Prediction markets are being talked about more and more in crypto, from elections & sports to large-scale macro topics. But behind the lively prediction interfaces lies a much bigger question: who is actually building the financial systems that allow these predictions to become real, valuable transactions?

This article takes a deeper look at the new layer of financial infrastructure that is quietly forming behind prediction markets.

What is Financial Infrastructure in Prediction Markets?

Financial infrastructure in prediction markets is the system that turns simple predictions into real, enforceable financial transactions. When people talk about prediction markets, most only think about betting on future events, who will win an election, which team will become champion, or how high Bitcoin’s price will go.

But behind every prediction trade is a complex system that often goes unnoticed: financial infrastructure.

Imagine you place $100 on Trump winning an election. When the result is announced, what happens next? Who verifies the outcome? Who ensures the losing side pays the winner? Who manages the risk if one party cannot settle their obligation?

This is where financial infrastructure comes into play:

- Clearing: Verifying and matching transactions between parties.

- Settlement: The final transfer of assets after the outcome is confirmed.

- Risk Management: Managing counterparty risk and ensuring all participants meet their obligations.

In traditional finance, DTCC handles clearing for U.S. equities, while CME Clearing does the same for derivatives. These are invisible but essential “circulatory systems” of the market. Without them, markets would simply stop functioning.

So the question becomes: Who is building this kind of infrastructure for on-chain prediction markets?

Polymarket: The New Financial Infrastructure Behind Prediction Markets

While researching prediction markets and on-chain infrastructure, Whales Market came across an insightful post on X by @willyLee. That post completely changed how Polymarket was viewed, not as a prediction product, but as a financial infrastructure layer quietly being built behind the scenes.

Below are the most important insights Whales Market gathered.

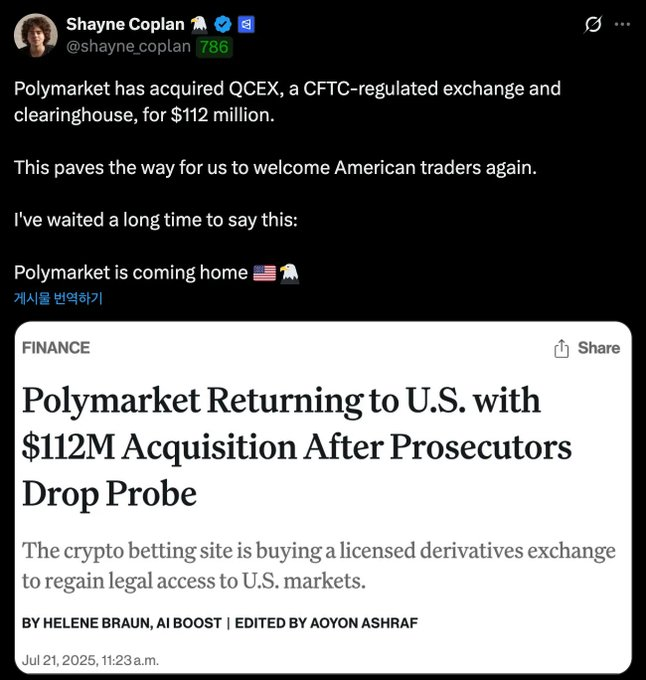

Acquiring QCEX: A Licensed Clearing Platform

In July 2025, Polymarket spent $112M to acquire QCEX (Qualified Contract Exchange), a Florida-based exchange licensed by the CFTC to operate as:

- DCM (Designated Contract Market): A designated contract trading exchange.

- DCO (Derivatives Clearing Organization): A derivatives clearing organization.

This was not a typical M&A deal. Polymarket was not buying technology or a user base, it was buying regulatory legitimacy within the U.S. legal framework. This allows Polymarket to perform clearing functions in a fully compliant manner.

Partnering With DraftKings: From Platform to Infrastructure Provider

In October 2025, DraftKings, the largest sports betting company in the U.S, entered the prediction market space by acquiring Railbird Exchange LLC.

The key detail is this: Polymarket Clearing became the official clearinghouse for DraftKings.

As @willyLee pointed out, this marked a symbolic turning point. Polymarket was no longer just a market. It became an industry enabler, providing the execution layer for Web2 companies that want to operate on-chain.

ICE Invests $2B: When Wall Street Truly Pays Attention

Also in October 2025, Intercontinental Exchange (ICE), the parent company of the NYSE, invested $2B into Polymarket, valuing the company at $9B.

ICE is not a typical VC fund. It owns and operates some of the largest clearing networks in the world. This investment sent a very clear signal: the boundary between traditional financial infrastructure and on-chain systems is rapidly fading.

Markets on everything.

— Shayne Coplan 🦅 (@shayne_coplan) October 7, 2025

We’re proud to announce that $ICE, the owner of @NYSE and the largest exchange company in the world, is making a strategic investment of $2 billion into Polymarket, valuing us at $9 billion post-money.

Our partnership with ICE marks a major step in… pic.twitter.com/oShaglRx9p

What Does This All Mean?

Polymarket Is No Longer Just a “Crypto Startup”

With a $9B valuation and backing from ICE, Polymarket now stands alongside traditional clearinghouses, but built natively on blockchain. This represents a major shift in perception.

Polymarket before:

- A retail-focused prediction market.

- Competing with Kalshi and PredictIt.

- Revenue mainly from trading fees.

Polymarket now:

- Financial infrastructure for institutions.

- Competing with DTCC and CME Clearing.

- Revenue from clearing services.

A New Business Model: Infrastructure-as-a-Service

Instead of only earning trading fees on its own platform, Polymarket can now:

- Clearing Fees: Charge clearing fees to other platforms, such as DraftKings.

- Settlement Infrastructure: Provide settlement infrastructure for new prediction market projects.

- Industry Backbone: Become the backbone of the entire prediction market sector.

Implications for Investors

- Faster Mainstream Adoption: Prediction markets are likely to go mainstream faster. With licensed infrastructure and Wall Street backing, regulatory barriers are gradually being removed.

- Repositioning for Other Protocols: Other prediction market protocols may need to rethink their positioning. Competing with Polymarket at the platform level may no longer be realistic. Instead, they could focus on niche markets or become customers of Polymarket Clearing.

- On-Chain Settlement Becomes the Standard: When ICE, one of the biggest players in traditional finance, invests in on-chain infrastructure, it signals that blockchain settlement is no longer an experiment. It is becoming mainstream.

Conclusion

As @willyLee summarized perfectly in the original post:

“Predictions create data. Data becomes value. And value only gains credibility through the mechanisms that clear, reconcile, and settle it.”

Polymarket has built those mechanisms. From clearing exposure to settling capital, it is quietly becoming the circulatory system of on-chain finance — where a simple act of prediction evolves into trust infrastructure.

For anyone watching the prediction market space, this is the time to look beyond trading volume numbers. The real game is happening at the infrastructure layer, and Polymarket is leading the way.

References:

FAQs

Q1: Why Is Polymarket Compared to DTCC in Crypto?

Polymarket is compared to DTCC because it does more than run a market. It handles clearing and settlement for prediction markets, ensuring trades are reconciled, enforced, and completed, not just matched.

Q2: What Is the Strategic Value of Acquiring QCEX?

QCEX gives Polymarket CFTC-recognized clearing and exchange licenses. This allows Polymarket to operate prediction market infrastructure within the U.S. regulatory framework and offer financial infrastructure services to large institutions.

Q3: Why Did DraftKings Choose Polymarket Clearing Instead of Building Its Own System?

Building clearing infrastructure is expensive and legally complex. Polymarket already has the systems and licenses in place, allowing DraftKings to launch prediction markets quickly without taking on compliance and operational risk.

Q4: What Does ICE’s Investment Say About the Future of On-Chain Settlement?

ICE’s investment shows that traditional financial institutions are taking on-chain settlement seriously as real infrastructure, not an experiment. This suggests blockchain could become the new standard for clearing and settlement.

Q5: Is Polymarket Still a Competitor to Other Prediction Markets?

At the infrastructure level, Polymarket is not just a competitor. It can also become a service provider for other prediction markets, acting as the backbone of the entire industry rather than competing directly on products.

Q6: What Does This Mean for Crypto Investors and Builders?

Investors should view Polymarket as a long-term infrastructure thesis, not just a trading platform. For builders, this trend shows that real value is shifting from front-end products to infrastructure, where barriers to entry are higher and advantages are more sustainable.