After Hyperliquid and Aster, perp DEXs are no longer a "DeFi experiment", it becoming a product segment that has already proven product-market fit with real demand and real users.

As capital starts hunting for "the second Hyperliquid," the number of new projects and users jumping into this game is rising quickly. Lighter is one of the names being closely watched.

Right now, there are already several Polymarket markets around Lighter's valuation. This article will dive into three things: what the market is actually pricing in, where it might be wrong, and how to turn the current odds into a pre-market strategy to prepare for Lighter's TGE.

Lighter Overview

Lighter is a decentralized perpetual exchange that runs on a bespoke zero-knowledge rollup aligned with Ethereum. Its goal is to narrow the gap between CEX and DEX experiences: users get centralized-style speed and liquidity, but execution, risk and custody all stay onchain, backed by cryptographic guarantees instead of trust in an intermediary.

Under the hood, Lighter uses custom ZK circuits to prove order matching, position updates, and liquidations, with final settlement anchored to Ethereum. This enables tens of thousands of orders per second at millisecond latency, while keeping every fill independently verifiable onchain.

On fees, Lighter targets retail with zero-fee perp trading, and monetizes mainly through competitively priced institutional, API, and high-frequency order flow.

Read more: DEX vs. CEX Pre-Market: Why Decentralized Trading Wins for Early Crypto Exposure

According to CryptoRank, Lighter has raised $68M at a $1.5B valuation with participation from Robinhood, Founders Fund, Ribbit Capital, Haun Ventures and others.

This is likely only one of the rounds that Lighter has disclosed, because on the project’s website there is also mention of participation from a16z, DragonFly and others.

What investors should focus on is not every single round, but this $1.5B valuation milestone, because it will be an important reference level to bet around.

Lighter DEX's current performance

First, let’s go through Lighter’s operating performance. As of December 15, Lighter has officially run two point seasons:

- Season 1 started from January 23, 2025 to September 20, 2025.Season 2 started from October 1, 2025 and is ongoing (as of December 15, 2025), and is expected to end on December 31, 2025.

After almost one year of running the point program, these are the key numbers Lighter has achieved:

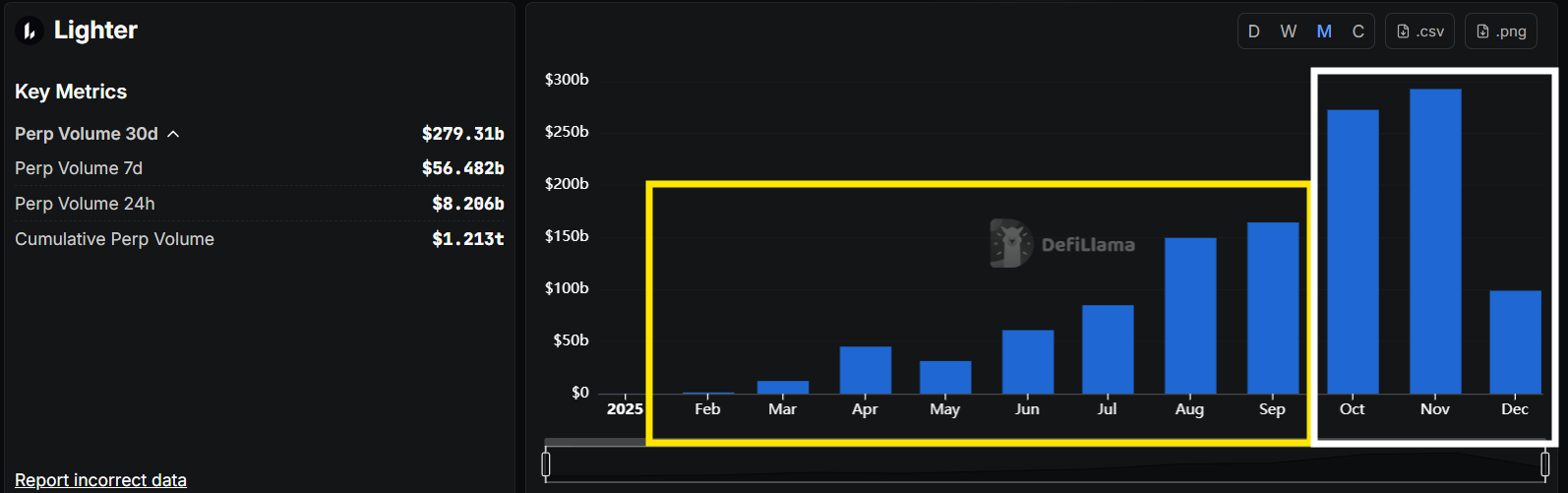

- The project’s volume has gradually increased over time, with the peak in October and November reaching nearly $300B in monthly volume. This is equivalent to about $10B in trading volume per day on Lighter.

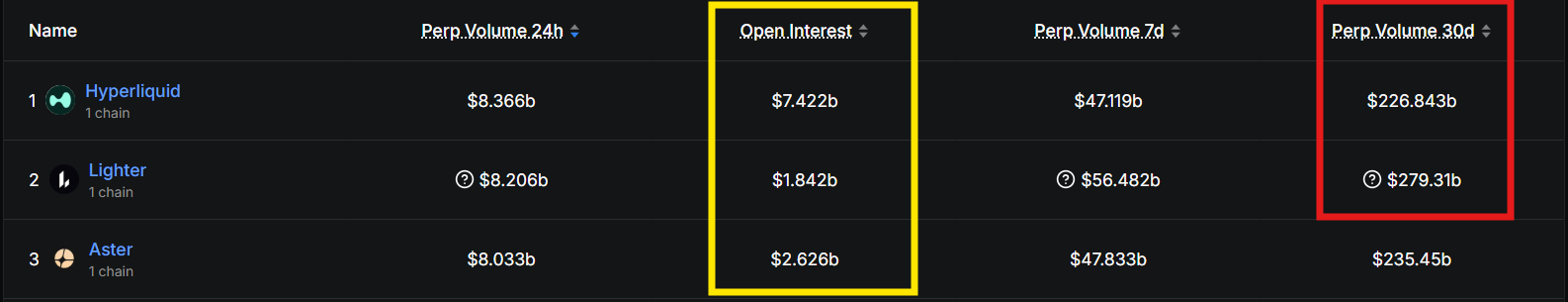

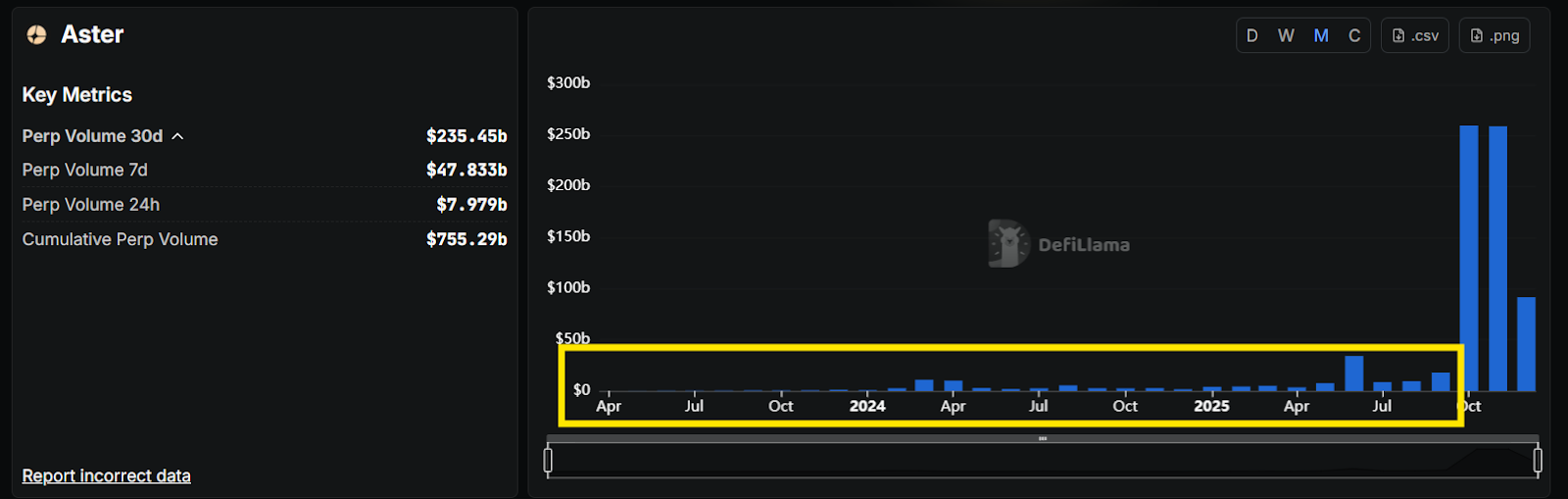

- To make it easier to visualize, Lighter only trails Hyperliquid, the current number one perp DEX, and its volume is almost 10 times higher than other perp DEXs that also have airdrops such as edgeX, Paradex, GRVT, Reya, and even Aster, which users often compare as Hyperliquid’s main competitor but still ranks behind Lighter.

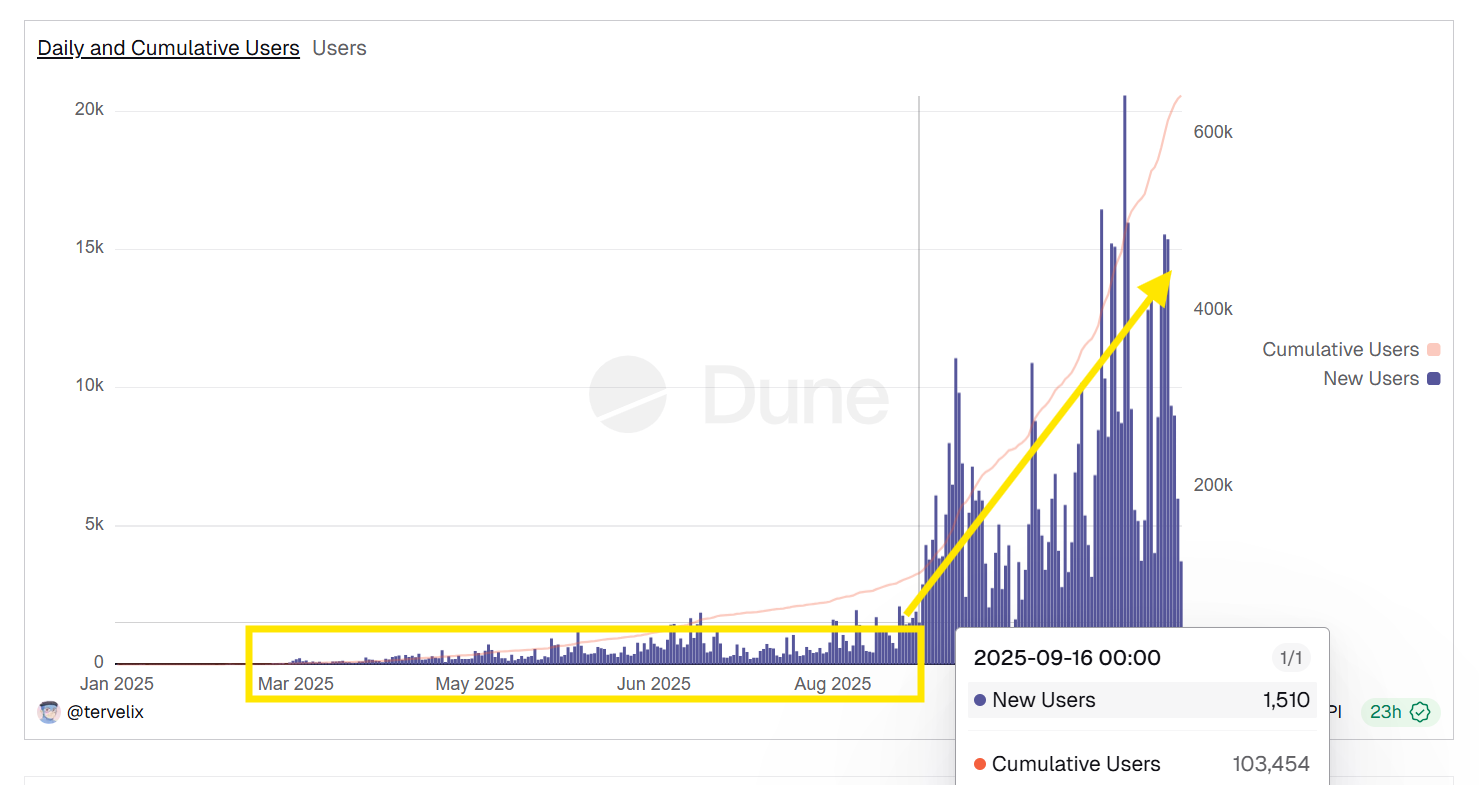

The number of users on Lighter only really exploded from around September onward. This is an important data point for investors to pay attention to, so let’s break it down:

- Season 1: From January 23 to September 15, 2025, roughly 7 months, Lighter attracted around 100K users. This very likely means this will be the largest user group controlling most of the tokens from the airdrop. This was also the period when there were very few invite codes opened, which limited the number of people who could join, and it is possible that the Lighter team itself holds a large share of the points in this phase.

- Season 2: From mid September 2025 to December 15, 2025, Lighter added more than 500K new users. This large number of users in a shorter period means the points in this phase will be more evenly distributed among retail investors, but it also implies that no one will hold too many tokens from Season 1 alone to be able to dump the chart at TGE.

Another factor that supports the view that Lighter’s airdrop is controlled by a relatively small group of users:

- Season 1 volume (yellow block) is about $550B for around 110K users.

- Season 2 volume (white block) is about $664B for around 640K users.

This highlights several points:

- As a peer competitor to Hyperliquid at the moment, Lighter’s FDV is unlikely to deviate too much from Hyperliquid’s FDV. This is entirely plausible when looking at the metrics. Investors can see the gap between points and users, and it is highly likely that in the early phase the people who really hold the points are the project team.

- Even though Lighter is zero fee, in terms of liquidity depth it certainly cannot match Hyperliquid. If we look at OI, most of Lighter’s current open interest comes from rapid opening and closing of positions to farm the airdrop. This means that when the airdrop happens and Lighter still wants to compete, it will have to offer a good enough airdrop with an FDV that is not too low in order to retain users, similar to how Hyperliquid treated its early contributors.

From the above analysis, if a large portion of points is likely held by the team and Lighter needs a strong airdrop to make noise and retain users, then Lighter’s initial FDV will at least need to be in the “decent to good” range.

So what does “decent to good” look like in numbers? Let’s analyze further below.

What will Lighter’s FDV be one day after launch?

The FDV on launch day therefore becomes a key variable; it will largely determine how successful the airdrop is, how much profit farmers can lock in, and how the community frames the Lighter story in the first days of trading.

After understanding the factors that shape Lighter’s FDV, we can now look at the FDV of Lighter’s competitors on their first TGE day and one day after:

- Hyperliquid’s FDV at TGE was around $3.9B (November 29, 2024). One day later, the project’s FDV ranged around $6B to $7B. This was also when BTC first reached the $100K milestone.

- Aster’s FDV at TGE was around $4.8B (September 19, 2025). One day later, the project’s FDV ranged around $7B to $8.5B. Even though BTC was in a correction phase during Aster’s TGE, the project still delivered very strong performance, pumping straight to a price above $2.

So both of Lighter’s competitors had very good performance after their first day of listing, even though BTC had completely opposite performance at those two times.

However, there is one common point that investors can see between Aster, Hyperliquid and Lighter:

- Very few people knew about or hunted the Hyperliquid airdrop in advance. The project only really created a frenzy after the actual airdrop.

- Similarly with Aster, which had relatively low volume at first and only truly exploded after CZ started shilling it and the project launched multiple airdrop seasons after TGE.

- For Lighter, although it has had a relatively successful pre-TGE phase, in Season 1 users still needed invite codes to participate. This created an imbalance where a large portion of points was controlled by a small group of users.

Now let’s analyze the chances currently available on Polymarket to see where the opportunities are for traders.

Scenario 1: Opportunity with lower risk

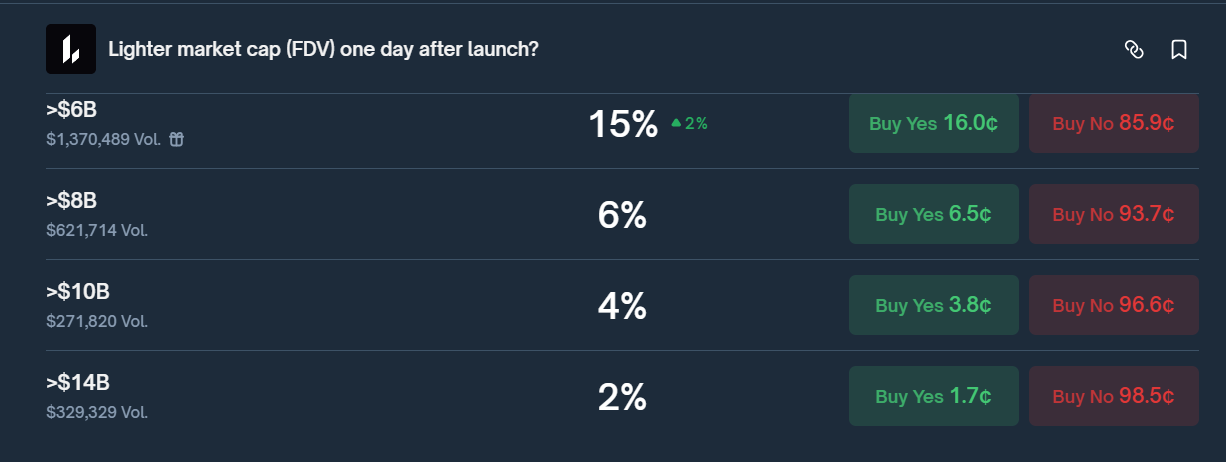

On Polymarket at the moment (December 15), the FDV of Lighter one day after launch is being priced with probabilities as shown in the chart.

Overall, the chance that Lighter has an FDV above $2B one day after launch is relatively high. This is already reflected in the numbers 90% and 83%.

- The only real reason for many investors to bet NO is probably that the overall market is not in great shape and people are worried that the broader environment will drag Lighter’s valuation down.

- However, with the last round valuing Lighter at $1.5B and many rumors around undisclosed funding rounds from a16z, the brackets >$1B and >$2B look almost like “free money”.

- Monad recently launched in a bad market and the public sale still gave investors a decent ROI, while it has also managed to hold above the $2B mark.

The opportunities at FDV >$3B and >$4B come with clearly higher risk, as the market is showing hesitation at those probability levels because:

- Lighter is in a worse position now that BTC is not only weak in price but also in market sentiment. At Aster’s TGE, people were still relatively optimistic about Q4 and the strong rally phase of the market, whereas now the community is viewing a downtrend more than ever.

- The brackets >$3B and >$4B will also face skepticism, because airdrop sell pressure will definitely appear when investors want to realize profits after a long period of paying fees and also prepare enough capital for the bear market.

In short:

- $1B and >$2B are valuation levels that look relatively solid, where investors can still capture profit.

- However, the ROI for these two levels is quite similar, so there is no strong reason for investors to accept higher risk just to get almost the same ROI. Therefore, >$1B is almost “free money”.

- For the $3B and $4B brackets, a lot will depend on market sentiment leading up to TGE as well as the tokenomics details that the project discloses in the coming period.

Scenario 2: Opportunity with higher risk

The remaining valuation brackets are very unlikely to happen for several reasons:

- The market is currently at the beginning of a downtrend, liquidity is thin, and ETF and DAT flows have cooled significantly. These two flows were the main drivers that pushed the market up in this cycle. This environment is very different from the time of Aster or Hyperliquid.

- Even if the team controls most of the total supply, that does not mean Lighter’s chart will remain strong. They can completely dump in order to prepare for the bear market.

- Overall, Lighter still has a larger share of retail investors compared to Hyperliquid and Aster, which also makes it harder for the project’s FDV trajectory to follow the same pattern as those two competitors.

If an investor chooses to bet on these brackets, they really have to be very degen and accept extremely high risk.

In addition, the odds can change if tokenomics information is released or the market “warms up again”. In the end, the >$1B bracket is likely to remain the most realistic choice for Lighter.

Conclusion

Taken together, the data points around Lighter are converging in the same direction: perp DEXs are no longer a “DeFi experiment”, and Lighter is already sharing the same track as Hyperliquid and Aster in terms of volume and activity.

The latest funding round at $1.5B, the 8 month private beta phase and the way points are distributed between Season 1 (core users) and Season 2 (mass retail) all indicate that the team has an incentive to set FDV in a “decent to good” range, not too low but also not excessively inflated.

In that context, FDV brackets above $1B and $2B look more like the base case than a speculative long shot. The >$3B and >$4B ranges start to depend heavily on late cycle market sentiment, tokenomics details and how much fresh liquidity is ready to come in.

For traders, the key is not to guess a single exact number, but to use the odds on Polymarket as a probability map: the lower brackets can be treated as safer positions to capture the likelihood that Lighter will exceed its private valuation, while the higher brackets should be viewed as degen bets with much greater risk.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Why does the $1.5B private valuation matter for public pricing?

The $1.5B round gives traders a reference anchor, because it signals what sophisticated capital previously accepted as a fair valuation. Even if the market trades below that level in a risk-off environment, many participants still use $1.5B as a baseline for judging whether the token is “cheap” or “overpriced.”

Q2. Which metrics tell you whether Lighter’s first-day FDV can hold, not just spike?

Liquidity depth, open interest quality, and user activity after incentives matter more than headline volume alone. If volume is mostly fast open-close loops to farm points, the FDV can look strong briefly but weaken once farming demand fades.

Q3. Does “zero fees for retail” guarantee a stronger token chart?

Zero fees can improve user growth and trading activity, but it does not guarantee price strength. The token still depends on supply dynamics (float and unlocks), narrative timing, and whether the protocol can monetize institutional/API flow without pushing users away.

Q4. How do Season 1 vs Season 2 point dynamics affect sell pressure at launch?

Season 1 tends to create a smaller group with heavier point concentration, so that group can create sharper sell pressure if they decide to take profit early. Season 2 brings a larger retail base, which can reduce single-wallet dominance, but it can also create broad “everyone sells a little” pressure that still caps upside.

Q5. Why do higher FDV brackets (> $3B, > $4B) face more skepticism than > $1B or > $2B?

Those higher brackets require stronger risk appetite and fresh liquidity, especially if the broader market is already sliding into a downtrend. Traders also expect visible airdrop profit-taking after a long farming period, so they hesitate to price in an aggressive upside without a clear catalyst.