As decentralized perpetual exchanges continue to gain traction, the need for platforms that combine CEX-level performance with true decentralization has never been greater. Lighter emerges as a next-generation perpetual DEX leveraging custom zero-knowledge rollup technology to deliver verifiable, high-speed trading on Ethereum. So what is Lighter? Let's dive into this article.

What is Lighter?

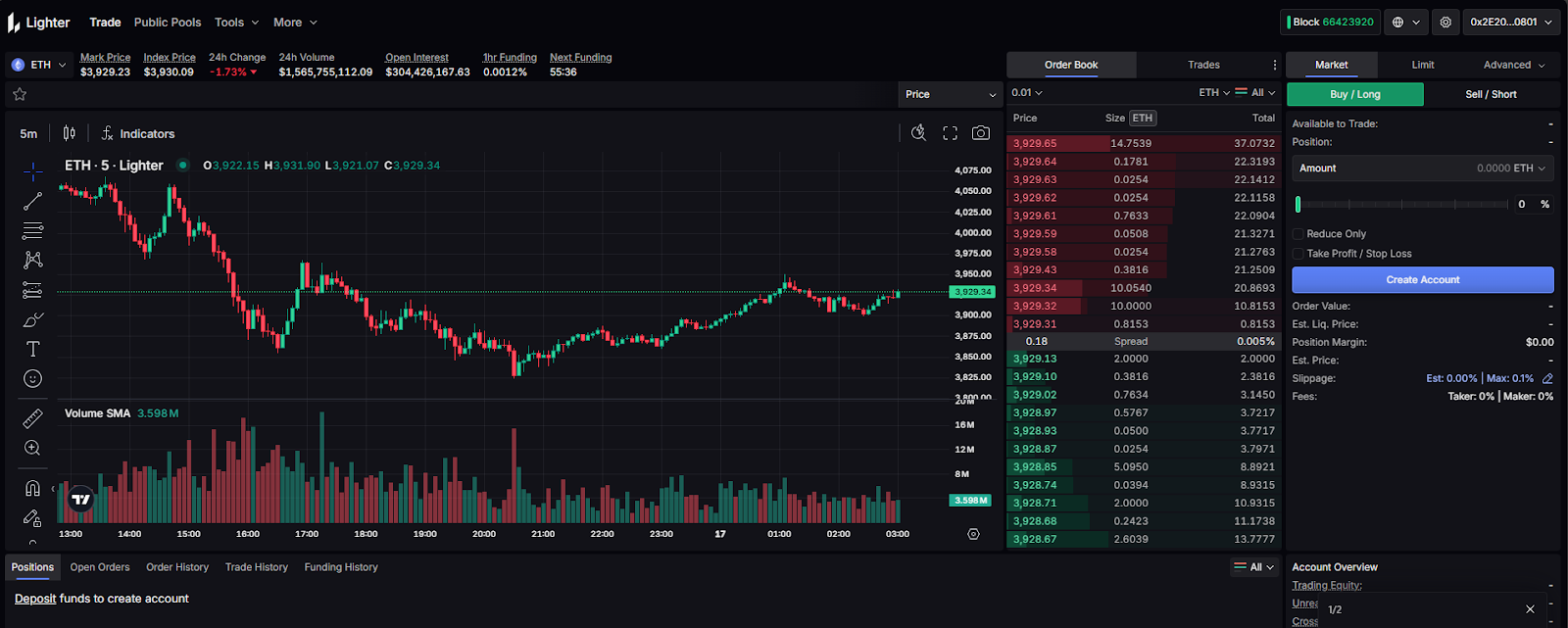

Lighter is a decentralized perpetual futures exchange built on a custom zero-knowledge rollup for Ethereum. The platform bridges centralized and decentralized trading by delivering CEX-level speed and liquidity while maintaining full transparency and self-custody through cryptographic proofs.

Lighter uses custom ZK circuits to generate cryptographic proofs for all operations including order matching and liquidations, with final settlement occurring on the Ethereum blockchain. This approach enables the platform to process tens of thousands of orders per second with millisecond latency, while ensuring every trade is provably fair and verifiable onchain.

The protocol distinguishes itself through its zero-fee model for retail traders, making perpetual futures trading more accessible while charging competitive fees only to institutional API and high-frequency trading flows.

How does Lighter work?

Lighter operates as a zero-knowledge rollup on top of Ethereum, optimized for speed, throughput and scale. The platform's architecture consists of several key components that work together to deliver high-performance decentralized trading:

Custom ZK Circuits

Transactions flow through custom circuits that verify signatures and balances instantly while generating cryptographic proofs. This ensures that all operations are mathematically proven to be correct and fair, eliminating the possibility of manipulation or censorship.

Verifiable Order Matching

Trades match by price-time priority with cryptographic proofs, eliminating censorship or favoritism. Every order execution is provably fair and can be verified publicly on Ethereum, creating a transparent and trustless trading environment.

Automated Risk Management

A risk engine monitors margin and auto-liquidates risky accounts, backed by insurance funds. This system ensures market stability while protecting both traders and liquidity providers from systemic risks.

Ethereum Settlement Layer

Lighter uses Ethereum as the base layer for proofs and system state changes, with users able to deposit or withdraw securely through Ethereum with all proofs verified publicly. This architecture provides users with guaranteed withdrawal rights and self-custody, even if the Layer 2 sequencer goes offline.

Liquidity Pools (LLP)

The platform features Public Liquidity Pools where users can contribute liquidity and earn yield based on trading activity. LLP tokens represent shares in these pools and can be used across the Ethereum DeFi ecosystem, enabling composability with protocols like Aave for additional yield opportunities.

Lighter Token Information

Lighter Token Key Metrics

Currently, Lighter has not announced official token details. The project is running a points program (currently in Season 2) that is widely expected to serve as the distribution mechanism for future token rewards.

Here is what we know about Lighter's token structure:

- Token Name: TBA (To Be Announced)

- Ticker: TBA

- Token Type: TBA

- Total Supply: TBA

- Contract address (CA): TBA

Lighter Token Use Case

Currently, Lighter has not announced any official use case for the project token. However, based on similar perpetual DEX models, potential use cases may include trading fee discounts, governance rights, staking rewards, and insurance fund contributions.

Whales Market will update immediately when the official Lighter website announces token utility details.

Lighter Token Listing

Here are important details revealed about Lighter's token:

- Listing time: Expected Q4 2025 (November-December 2025)

- Confirmed CEX Listings: TBA

Fundraising

Lighter has raised a total of $68M through an undisclosed funding round completed on November 11, 2025, at a reported valuation of $1.5B.

The round was led by Ribbit Capital and Founders Fund, with participation from Robinhood and Haun Ventures. The funding reflects strong institutional backing from investors with deep experience across fintech, crypto infrastructure, and consumer financial platforms.

In addition, Lighter is supported by a broad network of leading venture firms and angel investors, including Andreessen Horowitz (a16z), Coatue, Lightspeed, CRV, SVA, 8VC, and Abstract Ventures, among others. This diverse investor base highlights strong conviction in Lighter’s long-term vision and infrastructure potential.

Lighter Roadmap & Team

Roadmap

Lighter has achieved several key milestones in 2025:

- January 2025: Private beta launch with invite-only access

- September 30, 2025: End of private beta phase

- October 2, 2025: Public mainnet launch after approximately eight months of private testing

- October 2025: Launch of Season 2 points program

- Q4 2025: Expected token generation event (TGE) and token listing

The platform is actively developing new features, including the ability to use LLP positions as margin, allowing traders to simultaneously earn yield and trade with the same capital.

Team

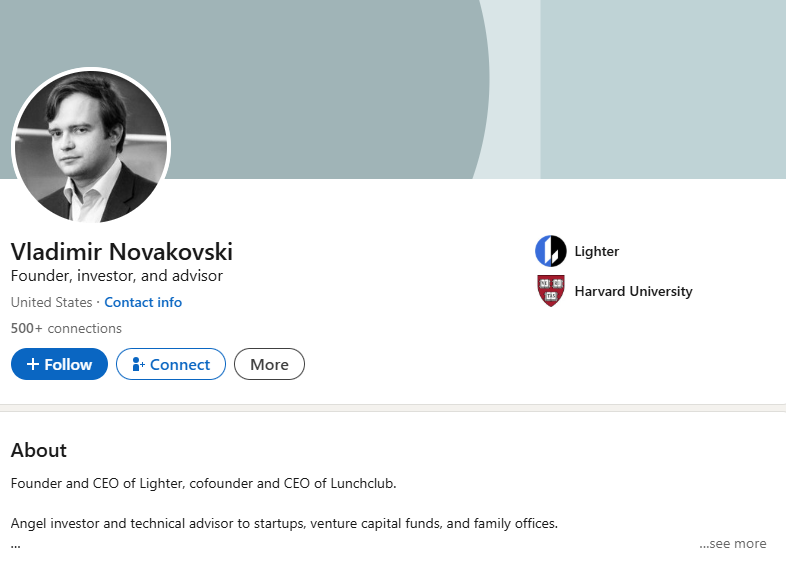

Vladimir Novakovski - Founder & CEO

Vladimir Novakovski is the Founder and CEO of Lighter, with a background in quantitative trading at Citadel, machine learning at Quora, and engineering leadership at Addepar. He previously co-founded Lunchclub and holds a degree from Harvard University.

The Lighter team comprises experienced engineers specializing in zero-knowledge cryptography, blockchain infrastructure, and quantitative finance.

Conclusion

Lighter represents an advancement in decentralized perpetual futures trading, combining custom zero-knowledge rollup technology with Ethereum settlement to deliver verifiable, high-performance onchain trading.

With its zero-fee model for retail traders, backing from top-tier VCs like a16z and Lightspeed, the platform is well-positioned in the rapidly growing perpetual DEX sector. The ongoing Season 2 points program and anticipated Q4 token launch make Lighter a compelling project for traders and DeFi participants to watch.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1: What is the native token of Lighter?

Lighter has not yet announced its native token. The project is currently running Season 2 of its points farming program, expected to convert into token rewards at TGE in Q4 2025.

Q2: What is Lighter?

Lighter is a decentralized perpetual futures exchange built on a custom zero-knowledge rollup architecture for Ethereum, offering CEX-level performance with full transparency and self-custody.

Q3: How much has Lighter raised?

Lighter has secured backing from prominent VCs including a16z, Lightspeed Venture Partners, Haun Ventures, Dragonfly, and Founders Fund. The exact funding amount has not been publicly disclosed.

Q4: When is Lighter's TGE?

The TGE is expected in Q4 2025, potentially in November or December. Whales Market will update immediately when Lighter announces official token launch details.

Q5: What is the price of Lighter token today?

Lighter has not yet announced official token details. For the most accurate and updated information, please refer to the official Lighter website and social channels. Once the token launches, you can trade it on leading CEXes like Binance, Bybit or OKX.