The Polymarket ecosystem has grown rapidly as one of the most active prediction markets on-chain. With the massive growth in trading volume and users, the question of launching a native token and a large airdrop to the community is almost inevitable.

So, if $POLY launches, who will be eligible for this airdrop? Let’s dive into this thread.

What is Polymarket?

Polymarket is known as the world's largest prediction market platform, where users can stay updated with timely information and profit from their knowledge by betting on the outcomes of upcoming events across diverse fields.

Unlike conventional forecasting methods, this platform leverages market mechanisms to aggregate opinions from news, surveys, and experts, thereby creating accurate, objective probabilities that are continuously updated on important issues.

Why does Polymarket need $POLY?

While Polymarket has been successful without a native token, the launch of $POLY is a strategic and almost mandatory move in the current landscape:

Decentralized Governance

Top Web3 projects are all about giving control to the community. A native token would allow $POLY holders to vote on important platform decisions, including:

- Deciding on new market types to list.

- Adjusting transaction fees and payment mechanisms.

- Allocating treasury funds for development activities.

Incentivize Liquidity & Usage

Prediction markets need deep liquidity to operate effectively. The $POLY token can be used to:

- Reward liquidity providers for markets.

- Reduce or rebate transaction fees for active users.

- Reward community members who correctly resolve market outcomes.

Competitive Edge

With the emergence of competitors like Kalshi (regulated in the US) or Limitless, a native token would create a closed-loop economy, helping Polymarket retain loyal users and attract new users looking for airdrop opportunities.

$BTC$ETH$BNB$SOL$POLY 🤔 https://t.co/HmMobU6nBh

— Shayne Coplan 🦅 (@shayne_coplan) October 8, 2025

Who will be eligible for the Polymarket Airdrop?

Polymarket is a prediction market, so the airdrop model will most likely revolve around rewarding real usage, liquidity, behavioral diversity, and long-term contribution. Here are the user groups that are most likely to be prioritized:

Heavy Traders With Sustained Activity

Wallets that trade consistently over weeks or months are highly likely to be considered. Prediction markets perform best when liquidity circulates continuously, so platforms tend to prioritize users who generate stable, repeated value.

Key signals that may be counted:

- Total cumulative trading volume

- Number of active days per week/month

- Total markets participated in

- Ratio of opening and closing trades vs pure buy-and-hold

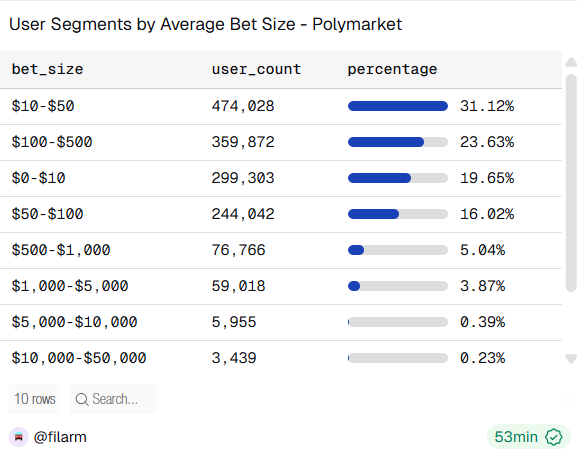

According to Dune, the Polymarket user base isn’t dominated by a handful of mega-whales. In reality, the platform is driven by small size traders: 75.8% all wallets, roughly 1.12M users, fall within the $10 - $1000 volume range. The single largest segment, representing 31.13% users, trades between $10 - $50, forming the true core of the community.

Whales in the $1000 -$10,000 range account for only 4.18%, while mega-whales trading over $10,000 make up just 4,035 wallets (0.28%). Even low-volume tourists under $10 represent only 19.75%.

Based on the above data, placing bet more than $1000 usually could make user's wallet address get into the minority on Polymarket, thereby increasing their chance and maybe amount of airdrop received.

Read more: How to Predict on Polymarket: Complete Beginner's Guide

Multi-Market Participants

A clear signal of genuine usage in prediction markets is participation across multiple categories (politics, sports, crypto, global events). Farmers rarely do this, while real users naturally spread their activity.

Signals likely to matter:

- Number of categories traded

- Number of distinct markets

- Participation spread across time, not clustered in one farming window

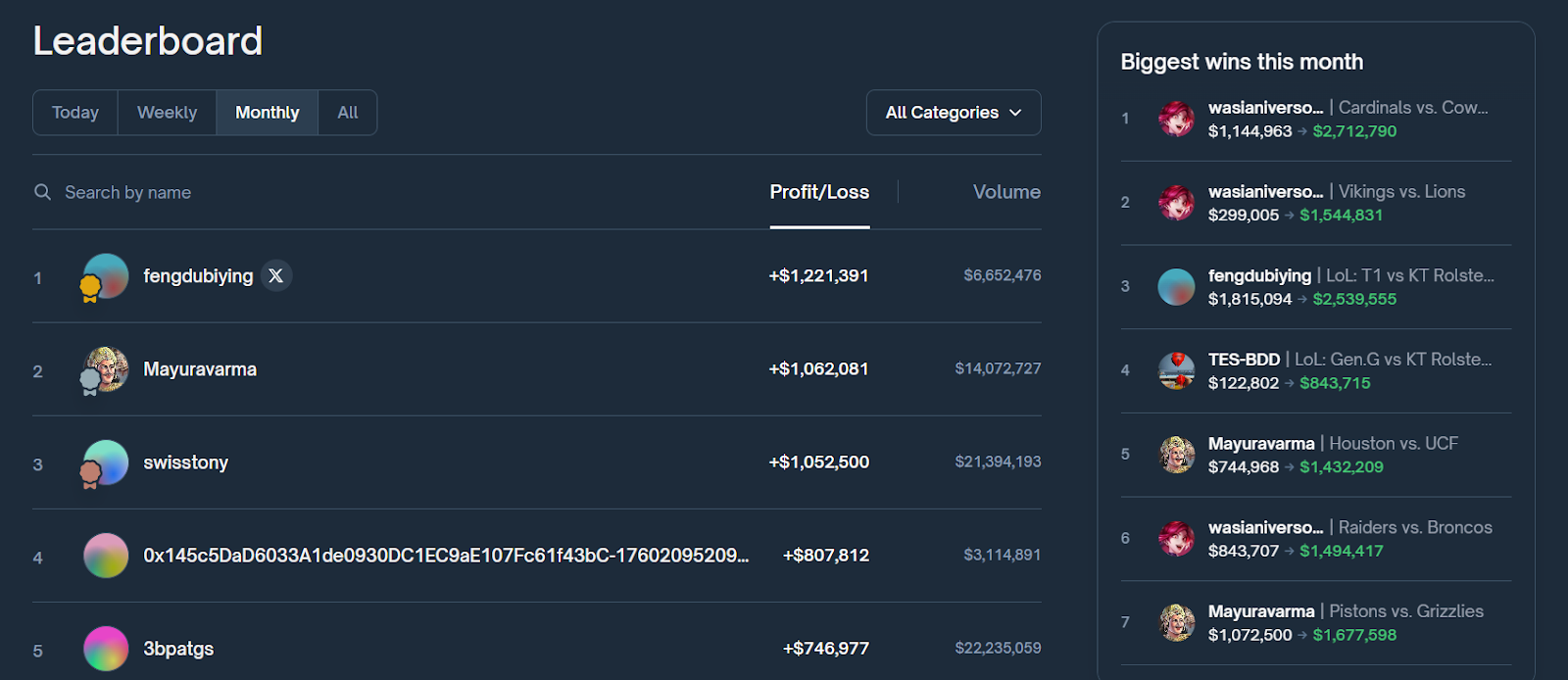

Liquidity Movers and Larger-Size Traders

Users placing meaningful order size or trades that shape market depth are likely to receive stronger weighting. Healthy prediction markets depend heavily on deep liquidity and meaningful positions.

Possible scoring factors:

- Large individual trades

- Frequent size adjustments

- Contributions to open interest during volatile periods

Early Users and Long-Term Participants

Users active since 2021–2023 may have a significant advantage. Prediction markets evolve slowly, and platforms typically reward those who have participated across multiple cycles, not just short-term bursts.

Signals that may count:

- First interaction date

- Activity streak over multiple quarters

- Lifetime number of markets participated in

Note

Polymarket’s scoring framework is built around real, verifiable user behavior, not artificial activity or bot-style farming. Here are a few points to keep your eyes on:

- Focus: Trading volume, number of trades, and average trade size.

- Target: Likely the top 20% of users.

- Won't count: Low-volume for farming strategy

- Boosters: Liquidity provision and community contributions (such as ecosystem badges) may improve your chances.

Conclusion

Polymarket hasn’t announced an official airdrop, but user activity patterns give strong hints about which groups may be prioritized. Active traders, consistent participants, engaged users across multiple markets, and on-chain contributors are all likely candidates.

If you want to position yourself well, focus on genuine usage, regular participation, and diversified market engagement. Airdrops typically reward real adoption, so the best approach is simple: use the platform consistently and authentically.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is the native token of Polymarket?

The native token of Polymarket is $POLY.

How is Polymarket funded?

Raised over $2.3B including $2B from ICE (NYSE parent). Previous rounds led by Founders Fund, Blockchain Capital, and others at valuations from $350M to $9B.

Will Polymarket launch a token?

There has been speculation about a potential POLY token launch and airdrop based on hints from the team. No official announcement has been made as of October 2025. If a token launches, it may be available for pre-market trading on platforms like Whales Market.

What is the Polymarket token pre-market price?

As of October 16, 2025, Polymarket has not launched a token yet. If it does, you may be able to trade it on Whales Market before CEX listings like Binance or Bybit.

What is the price of $POLY today?

$POLY does not yet have an official market price since it has not been listed. However, you will soon be able to trade it on the leading pre-market platform, Whales Market. Here, you can buy more $POLY or sell to take profit before it is officially listed on CEXs like Binance or Bybit.