tea Protocol is a project that was invested by Binance Labs in the seed round with an investment of $8M. So what is tea Protocol? Let’s dive into this article.

What is tea Protocol?

tea Protocol is a decentralized technology framework protocol that allows developers and maintainers of open source code to receive rewards for their contributions.

The project is tasked with solving the Nebraska problem for developers, keeping open source software running smoothly, anytime, anywhere. The platform enhances the security of the software supply chain by rewarding OSS (open source) projects based on their impact in the ecosystem.

How does tea Protocol work?

tea rank

Projects registered on tea Protocol will be ranked based on teaRank, which measures the usage or dependency of the project in the open source ecosystem. The project's teaRank is calculated using the Proof of Contribution algorithm, which measures the impact of the project on the entire open source software ecosystem.

Based on teaRank of the registered developer project, the protocol will determine number of rewards that will be distributed daily. Higher TeaRank, more open source software (reputable) it is adopted, which will result in more rewards.

Proof of Contribution

Proof of Contribution is a ranking algorithm that measures the value, position, and impact of open source software projects. The algorithm designed to provide fair, equitable rewards for the OSS ecosystem.

The system continuously evaluates the open source software graph, which changes in real time. There are three core elements of proof of contribution on tea Protocol:

- A comprehensive graph containing data from all supported package managers, linking projects to Tea Protocol.

- The proof of contribution algorithm is passed to projects, automatically assigning a daily TeaRank score.

- TeaRank scores from 0 to 100, allowing Tea Protocol to calculate and distribute rewards based on the impact of the project.

Components of tea Protocol

Open Source Software

OSS (open source software) is software with public source code, allowing anyone to study, change and improve it for their own purposes or to create other software.

Although OSS software is important, it is limited in recognizing the contributions of developers. Therefore, tea Protocol was built to solve the above problem.

Users

Users are supporters and contributors to the development of OSS software. They can participate in the network as follows:

- Choose the appropriate OSS according to users needs: OSS model, total number of users staking, yield level received, teaRank level...

- Stake the types of tea protocol tokens supported.

- Receive yield or stTEA tokens for governance in the protocol.

$TEA Token Information

$TEA Key Metrics

Here is the information of $TEA

- Token Name: tea Protocol

- Ticker: $TEA

- Token Type: Governance-Balanced Token

- Total Supply: 100B $TEA

- Contract address (CA): TBA

$TEA Use Case

- Gas Token: TEA is consumed for gas on every transaction on Tea Network

- Staking & Slashing: Various protocol roles will involve staking TEA.

- Incentive Alignment: TEA is still staked to signal support for projects

$TEA Listing

Here are important details revealed to $TEA:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

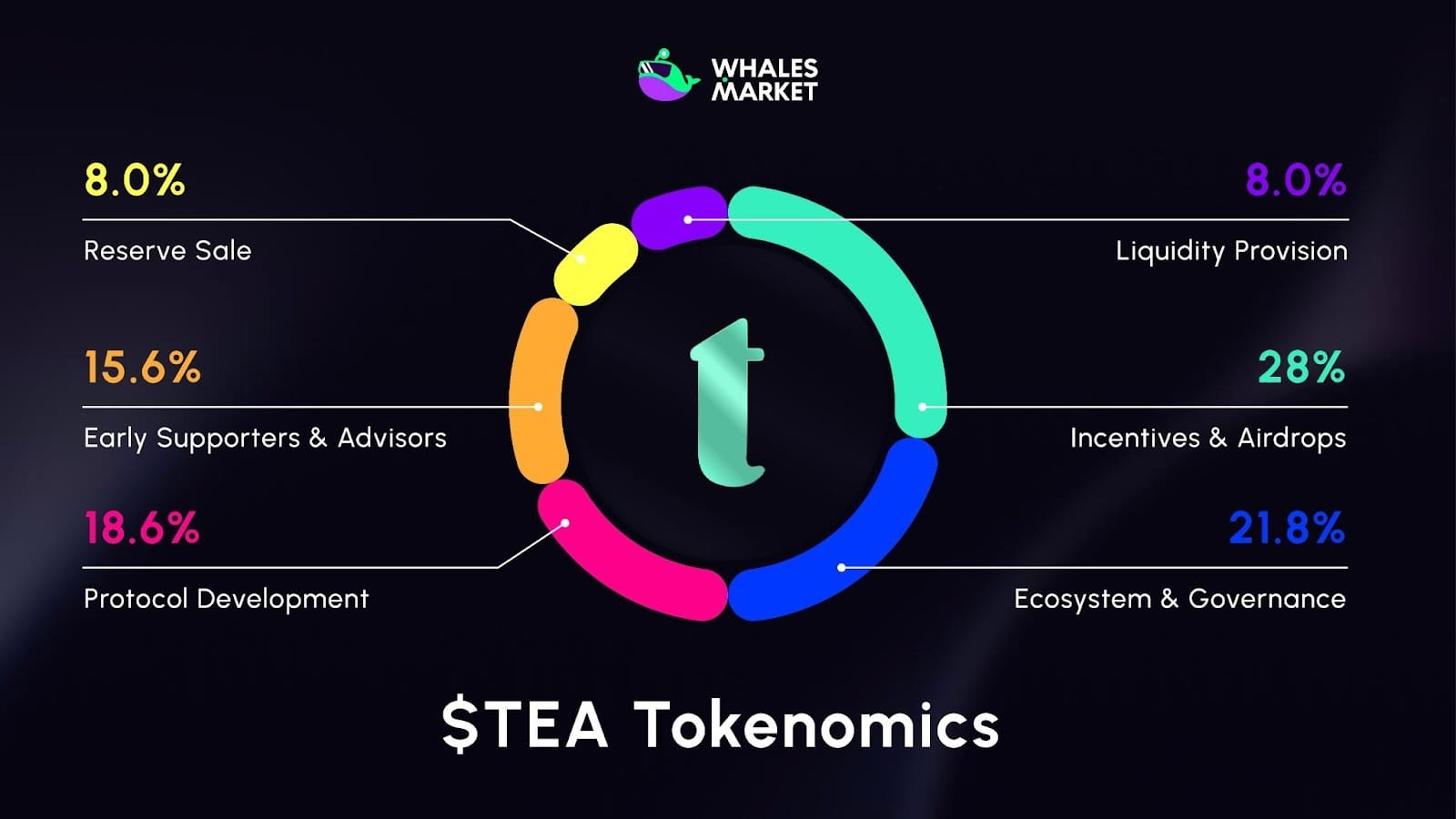

tea Protocol Tokenomics & Fundraising

Tokenomics

- Total Supply: 100B $TEA

- $TEA Allocation:

- Incentives & Airdrops: 28.0%

- Ecosystem & Governance: 21.8%

- Protocol Development: 18.6%

- Early Supporters & Advisors: 15.6%

- Reserve Sale: 8.0%

- Liquidity Provision: 8.0%

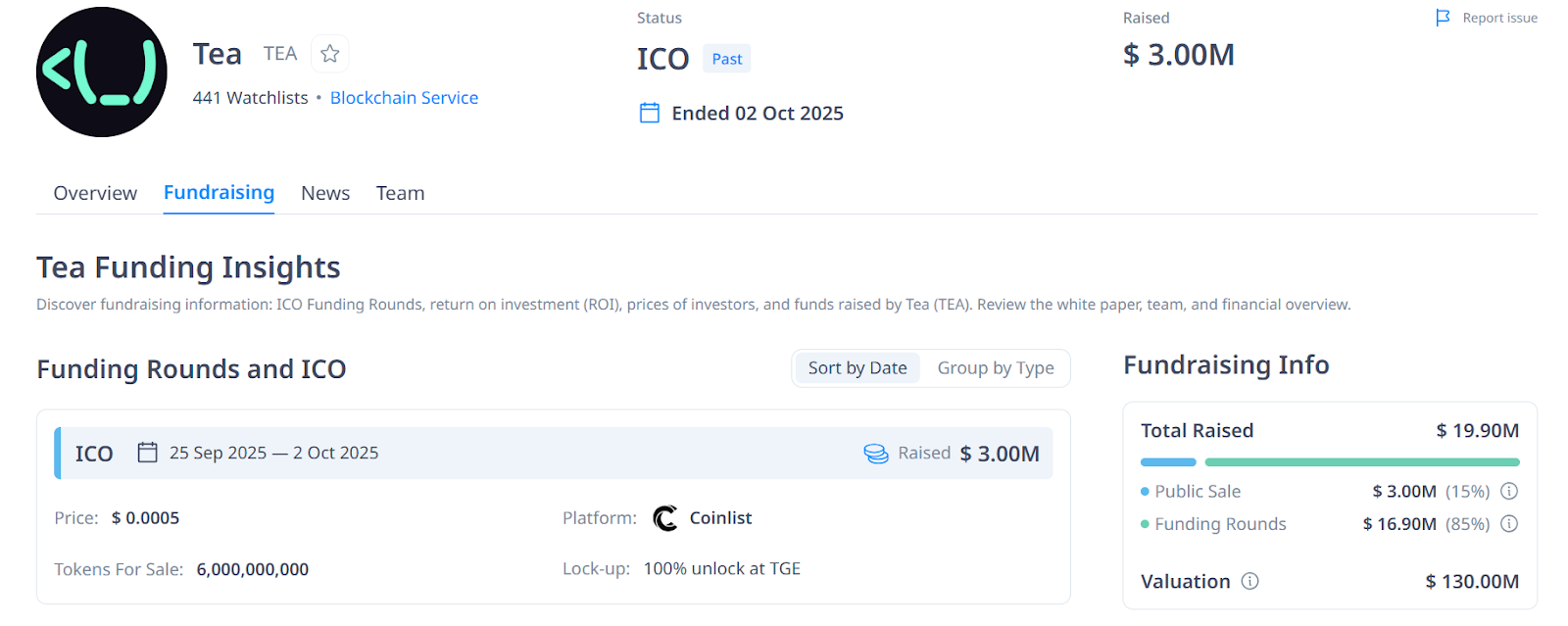

Fundraising

tea Protocol has raised successfully total of $19.9M across the funding rounds, led by Yzi Labs. In addition, tea Protocol launched the Public Sale on Coinlist with $0.0005 per token.

tea Protocol Roadmap & Team

Roadmap

Here is latest update about roadmap of tea Protocol:

- Coinlist (2025): Early supporters enter the ecosystem, laying the foundation for the Tea network.

- Q4/2025 – Mainnet + TGE: Official launch of the TEA token, enabling protocol-wide staking, GPG rewards distribution, and the introduction of teaDAO.

- Q1/2026 – Brew.fun Launchpad & Immutable Package Manager: Launch of the Brew.fun platform for OSS projects and the Immutable Package Manager, expanding development opportunities within the Tea ecosystem.

- Q1/2026 – Permissionless Nodes: Community-run IPFS and CHAI oracles go live, decentralizing Tea’s core infrastructure.

- Q2/2026 – Universal App Store: Launch of a permissionless, decentralized app store, enabling free and transparent distribution of applications across the network.

Team

Here is the core team of tea Protocol:

- Max Howell: CEO

- Tim Lewis: Co-Founder

- Daniel Mulligan: Head of Marketing

Conclusion

tea Protocol represents a groundbreaking step toward empowering open-source developers by creating a decentralized system that rewards real contributions. With strong backing from Binance Labs and a clear roadmap leading to Mainnet and beyond, tea aims to redefine how OSS projects are valued and sustained.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of tea Protocol?

The native token of tea Protocol is $TEA, used to facilitate coordination across the ecosystem.

2. What is tea Protocol ($TEA) pre-market price?

Currently, $TEA is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of tea Protocol ($TEA) today?

While tea Protocol ($TEA) hasn't been listed yet, users can trade $TEA pre-market on Whales Market before the TGE. Here you can trade $TEA before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. How much has tea Protocol ($TEA) raised?

tea Protocol has raised successfully total of $19.9M across the funding rounds, led by Yzi Labs. In addition, tea Protocol launched the Public Sale on Coinlist with $0.0005 per token.

5. What is $TEA allocation?

The $TEA token is distributed as follows: 28% for incentives and airdrops, 21.8% for ecosystem and governance, 18.6% for protocol development, 15.6% for early supporters and advisors, and 8% each for reserve sale and liquidity provision.