Monad is approaching TGE with an engaged community, a clearly defined technical roadmap, and an ICO on Coinbase that prices the project at a $2.5B fully diluted valuation.

In a strong bull market, a setup like this might be easier for investors to accept. Today, however, conditions are less supportive: Bitcoin has pulled back from its highs and overall risk appetite has weakened.

In this context, one question matters more than whether Monad will pump in the short term: Is Monad’s ICO valuation already too high?

Where is Monad’s innovation?

With roughly $431M raised, Monad holds a “war chest” large enough to compete with any major L1. Beyond capital, it also has strong momentum: an airdrop campaign that set X buzzing, an active testnet community, and an early cultivated ecosystem culture advantages few projects manage to build.

Love or hate, the matters is where the opportunities & returns for investors and Monad, that story starts with its technology.

Technology

Monad is a L1 blockchain built by Monad Labs to deliver a platform that is fully EVM compatible while dramatically improving performance to address Ethereum’s speed and cost constraints.

The philosophy behind Monad’s technical innovation is also what helped it raise hundreds of millions from Tier-1 VCs. To pursue ~10,000 TPS, ~0.4s block time, and <1s finality, Monad introduces several key innovations:

- High EVM compatibility: Bytecode-level compatibility with the EVM means Solidity contracts from Ethereum can deploy directly without code changes. This makes Monad an ideal target for migrating dApps from Ethereum include DeFi, NFTs, gaming, and more.

- Parallel execution: Unlike Ethereum’s sequential processing, Monad uses optimistic parallel execution to handle many transactions at once while preserving linear ordering and determinism. Conflicts are detected and transactions reordered when needed, boosting throughput without burdening developers.

- Asynchronous/deferred execution: Consensus is separated from execution. MonadBFT (inspired by HotStuff) finalizes quickly first, with parallel execution afterward optimizing block times and reducing latency.

- Additional optimizations: Superscalar pipelining, JIT compilation, and a ground-up implementation in C++ and Rust (vs. Ethereum’s Go components) create a tightly integrated stack from consensus to storage.

- MonadDB (custom database): A database optimized for parallel access enables fast concurrent reads/writes and lowers node hardware requirements supporting decentralization across the network.

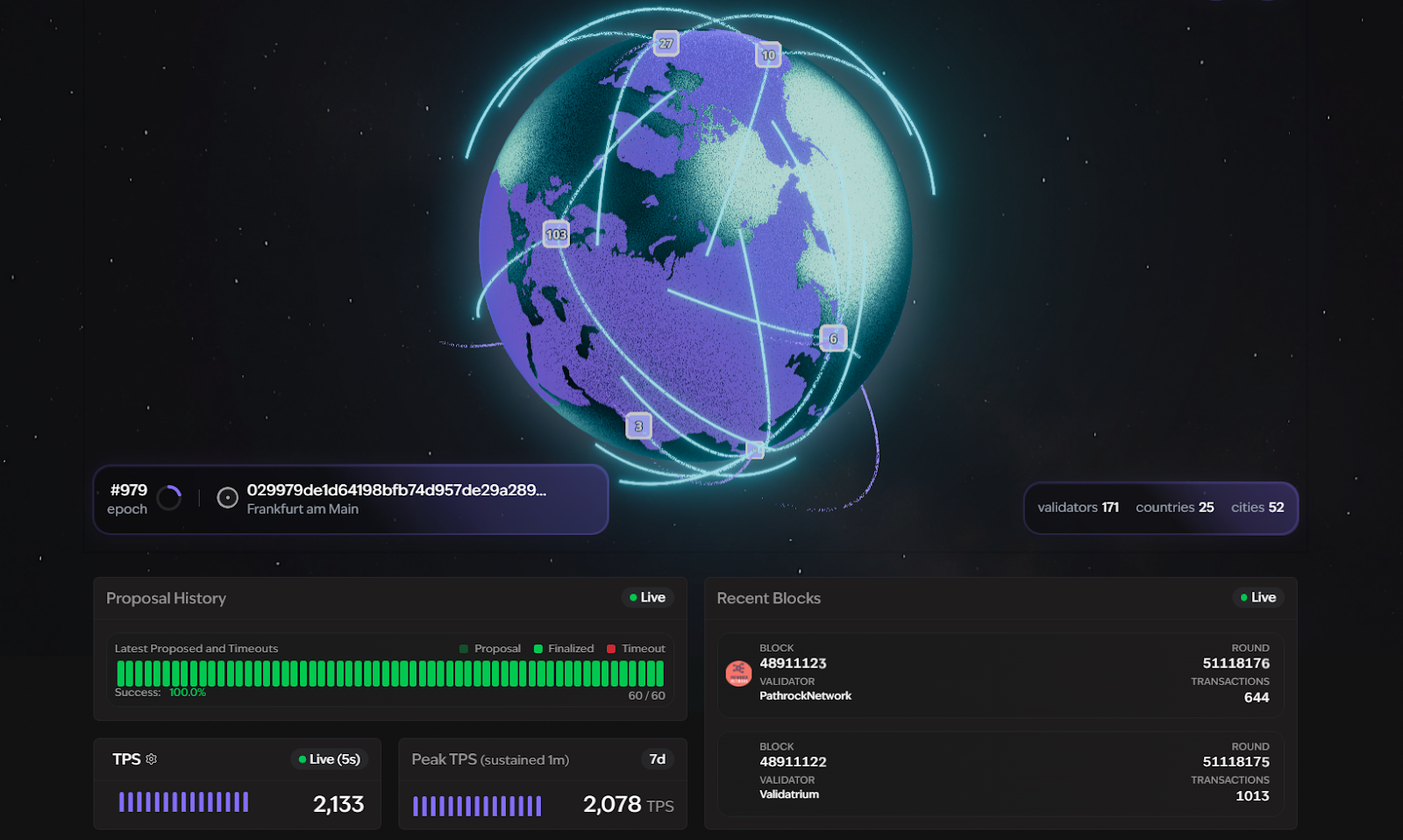

Recent testnet stats highlight promising early results:

- 171 validators across 25 countries and 52 cities, delivering notable decentralization for an early-stage L1.

- Live TPS sustained around 2,000 - 2,100.

Comparing with existing L1s

Versus other L1s (EVM and non-EVM), Monad appears competitive on performance:

- Non-EVM L1s: Solana - 1,504, Sui - 854, Aptos - (16 - 56), TON - 175 (Source: CoinGecko)

- EVM L1s: BNB - 378 TPS, NEAR - (63–85), Avalanche - 89 TPS (Source: CoinGecko)

Overall, if Monad delivers its 10,000 TPS target or even half that in real conditions it would still translate into a markedly better user experience versus most current L1s.

Developer Friendly

A thriving ecosystem also depends on being welcoming to developers. Monad brings:

- No new language barrier:Monad targets full EVM compatibility, so developers that already use Solidity can continue working with the same language and mental model. By contrast, building on non-EVM chains such as Solana (Rust) or Sui/Aptos (Move) typically involves working with different languages and paradigms.

- Familiar tooling: With EVM support, developers can often reuse many of their existing Ethereum-oriented tools, including editors, IDEs, testing frameworks, and deployment utilities. Non-EVM ecosystems usually provide their own frameworks and CLIs, which may require additional setup and learning for developers who are new to those stacks.

- Easy dApp migration: The vast Ethereum codebase can be ported quickly to Monad and benefit from higher throughput (up to 10,000 TPS) without heavy rewrites attractive for teams frustrated by Ethereum’s fees and latency.

- Lower entry barriers → faster adoption: Newcomers and cross-chain devs can start building immediately, accelerating ecosystem growth, unlike non-EVM environments where niche languages slow adoption.

- Composability & integrations: Solidity code composes easily with Ethereum-native protocols, smoothing multi-chain integrations and attracting liquidity from major dApps like Uniswap, Aave, and others fueling network effects.

All of the above makes Monad more approachable for developers and reduces the effort required to launch and maintain dApps on the network.

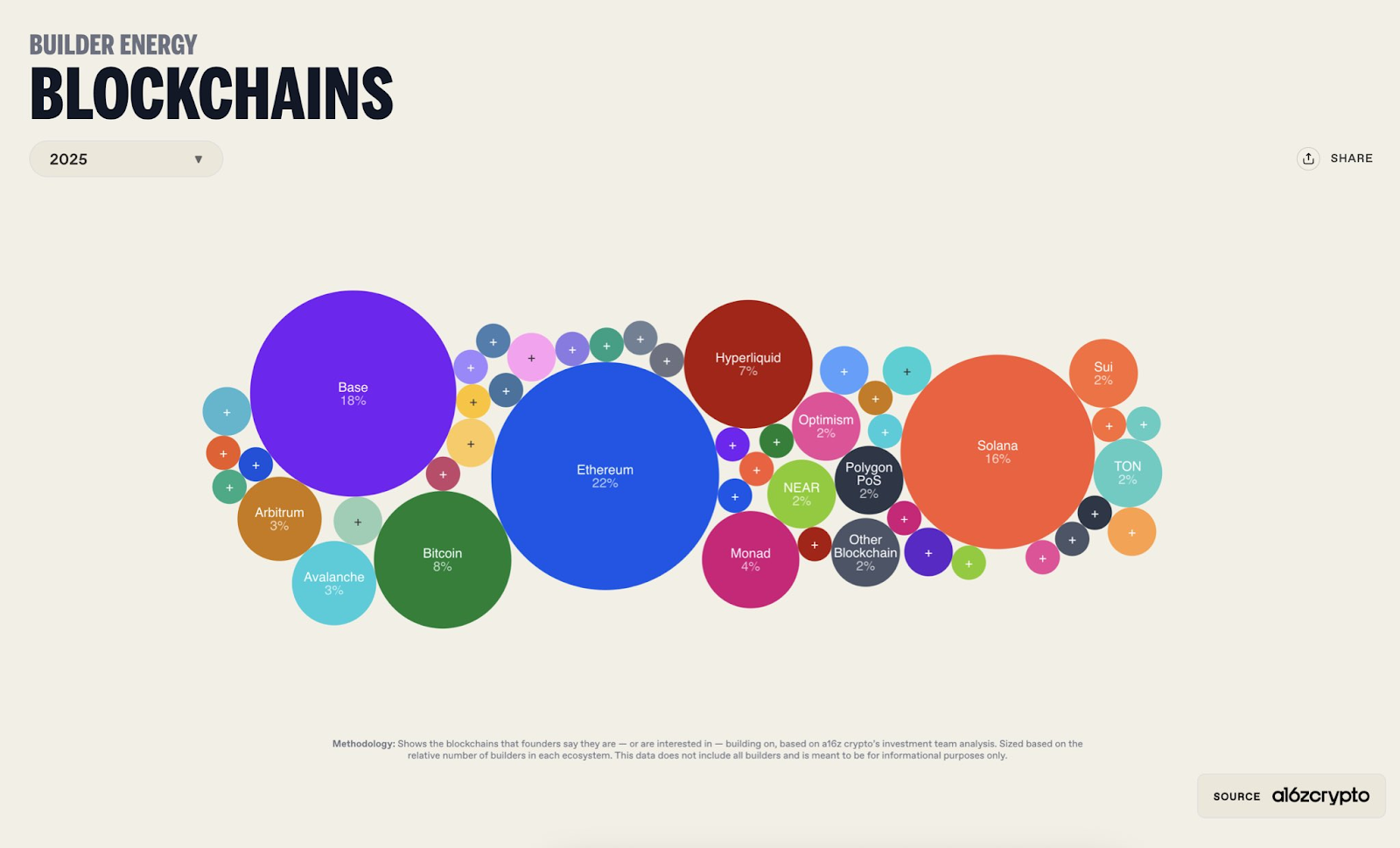

As the (hypothetical) “bubbles map” suggests, EVM compatibility can reinforce network effects not only at the dApp layer but also through user familiarity, liquidity routing, and cross-EVM interoperability.

Bottom line on infrastructure: Monad’s tech gives it a credible shot at capturing L1 market share. So, how is the community side shaping up?

Community - Monad’s special weapon

For any ecosystem, community activity is essential to network success. On Monad, this activity has been cultivated since the earliest days and the way the team grows community is worth a closer look.

NFTs - The spark for community activity

NFTs on Monad are deliberately prioritized and have become a foundation for the ecosystem’s vibrancy. Beyond the sheer number of projects, Monad appointed an NFT Lead for the entire ecosystem, Karma.

Read more: Top 5 Monad NFT Collections with Airdrop Potential

It’s not just a title. Monad actively supports NFT initiatives across social channels. They also host X Spaces on NFTs, most notably NFTea led by Karma. On the official website, there’s a dedicated NFT section to onboard new users.

Introducing <Mach 2: NFT>, the Monad NFT Accelerator.

— Monad Eco (mainnet arc) (@monad_eco) January 22, 2025

- Lectures with experienced NFT founders

- Launch & marketing strategy discussions

- Hot takes lounge with feedback

Building an NFT collection on Monad? Learn more: https://t.co/jCyKDaPfwa

Applications due Friday, Jan 24! pic.twitter.com/ApCo7HSkEy

Monad NFT Accelerator

Monad further highlights community-built NFT tools, such as:

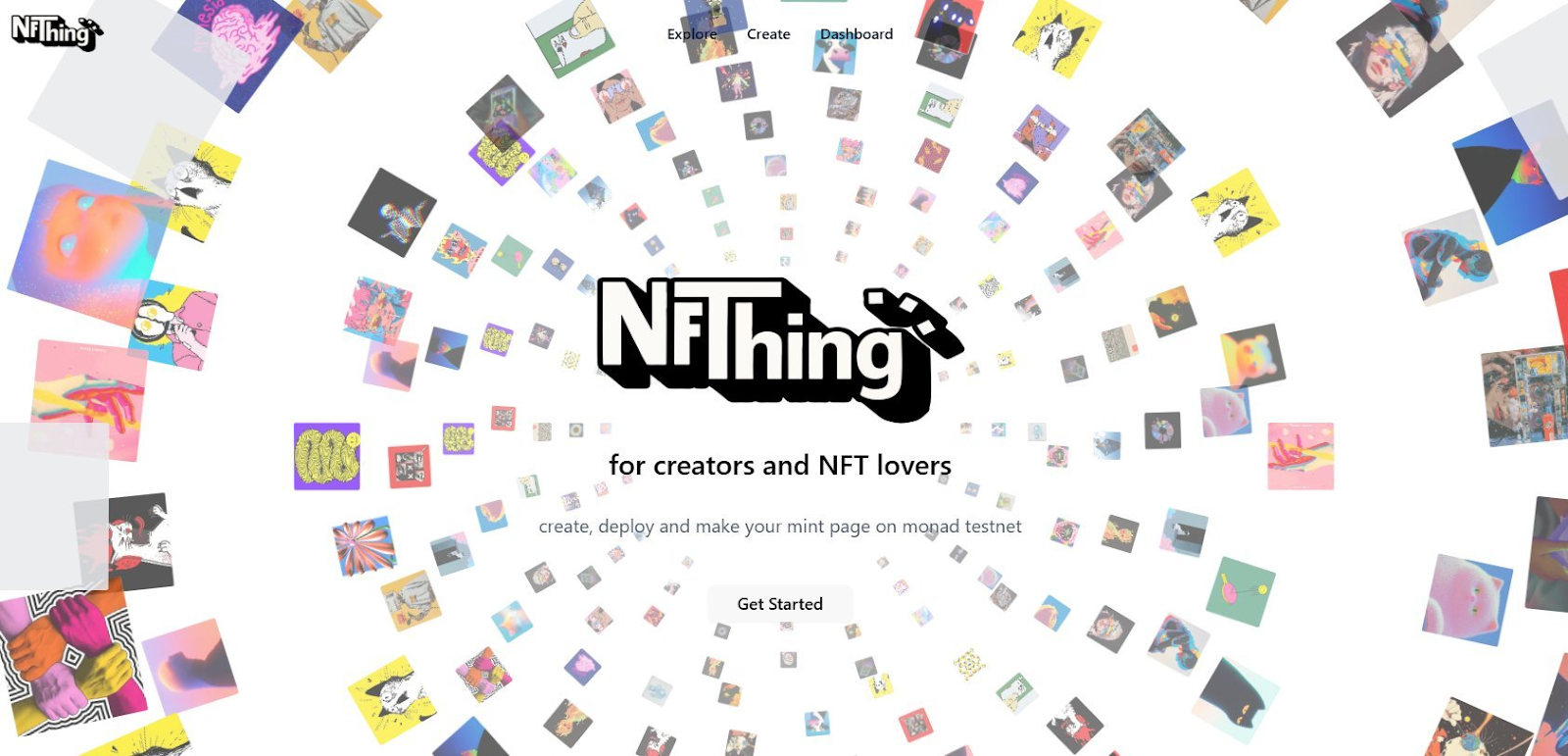

- NFThing: No-code NFT creation platform

- MoNFT: Terminal-style UI for creating NFTs

- NadTools: Collection snapshotting and NFT messaging

This focus has produced a rich NFT ecosystem that played a major role in the testnet phase, as users hunted for early whitelists with hopes of upside when mainnet launches.

Notable NFT projects showcased by Monad’s site include:

- @ChogNFT: A cat-themed collection backed by one of the loudest, most united communities. It’s the officially chosen Monad Mascot.

- @pepenads : pepe NFTS leading the charge for monad adoption.

- @thedaks_png: Monanimals-inspired, powered by a strong community, clear vision, and real utilities.

- @monadverse: A community-driven NFT collection featuring monanimals.

- @chogstarrr: Cat-inspired project in a similar aesthetic to Chog, launching straight on Mainnet with distinct fundamentals and roadmap.

- @ExploreOmnia: An upcoming pet battle and adventure game. Brought to users by Sappy.

- @llamao_: An NFT collection of 5,000 items built as an IP-focused brand centered on mindfulness. Llamao introduces “Llamaoism,” a meme-driven philosophy blended with mindfulness themes.

If users are active on X, users may often see Monad PFPs and memes derived from these NFT sets fueling a rare level of organic community energy, even at testnet/devnet stages.

Hackathons - How Monad “take care” builders and dApps

Beyond end users, Monad invests heavily in developers with hackathons and coding education leading up to mainnet:

- evm/accathon: Monad’s first hackathon kicked off on Feb 24, hybrid online/offline, with $100K+ in prizes

- Monad Madness Hong Kong: An April pitch competition for creative builders, $257K prize pool, access to top VCs, Mandarin-first format

- Monad 101 SEA Tour: Roadshow/mini-workshops across Southeast Asia introducing Monad, EVM parallelism, and tooling onboarding new devs and forming a community core

- Master Monad: Online course/hack series with mentors and real-world assignments (smart contracts, tooling), typically ending in a mini-hack or showcase

- Monad Founder Residency: For founders with live products but limited growth, culminating in a Demo Day before 100+ VCs

There are many more: Monad Shark Tank, Monad Blitz, Master Monad, MCP Madness, Monad Learning Track…

In short, Monad has built a full pipeline from “Onboarding → hack/sprint → IRL hubs → pitch → incubation” before mainnet.

Alongside this, numerous community-run side events during testnet have strengthened ties between the community and the Foundation. The result is an ecosystem that already looks well-rounded across DeFi, Gaming, NFT, and consumer apps.

Integrations & partners

Monad has announced/confirmed a range of integrations that enrich the network:

- Circle integration to support native USDC at mainnet launch

- AUSD and Lido wstETH deployments, plus yield aggregators for cross-ecosystem optimization

- Major DEX/Lending names (e.g., Uniswap, PancakeSwap, Balancer, Euler Finance, Renzo Protocol, Agora Finance, FolksFinance, Morpho, OpenOcean) deployed on Monad

- Integrations with Wormhole, deBridge, Hyperlane, LayerZero, LiFi, GasZip for seamless liquidity flows without clunky bridges

- Chainlink ready to integrate RPC for oracle data; Pyth for price feeds; Biconomy for gasless transactions

- Blocksense and Backpack enabling embedded wallets and infra for perps, gaming, and payments with near-zero fees

Community meetups - Monad’s “signature”

Monad arguably has one of the most meetup-active communities in Web3. Each country builds a well-organized local group, helping Monad expand globally from Asia to Europe.

Some standout communities:

- @japanads - Japan

- @monad_zw - China

- @MonadBangladesh - Bangladesh

- @koreanads - Korea

- @monadthailand - Thailand

- @indonads - Indonesia

- @RomaniaNADs - Romania

- @vietnads - Vietnam

- @MonadSGMY - Singapore & Malaysia

- Community Meetup Fillipinads - Philippines

Overall, Monad is weaving tight links across end users, dApps, and devs, making it easier to roll out growth initiatives once the two pillars (users and infrastructure) are in place.

Read more: Monad Ecosystem: Key Highlighted Projects

Now, wait to see how Monad Foundation “plays the game” post-TGE. Given how they executed pre-TGE, a bright outlook is reasonable and instructive for the wider crypto industry.

Reality vs Expectations

In a supportive bull market environment, Monad looks well positioned: it combines solid technical design, reputable backers, and an early but active ecosystem. If risk appetite remains strong, it would not be surprising to see prices move meaningfully above current pre-market levels.

If we look back at the past, early infrastructure projects leading a new technology trend have often had extremely successful TGEs.

- Arbitrum once reached an FDV of nearly $20B at the time of TGE, while for Optimism this figure was close to $10B. Both were at the forefront of the Optimistic Rollup narrative.

- Starknet also reached an FDV of almost $40B at TGE thanks to its position as a leader in the ZK Rollup trend.

- Monad is now positioned as a 10,000 TPS L1 with parallel execution, and it is also the first project to launch an ICO on Coinbase. For these reasons, a successful TGE is entirely within reach.

However, that was in a bull market. Right now, the environment is not exactly in Monad’s favor: Bitcoin has dropped to around $85K and there are several other reasons why Monad’s current FDV looks quite high.

- 4-year cycle: If the market is entering its late-cycle phase, it becomes hard for any project to “swim against the tide.”

- Real TPS: While 10,000 TPS is the target, only mainnet will ultimately show how theory translates into practice. Sui, Aptos, and even Solana have seen real-world TPS far below on-paper claims.

- Ecosystem ignition: A passionate community and complete stack are necessary but not sufficient. Breakout growth still depends on incentives, genuinely differentiated models, and macro liquidity factors no one can be certain about today.

- Macro risks: Macro uncertainty persists. FED can turn more hawkish after FOMC; Trump-era tariff risks could resurface; the market can seize on any of these as reasons to dump.

- Monad’s practical context: Current pre-market valuation reflects fundraising size and TGE hype more than “operational health.” A lower valuation at TGE is possible.

A few similar case studies have already played out, such as:

- 0G Labs raised over $300M, but the token trended down and now trades around a $300M market cap.

- Pump.fun reported about $700M in revenue and raised $500M at a $4B valuation, yet after TGE the price traded below the public sale level for a time.

So, taking partial profits on the pre-market before TGE remains a prudent option to consider. Airdrop allocations are nearly “free cost,” and positions bought in the Coinbase Public Sale are currently showing a fairly attractive profit, with:

- Public Sale price: $0.025 (FDV $2.5B)

- Pre-market price on Whales Market: $0.033 (FDV $3.33B)

Another interesting data point is that Polymarket also gives a useful snapshot of how the broader community is thinking about Monad’s pricing.

- Traders assign an 86% probability that the token will open above a $2B FDV

- Roughly a 40% chance it trades above $3B on the first day.

This expectations do not reflect a market expecting “hidden value” at the ICO price. Instead, they suggest that most participants already view the $2.5B valuation as elevated and are positioning for a range that is equal to or higher than the sale price.

From a sentiment perspective, this reinforces one point: Monad is entering the market with expectations set high, not low.

Conclusion

Monad has many elements that could support strong upside if market conditions stay favorable, and its fundamentals give it a better starting point than many recent L1 launches. However, the broader context still matters.

Late-cycle risks, uncertain real-world performance, ecosystem ignition challenges, and past examples such as 0G Labs and Pump.fun all show how quickly sentiment can shift after TGE.

With ICO priced at a $2.5B FDV and pre-market trading already above that level, Monad is not cheap and comes with meaningful downside if expectations are not met. For most investors, the key is to stay objective: recognize the early hype, be aware of the post-TGE volatility seen in past L1 launches, and wait for clearer signals from mainnet performance and real ecosystem activity before drawing stronger conclusions.

FAQs

Q1. What makes Monad’s approach to scaling different from other L1s?

Monad focuses on parallel execution and high EVM compatibility, allowing it to scale without forcing developers to learn new languages or rewrite their applications.

Q2. Why are developers paying attention to Monad before mainnet?

Because it offers familiar tooling, easy migration from Ethereum, and a fast-growing support ecosystem through hackathons, workshops, and residency programs.

Q3. How important is Monad’s community to its growth?

Community activity is one of Monad’s strongest drivers, with NFT-led engagement, active meetups, and creator-driven tools fueling early momentum.

Q4. Will Monad’s testnet performance translate to mainnet results?

Testnet numbers look promising, but the real test is mainnet, where decentralization, traffic, and real user behavior will reveal true throughput.

Q5. What should investors watch closely after TGE?

Market conditions, real TPS, ecosystem incentives, and how well Monad converts its strong pre-launch energy into sustained post-launch adoption.

Q6: What is the price of Monad ($MON) today?

While Monad ($MON) hasn't been listed yet, users can trade $MON pre-market at $0.033 on Whales Market before the TGE. Here you can trade $MON before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

Q7: How to trade $MON (Monad) on Whales Market?

If you want to trade $MON (Monad) on Whales Market, you can either create an offer or buy/sell from other users’ offers. For full details, please read the Whales Market docs.