MegaETH delayed its TGE from the January 2026 timeline stated in the whitepaper. The mainnet officially launched on February 9, and there has still been no official announcement about the token distribution date. On Whales Prediction, 67% of bets are concentrated on the scenario where the airdrop happens before June 30, 2026, while shorter-term windows in February and March remain at very low probability levels.

So why does the market believe an immediate airdrop is unlikely, yet still see it as almost certain within the first half of the year? This article breaks down the signals the market is reading and explains why expectations are converging around a specific time frame.

What is the Market Expecting for the $MEGA Airdrop?

MegaETH is an Ethereum Layer-2 network developed by MegaLabs. It positions itself as a “Real-Time Blockchain,” aiming to be the first blockchain capable of real-time performance. The technical ambition is high: processing over 100,000 transactions per second with latency under 10 milliseconds.

MegaETH has raised approximately $107.68M through seed, public, and ICO rounds, with backing from Dragonfly Capital, Vitalik Buterin, and several established crypto funds. This level of participation suggests strong investor interest and broad market confidence in the project.

On January 28, MegaETH announced that the mainnet would launch on February 9. Since then, market attention has gradually shifted toward the next milestones in the roadmap, especially the TGE and token distribution mechanics.

@HSNShoppingDiva went to youtube and watched RG for the first time - what the F*? Why would anybody put up with that sh**?

— apezoo/peaberryjo (@peaberryjo) June 3, 2009

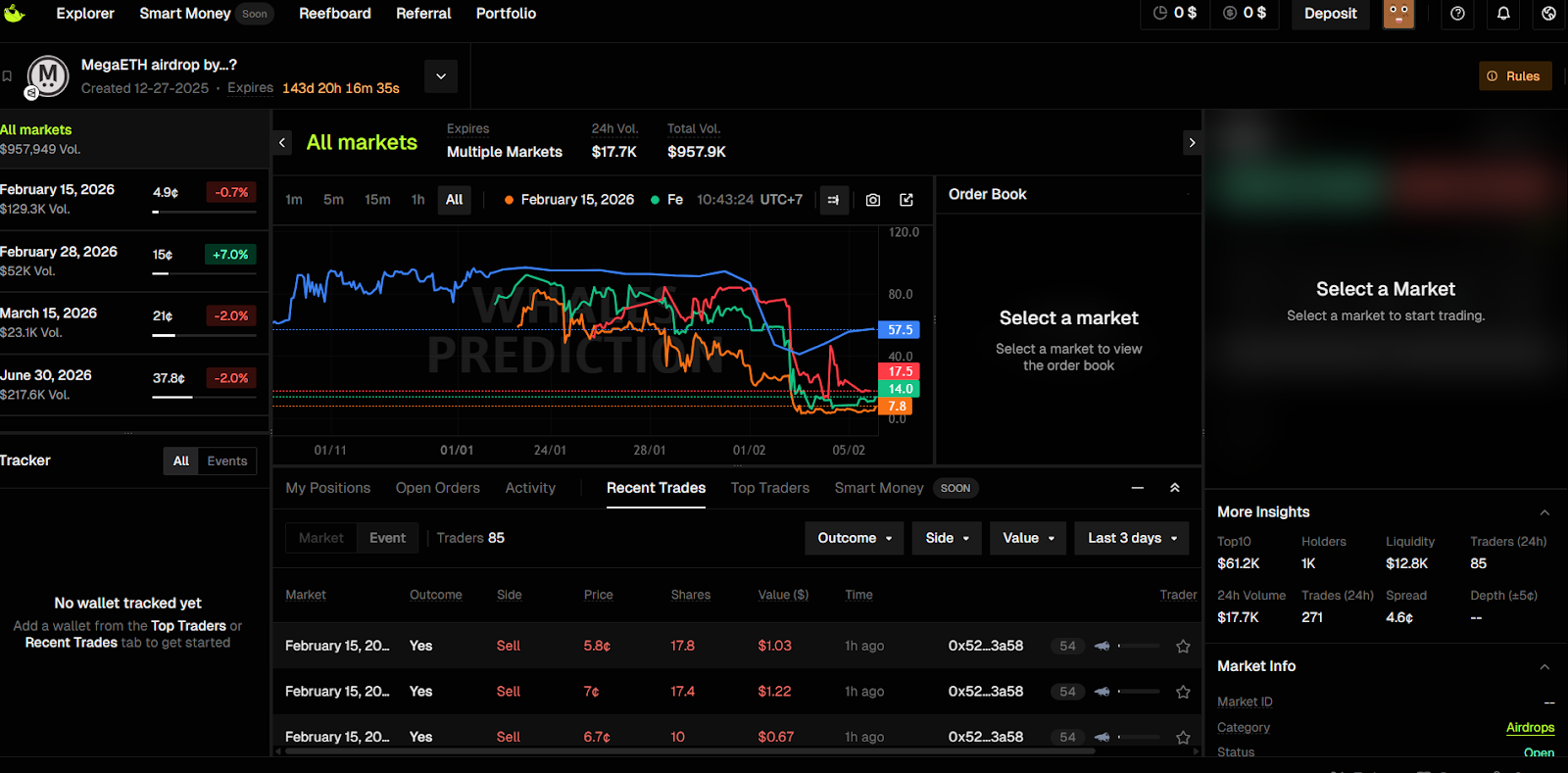

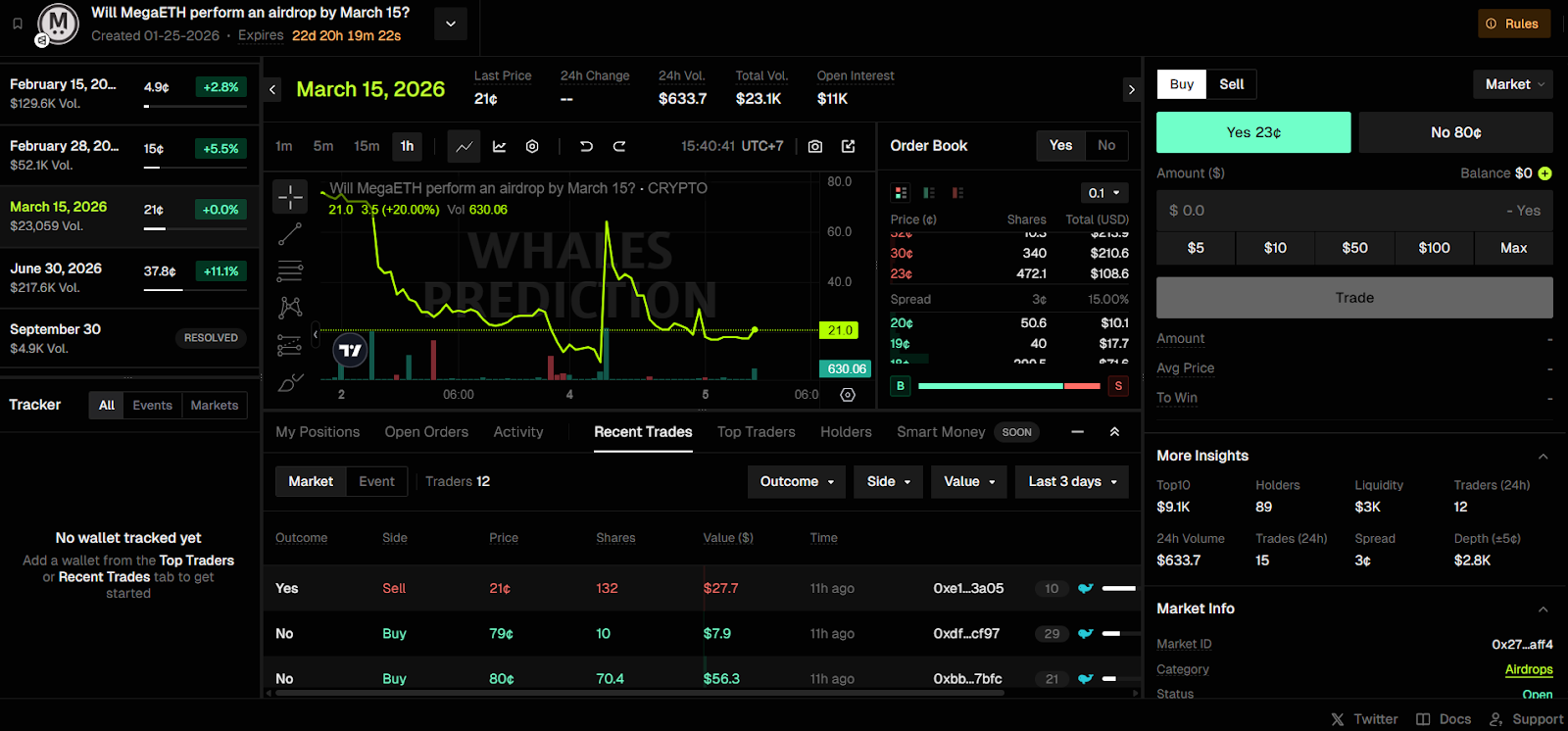

On Whales Prediction (a high-performance trading terminal aggregator for prediction markets), total trading volume for the market “MegaETH airdrop by…?” has exceeded $957,000. Most of the liquidity is concentrated in the final option: an airdrop before June 30, 2026.

Current Odds by Timeline (As of February 6, 2026):

- February 15, 2026: YES odds at 5%.

- February 28, 2026: YES odds at 15%.

- March 15, 2026: YES odds at 21%.

- June 30, 2026: YES odds at 67%.

At the moment, there are only four markets predicting the MegaETH airdrop date. Most traders still believe that $MEGA will launch before July 2026. The question is which date carries the highest probability.

Read more: MegaETH Prediction: $MEGA Market Cap (FDV) One Day After Launch?

What Day Will $MEGA Airdrop Be?

Why are many traders betting NO on February and March?

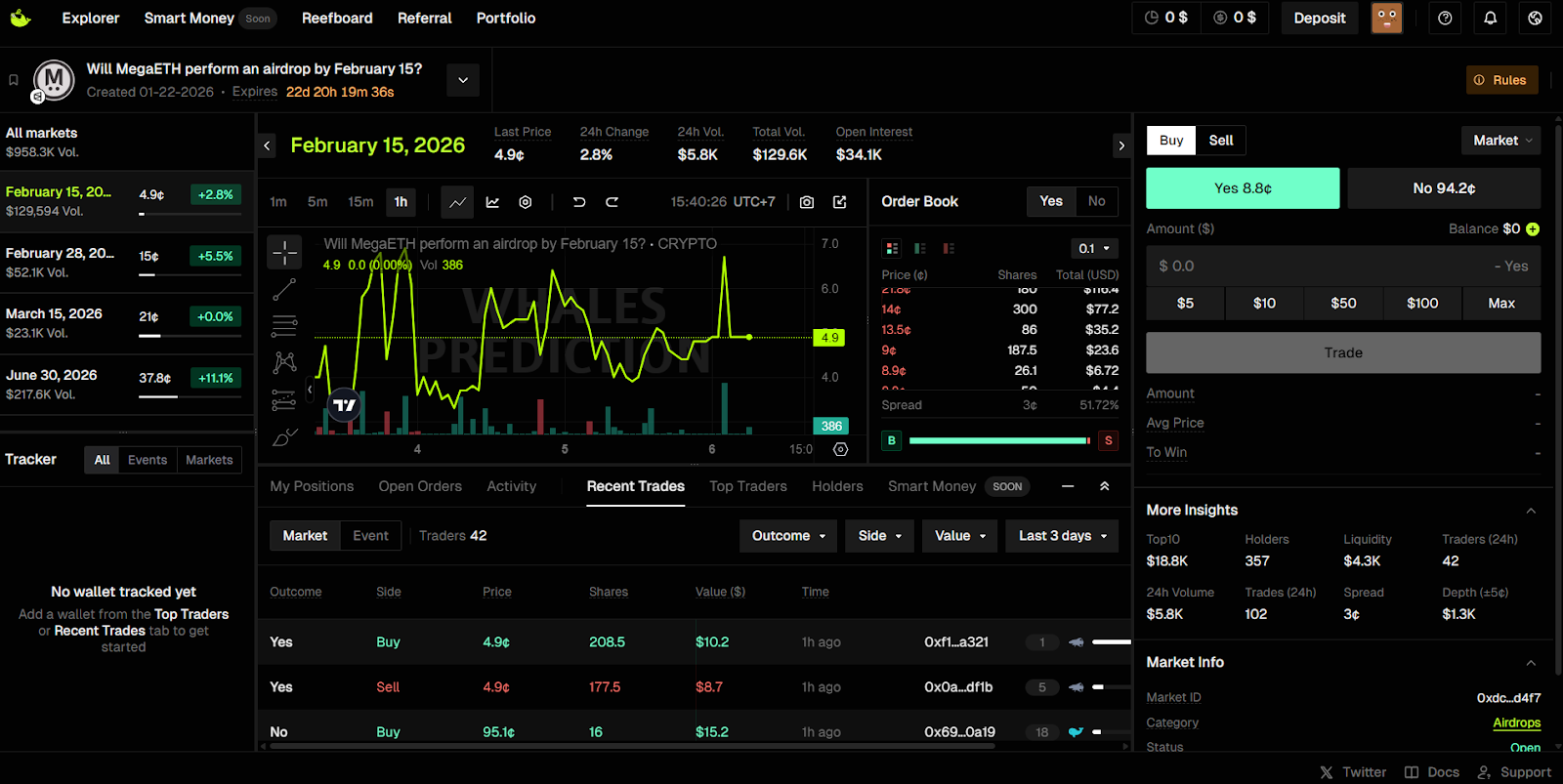

Looking at the odds, both February markets remain low, with 5% for February 15 and 15% for February 28. The market message is clear: even though the mainnet is live, a February TGE is considered very unlikely.

The main reason is the absence of key preparation signals. There has been no snapshot schedule, no airdrop claim form, and no eligibility checker announced. Even with the mainnet already live, none of these steps have been introduced.

Because of this, the community lacks confidence that $MEGA will launch in February. As a result, March odds are also suppressed, since the two months are very close on the timeline.

Why is Q2 2026 the most heavily bet scenario?

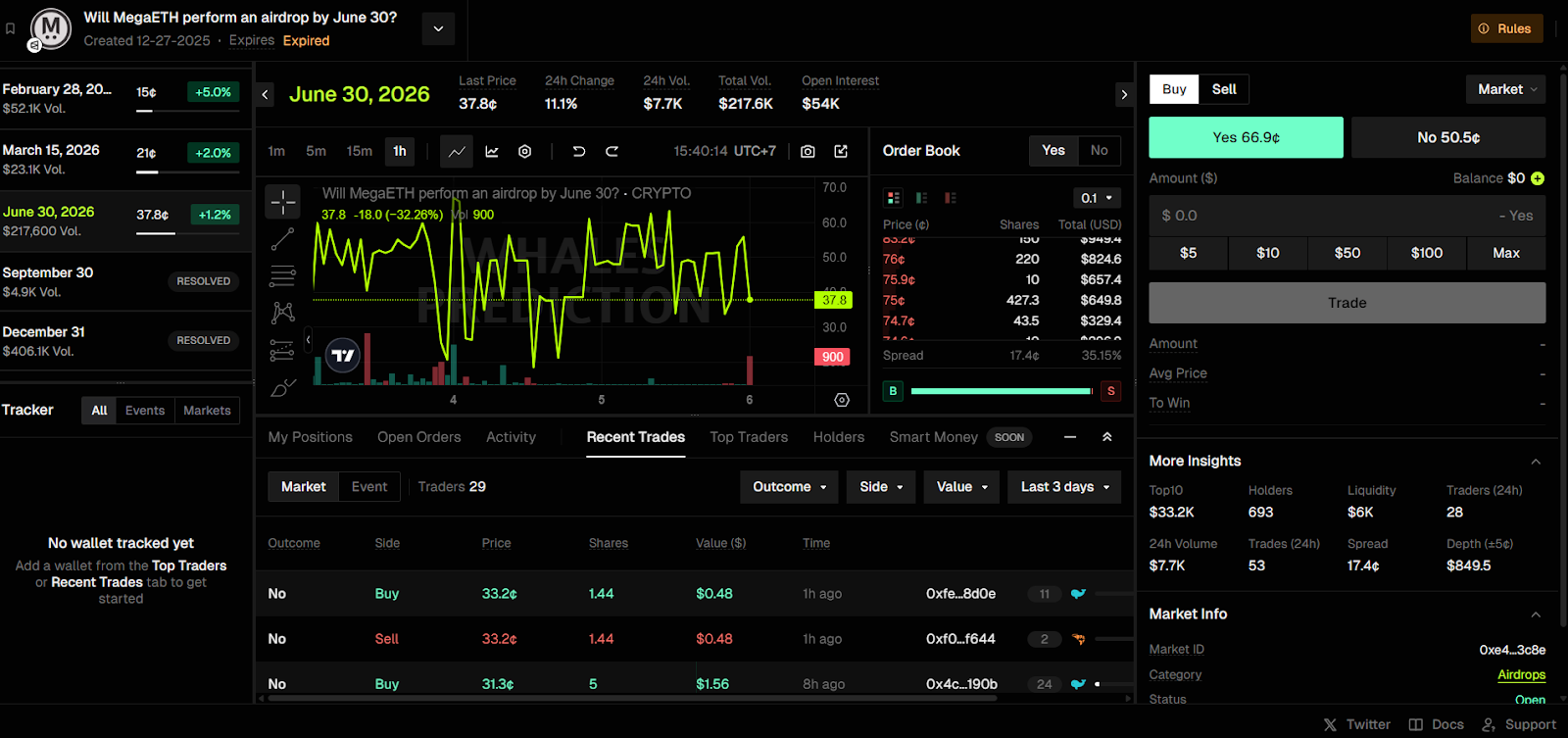

On Whales Prediction, the June 30, 2026 option leads with 57% odds, but this number can be misleading. This market does not predict an airdrop exactly on June 30. It resolves YES if the airdrop happens at any time before that date.

The concentration of capital on this option reflects a clear market expectation based on both operational logic and real-world constraints.

First, this is a high-probability timeline. From February to June, MegaETH would have been running its mainnet for nearly four months. This is generally more than enough time for a project to conduct a TGE. Historically, most crypto projects launch their tokens shortly after mainnet, and long delays are relatively rare.

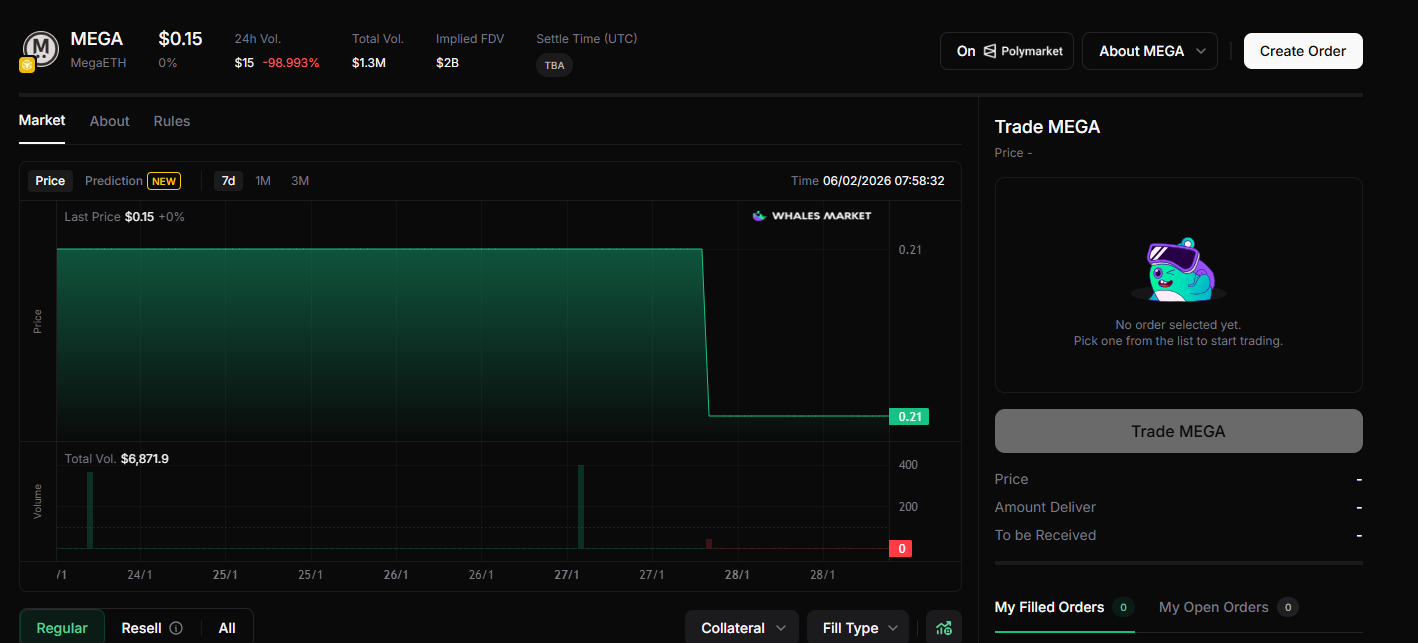

Second, a pre-market price already exists. On Whales Market (pre-market trading platform), $MEGA has been trading steadily around $0.15 in pre-market conditions. Since the price has already been priced in by the market, traders tend to favor a Q2 2026 TGE rather than a prolonged delay into the second half of the year.

Betting Strategy on $MEGA Airdrop Day Odds

Based on the data above, the following strategies stand out on Whales Prediction.

Bet YES before June 30, 2026 (67%)

This is the most balanced risk-to-reward option. The market covers the entire Q2 window and aligns well with post-mainnet execution logic. It suits traders who prefer to follow market consensus rather than betting on a specific date.

Bet NO on all February markets

This is a low-risk, low-return strategy, with potential returns around 5%. It fits users who believe a TGE cannot realistically happen immediately after mainnet without a snapshot, claim form, or checker.

Be careful with March

March sits in an uncertain middle ground. The market still has nearly a full month before resolution, and the project could launch at any point during that time or skip it entirely. A small position may be reasonable, but exposure should remain limited.

Risk Disclaimer

Before placing any bets, several points are worth remembering.

- Market uncertainty: Crypto markets are inherently unpredictable, and MegaETH is no exception. Even when Polymarket consensus strongly favors one outcome, it does not guarantee accuracy, as market sentiment can change rapidly with new information or unexpected developments.

- Timeline risk: Although current odds support an airdrop in H1 2026, delays into H2 remain possible. The team may need additional time for audits, technical fixes, or to wait for clearer regulatory signals before proceeding.

- Liquidity and manipulation risk: Betting signals can be distorted by large players. With total airdrop market volume around $958,000, a small number of large trades can materially shift odds, reducing their reliability as true probability indicators.

- Team communication risk: Unlike projects where leadership frequently hints at timelines, the MegaETH team has remained largely silent since delaying the January 2026 TGE. This silence may reflect careful preparation or unresolved issues behind the scenes.

Conclusion

Based on current information, the most reasonable approach is to avoid February and March markets and focus on the YES option before June 30, 2026. This scenario aligns with realistic execution timelines and a price that has already been reflected by the market. At the same time, caution remains necessary, as an airdrop delay into H2 is still possible due to external or operational factors.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Does the mainnet launch mean the airdrop will happen soon?

The mainnet launch is a necessary condition but not a sufficient one for an airdrop. Market data shows that without a snapshot, eligibility checker, or clear claim instructions, the probability of an airdrop happening immediately after mainnet remains very low.

Q2. How does the pre-market price of $MEGA affect airdrop expectations?

The fact that $MEGA has traded pre-market around $0.15 suggests the market has already priced in the token early. This reduces the incentive to delay the TGE for too long, since profit expectations are partially reflected in advance.

Q3. Why is the trading volume on MegaETH airdrop prediction markets considered low?

Total volume of around $958,000 is relatively small compared to larger Polymarket markets. This means odds can be heavily influenced by a few large orders, making them less representative of true market probabilities.

Q4. Would it be surprising if the airdrop is delayed to H2 2026

Even though current consensus leans toward H1 2026, a delay into H2 would not be unexpected. With increasing regulatory complexity and audit requirements, many large projects have chosen to postpone launches to reduce risk.

Q5. How can $MEGA be traded before the official listing?

Users can buy or sell pre-TGE $MEGA on Whales Market by placing or filling orders. These trades use a collateral-based settlement mechanism, allowing early access to the token before its official exchange listing.