The wave of airdrop hunting through trading on derivatives exchanges only truly accelerated after the Hyperliquid airdrop. Following that event, several other names such as Aster, Lighter, and Variational began to gain attention.

However, before Hyperliquid triggered this broader market excitement, Backpack was already one of the exchanges heavily used by traders for airdrop. This early traction was driven by strong momentum from the Solana ecosystem and the Mad Lads NFT collection.

Backpack Overview

Backpack Exchange is a centralized exchange founded in 2023, designed to provide a seamless user experience across spot trading, derivatives trading, digital asset management, and participation in DeFi-related activities.

One of Backpack’s defining characteristics is its hybrid architecture. The platform allows users to retain self-custody of assets through an integrated wallet while still accessing centralized exchange functionality.

- On the centralized side, Backpack operates similarly to a traditional CEX, offering spot trading, perpetual futures, lending and borrowing services, and requiring KYC for advanced features such as perpetual trading and margin usage.

- On the self-custodial side, Backpack integrates directly with Backpack Wallet, a non-custodial wallet where users maintain full control over their private keys. This design enables users to trade with the speed and liquidity depth of a centralized exchange while preserving asset self-custody when needed.

The Backpack team includes former members of FTX and Alameda Research, with professional backgrounds at major financial institutions such as Barclays, State Street, HSBC, and exchanges like Coinbase.

In parallel, the success of the Mad Lads NFT collection, which minted at 6.9 SOL and later reached an all-time high of 226 SOL, helped Backpack establish a relatively strong early community. Many Mad Lads holders are influential figures within the Solana ecosystem, contributing to early trader adoption on the platform.

Backpack officially launched its Backpack Points program starting with Season 1 in March 2025. The program has continued through subsequent seasons, with Season 4 ongoing at the time of writing in January 2026.

Backpack Exchange current performance

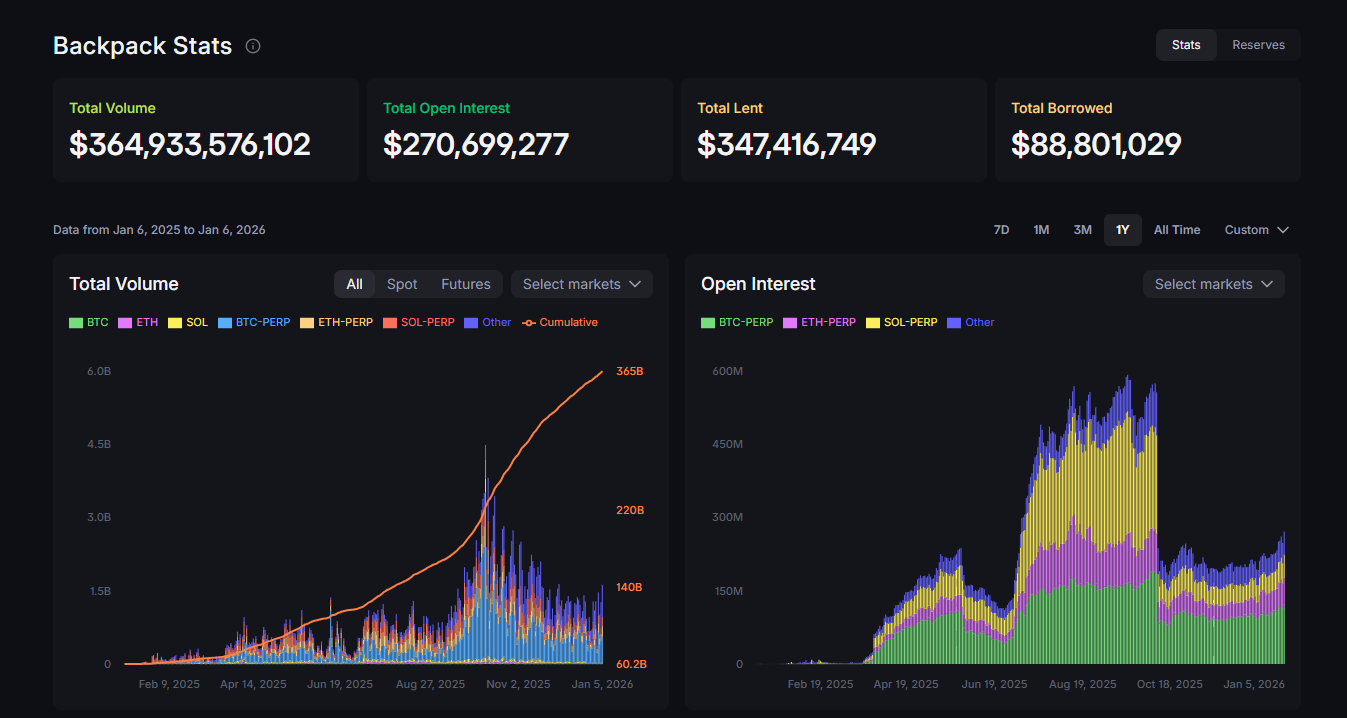

Backpack has been live since February 2024 and expanded significantly throughout 2025. As of early January 2026, the platform’s key operating metrics are as follows.

Volume & Liquidity Growth

Backpack has scaled significantly since its February 2024 launch:

- Lifetime trading volume reached $363.31B as of January 4, 2026.

- Rolling 30-day trading volume stood at $22.4B as of January 3, 2026, implying an average daily volume of approximately $747M across both spot and derivatives.

- Daily spot volume typically ranges between $40M and $70M.

- Daily perpetual futures volume is approximately $1.545B.

- Total open interest stands at $247.76M.

- Weekly trading volume peaked at $10.25B in September 2025, with single-day volume reaching highs of $2B.

Perpetual futures dominate Backpack’s trading activity, accounting for roughly 94% of daily volume, with perpetuals at around $1.545B compared to spot volume of roughly $43M. This indicates stronger adoption among institutional and derivatives-focused traders.

However, dividing the $22.4B rolling 30-day volume across 30 days highlights seasonal fluctuations driven by points-based incentive campaigns. Daily volume is not consistently maintained at $747M but instead spikes during active seasons.

When comparing Backpack’s trading volume with other derivatives platforms currently running airdrop programs, Backpack appears notably less attractive to short-term capital and airdrop-focused traders.

Backpack’s lifetime trading volume is $363.31B. In comparison:

- Lighter recorded $564B in trading volume during November and December 2025 alone.

- Hyperliquid generated $720B in perpetual volume in Q4.

- Aster recorded $436B in trading volume during November and December 2025.

These comparisons suggest that if Backpack were to launch its token at the current time, valuation based on volume and revenue metrics would likely be lower than that of existing perpetual DEX competitors.

Additionally, the requirement to complete KYC in order to participate in airdrop farming may act as a barrier for whales and users who prefer to avoid identity verification.

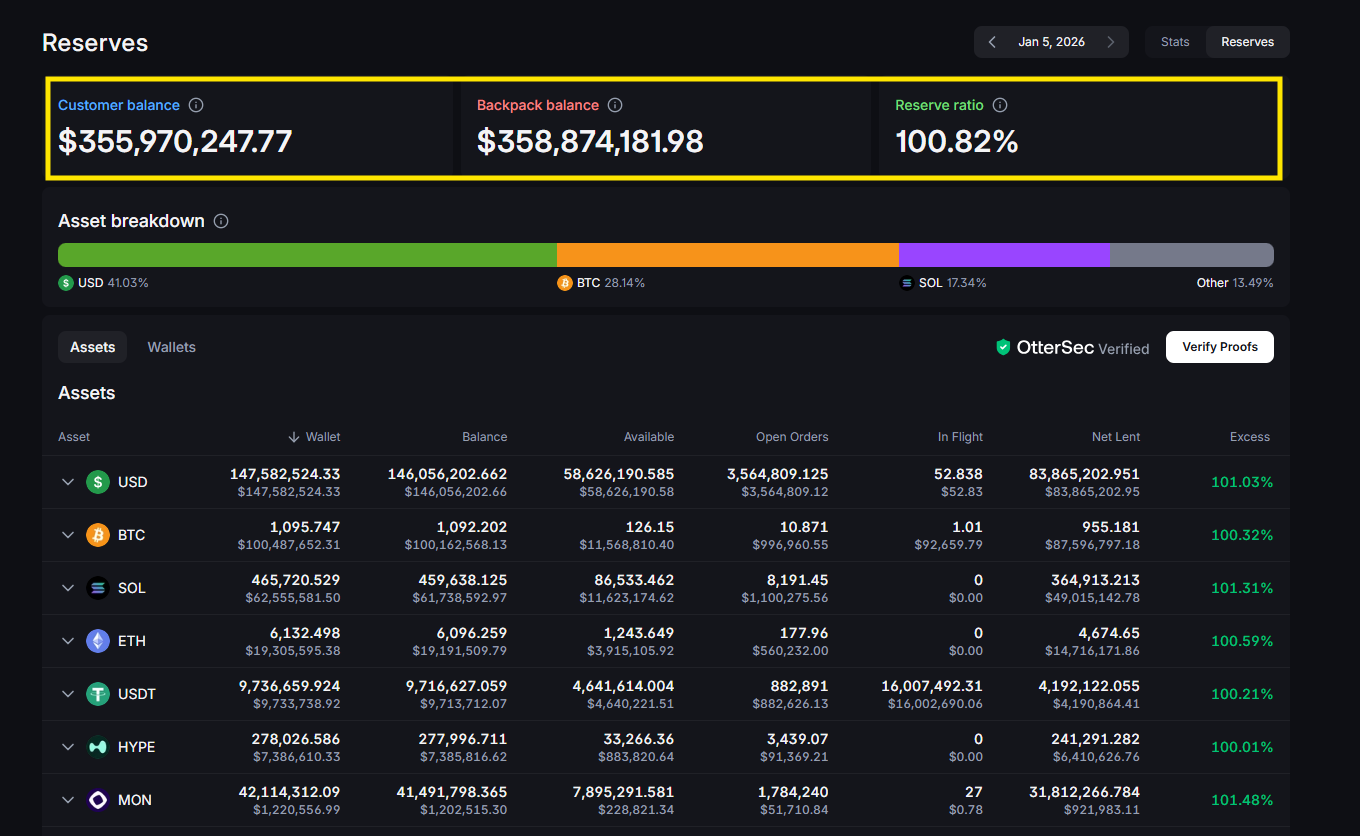

User Base & Asset Concentration

- As of October 2025, Backpack had over 650K registered users who completed KYC, up from 500K in March 2024. This figure includes approximately 110K former FTX EU customers onboarded in September 2025.

- Assets under management on the platform total approximately $400M, up from $150M in early 2025.

- Exchange reserves currently stand at $355M in deposited assets.

Comparing Backpack with other centralized exchanges provides additional context.

- Backpack holds approximately $355M in reserves, primarily focused on spot and perpetual products, with peak AUM previously reaching around $600M before declining due to market conditions.

- MEXC holds approximately $618M in reserves, which is relatively low compared to its trading volume and primarily concentrated in spot and altcoin futures.

- KuCoin maintains roughly $4.04B in reserves, with strength in altcoins and a large user base.

- Bybit holds approximately $19.5B in reserves, largely in spot assets, with total reserves potentially higher when accounting for user perpetual assets of around $5.9B in USDT.

- OKX holds approximately $23.7B in reserves and is considered a leader in derivatives with strong proof-of-reserves transparency.

- Binance dominates with approximately $175B in reserves, accounting for a significant portion of the industry’s total reserves of around $286B.

Overall, Backpack faces a challenging position, with trading volume trailing perpetual DEXs and AUM significantly lower than major centralized exchanges. Despite this, the platform continues to offer incentives through point distribution.

Backpack Points Program: Season Distribution

Unlike traditional perpetual DEX airdrops, Backpack distributes tokens through a points-based system spanning multiple seasons:

- During Seasons 1 to 3, running from March to November 2025, approximately 400K to 500K users accumulated points through trading, lending and borrowing, referrals, and staking. The total points pool across these seasons is estimated at around 200M to 300M points. Season 1 ran from March 21 to May 29, Season 2 from July 3 to September 10, and Season 3 from September 11 to November 20.

- Season 4 began in November 2025 and spans roughly 10 weeks. This season introduces quest-based point earning mechanisms, including PnL Royale, which offers $100K in rewards to top traders achieving over $1M in perpetual trading volume.

Backpack has not disclosed an official total supply of points. Points are generally distributed on a weekly basis, and the program is currently in its fourth season.

Read more: How to Get the Backpack Airdrop? Step-by-step Guide

What will Backpack FDV be one day after launch?

FDV comparison with competitors

At present, the primary factor influencing Backpack’s FDV is the magnitude of selling pressure at TGE. Since tokenomics have not yet been disclosed, users must rely on metrics such as trading volume and open interest to benchmark Backpack against peers and estimate potential FDV outcomes.

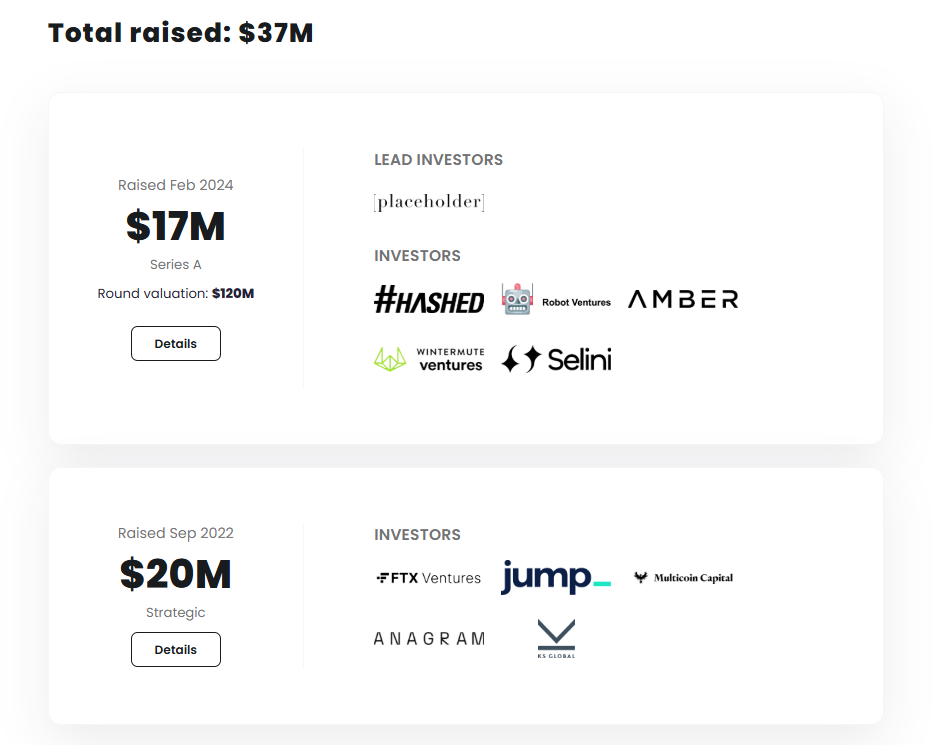

It is also important to note that Backpack has raised a relatively modest $37M, with its most recent Series A round valuing the company at $120M.

Several sources of selling pressure are likely at TGE, including Airdrops allocated to Mad Lads holders, point farmers, active Backpack Wallet users, and strategic partners.

Mad Lads holders have historically received numerous airdrops within the Solana ecosystem, making it plausible that a portion of the token supply will also be allocated to partner distributions.

To set expectations, let's first look at how Backpack's peers performed on their launch days:

- Hyperliquid launched with an FDV of approximately $3.9B at its TGE on November 29, 2024. Within 24 hours, its FDV expanded to the $6B to $7B range, coinciding with Bitcoin’s first move above $100K.

- Aster launched with an FDV of around $4.8B on September 19, 2025. One day later, its valuation increased to approximately $7B to $8.5B, despite Bitcoin being in a corrective phase at the time. Aster’s token price rallied directly above $2.

- Lighter launched with an FDV of approximately $2.6B under less favorable market conditions, as Bitcoin was trading sideways after pulling back from its $126K all-time high.

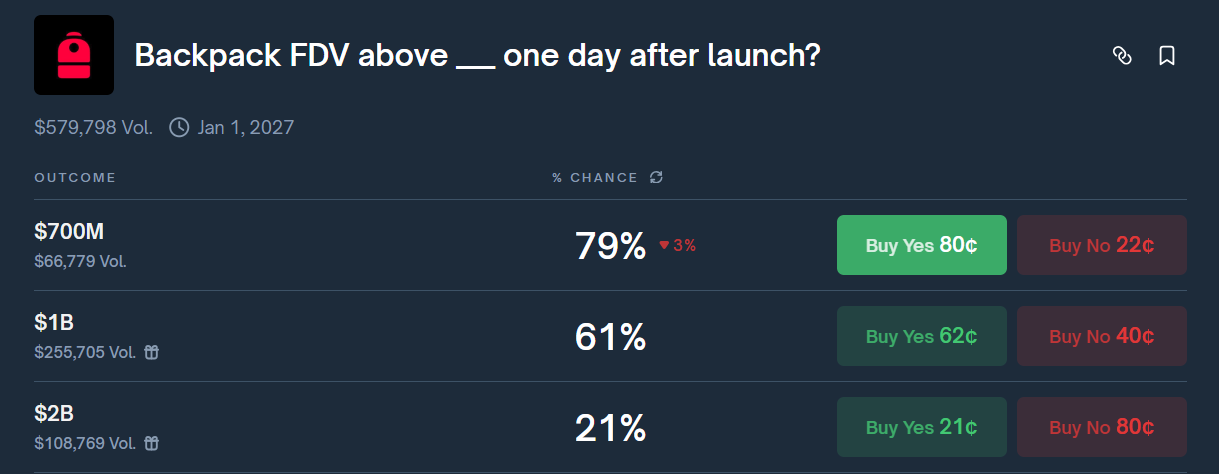

Polymarket Odds Analysis

On Polymarket, based on these benchmarks, a base case FDV for Backpack at TGE appears to fall within the $1.5B to $1.8B range. Achieving an FDV above $700M or even $1B does not seem particularly difficult given Backpack’s branding, product offering, and team background.

However, surpassing $2B appears more challenging. Even Lighter, which demonstrated stronger volume, sentiment, and funding metrics than Backpack, only achieved an FDV slightly above $2B.

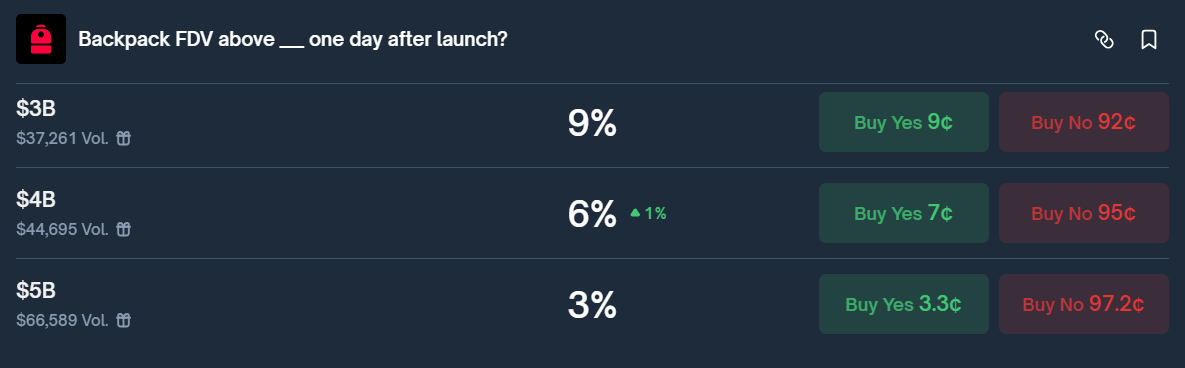

Scenarios where Backpack trades above $3B likely require extremely bullish market conditions. Lighter did not reach such valuations despite significantly stronger metrics.

Additionally backpack’s product suite, wallet ecosystem, and Mad Lads brand do not currently exhibit standout technological or structural differentiation. As a result, justifying a substantially higher valuation is difficult from a fundamental perspective.

Backpack also lacks the surprise element seen with Hyperliquid’s unexpected airdrop or the endorsement factor associated with Aster. The project is largely a known quantity, which limits upside from narrative-driven repricing.

From a risk management perspective, exposure to outcomes around the $2B level should be viewed as higher risk. Odds of 9% for outcomes above $3B may offer attractive risk-reward for hedging strategies. An FDV above $1B, however, would not be surprising given what Backpack has built since 2023.

These odds will inevitably change once tokenomics are released, at which point users will have more concrete data to assess selling pressure from airdrop allocations at TGE.

Whales Market, the destination for pre-market crypto trading and crypto prediction markets, will provide updates on odds analysis when a project’s tokenomics go live.

Conclusion

Backpack’s point farming journey is approaching its later stages. While the platform began strongly, recording $1B in trading volume on its first day, the rise of perpetual DEXs such as Lighter and Hyperliquid has gradually weakened Backpack’s competitive position and increased challenges in retaining active traders.

The scale and structure of the airdrop will play a decisive role in Backpack’s long-term trajectory. Projects like Lighter and Hyperliquid successfully retained users through large-scale airdrops, and Backpack may need to adopt a similar approach to sustain engagement going forward.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What price range could Backpack realistically trade in after TGE?

Based on comparable launches and current operating metrics, Backpack is more likely to trade within a moderate valuation range rather than immediately reaching aggressive upside scenarios.

Q2. Why is FDV more important than token price for Backpack at launch?

Without finalized tokenomics, FDV provides a clearer framework to compare Backpack’s valuation against peers by accounting for total supply rather than just circulating tokens.

Q3. Could Backpack’s token experience a post-launch pump similar to Hyperliquid?

A strong post-TGE rally is possible but less likely without a major narrative catalyst or unexpected airdrop structure that shifts market sentiment.

Q4. What downside risks could pressure Backpack’s token price early on?

Early selling from airdrops, limited retail FOMO, and lower relative trading volume compared to other derivatives platforms could weigh on initial price action.

Q5. How should traders interpret market odds for Backpack FDV outcomes?

FDV odds should be viewed as probabilistic scenarios rather than precise targets, helping traders assess risk-reward when positioning ahead of TGE.