Have you ever placed a crypto buy order, then realized the actual filled price was much higher than what you saw when you clicked? That’s a common problem many traders run into when using Market Orders. The good news is there’s a tool that lets you stay in full control of your trading price: the Limit Order.

This article explains what a limit order is, how it works, its advantages and drawbacks, and how to use it on Whales Prediction, a professional trading hub for prediction markets.

What is a Limit Order?

Limit Order is a type of trade order that lets you set the exact price you want to buy or sell assets (such as crypto, stock…). Unlike a Market Order, which executes immediately at the current market price, a Limit Order only executes when the market reaches the price you set.

Market Orders are useful when you need to enter or exit immediately and don’t care about small price differences. Limit Orders are for people who want price control, can wait, or trade low-liquidity tokens.

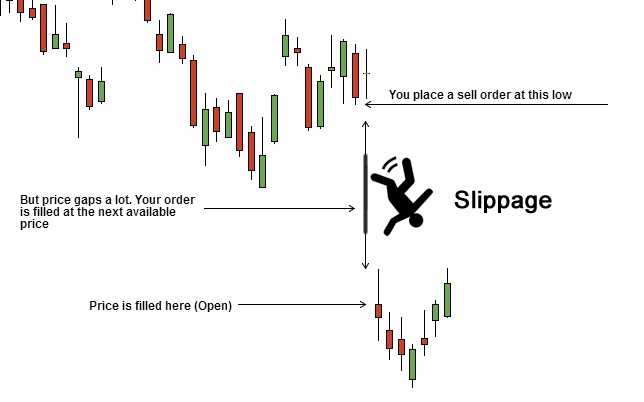

How Limit Orders help preventing Slippage

Slippage is the difference between the price you expect and the price you actually get when your order executes. According to research from the Sei, total slippage costs in 2024 exceeded $2.7B, up 34% from the previous year.

Slippage is usually driven by a combination of market conditions and execution mechanics. It often occurs when liquidity is low, meaning there are not enough matching orders at the desired price. During periods of high volatility, prices can move rapidly while an order is being processed.

Large trade sizes can also cause slippage by consuming multiple price levels. On DEXs, AMM mechanics amplify this effect, as large trades shift the token ratio in the pool and push the execution price away from the expected level.

How does a Limit Order solve the slippage problem?

By placing a Limit Order, you clearly define the maximum price you are willing to buy or the minimum price you are willing to sell. The order will never execute at a worse price than what you set, helping you avoid negative slippage even in volatile or low-liquidity markets.

Common Types of Limit Orders

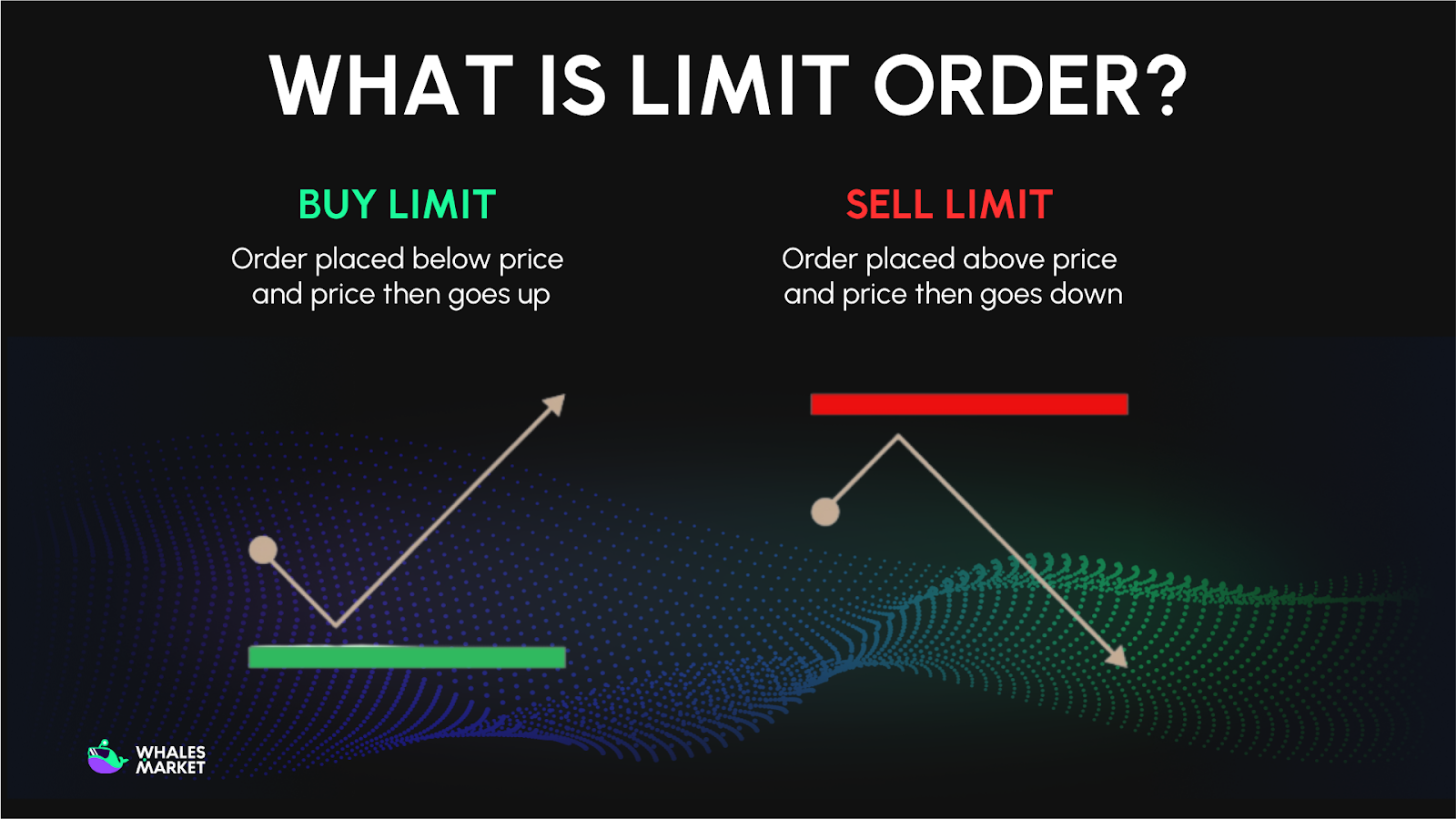

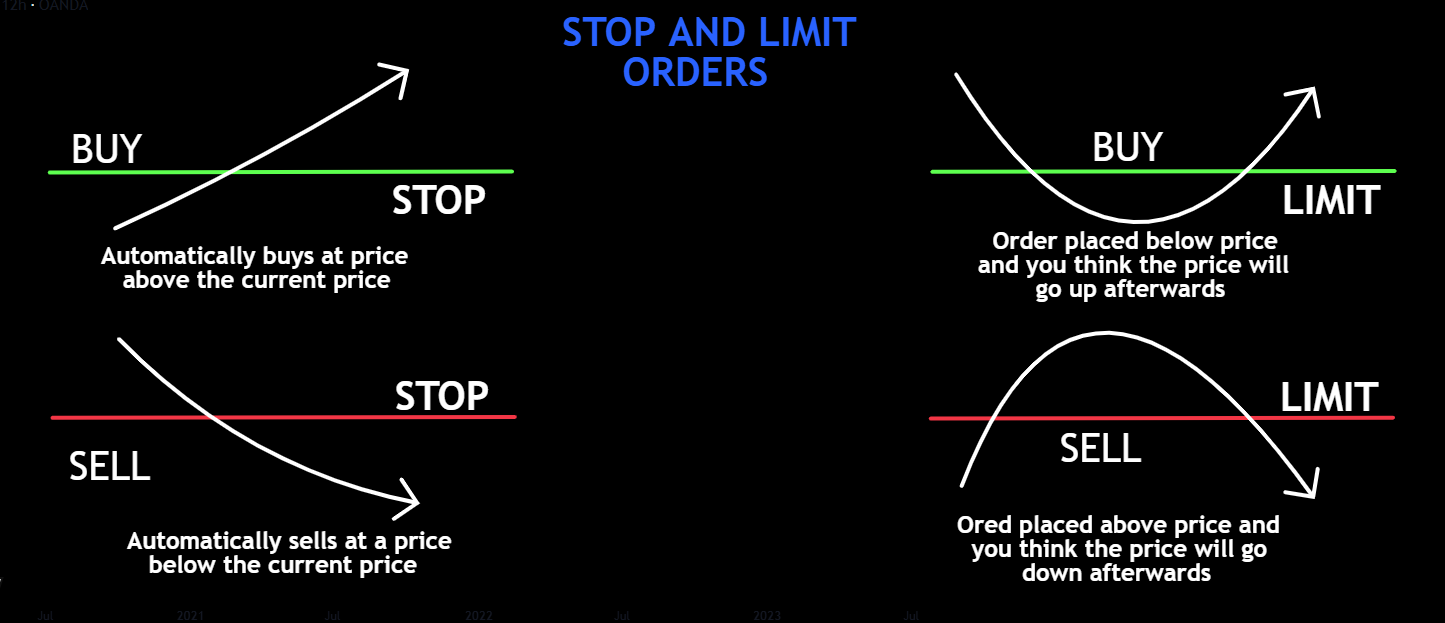

Buy Limit Order

You place a buy order at a price lower than the current price. The order executes only when the price drops to your specified level or lower. This fits when you believe the price may dip before moving up.

For example, if BTC is trading at $70,500 and you believe a short-term pullback is likely, you can place a buy limit order at $70,000. The order will only execute if the market trades at that price or lower. This approach helps avoid buying into temporary price spikes and gives you more control over entry price.

Sell Limit Order

You place a sell order at a price higher than the current price. The order executes only when the price rises to your specified level or higher. This is commonly used to take profit at a target price.

Suppose BTC is trading at $60,000 and your target is $80,000. By placing a sell limit order at $80,000, the trade will execute automatically once the price reaches that level. If the market fails to rally, the order remains open. This method enables disciplined profit-taking without constant monitoring.

Stop-Limit Order

This combines a Stop Order and a Limit Order. You set two prices: a Stop Price (trigger price) and a Limit Price (execution price). When the market hits the Stop Price, the Limit Order becomes active.

For example, you bought SOL at $120 and it is now trading at $135. To protect profits, you set a stop price at $128 and a limit price at $126.

When the market hits $128, a sell limit order at $126 becomes active. The trade executes only if liquidity exists at that price, avoiding extreme slippage during sharp moves.

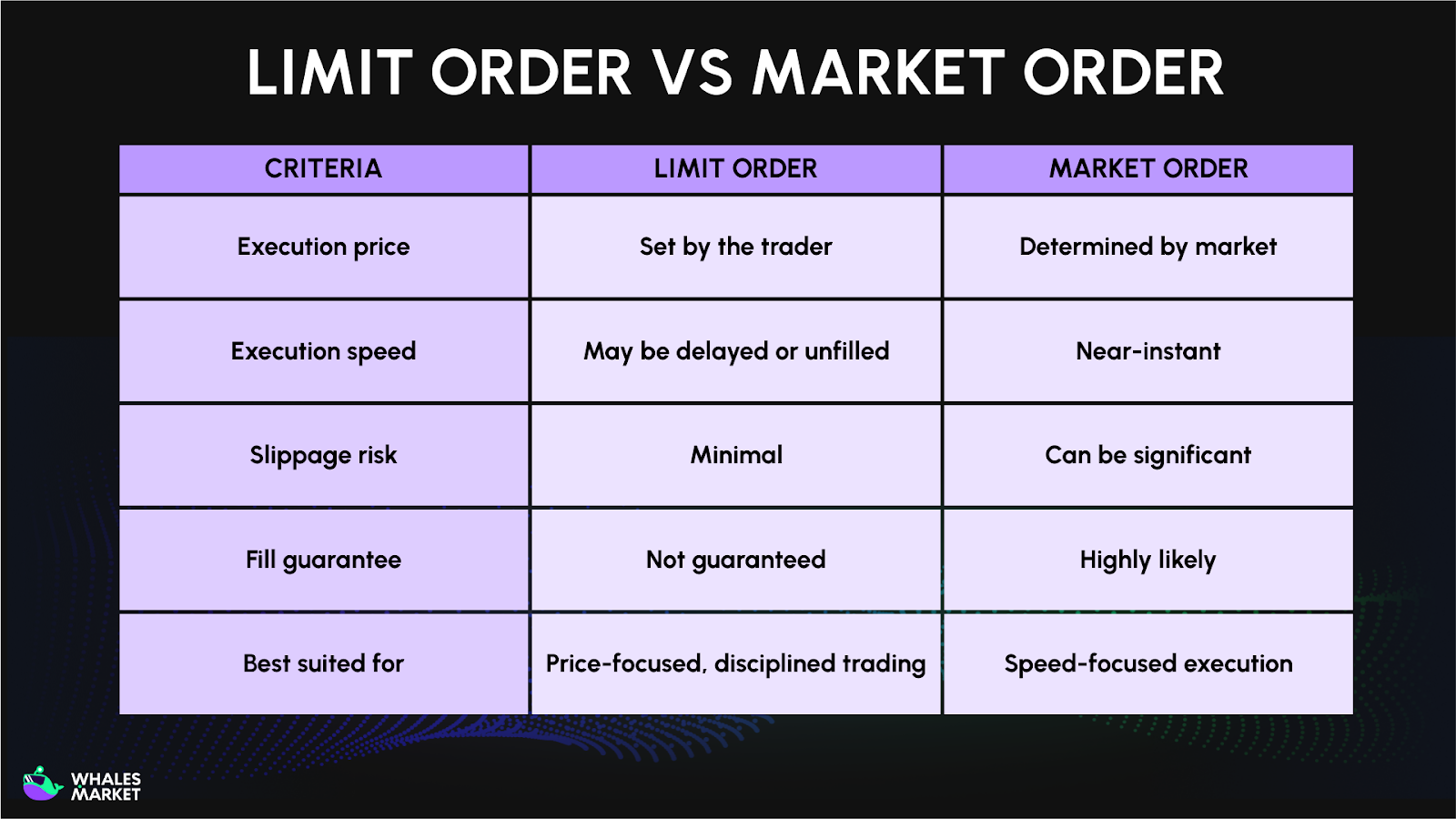

Differences between Limit Order vs Market Order

The main difference between limit orders and market orders comes down to the trade-off between price certainty and execution speed. A market order prioritizes immediate execution, making it useful when speed matters, but it exposes traders to slippage, especially during high volatility or when liquidity is thin.

A limit order, on the other hand, lets you define the exact price you are willing to trade at, offering better cost control and discipline. The downside is that execution is not guaranteed, and fast-moving markets can leave limit orders unfilled.

Pros and Cons of Limit Orders

Pros

First, limit orders give you full control over execution price. You choose exactly where you want to buy or sell, rather than accepting whatever the market offers at that moment. This is especially useful in choppy conditions, where small price differences can meaningfully affect long-term returns.

Second, because a limit order only executes at your chosen price or better, it protects you from unexpected slippage during volatile moves. Even when the market spikes or drops quickly, you will never be filled at a worse price than intended, which helps preserve your risk-reward assumptions.

Third, once a limit order is placed, it works for you in the background. You do not need to watch the chart constantly or react emotionally to short-term price movements. When price reaches your level, the trade executes automatically, making execution more systematic and less stressful.

Finally, using limit orders encourages patience and discipline. Instead of chasing price or reacting to sudden momentum, you commit to predefined levels aligned with your strategy. Over time, this reduces FOMO-driven decisions and helps maintain consistency across different market conditions.

Cons

The biggest downside of limit orders is that execution is not always guaranteed. If the market moves close to your price but never actually trades at it, the order remains unfilled. In strong trends, this can mean watching price move away without you.

Furthermore, even if the market touches your limit price, a limit order may not fully execute. If available liquidity at that level is limited, only part of your order will be filled, while the rest stays open. This can be frustrating during fast or crowded markets.

Markets do not always move cleanly. Price can reverse sharply or continue trending in your favor without ever touching your limit level. In those cases, a strict limit order may cause you to miss an otherwise profitable trade, especially during high-momentum moves.

Limit Orders in trading Prediction Market

Limit orders are not limited to traditional asset trading. They also apply to prediction markets, allowing traders to set specific odds for entry or exit. Platforms like Whales Prediction extend this mechanism to optimize execution and overall trading experience.

Whales Prediction is a leading Trading Terminal Aggregator for Prediction Markets, built by the Whales Market team, a platform that has processed over $300M in pre-market token trading volume. Whales Prediction integrates data from major prediction markets like Polymarket and Kalshi into one interface, helping traders see the full picture and trade more professionally.

Unlike market orders that execute immediately at the current price, limit orders on Whales Prediction allow traders to set their desired odds in advance. The order only fills when the market reaches that level, helping optimize entry points and maintain better cost control when trading predictions.

Read More: Introducing Whales Prediction: The Professional Trading Hub for Prediction Markets

How to place a Limit Order on Whales Prediction

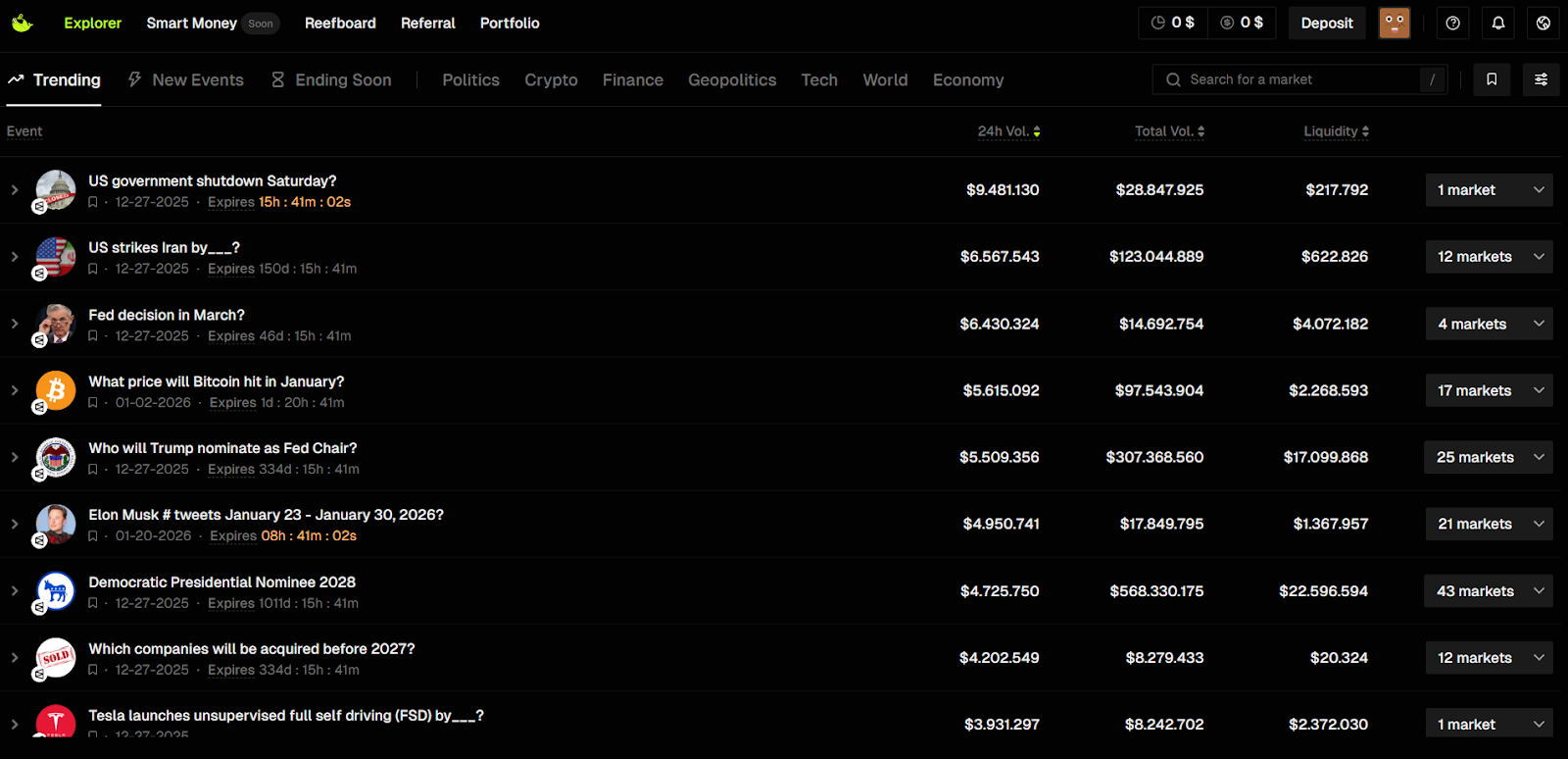

Step 1: Create an account and select the Trading Terminal

- Go to whales.market/prediction

- Click Sign in, and connect your wallet. You can also choose to create an account using your Polymarket wallet or simply sign up with your email.

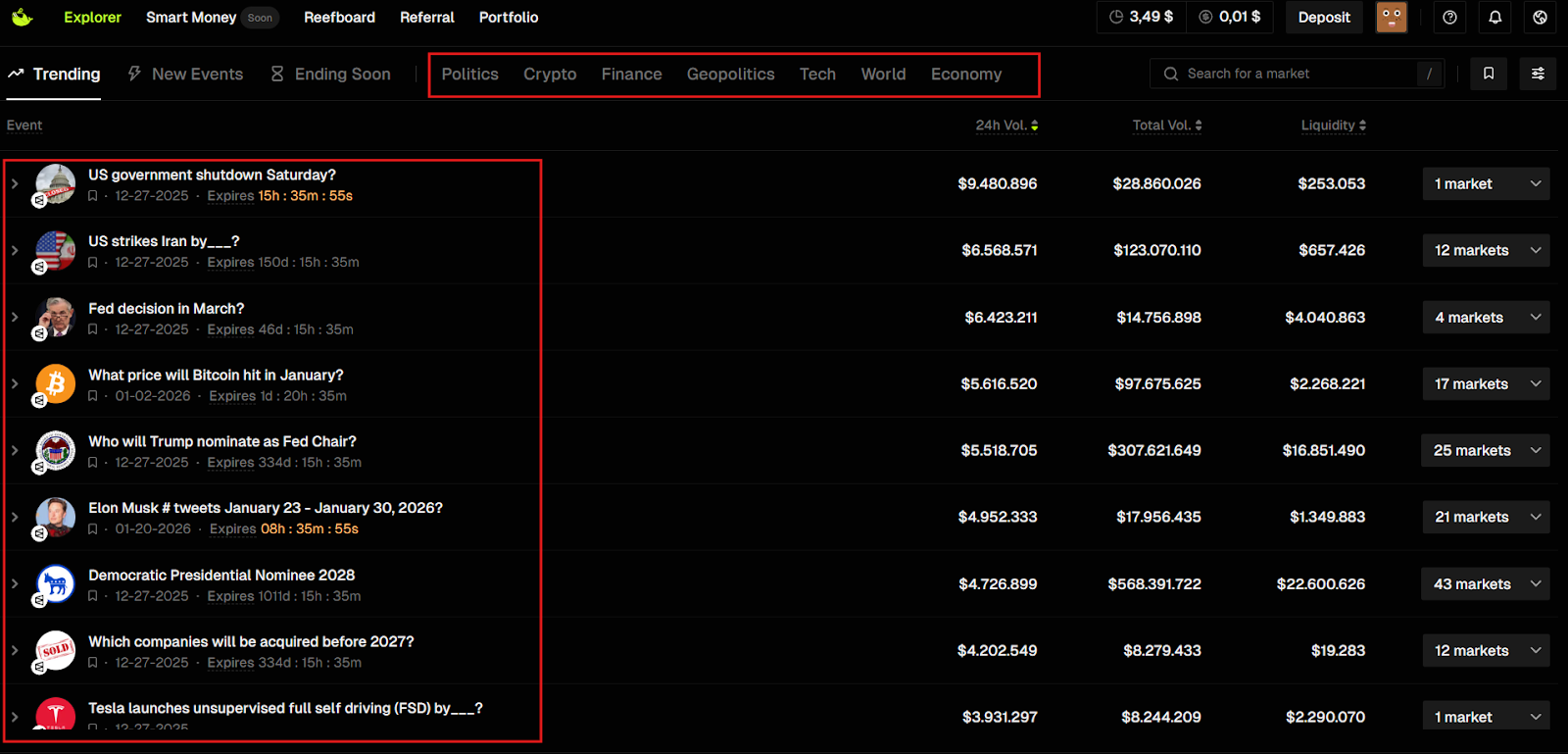

- From the Explorer page, find and select the market you want to trade.

- You can filter by categories like Politics, Crypto, Finance, Tech, Geopolitics, and more.

Step 2: Choose the market you want to trade

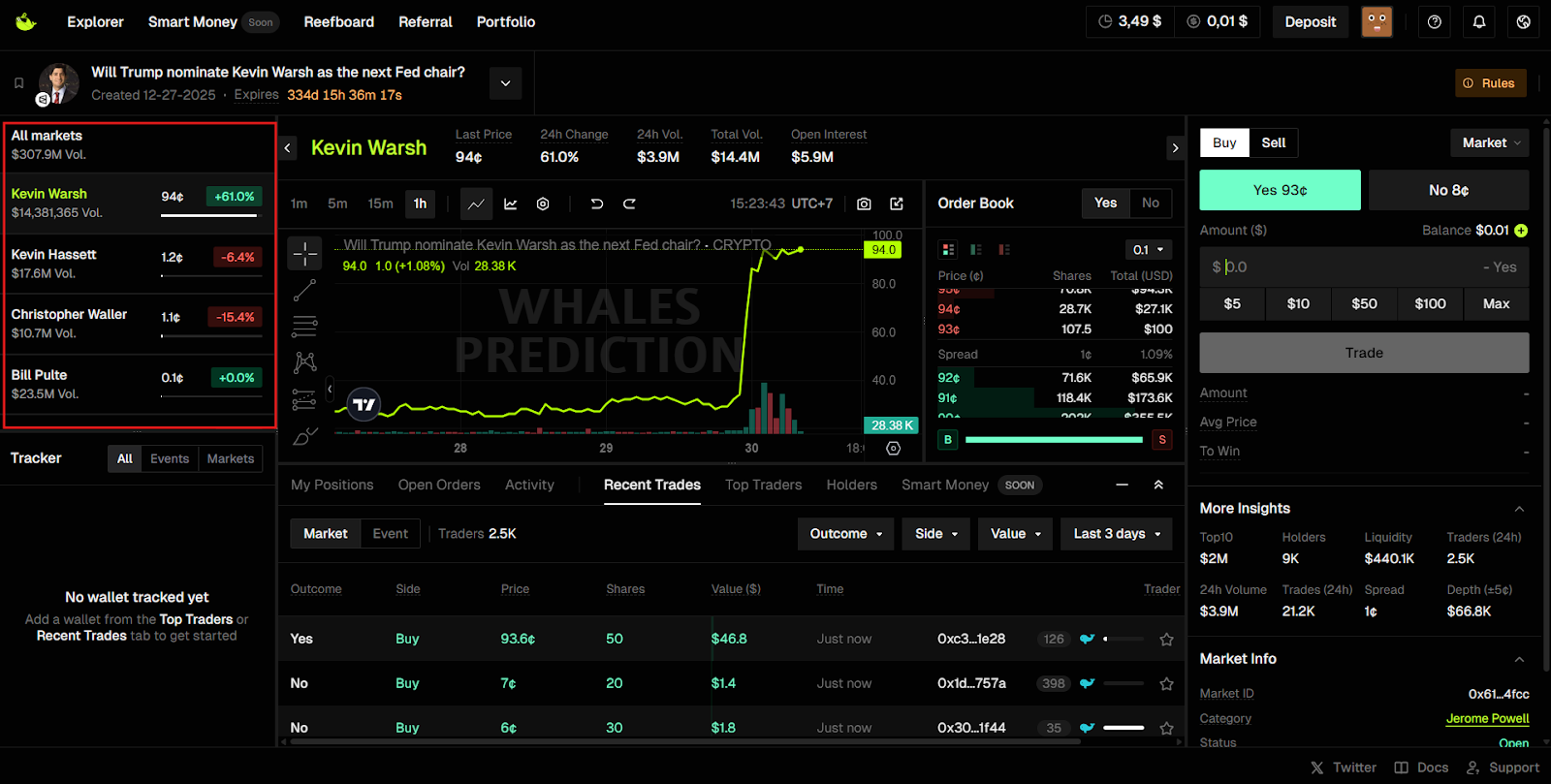

- Click a market to open the Trading Terminal.

- You will see 4 main zones: the price chart zone (candlestick charts), the order book depth zone, the market info and social signals zone, and the order placement zone.

- Then choose the market you want to trade.

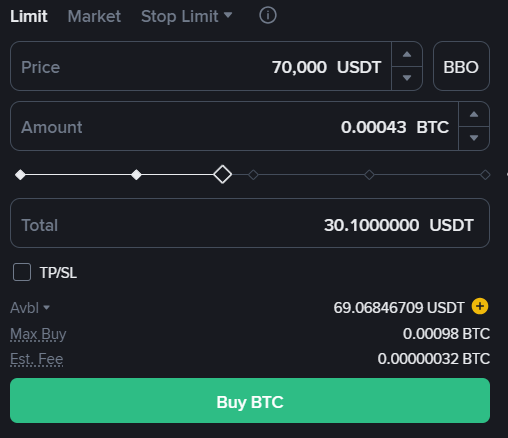

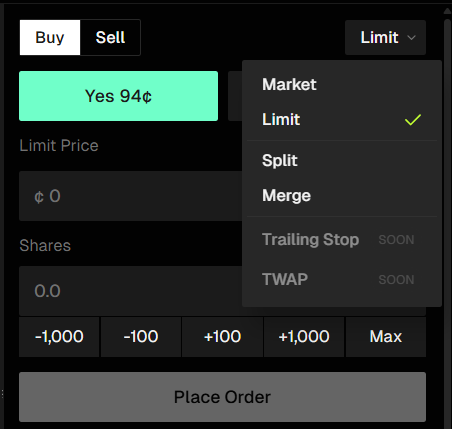

Step 3: Choose Limit

In the order panel, switch from “Market” to “Limit”. Whales Prediction supports these order types:

- Market Order (fills instantly at the best available price)

- Limit Order (fills only at the price you set).

- Split Shares (split shares).

- Merge Shares (merge shares).

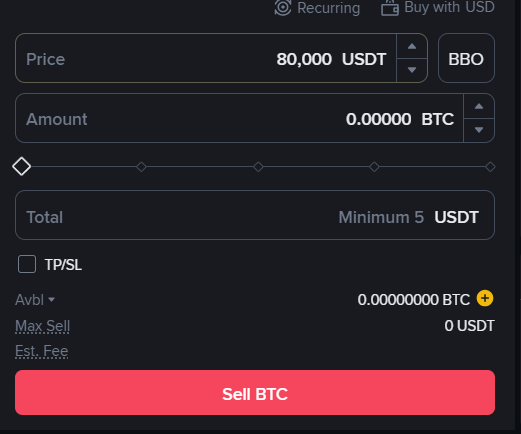

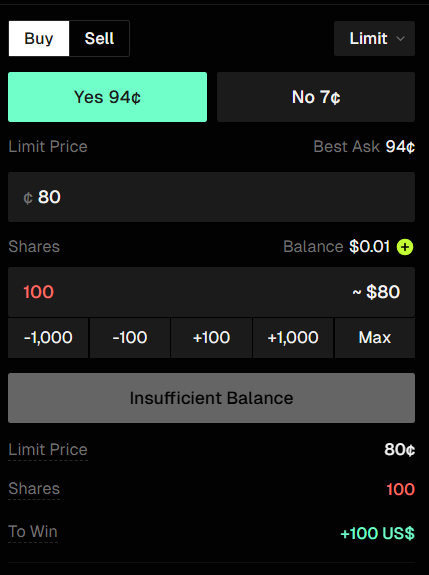

Step 4: Set your order details

- Choose Buy or Sell, then choose Yes or No shares.

- Enter the number of shares you want to trade.

- Set the Limit Price: the price you want to buy/sell at (example: 0.35 means 35 cents per share).

- Review the order book depth to evaluate liquidity at your target price.

Step 5: Review and confirm

Double-check everything: Market, share type (Yes/No), quantity, limit price.

Confirm the transaction in your wallet. Your order will be placed into the order book and will wait until someone matches it at your specified price.

Tips to use Limit Orders effectively in Prediction Markets

Because prediction markets behave differently from traditional asset markets, using limit orders here requires a few extra considerations. Odds, liquidity, and resolution mechanics all play a direct role in execution and outcomes, so a more deliberate approach is needed.

Before placing a limit order, always look at the depth of the order book to understand how much liquidity actually exists at your target odds. Thin depth can lead to partial fills or no execution at all, even if the odds briefly touch your level. Watching where large traders place their orders can also be helpful, as whale activity often signals stronger conviction or better information.

In low-liquidity markets, market orders tend to be especially costly, making limit orders the safer choice for controlling entry prices. It is also critical to read each market’s resolution rules carefully, since outcomes depend on specific conditions rather than price movement alone.

Finally, using an aggregator like Whales Prediction allows you to compare odds across multiple sources, helping identify better pricing and potential arbitrage opportunities.

Conclusion

Limit Orders are a must-have tool for any serious trader, especially in prediction markets where liquidity is often low and spreads are wide. They help you control your trading price, avoid slippage, and trade with more discipline.

As a leading Trading Terminal Aggregator, Whales Prediction provides everything from professional charts and order book depth to smart money tracking and multiple order types, including Limit Orders. It’s a solid platform for both beginners learning prediction markets and experienced traders optimizing their strategies.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. When should you prioritize using a Limit Order instead of a Market Order?

You should prioritize Limit Orders in low-liquidity markets, wide spreads, or high volatility conditions. Limit Orders give you precise price control and help avoid hidden costs caused by slippage during fast market movements.

Q2. Are Limit Orders suitable for beginners in prediction markets?

Yes, Limit Orders are very suitable for beginners. They encourage disciplined trading, reduce emotional decisions like FOMO, and give new traders more time to analyze the order book and overall market behavior.

Q3. Why is order book depth important when placing a Limit Order?

Order book depth shows available liquidity at each price level. Checking depth helps you estimate whether your order is likely to fill, avoid partial fills, and prevent placing limit prices too far from realistic market levels.

Q4. Can Limit Orders improve long-term trading strategies in prediction markets?

Yes. Limit Orders support long-term strategies by enforcing predefined entry and exit prices. They reduce emotional reactions to volatility, improve consistency, and help traders execute plans more effectively over time.

Q5. What advantages does Whales Prediction offer when using Limit Orders?

Whales Prediction provides visual order book depth, aggregated market data, and smart money tracking. These tools help traders place more accurate Limit Orders, access better pricing, and identify opportunities earlier across multiple prediction markets.