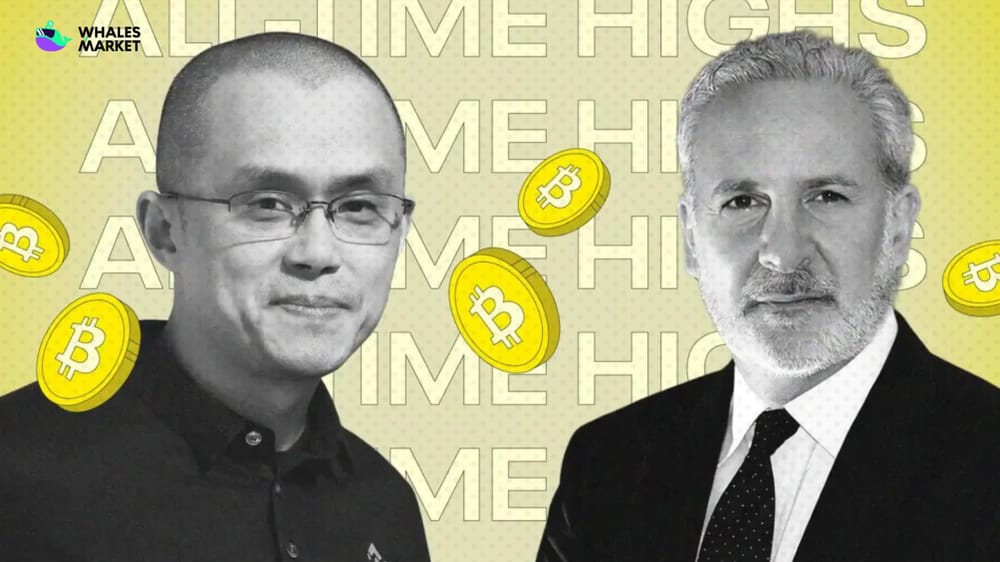

A recent exchange between Binance CEO Changpeng Zhao (CZ) and economist Peter Schiff has sparked discussion within the cryptocurrency community. The exchange, initiated by Schiff's critical stance on Bitcoin, drew a direct response from Zhao, highlighting differing perspectives on the digital asset's investment potential. This interaction underscores the ongoing debate surrounding Bitcoin's role in the financial landscape.

CZ Responds to Schiff's Bitcoin Investment Warning

Peter Schiff, known for his skepticism towards Bitcoin, asserted that individuals investing in Bitcoin would lose money. Changpeng Zhao, the CEO of Binance, countered this claim by questioning the number of people Schiff believed would suffer losses. This exchange reflects the contrasting viewpoints between traditional financial analysts and proponents of cryptocurrency.

Peter Schiff's Long-Standing Criticism of Bitcoin

Schiff has consistently voiced concerns about Bitcoin, often comparing it unfavorably to gold. He argues that Bitcoin lacks intrinsic value and is prone to speculative bubbles. His commentary frequently appears on social media platforms, where he engages in debates with cryptocurrency advocates. Schiff's perspective aligns with a segment of financial experts who remain unconvinced of Bitcoin's long-term viability.

Binance's Continued Advocacy for Cryptocurrency

Binance, under CZ's leadership, has remained a prominent advocate for the broader adoption of cryptocurrencies. The company consistently promotes education and awareness initiatives aimed at increasing understanding of digital assets. CZ's response to Schiff can be viewed as part of Binance's ongoing effort to defend and legitimize Bitcoin and other cryptocurrencies in the face of criticism.

Market Reactions and Community Sentiment

The exchange between CZ and Schiff has generated considerable discussion within the cryptocurrency community. Many Bitcoin supporters have criticized Schiff's views, while others have acknowledged the risks associated with cryptocurrency investments. The debate highlights the diverse opinions and ongoing uncertainty surrounding the future of Bitcoin and its role in the global economy.

Conclusion

The exchange between Changpeng Zhao and Peter Schiff exemplifies the ongoing dialogue surrounding Bitcoin's value and investment potential. As the cryptocurrency market continues to evolve, these differing perspectives will likely continue to shape the conversation around digital assets and their place in the broader financial system.

FAQs

What is Peter Schiff's primary argument against Bitcoin?

Peter Schiff primarily argues that Bitcoin lacks intrinsic value and is susceptible to speculative bubbles. He often compares it unfavorably to gold, which he considers a more reliable store of value. Schiff believes that Bitcoin's price is driven by hype and speculation rather than fundamental economic factors, leading him to predict eventual losses for investors.

What is Binance's general stance on cryptocurrency adoption?

Binance actively promotes the adoption of cryptocurrencies through various educational initiatives and awareness campaigns. The company aims to increase understanding of digital assets and their potential benefits. Binance also works to create a user-friendly platform for trading and managing cryptocurrencies, further encouraging wider participation in the market.

How do differing opinions like Schiff's impact the cryptocurrency market?

Differing opinions, such as Schiff's skepticism, contribute to market volatility and influence investor sentiment. Negative commentary can create fear, uncertainty, and doubt (FUD), potentially leading to price corrections. Conversely, strong support and positive news can drive market rallies. These contrasting viewpoints ultimately shape the ongoing narrative and perception of cryptocurrencies.

What are some common risks associated with Bitcoin investments?

Bitcoin investments carry risks including price volatility, regulatory uncertainty, and security vulnerabilities. The price of Bitcoin can fluctuate dramatically in short periods, leading to potential losses for investors. Changes in regulations or government policies can also impact the value and legality of Bitcoin. Additionally, the risk of theft or hacking remains a concern for those holding Bitcoin.