Amid a wave of disappointing token TGEs in 2025, Polymarket has emerged as a place that reflects real market expectations. For Rainbow, odds on Polymarket show clear caution compared to fundamentals. The key question is where the market is truly pricing $RNBW one day after launch, and why.

Rainbow Overview

Rainbow is a non-custodial wallet that allows users to manage, trade, and explore digital assets such as tokens, NFTs, and on-chain activities. Founded in 2019, it started on Ethereum and later expanded to support multiple blockchains.

Rainbow has also introduced new products, including perpetual trading integrated with Hyperliquid and prediction markets from Polymarket. These features were launched in late 2025, when Rainbow announced its ambition to become an “Onchain Robinhood,” offering cross-chain token swaps and on-chain prediction trading.

This shift shows that Rainbow is actively repositioning its product strategy, with $RNBW likely serving as the main driver of this transition.

Learn more: How to use Rainbow Wallet

Additional reference information users may find useful includes:

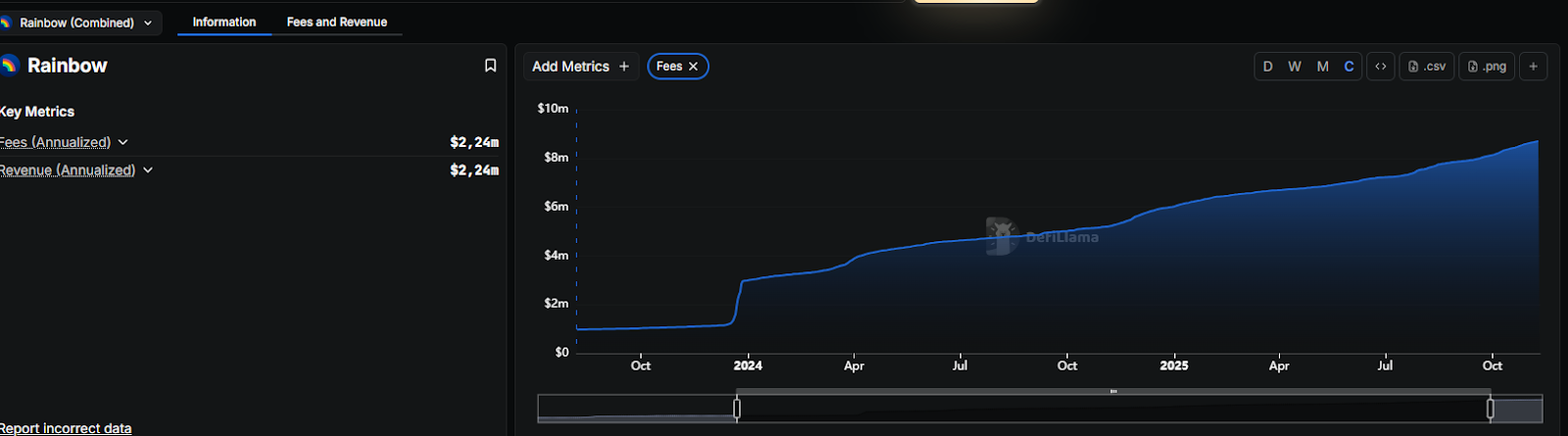

- Total funding raised: $22.5M.

- Cumulative revenue: $9M.

What will Rainbow ($RNBW) FDV be one day after launch?

The 2025 TGE Context: 85% of New Tokens Declined

Before analyzing Rainbow, it is important to look at the broader picture. According to data shared by analyst Ash (@ahboyash), among 118 token TGEs in 2025:

- 84.7% (100 out of 118) recorded FDV lower than at TGE.

- The median FDV dropped by 71% from launch.

- Only 15% of tokens maintained an FDV above their TGE level.

Well-known names such as Berachain (-93%), Animecoin (-94%), and Bio Protocol (-93%) followed the same pattern. The total FDV of this batch fell from $139B to $54B.

This raises a more grounded question: Is Rainbow Wallet actually different enough to avoid the same outcome, or will it face similar post-TGE pressure despite relatively solid fundamentals?

2025 token launches have mostly been a bloodbath

— Ash (@ahboyash) December 20, 2025

Tracked 118 TGE launches this year and compared today’s FDV vs opening:

• 84.7% (100/118) are below TGE valuation

• This means ~4 out of 5 launches are below their opening valuation

• Median token is -71% FDV (-67% MC) from… pic.twitter.com/dtCHTvedpZ

Float and FDV Models: Which Path Is Rainbow Taking?

There are two common models when launching a token.

High Float / Low FDV

- Float: High - Circulating supply is high, meaning a large portion of tokens is available on the market from day one, allowing users to buy and sell immediately with better liquidity.

- FDV: Low - The total valuation assuming 100% of tokens are in circulation at the current price is relatively low, which suggests the project may still have meaningful upside if adoption and demand grow over time.

- Characteristics: Prices tend to be less volatile. A larger circulating supply supports market stability and is often more suitable for long-term participants.

Low Float / High FDV

- Float: Low - Circulating supply is limited at launch, which can make price easier to push up in the short term due to scarcity, but also increases volatility once more tokens enter circulation.

- FDV: High - The total valuation assuming full token circulation is already large, leaving less room for upside and creating higher downside risk if expectations are not met.

- Characteristics: Prices can be pushed up quickly in the early phase due to limited supply, but this model carries higher downside risk when token unlocks and selling pressure appear.

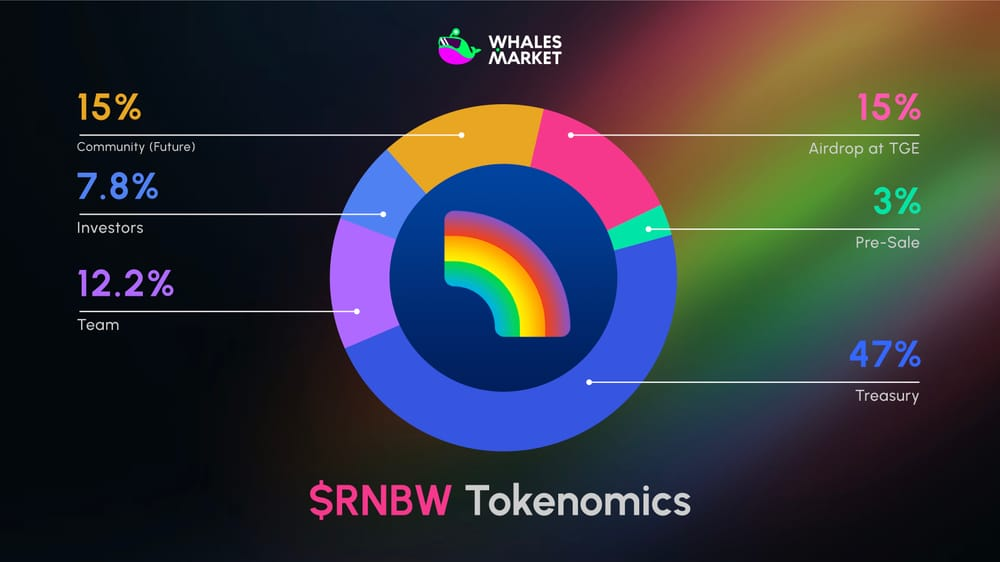

Rainbow has published full tokenomics details, with 18% allocated at TGE, including 15% for airdrops and 3% for pre-sale. In addition, Rainbow conducted a public sale on CoinList at $0.10 per token, allocating 3% of supply, or 30M RNBW.

With a total supply of 1B tokens, this implies an FDV of $100M at the public sale stage.

Read More: Who will be eligible for the Rainbow Wallet airdrop?

With a moderate float of around 18% and a relatively low FDV of $100M, Rainbow is clearly taking a cautious approach. After TGE, there are no major cliff unlocks. Team and investor tokens are released gradually over time, helping reduce immediate selling pressure.

Compared to projects that launched with extremely high FDV, such as Plasma, which dropped around 90%, or Berachain, which fell about 93%, Rainbow sets much lower initial expectations. This reduces the risk of a sharp post-TGE collapse.

Premarket Signals: What Is the Market Expecting?

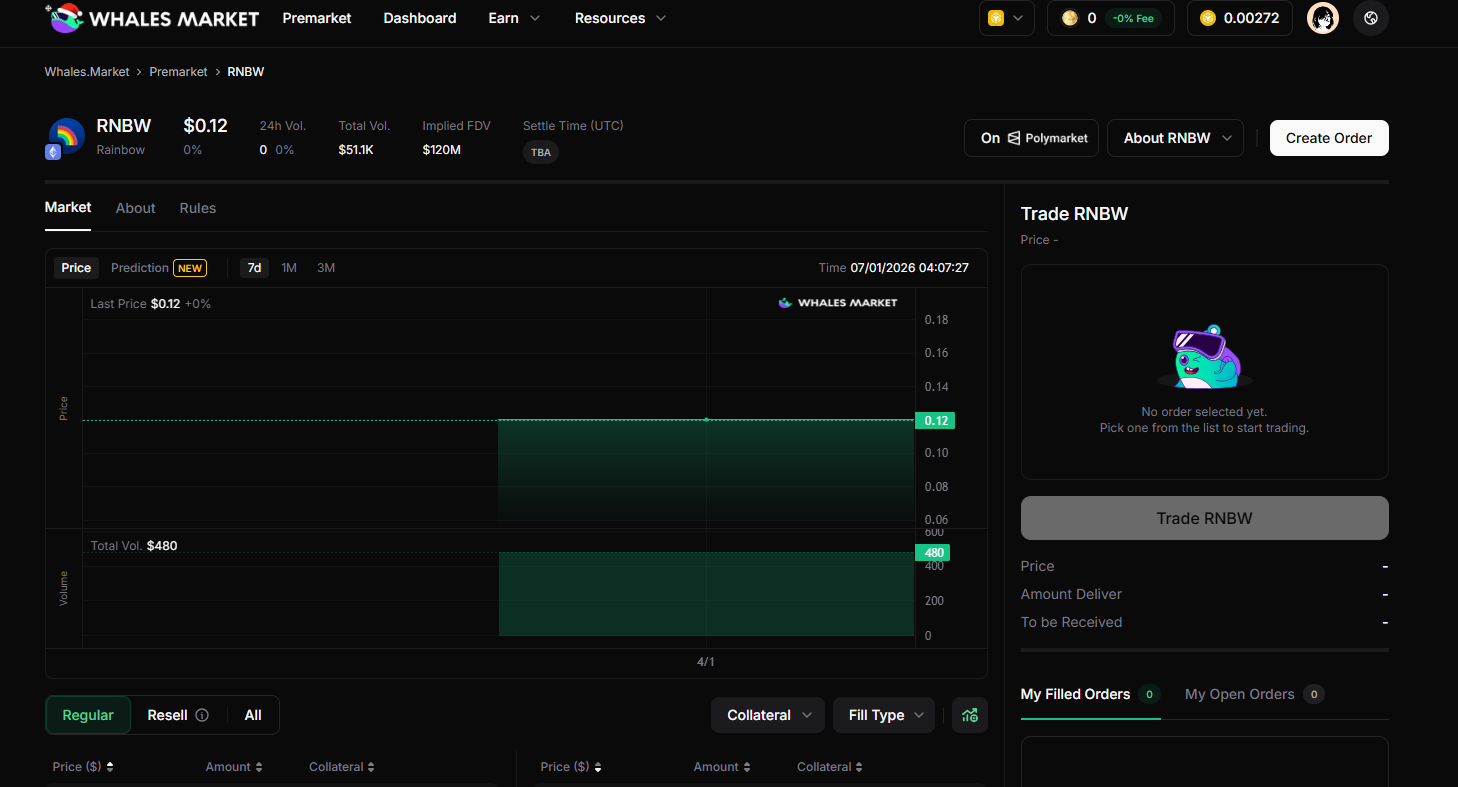

According to data from Whale Market, as of January 6, 2026, $RNBW is currently trading around $0.12, roughly 20% above the ICO price of $0.10. This implies an FDV of approximately $120M.

Trading volume remains low, with total volume around $51K. This suggests the market is still in a discovery phase, reflecting cautious optimism without strong FOMO signals.

Polymarket Odds Analysis

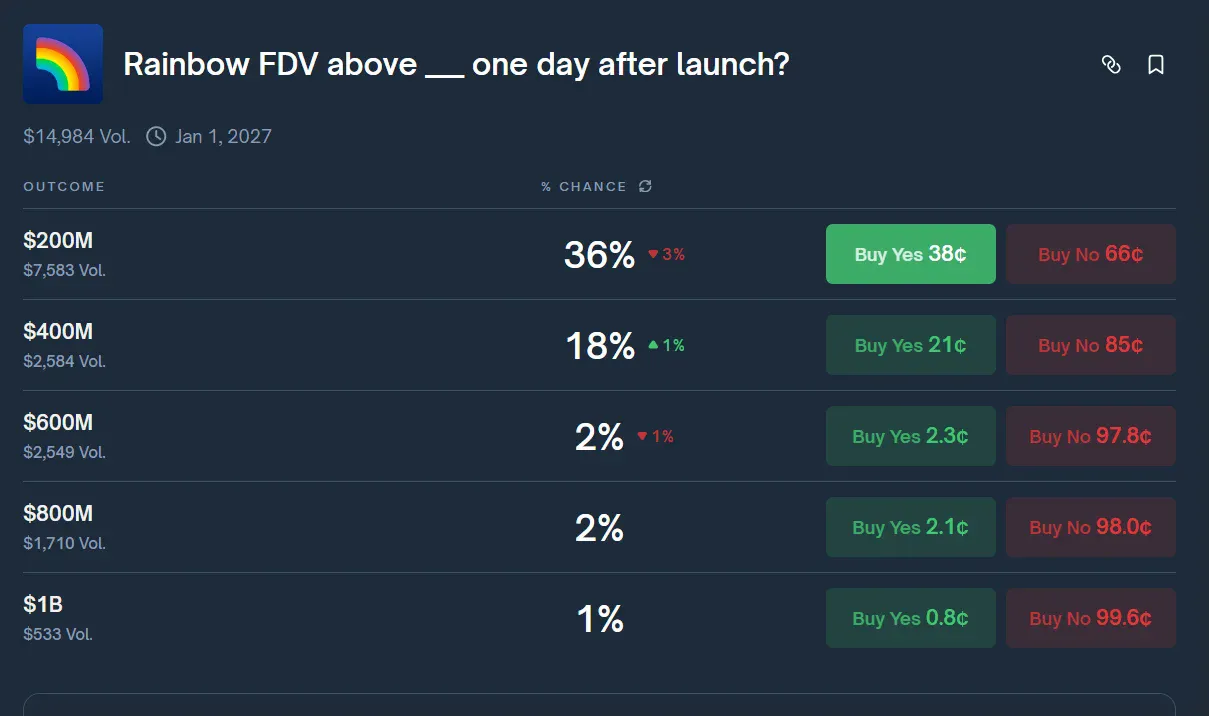

Looking at current odds on Polymarket, the market is showing bearish sentiment toward Rainbow, even more bearish than fundamentals might suggest.

- FDV above $200M: YES probability at 36%.

- FDV above $400M: YES probability at 18%.

- FDV above $600M: YES probability at 2%.

- FDV above $800M: YES probability at 2%.

- FDV above $1B: YES probability at 1%.

Market assigns a 64% probability that Rainbow’s FDV will be below $200M one day after launch, meaning they believe it could trade near or even below the ICO valuation of $100M. Several factors explain this bearish positioning:

- The Rainbow Points program has been running since December 2023. Users earned points through swaps, bridges, and other on-chain activities. Many participants have waited over two years for the token, making profit-taking pressure likely.

- Rainbow also ran a “vampire attack” campaign that rewarded bonus points for importing wallets from MetaMask. This attracted both genuine users and airdrop hunters, who typically sell quickly after launch.

- Compared to competitors such as MetaMask, Trust Wallet, and Rabby, Rainbow still has lower brand recognition and a smaller user base. As a result, broader community expectations are more restrained.

So what should traders do? Based on current Polymarket options, two general strategies emerge:

- The lower-risk approach is betting YES on FDV above $200M. This level remains modest for a project that has raised over $20M, with valuation only around 2x the pre-sale price. It is reasonable to expect Rainbow to hold above this level after the first day.

- Higher-risk, higher-reward approach targets levels above $400M. This scenario requires a shift in overall market sentiment, fading bearishness, and a meaningful catalyst that allows Rainbow to generate short-term momentum.

Conclusion

Based on premarket data, tokenomics, and Polymarket odds, the most realistic scenario places $RNBW trading around $100M to $200M FDV on day one.

A move above $400M would require fresh capital and a strong narrative, while a deep drop below ICO valuation would only occur if selling pressure fully overwhelms initial demand.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Why Are Polymarket Odds More Bearish Than Rainbow’s Fundamentals?

Polymarket reflects short-term expectations and defensive trading behavior. For Rainbow, a long points accumulation period and large airdrop allocation push the market to price in early profit-taking risk, even though the tokenomics structure itself is relatively conservative.

Q2. How Should Low Premarket Volume on Whale Market Be Interpreted?

Low volume indicates the market is still testing price levels, with no strong speculative capital entering yet. This often aligns with moderate FDV expectations, limited FOMO, and a higher chance of stable pricing rather than a rapid post-launch spike.

Q3. How Do Polymarket and Hyperliquid Integrations Affect Token Valuation?

These integrations strengthen Rainbow’s long-term use cases and narrative. However, in the short term, valuation remains driven mainly by airdrop supply and selling behavior, rather than future product potential.

Q4. How Long Does Airdrop Selling Pressure Typically Last After TGE?

Selling pressure is usually strongest in the first 24 to 72 hours, as long-term point farmers realize gains. Without major cliff unlocks, this pressure tends to fade as the market gradually absorbs available supply.

Q5. What Differentiates Rainbow From Other 2025 TGE Tokens That Crashed?

Rainbow launched with a lower initial FDV and a moderate float, avoiding aggressive overvaluation. This approach reduces the risk of sharp post-launch declines and allows price to reflect real supply and demand dynamics.

Q6. What Could Quickly Change Polymarket Odds for Rainbow?

Odds could shift if clear catalysts appear, such as renewed speculative flows, stronger marketing around the “Onchain Robinhood” narrative, or a sudden increase in liquidity. Without these triggers, market sentiment is likely to remain cautious.