Fogo, currently one of the most controversial SVM names, largely because of the valuation narrative.

On one side, the project’s initial messaging led many people to believe Fogo was anchored around $1B. On the other side, traders on Polymarket are pricing a very different scenario.

So where exactly is the market disagreement, and how can investors take advantage of this expectation gap to look for opportunities?

Fogo Overview

Fogo is a Layer 1 blockchain designed to achieve high throughput, low latency, and large scale transaction processing. Fogo is compatible with the Solana Virtual Machine (SVM), allowing existing programs, tools, and infrastructure on Solana to be migrated to Fogo more easily.

In simple terms, just as Monad, Avalanche, BNB Chain, and Polygon are Layer 1s compatible with Ethereum’s EVM environment, Fogo is compatible with Solana’s SVM environment.

Fogo Chain uses Firedancer, a high performance client developed by Jump Crypto, enabling maximum speed and bandwidth while keeping latency low. In addition, although it is SVM compatible, Fogo is fully separated from Solana’s system, which helps avoid congestion within the system.

Firedancer is a validator client software developed for the Solana blockchain to help it process transactions faster and more efficiently than current validator clients.

Fogo update

As of the time of writing, Fogo has raised $13.5M through 2 main rounds:

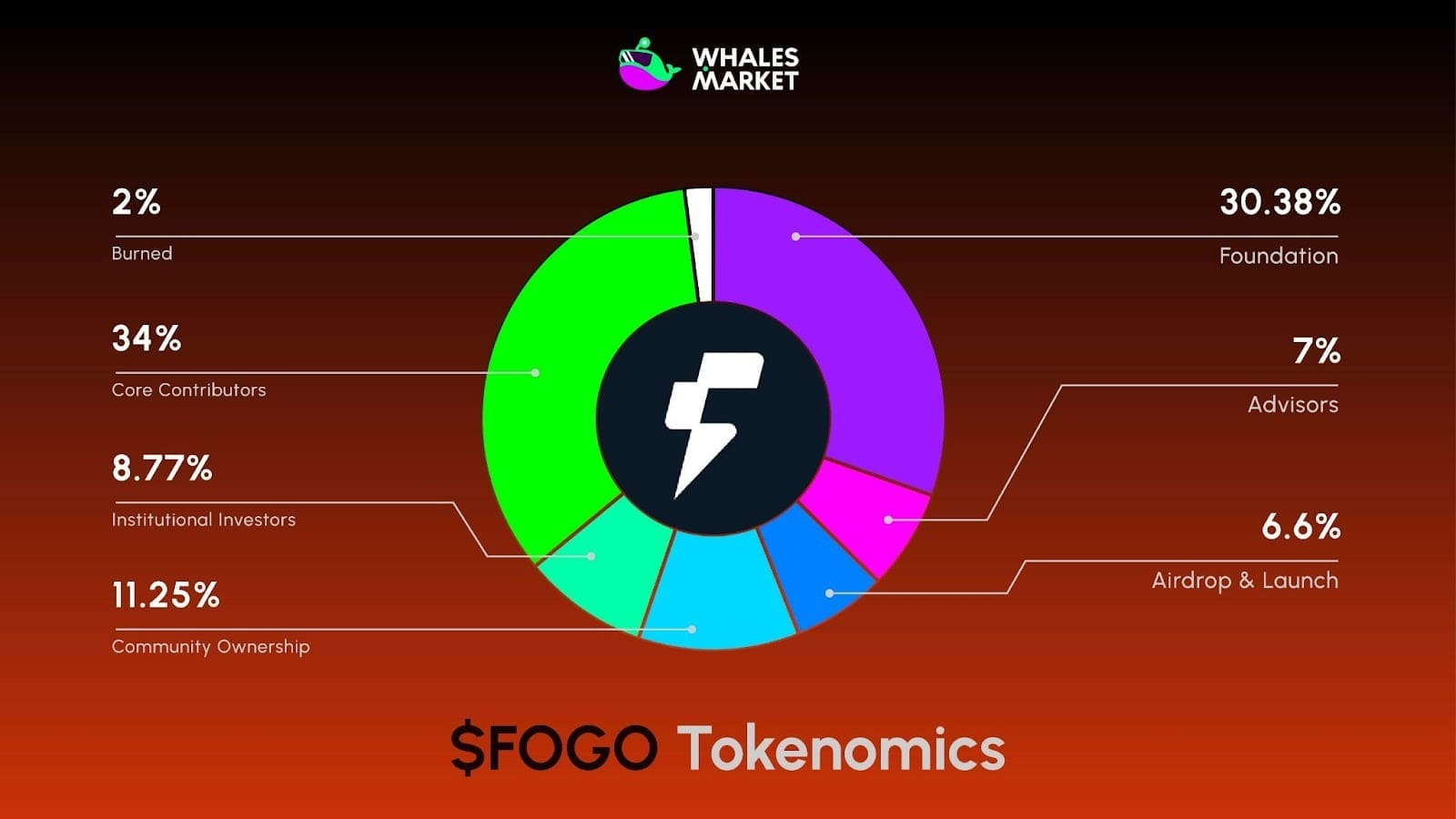

- Community Ownership (11.25%): 9.25% was split into 2 batches, with $8M at a $100M valuation through the Echo platform, with more than 3,200 participants, and $1.25M at a $200M valuation (also via Echo).

- Institutional Investors (8.77%): $4.5M was invested by Distributed Global and CMS Holding.

Previously, the project also planned to sell a public sale of 2% of the total token supply at a $1B valuation. However, this plan received a lot of mixed feedback, mostly arguing that the valuation was unreasonable since the ecosystem and network had not officially launched mainnet, yet the valuation had increased 10x in less than 1 year.

As a result, the project cancelled that public sale and moved that 2% into the community airdrop pool.

In addition, here is what Fogo currently has:

- Speed and performance: Block time under 40ms (lowest around 20ms on devnet, currently around 40ms on mainnet), finality under 1 second, peak throughput 54K TPS (sustained 1K to 2K TPS currently)

- Team background: Built by former Jump Crypto, JPMorgan, Ambient Finance

- Has it launched mainnet yet? Fogo officially launched mainnet on 25/11/2025. This stage is called “genesis” or “mainnet beta,” mainly so the team and community can test early to see whether everything is stable.

- Community campaigns: Flames points (earned via staking Pyth, trading, content), Fogo Fishing (test mainnet, earn rewards via bridging and trading, more than 2K users), Lil Forgees NFT (free mint for top leaderboard, perks after TGE)

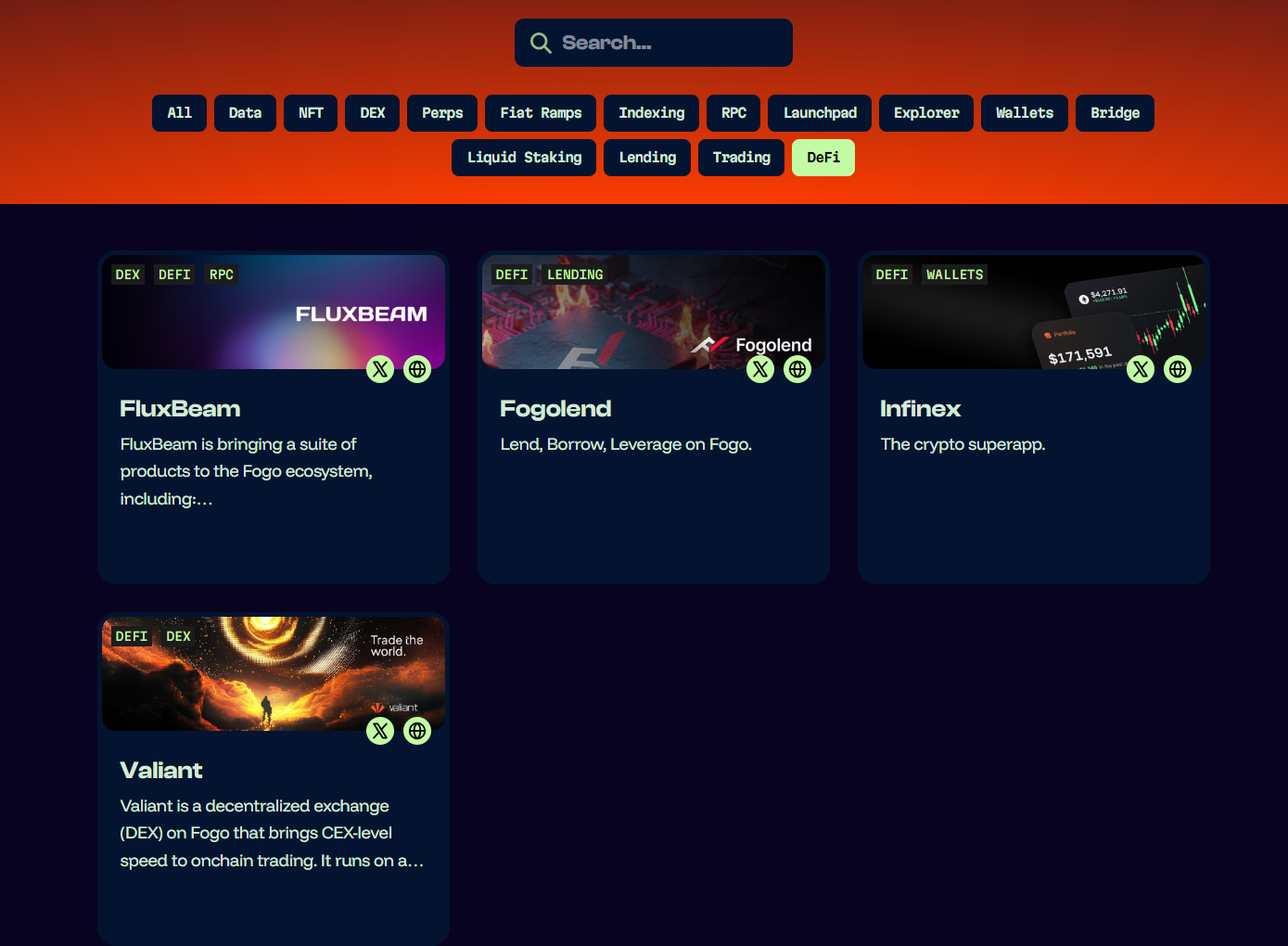

- Ecosystem: In terms of ecosystem, Fogo’s ecosystem is still not very developed. The dapps look similar to other chains. The network also does not own any standout narratives such as memecoin, NFT, or prediction market.

If we compare Fogo with previous SVM chains, Fogo’s current situation is relatively far behind:

- Eclipse used to get attention thanks to the ASC NFT set with a leader named Alucard. Its ecosystem was far ahead of Fogo, and the project also raised $65M , with FDV around $340M one day after launch.

- Soon is another SVM Layer 1. While it was not as “loud” as Eclipse, it is also a Layer 1 backed by Jump Crypto and Hack VC, raising $65M. After the first day of its token launch, Soon’s FDV was around $443M.

The common points of the two projects above are:

- Both had strong sell pressure on day one from airdrops and Binance Alpha.

- Both launched during a relatively favorable market period.

- Both already had part of an ecosystem shape before the token launch.

- Both raised relatively large funding amounts and focused on a philosophy of improving performance.

Another project in the SVM narrative is Sonic SVM, a Layer 2 for gaming. However, its TGE FDV at $2.4B to $2.8B is beyond most analysis methods, whether fundamental or technical, so its relevance as a reference point for Fogo is not high.

Therefore, investors can refer to the two closer case studies, Eclipse and Soon, to make a decision.

What will Fogo’s FDV be one day after launch?

After identifying Fogo’s closest competitors, the next step is to look directly at tokenomics and the current market context to make a reasonable forecast.

The most important point is the unlock structure: 38.98% of total supply will be unlocked immediately at TGE, a very large ratio and fairly similar to Monad. This includes:

- Foundation: 30.38%

- Airdrop and Launch: 8.6%

When the Foundation holds more than 30.38%, the biggest variable is no longer “natural demand,” but the team’s goals and operating approach. Put simply, the price of $FOGO can be heavily shaped by the project’s distribution strategy, liquidity decisions, and short term direction.

Placing these tokenomics into the current market context makes the story even less favorable for a high FDV launch, especially for a project that is not yet fully in an official mature mainnet phase while the ecosystem still has not shown clear breakout signals.

1,477 TPS on mainnet btw.

— Fogo (@fogo) November 28, 2025

One dapp live.

And it's alpha right now.

do with that what you will. pic.twitter.com/1T7XwXaHnK

Fogo Genesis Mainnet

Even though the market has already received information about the third rate cut of the year, the reaction has been fairly muted. Liquidity remains thin after the crash on 10/10, retail investors remain cautious. Flows from ETFs and DATs have also slowed and outflows have appeared, while this capital group previously played a leading role in the last crypto cycle.

So instead of guessing emotionally, let’s go case by case to see which FDV scenario is reasonable for Fogo right after launch.

Case 1: Fogo is valued under $1B

At valuations under $1B, the market is split into 2 possibilities.

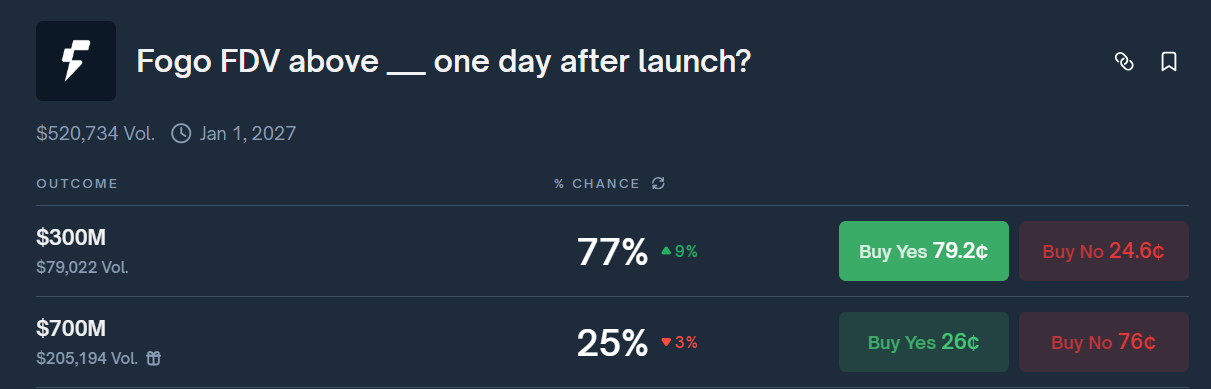

First is above $300M one day after launch. The market currently assigns a 77% chance to this outcome. Why 77%, and is it reasonable? Let’s break it down:

- The most recent Echo valuation round for $FOGO was $200M. All tokens from this round will be locked for the first 12 months. Therefore, there should be no sell pressure from this allocation at TGE.

- The only meaningful selling pressure would be from the airdrop (6.6%). However, Fogo has not really run many large scale airdrop programs beyond Discord roles, or a short activity period in the genesis mainnet phase (24/11). Therefore, the airdrop distribution may also be concentrated among a relatively small group of users.

- Selling pressure from small retail users also does not look too large based on the analysis above.

Therefore, a scenario where Fogo launches above $300M has a reasonable basis. This may be why many investors have bet “YES,” pushing the odds for this case to 77%.

However, the risk of betting “YES” is also significant, including:

- The market is no longer ideal for sustaining projects at high FDV. For a project that does not yet have much like Fogo, the team could “optimize” by extracting value for treasuries in order to survive through a bear market.

- Because the team holds a large portion of tokens, betting at the current time is very difficult to base on analysis. It leans more toward gambling.

Therefore, if an investor wants to “gamble” this trade, the risk reward may look more attractive on betting “NO,” because whether it is “above or below $300M” depends almost entirely on the project itself, not on other fundamentals.

On Polymarket, for the above $700M case, betting “NO” would be safer and more attractive in risk reward terms, because a Fogo launch above $700M would be relatively unreasonable. Even Eclipse or Soon in a favorable market did not reach such a large FDV.

The market is also leaning heavily toward “NO,” with only a 25% chance for this scenario. Many traders betting “YES” may be relying on pre market pricing on Hyperliquid. However, Whales Market, the earliest pre market trading platform prices should only be used as a reference because they can be manipulated easily.

The odds of this market will continue to change if Whales Market, the crypto premarket platform price continues to fall. Therefore, it can also be an indicator that traders can trade.

- If the pre market price drops below $0.07, the share price on the NO side will continue to rise.

- This could happen in reverse if some force pumps the pre market price higher.

Read more: Should Investors Hedge Tokens on Pre-Market Perps?

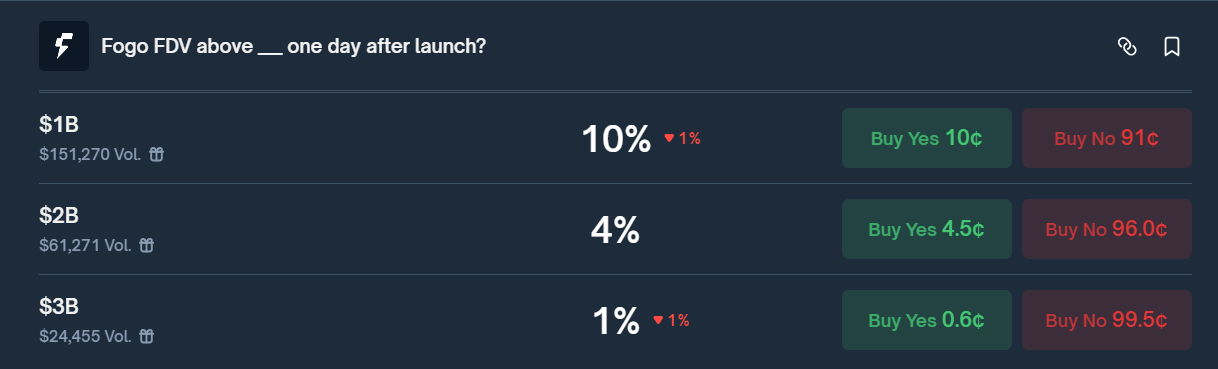

Case 2: Fogo is valued above $1B

On Polymarket, for the remaining cases, if Fogo is traded above $1B, $2B, or $3B, a NO position looks more favorable on a risk-reward basis

The risk for these bets, if Fogo is traded above $1B one day after launch, can be considered a “black swan” and an extremely rare event for traders. Therefore, risk management should still be prioritized no matter how clear the opportunity looks.

Conclusion

Fogo’s day one FDV will likely be determined less by what the chain can become and more by what the market can absorb on day one: unlock structure, early liquidity, and how participants behave around the airdrop and Foundation controlled supply.

Comparisons like Eclipse and Soon help frame a realistic range, while very high FDV outcomes should be treated as tail risk rather than the base case. If you trade the scenarios, treat pre market signals as directional clues, but size positions assuming volatility and fast shifting odds.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What does “genesis” or “mainnet beta” mean for launch pricing?

It usually means the network is live but still in an early, testing-heavy phase. Markets often price in higher execution risk (bugs, instability, incentive tweaks), which can cap valuation unless hype/liquidity overwhelms fundamentals.

Q2. Which parts of supply are most likely to affect the price on day one?

The portions that are unlocked and actually movable at TGE matter most. Even with a large unlock %, sell pressure depends on who receives those tokens (airdrop users vs. team-controlled wallets) and how liquidity is managed.

Q3. How can you tell if the airdrop sell pressure will be “sharp” or “spread out”?

Look for signals of distribution breadth: number of eligible wallets, how long the earning window was, whether rewards skew to a small leaderboard, and whether there were meaningful onchain actions beyond Discord roles and short test periods.

Q4. Why can pre-market prices (e.g., Hyperliquid) mislead traders?

Pre-markets can be thin, easier to push around, and dominated by a small set of players. They’re useful for directional sentiment, but not reliable enough to treat as “fair value.”

Q5. How should I use prediction market odds without over-trusting them?

Treat odds as “crowd positioning,” not truth. Odds can move because of limited liquidity, hedging flows, or narratives, so combine them with basic checks like unlock math, peer comps, and current risk appetite.