Every day, billions of people post content, interact, and build communities on social media platforms. Likes, views, and follower counts keep rising, yet the real value users receive often feels limited. While platforms continue to scale and generate profits, most content creators still struggle with monetization, ownership, and dependence on opaque algorithms.

In that context, SocialFi emerges as a new direction. It is a model where social activity does not only generate engagement, but also creates direct economic value for users. So what exactly is SocialFi, why did it emerge, and does it have enough potential to change how social networks work?

What is SocialFi?

SocialFi is the short form of Social Finance, combining social media with decentralized finance (DeFi). In simple terms, SocialFi allows users to earn money directly in crypto from online social activities such as posting content, interacting, or building communities.

It can be seen as blending the connection features of platforms like Facebook or Twitter with crypto-based financial mechanisms. Instead of receiving only likes and followers, users can earn tokens with real economic value from each interaction.

Why did SocialFi emerge in crypto market?

In reality, SocialFi is not a completely new idea. It was born from growing dissatisfaction with traditional social media platforms.

Problem 1: Users do not truly own what they create.

Users may spend many years building a fanpage with millions of followers, but one day a platform (such as Facebook) may decide that the account “violates community standards” and lock it immediately. There may be no clear notice, no detailed explanation, and no effective appeal process. Everything built over years can disappear overnight.

Problem 2: Algorithms are a black box.

It is common to wonder why one post reaches a large audience while another gets almost no visibility. How algorithms work is rarely disclosed. Platforms can prioritize paid content or reduce organic reach to push advertising, and users have no clear way to verify or challenge these decisions.

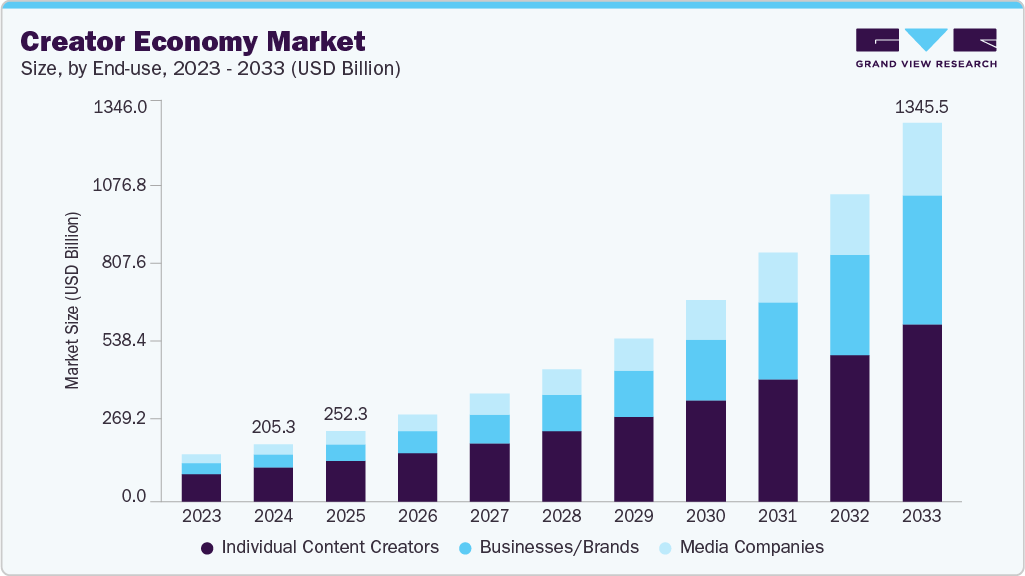

Problem 3: Creators lose a large share of revenue.

YouTube keeps around 45% of advertising revenue generated by creators. TikTok is often considered even less transparent, with creator funds paying very low rewards. According to Grand View Research, the global creator economy market size was estimated at USD 205.25 billion in 2024. However, only 12% of full-time creators earn more than $50K a year, while 46% of creators earn less than $1K in annual revenue . 97.5% of YouTubers don't make enough to reach the U.S. poverty line.

What technology powers Socialfi platforms?

SocialFi uses blockchain technology to change how social networks operate. In practice, it addresses the issues above in the following ways.

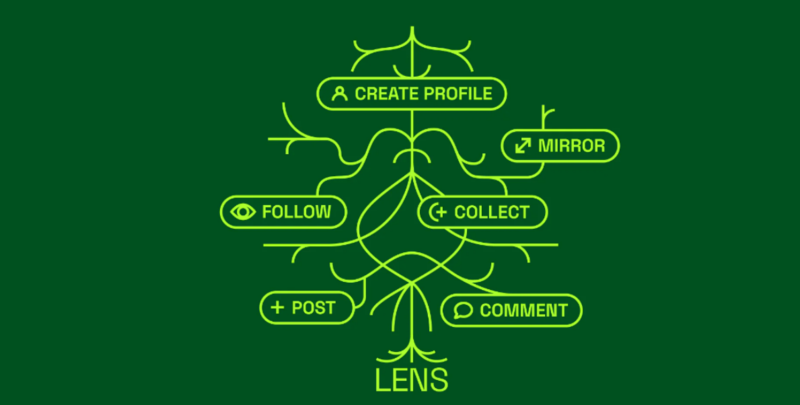

Real ownership through NFTs and blockchain

Real ownership through NFTs and blockchain refers to users owning their digital identities and content via blockchain’s decentralized, immutable ledger. NFTs assign verifiable ownership, enabling data portability, permanence, and independence from any single platform or application.

For example, on Lens Protocol, every profile, post, and even follower list is recorded on the blockchain as an NFT. This means users truly own their data and can move it to other applications, transfer it, or keep it long term. Even if an application shuts down, social data remains intact.

Direct monetization from every interaction

SocialFi platforms enable creators to monetize directly through native reward mechanisms such as tips, micro-payments, and token-based incentives. Users can send value instantly to creators for specific posts or interactions, without intermediaries, unlocking real-time, permissionless monetization that avoids revenue sharing and high platform fees common in traditional social networks.

On one of the largest SocialFi platforms today, Farcaster, users can tip each other using the DEGEN token. When high-quality content is published, readers can send rewards instantly, without intermediaries and without losing 30–45% in platform fees like on traditional networks. Each month, SocialFi platforms record over 25M tipping transactions, showing real demand for direct content monetization.

To send a $DEGEN or @degentokenbase token tip on @farcaster_xyz @warpcast, follow these simplified steps:

— sunnyrk ⬆️ ZyFAI (@RadadiyaSunny) February 7, 2024

1. Create a Smart Wallet via @biconomy Frames

-Use Frames to seamlessly set up your Smart Wallet.

2. Fund Your Wallet with $DEGEN Tokens

- Access your new wallet through… pic.twitter.com/ysglMIdaJO

Community-driven decision making

More than 60% of current SocialFi platforms use DAO*-based governance models. Token holders can vote on major changes, from adjusting fees to adding new features or setting long-term direction. Decisions are made collectively, rather than being fully controlled by a single company.

DAO (Decentralized Autonomous Organization) is a blockchain-based governance model where decision-making power is distributed among token holders, rather than centralized under a single company or authority.

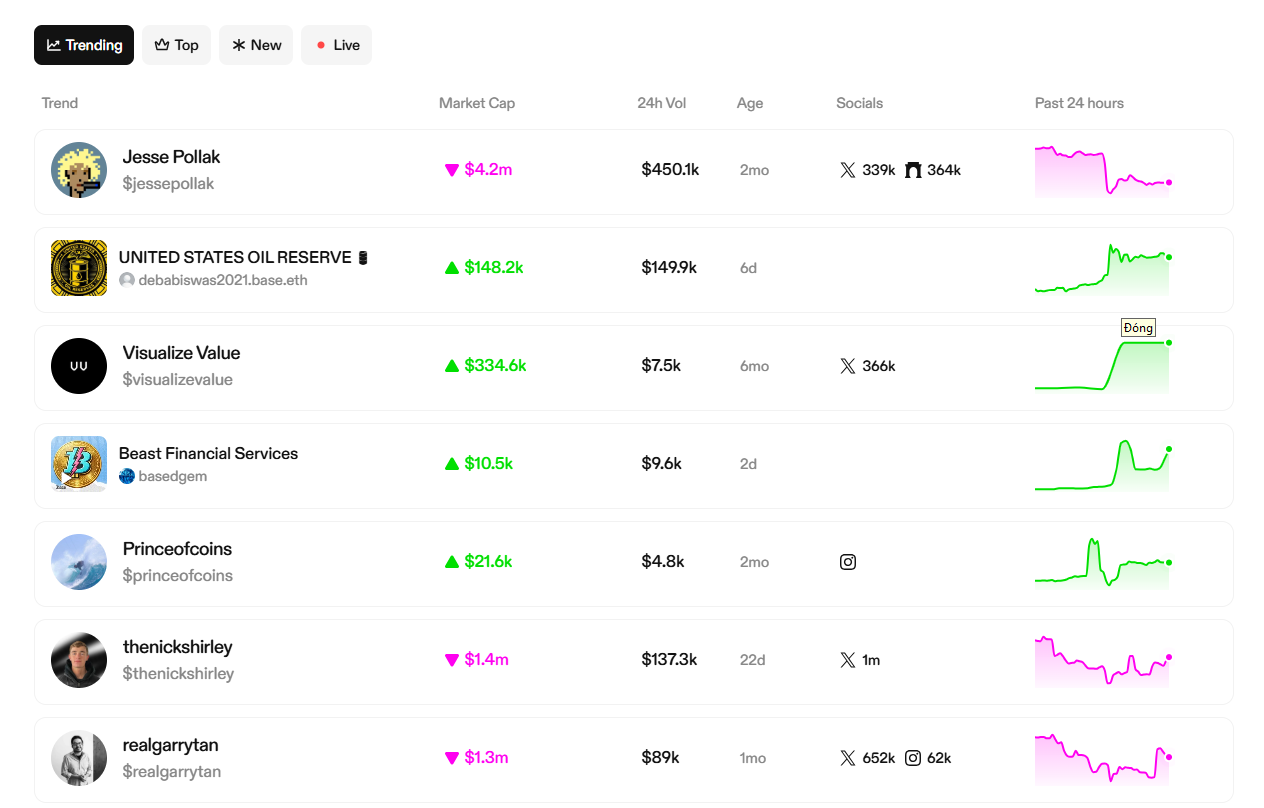

Top SocialFi Projects in crypto

SocialFi is no longer just theory. Several projects are already live and serving millions of users.

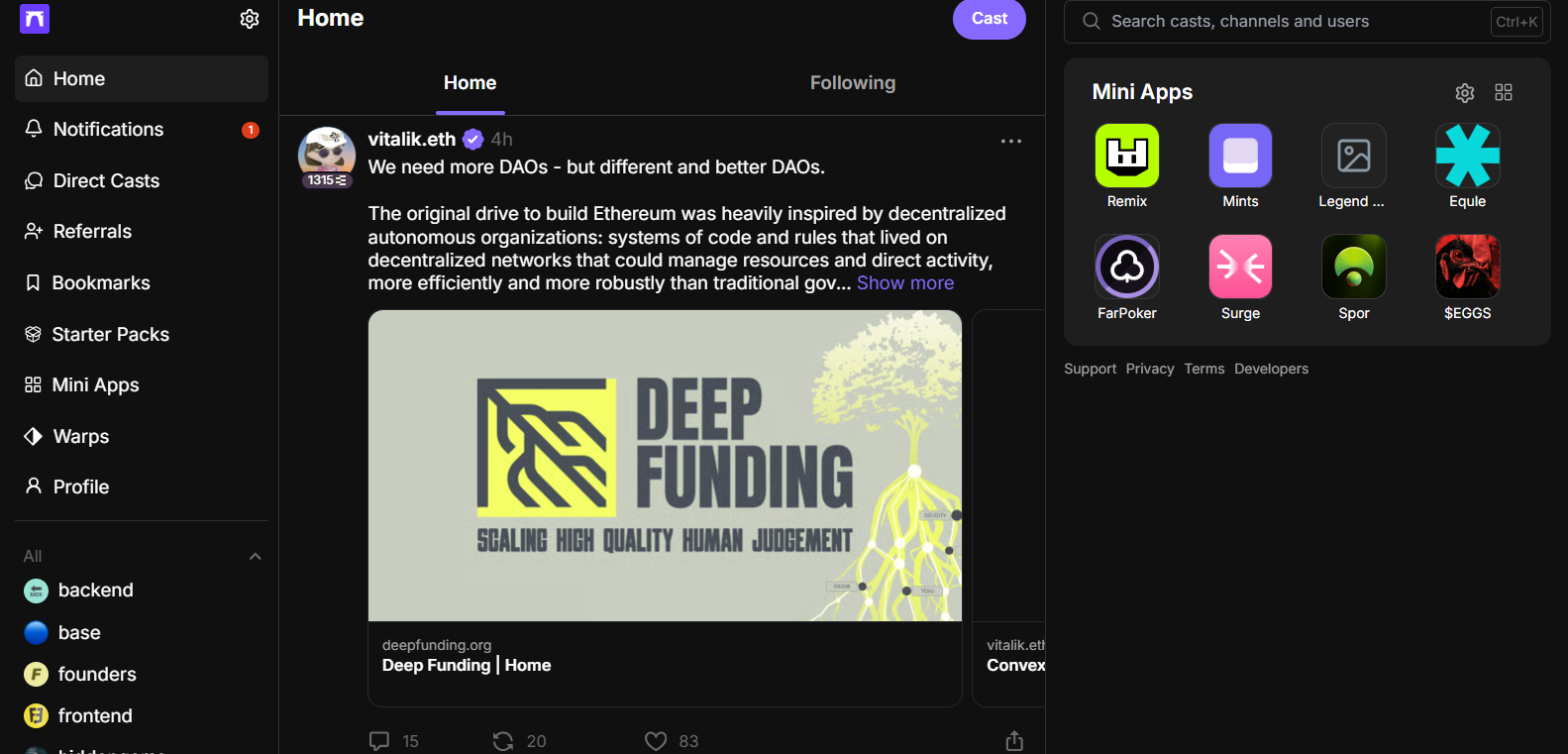

Farcaster: Web3 Twitter

Farcaster is one of the most talked-about SocialFi projects. Founded by two former Coinbase engineers, it has raised $180M, including a $150M round led by Paradigm in May 2024.

Its Frames feature allows mini-apps to run directly in the feed, such as minting NFTs, playing games, or shopping without leaving the app. After Frames launched, daily active users increased by 400% in just one week.

Learn more: How to get Farcaster Airdrop?

Lens Protocol: Infrastructure for Web3 social networks

Built by the Aave team, one of the largest DeFi protocols, Lens Protocol turns everything into NFTs, from profiles to follower lists. The key advantage is portability.

Users can move their entire social graph across any application built on Lens, without starting again from zero followers.

Zora: Where everything can be tokenized

Zora started as an NFT platform and later evolved into a content finance protocol. Every post, whether an image, video, or link, can be turned into a token and traded. Zora currently has over 2M monthly users and accounts for 45% of daily token creation on Base, Coinbase’s Layer 2 network.

Lessons from Friend.tech - Not Every SocialFi Project Succeeds

It would be incomplete to discuss SocialFi without mentioning Friend.tech. This project became a classic case study, illustrating both the rapid success and the sharp failure that SocialFi can experience.

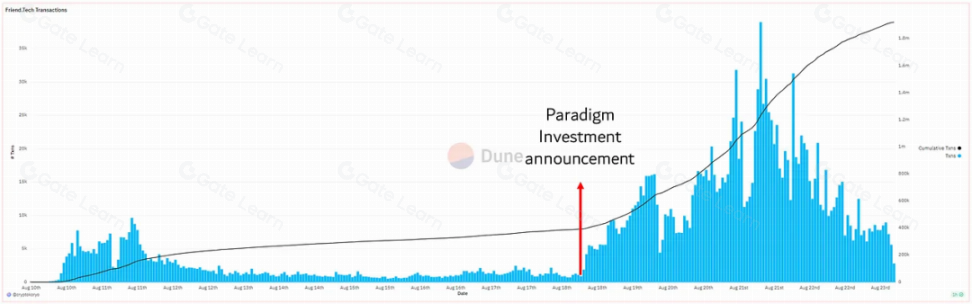

Launched in August 2023 on Base, Friend.tech allowed users to buy “Keys” associated with other users. Holding someone’s Key granted access to a private group chat with that person. The price of each Key increased based on the individual’s popularity and market demand.

A simple explanation of how @friendtech share pricing works (and other fun facts about friend tech's contract) 🧵: pic.twitter.com/wkZDuprVaY

— cygaar (@0xCygaar) August 19, 2023

Within the first 12 days, Friend.tech attracted around $62M, nearly 100,000 users, and 1M transactions. Its peak day, September 13, 2023, recorded more than 539,000 transactions, with daily revenue surpassing Ethereum. Crypto Twitter was filled with discussion, and FOMO spread rapidly across the market.

Then the momentum collapsed.

Just a few months later, transaction volume dropped by 97%, falling from around 540,000 to only a few thousand per day. Daily active users declined to fewer than 100. In May 2024, the project launched the FRIEND token at $3, but by September it had fallen to $0.08, a decline of 98%. Daily fee revenue also crashed, from about $2M per day to just $71 per day.

On September 8, 2024, the Friend.tech team transferred control of the smart contract to a burn address, effectively abandoning the project. From that point on, no one could update or modify the system.

Why did Friend.tech fail?

- First, most users joined due to FOMO and speculation, not because the product delivered lasting value. Once the hype faded, users quickly left.

- Second, the product saw almost no meaningful updates after launch. While Farcaster continued shipping new features like Frames and Lens attracted multiple applications built on its protocol, Friend.tech largely remained unchanged.

- Third, the token economics was not sustainable. A 10% transaction fee, split between creators and the platform, was considered too high, while the FRIEND token lacked clear utility to drive long-term demand.

The key takeaway is that SocialFi does not automatically succeed simply because it is Web3 or built on blockchain. Like any other product, it still requires strong fundamentals, the ability to retain users, and a sustainable economic model.

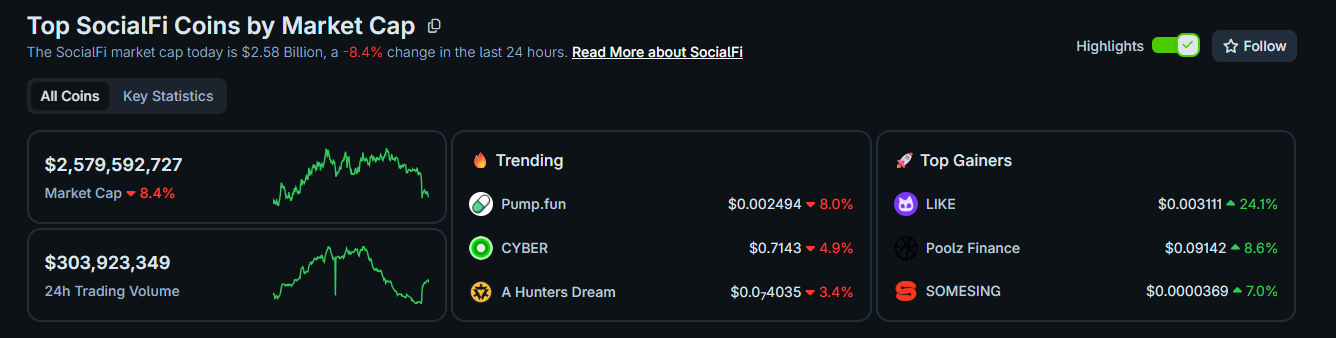

Where does SocialFi stand today?

As of January 2025, according to CoinGecko, the total market capitalization of SocialFi tokens is around $2.5B.

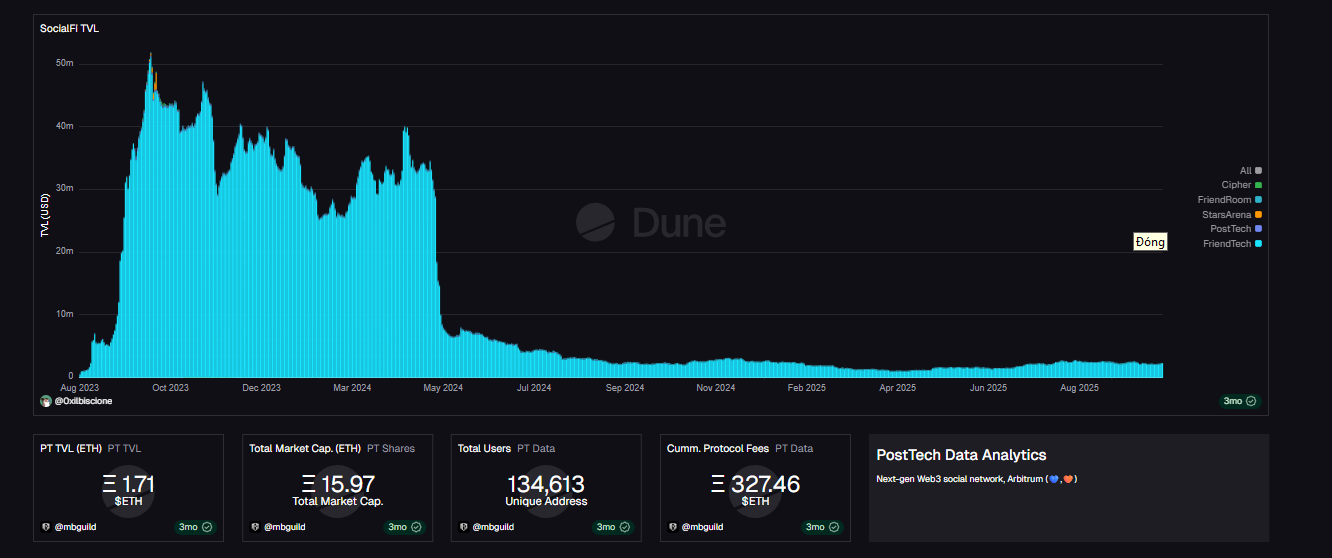

However, a closer look at on-chain data reveals ongoing challenges. Total value locked across the sector peaked at around $50M in late 2023, then dropped sharply from mid-2024 and has remained low since. This suggests that much of the capital entering SocialFi is experimental, flowing in quickly and exiting just as fast when expectations cool.

In other words, SocialFi has proven that the idea works, but it is not yet compelling enough to attract long-term capital at scale. The ecosystem is still experimenting with models, refining products, and searching for sustainable ways to create value for both users and projects.

Conclusion

Although SocialFi is a highly promising narrative, it is important to be realistic. Compared to traditional social networks, SocialFi remains very small. Facebook has nearly 3B users and processes around 4 petabytes of data per day, a scale that current blockchain infrastructure cannot support. User experience is also more complex, requiring wallets, gas fees, and transaction signing, which are significant barriers for newcomers.

These limitations are not the end of the story, but signs of an early stage. The internet in 1995 faced similar constraints before evolving into the foundation that reshaped how people connect and exchange information.

FAQs

Q1. Which user groups is SocialFi most suitable for today?

SocialFi currently fits early content creators, niche communities, and crypto-native users best. These groups are more willing to experiment with new models and accept early risks in exchange for ownership and direct monetization opportunities.

Q2. What is the biggest risk when participating in SocialFi?

The main risk comes from volatile capital flows and unfinished products. Many platforms are still testing their models, with unstable user bases, causing income and user experience to fluctuate strongly with market cycles.

Q3. What is holding SocialFi back from mass adoption?

User experience remains the largest barrier. The need to manage wallets, sign transactions, and understand blockchain fees makes SocialFi less accessible to users accustomed to simple, free Web2 social platforms.

Q4. What could drive SocialFi growth in the future?

SocialFi could accelerate if blockchain infrastructure becomes cheaper and faster, user experience is simplified, and applications emerge that meet real needs without requiring users to understand the underlying technology.

Q5. Will SocialFi fully replace traditional social networks?

In the medium term, SocialFi is unlikely to fully replace Web2 social platforms. Instead, it is more likely to grow alongside them, serving users who value ownership, transparency, and direct content monetization.

Q6. How should newcomers approach SocialFi safely?

Newcomers should start as users and focus on product experience before investing. Understanding how platforms create value, where capital flows, and how strong community engagement is matters more than chasing short-term trends.