While most of the crypto market continues to revolve around memecoins, Layer 2s, or AI tokens, one sector has been quietly absorbing institutional capital at remarkable speed: RWA, or Real World Assets.

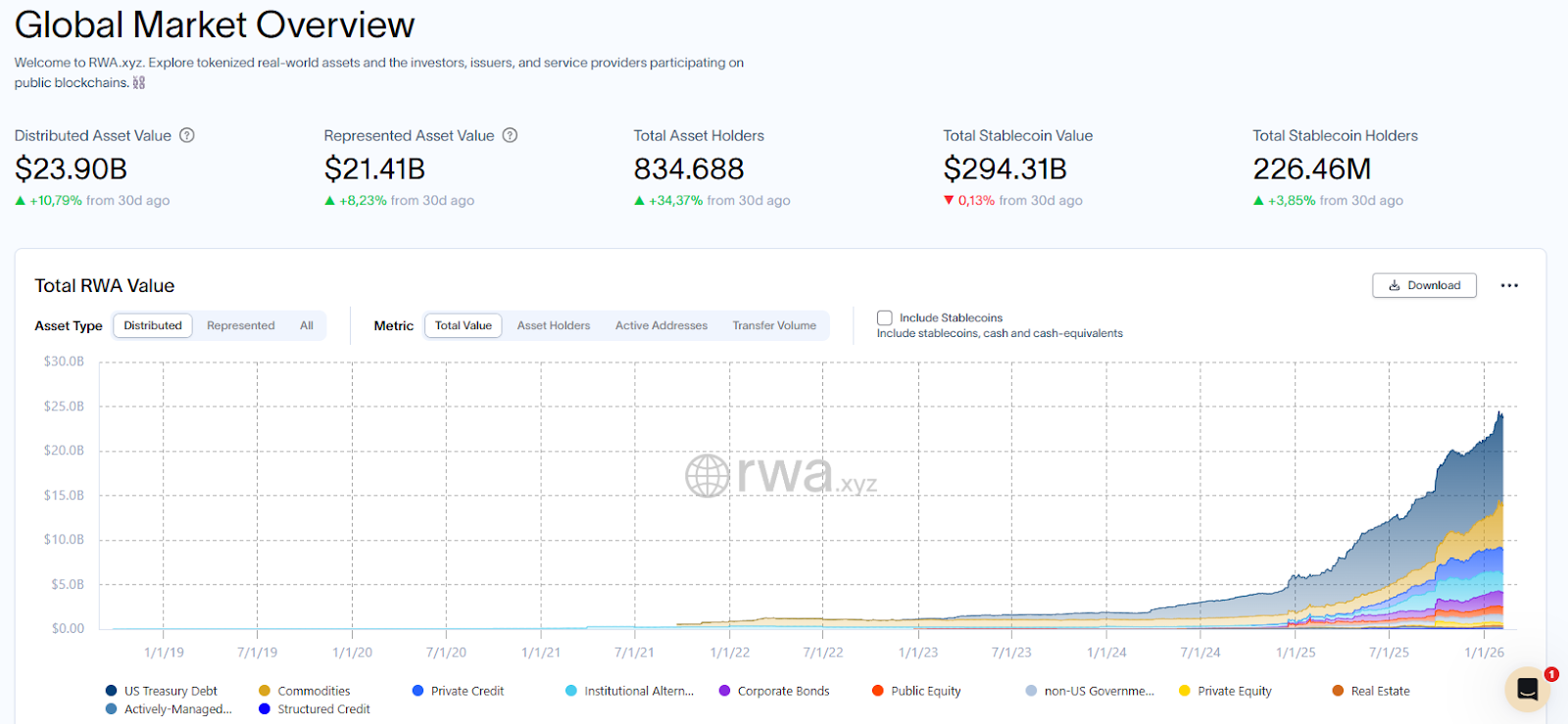

In 2025, the total value of Real World Assets tokenized on-chain, excluding stablecoins, tripled compared to the beginning of the year, rising to more than $300B. BlackRock, Franklin Templeton, and JP Morgan, some of the most influential names on Wall Street, have all entered this space.

What is RWA?

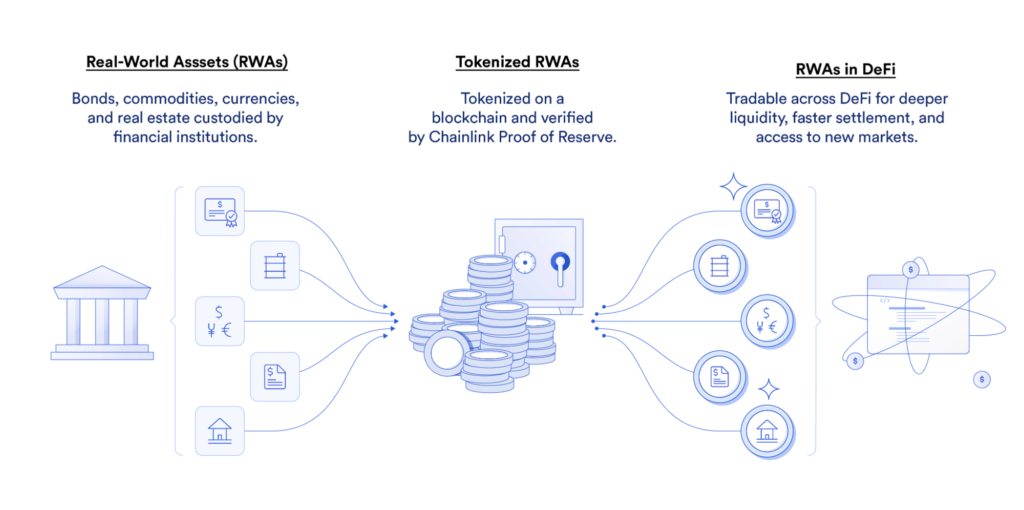

RWA (Real World Assets) is the process of bringing real world assets onto the blockchain in the form of digital tokens. These assets can include government bonds, stocks, real estate, gold, or even private credit and debt instruments.

In simple terms, instead of opening a U.S. brokerage account, going through extensive KYC procedures, and waiting T+2 days for settlement, users can now buy a token that represents U.S. Treasury bonds directly on the blockchain, earn yield, and trade it 24/7.

There are two main approaches to asset tokenization:

- Fungible tokens (ERC-20 or equivalent standards): Examples include USDT, USDC, OUSG, BUIDL, and USDY. Each token represents a share of real world value and is usually pegged 1:1 to the U.S. dollar.

- NFTs: Used to tokenize ownership of unique assets such as real estate, artworks, or music copyrights.

Among these, fungible tokens dominate in terms of liquidity and total market capitalization.

Why RWA Matters? Looking at the Bigger Picture

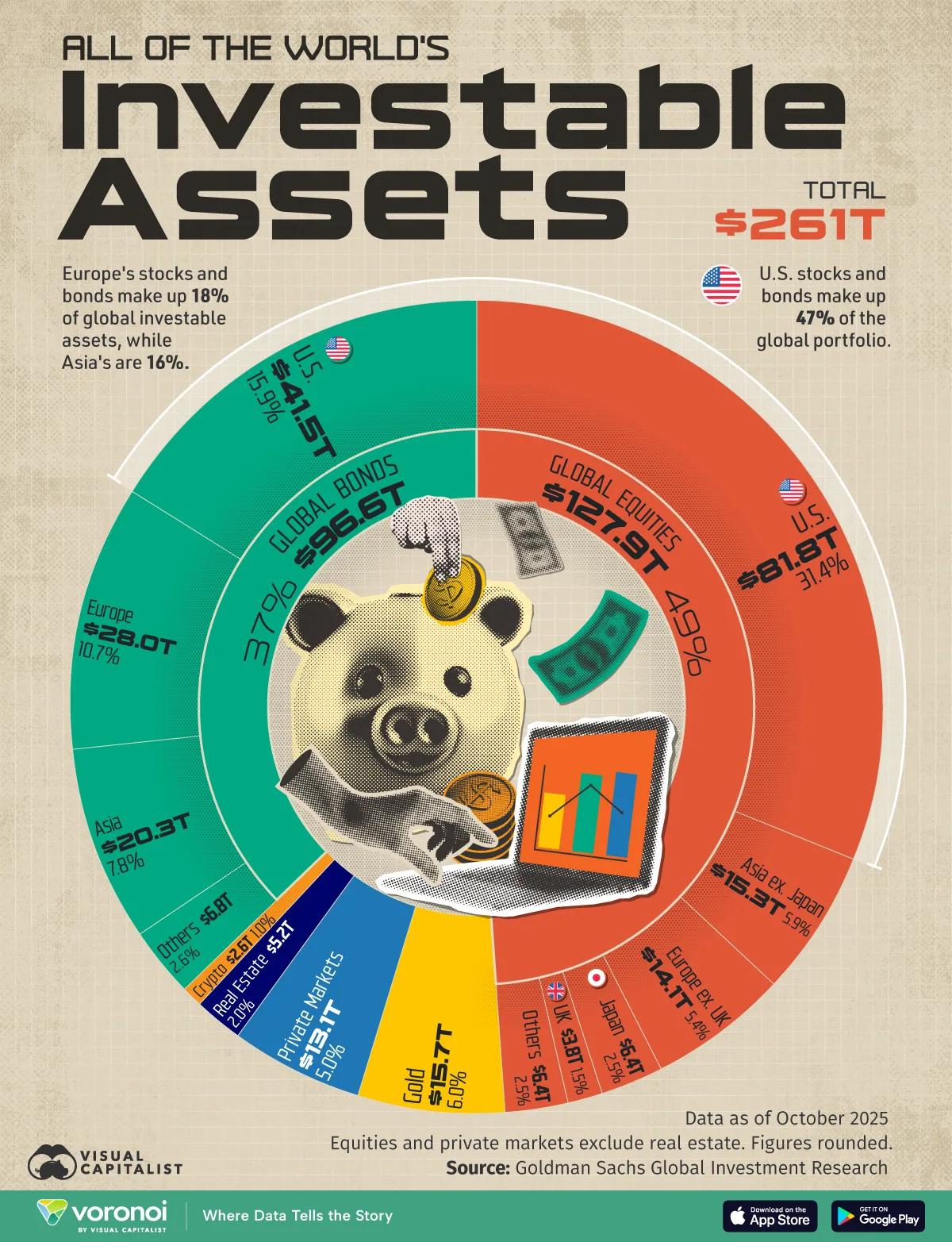

To understand the potential of RWA, it helps to look at the scale of global assets.

According to Visual Capitalist data from October 2025, total global investable assets are estimated at around $261T, including:

- Global equities: approximately $127.9T, accounting for around 49% of total investable assets.

- Global bonds: roughly $96.6T, equivalent to about 37%.

- Gold: around $15.7T, representing roughly 6%.

- Private markets (excluding real estate): approximately $13.1T, or about 5%.

- Investable real estate: about $5.2T, or roughly 2%.

By comparison, total RWA value in crypto stood at only around $300B by the end of February 2026, which is less than 0.01% of total global asset value.

This gap highlights the massive growth potential. McKinsey has projected that the tokenization market could reach $2T by 2030, according to The Defiant. Under more optimistic scenarios, the figure could rise to $4T.

Benefits Of RWA

Access To Global Capital

In the past, buying U.S. Treasury bills required opening a U.S. brokerage account, paying wire transfer fees, completing strict KYC, and often being restricted by qualified investor requirements.

With RWA tokens:

- Users only need a crypto wallet such as MetaMask, Phantom, or Trust Wallet.

- Products like OUSG or BUIDL can be purchased directly on DEXs such as Uniswap, Aerodrome, or PancakeSwap, or through platforms like Ondo Global Markets.

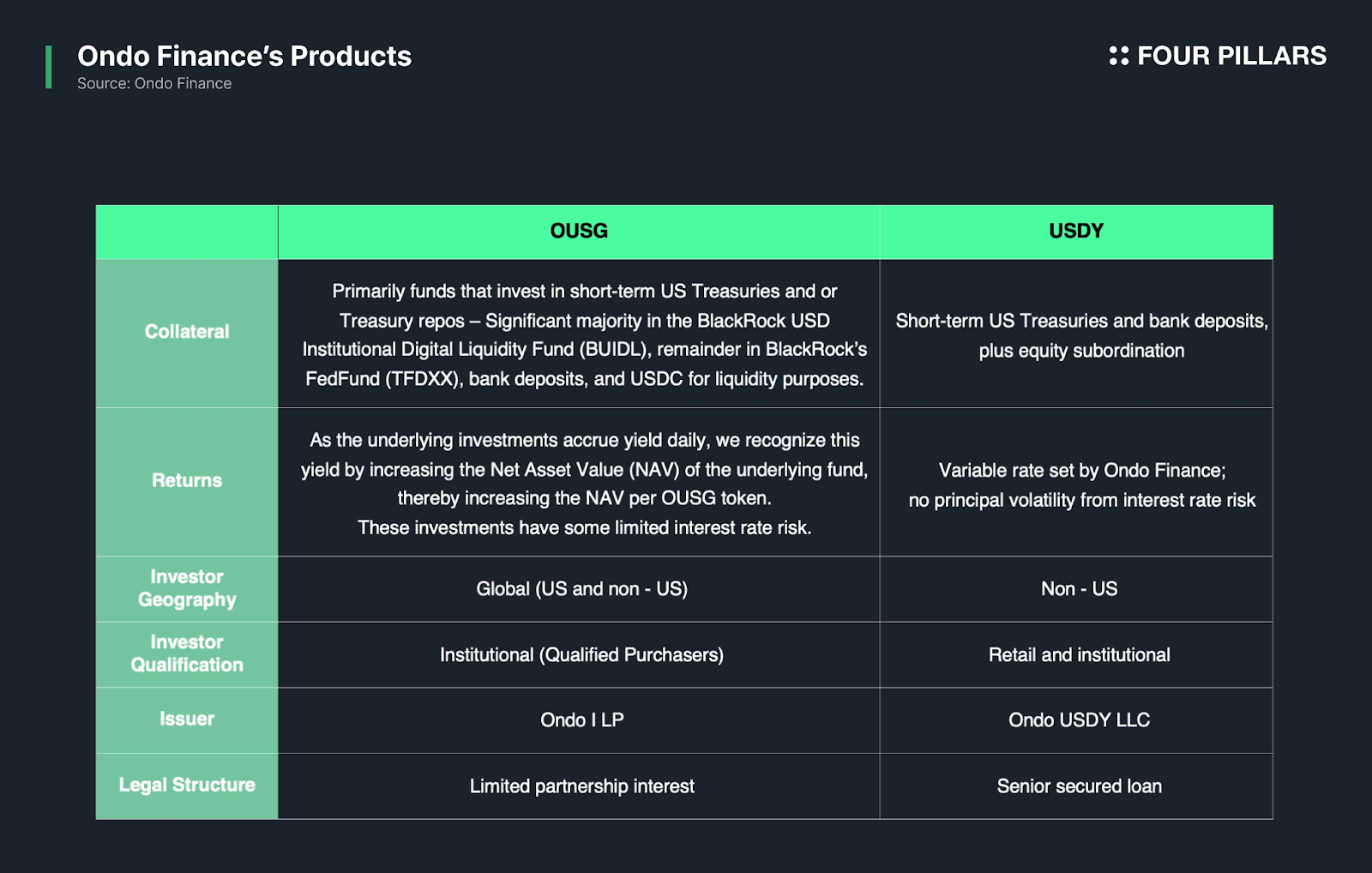

- OUSG, the Ondo US Short Term Government Bond Fund, allows minting and redemption 24/7 using stablecoins. Its yield is currently around 3.46% APY (as of 08/02/2026), backed by short term U.S. Treasuries and BlackRock managed funds.

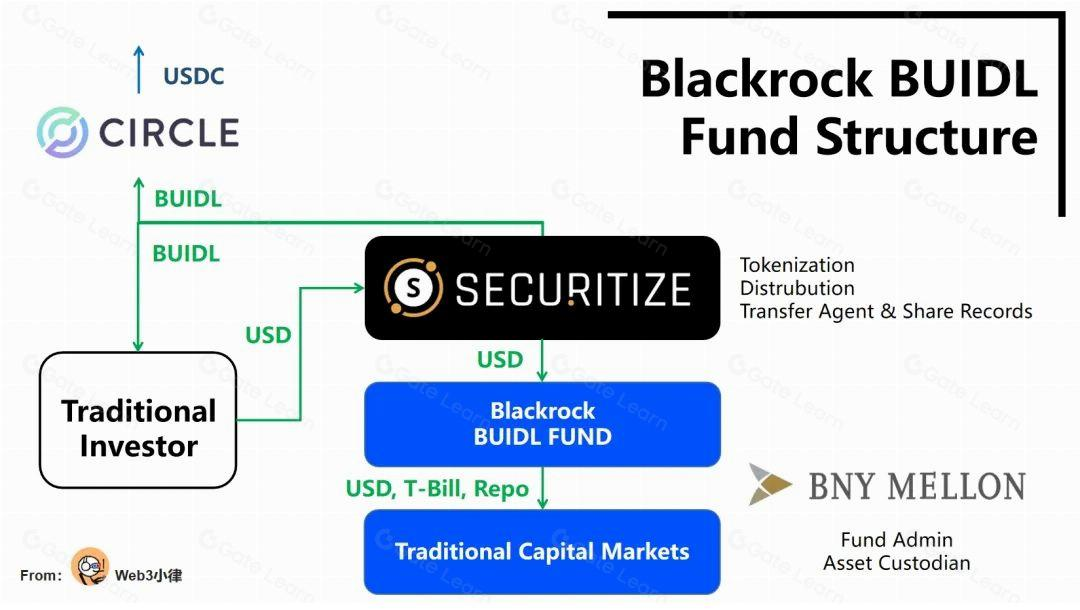

- BUIDL, the BlackRock USD Institutional Digital Liquidity Fund, is the largest tokenized fund, with AUM ranging from around $1.78B to $2.85B as of February 2026. It generates yield from overnight repo and U.S. Treasuries and has expanded to BNB Chain, Solana, and Aptos.

24/7 Trading And Near Instant Settlement

Traditional stock and bond markets remain constrained by fixed trading hours and slow settlement systems. Trades usually occur between 9:00 and 16:00 U.S. time, with T+2 settlement, while weekends and holidays are effectively inactive.

On-chain assets operate very differently. They can be traded 24/7, 365 days a year, with settlement times measured in seconds or under a minute on networks such as Ethereum L2s, Solana, or Base.

In practice, transferring a tokenized asset like BUIDL through peer to peer on-chain transactions costs around $0.01 to $0.1 in gas fees, with assets received almost instantly. No centralized clearinghouse such as DTCC is required.

According to BlackRock and Securitize, tokenized funds like BUIDL also support instant redemption into stablecoins, improving liquidity management and offering flexibility that traditional ETFs struggle to match.

Transparency

- Every transaction, ownership record, and yield accrual is recorded on-chain.

- Users can view real time NAV and portfolio composition.

- OUSG and BUIDL publish attestations from custodians such as BNY Mellon and Clear Street, along with independent audits.

Compared to traditional mutual funds that report quarterly, RWA provides an always on on-chain audit trail. Chainlink highlights that this transparency reduces overall systemic risk by making leverage and exposure easier to measure.

The RWA Ecosystem

Despite many projects branding themselves as RWA, the ecosystem mainly consists of three core product categories.

Stablecoins

Stablecoins are the first and most successful RWA products. USDT and USDC represent tokenized U.S. dollars backed by fiat and short term government bonds.

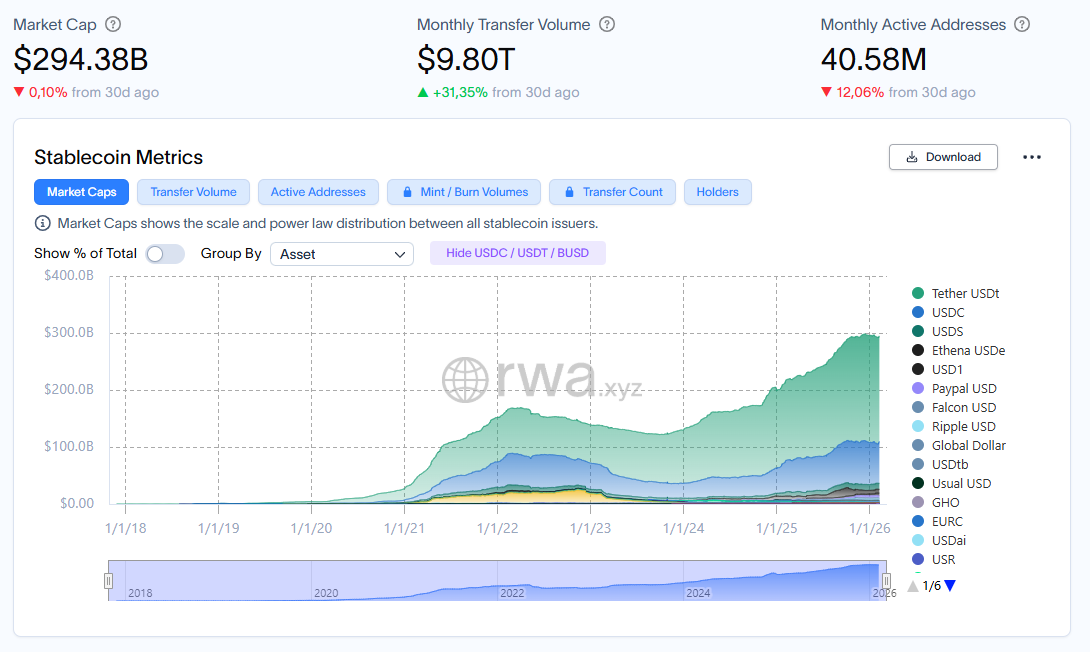

According to rwa.xyz, total stablecoin market capitalization exceeded $290B in early 2026, up nearly 50% from $205B at the beginning of 2025.

Market structure:

- USDT (Tether): ~60% market share, capitalization above $186B.

- USDC (Circle): ~25%, capitalization above $74B.

- Others (~15%): USDe, PYUSD, USD1, GHO, and more.

Stablecoin issuance follows a simple model:

- Institutions or market makers send USD to the issuer.

- The issuer mints an equivalent amount of stablecoins.

- Upon redemption, stablecoins are burned and USD is returned, minus a small fee.

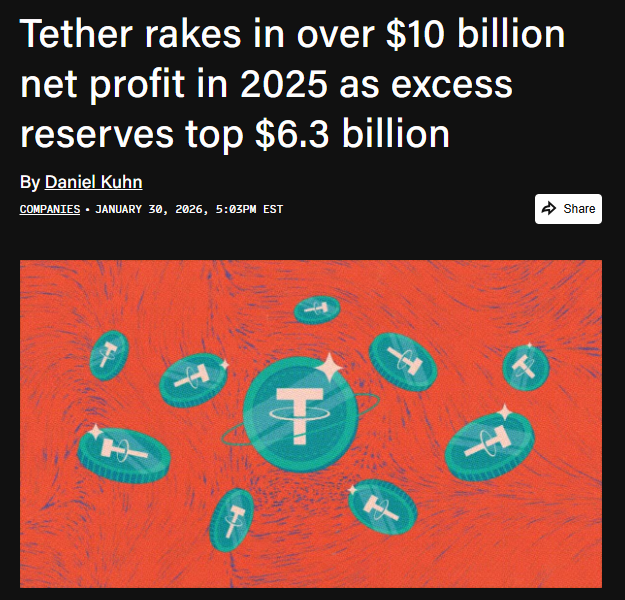

Tether invests these funds into U.S. Treasuries, gold, Bitcoin, and other assets. According to The Block, as of February 2025, Tether held over $122B in U.S. Treasuries, making it one of the largest holders globally.

The year 2025 marked a turning point due to regulatory clarity:

- GENIUS Act (U.S.): Signed in July 2025, establishing federal stablecoin rules with 1:1 reserve requirements.

- MiCA (EU): Effective since late 2024, providing regulatory clarity across Europe.

At the same time, major institutions reinforced stablecoins as financial infrastructure:

- Circle completed a successful IPO.

- Stripe enabled stablecoin payments in over 100 countries.

- PayPal expanded PYUSD.

- Circle, Paxos, and BitGo received OCC banking licenses.

However, stablecoins are infrastructure rather than direct investment opportunities. Tether and Circle do not issue governance tokens, and protocols like Ethena or MakerDAO treat stablecoins as only one part of a broader ecosystem.

Private Credit

On-chain private credit protocols connect crypto capital, such as USDC or ETH, from retail investors to real world businesses seeking loans. Instead of capital flowing through banks or traditional credit funds, funds move directly on-chain, with protocols acting as intermediaries that design products, manage risk, and distribute returns.

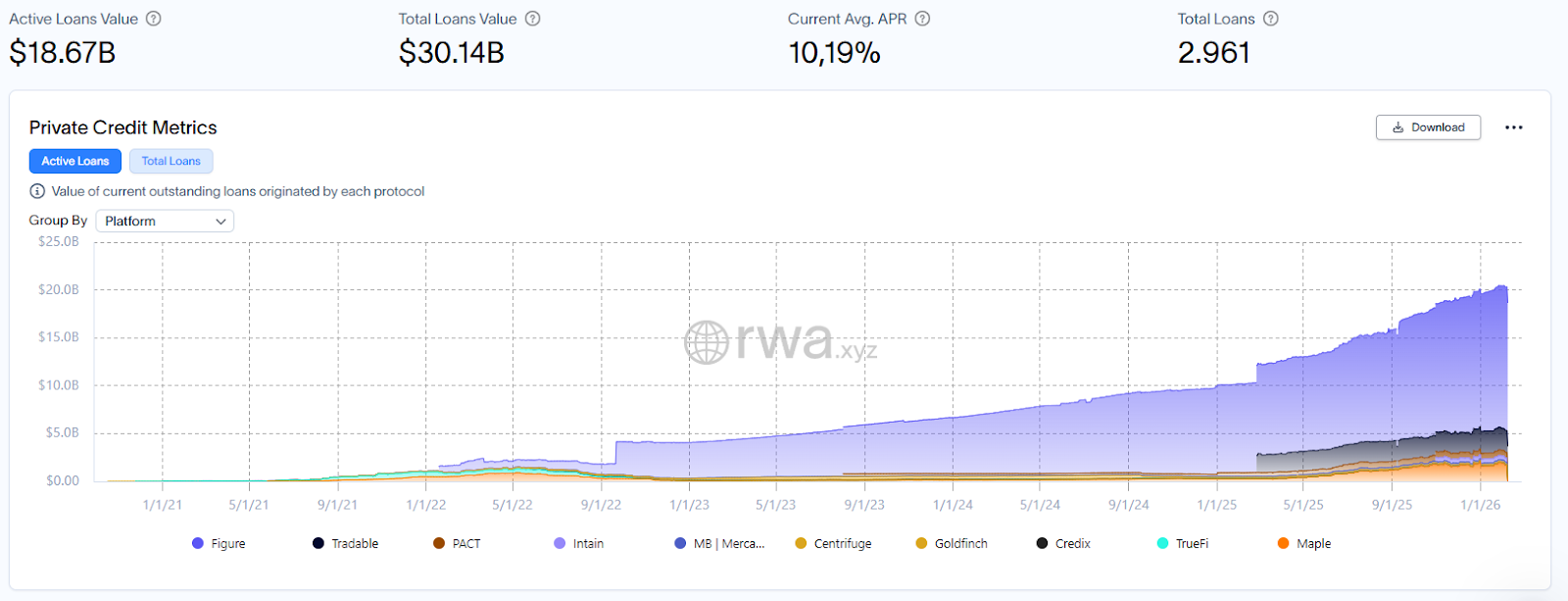

The total value of tokenized private credit has reached around $18B, up more than 380% since 2022. This indicates that real borrowing demand is gradually shifting toward on-chain infrastructure, at least within certain segments.

The operating model is generally simple:

- Capital inflow: Users deposit stablecoins such as USDC, DAI, or USDT into lending pools.

- Borrower matching: The protocol intermediates loans to businesses at attractive interest rates.

- Yield distribution: Loan interest, typically around 8% to 12% per year, is distributed to depositors.

Notable projects include:

- Maple Finance, which currently has over $777M in active loans and more than $3.3B in cumulative lending volume, using a model that allows funds to borrow against BTC or crypto collateral.

- Centrifuge, which focuses on helping small businesses tokenize invoices, contracts, or future cash flows to raise capital earlier.

- Goldfinch, which targets emerging markets where credit demand is high but traditional banking coverage is limited, using an undercollateralized lending model.

Risks To Consider

Private credit on-chain carries meaningful risks.

- Many loans are unsecured or lightly collateralized, making default risk significant.

- Unlike traditional finance, on-chain protocols have limited tools for effective debt recovery when borrowers default.

- In strong market conditions, yields of 10% to 12% per year may appear less attractive compared to holding tokens or using lower risk staking and restaking strategies.

For these reasons, on-chain private credit is currently more appropriate for monitoring and research, rather than active or high-risk participation, especially during bull market phases. The model has yet to fully solve the core challenge of credit at scale: managing and resolving bad debt.

Learn more: Top RWA projects to watch

Tokenized Assets

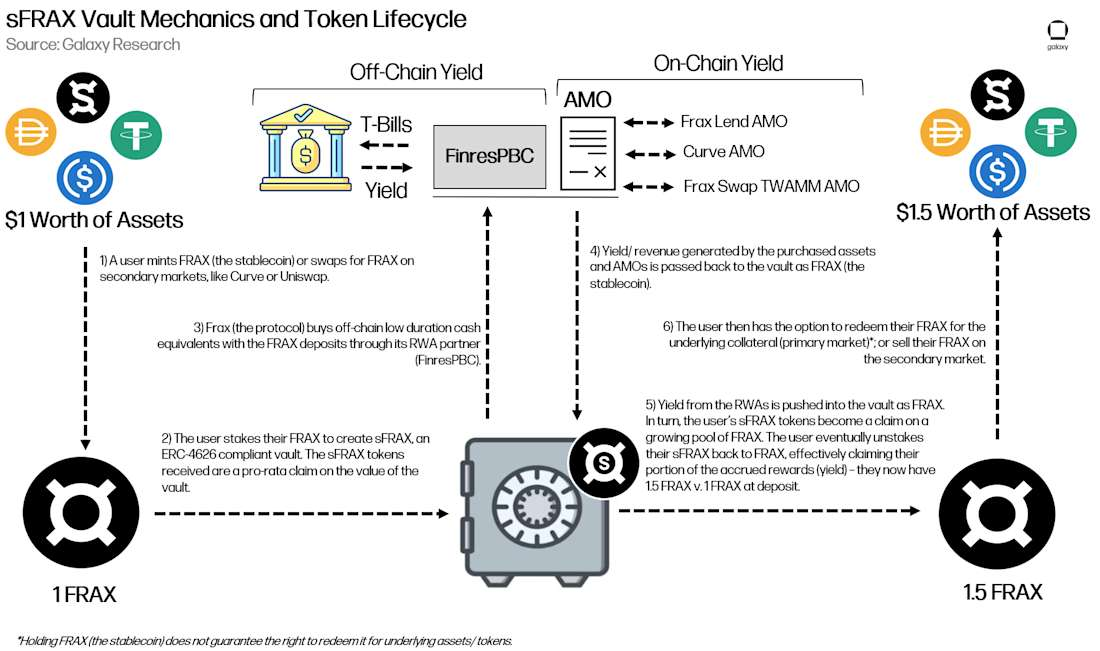

Tokenization refers to converting ownership or value of traditional financial assets, such as bonds, stocks, or investment funds, into digital tokens on the blockchain. At present, U.S. Treasury bonds are the most widely tokenized assets, due to their high safety, stable cash flows, and superior liquidity compared to other RWA types.

Operating Mechanism (Bond):

- Users deposit stablecoins like USDC or USDT into a protocol.

- The protocol uses the funds to purchase U.S. Treasury bonds from traditional markets and issues new tokens such as BUIDL, USDY, or OUSG to represent ownership.

- Bond yield, typically around 4% to 5% per year, is distributed to token holders.

For example, depositing 1,000 USDC into Ondo Finance results in receiving 1,000 USDY. After one year, an investor may earn approximately $50 in interest, while USDY can still be used as collateral in DeFi.

Tokenized U.S. Treasuries

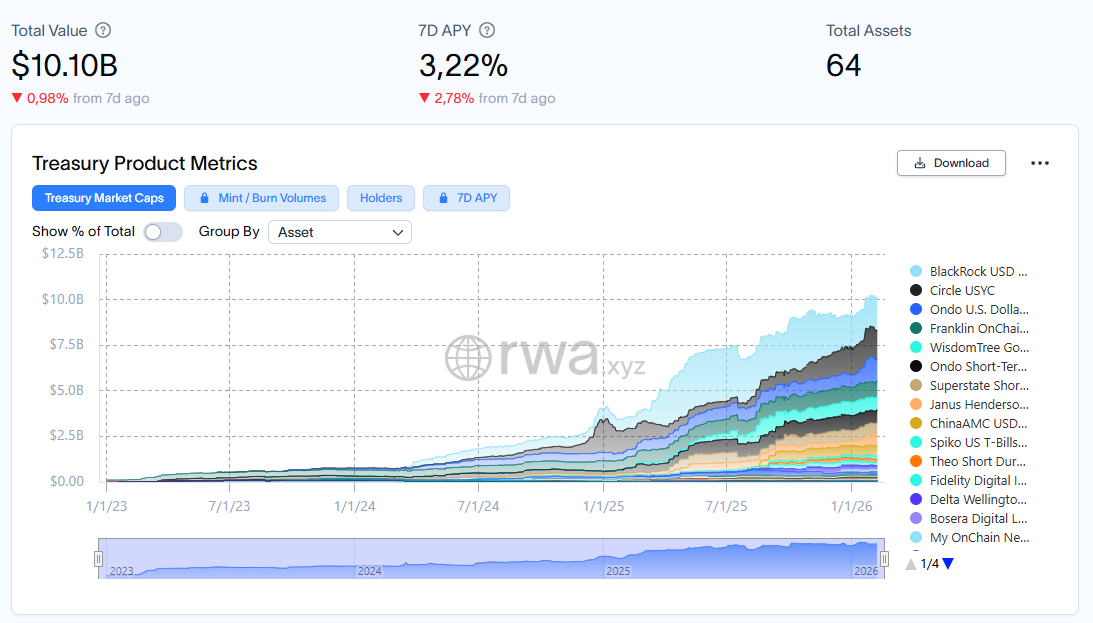

This segment has grown rapidly. By early February 2026, total value exceeded $10.1B, up from around $3.9B at the start of 2025.

Leading products include BUIDL from BlackRock and Securitize, BENJI from Franklin Templeton, and Ondo Finance products such as USDY and OUSG. BlackRock, Franklin Templeton, and Ondo together account for the majority of this segment’s capitalization.

The dominance of institutions like BlackRock and Franklin Templeton is not driven by technology, but by trust and regulatory compliance. Tokenization itself is not technically complex, but attracting large scale capital requires credibility.

BlackRock’s launch of BUIDL in March 2024 acted as a seal of approval, encouraging other financial institutions to follow. These firms already possess asset management infrastructure, legal frameworks, compliance systems, and custody solutions that crypto native projects struggle to build from scratch.

Over the long term, tokenization potential remains substantial. Fractionalization improves liquidity in traditionally illiquid markets such as real estate or private funds. Meanwhile, traditional asset markets are vast, with global bonds around $97T and equities around $127T, while on-chain RWA still represents only a small fraction.

After U.S. Treasuries, expansion is likely to continue into other sovereign bonds, equities, and investment funds. Ondo’s collaboration with Blockchain.com to bring tokenized U.S. equities to Europe is an early example of this direction.

Tokenized Stocks

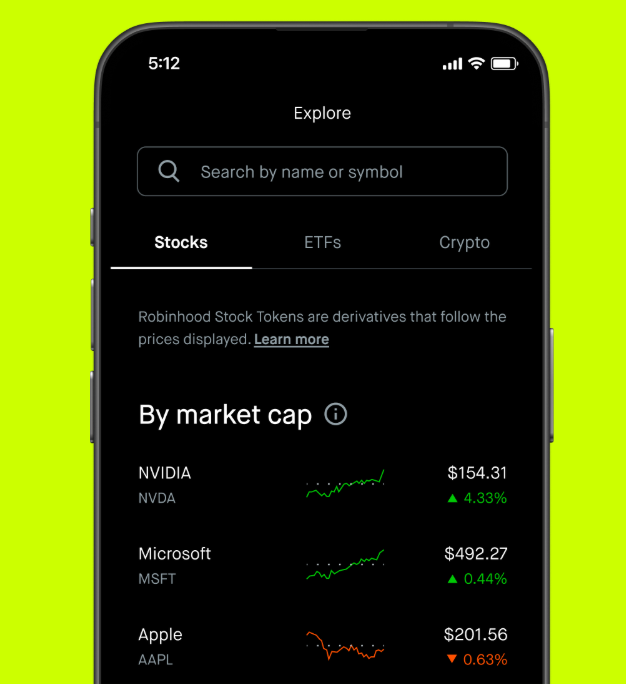

If tokenized Treasuries defined 2024, then 2025 marked a clear race in tokenized equities, as fintech firms and crypto exchanges entered the space. Market capitalization of tokenized stocks reached $1B by December 2025, up nearly 2,900% year over year.

The initial move came from Backed Finance with xStocks on Solana, bringing over 60 U.S. stocks on-chain, backed 1:1, tradable 24/7, and usable as DeFi collateral.

Around the same time, Robinhood launched Stock Tokens for European users, while Ondo Finance quickly captured over 50% market share through Ondo Global Markets. Nasdaq and the SEC also signaled increasing regulatory openness.

Even so, $1B remains tiny compared to the $127T global equity market. Liquidity is still limited, and ownership rights are not yet fully equivalent to traditional shares. Still, the direction is clear. Tokenized stocks are evolving into financial infrastructure rather than experimental products.

Challenges Of RWA

Despite opening new pathways between traditional assets and blockchain, RWA faces significant barriers related to regulation, liquidity, infrastructure, and ownership, which slow large scale adoption.

Fragmented Regulatory Frameworks

RWA operates between two systems with very different logic: a global blockchain network and nationally regulated traditional finance. Each jurisdiction has its own rules for issuance, custody, and ownership.

This complexity slows international expansion and forces many projects to restrict users or adopt complex structures to manage legal risk.

Secondary Liquidity Still Limited

Although RWA trades 24/7, most products suffer from thin liquidity and reliance on centralized platforms or a small number of market makers. Low volume, wide spreads, and limited exit options make RWA less suitable for large investors.

During volatile periods, being on-chain does not necessarily mean instant convertibility to cash.

Legal Ownership And Economic Rights Do Not Fully Align

In many models, RWA token holders receive economic exposure rather than direct legal ownership of the underlying asset. This gap becomes critical during disputes, bankruptcies, or regulatory changes at the issuer level.

As a result, RWA cannot yet fully replace traditional financial instruments in situations requiring clear legal ownership.

Dependence On Off-Chain Infrastructure And Intermediaries

Despite on-chain trading, RWA relies heavily on off-chain components such as custodians, banks, oracles, and asset managers. Failures in custody, pricing, or operations can directly impact token value. RWA does not eliminate centralization risk but redistributes it across different layers.

Technology Risk And Smart Contract Standardization

Smart contracts are central to issuing, managing, and distributing RWA yields.

However, technical standards remain inconsistent. Contract bugs, oracle errors, or incomplete design assumptions can lead to irreversible losses, especially when underlying asset values are large.

Deep dive: Advantages and disadvantages of Smart Contract

Conclusion

RWA is not a short lived trend. It represents a restructuring of how traditional assets are issued, traded, and managed. As regulation becomes clearer and on-chain infrastructure matures, tokenization is unlikely to replace traditional finance outright. Instead, it will integrate quietly as a new foundational layer.

Despite its clear potential, RWA faces real challenges. Regulatory fragmentation persists, especially for equities and real estate. Secondary liquidity remains thin. Legal ownership is not always equivalent to underlying assets. Risks from smart contracts, oracles, and custody infrastructure remain present.

FAQs

Q1. Which type of investor is RWA most suitable for at the current stage?

RWA is currently more suitable for investors who prioritize stability, cash flow, and risk management rather than short term gains. Products such as tokenized Treasuries are often viewed as capital allocation tools or liquidity parking options during volatile market cycles.

Q2. How does RWA differ from ETFs or traditional funds in user experience?

Unlike ETFs, RWA allows 24/7 trading, near instant settlement, and direct integration with DeFi. However, ETFs still offer stronger regulatory clarity and direct legal ownership of underlying assets.

Q3. What is the most important factor when evaluating an RWA project?

Investors should focus on the issuer, custodian, regulatory compliance, and transparency of underlying assets. Technology is necessary, but trust and legal structure determine long term scalability.

Q4. What additional risks arise when RWA is used in DeFi?

When RWA serves as collateral in DeFi, risks extend beyond smart contracts to include regulatory uncertainty, oracle reliability, and off-chain liquidity. This makes risk management more complex than with purely crypto native assets.

Q5. How important are oracles and off-chain data for RWA?

Oracles act as the bridge between Real World Assets and blockchain, determining valuation and state on-chain. Data errors, delayed updates, or reliance on a single source can create systemic risk across the entire protocol.