Validators play a critical role in maintaining the security and operational integrity of a blockchain network. To become a validator, users must stake a required amount of the network’s native token and are rewarded upon completing their duties.

But what exactly is a Validator? What responsibilities do they undertake, how essential are they to the blockchain, what does the validation process involve, and how does one qualify to become a Validator?

Validator Definition: What is a Validator?

A validator is an online server that runs node software on a Proof-of-Stake (PoS) blockchain to earn rewards. In PoS systems these nodes are called validators; in Proof-of-Work (PoW) they’re miners.

Validators verify transactions and create new blocks, which helps maintain the blockchain's security and integrity. In return, they must stake a minimum required amount of the blockchain's native token to be selected.

Simply put, a validator can be seen as a component within the blockchain network, authorized to validate new transactions before they are permanently recorded into a block on the blockchain.

The importance of validator nodes in the blockchain

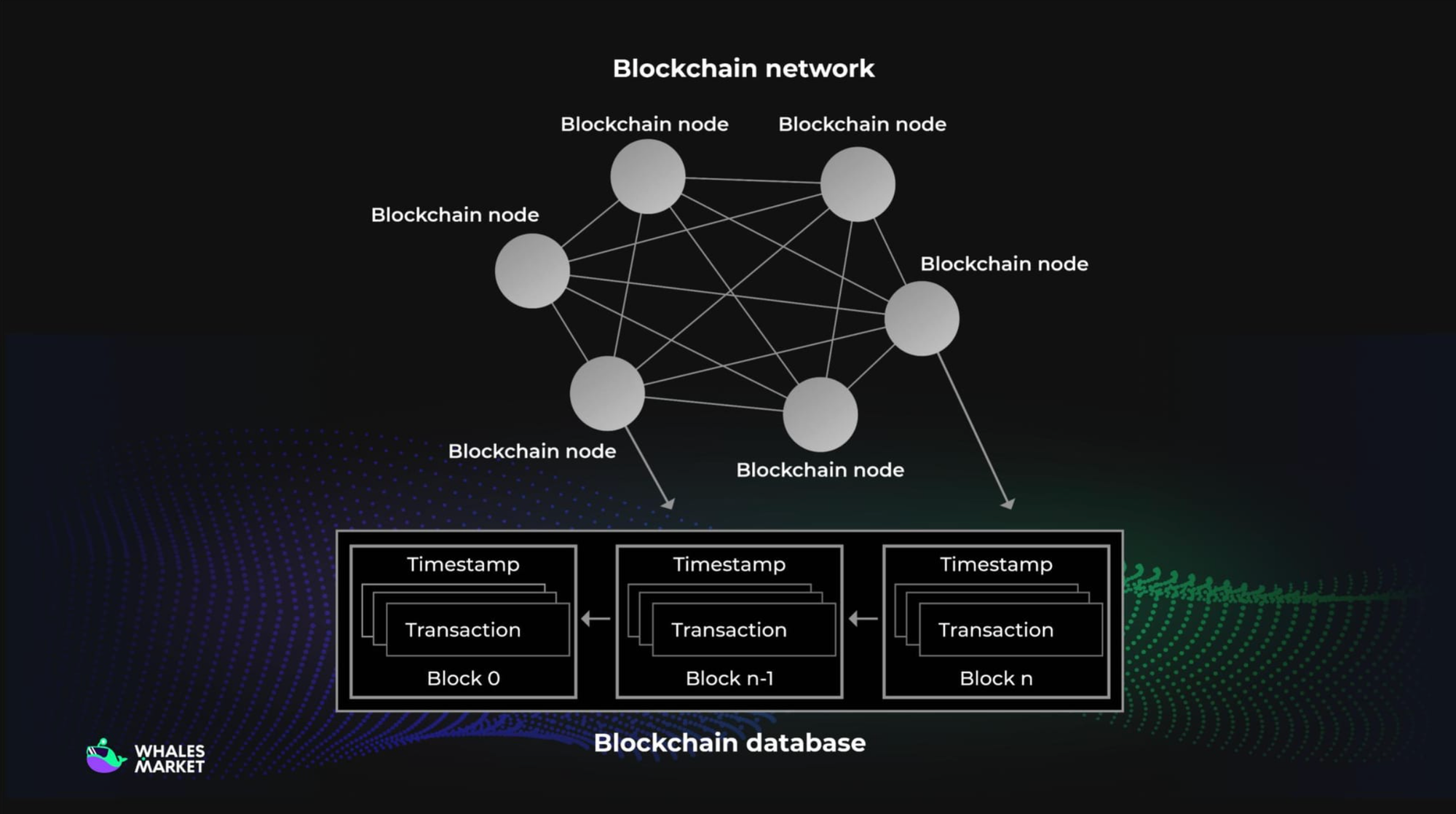

To begin, it is important to understand that a blockchain is a system operating through a globally distributed network of nodes.

Nodes are responsible for authenticating transactions and proposing new blocks to the blockchain. When nodes confirm a block and achieve consensus, the transaction is recorded on the blockchain and finalized. Each node must hold an identical copy of all transaction data on the blockchain and constantly communicate with other nodes to ensure consistency when new transactions are added.

Nodes that utilize the Proof-of-Stake (PoS) consensus algorithm are specifically called validators.

Thus, validators are often considered the "backbone of the blockchain," undertaking several critical roles essential for network operation and maintenance:

- Verify transaction validity: When authenticating a transaction, validators must check that it adheres to the blockchain's rules and protocols. If a transaction is invalid, the validator rejects it to maintain system integrity.

- Propose & create new blocks: Validators collect a set of valid transactions, bundle them into a new block, and propose that block to the other validators on the network.

- Maintain network’s security: Validators prevent fraudulent transactions (such as double spending) from being added to the blockchain, ensuring the network's integrity and security.

- Ensure network’s decentralization: A large number of validators operate concurrently and monitor the system. Each validator holds equal value and can check others, ensuring fairness and decentralization within the network. The required number of validators varies by blockchain rules.

- Participate in network’s governance: Validators typically have voting rights on blockchain proposals, contributing to decisions regarding changes or upgrades to the system.

How do validators authenticate transactions?

First, to become a validator, a user must stake a specific amount of token required by the blockchain. The blockchain selects validators based on the amount and duration of the user's stake; the more tokens staked and the longer the duration, the higher the probability of being selected.

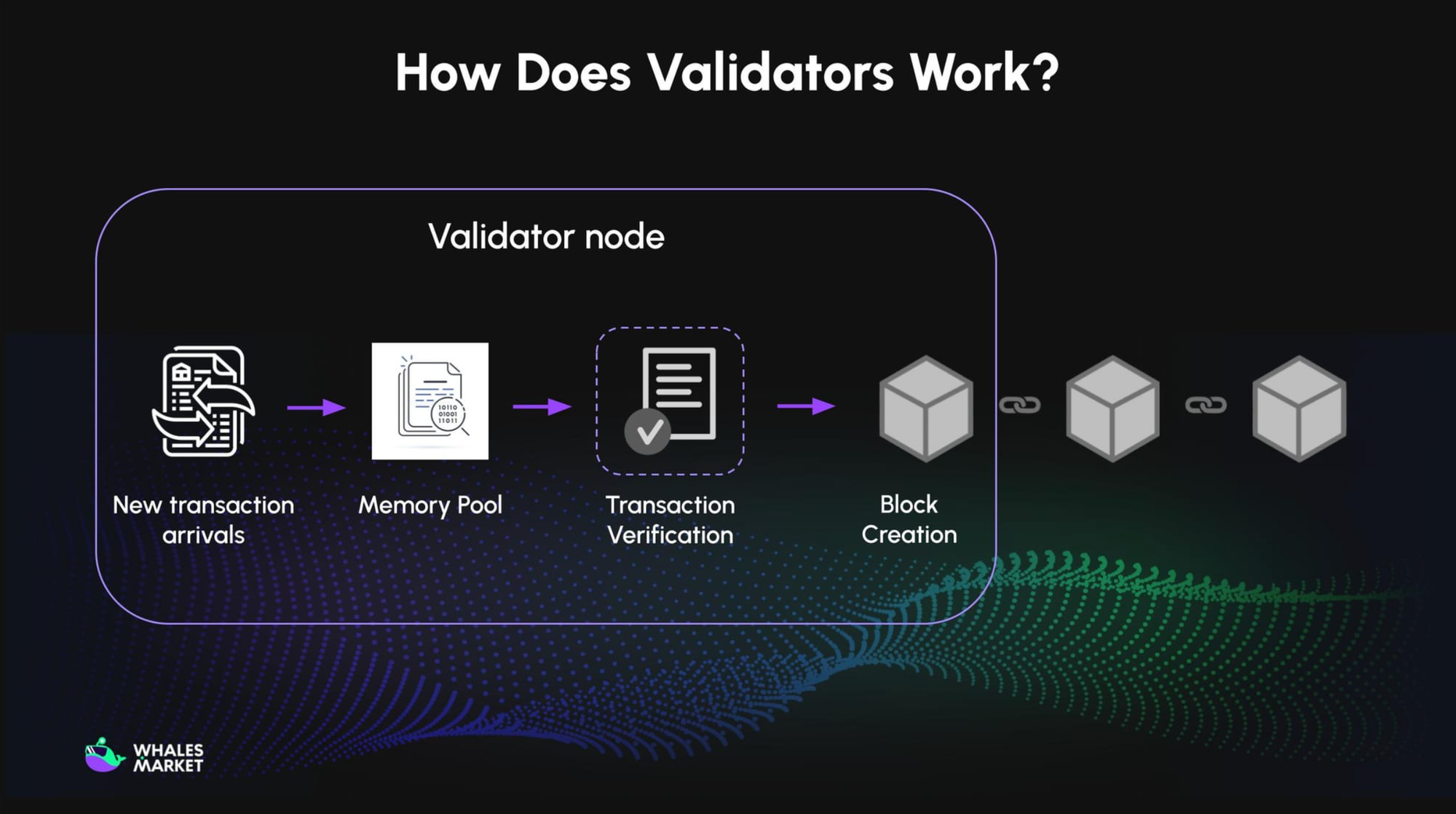

When a user executes a transaction on the blockchain, it is checked, authenticated, and added to the blockchain by validators through the following process:

- Receive transaction: The system randomly selects validators to participate in validating the transaction. The number of validators required varies by blockchain.

- Validate: The validators verify transaction information from the mempool, such as the sender's digital signature and the token amount, to confirm the transaction is valid.

- Propose: The validator records the valid transaction into a new block, signs the block with their unique identifier, and then transmits this block to all other validators in the network.

- Data synchronization: The other validators verify the new block and add the new transaction information to their copies of the blockchain to ensure network consensus.

- Finalize transaction and receive reward: The user's transaction is completed, and the validator receives the transaction fees, and (on some networks) MEV, as the reward.

3 key considerations before becoming a Validator

How to become a validator is a frequently discussed topic in the crypto market because validators can earn money from the blockchain under all market conditions (up, down, or sideways trends).

If a user is considering becoming a validator on a blockchain, researching and thoroughly understanding the requirements, potential returns, and risks are paramount.

Requirements

The requirements for becoming a validator vary depending on the blockchain's operating mechanism. Essentially, they involve three main steps:

- Select the blockchain network based on personal research and needs.

- Invest in hardware, software, and stake the required assets according to the blockchain's demands.

- Run and maintain the node.

While setting up the necessary hardware, software, and staking the assets is often simple, primarily requiring adherence to the blockchain's guidelines, running and maintaining the node demands a validator possess technical expertise in computer networking, cybersecurity, troubleshooting, and protocol management.

However, the crypto market offers several services designed to meet user staking needs without requiring them to become technical validators. Users can simply prepare their tokens and delegate their stake to a third party to perform the validator duties. Services serving this need include liquid staking, validator as a service (VaaS), and solo staking.

Rewards (Returns)

Validator rewards come from protocol issuance, transaction fees, and on some networks MEV. Rewards are typically calculated per epoch. The duration of an epoch varies by blockchain, such as:

- Ethereum: An epoch is the time it takes for validators to authenticate 32 blocks, roughly 6.4 minutes.

- Solana: An epoch lasts approximately 2 days.

Users can use websites with validator reward calculators to estimate the potential returns they could earn. The Staking Rewards website, for example, is a valuable tool that aggregates comprehensive data on validators across various blockchains (global staking market cap, average annual staking rewards, etc.).

Risks

Alongside receiving rewards for validating transactions and maintaining the network, users must also face significant risks that need careful consideration before deciding to become a validator:

- Slashing: A penalty mechanism for validators who commit misbehavior against the protocol rules, such as simultaneously validating two blocks, being offline for an extended period, attempting to manipulate the network, or validating an invalid block. Depending on the blockchain, validators can lose a partial or entire amount of their initial staked tokens and be temporarily or permanently removed from the validator pool.

- Liquidity & price risk: The staked tokens are locked and inaccessible. Consequently, the validator cannot sell their assets during sharp price movements (up or down).

- Operational cost & complexity: Validators must invest in hardware, software, electricity, and bandwidth to run the node, which can amount to thousands of USD.

Conclusion

Validators are the operational backbone of every Proof-of-Stake network, directly ensuring transactional integrity and network security. Their function extends beyond simply processing transactions; they are the mechanism that enforces fairness, preserves decentralization, and upholds the blockchain's overall validity.

As the industry shifts toward highly scalable and interconnected PoS ecosystems, the importance of robust, committed validation only grows. While becoming a validator demands technical knowledge, financial commitment, and acceptance of risks like slashing, the rewards make it a critical and sustainable role in the future of decentralized finance.

FAQs

What does “validator” mean?

A validator is a Proof-of-Stake (PoS) node that stakes the network’s native token to propose and/or attest blocks and earn rewards. Validators can be penalized via slashing if they violate protocol rules.

Should I become a validator?

Consider it if you have sufficient stake, 24/7 operations capability, and you accept technical and market risks. Otherwise, using delegation, liquid staking, or Validator-as-a-Service (VaaS) are better choices.

How do I become a validator?

To become a validator, you need to choose a network, provision secure infrastructure (server, networking, monitoring), generate/secure keys, run the client software, stake the minimum amount, and maintain high uptime. Set up alerts, backups, and an incident response plan.

How much do validators earn? Is APR fixed?

Rewards come from issuance and transaction fees, and APR fluctuates by network conditions, validator set size, uptime, and commission. Net returns also depend on operating costs and the token’s price.

Does every blockchain have validators?

No. PoS networks use validators; PoW networks use miners. Some permissioned chains use authority validators with different trust assumptions.