Crypto market could gradually approaching the final stretch of this cycle. If the market still follows the 4-year cycle, this is the time when investors should start considering taking profits to prepare for the bear market next year.

However, there are also some arguments suggesting that the 4-year cycle is no longer valid, and crypto market has now shifted to a new way of operating.

So, what is the truth? Let's explore through this article!

What is the 4-Year Cycle in the Crypto Market?

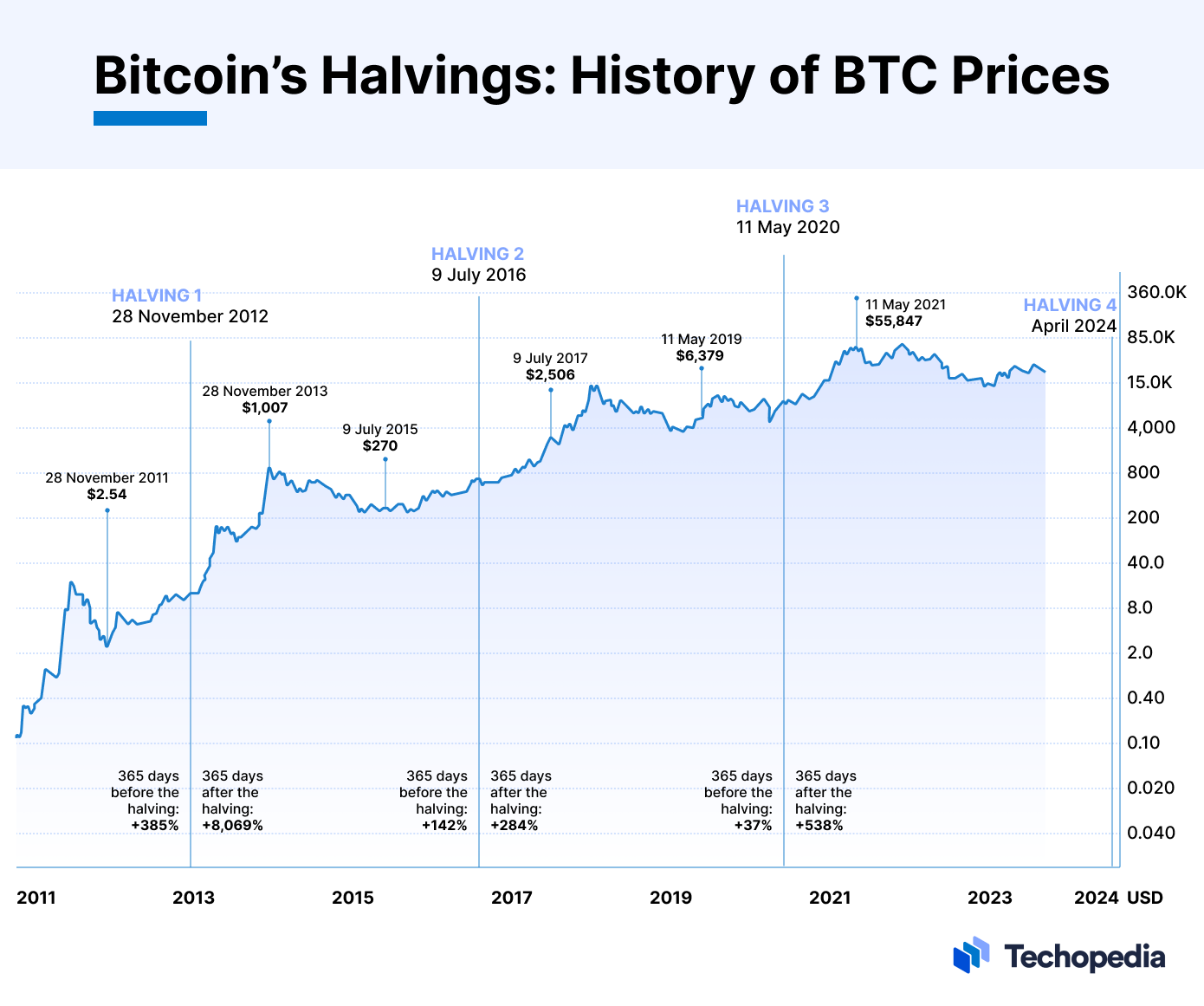

The 4-year cycle in the crypto market is a common recurring pattern, primarily related to Bitcoin - the most influential cryptocurrency. This is not a fixed rule like a clock, but an observed phenomenon from historical data, typically lasting about 4 years and tied to the event known as "Bitcoin Halving" (halving the reward).

To mine Bitcoin, miners use computers to solve complex mathematical problems to confirm transactions and receive rewards in new Bitcoin. However, to control inflation and maintain scarcity, Bitcoin has a "halving" mechanism - meaning that approximately every 210,000 blocks mined, the reward per block is halved. Since each block takes about 10 minutes to mine, halving occurs roughly every 4 years.

The 4-year cycle is the period between two consecutive halvings. It not only affects Bitcoin but also spreads to the entire crypto market, as Bitcoin always leads the price trends of other altcoins.

A typical cycle can be divided into 4 main phases, similar to the seasons in a year:

- Phase 1 Post-Halving (Accumulation): Right after the halving occurs, the amount of new Bitcoin created is halved, meaning new supply decreases. At this point, the market is often quiet, prices may stabilize or drop slightly as miners adjust (some small miners may quit due to reduced profits).

- Phase 2 Bull Run: About 6-12 months after the halving, Bitcoin's price starts to surge. Why? Supply decreases while demand remains the same or increases.

- Phase 3 Peak & Correction: When prices reach their peak, the market overheats, leading to profit-taking that inadvertently triggers panic selling. Prices drop sharply, sometimes losing 70-80% of their value. This is the "bear market" phase, where most investors leave the market.

- Phase 4 Recovery and Waiting for the Next Halving: The market gradually stabilizes, prices hit bottom, and begin a slow recovery. New projects develop, technology improves, preparing for the next halving.

The entire cycle repeats, but not always exactly 4 years, as it depends on mining speed (which can be faster if more miners participate).

Context of the 2024-2025 Cycle

Let's look back at history to get a broader overview of the timelines in past 4-year cycles.

Halving to ATH:

- 2016-2017: 526 days.

- 2020-2021: 549 days.

ATL to ATH:

- 2017 Cycle: 1068 days with BTC ATH at ~$20K.

- 2021 Cycle: 1061 days with BTC ATH at ~$69K.

Assuming $126K is the ATH for this cycle, it would have similar numbers as follows:

- Halving to ATH: 535 days.

- ATL to ATH: 1051 days.

The example above only helps readers gain an additional perspective on the time that has passed in the 2024-2025 cycle, without asserting that the cycle peak is $126K.

The numbers above are also quite similar to the data from past cycles. However, does this indicate we’ve already passed the cycle peak?

New Historical Events in the 2024-2025 Cycle

One interesting thing is that in this cycle, the crypto market has witnessed some new historical events that have never occurred before:

- BTC has ATH before Halving: Bitcoin hit $73K on 03/14/2024 (about 36 days before halving), surpassing the old ATH of $69K from 2021. This is the first time Bitcoin reached a new ATH before halving since the first cycle, mainly thanks to the approval of Bitcoin ETFs and early institutional capital inflows.

- Bottom Lower Than Previous Cycle Peak: This is also the first time the cycle bottom is lower than the previous cycle peak: $15K (2022) < $20K (2017).

- Hash Rate Hits Record: For the first time, hash rate exceeded 1 zettahash/second (4/2025), up 40% since halving, but not accompanied by strong price increases, leading to tightened miner profits.

Of course, these events will not directly determine how the market operates in the future. But they also inadvertently remind investors that:

"In the financial market, anything can happen".

Does the Crypto Market's 4-Year Cycle Still Exist?

The answer to this question is something almost no one can definitively provide. However, everyone could look at some opinions below to form the own answer.

The 4-Year Cycle Still Exists

If the market still follows the 4-year cycle, this means market gradually entering the early stage of a bear market, and the cycle peak is likely at BTC $126K.

And if this truly continues, this will be one of the harshest cycle in the crypto market with:

- No Real Altcoin Season, capital only moves quickly between narratives.

- Most altcoin investors lose money, the market enters a downtrend even without experiencing a euphoria period.

- ETH witnesses its worst performance in recent years, while many Dino Coins have impressive performances like DASH, ZEC, XRP... This is completely contrary to most investor expectations.

- Even many small investors and MMs go broke right in the Bull Run due to the crash on 10/10.

- Narratives follow narratives, x402, ERC-8004, Robotics... all are trends that come and go quickly. Extractors outnumber Believers.

- No new capital from retail investors, DATs gradually deplete resources, even MicroStrategy only buys a few tens of millions USD in recent times. Smaller players such as MetaPlanet, which mortgaged BTC to buy back its own shares, Sequans, and ETHZilla have started to sell in order to reduce debt, putting extra pressure on BTC and ETH.

- The US government shutdown affects the market, stalling many related activities.

Faced with such harshness, the majority of the market enters the Bear Market in a broke state and with extreme skepticism about the market.

The 4-Year Cycle Has Ended

On the opposite side, a more optimistic view is that the 4-year cycle has officially ended, and the market will enter a new era, a new way of operating, aligned with global liquidity. Some arguments are as follows:

The Influence of Bitcoin Halving Is No Longer as Before (1)

The halving of BTC supply every 4 years no longer has the same impact in a mature market. Maturity here means:

- BTC sees new buying pressure from ETFs and companies (DATs).

- BTC even becomes a reserve asset at the national level.

- BTC is discussed seriously as a political issue, between parties, politicians, and from the US President.

- Larry Fink - CEO of BlackRock - the world's largest asset management company - directly goes on TV and "shills" BTC to Wall Street.

- BTC is now accepted at the highest level as an asset. This is considered maturity.

Additionally, the block reward is no longer too significant (3.125 BTC/block), meaning it does not impact the BTC price path as much.

Distribution Between Generations of Holders (2)

- From July 2025: About 810K BTC were "revived."

- In October 2025: About 325K - 405K BTC left LTH wallets, the largest outflow since January 2025.

The selling from LTH (Long Term Holders) is mainly "profit-taking" from long-term holders. Especially in the context of BTC reaching a new ATH around $126K.

Nevertheless, throughout 2025, BTC had nearly 180 trading days above $100K. This somewhat shows the buying pressure and absorption by new holders.

This can be seen as a transfer from OG whales - those who bought a long time ago - to the new generation of holders, that are DATs, ETFs, or governments.

And of course, with a new "floor price," in the hands of new owners, a new price behavior could very well begin for BTC.

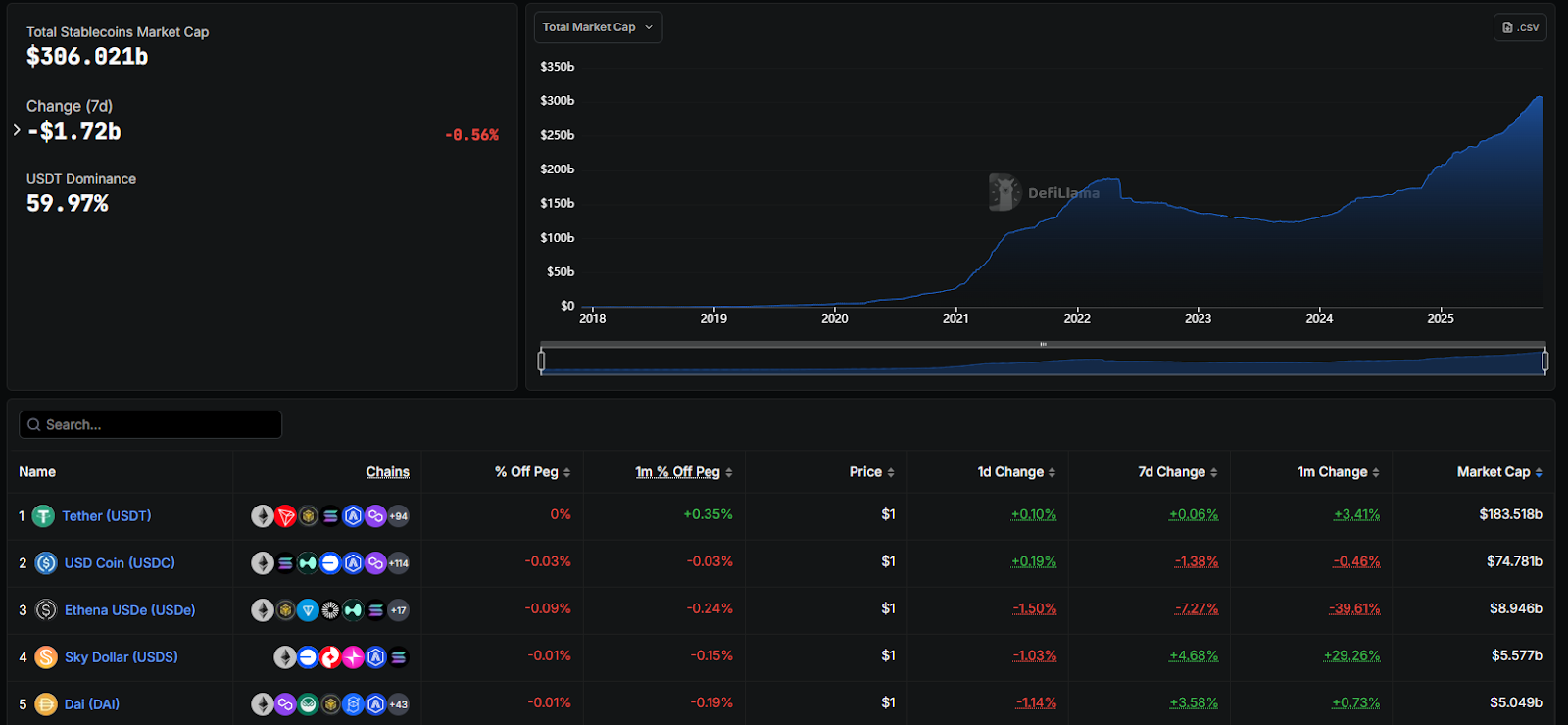

Liquidity Is Extremely Abundant (3)

- Stablecoins are at a record high of 306B, up 50% since the beginning of 2025.

- Money in US Money Market Funds is at 7.42T, lower than the record of 7.8T.

- The Fed has hinted that QT could end by Dec 2025, which also means QE (quantitative easing program) is about to happen, expected in 2026.

The above factors show that available liquidity in the market is very high, and they just need a "signal" to truly flow into risky markets like Crypto.

Additionally, most capital is also being sucked into stories around AI companies rather than other investment sectors.

Some Other Factors (4):

- Previously, in 2022, 2023, 2024, which were considered "Bear Market," the market still had waves of increases with various narratives.

- Throughout 2024, 2025, BTC's price was always driven by institutions, not retail. ETFs made BTC reach a new peak before Halving, ETH reached $5K thanks to Tom Lee and the accumulation wave he initiated. Institutions are truly leading this cycle.

From (1) + (2) + (3) + (4), everyone could the view that the 4-year cycle has now ended completely has a basis, and BTC as well as the crypto market is moving into a new way of operating, which could evolve according to global liquidity volume, instead of relying on Halving and retail as before.

Of course, the future is uncertain for anyone, and going all-in on one view will make investors pay a heavy price.

The important thing is not to be perfectly right. A better approach is to plan for multiple scenarios and prioritize risk management.

Conclusion

Hopefully, through this article, readers have gained more insights into the cyclical nature of the crypto market. The Whales Market team will always create more quality articles to serve our readers.

FAQs

Q1. Why do some analysts believe the 4-year cycle is breaking?

Several unusual signals suggest the market may be shifting. Bitcoin reached a new all-time high before the halving, hash rate continues to hit record levels without a matching price reaction, and large institutional buyers are entering the market. These factors indicate that Bitcoin may no longer move strictly according to the old four-year pattern.

Q2. If the cycle ends, what replaces it as the main market driver?

Macro forces may take over. Global liquidity conditions, ETF inflows, and long-term institutional allocation could become more influential than halving supply shocks, shaping price movements in new ways.

Q3. Does a broken cycle mean there will be no bear market?

Not necessarily. Bear markets can still occur, but their timing, duration, and severity may no longer align with the predictable four-year structure seen in previous cycles.

Q4. How should investors react if both scenarios are possible?

Instead of committing to a single narrative, investors should prepare for multiple outcomes. Prioritizing risk management, position sizing, and liquidity control is far more reliable than trying to predict which model will play out.

Q5. Why is the $126K price level mentioned so often?

This level serves as a comparative marker when analyzing timelines across past cycles. It is a reference point used for context, not a guaranteed target or peak price.