The timing of the OpenSea TGE may not be far away. After more than 6 years of operating, the day of the OpenSea airdrop might also be approaching.

So who will be eligible for the OpenSea airdrop?

What is OpenSea?

OpenSea is an NFT marketplace that allows users to mint, buy, sell, and auction unique digital assets such as artwork, game items, or domains. The platform launched in 2017 and mainly operated on Ethereum, later expanding to multiple chains.

Read more: Top 5 Monad NFT Collections with Airdrop Potential

Why does OpenSea need SEA?

OpenSea has been the largest NFT marketplace since 2017, and in theory, the platform can still operate normally without a token. However, launching a native token like $SEA could help OpenSea accelerate growth, expand its ecosystem, and strengthen its competitive position in the new phase of the NFT market.

Decentralized governance

A major reason to issue a token is to decentralize governance. Currently, all major OpenSea decisions such as marketplace fees, policies, supported chains, and creator priorities are made by the team behind it. This has caused controversies, especially during the periods when OpenSea changed royalty fees or shifted to a zero-fee model.

Launching SEA allows token holders to vote on:

- New fee structures.

- Decide how the treasury is allocated.

- Vote on the roadmap and new NFT standards.

- Give governance power to the community in a way similar to DAO models like Uniswap or Aave.

This helps OpenSea transition from a Web2.5 company into a true Web3 protocol.

Incentivizing liquidity and usage

Although the NFT market has cooled down, competition among NFT marketplaces for a relatively small market has become more intense than ever, with Blur, Magic Eden, Tensor, and OKX Marketplace. All of them run incentive programs, point systems, and airdrop seasons. Meanwhile, OpenSea does not have a token, which has caused it to lose a large portion of liquidity and traders to competitors.

SEA could reignite network effects in several ways.

- It can reward traders based on volume, similar to Blur points.

- It can reward creators when they mint or sell NFTs.

- It can reward activities such as listing, bidding, and NFT lending. It can also encourage users to return instead of farming and leaving.

When incentives appear, liquidity increases and volume rises. This leads to a more active marketplace that attracts creators back to OpenSea instead of fragmenting across platforms. This is especially important now that OpenSea lost market share to Blur and Tensor during their point seasons.

Unlocking new features and product expansion

SEA token could help OpenSea expand its product offerings in ways it currently cannot. For example:

- It can enable marketplace fee discounts for SEA holders.

- Unlock premium features such as analytics, collection tools, or private mint access.

- Users might use SEA to pay mint fees, listing fees, or for creator advertising campaigns.

- It can also support private groups or communities for KOLs or top collectors, and integrate with social and loyalty systems across the NFT ecosystem.

The NFT ecosystem is shifting toward an all-in-one model that combines trading, minting, royalties, social features, and gaming. A token acts as the shared economic unit connecting these components.

Rebuilding community

For years, OpenSea has been criticized for:

- Not having a token.

- Not rewarding early users.

- Not supporting creators strongly enough

- And being too Web2 focused as a profit-driven company.

A properly designed SEA airdrop could help OpenSea win back the community, similar to how Blur used airdrop seasons to capture market share, Tensor used points to dominate Solana NFTs, and Magic Eden used incentives to expand to BTC, Ethereum, and Solana.

An airdrop is not just about distributing tokens. It is a way to reactivate the community, bring liquidity back, and create a new narrative. If OpenSea splits the airdrop into multiple seasons, especially if the first season is designed to create strong impact, they can increase active users, attract volume, strengthen loyalty, and reaffirm their position as one of the leading NFT marketplaces.

The operational status of OpenSea

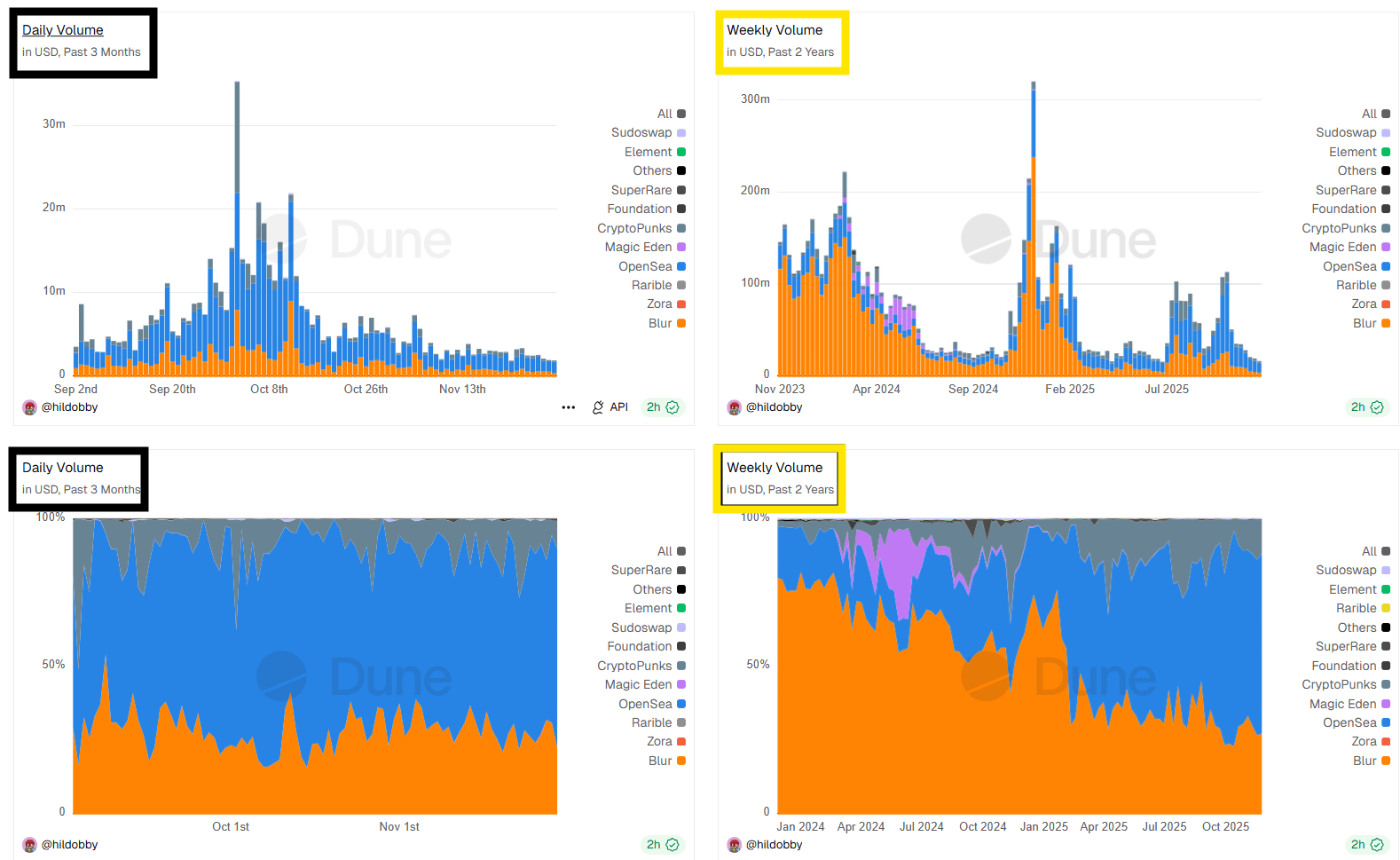

Looking at the two-year chart, Blur completely dominated and captured almost all market share between November 2023 and February 2025. This was the period when Blur ran incentive campaigns related to its long airdrop program that lasted nearly two years with four seasons, and season four ended on July 2, 2025.

In the last three months, OpenSea has gradually regained market share as Blur incentives ended and OpenSea introduced its own XP program for the platform’s upcoming airdrop.

Overall, the NFT market lacks liquidity and catalysts for growth. The market pie is already small and continues to shrink, so to acquire users, platforms must spend heavily on incentives.

However, these incentives are not a permanent cure. They are simply temporary pain relievers.

Who will be eligible for OpenSea Airdrop?

As an NFT marketplace, it is highly likely that OpenSea’s airdrop will target active and long-term users, including early users, accounts with NFT trading history before 2025 (especially between 2020 and 2024), and users active on OpenSea 2.0 through Voyages or Treasures.

According to CEO Devin Finzer, roughly half of the total SEA supply will be allocated to the community, with priority for users who remain consistently active, such as long-time buyers, frequent traders, and those who participate in new platform features.

To increase eligibility, users should build real usage history.

OG - Past activity

One of the main pillars for qualifying for the SEA airdrop revolves around historical participation on OpenSea. In particular, individuals who were active during the NFT boom from 2020 to 2022 are likely to be considered top candidates.

This period saw massive growth in the NFT space, and wallet addresses that were active at that time are viewed as real users because they contributed significant fees and trading volume.

For example, users who traded prominent collections such as CryptoPunks, Bored Ape Yacht Club, or early projects during the 2020 to 2022 bull phase may receive higher allocations, since these activities generated large revenues, strong metrics for the platform, and helped push OpenSea’s valuation higher in later funding rounds.

Even smaller traders who consistently listed items or executed many transactions over several months or years may still be eligible, because sustained participation is valued more than raw trading volume.

According to statements from Devin Finzer and community discussions, eligibility tiers may be based on indicators such as:

- Total number of transactions.

- Cumulative fees paid.

- The diversity of NFT collections a user has interacted with.

Participation in OpenSea 2.0 (OS2)

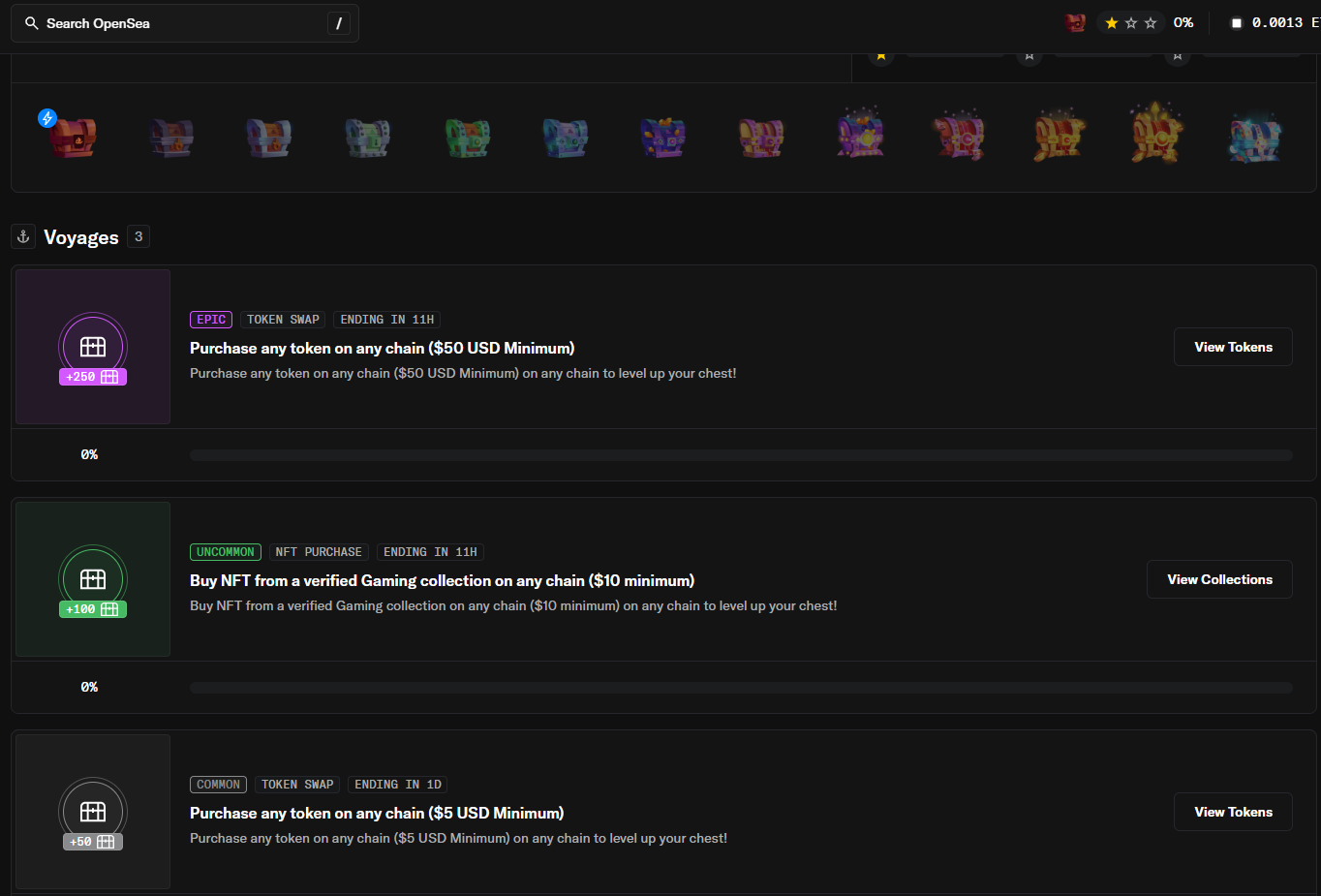

OpenSea 2.0 marks a shift toward a gamified model, where users accumulate experience points (XP) through on-chain interactions directly on the platform. The quest system covers core activities such as swapping tokens, trading NFTs on supported networks, listing collections, and joining specific events or challenges.

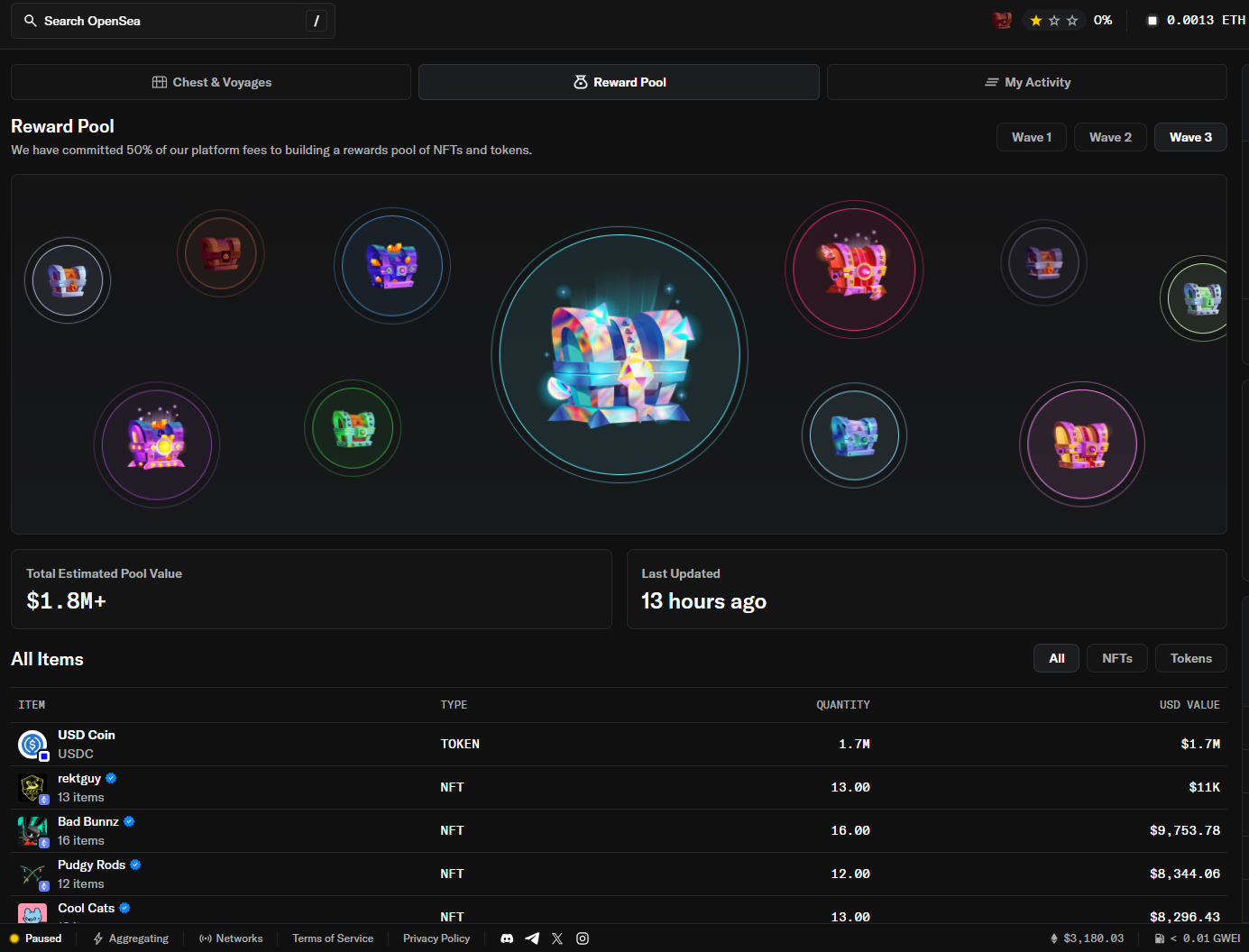

The program is deployed in phases called Waves. Following the initial launch and cross chain expansion of Wave 1, Wave 2 and Wave 3, which is currently active as of December 2025, focuses on more advanced tasks such as collaborating with creators and providing liquidity.

The reward system is designed to be cumulative. Continued participation across Waves allows users to accumulate XP over time, and this data will directly influence the airdrop allocation ratio, under the assumption that higher XP will correspond to a larger SEA token allocation.

The quest structure is divided into categories.

- Voyages are multi step journeys that require users to complete a sequence of linked actions. For example, a user might mint an NFT on OpenSea Studio and then trade that asset on the Polygon network in order to receive a bonus multiplier for finishing the full multi step flow.

- Treasures are limited rewards that can only be unlocked when users reach specific XP milestones or take part in events within a defined time window.

Community interaction

In addition to on-chain trading activity, OpenSea also considers how users engage with the broader community ecosystem as an important evaluation factor. Active participation in social channels such as X (Twitter), Discord, or official forums is recorded as a positive signal in the eligibility review, since it reflects real interest in the platform’s long term direction.

Engagement strategy and profile building:

- The quality of discussion is important. Asking thoughtful questions about the product roadmap, the utility of the SEA token, or technical improvements in OS2 helps position a user as an informed participant with long term commitment.

- Touchpoints with key entities also matter. Interacting with core accounts such as CEO Devin Finzer (@dfinzer) or the official @opensea channel can increase the visibility of a user’s profile.

Historical data and bonus factors:

Data from previous airdrops in the market suggests that users who make constructive contributions, such as reporting bugs, proposing improvements for the Seaport Protocol, or joining technical discussions, are often considered for bonus multipliers.

In addition, taking part in AMA sessions, participating in governance votes after the SEA token is launched, or creating educational user generated content can further strengthen a user’s profile in the eyes of the project.

Others

Some secondary factors may include:

- Multi-chain activity: OpenSea supports many chains including ETH, Polygon, Arbitrum, Optimism, and Solana. Wallets that trade across multiple chains are usually real users with strong engagement and experience across multiple OpenSea versions such as classic, pro, and drops.

- Another factor is the usage of multiple OpenSea: Ecosystem products such as OpenSea Studio, OpenSea Drops, Creator Contract, or the Seaport Protocol. Using diverse products shows real on-chain behavior and helps filter out bots.

Conclusion

The OpenSea airdrop may be seen as the last dance of the NFT golden era. Although NFTs no longer attract the same attention as before, collections that have survived the bear market and expanded into Web2, such as Pudgy Penguins and Azuki, show that NFTs can still grow into something meaningful if projects truly invest.

If OpenSea launches SEA, it will be an opportunity for long-time users to be recognized for their contributions and could be the final push of an NFT cycle before entering a more mature phase where value depends on real products, real communities, and utility beyond short-term speculation.

FAQs

Q1. How might $SEA change OpenSea’s business model?

SEA can shift OpenSea from a fee driven Web2.5 company toward a token driven protocol. Part of the value created by trading, creator activity, and new features can be recycled back to users and builders through governance, rewards, and incentives.

Q2. Does using OpenSea now guarantee an airdrop?

No. The article suggests patterns from past airdrops, not any guarantee. Building real activity over time, especially through OpenSea 2.0 programs like Voyages or Treasures, only increases the probability of being included if an airdrop happens.

Q3. How is OpenSea’s approach different from Blur or Tensor?

Blur and Tensor already leaned heavily on points and airdrop seasons to grab market share. OpenSea has focused more on product and brand, and a potential $SEA token would be used to regain liquidity and reward long term users rather than just short term farmers.

Q4. Why does historical activity matter for a potential $SEA airdrop?

Activity between 2020 and 2024 represents the NFT boom when many real users paid significant fees and contributed volume. Those wallets helped build OpenSea’s position, so they are natural candidates to be recognized if $SEA is distributed.

Q5. What is the role of XP and OpenSea 2.0 in a future airdrop?

XP in programs like Voyages and Treasures acts as an on chain record of recent engagement. It lets OpenSea distinguish between passive wallets and users who actively trade, explore new features, and support the updated product over time.

Q6. Where to trade $SEA pre-market?

$SEA is expected to list pre-market on decentralized pre-TGE platforms like Whales Market, where users can trade allocations trustlessly before the token launches.

Q7. What is the price of $SEA today?

Since $SEA is not listed yet, its price is not available. Users can monitor pre-market platforms for early pricing before the official TGE.