Theoriq focuses on building infrastructure for autonomous AI agents operating on blockchain. The system is designed to optimize liquidity, handle complex financial actions, and reduce human errors while keeping everything fully decentralized.

What is Theoriq?

Theoriq describes itself as an “agentic base-layer protocol”. In simpler terms, it is the core foundation where AI agents can operate, coordinate, and interact autonomously across the crypto ecosystem.

The platform enables users to perform DeFi activities such as liquidity provision, yield optimization, and automated trading without switching across multiple apps or dealing with constant manual management.

The system aims to solve three major challenges in DeFi:

- Complexity of Yield Farming: Automating the process of monitoring, reallocating, and managing capital across numerous DeFi protocols.

- Lack of Intelligence: Most auto-compounders today rely on rigid rules, offering limited adaptability in fast-changing market conditions.

- High Management Demand: DeFi promises “passive income”, but in reality it requires constant supervision. Theoriq attempts to turn this promise into something closer to the truth.

How Theoriq Works?

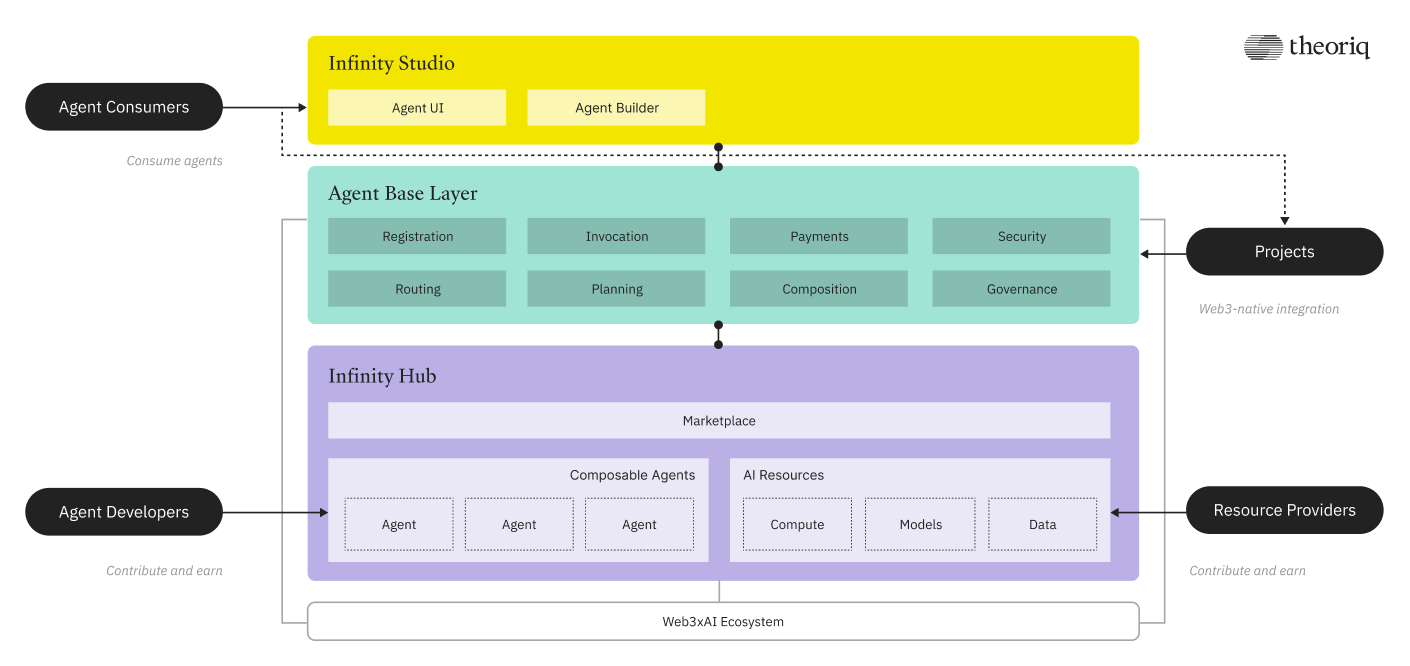

Theoriq is built on a multi-layer architecture that combines Ethereum smart contracts with off-chain nodes running Evaluator and Optimizer systems. This hybrid design creates a more adaptive and intelligent ecosystem compared to traditional DeFi platforms.

Alpha Protocol

Alpha Protocol is the core layer of Theoriq, a decentralized system built for multi-agent coordination. It allows AI agents to register, communicate, respond to events, and collaborate as independent economic actors.

The protocol supports on-chain escrow, dynamic swarm formation, and intelligent negotiation, all designed for real-world use cases such as cross-chain yield optimization, decentralized market making, and efficient liquidity provisioning.

AlphaSwarm

AlphaSwarm is the flagship agent layer of Theoriq, a system where AI agents deploy and manage capital across DeFi. The model uses AI-driven price forecasting and reinforcement learning, allowing the agent network to become smarter and more efficient over time.

Agents inside AlphaSwarm work together using a swarm model that includes:

- Signal Agents: Collecting and processing real-time market data.

- Strategy Agents: Developing and refining strategies from aggregated signals.

- Action Agents: Executing on-chain transactions based on approved strategies.

AlphaVault

Launched on December 5th, 2025, AlphaVault is the first DeFi vault where specialized AI agents autonomously manage risk and rebalance user capital. A key differentiator is transparency: every decision is logged and explained.

Its “vault-of-vaults” architecture enables an Allocator Agent to distribute funds across multiple sub-vaults, each with its own strategy and risk profile. User capital is protected by “policy cages”, strict on-chain rules defining approved assets, allowed protocols, and position size limits.

$THQ Token Information

$THQ Key Metrics

- Token Name: Theoriq

- Ticker: $THQ

- Type: Utility and Governance

- Total Supply: 1,000,000,000 $THQ

- Contract Address: TBA

$THQ Use Cases

- Protocol Access: Required for agents to operate on AlphaProtocol.

- Staking (THQ → sTHQ): Secures the network and earns emissions.

- Locking (sTHQ → αTHQ): Boosts rewards with time-weighted power.

- Delegation to Agents: Improves agent performance and unlocks fee discounts.

- Slashing Collateral: Ensures agent accountability and system safety.

- Protocol Fee Sharing: Earns a share of agent-generated fees.

- Ecosystem Access: Required by projects using AlphaProtocol.

- Liquidity Participation: Earns rewards from AI-driven vault strategies.

- Agent Developer Rewards: Incentivizes building and operating high-performing agents.

$THQ Listing Details

- TGE Date: TBA

- CEX Listings: TBA

- Pre-market Price (Whale Market): TBA

$THQ Tokenomics and Fundraising

Tokenomics

Total Supply: 1,000,000,000 $THQ

Allocation:

- Community: 18%.

- Treasury: 28%.

- Core Contributors: 24%.

- Investors: 30%.

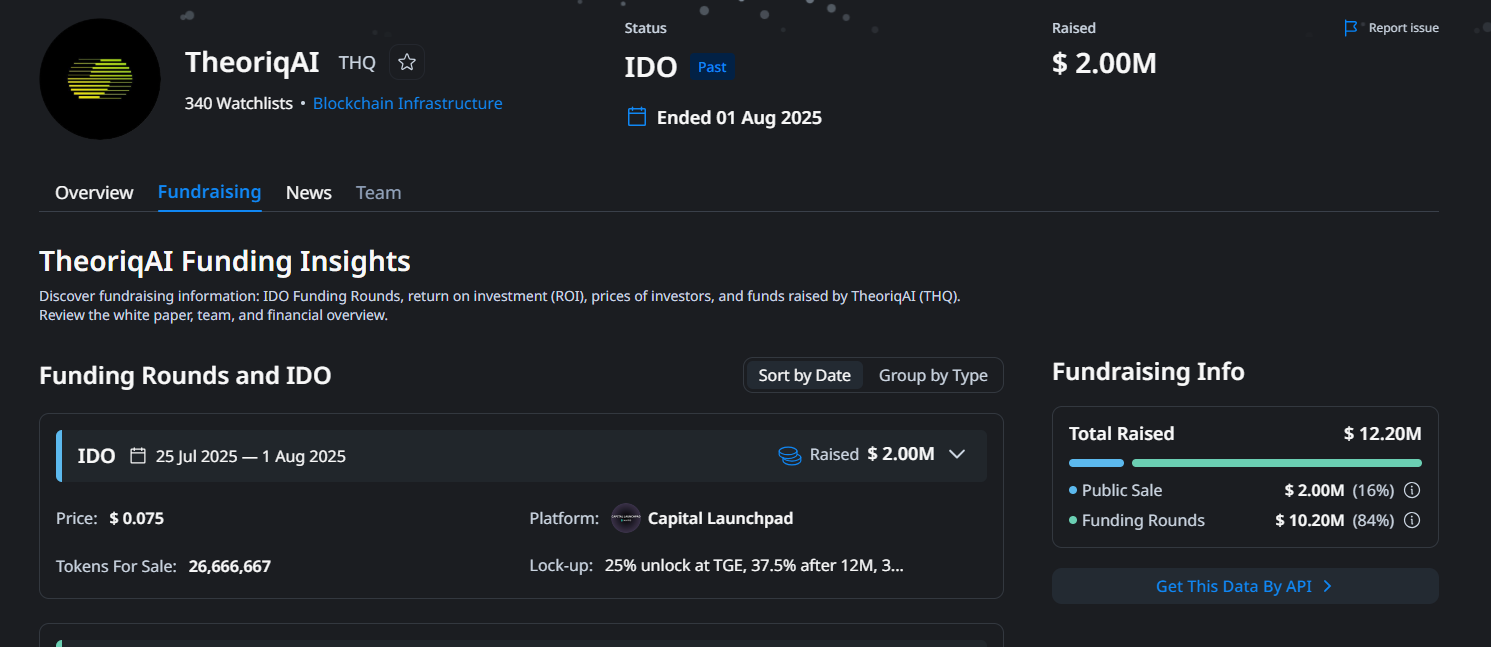

Fundraising

Theoriq has raised a total of $12M across multiple rounds. Backers include Hack VC, IOSG Ventures, NxGen Partners, Framework Ventures, and others.

Roadmap and Team

Team

- Ron Bodkin - CEO & Co-Founder

- David Mueller - CPO & Co-Founder

- Arnaud Flament - CTO & Co-Founder

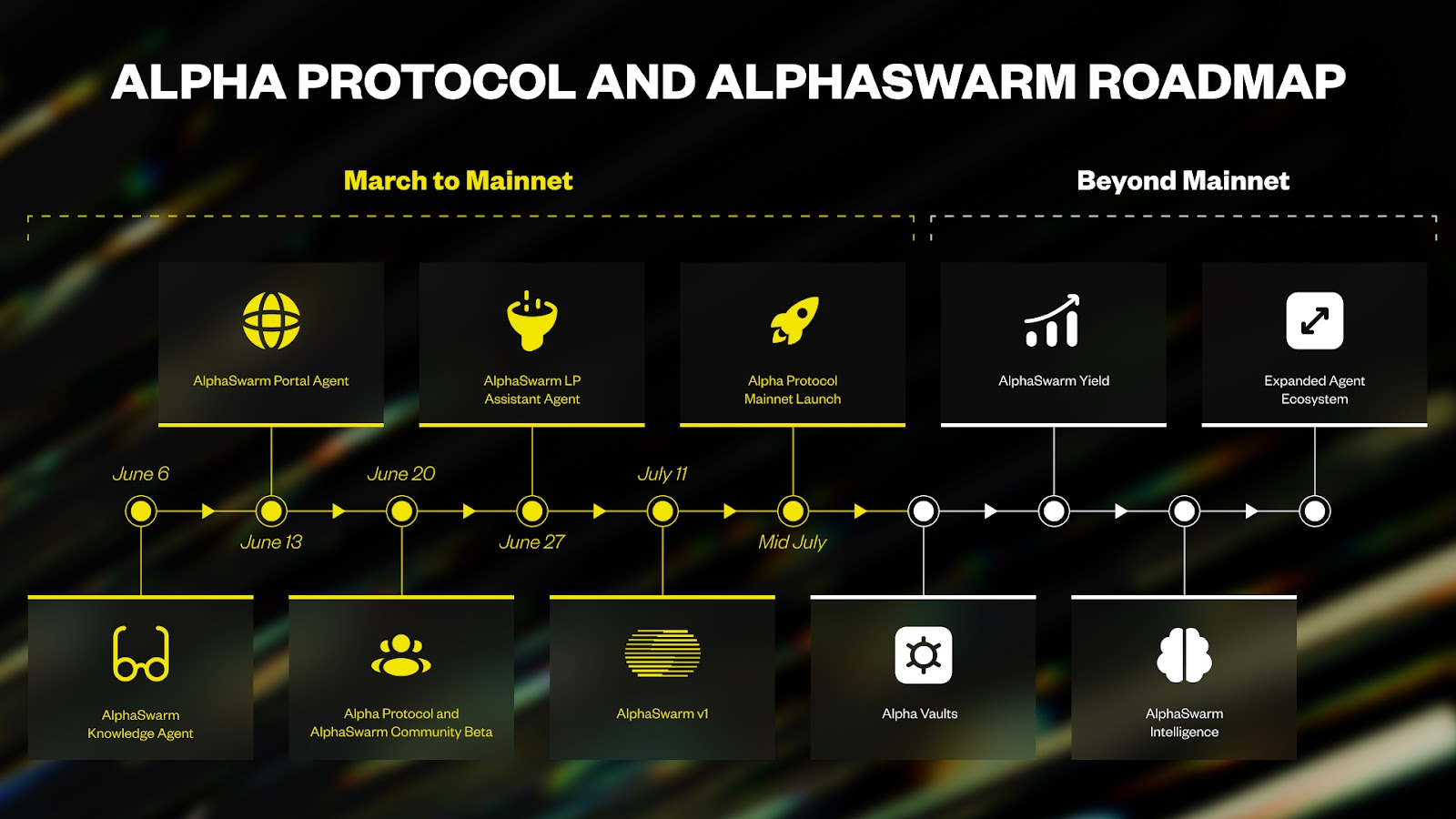

Roadmap

A detailed roadmap has not yet been published. Updates will be provided once the project releases official information.

Conclusion

Theoriq introduces a decentralized agentic AI platform built around user experience, transparency, and intelligent automation. With a multi-chain approach and strong focus on reducing human error, the system aims to support both newcomers and experienced crypto users with safer and more adaptive financial tools.

FAQs

Q1. What benefits does AlphaSwarm bring to DeFi users?

AlphaSwarm analyzes markets automatically, refines strategies, and executes on-chain actions to enhance performance without constant manual oversight.

Q2. How is AlphaVault different from traditional DeFi vaults?

AlphaVault uses specialized AI agents to manage risk, rebalance capital, and provide transparent logs, making strategies easier for users to follow and trust.

Q3. Which type of users benefit most from Theoriq?

The platform suits users aiming for smarter yield, automated trading, or AI-managed capital allocation without handling multiple protocols manually.

Q4. How does Theoriq differ from other automated DeFi platforms?

Theoriq relies on AI agent swarms instead of rule-based scripts. Agents learn and adapt over time using reinforcement learning and operate within safety-focused policy cages, with full decision logs.

Q5. What is the current price of $THQ?

$THQ has not been officially launched. Pre-market pricing will be available on Whales Market once the token opens for pre-TGE trading.

Q6. How can users trade $THQ before official listing?

Users can trade $THQ pre-TGE on Whales Market by creating or matching collateral-backed orders, enabling secure and transparent pre-market transactions.