Stepping into the crypto world, many quickly come across the term “utility token.” It might sound technical, but the idea is actually simple. Think of a utility token as a “ticket” to use a service inside a blockchain project.

This article breaks it down from A to Z: What is a utility token? How does it works? Real examples, and the pros and cons.

What is a Utility Token?

Utility token is type of digital asset on blockchain designed to give users access to specific products or services within an ecosystem. In contrast to payment tokens like Bitcoin, which primarily function as a store of value or medium of exchange, utility tokens act as the underlying fuel for specific protocols, granting holders rights to interact with an ecosystem's unique features.

Utility token can be used for paying fees, voting, unlocking content, or earning rewards. This type of token became popular during the crypto ICO boom in 2017 and has since shifted toward more practical use cases, partly to avoid strict regulatory scrutiny.

Imagine buying a ticket to an amusement park. That ticket allows entry and access to the rides, but it doesn’t make the holder a shareholder of the park. A utility token works the same way: it grants usage, not ownership.

How do Utility Tokens work?

Utility tokens are usually issued on blockchains with a specific token standard, such as Ethereum (ERC-20 standard), Solana (SPL standard), BNB Chain (BEP20 standard)... The basic process of how utility token works will look like this:

- Issuance: A project creates tokens and distributes them through public sales or airdrops to attract community members.

- Usage: Users buy tokens with crypto or fiat money, then spend them to access services. For example, paying transaction fees on Ethereum or purchasing in-game items.

- Incentives: Many projects design their tokens for staking, voting, or rewarding active users.

Put simply, a utility token acts as the “fuel” that keeps a project running. As more users engage with the service, demand for the token increases, and so might its value. Still, it remains volatile and is not as stable as a stablecoin.

Utility Token Examples

Here are some well-known utility tokens commonly used across major blockchain ecosystems:

- BNB (BNB Chain): BNB functions as the core utility token of the BNB Chain ecosystem. It is widely used to pay transaction fees, participate in on-chain applications, and access services across Binance-related products. Holding BNB can also unlock fee discounts and other ecosystem-level benefits.

- LINK (Chainlink): LINK is the utility token powering the Chainlink oracle network. It is used to pay node operators for delivering real-world data to smart contracts, securing decentralized applications across DeFi, gaming, and enterprise use cases.

- UNI (Uniswap): UNI enables governance participation within the Uniswap protocol. Token holders can vote on proposals related to protocol upgrades, fee structures, and ecosystem development, shaping the future direction of one of the largest decentralized exchanges.

Together, these examples highlight how utility tokens serve practical roles within their respective ecosystems. Rather than acting as speculative assets alone, they enable access, coordination, and participation across decentralized networks, reinforcing the idea that utility tokens are designed for usage, not ownership or profit-sharing.

Governance token vs Utility token vs Security token: What are the differences?

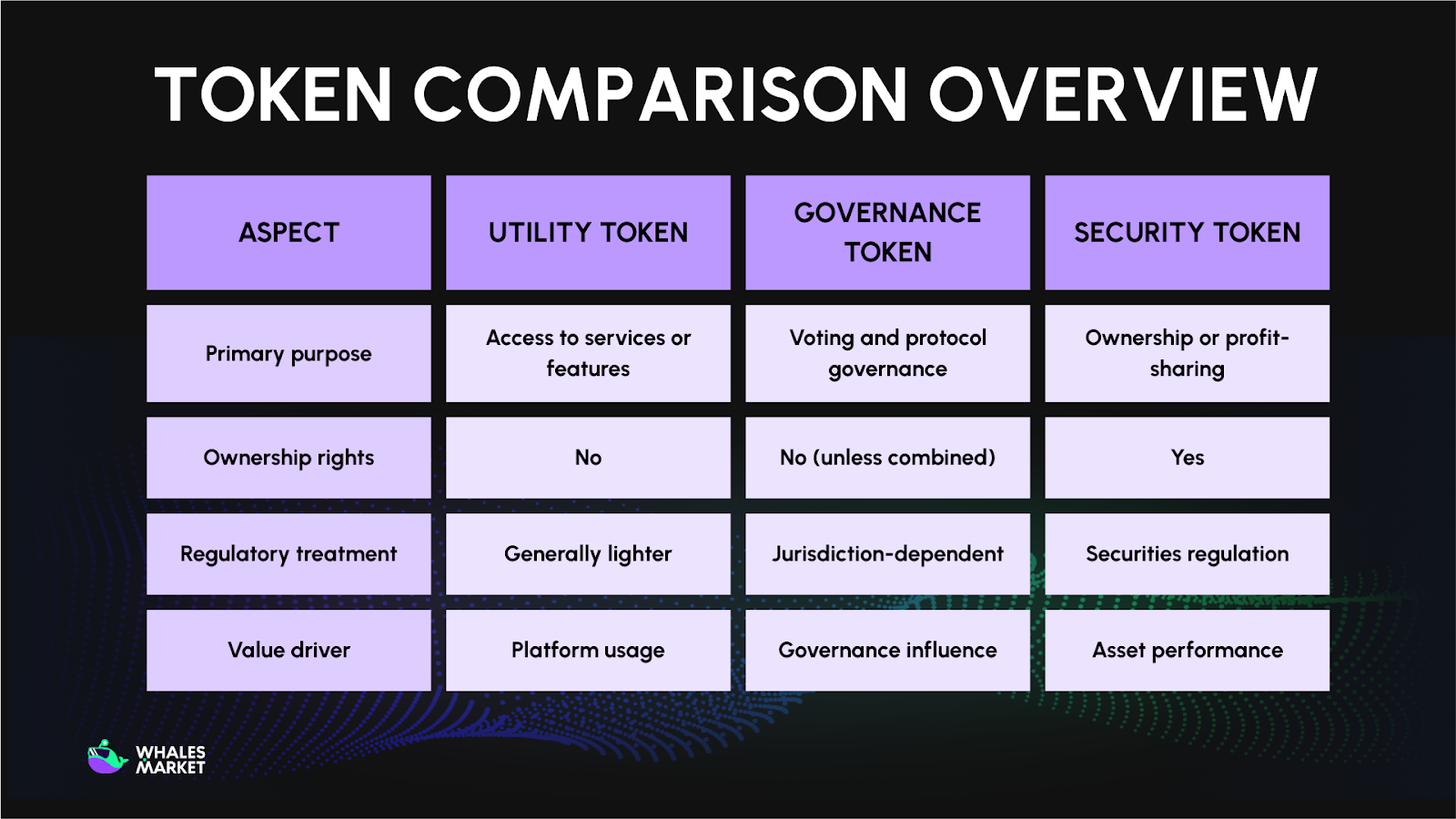

When entering the crypto space, many users encounter different token types that may look similar on the surface but serve very different purposes. The most popular token types include utility tokens, governance tokens, and security tokens. So how are they different?

Utility Tokens: Access and Usage, Not Ownership

Utility tokens function as access keys within a specific ecosystem. Holding a utility token does not grant ownership, equity, or profit rights in the project. Instead, it enables participation by allowing users to pay fees, unlock features, access services, or interact with on-chain applications.

The value of a utility token is therefore tied to how useful and necessary it is within the platform. Its purpose is functional rather than financial, and its demand comes from usage rather than ownership claims.

Governance Tokens: Community Control and Decision-Making

Governance tokens extend participation beyond usage by giving holders voting rights over protocol decisions. These decisions may include protocol upgrades, fee structures, treasury allocations, or changes to incentive mechanisms.

While governance tokens may also carry some utility functions, their primary role is to enable decentralized decision-making rather than access to services.

Example: Projects such as Uniswap (UNI), Aave (AAVE), and Compound (COMP) use governance tokens to decentralize control and give their communities a direct voice in shaping the protocol’s future.

Security Tokens: Digital Ownership and Financial Rights

Security tokens represent a fundamentally different category. They are digital representations of traditional financial instruments, such as equity, debt, or profit-sharing rights. Holding a security token is comparable to owning shares in a company or holding a financial claim on an asset.

Because of this, security tokens fall under strict regulatory frameworks. In the United States, for example, they are subject to SEC oversight, securities laws, KYC and AML requirements, and restrictions on who can buy or trade them.

Example: Projects such as INX (INX Token), tZERO, and Securitize issue or support security tokens that represent regulated ownership stakes, revenue-sharing rights, or tokenized real-world assets. These tokens are designed to comply with securities regulations while enabling on-chain settlement, transparency, and programmability.

What are the Advantages and Disadvantages of a Utility Token?

Advantages

Boosts Ecosystem Engagement

Utility tokens create powerful network effects by rewarding active participation. When users need tokens to access services, they become invested in the ecosystem's long-term success. This creates a self-reinforcing cycle where more participants lead to greater value for everyone.

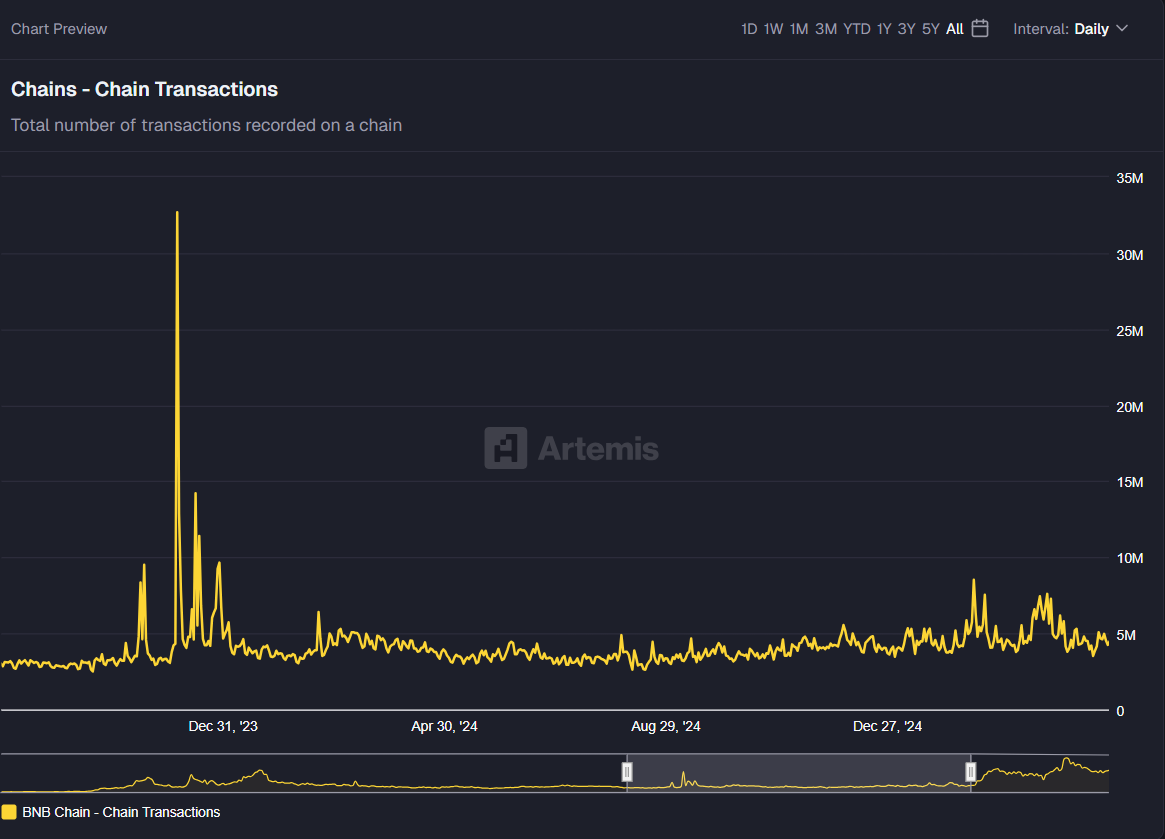

BNB demonstrates this perfectly. Holders receive trading fee discounts, exclusive Launchpad access, and can participate in BNB Chain DeFi applications. This drove an average of 4M daily transactions on BSC throughout 2024, with the ecosystem reaching 486M unique addresses, according to BNB Chain Annual Report.

Lighter Regulatory Burden

Unlike security tokens that represent ownership stakes, utility tokens provide functional access rather than investment returns. This distinction allows them to avoid the strict compliance requirements, registration processes, and investor accreditation rules that securities face.

The regulatory flexibility enables rapid innovation. Projects can distribute tokens globally, build communities quickly, and iterate on their products without navigating lengthy approval processes. Ethereum's Ether, for example, was ultimately not classified as a security by the SEC because of its decentralized nature and clear functional utility within the network.

Organic Value Growth

Utility token value can be appreciated based on genuine demand for the underlying service, creating a direct link between product success and token price. This differs fundamentally from traditional investments where value derives primarily from company profits or dividends.

Chainlink exemplifies this model. As more smart contracts require external data feeds, demand for LINK tokens increases because node operators must be compensated in LINK. The growth in DeFi, insurance protocols, and enterprise blockchain adoption has driven consistent demand, with token value reflecting real utility rather than speculative narratives alone.

Disadvantages

Extreme Price Volatility

While utility tokens can appreciate based on demand, they remain highly susceptible to price swings driven by speculation, market sentiment, and macroeconomic factors. These movements often have little correlation with actual platform usage or token utility.

The 2022 crypto winter demonstrated this risk clearly. Solana's SOL dropped from its all-time high of approximately $260 to below $10, despite the network continuing to function normally. Users who acquired SOL simply to access DeFi applications or NFT marketplaces found their holdings worth a fraction of their original value.

Project Failure Risk

A utility token is only as valuable as the platform it serves. If the underlying project fails to deliver, loses user interest, or encounters fatal design flaws, the token loses its reason to exist and can become completely worthless.

Terra's collapse in May 2022 provides the most dramatic example. Within just three days, the algorithmic stablecoin UST lost its peg, triggering a death spiral that wiped out $45 billion in market capitalization. Retail investors who held LUNA for legitimate staking and governance purposes lost everything alongside speculators, with founder Do Kwon later sentenced to 15 years for fraud.

Scams and Pump-and-Dump Schemes

The relatively light regulatory oversight that benefits legitimate projects also creates opportunities for bad actors. The crypto space has witnessed countless tokens launched with promises of revolutionary utility that never materialized, designed purely to extract money from retail investors.

The Save The Kids token scandal in 2021 exemplifies this problem. FaZe Clan influencers promoted the charity-themed token to their millions of young followers.

Shortly after launch, insiders dumped their holdings, crashing the price by 90% and leaving retail investors with worthless tokens. YouTuber Coffeezilla's investigation revealed the anti-whale code was deliberately modified to enable the dump.

Platform Dependency

Unlike diversified assets, a utility token's fate is entirely tied to a single platform. Technical failures, security breaches, regulatory actions, or competitive displacement can devastate token value regardless of broader market conditions or the token's inherent utility.

The SEC's lawsuit against Ripple in December 2020 illustrates this concentrated risk. When the lawsuit was filed, XRP crashed 62% within days and faced mass delistings from major U.S. exchanges including Coinbase and Bitstamp.

For nearly five years, XRP holders endured regulatory uncertainty that suppressed the token's price and limited trading options, despite the underlying technology continuing to function.

Conclusion

Utility tokens are the backbone of many modern blockchain projects. Unlike purely speculative assets, they emphasize real-world use, serving as a bridge between blockchain technology and practical applications. While they carry risks, they also open doors to innovation and new forms of digital interaction.

FAQs

Q1: Are Utility Tokens safe to invest in?

Utility tokens are not traditional investment assets and often carry higher risk. Their value depends on real product usage, adoption, and execution. Market sentiment and token supply can cause strong volatility, so returns are not guaranteed.

Q2: Where can Utility Tokens be purchased?

Utility tokens are commonly available on centralized exchanges like Binance or Coinbase, as well as decentralized exchanges such as Uniswap or PancakeSwap. Users should verify the correct network, contract address, liquidity, and fees before purchasing.

Q3: Are Utility Tokens taxed?

In many countries, utility token transactions may trigger capital gains or income tax. Selling, swapping, or using tokens for services can be taxable events. Tax rules vary by jurisdiction, so local regulations should always be reviewed carefully.

Q4: How can users identify whether a token has real utility?

A token has real utility when it is required for essential actions in a live product, such as paying fees or unlocking features. Consistent usage, growing users, and demand beyond incentives are strong indicators.

Q5: How do Utility Tokens differ from regular cryptocurrencies?

Cryptocurrencies like Bitcoin mainly function as stores of value or mediums of exchange. Utility tokens operate within specific ecosystems, where their primary role is to enable access, features, governance, or protocol-level functionality.

Q6: Is XRP a utility token?

XRP is often considered a utility token within the Ripple ecosystem, supporting liquidity and settlement on the XRP Ledger. However, its legal and regulatory classification may vary depending on jurisdiction and specific use cases.