The prediction market is growing at an almost exponential pace. Beyond the increasing number of platforms competing for market share, a comprehensive ecosystem is taking shape. One of the most noticeable pieces in this wave is leveraged trading on prediction markets.

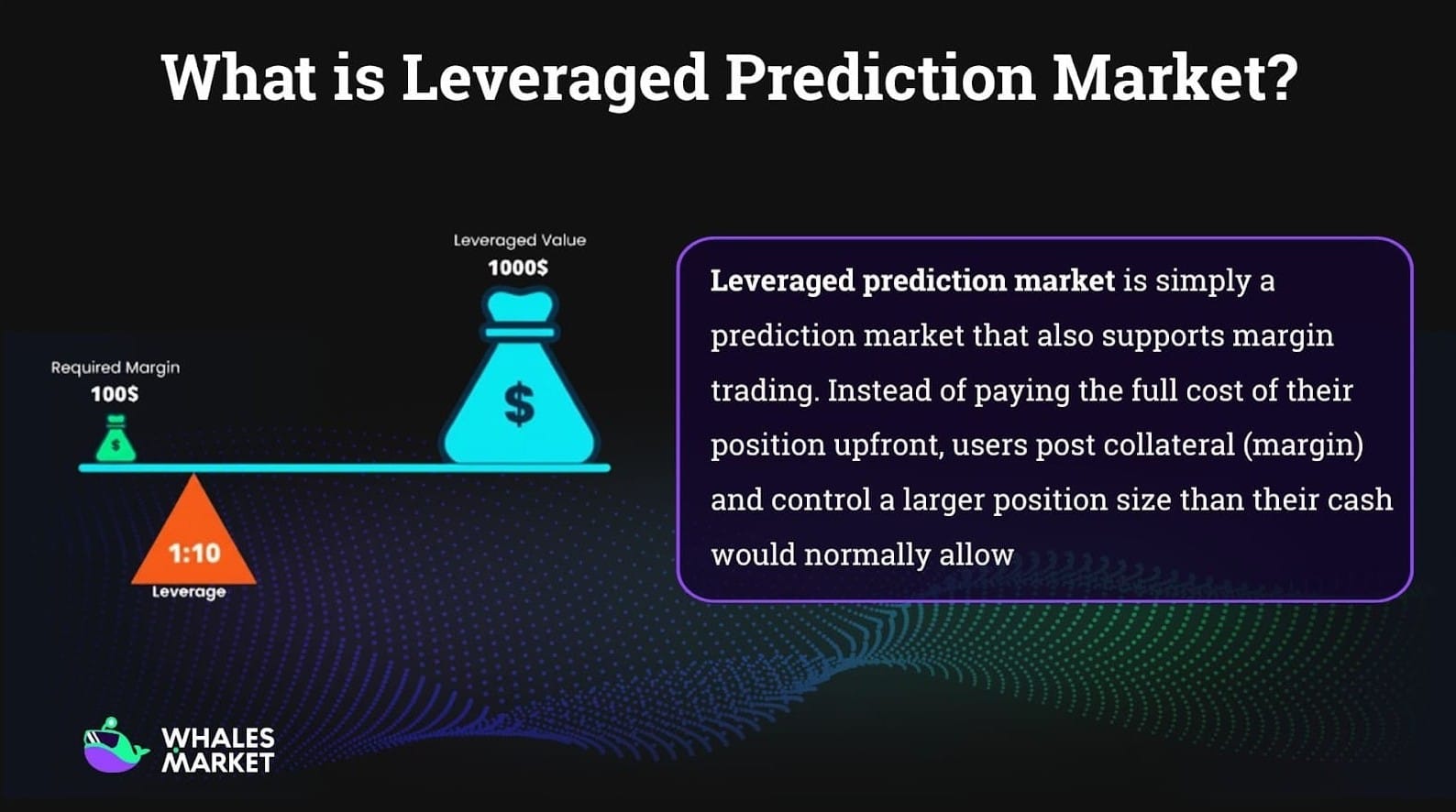

What is Leveraged Prediction Market?

Leveraged prediction market is simply a prediction market that also supports margin trading. Instead of paying the full cost of their position upfront, users post collateral (margin) and control a larger position size than their cash would normally allow.

Core Idea behind Leveraged on Prediction Market

Prediction markets are places where users or traders trade based on the outcome of a future question, often in a YES or NO format. A common setup on how prediction market works will look like this:

- Traders buy shares of YES/NO.

- When the outcome is finalized, each share settles at $1 if the prediction is correct and $0 if it is not.

- The share price is often used as a way to express probability, for example, YES at $0.35 is often read as about 35%, and in a YES or NO model the two prices often add up to roughly $1.

A common confusion is that prediction markets can already feel like leverage because binary payoff is built in. If YES is bought at a low price and the market later assigns a much higher probability, the percentage return on the amount paid can be large even without any margin.

However, leveraged prediction market in the technical sense usually refers to leverage through margin:

- Traders use margin to increase exposure, and because there is funded leverage involved, the system must include risk controls such as margin thresholds and liquidation.

- The most important difference between using leverage and not using leverage is not the market question or the final settlement logic ($1 or $0), but the price path before the market ends.

- With leverage, a position can be forcibly closed through liquidation before the final result is known if price moves make the margin no longer safe.

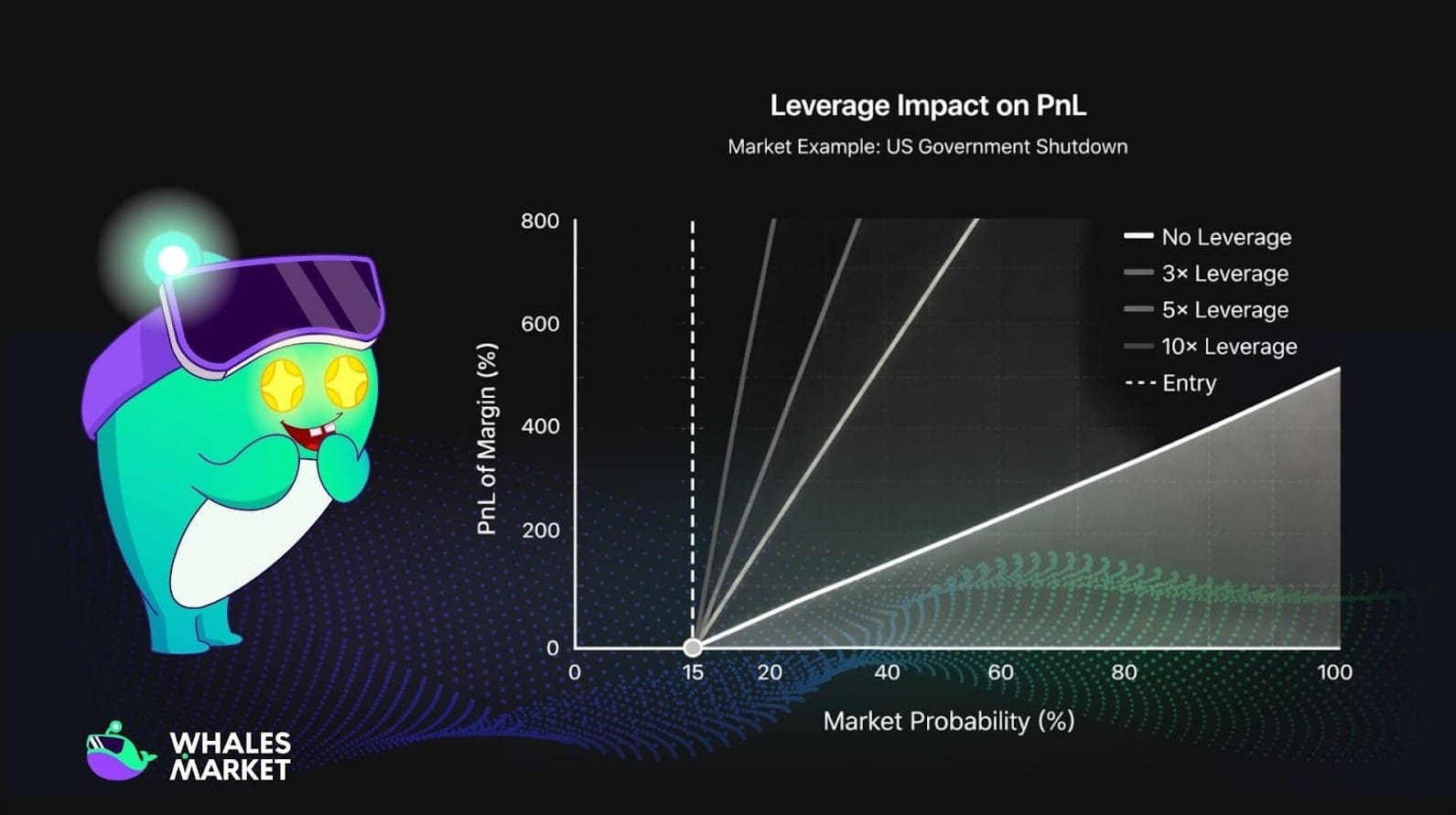

Example Market: “Will the U.S. government shut down before the end of the year?”

Current Market Probability: 15% (YES shares priced at $0.15)

- Users decide to buy 1,000 YES shares at $0.15.

- Without leverage, that costs $150.

- With 5× leverage, they only need to deposit $30 as margin (20% of the position value).

- If the market shifts to 30% ($0.30), their position doubles in value - now worth $300, giving you a $150 profit on just $30 margin (500% ROE).

- But if the odds fall to ≈13.33% (≈$0.13), your position would be liquidated.

How Leverage Works in Prediction Markets

At a conceptual level, leverage prediction markets typically revolves around three parts:

- Opening a position: When entering a trade, traders follow the same basic steps: choose YES or NO, choose a price, and choose the number of shares. The difference is that instead of paying the full position value, traders deposit only a smaller portion as margin. This margin allows traders to control a larger exposure through leverage.

- PnL still moves: After the position is opened, PnL still depends on whether the share price rises or falls. Traders can also exit before the market resolves by selling back at the market price. The key difference is that because the upfront capital is only the margin, the same price move can produce a much larger profit or loss in % terms compared with a non leveraged trade.

- A liquidation threshold: Because traders only post part of the capital, the platform needs risk controls. If the price moves against the position and the margin is no longer sufficient, the position can be liquidated before the market reaches its final outcome. This means traders can be forced to exit early even when the question has not been resolved yet.

Leveraged Prediction Market Example

Leveraged prediction markets still an early-stage niche. Most major prediction markets today are fully collateralized (no margin), so leverage mainly shows up in a few experimental designs that borrow derivatives-style mechanics (often isolated margin) to make event trading more capital-efficient.

Early examples include dYdX’s prediction market perpetuals and Drift’s BET prediction markets on Solana.

To understand how they work in practice, let’s walk through the example below:

Example market: “Will the Fed cut rates at the January 2026 FOMC meeting?”

Current YES share price is $0.40, meaning the market is pricing about 40% probability.

A trader takes YES and buys 1,000 shares.

The position value (notional) is 1,000 x $0.40 = $400.

No leverage vs. 5x leverage

- With no leverage, the trader pays the full $400 upfront.

- With 5x leverage, the trader posts only 20% as margin, so margin is about $80 for the same position/volume.

PnL still depends on the share price move.

If the YES price rises from $0.40 to $0.55. Profit is 1,000 x ($0.55 - $0.40) = $150.

- ROE with no leverage is $150 / $400 = 37.5%.

- ROE with 5x leverage is $150 / $80 = 187.5%.

If the YES price falls from $0.40 to $0.30, loss is 1,000 x ($0.40 - $0.30) = $100.

- ROE with no leverage is -$100 / $400 = -25%.

- ROE with 5x leverage is -$100 / $80 = -125%, so liquidation becomes more likely depending on the platform’s maintenance margin rules.

ROE = Return on Equity= PnL / equity.

Why jump risk matters?

If decisive news hits, such as an unexpected inflation spike and a hawkish Fed signal, the YES price can gap from $0.40 to $0.10 in minutes. With leverage, losses can overwhelm margin almost instantly, making the liquidation window extremely narrow.

This is why leveraged prediction markets are often harder to run than many smoother, continuous markets.

Learn more: Common mistakes when trading on Prediction market

Risks of Using Leverage in Prediction Markets

Leverage can boost returns, but it also amplifies losses, so the main question is not “what if I’m right” but “can I survive the move in between?

Liquidation risk comes first

With leverage, users can get liquidated even if the price only moves slightly against them.

In the example, YES dropping from $0.40 to $0.30 is a $0.10 move, but at 5x it becomes a $100 loss on roughly $80 margin, around -125% ROE. Once equity can no longer meet the maintenance margin, the platform may force-close the position.

Timing risk

Prediction prices often swing on headlines, rumors, or data releases. Users might still be correct about the final outcome, but a short-term dip can trigger liquidation before the market rebounds.

Without leverage, they can tolerate volatility more easily. With leverage, the buffer is smaller, so being correct on direction is not enough, timing matters too.

Execution and platform risk

Leverage adds risks beyond the outcome bet itself. Thin liquidity and wider spreads can make entries and exits expensive. Slippage during fast moves can worsen fills and push liquidation closer.

Liquidations also depend on the platform’s mark price, risk engine, and margin rules, so brief dislocations or settlement and oracle issues can lead to outcomes that differ from a simple fully collateralized YES or NO position.

Conclusion

Leverage does not change how a prediction market settles, but it changes how risk is carried along the way. Gains and losses can look much larger relative to the margin posted, and the liquidation threshold becomes the practical “line in the sand” that often matters more than the final resolution date.

For users or traders, the real question is whether the extra exposure is worth the tighter room for error, especially when probabilities can reprice quickly on breaking news.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What does a YES share price actually represent?

In most YES or NO markets, the YES price is a market based estimate of probability. For example, YES at $0.35 is commonly read as about 35%, while final settlement is still binary at $1 or $0.

Q2. Why can a trader be right in the end but still lose money with leverage?

Because leveraged positions can be liquidated before resolution. If price moves against the position and margin becomes insufficient, the position may be forced closed even if the final outcome later would have paid out.

Q3. What is the difference between notional position value and margin?

Notional is the full value of the position based on shares times entry price. Margin is the smaller collateral amount posted to control that notional exposure when leverage is used.

Q4. What does ROE mean in these examples?

ROE is return on equity, calculated as PnL divided by the margin or equity posted. With leverage, the same dollar PnL can translate into a much larger ROE.

Q5. Can traders exit before the market resolves, or do they have to wait for settlement?

Traders can typically exit by selling shares back at the market price before resolution. This matters more with leverage because managing drawdowns can reduce liquidation risk.