More than 70% of users on Polymarket are losing money, and most of them do not fully understand why. In 2025, prediction markets reached a record $7.4B in trading volume in October alone, but that capital did not flow evenly across participants. If the goal is to avoid burning your money to feed sharks, these are the mistakes every trader needs to understand and avoid.

Why do users keep making mistakes in prediction markets?

Prediction markets are not casinos, but many users treat them like gambling platforms. This misunderstanding is the root cause behind most losses.

Misunderstanding the nature of the market

Prediction market function like probability exchanges, not slot machines driven by luck. Each contract is priced between $0.01 and $0.99, representing the collective probability the market assigns to a specific event. Buying “Yes” at 70 cents only means the market currently estimates a 70% chance, not a guaranteed outcome.

The key point is that price reflects crowd perception at a given moment, not absolute truth. That perception can also be distorted. A study from Columbia University (November 2025) found that nearly 25% of trading volume on Polymarket may involve wash trading. This means price movements and volume can sometimes be artificial signals rather than real sentiment.

As a result, reading prices in prediction markets requires more than watching numbers. Users must separate reasonable probabilities from noise created by unhealthy trading behavior.

Psychological biases shape decisions

In reality, many trading decisions are driven less by data and more by familiar psychological biases. Behavioral finance research highlights several common ones:

- Overconfidence bias: Traders often believe they have a unique edge over the market. This confidence leads to excessive trading, sometimes 45% more than necessary according to the Survey of Professional Forecasters. The result is higher transaction costs, repeated mistakes, and annual performance dropping by 1–3% simply due to overtrading.

- Confirmation bias: Once a trader leans toward a specific outcome, information that supports that belief is favored, while opposing data is ignored or downplayed. Over time, this narrows perspective and weakens decision quality.

- Desirability bias: When a trader wants a certain outcome to happen, the brain naturally inflates its perceived probability. This is especially dangerous in prediction markets, where emotion can easily override actual odds.

Taken together, these biases make traders feel their decisions are well reasoned, while in reality emotion is often leading more than data.

A harsh zero-sum market

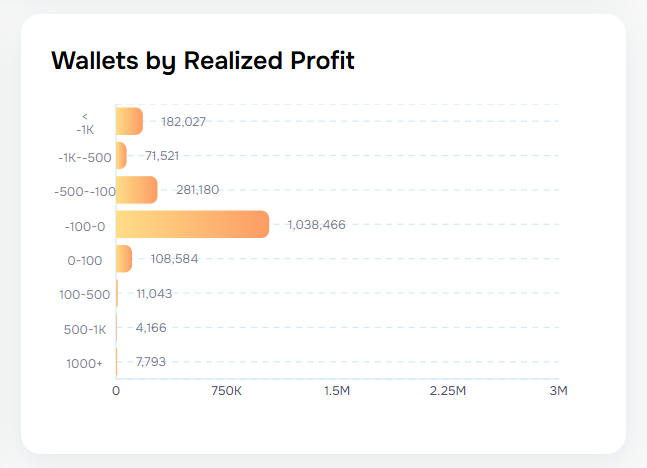

Prediction markets are not cooperative games. One trader’s loss becomes another trader’s profit. Data aggregated by Layer Hub shows that only around 4,000 wallets on Polymarket have achieved realized profits above $1,000, while roughly 1.5M wallets are losing money. More than 1M wallets are down less than $100 but still negative.

Most of the market exists to provide liquidity to a very small group. These sharp traders do not trade emotionally. They use bots to track money flows, algorithms to read odds movement, structured systems, and sometimes information advantages. They do not need to be right every time. They only need the majority to be wrong.

In short, prediction markets do not reward belief or emotion. They reward discipline, data, and the ability to avoid common mistakes.

Read More: Top 10 useful tools on Polymarket - Part 1

Common mistakes when trading on Prediction market

Trading on emotion without a strategy

Trading based on gut feeling is one of the fastest ways to lose money. Without a clear decision framework, every entry becomes a reaction to price movement rather than a probability-based choice.

A minimum strategy in prediction markets requires three elements:

- A clear thesis: The trader must answer one simple question: why is the market mispriced? Without a specific mispricing, there is no real edge, only personal belief.

- Position sizing: No single market should account for more than 5–10% of total capital. Even when probability appears high, unexpected risks always exist.

- An exit plan: Cut-loss and take-profit levels should be defined before entering a trade, not after price moves against expectations.

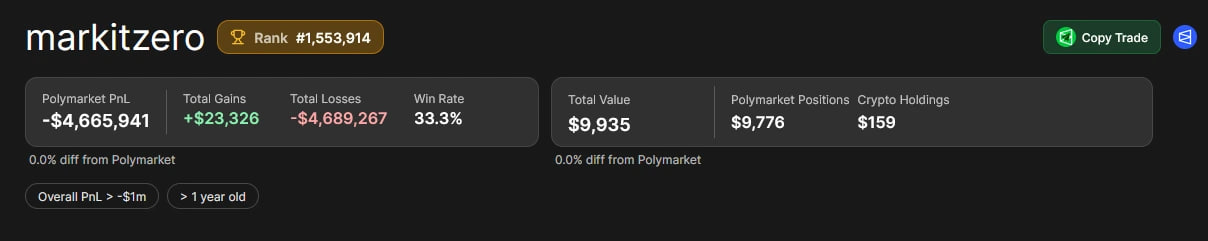

A well-known example is trader Markitzero, who lost approximately $4.6M by allocating all capital to the 2024 U.S. presidential election. The entire loss came from a single market. This case shows how lack of diversification can wipe out an account after one wrong decision.

Not reading resolution rules carefully

Every prediction market has its own resolution rules, and they are not always intuitive. Sometimes outcomes depend less on logic and more on how terms are defined on paper.

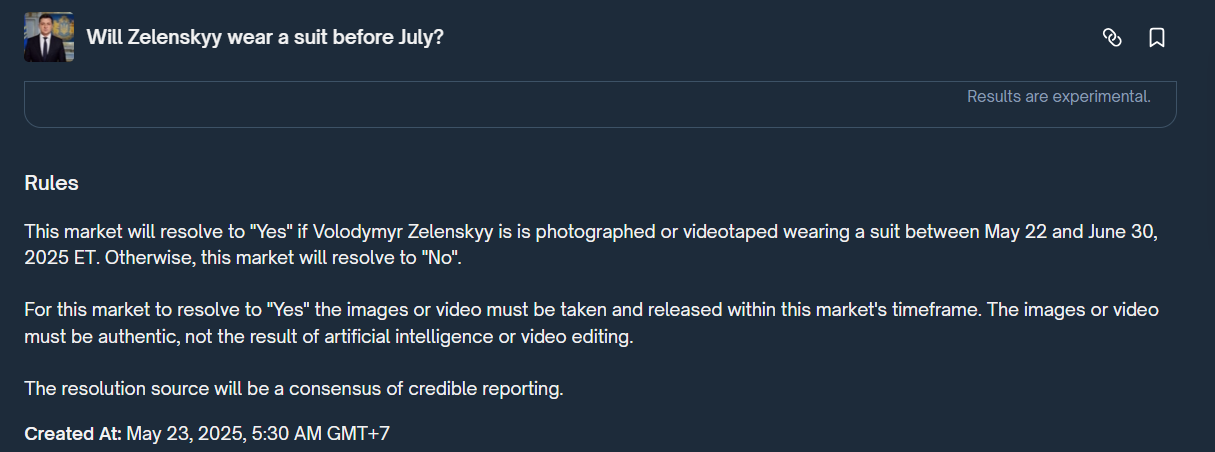

A famous example is the market “Will Zelenskyy wear a suit before July?” on Polymarket. The question appeared simple but triggered major controversy over the definition of a “suit”.

- Supporters argued that the outfit was made from the same material, had a similar color, and looked formal enough, so tailoring and cut should not matter.

- Opponents argued that the outfit consisted of a black shirt and a black jacket resembling a casual blazer rather than a traditional suit. They also pointed out that the sneakers did not match formal suit standards, making it an incomplete traditional outfit.

In the end, the market resolved as No, leading many traders who believed the outfit qualified as a suit to lose millions of dollars.

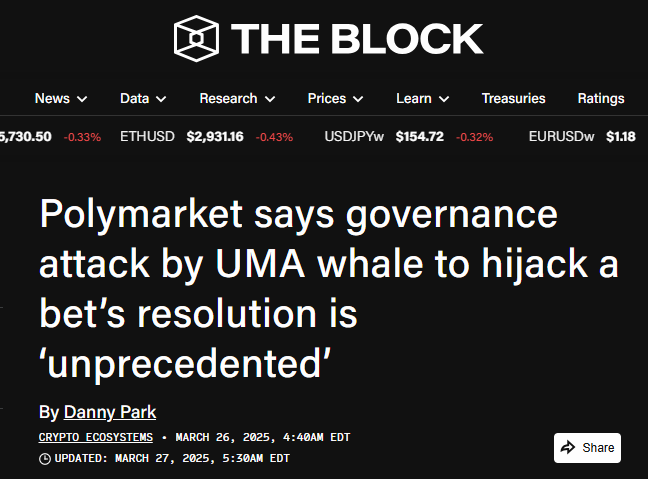

TLDR: A market titled “Will Zelenskyy wear a suit before July?” is being hijacked on @Polymarket.

— crypto.news (@cryptodotnews) July 7, 2025

Despite video proof, media reports, and confirmation from the designer, whales are trying to push a “No” outcome and they’re using a flaw in the UMA oracle system. pic.twitter.com/EIu7AbZczN

In prediction markets, resolution rules matter more than common sense. The market does not ask what looks reasonable. It asks whether something matches the exact written definition. Even vague terms like “suit,” “official,” “launch,” or “publicly available” can turn a seemingly safe trade into a technical loss if rules are not read carefully.

Using market orders in low-liquidity markets

Market orders execute instantly at the best available price. In low-liquidity markets, that price can be far from fair value. It is not uncommon for traders to buy at 50 cents when realistic probability is closer to 10 cents, simply because the order book is thin.

Low liquidity creates wide spreads, and displayed prices do not reflect true consensus. Even a small market order can sweep available levels and execute at a poor price.

Solution: always use limit orders to control entry price. Before trading, check order book depth. If spreads are wide or volume is thin, it is often better not to trade at all.

Ignoring the time value of money

Higher returns are not always better returns. A market offering 10% profit locked for 6 months is often less efficient than a market offering 5% in one week. The issue is not absolute return but capital turnover speed.

Opportunity cost is one of the largest hidden costs in prediction markets. Capital locked for long periods cannot be redeployed into better opportunities or react to new information.

Polymarket introduced Holding Rewards at around 4% APY to compensate long-term holders. However, this does not automatically make long-duration markets attractive. Traders must still evaluate whether the reward justifies the capital lock.

Managing time efficiency of capital is just as important as predicting outcomes correctly.

Trading outside the area of expertise

Success in one domain does not transfer automatically to another. Understanding U.S. elections does not mean understanding European politics. Being strong in crypto does not guarantee success in NFL or boxing markets.

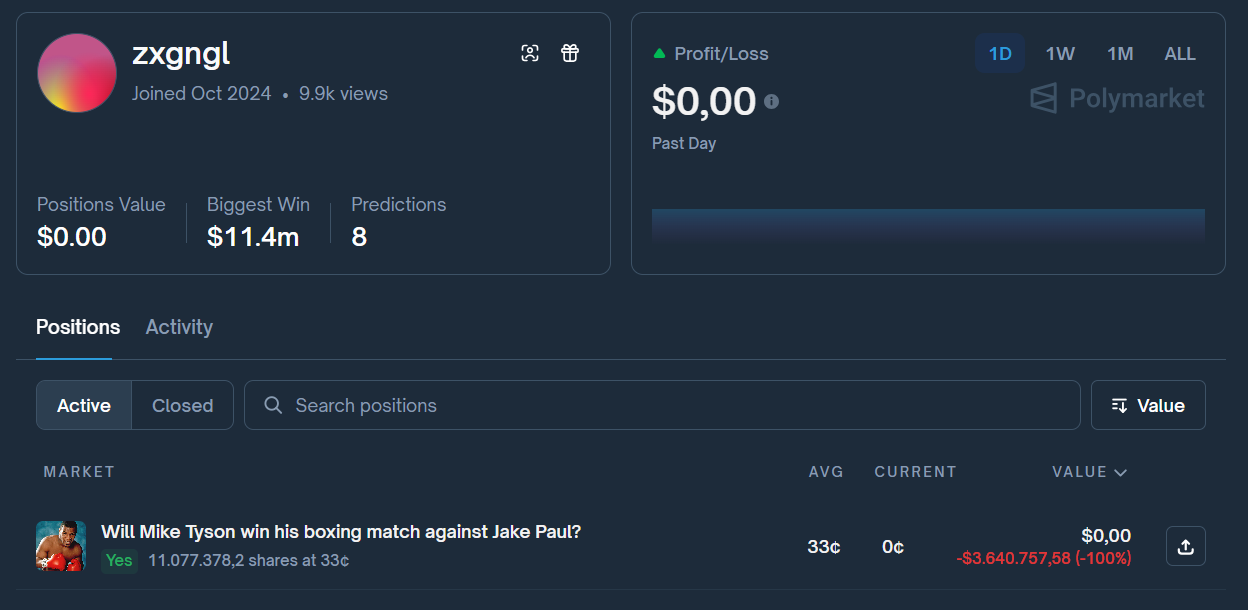

A clear example is trader zxgngl, who reportedly earned around $29M from Trump-related election markets but later lost $3.6M betting on the Mike Tyson vs Jake Paul fight, a domain far outside core expertise.

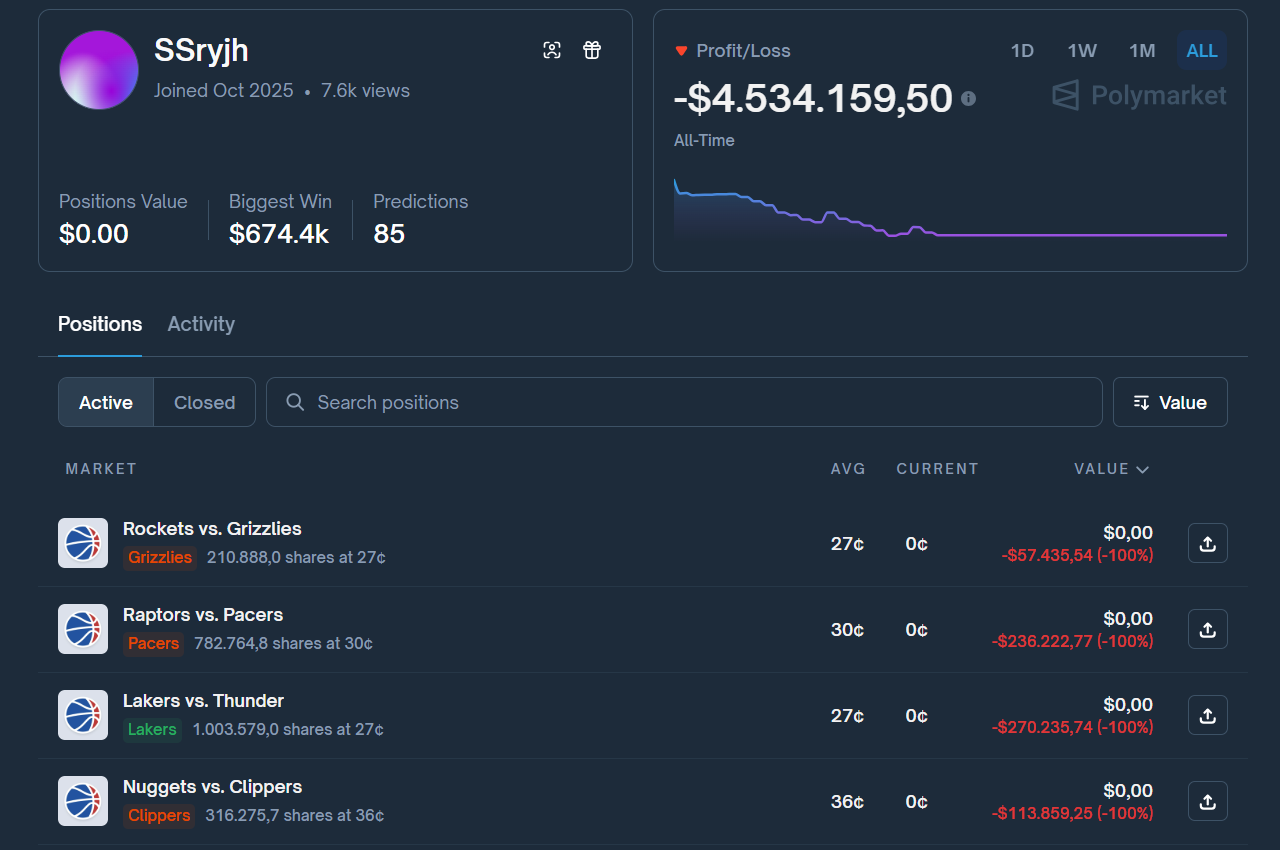

Another case involved trader SSryjh, who lost approximately $4.5M by blindly trusting favorites in sports markets.

These examples highlight a simple truth: domain knowledge creates real edge. Outside that domain, trading becomes speculation rather than strategy.

Failing to stay updated with information

Prediction markets react to news almost in real time. Professional traders often rely on bots monitoring headlines, media outlets, and official sources 24/7. Without alerts, users are almost always the last to know, and by then prices have already moved.

In these markets, the advantage is not understanding the news, but learning it minutes earlier. Even a small delay removes opportunity.

Traders monitoring live news were able to capture short-lived arbitrage opportunities in early price movements. Those without live tracking only saw prices after adjustments were complete.

In prediction markets, delayed information means lost edge. Without alerts or continuous updates, traders often become liquidity providers for faster participants.

I might have just found an OpenAI employee’s wallet on Polymarket

— Lirratø (@itslirrato) December 12, 2025

User 'pony-pony' is up $80,000+ betting on internal company timelines that nobody else could possibly know

Look at the precision:

- GPT 5. Knew it wouldn't be released by Aug 5, but was guaranteed by Aug 10. And… pic.twitter.com/zWjxPViBz7

Waiting for resolution instead of exiting early

It is not necessary to wait for final outcomes to make money. Buying “Yes” at 30 cents and selling at 80 cents locks in 50 cents profit without waiting for the event to occur.

Holding until resolution introduces unnecessary risks:

- Resolution disputes may arise

- New information can reverse prices

- Capital remains locked too long

UMA Oracle has faced multiple controversies on Polymarket involving delayed or disputed resolutions.

Knowing when to exit is as important as being right. Many traders lose not because their thesis was wrong, but because they stayed too long after the market had already priced in the profit.

Revenge trading after a loss

After a loss, increasing position size to “win it back” is a common reaction and one of the fastest ways to lose more. When emotion takes control, decisions shift away from probability and data toward emotional recovery.

Behavioral finance research shows revenge trading reduces decision quality by over 70% compared to normal trading conditions. Traders rush entries, ignore risk management, and create chains of mistakes.

The most effective response to a loss is not a new trade, but a pause. Stepping back, reviewing mistakes, and returning only when emotionally stable preserves discipline. In prediction markets, discipline after losses is as valuable as finding good trades.

Blind copying leads to lost money and lost learning

Copying trades without understanding context often results in losses. Even top traders make mistakes or act based on information and goals unknown to others. Overreliance on external decisions removes independent judgment and learning.

In prediction markets, copying should remain a reference, never a strategy.

Read More: What is Pre-market on Prediction Market?

Conclusion

Prediction markets are sophisticated financial instruments, not games of chance. Most traders lose not because markets are impossible, but because they treat them like gambling: without clear strategy, without discipline, and without understanding how the system works.

The most important lesson is recognizing personal limits, trading only within areas of understanding, prioritizing risk management before profit, and remembering that at the table, if it is unclear who is paying for mistakes, it is often the trader themselves.

FAQs

Q1. What type of trader is best suited for prediction markets?

Prediction markets favor disciplined traders who understand probability, have strong domain knowledge, and prioritize risk management over emotion.

Q2. Why do many traders lose money even when their predictions are correct?

Because they enter at poor prices, use market orders in low-liquidity markets, or hold positions too long after profits are already priced in.

Q3. When should a trader skip a market even if it looks attractive?

When spreads are wide, liquidity is thin, rules are unclear, or capital is locked too long relative to expected returns.

Q4. What should new traders focus on before increasing position size?

Understanding pricing mechanics, reading resolution rules, managing capital, and learning when to exit early instead of waiting for resolution.

Q5. How can traders avoid being exploited by sharper participants?

By avoiding emotional trading, revenge trades, blind copying, and by staying within areas they truly understand.

Q6. What is the most sustainable edge in prediction markets?

Discipline, fast access to information, and the ability to avoid common mistakes made by the majority.