In recent years, RWA has gradually moved from an experimental concept to a more practical direction within crypto. Bringing real world assets onto blockchain does not only expand use cases, but also creates a new layer of infrastructure that is attracting growing attention from the market and major institutions.

So which RWA projects stand out the most today, and why are they leading this wave?

RWA Overview

RWA is no longer just an experiment. It is becoming real infrastructure in crypto, drawing serious institutional attention. So which projects truly stand out, and why are they leading this shift?

Real World Assets, or RWA, refers to the process of bringing tangible assets such as government bonds, real estate, gold, equities, and private credit onto blockchain in the form of digital tokens. Each token represents ownership, or partial ownership, of the underlying asset. This allows assets to be traded and transferred 24/7 without relying on traditional intermediaries such as banks or stock exchanges.

Tokenization is not simply about wrapping assets with new technology. It is a structural upgrade that directly addresses several core limitations of traditional finance:

- Fractional Ownership: Allows users to buy $100 worth of US Treasuries instead of committing tens of thousands of dollars to a full asset, lowering the entry barrier and expanding access.

- Near-Instant Settlement: Reduces complex reconciliation processes and eliminates the T+2 waiting period common in traditional markets, making capital more efficient.

- Blockchain Transparency: Records every transaction and ownership change on-chain, enabling public verification and reducing reliance on opaque intermediaries.

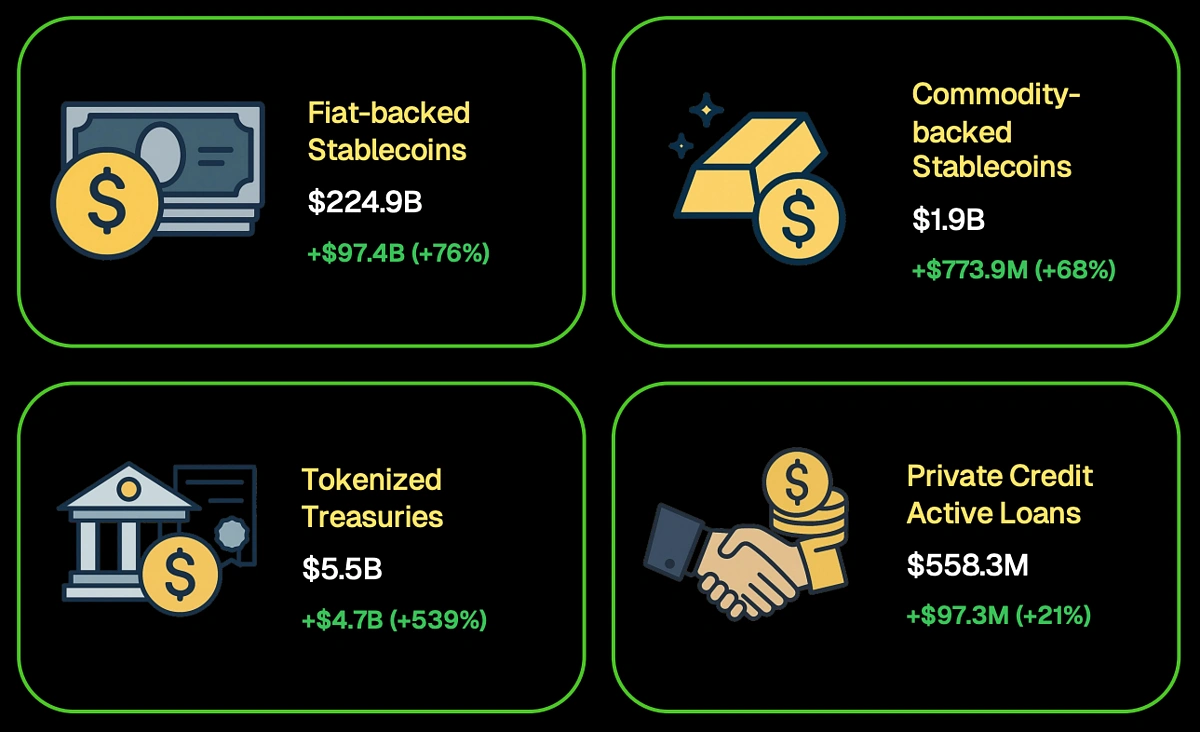

If 2024 was just the starting point, then 2025 officially became the breakout year for RWA. According to the CoinGecko RWA Report 2025, the total RWA market, including stablecoins, surpassed $230B. Within that:

- Fiat-Backed Stablecoins: Reached around $224.9B, remaining the largest segment and the primary gateway into RWA.

- Tokenized US Treasuries: Reached about $5.5B, marking a 539% increase from January 2024 to April 2025, and later surged to nearly $8B by the end of 2025.

- Commodity-Backed Tokens: Such as gold and silver reached around $4B, led by Tether Gold and Paxos Gold.

- Private Credit: Recorded around $558M in active loans as of April 2025, and continued to grow strongly in the second half of the year.

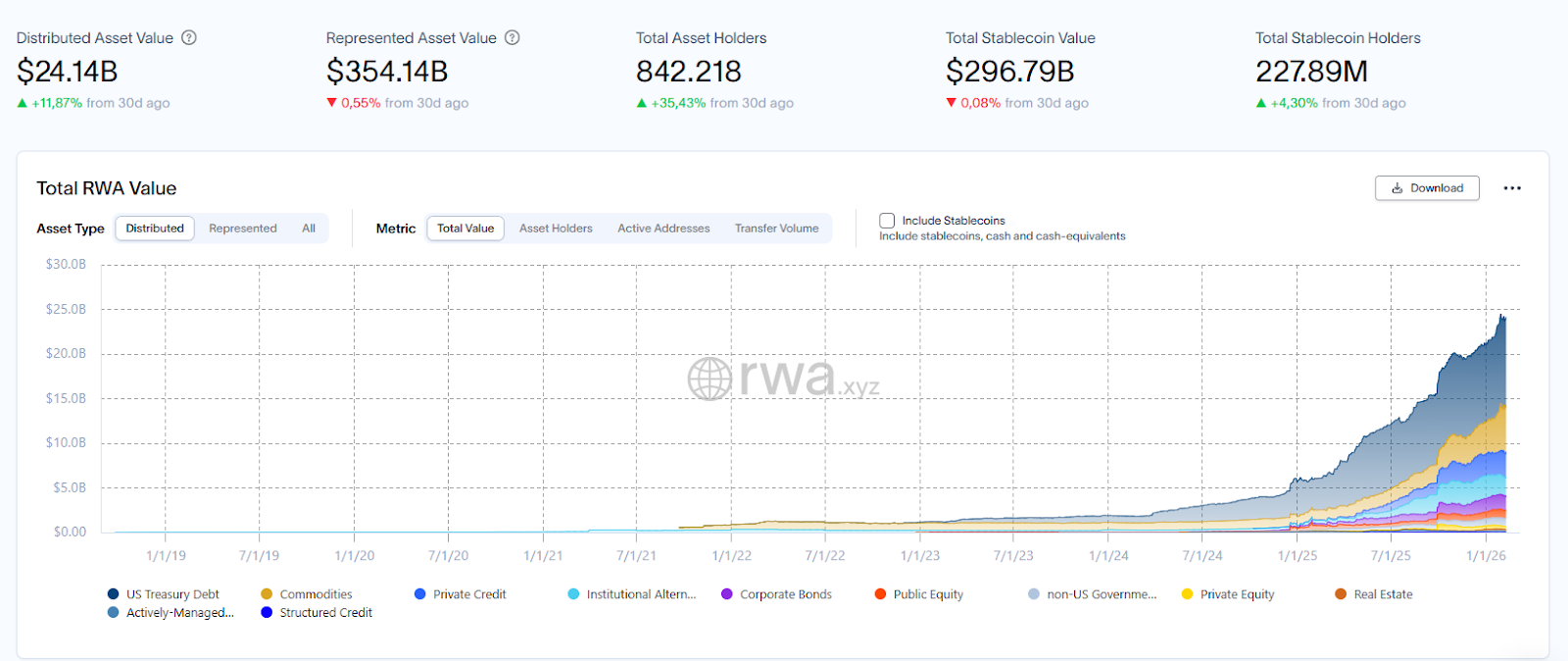

Excluding stablecoins, RWA TVL in DeFi increased from around $5.5B at the beginning of 2025 to a peak of $18.2B in October 2025. That is more than three times the level at the end of 2024.

Notably, RWA surpassed DEX to become the fifth largest category in DeFi by TVL, a position it did not even hold within the top 10 at the beginning of 2025, according to Cointelegraph.

The number of holders directly owning tokenized RWA assets also doubled, from around 242,000 in 2024 to more than 594,000 by the end of 2025. As of February 2026, that number has exceeded 800,000 holders.

RWA has come a long way, from a questioned narrative to a seriously deployed financial infrastructure segment. As regulatory frameworks become clearer and large institutions deepen their involvement, tokenization is no longer an experiment. It is increasingly becoming part of the modern financial system.

In this context, examining the leading RWA projects helps clarify the broader picture.

TOP 5 RWA Projects

Tether

When discussing RWA, Tether cannot be ignored. Although often seen simply as a trading stablecoin, USDT is fundamentally an RWA product. Each token is backed by real assets, mainly US Treasury bills and cash equivalents.

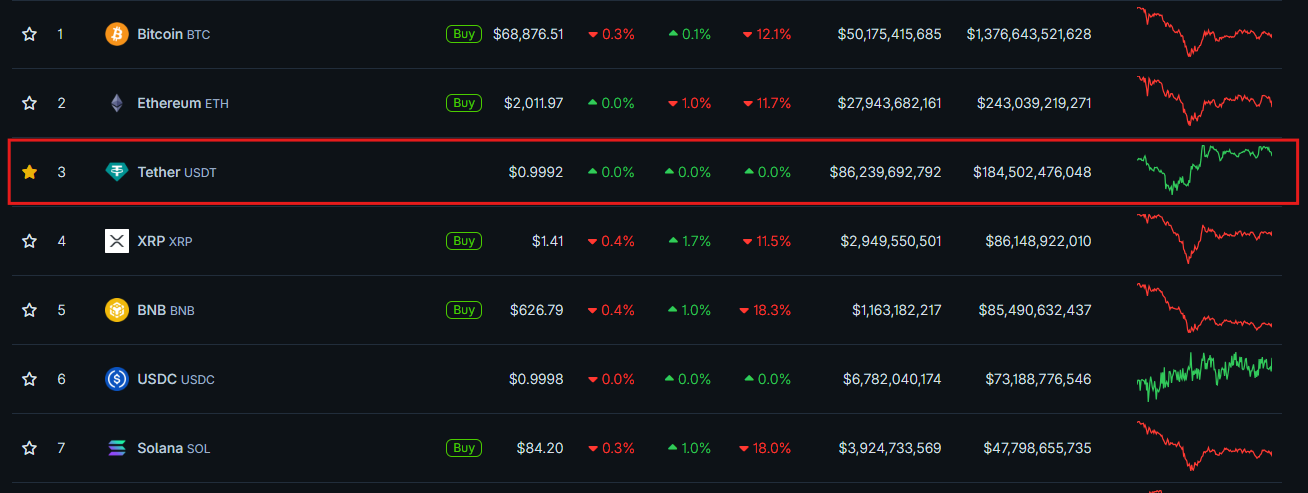

Key figures include:

- Market cap: Around $184.5B as of February 2026, ranking in the top 3 across the entire crypto market.

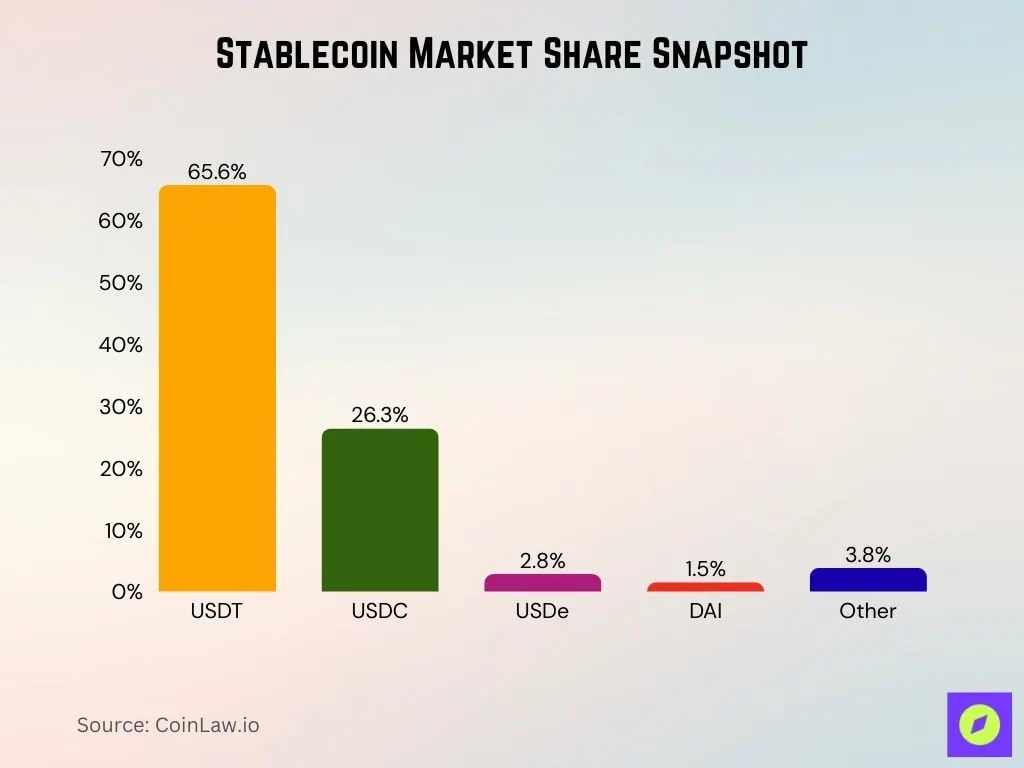

- Stablecoin market share: Around 60%, down from a peak of 67.5% in early 2025 due to increasing competition from USDC.

- Profit: More than $10B in the first three quarters of 2025, a level that has drawn comparisons with traditional banks, according to AInvest.

- Reserves: Approximately $135B in US Treasuries and $6.8B in excess equity, according to CoinMarketCap AI.

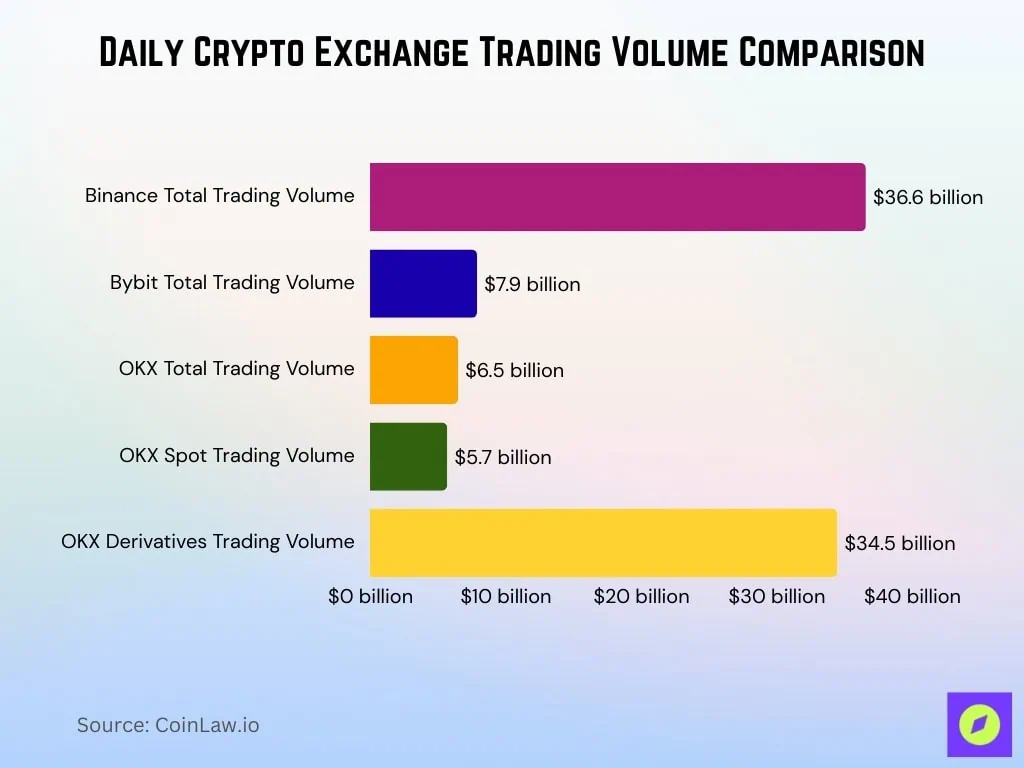

- Volume: USDT trading volume frequently exceeds that of both Bitcoin and Ethereum, according to CoinLaw.

USDT also benefits from deep liquidity and broad presence across multiple blockchains such as Ethereum, Tron, BNB Chain, and Solana. It is often considered the common currency of the crypto market.

Despite its dominance, Tether has not undergone a full audit by a Big Four firm, relying mainly on attestations. S&P rated USDT “Weak” 5 out of 5 in terms of transparency. MiCA regulations in the EU have led to USDT being delisted from several major European exchanges, and the GENIUS Act in the US, if fully implemented, could create additional compliance pressure.

Circle

If Tether is seen as the giant, Circle represents the rising challenger with a clearly different strategy. Circle prioritizes regulatory compliance first, then scales growth.

Circle is a US-based fintech company focused on building blockchain-based payment and digital finance infrastructure, with USDC as its core product. Instead of chasing liquidity at any cost, Circle has chosen to work closely with regulators, banks, and traditional financial institutions from the start.

Notable metrics include:

- Market cap: Around $75B by the end of 2025, up 73% YoY.

- Stablecoin market share: Reached 25.5% in 2025.

- Revenue: $740M in Q3 2025, up 66% YoY, with net income of $214M, according to CoinLaw.

- Support: USDC operates natively on more than 30 blockchains, the highest among stablecoins.

USDC extends beyond being just a stablecoin. It supports a rapidly expanding RWA ecosystem.

- USYC: A tokenized US Treasury fund managed by Circle, reached around $635M in market cap and operates on Ethereum, Solana,, Base,... In early January 2026, USYC even surpassed BlackRock’s BUIDL to become the largest tokenized treasury fund at $1.69B versus $1.68B, following integration into Binance collateral rails, according to Messari.

- Circle Payments Network connects banks, blockchain networks, and fintech platforms.

- EURC is a euro-pegged stablecoin fully compliant with MiCA.

Circle complies with MiCA in the EU and the GENIUS Act in the US. Reserves are managed by BlackRock and audited monthly by Deloitte. USDC has been integrated by Visa, Mastercard, and Deutsche Börse. William Blair described Circle as the “most important company in the stablecoin ecosystem” and projected that USDC market cap could reach $150B by 2027, according to CoinDesk.

Risk factors remain. Circle’s revenue depends heavily on US Treasury yields. If the Federal Reserve cuts rates significantly, profit margins may narrow. In addition, a large share of USDC volume is distributed through Coinbase, creating partner concentration risk.

BUIDL

BUIDL (BlackRock USD Institutional Digital Liquidity Fund), is not a typical crypto project. It is a money market fund managed by BlackRock and tokenized on blockchain. Each BUIDL token is valued at $1 and backed by US Treasury bills, repos, and cash, consistent with a traditional money market fund structure.

Key figures include:

- AUM: Peaked at nearly $2.9B in mid 2025, representing more than 40% of the tokenized Treasury market. By the end of 2025, AUM stabilized between $2.4B and $2.8B after several redemptions, according to CCN.

- Supported blockchais: Operates on 8 chains including Ethereum, Solana, Polygon, nAvalanche, Arbitrum, Optimism, Aptos, and BNB Chain.

- Partners: Securitize handles tokenization and transfer agent duties, Bank of New York Mellon acts as custodian, and the fund is registered with the SEC.

BUIDL is more than a financial product. It signals a strong move from traditional finance. BlackRock bringing its reputation and scale onto blockchain sets a precedent for other institutions.

- On-chain collateral: Since November 2025, BUIDL has been accepted as off-exchange collateral on Binance, as well as on Crypto.com and Deribit. This allows institutional traders to use yield-bearing assets as margin, according to CoinDesk.

- DeFi composability: BUIDL serves as backing for new stablecoins such as frxUSD from Frax Finance and supports products like OUSG from Ondo Finance.

Ondo Finance

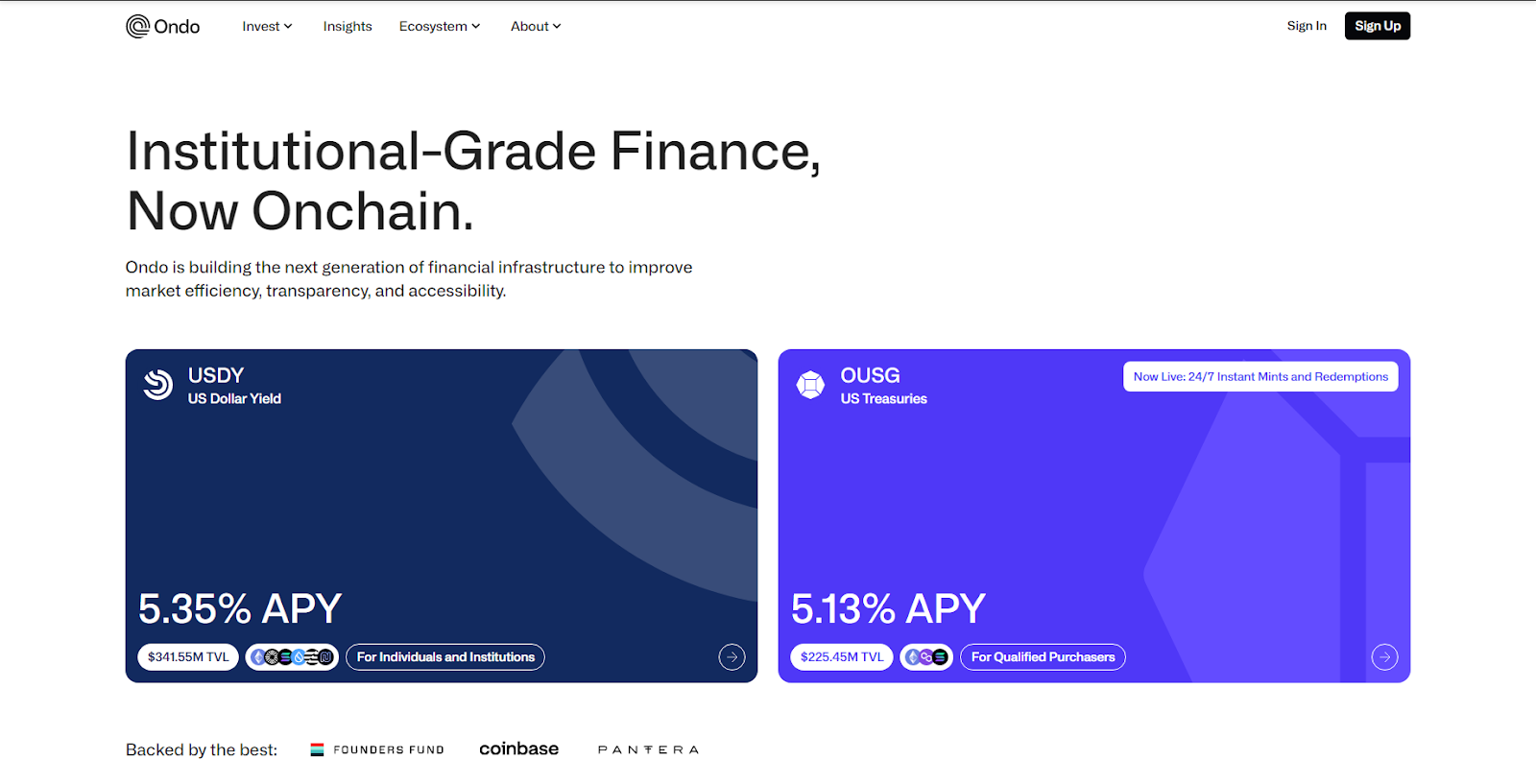

Ondo Finance is an RWA project offering products such as OUSG and USDY, tokenized from US Treasuries and demand deposits. Users deposit capital and receive stablecoin-like tokens that generate yield from US government bonds.

This solution enables access for individuals who want exposure to US Treasuries but face geographic or regulatory barriers. It supports cross-border investment and reduces friction across jurisdictions.

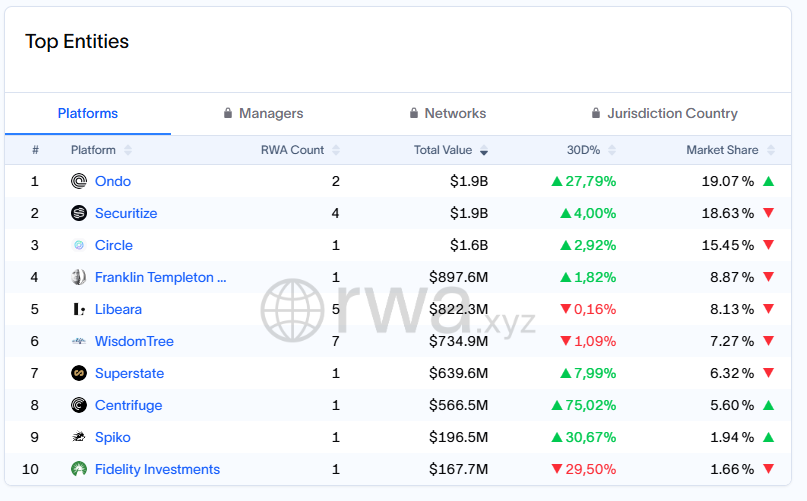

With more than $1.9B in assets, Ondo is the top RWA project in terms of tokenized Treasury holdings in the market.

Why has Ondo become a leader in this segment?

- Ondo products hold the largest TVL in tokenized Treasuries, ranking above traditional giants such as BlackRock and Franklin.

- Backed by BlackRock through BUIDL, which Ondo uses as collateral for OUSG and USDY.

- Raised $24M from major investment funds including Pantera Capital, which led both funding rounds, along with Founders Fund and Coinbase Ventures.

Maple Finance

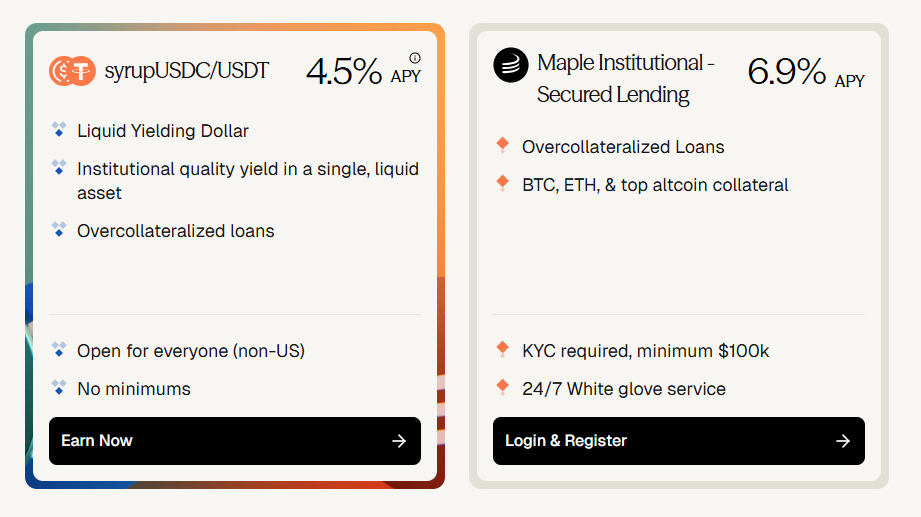

While many projects focus on stablecoins and government bonds, Maple Finance takes a different approach by targeting private credit. The protocol brings real-world corporate lending onto blockchain, connecting on-chain capital with off-chain borrowing demand.

Maple’s model stands out within DeFi. Instead of requiring over 100% collateral like Aave or Compound, Maple offers undercollateralized loans to institutions that have completed KYC and undergone credit assessment. Pool Delegates manage each pool, evaluate borrowers, set loan terms, and oversee risk. This structure resembles traditional credit funds more than a typical crypto lending pool.

Expansion 2025 to 2026 includes:

- Integration of Chainlink CCIP for cross-chain transfers in August 2025.

- Launch on Solana in June 2025, expanding into a new ecosystem.

- 25% of revenue allocated to SYRUP token buybacks, aligning protocol growth with token value.

Conclusion

RWA is not a short-lived narrative. It is one of the few segments in crypto where growth is driven by real demand, supported by institutional capital, increasing regulatory clarity, and the search for stable yield among users.

When BlackRock, JPMorgan, Fidelity, and Robinhood actively build on RWA infrastructure, the key question is no longer whether RWA is sustainable. The focus shifts to who will lead the next phase.

With projections suggesting tokenized assets could reach $2T to $4T by 2030, and even up to $30T in long-term scenarios, 2025 may only be the opening chapter of a much longer growth cycle.

FAQs

Q1. What is the core difference between Tether and Circle among leading RWA projects?

Tether focuses on liquidity and broad coverage across the crypto market, while Circle prioritizes regulatory compliance and deep integration with traditional finance. These reflect two distinct RWA strategies.

Q2. Why is BlackRock’s BUIDL considered a milestone for RWA?

BUIDL demonstrates that a traditional money market fund can operate directly on blockchain at multi-billion dollar scale. This sets a precedent for other large institutions to implement RWA beyond experimental stages.

Q3. What problem does Ondo Finance solve that other tokenized funds have not fully addressed?

Ondo emphasizes accessibility by enabling global users to gain exposure to US Treasuries through permissionless products. This extends RWA beyond the traditional institutional investor base.

Q4. How is Maple Finance different from common DeFi lending platforms?

Maple targets private credit and provides undercollateralized loans to vetted institutions instead of requiring excess collateral. This brings traditional banking logic onto blockchain with potentially higher yield.

Q5. Why do many RWA projects show strong product growth but relatively weak token performance?

The core value of RWA lies in the underlying assets and real cash flows, not directly in governance tokens. As a result, AUM and TVL can grow rapidly while token prices may not reflect that growth proportionally.

Q6. What overall market trend do the top RWA projects reflect?

Leading projects show that RWA is shifting from experimental narrative to real financial infrastructure. The focus is no longer hype, but scalability, compliance, and integration with traditional capital.