Yield farming in DeFi has long been a challenge for many users. Tracking dozens of protocols, comparing APYs, bridging assets across chains, and constantly worrying about smart contract risk can quickly become overwhelming. YO Protocol addresses these problems by offering a multi-chain yield optimizer that automatically allocates capital to the best yield opportunities after accounting for risk.

What is YO Protocol?

YO, short for Yield Optimizer, is a DeFi protocol that allows users to deposit assets, while the system automatically searches for and allocates capital to the most attractive yield pools across multiple blockchains. Instead of manually moving funds between Ethereum, Base, Solana, or other chains, users make a single deposit and YO handles the rest.

The difference between YO and traditional yield aggregators, such as Yearn Finance, lies in its cross-chain capability combined with a risk-adjusted approach. Instead of prioritizing the highest APY as a primary objective, YO evaluates the risk profile of each pool and allocates capital based on a more balanced assessment of return and risk.

YO was developed by the team behind Exponential.fi, a DeFi risk assessment platform that has been active since 2022.

Key features of YO Protocol

Embassy architecture

Instead of relying on cross-chain bridges to move assets, which are widely considered one of the largest security risks in DeFi, YO uses an architecture called Embassy. Each supported blockchain has its own independent vault that holds the native assets of that chain.

As co-founder Mehdi Lebbar explained to CoinDesk, bridging assets exposes users to bridge risk. YO’s approach creates separate vaults on each chain that hold native assets. USDC on Arbitrum remains USDC on Arbitrum, without an additional bridge layer in between, making the system significantly safer.

yoTokens

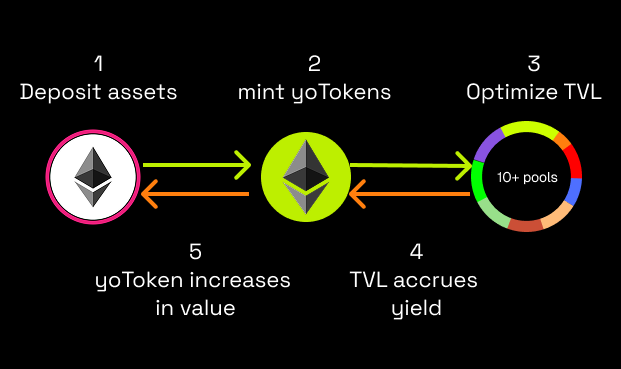

When assets are deposited into YO, users receive corresponding yield-bearing tokens called yoTokens, such as yoETH, yoUSD, or yoBTC. These tokens follow the ERC-4626 standard, and their value increases automatically over time as yield is accumulated within the vault.

A yield-bearing token is a token whose underlying value increases automatically over time without requiring manual actions. Unlike traditional staking, where rewards must be claimed and compounded, yield-bearing tokens such as yoETH embed yield directly into the token’s value.

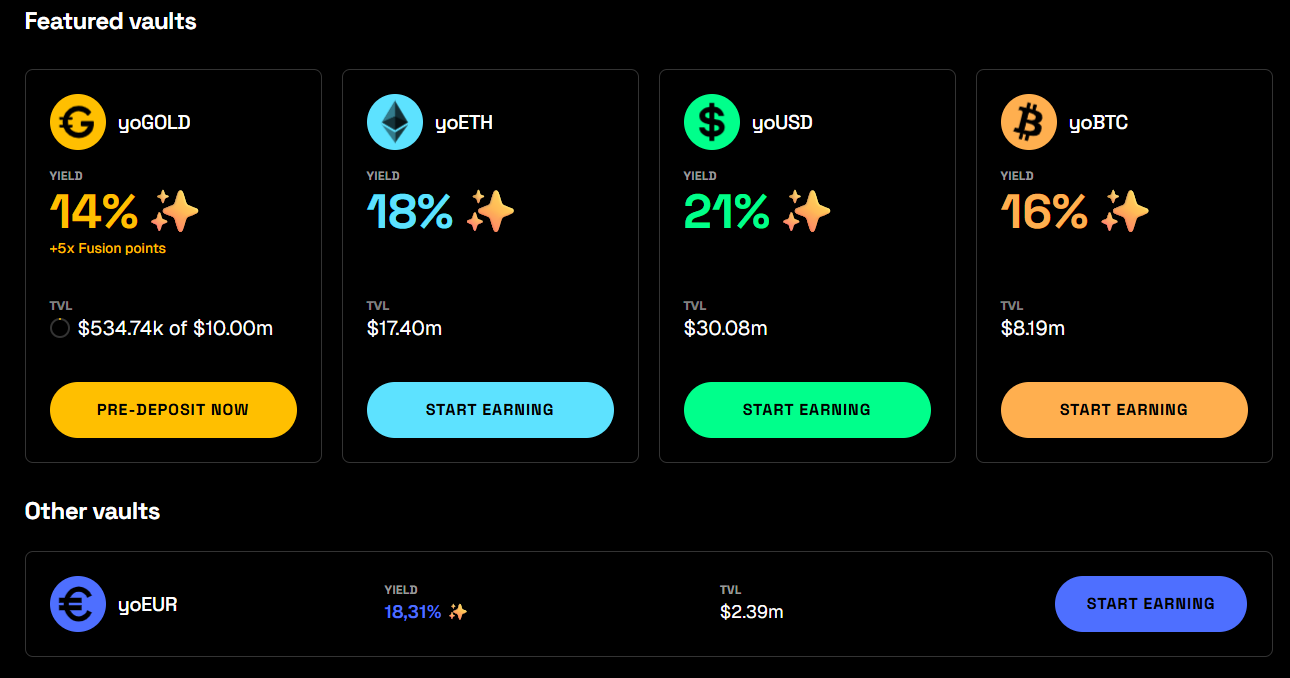

Available yoTokens:

- yoUSD: Vault for stablecoins such as USDC and USDT.

- yoETH: Vault for ETH and liquid staking tokens.

- yoBTC: Vault for wrapped Bitcoin.

- yoEUR: Vault for euro stablecoins such as EURC.

- yoGOLD: Vault for tokenized gold.

Risk-adjusted Yield

YO does not simply allocate capital to the highest APY pools. The protocol analyzes thousands of risk vectors, including:

- Protocol age.

- Audit history.

- Smart contract security.

- TVL stability.

- Historical performance.

Based on these factors, YO calculates a default probability for each yield opportunity and optimizes allocations for risk-weighted returns. This entire risk evaluation framework is built on top of Exponential.fi, the platform developed by the same team.

How Does YO Protocol Work?

YO Protocol operates through a fully automated workflow that removes the need for users to manually track yield opportunities or move assets across protocols and blockchains.

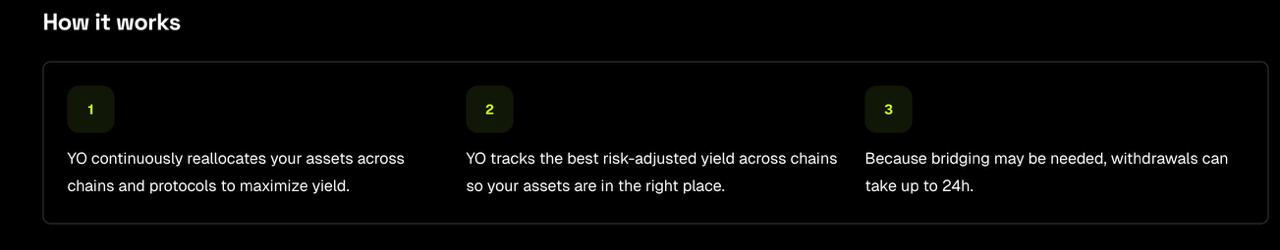

- Step 1: YO continuously reallocates deposited assets across different chains and protocols to optimize yield.

- Step 2: The system monitors risk-adjusted yield opportunities across multiple blockchains, ensuring assets are positioned where they are most effective based on both return and risk.

- Step 3: Because cross-chain movements may be required, withdrawals can take up to 24 hours in some cases.

When assets are deposited into $YO, they are placed into yoVaults. These are ERC-4626, compliant smart contract vaults that automatically allocate capital to yield pools based on risk ratings provided by Exponential.fi.

Each yoVault functions like an automated fund manager:

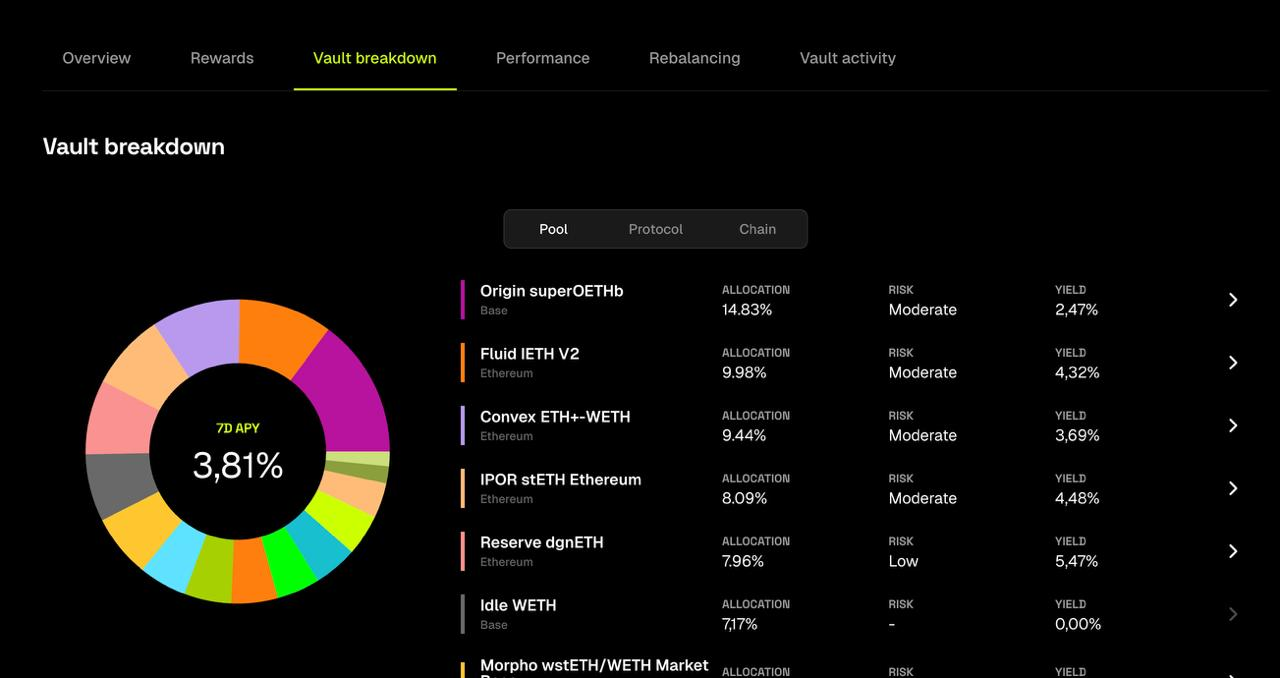

- Diversification: Capital is spread across multiple pools instead of being concentrated in a single position.

- Multi-chain deployment: Assets can be deployed on Ethereum, Base, Arbitrum, and other supported chains depending on yield conditions.

- Multi-protocol integration: YO integrates with leading protocols such as Morpho, Fluid, Convex, IPOR, Reserve, Idle, Origin, and others.

One notable feature of YO is transparency. Users can view exactly how assets are allocated within each vault. For example, the yoETH vault includes a Vault Breakdown interface that clearly dis

Each pool clearly displays its current risk level (Low, Moderate, High) alongside its yield. The system balances higher-yield, higher-risk pools with safer, lower-yield options. This trade-off is the core of YO’s risk-adjusted yield approach.

YO does not allocate capital once and leave it unchanged. The system continuously monitors and rebalances vaults based on:

- Changes in pool yields.

- Updates to risk ratings.

- Broader market conditions.

At the same time, the rebalancing logic accounts for costs such as gas fees, bridging fees, and slippage. Rebalancing only occurs when a yield trend is clearly established, avoiding unnecessary transactions and focusing on sustainable returns rather than short-term APY fluctuations.

Token Information

$YO Key Metrics

- Token Name: YO

- Ticker: $YO

- Type: Governance

- Total Supply: 1,000,000,000 $YO

- Contract Address: TBA

YO Use Cases

The YO Protocol token is designed as a governance token, allowing holders to actively shape the future of decentralized yield infrastructure:

- Governance: Holders can vote directly on key protocol decisions, including ecosystem initiatives and adjustments to vault parameters.

- Decentralization: After TGE, control will gradually transition from the core team to token holders according to a decentralization roadmap, with the goal of fully on-chain governance.

- Rewards program: Users can earn the YO Protocol token by depositing into YO Vaults (yoUSD, yoETH, yoEUR, yoBTC, yoGOLD) or by participating in supported DeFi activities.

Listing

- TGE date: TBA.

- CEX listings: TBA.

- Pre-market (Whales Market): TBA.

Tokenomics and Fundraising

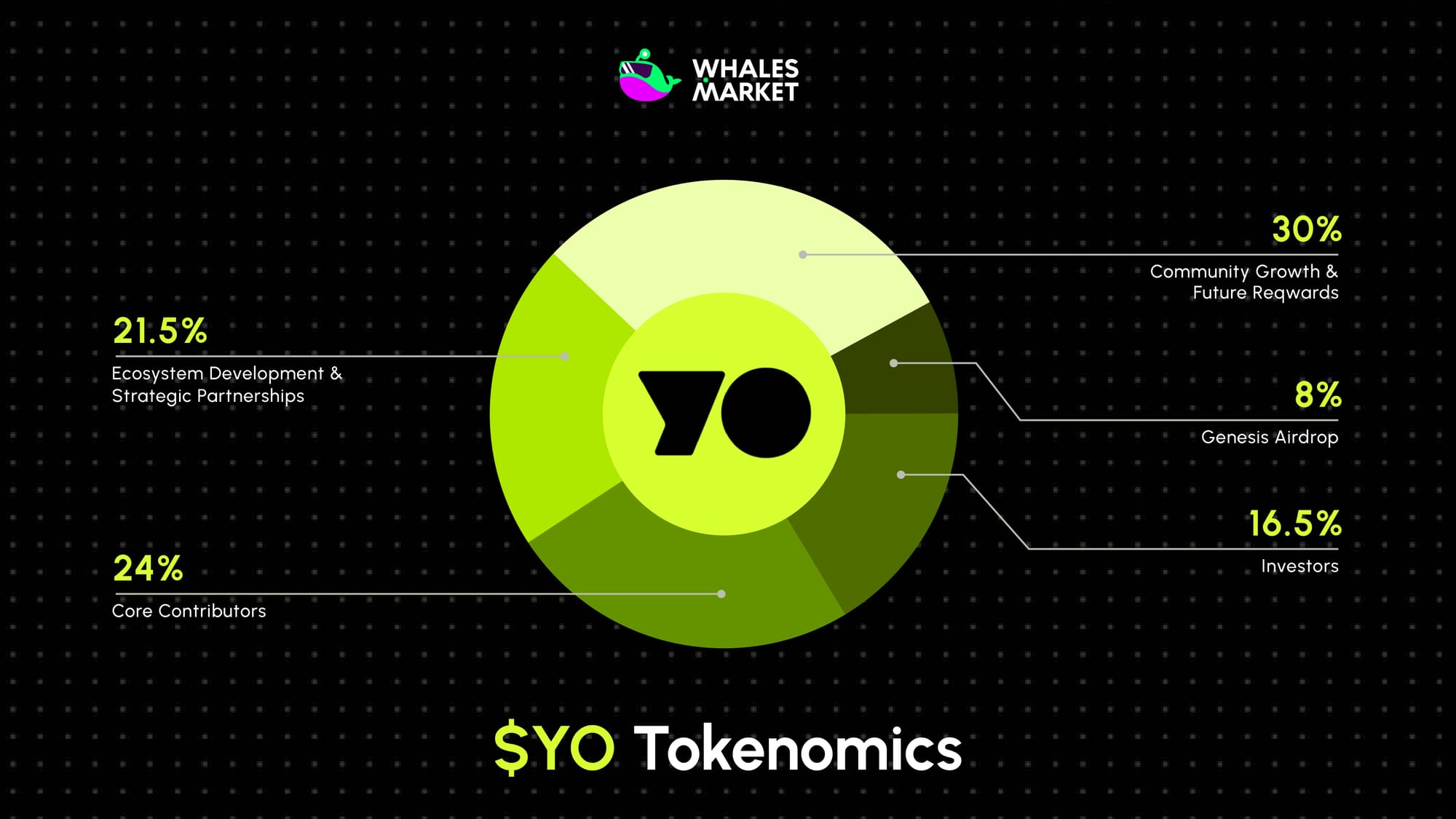

Tokenomics

Total Supply: 1,000,000,000 $YO

Allocation:

- Community Growth & Future Rewards: 30.0%

- Core Contributors: 24.0%

- Ecosystem Development & Strategic Partnerships: 21.5%

- Investors: 16.5%

- Genesis Airdrop: 8.0%

Fundraising

YO Protocol, through YO Labs and Exponential, has raised a total of $24M through 2 funding rounds.

Seed round in October 2022: $14M.

- Lead investor: Paradigm.

- Participants: Haun Ventures, Solana Ventures, Polygon, Circle Ventures, and multiple angel investors.

Series A in December 2025: $10M.

- Lead investor: Foundation Capital.

- Participants: Coinbase Ventures, Scribble Ventures, Launchpad Capital.

YO Labs has secured $10m in Series A financing, led by @FoundationCap with participation from @cbventures, @ScribbleVC, and Launchpad Capital.

— YO (@yield) December 14, 2025

The raise will accelerate YO’s unified, risk-optimized yield platform as it powers the next generation of crypto and fintech apps. pic.twitter.com/rTl1LkqDka

Tokenomics

There is currently no official information regarding token allocation. Further details are expected closer to the token launch.

Team and Roadmap

Team

Driss Benamour (Co-founder and CEO):

- Former fintech product lead at Uber, where he worked on the Instant Pay feature.

- Previously worked at SmartBiz Loans and Zynga.

- Graduated from ENSAE Paris and Stanford.

Roadmap

The project has not publicly disclosed a detailed roadmap.

Conclusion

YO Protocol focuses on a practical problem in DeFi: earning yield without constant monitoring or complex risk management. By combining cross-chain vaults, structured risk analysis, and a fee-free model, it offers a calmer, more deliberate way to access yield. The approach favors sustainability over short-term optimization, which may appeal to long-term DeFi participants.

FAQs

Q1. Which types of DeFi users is YO Protocol designed for?

YO Protocol is designed for users who want to optimize DeFi returns passively. It suits those who do not have time to monitor APYs, manage risk, or move capital across multiple chains, while still prioritizing a higher level of safety.

Q2. Is YO Protocol safer than traditional yield aggregators?

YO Protocol significantly reduces bridge-related risk through its Embassy architecture. It also uses the risk-adjusted yield framework from Exponential.fi to evaluate default probabilities, helping balance potential returns with overall protocol safety.

Q3. How is yield accumulated and reflected in yoToken value?

yoTokens follow the ERC-4626 standard, and their value increases over time as yield is accumulated in the vault. This allows users to benefit from compounding returns without manually claiming or reinvesting rewards.

Q4. How does YO Protocol respond to unexpected DeFi incidents?

Through the DeFi Graph system, YO monitors dependency relationships across multiple protocols. When indirect risk or cascading failures are detected, the system can automatically withdraw funds to reduce potential losses.

Q5. How does the Zero Fee Model impact users?

YO does not charge management or performance fees, allowing users to retain more net yield. Rebalancing costs are covered by the protocol, with only necessary bridging fees shared among vault depositors.

Q6. What is the current price of $YO?

$YO has not officially launched yet. There is no official trading price on major exchanges, and the token of YO Protocol is not currently being traded on a pre-market basis on Whales Market.