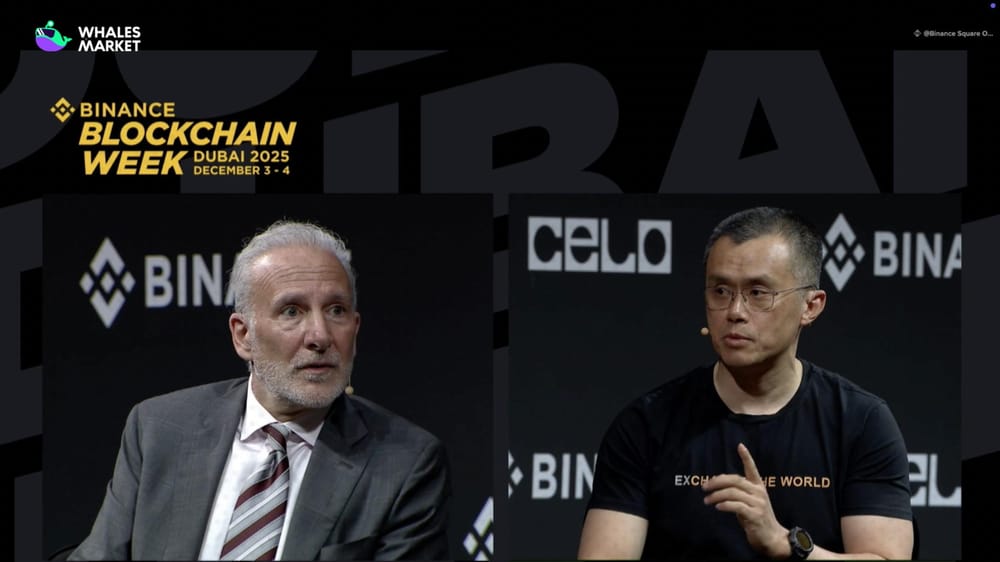

A recent interaction between Peter Schiff, a well-known economist and gold advocate, and Changpeng Zhao (CZ), the founder of Binance, has sparked debate online. The exchange involved a purported gold bar gifted by CZ to Schiff, the authenticity of which Schiff publicly questioned. This incident highlights the ongoing discussion about the value and verification of assets, both traditional and digital.

Schiff's Uncertainty Over Gold Bar Authenticity

Peter Schiff, known for his skepticism towards cryptocurrencies and strong advocacy for gold, received a gold bar from Changpeng Zhao. Following the exchange, Schiff expressed uncertainty about the bar's authenticity. He publicly stated that he couldn't definitively confirm whether the gold bar was genuine. This uncertainty underscores the challenges individuals face in verifying the value and authenticity of physical assets.

Changpeng Zhao's Gift and Public Reaction

Changpeng Zhao, the founder of Binance, gifted the gold bar to Peter Schiff, seemingly as a gesture related to ongoing discussions about asset value. The incident quickly gained traction on social media platforms. Many users commented on the irony of a prominent gold proponent questioning the authenticity of a gold bar. The exchange further fueled the debate between proponents of traditional assets like gold and those advocating for digital assets.

The Broader Context of Asset Verification

The incident between Schiff and Zhao highlights the broader issue of asset verification in both traditional and digital markets. Verifying the authenticity and value of assets is crucial for investor confidence. In the cryptocurrency space, this is addressed through blockchain technology and cryptographic verification. In the realm of physical assets like gold, verification relies on trusted dealers, certifications, and physical testing methods.

Conclusion

The exchange between Peter Schiff and Changpeng Zhao serves as a reminder of the importance of due diligence and verification in all asset classes. Whether dealing with physical commodities like gold or digital assets like cryptocurrencies, ensuring authenticity and value remains paramount. The incident underscores the ongoing dialogue between traditional finance and the evolving digital asset landscape.

FAQs

What methods are typically used to verify the authenticity of a gold bar?

Several methods exist to verify the authenticity of a gold bar. These include visual inspection for hallmarks and stamps indicating the refiner and purity, weighing the bar to ensure it matches the expected weight for its size, and conducting tests such as ultrasonic testing or X-ray fluorescence (XRF) analysis to determine its composition. Reputable dealers also provide certificates of authenticity, though these should be independently verified when possible.

Why is asset verification so important in both traditional finance and cryptocurrency?

Asset verification is crucial for maintaining trust and stability in financial markets. In traditional finance, it prevents fraud and ensures that investors are trading genuine assets. In the cryptocurrency space, verification through blockchain technology ensures the integrity of transactions and the authenticity of digital assets, mitigating risks associated with counterfeiting or double-spending.

What are some common arguments made by Peter Schiff regarding cryptocurrency?

Peter Schiff is a well-known critic of cryptocurrency, often arguing that it lacks intrinsic value and is prone to speculative bubbles. He frequently compares Bitcoin and other cryptocurrencies to Ponzi schemes, suggesting that their value is solely dependent on new investors entering the market. Schiff also emphasizes the volatility of cryptocurrencies and their potential for significant losses, advocating instead for investments in traditional assets like gold.

How does blockchain technology contribute to asset verification in the cryptocurrency space?

Blockchain technology provides a transparent and immutable ledger of all transactions, making it difficult to counterfeit or manipulate digital assets. Each transaction is cryptographically secured and verified by a network of nodes, ensuring the integrity of the data. This decentralized and transparent system enhances trust and reduces the need for intermediaries in asset verification, making it a key component of the cryptocurrency ecosystem.