Fully Homomorphic Encryption (FHE), one of the most promising technologies for improving user privacy. Alongside ZK proofs, FHE is positioned as another major path to make on-chain activity more confidential, and Zama is building around this direction.

Zama Overview

Zama is project that focuses on Fully Homomorphic Encryption (FHE), a cryptography method that lets computations run directly on encrypted data without ever decrypting it, keeping information private end-to-end.

On top of that, the team is developing the Zama Confidential Blockchain Protocol, a crosschain approach that brings FHE-powered confidentiality to EVM-compatible networks like Ethereum, Polygon, and various Layer 2, enabling developers to build confidential smart contracts across these ecosystems.

By encrypting both transaction details and on-chain state, the protocol addresses one of blockchain’s biggest trade-offs: transparency vs privacy. At the same time, it still supports real use cases such as DeFi, on-chain governance, and asset tokenization, where sensitive data often needs stronger protection.

The project has reached several notable milestones:

- Public testnet (launched in July 2025): it recorded more than 1.4M transactions, 128.8K active wallets, and 19.7K confidential contracts.

- Zama has reached mainnet and had its first transaction on Ethereum.

- According to CryptoRank, the project raised $130M across two funding rounds and is planning to raise an additional $55M from the community.

Overall, the project has only recently completed its testnet phase and is moving toward mainnet. Demand and real adoption for Zama’s applications are still not fully clear. However, based on the project’s statements, the platform fees will be used to burn the token.

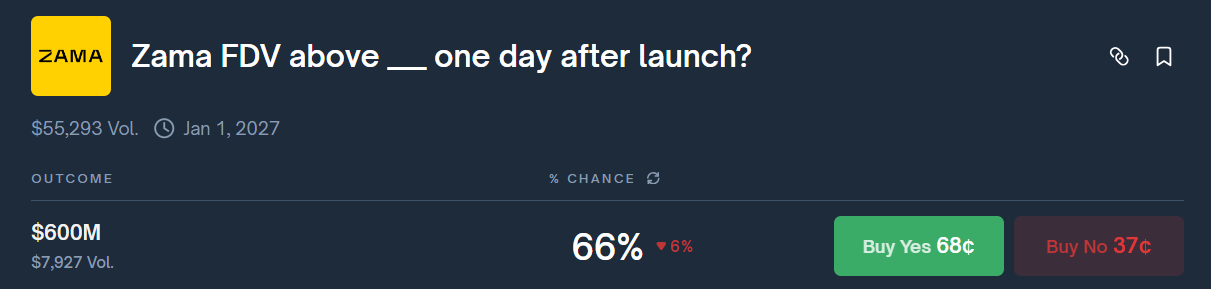

What will Zama FDV be one day after launch?

Sell Pressure at Zama’s TGE

At the moment, the project has not published clear tokenomics. However, there will likely be two main sources of sell pressure at TGE that could affect Zama’s FDV:

NFT Holders(2%): There are around 5.5K OG NFTs in circulation, which allow holders to join a fixed-price sale. Each wallet can buy up to 40K ZAMA at an FDV of $55M.

Public sale buyers (8%): Anyone can participate through a sealed-bid Dutch auction. Users submit two inputs: the price they are willing to pay per token and the quantity. The minimum price is $0.005.

- Example: User submits a bid such as, “I want to buy 10K tokens at $0.01 each” (total $100). The bid is private and not visible to others because it uses Zama’s FHE.

- After bidding (Jan 16, 2026 to Jan 19, 2026), the system sorts all bids from highest to lowest based on price. The clearing price is the lowest price level that still sells the full 880M tokens.

- For NFT holders, a high ROI at an FDV of $55M is easy to understand. This is especially notable because in the latest round, Zama was valued at $1B by funds. As a result, sell pressure from this group is very likely.

For public sale participants, the market will only learn the exact average purchase price once the project completes distribution and users receive their tokens. This can cause major shifts in Polymarket pricing once the information becomes public.

If the FDV ends up low, it may create profit-taking pressure when everything is unlocked at TGE. In addition, sell pressure from an airdrop remains an unknown factor because the project has not published detailed tokenomics.

Polymarket Odds Analysis

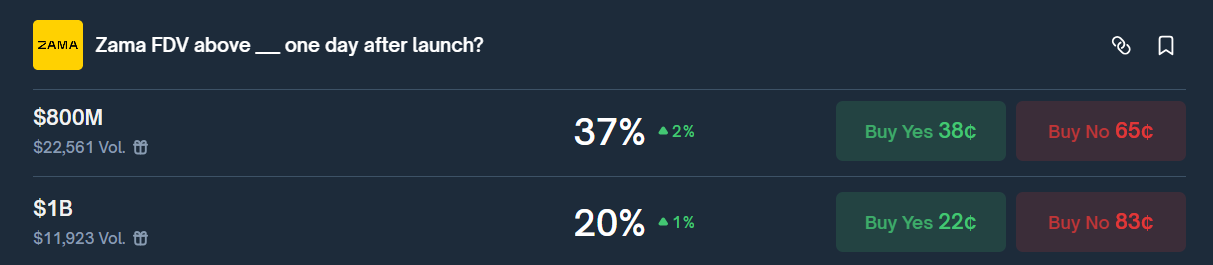

Even though Zama was valued at $1B by funds, scenarios involving FDV above $1B still suggest hesitation from the market. This is especially true because tokenomics details are not yet clear, and the 8% public sale remains a major variable that makes traders uncertain.

A YES bet on FDV > $600M may be relatively reasonable compared with the fund valuation, but users should still watch the average price paid in the public sale.

For FDV > $800M or FDV > $1B, the market does not appear very optimistic. It is possible that the launch FDV prints above $1B, but sell pressure from NFT holders could push the project down quickly. In that case, $600M could become a key level for the project.

FHE is also receiving less attention from the broader market compared with narratives like Perp DEXs, prediction markets, or RWA. This hesitation is not without reason.

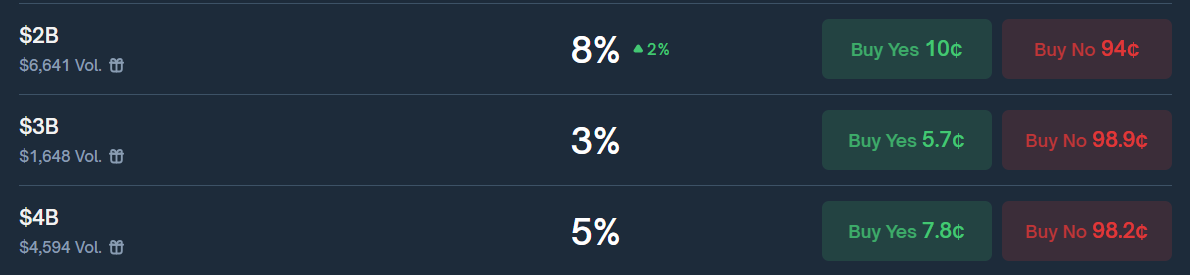

Scenarios above $2B are priced as unlikely. This is reasonable because:

- Infrastructure projects often have low token demand if they do not have a strong token flywheel. Demand is typically limited unless there are entities that need the token to build on the platform and access specific features.

- Monad and Lighter both had strong attention during the pre-TGE phase and launched with an FDV around $2B to $2.5B. Zama does not have the same level of sentiment. Much of its discussion comes from its content program rather than clear utility and real demand in the way Monad or Lighter have been perceived.

- Users should treat these odds as a way to hedge with a small YES position, rather than betting NO with a “sure win” or “free money” mindset.

Conclusion

Overall, Zama still has many missing details that could move these odds:

- Tokenomics

- The average purchase price from the auction

- The airdrop percentage

These are the key factors users should monitor when participating in this prediction. FHE is still a relatively new narrative, and real adoption and demand will need time to be proven. In the early stage, the project’s valuation may fluctuate heavily due to short-term factors.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What is Zama and why is Zama FHE important for blockchain privacy?

Zama is an encryption-focused project building with Fully Homomorphic Encryption (FHE). Zama FHE enables confidential computation so sensitive on-chain activity can remain private while still being usable in smart contracts.

Q2. What is the Zama Confidential Blockchain Protocol used for?

The Zama Confidential Blockchain Protocol is designed to bring FHE-based confidentiality to EVM networks, helping developers build confidential smart contracts across Ethereum, Polygon, and Layer 2 chains.

Q3. How does Zama’s public sale auction impact Zama FDV expectations?

Zama’s sealed-bid Dutch auction can change Zama FDV expectations because the final clearing price is unknown until the auction ends, which can trigger fast repricing once the average purchase price becomes public.

Q4. Why can Zama FDV on day 1 be volatile after Zama TGE?

Zama FDV can swing after Zama TGE due to new information about auction clearing price, token distribution, unlock behavior, and potential profit-taking from early participants.

Q5. What should traders monitor before betting on Zama FDV on Polymarket?

Before betting on Zama FDV, traders should monitor Zama tokenomics, Zama public sale clearing price, Zama airdrop details, and any unlock or distribution timelines affecting early circulating supply.