DeFi originated from a seemingly vague concept that unexpectedly became a powerful movement with many innovations, and now it is gradually becoming the future of the financial industry.

So, what is DeFi? Let's explore through the article below.

DeFi Definition: What is DeFi?

DeFi (or Decentralized Finance) is an open, global financial system built on blockchain technology. It allows users to perform traditional financial services such as borrowing, lending, trading, staking, payments, insurance, and asset management without the intervention of intermediaries like banks, centralized exchanges, or traditional financial institutions.

Instead, DeFi uses smart contracts self-executing code on the blockchain to handle transactions automatically, transparently, and in a trustless manner.

DeFi originated in 2017-2018 on the Ethereum platform, when developers realized that blockchain could not only store cryptocurrencies but also support complex financial services.

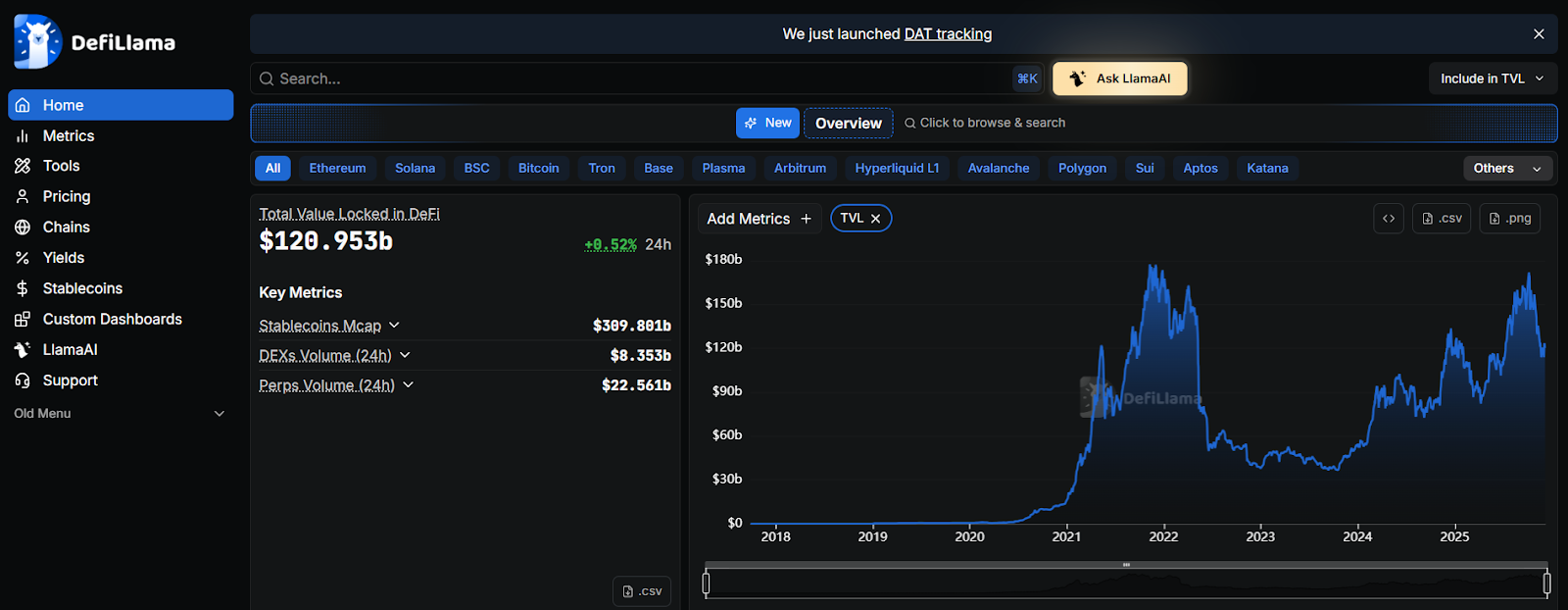

By 2025, DeFi has expanded to many other blockchains such as BNB Chain, Solana, Polygon, and various Layer 2/Layer 1 solutions to reduce costs and increase speed. According to DeFiLlama in 12/2025, DeFi market now has a Total Value Locked exceeding $120B, with millions of global users, especially in developing countries where traditional banking systems are still limited.

The Essence of DeFi

The core essence of DeFi lies in decentralization, allowing the building of an open financial system not controlled by any central entity. It relies on blockchain to ensure transparency, security, and global accessibility. Here are the key elements that define the nature of DeFi:

- Permissionless: Anyone with an internet connection and a cryptocurrency wallet (like MetaMask) can access most DeFi protocols without going through traditional account opening processes. Some products or jurisdictions may still require KYC, but in general users can join, transact, and build on an open financial system on public blockchains.

- Trustless: Transactions are executed by code rather than people. Users can review open-source code and verify transactions on the blockchain using blockchain explorer tools (like Etherscan), reducing fraud risks from intermediaries.

- Transparency and Automation: All transactions are publicly recorded on the blockchain and cannot be altered. Smart contracts automate processes, for example, automatically paying interest when due without needing bank staff.

- Interoperability: DeFi is often likened to “money legos,” where different protocols can connect and compose with each other. For instance, users can borrow from Aave and then trade on Uniswap, all in a single atomic transaction.

- Innovation: Because protocols are open and composable, developers can quickly experiment, fork, and launch new products. This accelerates the creation of new financial primitives that would be slow or impossible to build in traditional finance.

- Blockchain-based: Instead of depositing funds with a centralized intermediary, users hold and control their assets directly through private keys or smart contract wallets. This reduces reliance on third parties but also means users must manage their own security.

In summary, DeFi is not just a financial tool but a revolution, shifting power from centralized organizations to individuals and communities.

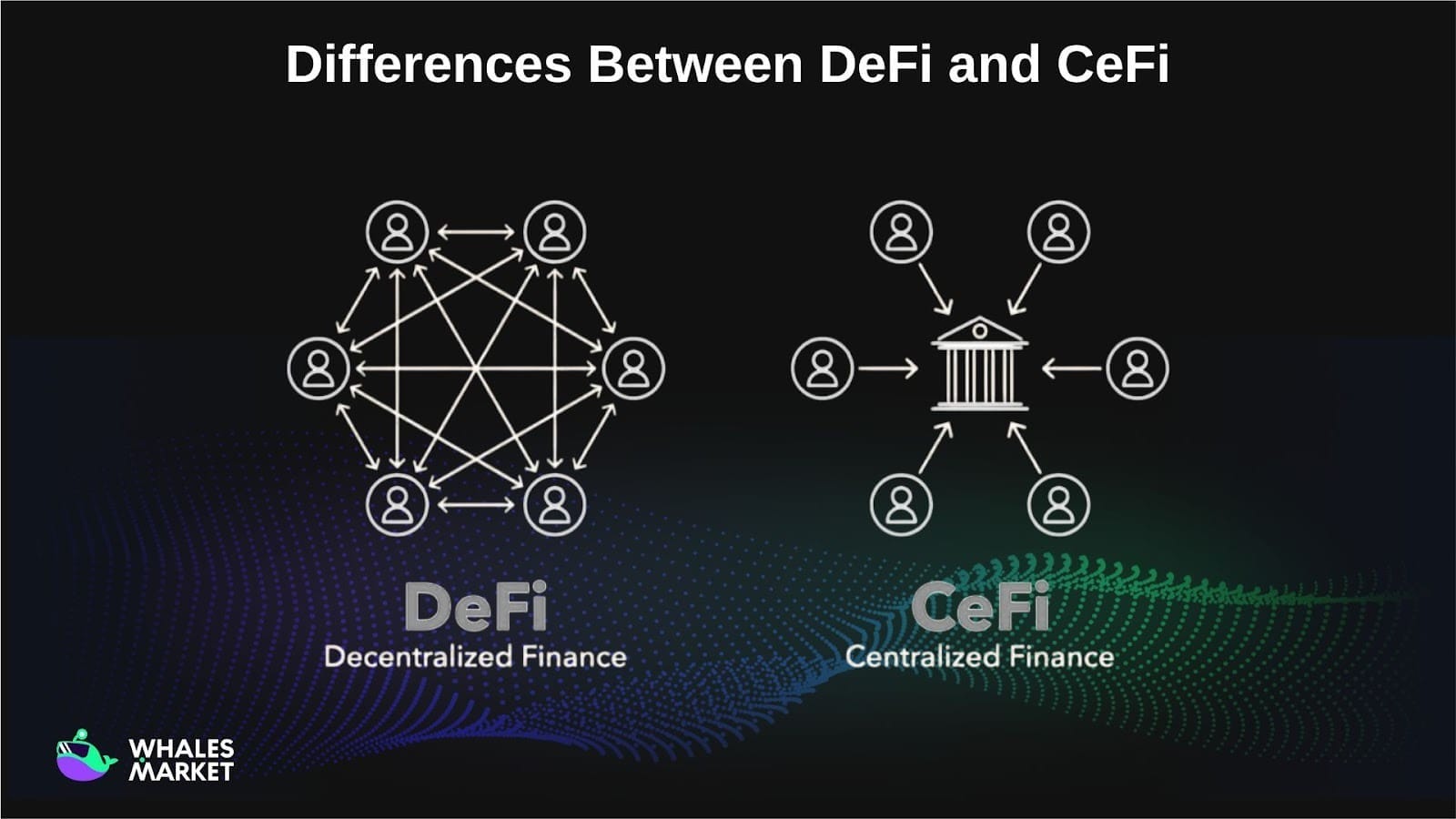

Differences Between DeFi vs CeFi

CeFi (Centralized Finance) is a financial model based on centralized platforms such as cryptocurrency exchanges (e.g., Binance, Coinbase), banks, and asset management companies.

To make it easy to visualize, here are the differences between DeFi and CeFi:

DeFi prioritizes permissionless access and transparency, while CeFi offers convenience and stability. Many users combine both, for example, buying crypto on CEXs and then transferring to DeFi to earn higher returns. Simply put:

- In CeFi, borrowing activities are controlled by centralized institutions such as banks, which must follow internal processes and legal requirements, including credit checks and asset appraisal, before loans can be approved and disbursed.

- In DeFi, everything is operated through smart contracts automatically, saving time and eliminating cumbersome procedures. As a result, borrowing through lending protocols has become a popular choice for many individuals.

Components that make up DeFi

DeFi is a complex ecosystem with multiple layers. To avoid confusion, it’s can roughly divide its components into two groups: Architecture (protocol/infrastructure) and Applications (user-facing protocols).

DeFi Architecture

- Settlement Layer (Base Layer/Layer 1): Layer 1 blockchains act as the base layer where transactions are recorded, data is stored, and smart contracts are executed. This is the core foundation for all DeFi activities. Example: Ethereum, Solana, BNB Chain...

- Execution & Scaling Layer (Layer 2/Rollups): Helps scale DeFi by processing transactions off-chain (or in batches) and then settling them back to the base layer (L1), reducing fees and improving speed. Example rollups like Arbitrum, Optimism...

- Smart Contracts: Code segments deployed on these blockchains that automatically execute financial logic, such as paying interest, liquidating collateral, or swapping tokens without intermediaries.

- Oracles: Bring off-chain data like asset prices or market events, on-chain so smart contracts can react correctly during pumps, crashes, or liquidations.

- Bridges: Transfer assets or data between different blockchains from (L1 to L2, or across L1s), helping liquidity move across ecosystems.

DeFi Use Case (Applications)

- Stablecoins: Stable-priced cryptocurrencies such as DAI, USDT, and USDC serve as relatively stable mediums of exchange and help reduce volatility when using DeFi.

- Wallets: Tools like MetaMask and Trust Wallet that let users store assets, sign transactions, and interact with DeFi protocols.

- DEXs (Decentralized Exchanges): Protocols such as Uniswap and PancakeSwap typically use the AMM model with liquidity pools to trade tokens instead of traditional order books. More recently, projects like Orderly and Hyperliquid have developed on-chain CLOB (Central Limit Order Book) models that are also optimized for blockchain environments.

- Lending/Borrowing Protocols: Platforms like Aave and Compound allow users to lend crypto to earn interest, or borrow by posting collateral.

- Pre-market DEX: Decentralized exchanges that allow buying and selling "rights"/IOUs (i own you) of tokens before the token officially launches (TGE/listing). It’s similar to the “pre-open session” of stocks, but on-chain. Whales Market, the best pre market trading platform in DeFi for this type of IOU trading.

- Staking Protocol: Platforms that let users stake assets (for example, ETH) and receive liquid staking tokens (LSTs) that represent their staked position. These LSTs still earn staking rewards while remaining usable in other DeFi activities.

- Liquid Restaking Protocols: Platforms that allow users to restake their staked assets or LSTs to secure additional networks or services and earn extra yield. This increases potential returns but also adds more smart-contract and slashing risk; EigenLayer and Symbiotic are typical examples.

These components connect like "legos" to create an automatically operating financial system without intermediaries, saving time and enhancing user experience.

Limitations of DeFi

Although DeFi brings a lot of innovation, it still comes with important limitations that users need to understand clearly. These issues can range from inconvenience (high fees, complex UX) to complete loss of funds if things go wrong.

- Security and hack risks: Smart contracts can contain bugs or design flaws that attackers exploit, leading to large asset losses from hacks.

- Market volatility: Crypto assets are highly volatile, so collateral value and profits can change sharply in a short time.

- Scalability and performance: Many blockchains still struggle with high gas fees and slow confirmations when the network is congested. Ethereum is a typical example, and even newer high-performance Layer 1s (such as Solana, Hyperliquid, Aptos, and Sui) are still being tested on whether they can handle large, sustained transaction volumes and user loads.

- Complexity for newcomers: Interfaces and processes are often difficult to use, requiring knowledge of wallets, seed phrases, gas fees, and different blockchains.

- Lack of support and protection: There is usually no professional customer service; if users lose their private key or sign a malicious transaction, assets can be lost permanently.

- Regulatory and legal risks: Regulation is still light and unclear, which means limited legal protection for users and the possibility that DeFi services may later be restricted or banned in some countries.

- Governance and centralization risks: Many DeFi protocols still rely on admin keys or multisig-controlled contracts. Mismanagement, collusion, or key compromise can lead to protocol shutdowns, fund freezes, or even rug pulls (situations where insiders drain liquidity or user funds and then abandon the project).

- Liquidity and stablecoin/peg risks: Thin liquidity or unstable stablecoins can cause severe slippage, difficulty exiting positions, or cascading liquidations when a major asset loses its peg.

Conclusion

The foundation and infrastructure of DeFi are now increasingly solid, especially as regulations have become clearer, helping projects have a framework to comply with.

Additionally, stablecoin issuers are playing an increasingly important role in creating demand for US government bonds, so the future of DeFi is very open with many advantages that the traditional financial market lacks.

FAQs

What does DeFi mean?

DeFi, short for Decentralized Finance, is a blockchain-based financial infrastructure that operates independently of traditional, centralized intermediaries. By leveraging smart contracts, DeFi enables a transparent and permissionless ecosystem where users can engage in complex financial activities directly with one another on a global scale, such as lending, borrowing, and asset management.

How is DeFi different from CeFi?

DeFi is permissionless and non-custodial. Anyone with a crypto wallet can access it, transactions are recorded transparently on-chain, and users remain in control of their private keys and funds.

CeFi (Centralized Finance) operates through companies such as exchanges or lending platforms. Users usually have to complete KYC, send assets to the platform’s wallet and trust the company to manage custody, security and customer support.

Why is DeFi important?

DeFi is important because it opens access to financial services for anyone in the world with an internet connection, without needing a bank account. Many DeFi products operate 24/7 with lower fees and faster settlement compared with traditional finance, and new ideas such as automated market makers or yield farming would not exist without it.

Most importantly, DeFi lets users control their own assets, choose the level of risk they are comfortable with and move between protocols without asking permission.

When did DeFi emerge?

DeFi started to take shape around 2017–2018 on Ethereum, with early projects such as decentralized exchanges and lending protocols. The “DeFi summer” of 2020 marked a big turning point, when liquidity mining and yield farming attracted large amounts of capital and users.

Today, DeFi has expanded beyond Ethereum to many other chains, including Solana, BNB Chain, Polygon and various Layer 2 networks, each with its own ecosystem of apps.

What is a smart contract in DeFi?

A smart contract in DeFi is a piece of code deployed on a blockchain that automatically executes agreed conditions. For example, a lending contract will release collateral when a loan is repaid, or a DEX contract will swap tokens at a given price when a user sends a transaction.

Because the code and transaction history are public, users can verify how the contract works instead of trusting a human middleman, although they still face technical risks such as bugs or exploits.