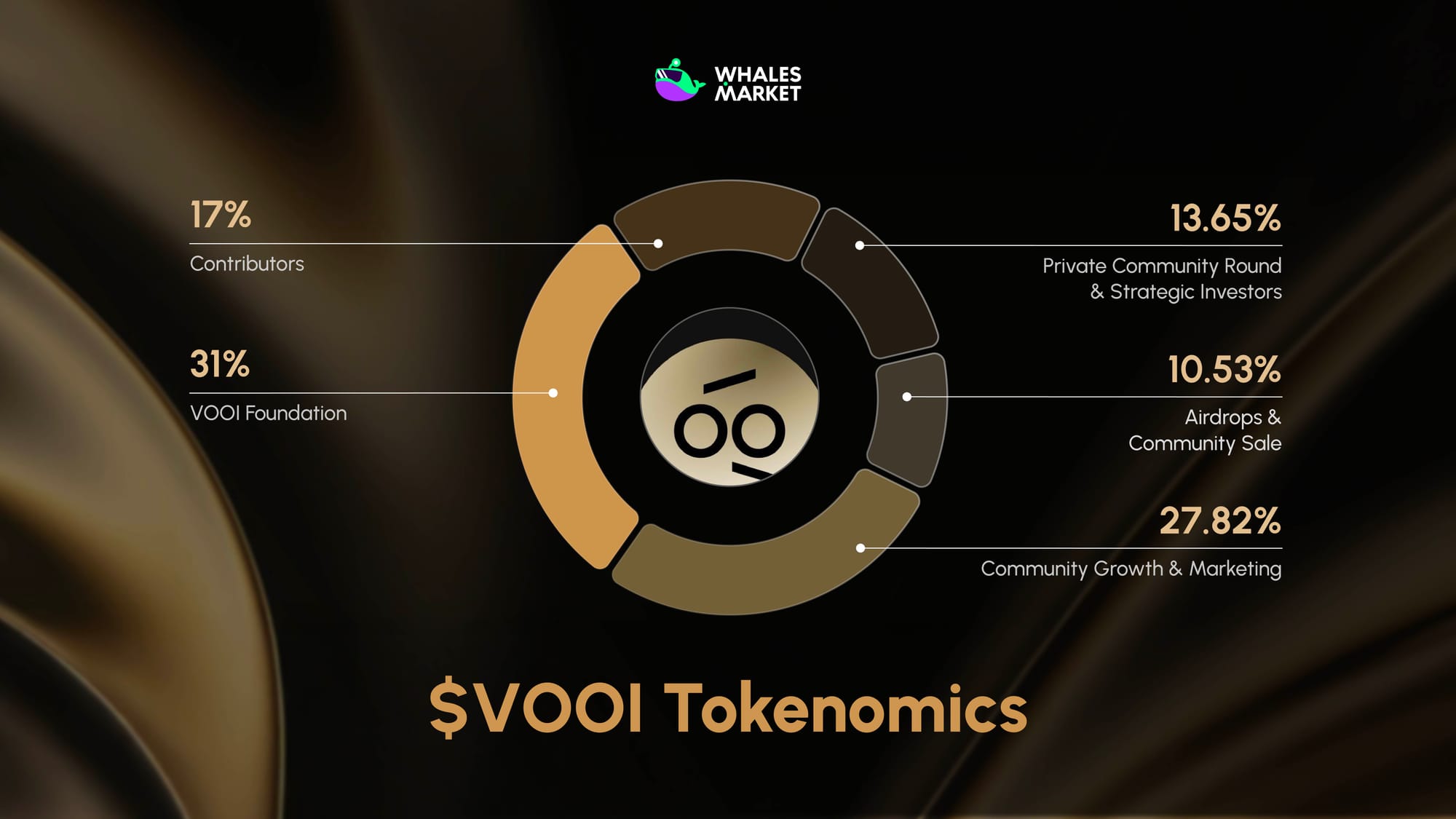

$VOOI Tokenomics

Total Supply: 1,000,000,000 $VOOI

$VOOI Allocation:

- VOOI Foundation: 31%

- Community Growth and Marketing (incl. Airdrop Season 2): 27.82%

- Contributors: 17%

- Private Community Round and Strategic Investors: 13.65%

- Airdrops and Community Sale: 10.53%

VOOI Fundraising

On August 22nd, 2024, VOOI crypto company received private funding from YZi Labs (formerly known as Binance Labs) as a part of its BNB Chain’s Most Valuable Builder (MVB) Program. The funds raised remain undisclosed.

VOOI’s Roadmap & Team

Roadmap

Phase 1 (2024 Q2) - Done: VOOI v1 – Unified Trading Terminal

Phase 2 (2025 Q1–Q2) - In progress:

- Q1: Introduction of Derivative Marketplaces & AI support introduction;

- Q2: Launch of VOOI based on the Chain Abstraction approach and VOOI XP Program introduction.

Phase 3 (2025 Q3–Q4): VOOI V3 – VOOI Ultra

Team

The team behind VOOI consists primarily of members with substantial prior experience in the cryptocurrency market:

- Will K (Co-Founder and CEO at VOOI): He previously held the role of Co-Founder at the Symbiosis project.

- Aleksei Svetlovskii (CPO and CMO at VOOI): He brings 14 years of executive experience, having served as CPO for various crypto projects.

Conclusion

VOOI’s dual-product approach marks a significant step toward solving the current fragmentation crisis in perpetual DEX trading. By strategically employing Chain Abstraction (in VOOI Light) to enable gas-efficient cross-chain operations and integrating a full suite of professional risk management tools (in VOOI Pro), the platform positions itself to lower the barrier to entry for complex trading strategies.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of VOOI?

The native token of VOOI Network is $VOOI. It is officially designated as a Governance and Utility token, with its primary function being decentralized participation in platform decisions.

2. Is $VOOI a good investment?

This depends on your risk tolerance and diligence. Carefully evaluate:

- Product adoption and uptime across venues.

- Security posture and audits.

- Fee and routing quality.

- Breadth of integrations.

- Clear tokenomics (supply, unlocks, emissions, buyback policy).

- And real value capture for holders.

Until tokenomics and listings are public, any view is speculative. This is not financial advice.

3. What is VOOI ($VOOI) pre-market price?

As of the article's date (November 17, 2025), no official pre-market or presale price for $VOOI has been announced.

4. What is the price of VOOI ($VOOI) today?

No official listing or live market price has been announced as of the article's date (November 17, 2025). If you see OTC/IOU quotes on third-party platforms, treat them as unofficial and highly speculative.

5. How much has VOOI ($VOOI) raised?

VOOI received private funding from Changpeng Zhao’s family office, YZi Labs (formerly known as Binance Labs). However, the specific amount of funds raised remains undisclosed.