More than $5.4M is currently being wagered on a single question: Will Lighter launch an airdrop in 2025? On Polymarket, sentiment is leaning heavily toward YES, while the community continues to circulate hints from the CEO alongside speculation about possible insider activity. But which signals truly matter, and which are simply narratives? Is this a clear opportunity, or just a high-stakes bet?

Overview of Lighter's Airdrop

Lighter is a decentralized perpetual exchange built on Ethereum Layer 2, designed to deliver fast execution and a trader-first experience. The platform leverages custom zero-knowledge (ZK) circuits to enable verifiable order matching and liquidations, while inheriting Ethereum’s security and composability. Retail traders benefit from zero trading fees, low latency, and an execution environment free from hidden frictions.

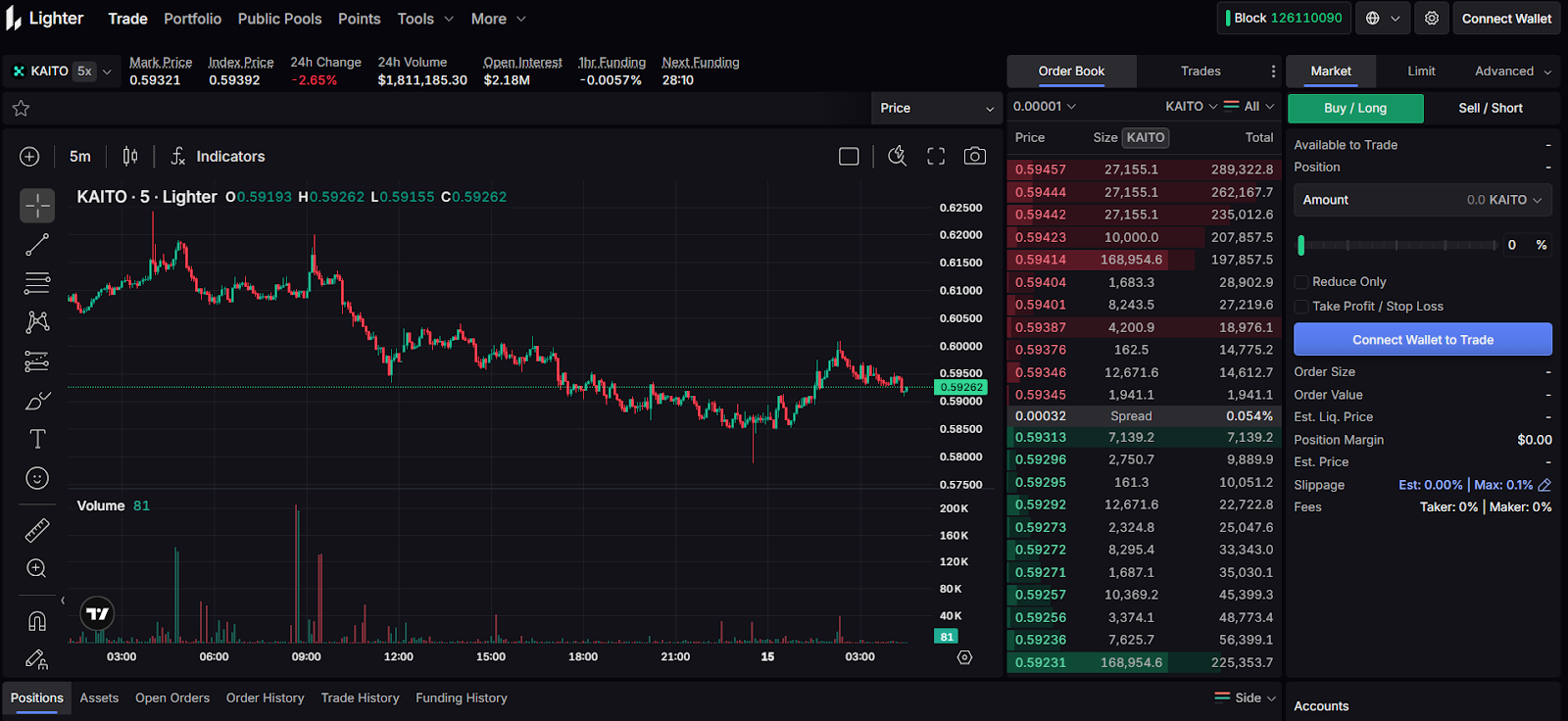

Since its private beta launch in January 2025, Lighter has grown into one of the most active perp DEXs in the market. The platform opened its public mainnet on October 1, 2025, removing invite code requirements and allowing broader access, while still maintaining referral incentives.

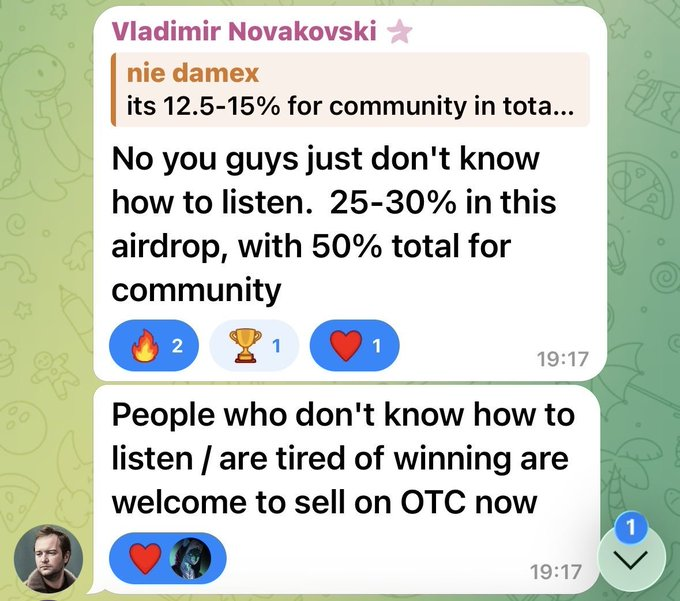

The upcoming airdrop is directly tied to Lighter’s points program, which rewards active participation across the ecosystem. According to founder and CEO Vladimir Novakowski, the token distribution is designed to heavily favor the community.

Key allocation expectations include:

- 25-30% of the total token supply allocated to the initial airdrop.

- Up to 50% of total supply reserved for the community overall.

- Community estimates often place the airdrop share between 30-50%, based on recent perp DEX precedents such as Hyperliquid, Avantis, and Aster.

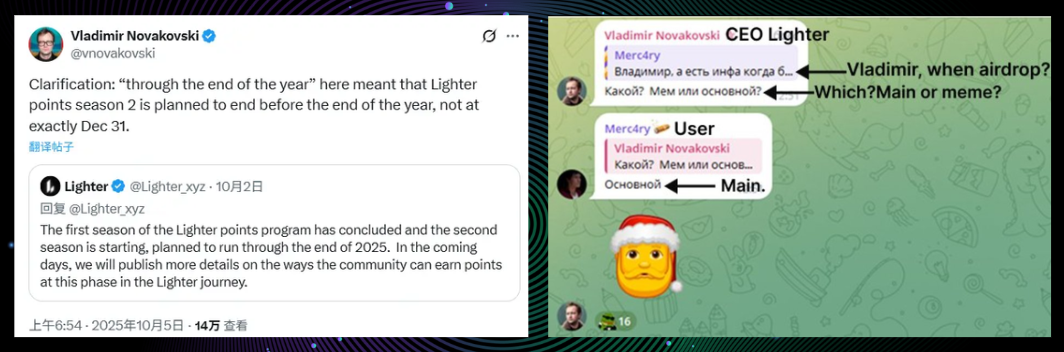

The token generation event (TGE) is expected to take place in Q4 2025, potentially before December 31. The CEO has hinted at a pre-Christmas launch, signaling an intention to close the year with strong momentum.

The Points Program: Structure and Seasons

Season 1 (January 23 to September 30, 2025)

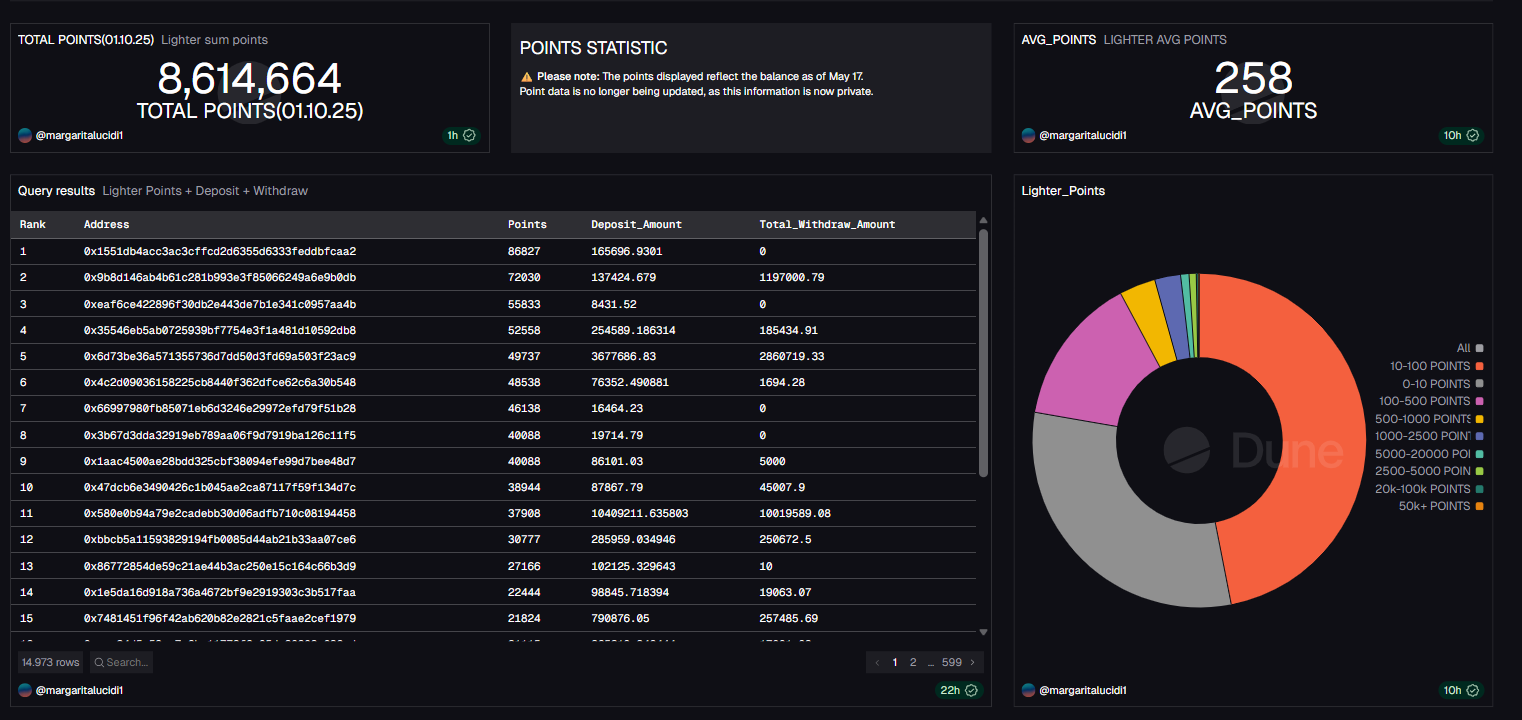

Season 1 ran during the private beta phase and lasted approximately seven months. During this period, Lighter onboarded an estimated 100,000 to 110,000 users and generated around $550B in total trading volume. Access was limited through invite codes, leading to speculation that early users and the team accumulated a significant share of total points.

Key characteristics of Season 1 include:

- Total points distributed: approximately 8.65M

- Gradual lifting of deposit limits, reaching up to $500,000 by August 2025

- Introduction of trading competitions and liquidity provider (LLP) boost mechanisms

Season 2 (October 1 to December 31, 2025)

Season 2 began with the public mainnet launch and marked a sharp expansion in user participation. More than 500,000 new users joined during this phase, bringing the total user count to approximately 640,000-750,000. Trading volume during Season 2 reached approximately $664B.

Points distribution during Season 2 follows a weekly schedule, typically on Fridays:

- Initial distribution of 600,000 points during the first 2.5 weeks.

- Additional compensation drops, including 250,000 points related to the October 10 downtime.

- Expected total points by year-end: approximately 12.15M.

Season 2 places strong emphasis on anti-Sybil enforcement. Wash trading is explicitly banned, and fees apply only to API-based users such as market makers.

As of December 12, 2025, nearly 12M points have been distributed across both seasons, with weekly drops ranging between 250,000 and 600,000 points. Users can track their rankings and point balances through the leaderboard interface.

Will Lighter have an airdrop in 2025?

On Polymarket, this question has attracted more than $5.4M in total volume, with over 78% of participants betting that Lighter will launch an airdrop before December 31, 2025. Why is the market leaning so strongly toward YES? The key reasons are outlined below.

Why Many Users Prefer Betting YES

Signals from the CEO

Founder and CEO Vladimir Novakovski stated in a Russian AMA that Season 2 of the points event will run until TGE. He also mentioned on X that the points program would end before year-end, but not necessarily on December 31. More recently, when asked about the TGE timeline, Novakovski replied with a Christmas tree emoji in a CIS community chat, which many interpreted as a reference to December 25.

Insider Speculation Around the Project

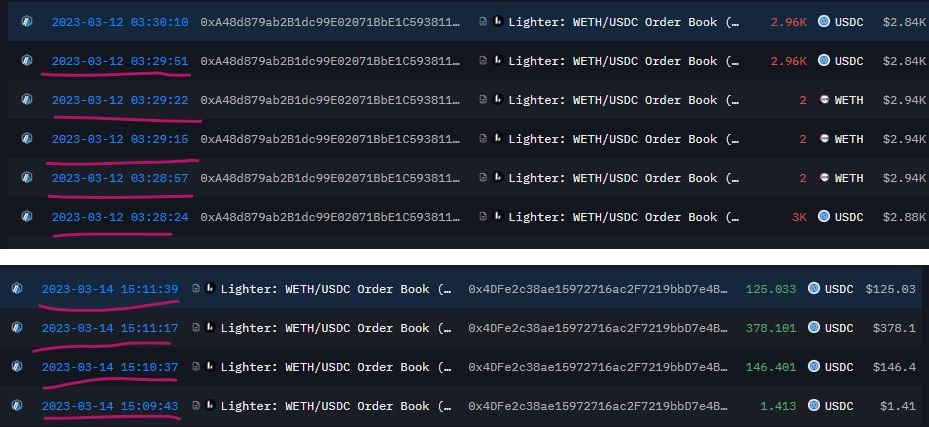

Researcher @Andrey_10gwei suggested that Lighter’s airdrop and TGE could take place within three weeks, before December 31, 2025. This view is based on Polymarket betting activity, where two accounts believed to belong to the same individual placed a combined $125,000 on Lighter FDV markets with a YES outcome.

- Account 1: https://polymarket.com/@0x1E9c0e8D5921dEa0A7e746e34E530373b795409c-1762892527849

- Account 2: https://polymarket.com/@k13florist

According to the on-chain analysis, both accounts were funded by the same wallet cluster. One of these wallets deposited approximately $1.7M into Lighter months earlier. Another linked wallet made its first deposit on January 21, 2025, three days before Lighter opened invite-only access to external users on January 24.

The analysis also highlighted shared deposit addresses on Coinbase and Binance, as well as interactions with Lighter smart contracts dating back to 2023, when the protocol was not publicly accessible. Based on these signals, some market observers speculate that the bets could have been placed by insiders or individuals closely connected to the Lighter team.

However, this remains unconfirmed and should be treated as market speculation rather than factual evidence.

To date, this analysis has received over 200,000 views, and discussion within the Lighter community has intensified, reinforcing confidence among traders and pushing more volume toward YES.

Why some traders still choose NO?

Despite the strong YES sentiment, some traders continue to choose NO, primarily as a play on timing risk. Under Polymarket rules, if Lighter does not TGE before December 31, 2025, even by a few days, the NO side wins.

The NO thesis is typically based on:

- No official TGE announcement yet: With only weeks remaining, tokenomics and a launch schedule have not been formally published.

- Risk of last-minute delays: Technical issues, unfavorable market conditions, or strategic considerations could push TGE into early 2026.

- Higher payout potential: NO is currently trading around $0.23, meaning a $100 bet could return approximately $400 if correct, offering a much higher upside compared to YES.

However, NO is far from risk-free:

- Going against the insider thesis: If the on-chain analysis is accurate, NO may be positioned against better-informed participants.

- Total loss if TGE happens on time: If Lighter launches before December 31, the entire NO position is lost.

Conclusion

Although Polymarket sentiment strongly favors YES, this remains a binary outcome driven entirely by timing. CEO hints and on-chain signals are indicators, not guarantees. Independent research, careful risk assessment, and disciplined capital management remain essential before making any decision.

FAQs

Q1. What criteria does Polymarket use to resolve the Lighter market?

Polymarket only considers whether Lighter completes its TGE before December 31, 2025, regardless of FDV or token price.

Q2. Can the airdrop and TGE happen separately?

Yes, but in this context, the market and community largely assume both events occur within the same timeframe.

Q3. Are Lighter points guaranteed to convert into tokens?

No official confirmation exists, but CEO statements suggest points are directly tied to TGE and token distribution.

Q4. Does on-chain data guarantee that TGE will happen?

No. On-chain data reflects behavior and sentiment, not official confirmation from the project.

Q5. What do YES and NO prices on Polymarket represent?

They reflect the probability the market assigns to each outcome at a given moment.

Q6. What is a safer way to approach this market?

Only allocate capital that can be lost, fully understand resolution conditions, and avoid decisions based solely on rumors or sentiment.