In recent years, Prediction Markets have emerged as one of the most fascinating experiments in decentralized finance. By turning public expectations and data into tradable assets, these platforms blur the line between speculation and information discovery. Rather than relying on luck, participants engage in collective forecasting - where every trade reflects the wisdom, sentiment, and confidence of the crowd.

This article explores how Prediction Markets work, why they’re gaining traction across the DeFi landscape, and what makes them a potential pillar for the next generation of data-driven economies.

What is a Prediction Market?

A Prediction Market is a model that allows participants to trade or bet based on the outcome of a future event, functioning similarly to a miniaturized stock exchange.

Here, each contract represents a possible outcome of an event. If the event occurs as predicted, the contract reaches its maximum value (e.g., $1); otherwise, it is worth 0. The price of a contract reflects the collective belief in the likelihood of the event occurring and continuously changes as new information emerges.

Unlike a casino, where players rely solely on luck, a crypto prediction market enables those with knowledge or early access to information to profit based on their analysis.

How does Prediction Market work?

Prediction market operates on the principle of aggregating collective intelligence through a financial trading mechanism. Users don’t just “predict” outcomes but actively buy and sell shares representing the results of future events.

Examples include “Candidate A wins the election,” “Bitcoin surpasses $100K by year-end,” or “Movie X wins an Oscar.”

How it works specifically:

- Participants choose the outcome they believe will occur and purchase corresponding shares. Each share is priced between 0 and $1, reflecting the market’s perceived probability of that outcome, called odd.

- As new information emerges, the price of shares fluctuates. If news strengthens the likelihood of an outcome, the share price rises; conversely, if unfavorable information appears, the price drops.

- Investors can sell their shares when the price increases to lock in profits or hold them until the event concludes. If the prediction is correct, each share is worth $1; if incorrect, it’s worth 0, similar to how stocks react to corporate news.

Example:

Suppose there’s a prediction market for whether Bitcoin will exceed $100K by December 31, 2025.

- A user believes this will happen and buys 100 “Yes” shares at $0.45 each (investing $45).

- Months later, major institutions announce plans to invest in Bitcoin, causing the “Yes” share price to rise to $0.75.

- At this point, the user can sell to lock in a $75 profit or hold until year-end to potentially receive $100 if the prediction is correct.

Through this mechanism, Prediction Markets are not just a platform for “betting” but also a tool that reflects collective beliefs and the community’s expectations about real-world events, spanning economics, politics, sports, and culture.

Why Crypto Prediction Markets Hold Potential

Applications

Crypto prediction markets are not merely platforms for betting on event outcomes, they are increasingly becoming systems for collective intelligence with applications across numerous fields.

Rather than betting to win money, participants trade based on their beliefs and data, generating prices that reflect the crowd’s expectations about the future. This “opinion → price → reality” mechanism transforms Prediction Markets into a highly accurate tool for studying behavior and trends.

In the future, prediction markets could be used to:

- Market Research and Consumer Behavior: Businesses can test customer reactions to product designs, pricing, or advertising campaigns before launching them.

- Business Decision-Making: Managers can forecast risks, demand, or competitive trends based on predictive price signals.

- Healthcare and Technology: Predict the success of new drugs, research progress, or the adoption of new technologies.

- Culture and Society: Analyze social media phenomena, cultural trends, or even public voting outcomes.

As user experience improves and authoritative data is integrated, Prediction Markets will move beyond being a “betting platform” to become a new decision-making layer for society and businesses, where individuals can transform information into value and value into decisions.

Learn more: Why Pre-market on Prediction Market matters

Direct Competition with Traditional Betting

The traditional betting (gambling) market is significantly larger, with similar user behavior: placing bets on outcomes to earn profits.

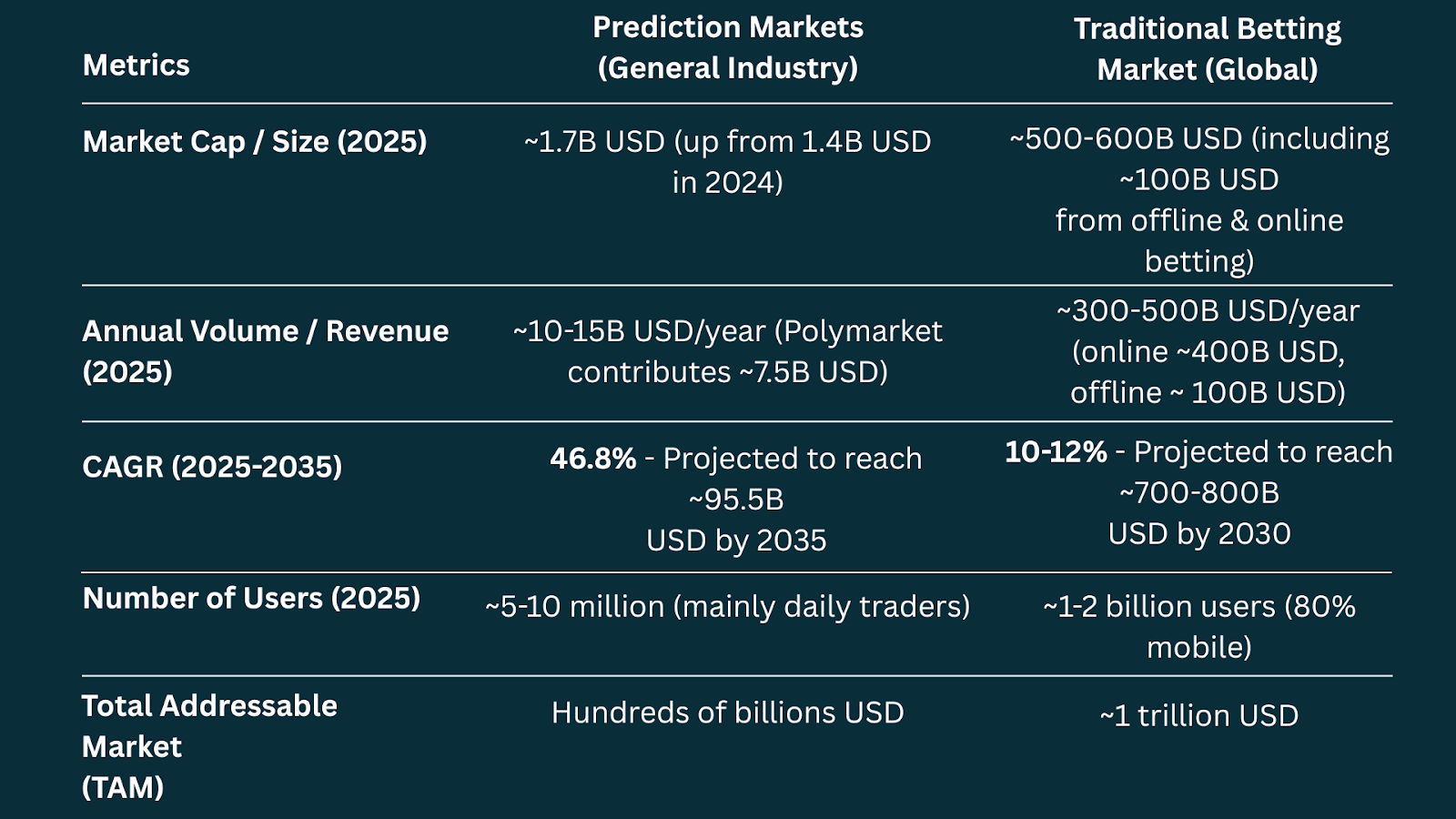

However, Prediction Markets have advantages in transparency (via blockchain), no geographical limitations, and lower fees. Below is a comparison of key metrics based on 2025 data:

In reality, the Total Addressable Market (TAM) of Prediction Markets can grow without limits. Since any event can be brought to the platform for prediction, the capitalization of these markets can expand continuously.

Pieces of the Crypto Prediction Market Landscape

Prediction Platforms

The platforms below form the foundational platforms of the entire Prediction Market picture, where events are created and traded:

- Polymarket is valued at $9B

- Kalshi at $5B

- Limitless is also generating FOMO among retail investors with over $200M raised in the market .

- Beyond these major names that have already secured a certain position in the space, several smaller projects are also striving to carve out their market share, especially those on the BNB Chain- where there is currently a $1B fund from YZi Labs dedicated to builders.

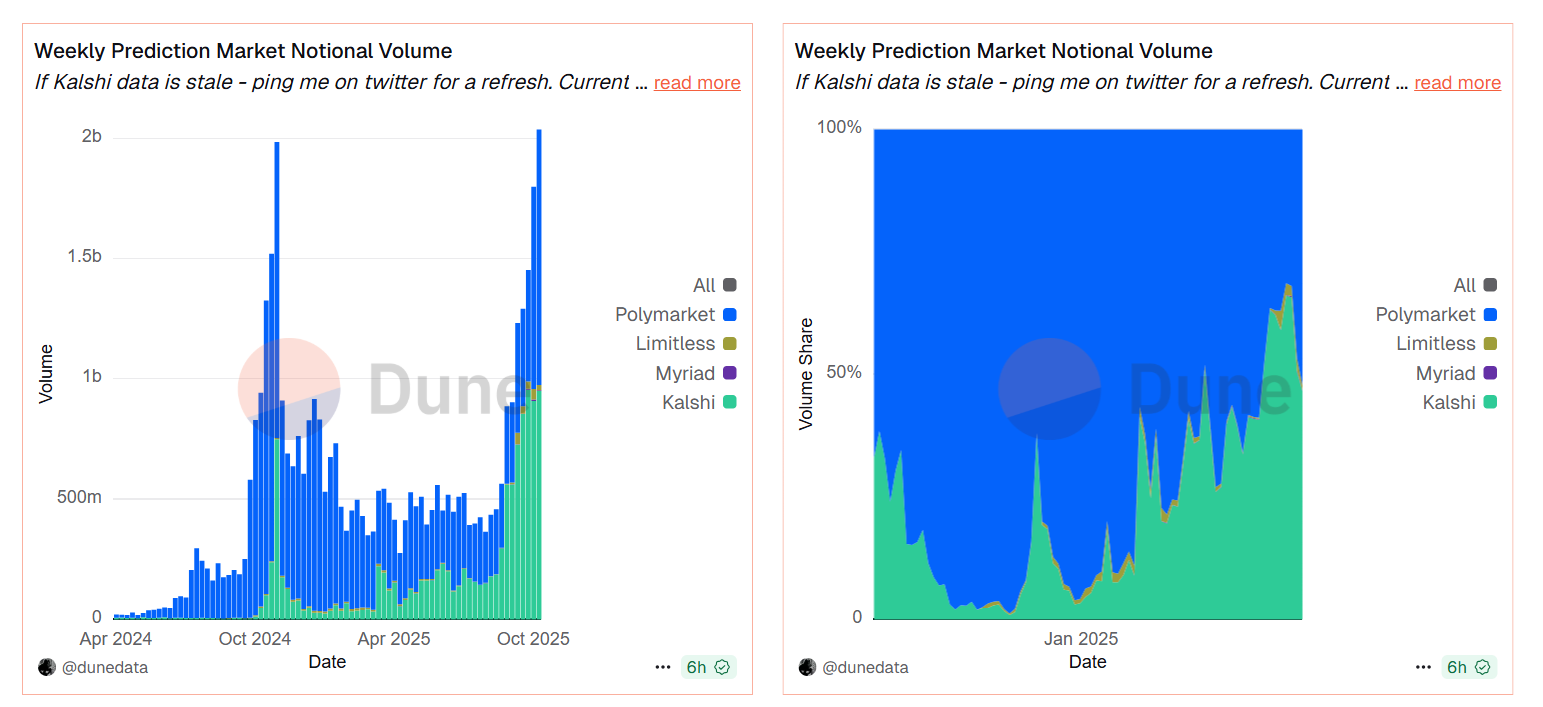

Currently, the market is witnessing the dominance of Polymarket and Kalshi, as these two platforms have captured more than 97% of the total trading volume in the market .

However, even though betting only takes place primarily on these two platforms, several issues in this niche are also being exposed:

- Liquidity Issues: Prediction Markets rely on attention to function, and if they fail to attract sufficient community participation, spreads become very wide. Additionally, order matching on order book markets can take a long time, leaving users waiting extensively for their orders to execute.

- Capital Efficiency Problems: This is also an extremely challenging issue that needs resolution, particularly for markets with relatively long durations- for instance, predicting which team will win the EPL 2025/2026 season, which ends in Q2/2026, while it's currently only September 2025. This means waiting more than half a year for the event's outcome.

These problems are expanding the overall picture of the prediction niche with the emergence of projects that address these pain points.

Lending in Crypto Prediction Markets

Many events in prediction markets take a significant amount of time to resolve with a definitive outcome. As a result, several projects have emerged to allow users to collateralize their betting positions, optimizing capital efficiency.

However, the components in this niche are still quite limited, primarily focusing on addressing the issue of capital lock in long-term betting positions. A notable project in this field is Gondor.

Gondor is the leading project in this space, operating as a specialized DeFi protocol for prediction markets. Its mechanism enables users to collateralize open positions on platforms like Polymarket (e.g., Yes/No shares in political or sports events) to borrow stablecoins such as USDC, freeing up capital without closing positions.

The risk assessment system is based on event probabilities, price volatility, and supports looping. Gondor is considered the "Aave of prediction markets," with a focus on liquidity and security. The project has received funding from VCs like Maven11 Capital and is expanding.

Aggregation in crypto Prediction Markets

Aggregation in prediction markets refers to the process of collecting and combining information from various sources to produce more accurate forecasts, rather than relying on a single opinion.

Imagine this: Instead of asking one expert to predict an election outcome, users gather insights from thousands of people (through buying/selling shares), combine them with real-world data, AI analysis, or even data from other markets.

The result is a "crowd-sourced" prediction that is often more accurate than traditional polls because people stake real money on their beliefs.

For example, in a prediction market for “Who will win the 2026 World Cup?”, aggregation might involve combining:

- Share prices from traders (reflecting probabilities based on transactions).

- Historical data and player injury updates from AI.

- Data from other platforms like Polymarket and Kalshi to identify arbitrage opportunities.

These are primarily analytics platforms or terminals that aggregate data from prediction markets like Polymarket and Kalshi, helping users analyze, track, and optimize their strategies.

Some notable projects include:

- Polyburg Terminal (@polyburg): This acts as a “whisperer” for Polymarket, a tool that tracks and aggregates real-time market data. It helps users “listen” to price movements, trader positions, and opportunities without guesswork. For example, it aggregates transaction history to predict trends.

- Polymarket Analytics (@poly_data): Specializes in aggregating detailed data from Polymarket, including all traders, markets, positions, and transactions. It serves as a “dashboard” to see who’s betting what and how money is flowing. Supported by Polymarket and Goldsky, it helps detect patterns or arbitrage opportunities.

- HashDive - Prediction Market Analytics (@hash_dive): Focuses on advanced analytics for Polymarket and Kalshi, particularly with “Smart Scores”- a composite metric that evaluates the intelligence of predictions based on historical data. It aggregates data from multiple sources to calculate scores, helping users identify trustworthy markets.

- Polysights (@polysights): Uses AI to aggregate and analyze data from Polymarket, providing insights like opportunity alerts and arbitrage between markets. It acts as an “AI assistant” to optimize strategies, turning large datasets into easy-to-understand reports.

AI Agents in Crypto Prediction Markets

The AI Agents segment in prediction markets refers to "smart agents" that autonomously use artificial intelligence to analyze data, predict event outcomes (such as sports, politics, or finance), and execute trades or bets without human intervention.

These agents function as "intelligent bots" on blockchain, leveraging real-time data from oracles, on-chain analytics, and machine learning to generate profits (yield) for users.

For example, an agent might scan thousands of markets on Polymarket or Kalshi, calculate betting win probabilities based on historical data and trends, and automatically place orders.

Some notable projects in this trend include: AIxBET (@aixbet_ai), SIRE (@sire_agent), Billy Bets (@BillyBets_ai).

Conclusion

The rise of platforms like Polymarket and Kalshi highlights the growing appeal of this sector. With increasing liquidity and trading volume, Prediction Markets are evolving beyond simple betting platforms to become powerful tools for data research, policy making, investment, and risk management.

If DeFi is where capital is redefined, then Prediction Markets are where trust is digitized - a new direction that helps people understand the market, and the market understand people.

FAQs

Q1. What is a Crypto Prediction Market?

A platform where users trade shares on future events - prices reflect the market’s belief about outcomes.

Q2. How is it different from betting?

Unlike gambling, Prediction Markets use real data and analysis, not luck, to forecast results.

Q3. Why are Polymarket and Kalshi popular?

They dominate over 97% of market volume, proving strong growth and investor confidence.

Q4. What are the real-world uses?

Used for market research, policy forecasting, investment, and risk management.

Q5. What’s next for Prediction Markets?

With AI and blockchain, they’re turning trust and data into a new tradable asset class.