Nearly every major blockchain today runs one shared engine: the Ethereum Virtual Machine (EVM). It’s the backbone of Web3’s multi-chain era, powering billions in DeFi transactions and thousands of decentralized apps across the globe.

But what exactly makes the EVM so universal in crypto, and why has it become the standard that every blockchain wants to be compatible with?

What is EVM in crypto?

The Ethereum Virtual Machine (EVM) is a decentralized computation engine responsible for executing smart contracts on the Ethereum network and managing the state of the blockchain.

EVM acts as the runtime environment for all Ethereum accounts and smart contracts, enabling developers to deploy decentralized applications that operate securely without relying on any central authority.

The EVM operates within Ethereum client software that users run to operate a node. Every node on the Ethereum network runs the EVM to maintain data consistency across the blockchain while preserving its decentralized nature.

Some definitions related to EVM in crypto

Anyone involved in crypto has likely come across the term EVM compatibility (or EVM compatible). It refers to the ability of a blockchain, wallet, or decentralized application (dApp) to support and execute smart contracts originally written for the Ethereum Virtual Machine (EVM).

In simpler terms, if something is EVM-compatible, it can run Ethereum-based code with little or no modification.

- EVM blockchain: Any blockchain that can interpret and execute EVM bytecode. These networks (such as BNB Chain, Polygon, Avalanche, and Fantom) mirror Ethereum’s execution environment, allowing developers to deploy existing Ethereum smart contracts seamlessly across multiple chains.

- EVM address: A unique 42-character identifier (starting with “0x”) assigned to every account or smart contract on an EVM-compatible blockchain. It functions like a public account number, used to send or receive crypto assets and interact with smart contracts.

- EVM wallet: A software tool that generates and manages EVM addresses. It stores private keys, signs transactions, and connects users to decentralized applications. Each wallet can manage one or multiple EVM addresses. Popular EVM wallets examples include MetaMask, Trust Wallet, and Rabby Wallet.

How Ethereum Virtual Machine works

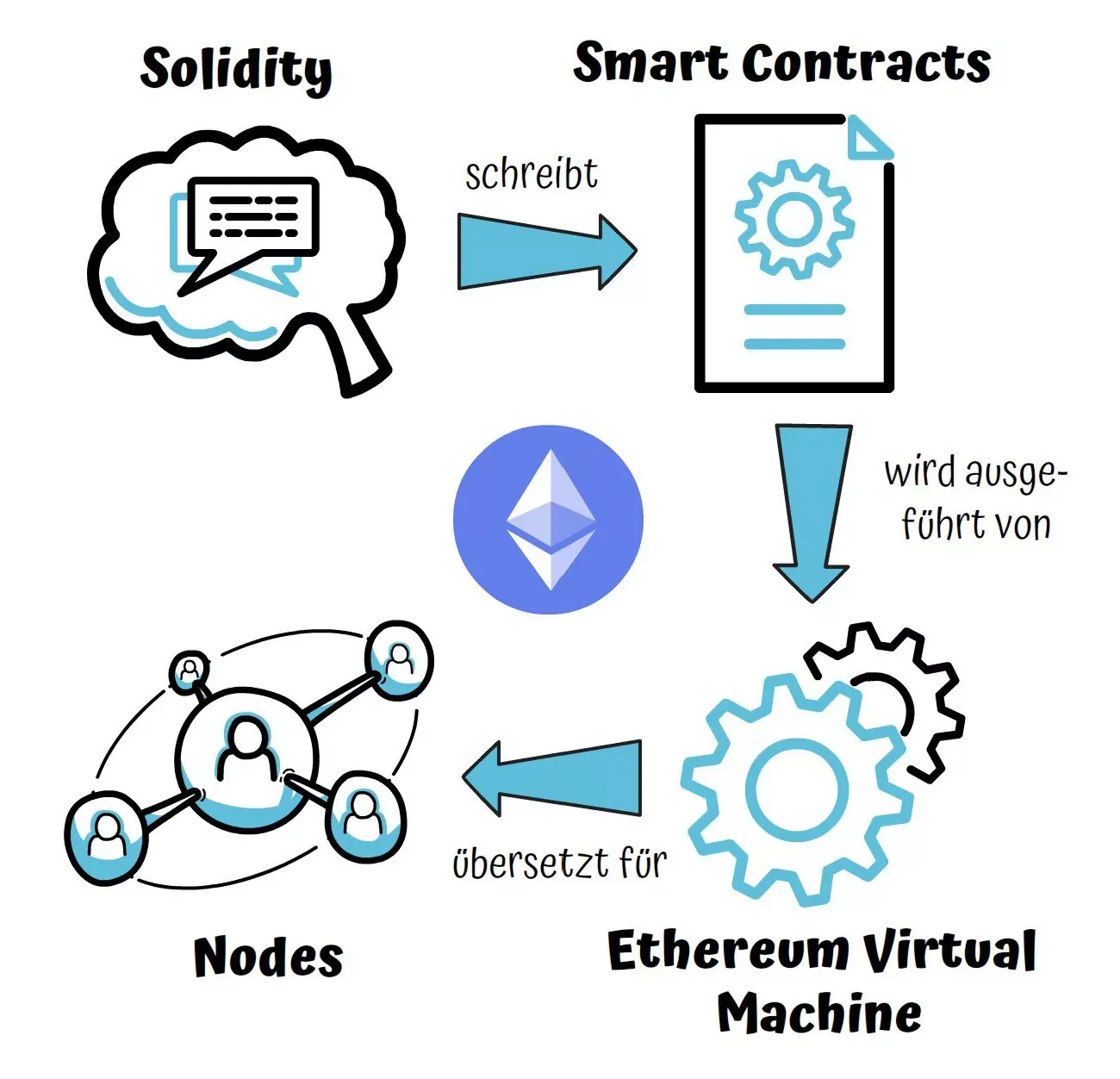

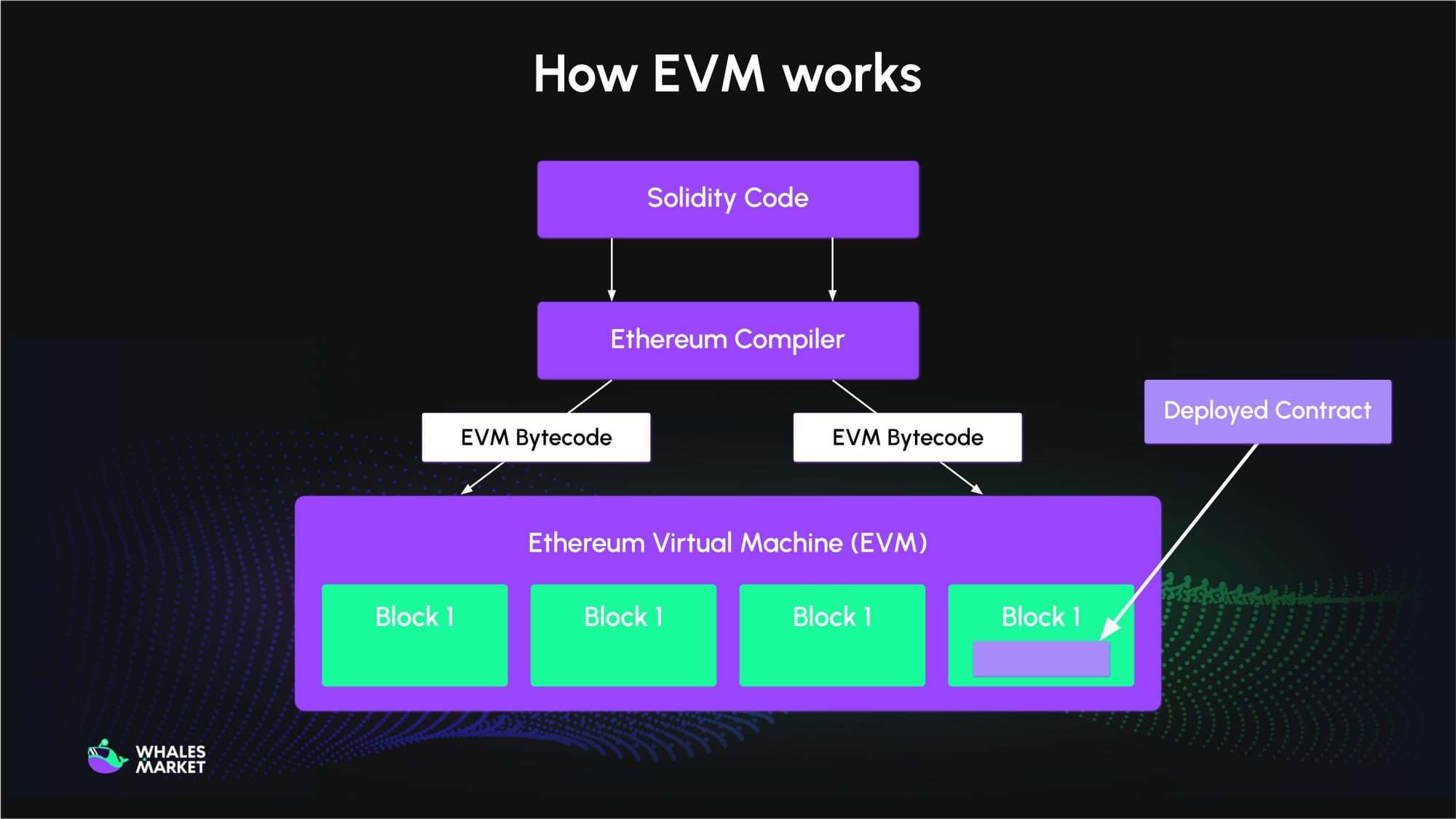

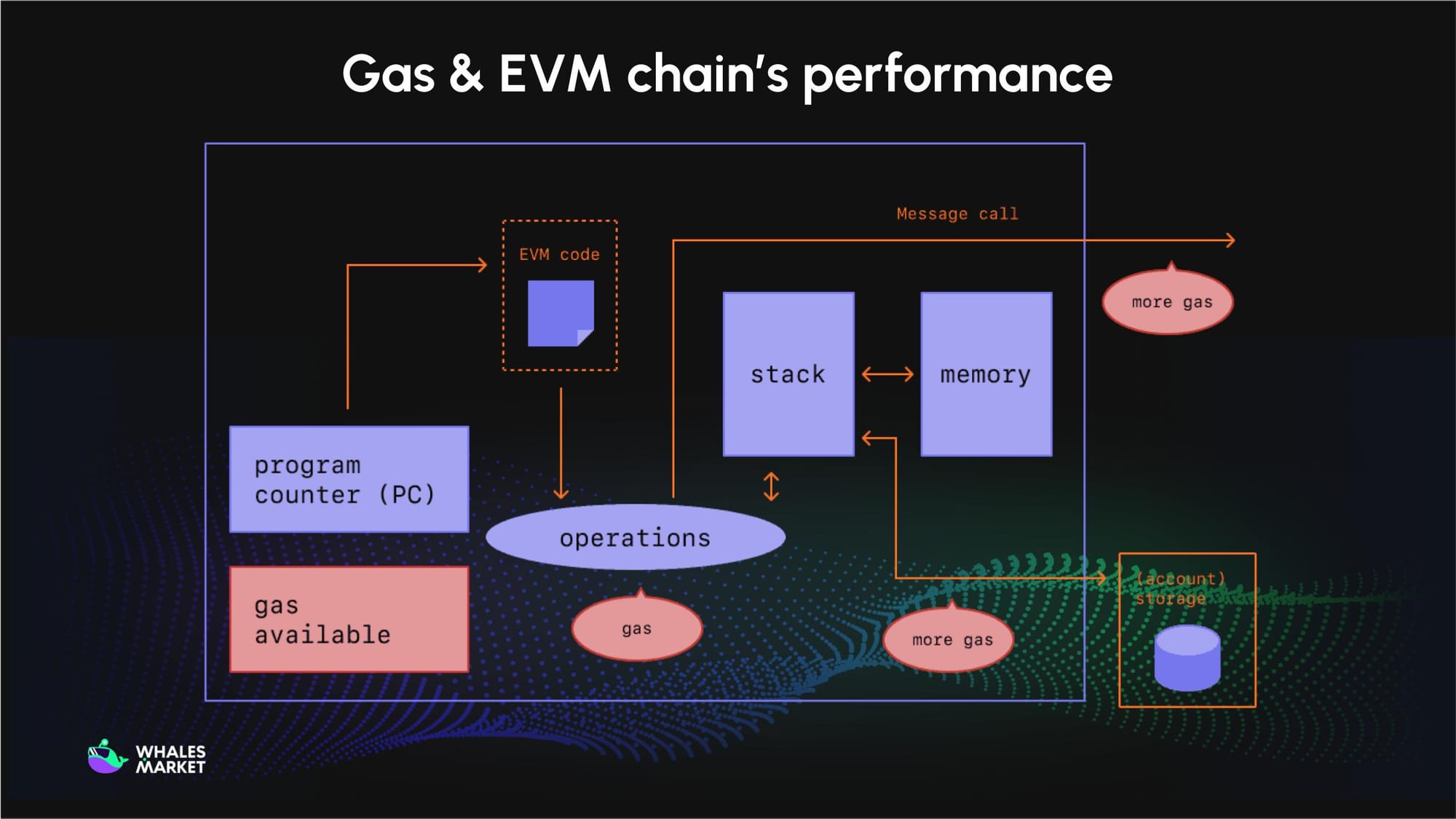

When a transaction triggers a smart contract, the Ethereum Virtual Machine (EVM) loads all relevant data before execution begins, including the gas limit, wallet address, balance, and input parameters. Smart contracts are written in Solidity or Vyper and compiled into bytecode, the low-level machine code that the EVM can interpret and run.

The EVM operates under two fundamental principles:

- As a state machine, it processes inputs such as transactions or contract calls and produces a new global state for the Ethereum network. For example, updating wallet balances, modifying contract data, or adding new blocks.

- As a stack machine, it manages temporary data using a stack (last in, first out), enabling efficient execution of calculations, logic operations, and function calls.

Every node in the Ethereum network (running clients such as Geth, Nethermind, or Besu) contains its own copy of the EVM. All nodes execute the same instructions in the same sequence to ensure consistent and decentralized results across the network.

If a transaction runs out of gas during execution, the EVM halts and reverts all temporary changes, though validators still receive gas fees for the computation performed.

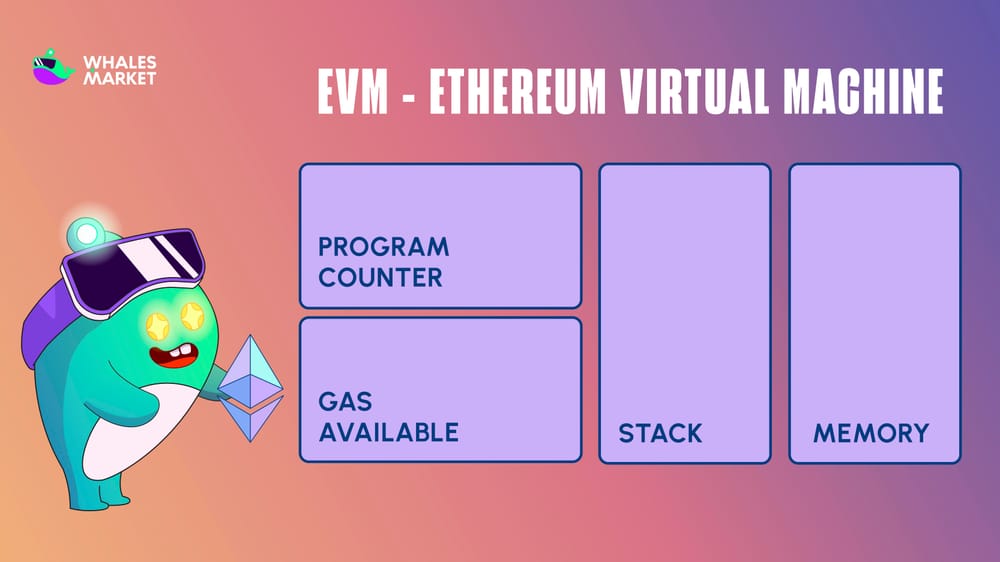

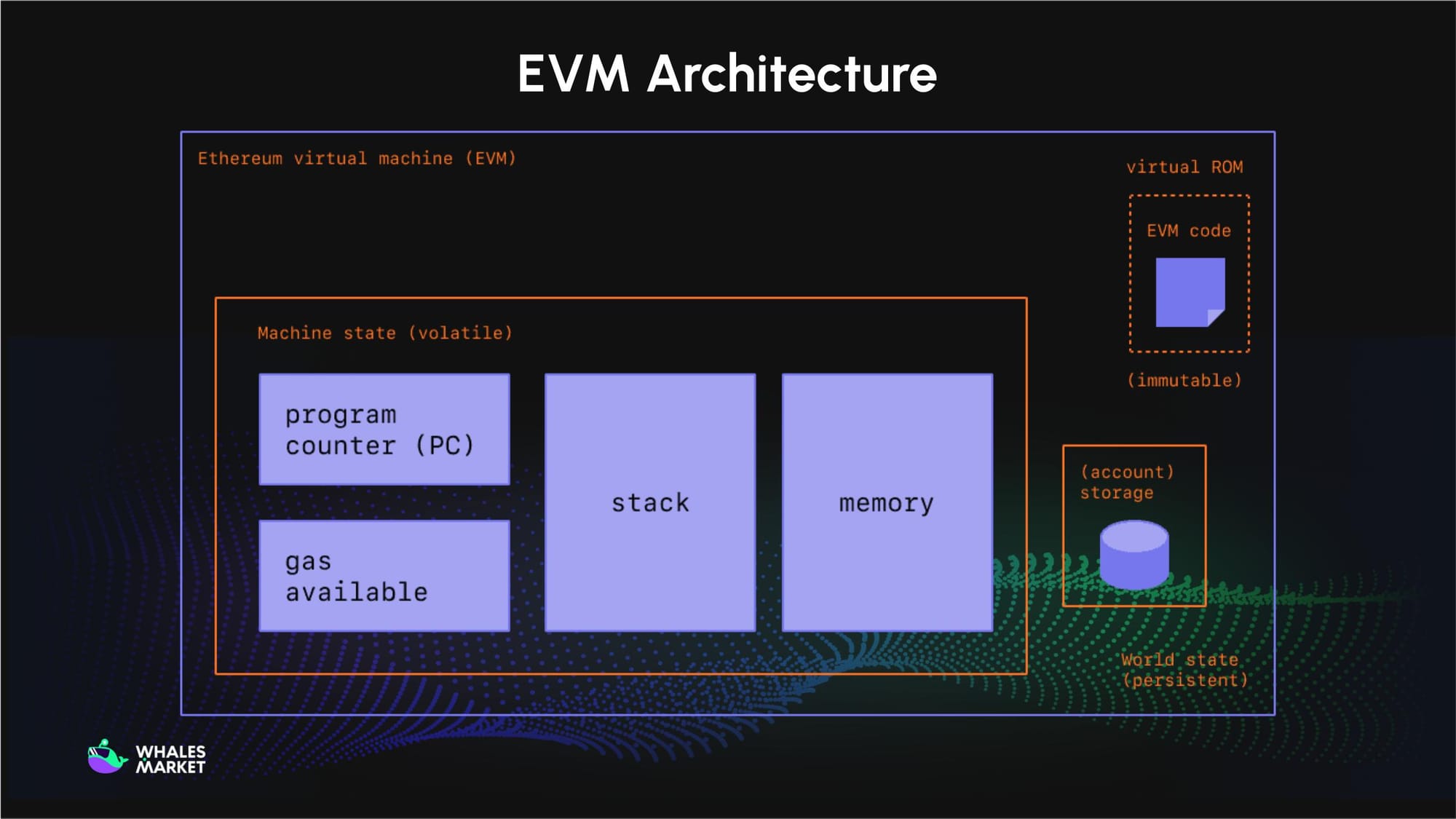

Inside the EVM, three main components work together:

- World state: Stores all accounts, balances, and contract code on the Ethereum network.

- Machine state: Tracks the execution process, including the program counter, remaining gas, stack, and temporary memory.

- Virtual ROM: A read-only section containing immutable bytecode that the EVM interprets and executes.

Through this design, the EVM guarantees that every transaction on Ethereum is processed securely, consistently, and automatically across thousands of nodes. Thus making Ethereum a true global computer for the Web3 era.

Features of Ethereum Virtual Machine (EVM)

Some key features of EVM include:

- Deterministic execution: For any given input, EVM always produces the same output, no matter when or where it’s executed. This ensures all nodes on the network reach the same result when processing transactions or running smart contracts, which is critical for maintaining consensus in a decentralized environment.

- Isolation and Security: Every smart contract on Ethereum runs in an isolated environment, separated from the main network and from other contracts. This isolation prevents bugs or malicious behavior in one contract from affecting the rest of the system, protecting the overall blockchain from cascading failures or attacks.

- Termination via gas mechanism: EVM introduces a gas system to prevent infinite loops and resource abuse. Each operation requires a certain amount of gas, and when the gas limit is reached, execution stops automatically. This ensures that all computations are bounded, protecting the network from overloads and encouraging developers to write efficient code.

- Turing-complete computation: EVM can, in theory, compute any solvable problem given enough resources. This flexibility allows developers to build a vast range of decentralized applications all within the same ecosystem, from simple payment contracts to complex DeFi protocols and DAOs.

- Universal compatibility: The EVM’s interoperability enables projects to deploy across multiple networks (like BNB Chain, Polygon, and Avalanche), helping expand Ethereum’s influence beyond its own chain.

Gas and How it affects the performance of EVM

In the Ethereum Virtual Machine (EVM), gas represents the computational cost of every action, from executing smart contracts to transferring tokens. Each transaction requires a certain amount of gas, paid in Ether (ETH), to compensate validators.

When network activity increases, Ethereum’s fee market causes gas prices to rise, as users compete to include their transactions in the next block.

Gas directly impacts EVM performance because it limits how much computation can occur in a single transaction. The EVM tracks:

- Gas limit: The maximum amount of work a transaction can perform.

- Gas used: The amount consumed during execution.

- Gas price: How much a user is willing to pay per unit.

If gas runs out mid-execution, the EVM halts the transaction and reverts changes, maintaining network consistency. To overcome high fees, EVM-compatible chains use Layer-2 solutions like Optimistic Rollups and zk-Rollups, which bundle many off-chain transactions into one mainnet update.

This reduces costs and increases throughput, though often with trade-offs such as lower decentralization or smaller validator sets.

Why many developers build EVM chains

EVM chains are blockchain networks that use the Ethereum Virtual Machine (EVM) to execute smart contracts written in Solidity.

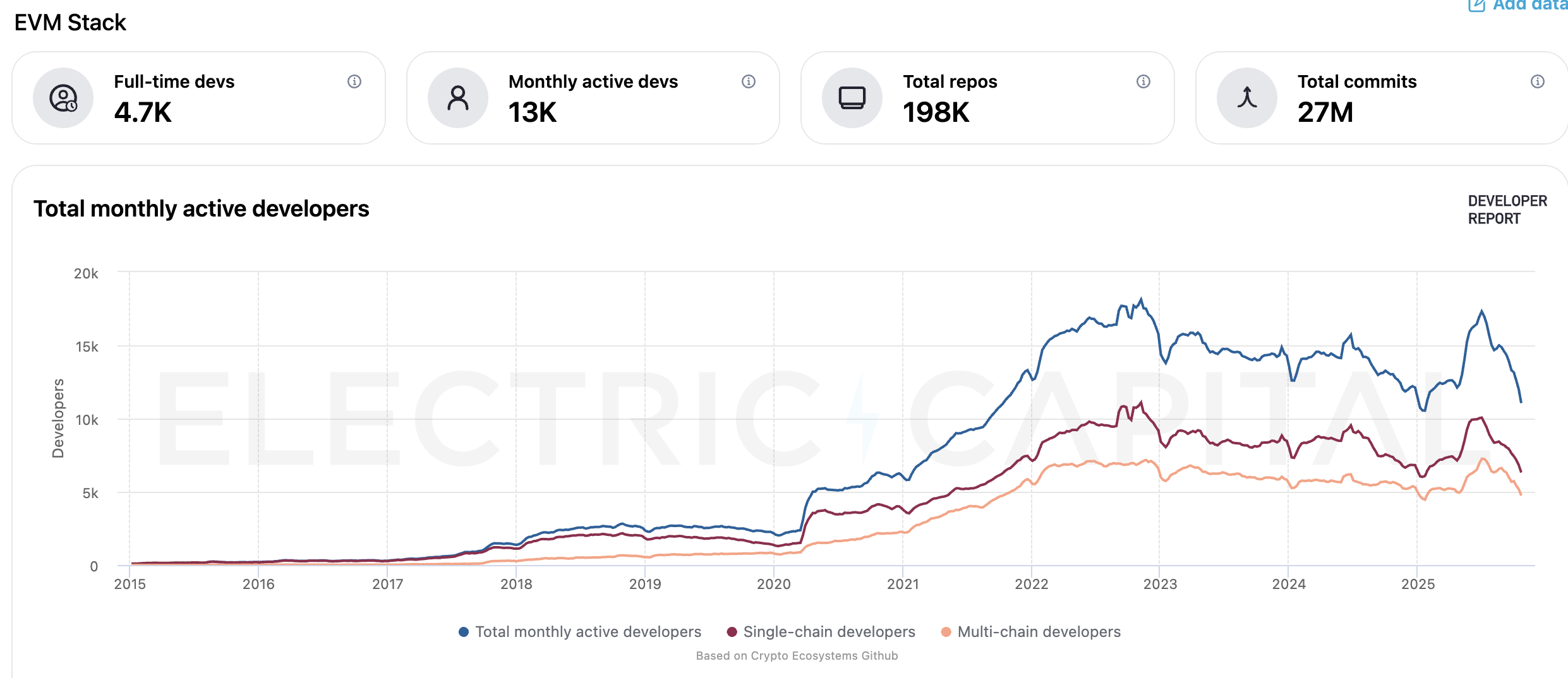

Since Ethereum introduced the Ethereum Virtual Machine (EVM), it has become the industry standard for smart-contract development. Building on the EVM lets developers reuse available tools, deploy existing dApps with minimal code changes, and instantly connect to Ethereum’s massive user base and liquidity.

New EVM-compatible chains can tailor performance, offering lower gas fees, faster transactions, and custom consensus models, while remaining interoperable with Ethereum. This flexibility makes EVM the foundation of today’s multi-chain Web3 ecosystem, inspiring dozens of networks that extend Ethereum’s reach and scalability.

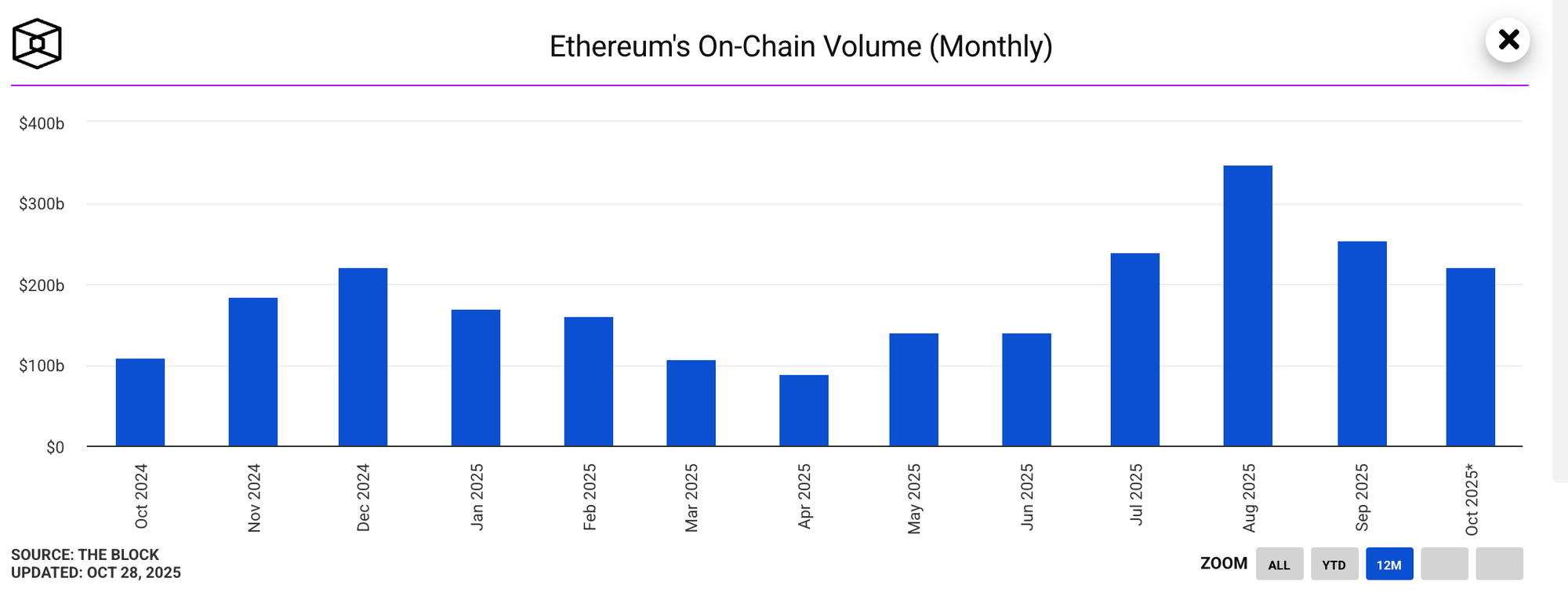

Moreover, as of October 28, 2025, Ethereum remains the largest blockchain ecosystem, with $88 billion in total value locked (TVL) and over $100 billion in monthly on-chain transaction volume.

For this reason, EVM compatibility has become a strategic advantage, enabling any blockchain or dApp to seamlessly connect to Ethereum’s thriving liquidity, infrastructure, and developer community.

Top EVM chains

Below are five of the most prominent EVM chains driving that expansion.

BNB Chain

BNB Chain (formerly BNB Smart Chain) is the blockchain network developed by Binance. It offers full EVM compatibility so that smart contracts written for the Ethereum Virtual Machine can run with minimal modification.

Outstanding features:

- High throughput and low transaction fees thanks to its optimized consensus model and network design.

- Strong ecosystem support from Binance, including project grants, funds and tooling, making it friendly for developers launching DeFi, GameFi or meme-token projects.

- Rapid user growth and real-world uptake in Asia and emerging markets, leveraging its integration with Binance’s broader infrastructure.

BNB Chain remains one of the top Layer-1 ecosystems by TVL and user activity. As of October 22, 2025, its total value locked (TVL) was $13.42B. BNB Chain has been ranked among the four highest chains by TVL, and its 2024 annual report showed a 58% TVL growth.

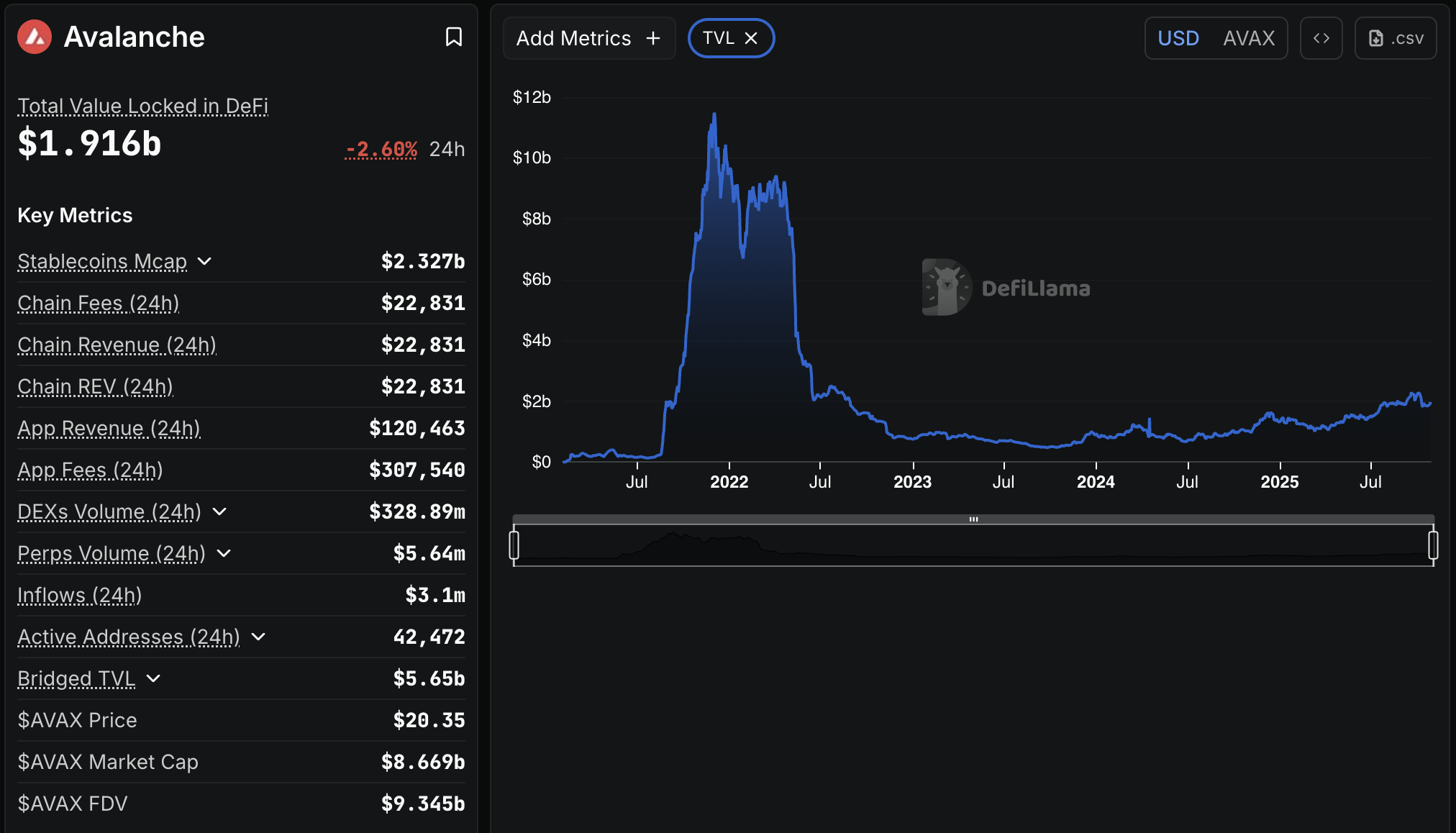

Avalanche (C-Chain)

Avalanche is a Layer-1 blockchain that supports EVM compatibility via its Contract Chain (C-Chain). Developers can deploy Solidity-based smart contracts while benefiting from Avalanche’s native consensus and performance features.

Outstanding features:

- Very fast finality and high throughput thanks to Avalanche’s unique consensus protocol.

- Flexible architecture with subnets and support for custom chains, enabling bespoke deployments for gaming, DeFi or enterprise use.

- EVM compatibility ensures interoperability with Ethereum tooling and assets.

Avalanche maintains meaningful DeFi activity and asset lock-up. According to DeFiLlama, Avalanche’s TVL is recorded around several billion USD, e.g. stablecoin market cap on Avalanche is ~$2.327 billion according to recent data. Its DEX volume also shows strong activity (e.g., ~$328.89 million in 24h as of 28/10/2025).

Arbitrum

Arbitrum is an EVM-compatible Layer-2 roll-up built on Ethereum. It allows smart contracts to run off-chain (or semi off-chain) to reduce costs and improve speed, with roots and final settlement on Ethereum L1.

Outstanding features:

- Strong adoption with many dApps migrating or launching on Arbitrum, thanks to its high compatibility and lower fees.

- Ethereum-level security for transactions because settlement ultimately occurs on Ethereum’s base layer.

- Fast growing ecosystem with tools and bridges making deployment and scaling easier.

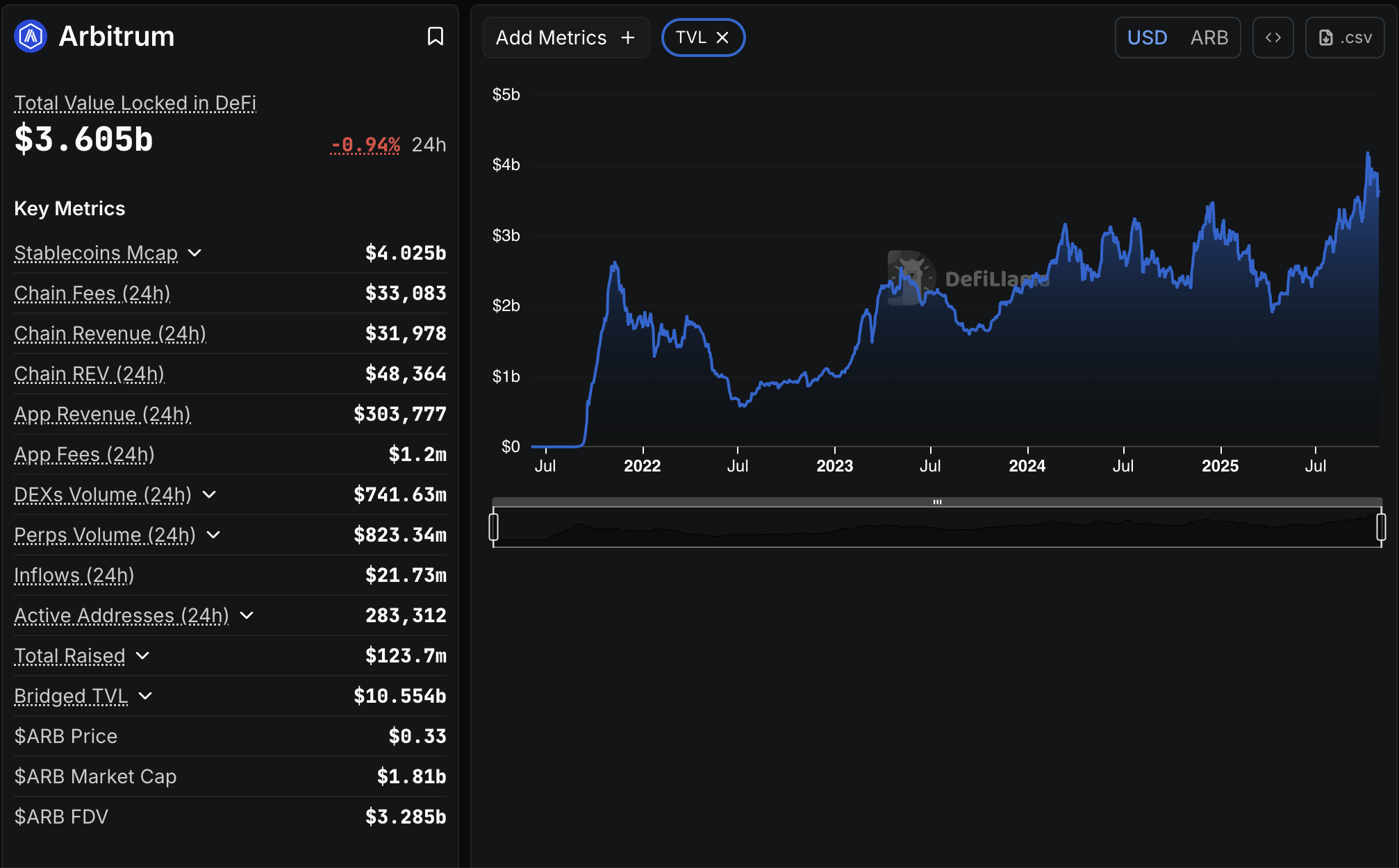

According to DefiLlama, Arbitrum’s TVL in DeFi is about $3.60B as of October 28, 2025. It is one of the dominant roll-up platforms in the Ethereum ecosystem and captures a significant share of Layer-2 DeFi flows.

Optimism (OP Mainnet)

Optimism is another EVM-compatible Layer-2 scaling solution for Ethereum, using optimistic roll-up technology. It aims to enhance Ethereum’s capacity while maintaining compatibility with existing Ethereum contracts and infrastructure.

Outstanding features:

- Compatible with Solidity contracts and Ethereum tooling, making migration and cross-chain work easier.

- Focus on decentralization and ecosystem governance via the Optimism Collective, aligning growth incentives with the community.

- Lower transaction costs and faster throughput compared to Ethereum L1, improving user experience for dApps.

Metrics on DefiLlama show that Optimism’s TVL is more modest compared to some other chains. For example, one dataset shows its total value locked around $358M (as of October 25, 2025). Despite this, it is considered a strategic and growing layer-2 platform with emphasis on governance and composability.

Base

Base is an EVM-compatible chain developed by Coinbase (launched in 2023/2024) built to bring Web3 applications to a broad user base, leveraging Coinbase’s ecosystem and bridging assets from Ethereum.

Outstanding features:

- Deep integration with one of the largest regulated crypto exchanges in the U.S., enabling potentially smoother onboarding and compliance pathways.

- Full EVM compatibility means developers can deploy existing Ethereum smart contracts with minimal changes.

- Designed for scale and mass adoption, with focus on user experience, low fees, and broad tooling from the Coinbase ecosystem.

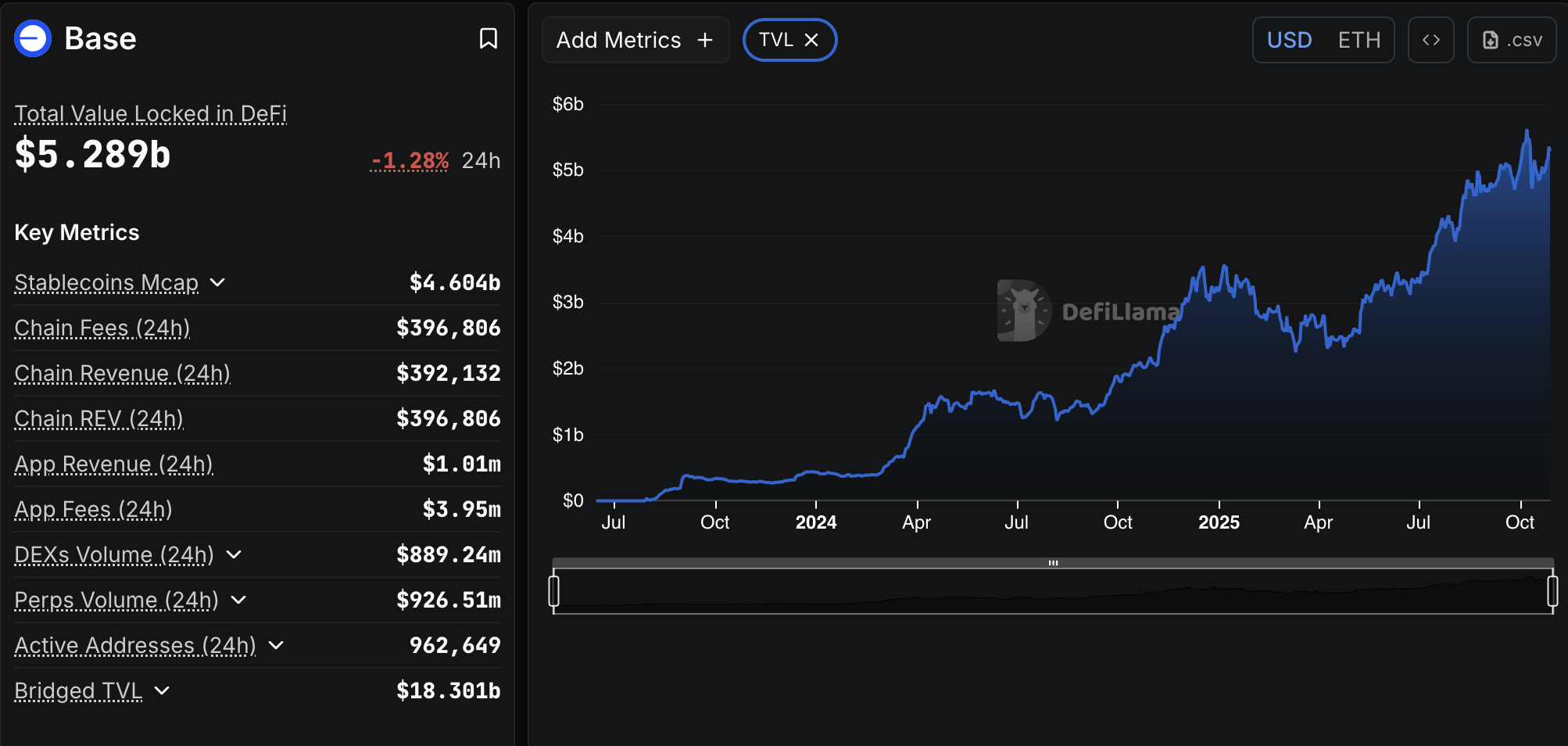

While still early compared to older chains, Base is positioned as a growth platform with potential to capture mainstream users. According to DeFiLlama (Oct 2025), Base’s Total Value Locked (TVL) is around $6.4 billion, making it the third-largest L2 by TVL, behind Arbitrum and Optimism.

Conclusion

The EVM has grown from a technical component of Ethereum into the universal standard for blockchain computation. Its shared framework fuels innovation across dozens of networks, linking developers, liquidity, and communities in one connected Web3 economy.

As the crypto space moves toward modular architectures, zero-knowledge rollups, and cross-chain scalability, the EVM is expected to become even more efficient and accessible. In many ways, it’s not just Ethereum’s virtual machine anymore, it’s the engine driving the next generation of decentralized innovation.

FAQs

What does EVM stand for in crypto?

EVM stands for Ethereum Virtual Machine, which is the decentralized computation engine that runs smart contracts and manages the state of the Ethereum blockchain.

What does the Ethereum Virtual Machine do?

The EVM executes smart contracts, processes transactions, and ensures all Ethereum nodes produce the same results. It’s what keeps the blockchain consistent, secure, and decentralized.

What is the purpose of Ethereum Virtual Machine?

EVM’s purpose is to provide a universal execution layer for decentralized applications (dApps). It lets anyone deploy code that runs exactly as programmed, without intermediaries.

Is Solana EVM compatible?

No. Solana uses its own virtual machine and programming model (based on Rust), so it’s not EVM-compatible. However, there are some projects aiming to bridge that gap by allowing Ethereum-based apps to run on Solana, such as Neon EVM.

Where can I find my EVM wallet address?

You can find your EVM wallet address in any EVM-compatible wallet such as MetaMask, Trust Wallet, or Rabby Wallet. It’s a 42-character string starting with “0x”, used to send, receive, and interact with tokens and smart contracts.