DeFi promises yield, but the reality is messy: juggling wallets, gas on every chain, bridges, and noisy alpha that’s hard to act on, plus rising privacy concerns. Tea-Fi steps into that gap with a self-custodial, privacy-forward SuperApp that abstracts gas, unifies swaps and staking, and layers in guided discovery and rewards.

What is Tea-Fi?

Tea-Fi is a privacy-first, all-in-one DeFi platform designed to simplify crypto management, trading, and growth while prioritizing user privacy and security. It unifies core DeFi pillars (such as swaps, staking, lending, and yield farming) into a seamless interface that removes common pain points such as gas hassles and cross-chain complexity.

Built on zero-knowledge (ZK) proofs for anonymous transactions, Tea-Fi aims to turn DeFi's noise into actionable opportunities, allowing users to earn rewards without managing private keys or multiple wallets.

How does Tea-Fi work?

As a self-custodial platform, Tea-Fi enables users to connect a wallet and access multi-chain DeFi tools without juggling native gas tokens, thanks to Easy-Gas. It is a gas abstraction layer that allows Tea-Fi to handle network fees on behalf of user. Meanwhile:

- Super Swap (Tea-Fi’s cross-chain router) handles swaps and transfers across networks.

- AI Copilot (an in-app assistant) analyzes routes and yields to suggest cheaper paths or better opportunities.

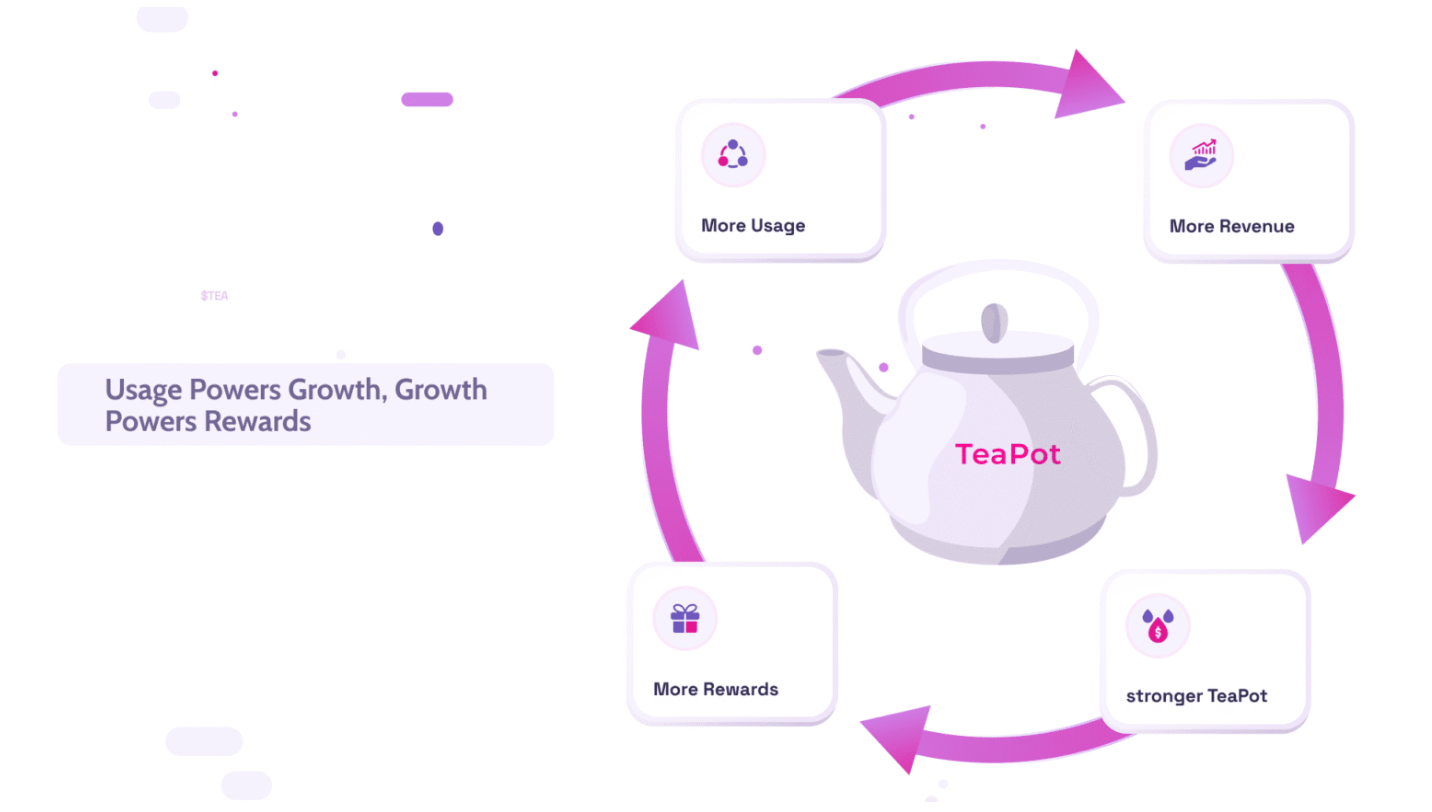

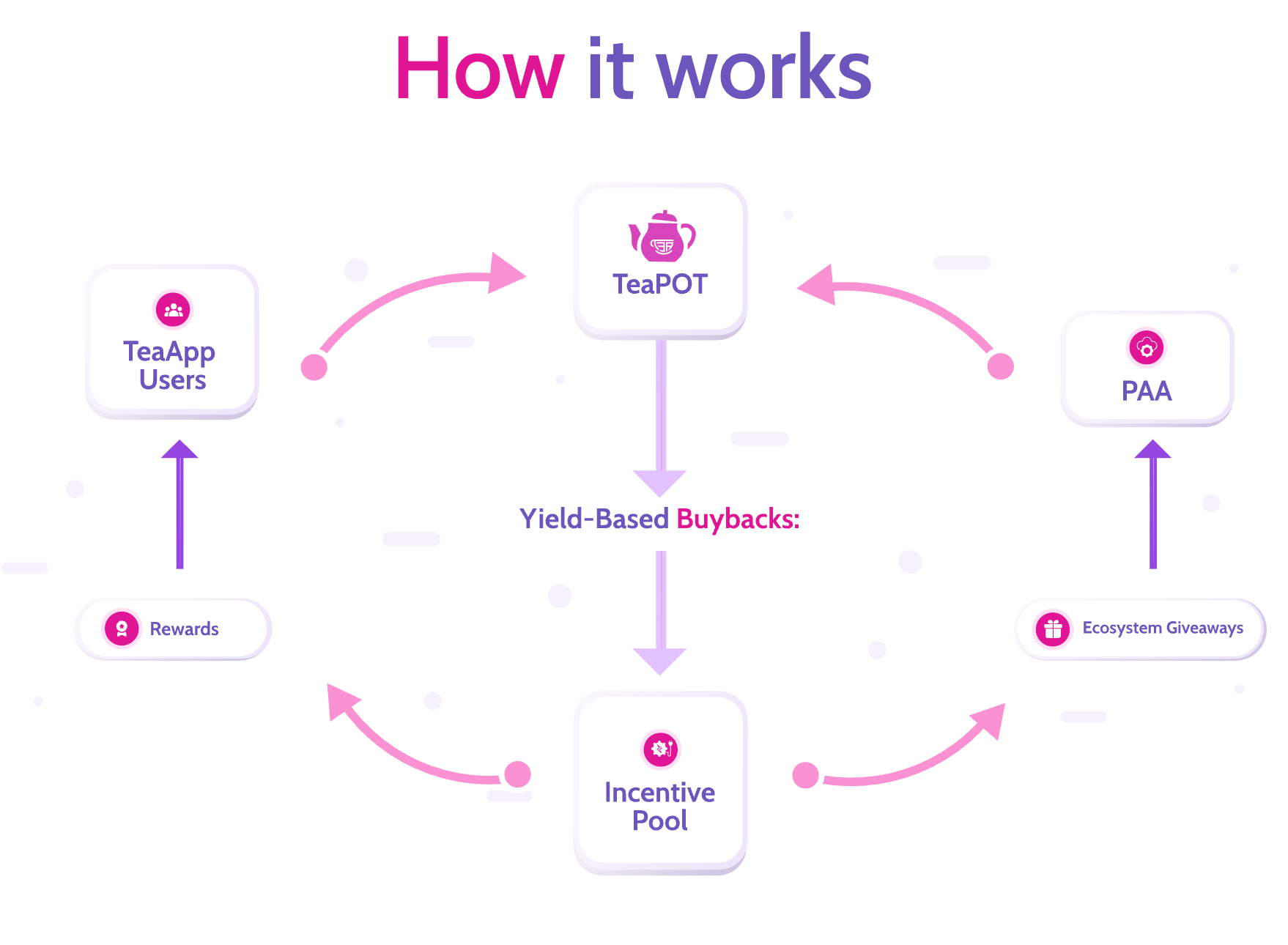

Tea-Fi uses a rewards-driven model to align usage with growth. A share of protocol fees flows into TeaPOT, the on-chain treasury. From this pool, Tea-Fi performs $TEA buybacks and schedules TeaDrops (periodic reward distributions, typically in $TEA).

Users who lock $TEA for veTEA (vote-escrowed TEA) gain voting power to steer where incentives go, especially toward Protocol-Aligned Applications (PAAs), which are third-party DeFi integrations that share a portion of their revenue back to the treasury.

The effect is a flywheel: activity funds the treasury, then treasury fuels user rewards, and rewards attract more activity.

On privacy, Tea-Fi positions itself as privacy-first by employing zero-knowledge (ZK) techniques. This reduces what an individual transaction reveals, while keeping the experience compliant and self-custodial. In practice, this should be understood as privacy-enhancing, not full anonymity, unless and until formal technical documentation proves otherwise.

So how does the system pay for itself?

Tea-Fi emphasizes revenue-funded rewards over constant new emissions. Fees from swaps and other features feed TeaPOT; buybacks and TeaDrops are then directed by veTEA governance toward users and PAAs that drive the most impact.

In short: usage finances rewards, and governance steers where those rewards go.

Tea-Fi’s Key Features

Inside the TeaApp, a Tea-Fi's application focuses on optimizing yield with simplicity, privacy, and multi-chain support:

- Yield aggregation: Stake synthetic assets (such as tETH, tBTC, and tSOL) to diversify beyond a single coin while keeping the flow in one place. When staking, users earn $TEA and loyalty bonuses that increase with continued participation, plus daily “Sugar Cubes” (the app’s reward units) for holding tAssets in staking.

- Dynamic staking rewards: Stake $TEA and users’ rewards are automatically scaled over time via loyalty bonuses. They also receive daily Sugar Cubes for staking $TEA. Unstaking is flexible with a short 14-day cooldown, offering a clearer path to exit than long lockups.

- Lending and Borrowing: Lend supported assets to earn consistent, flexible returns. For borrowing, Tea-Fi aims simplified access to liquidity without extensive collateral (i.e., reduced-collateral or credit-style options where available).

- Crypto Indices (developing): Follow sector-based, rules-driven baskets while keeping full custody of your assets. Users can track expert-curated performance and use the data to rebalance or diversify with minimal effort, aiming for more stable, long-term growth without handing over control.

- Tea-Fi Card (developing): Spend crypto like fiat via a Mastercard-powered debit experience, managed directly inside Tea-Fi for seamless control. Where supported, access over-collateralized credit for flexible purchasing power while on-chain portfolio keeps working.

$TEA Information

$TEA Key Metrics

Here is the information of $TEA

- Token Name: Tea-Fi

- Ticker: $TEA

- Token Type: Utility Token

- Total Supply: 300M $TEA

- Blockchain: TBA

- Contract address (CA): TBA

$TEA Use Case

$TEA powers the Tea-Fi ecosystem as a utility, governance, and growth token.

- Staking: Holders can lock $TEA to receive veTEA (vote-escrowed TEA). This unlocks staking rewards and loyalty-based boosts on eligible yields and distributions (such as scheduled TeaDrops).

- Fees & SuperApp access: $TEA can be spent for platform fees and to access features within the TeaApp, including cross-chain actions and yield tools. In some cases, active usage may unlock enhanced in-app benefits.

- Governance: veTEA confers voting power over how treasury rewards are allocated, which Protocol-Aligned Applications (PAAs) receive incentives, and the direction of future protocol improvements and upgrades.

Tea-Fi Tokenomics & Fundraising

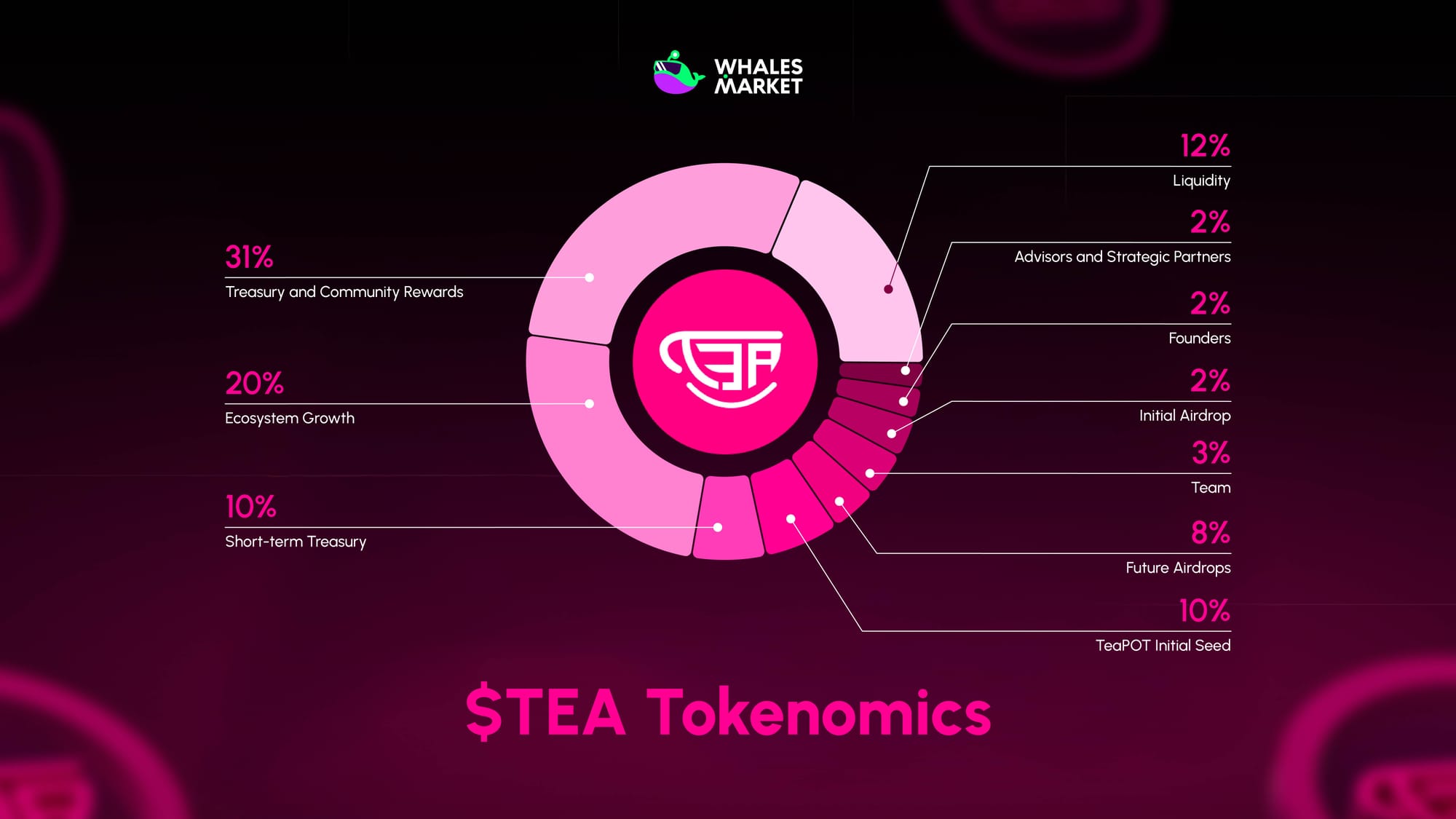

$TEA Tokenomics

- Total Supply: 300M $TEA

- $TEA allocation:

- Treasury and Community Rewards: 31%

- Ecosystem Growth: 20%

- Liquidity: 12%

- TeaPOT Initial Seed: 10%

- Short-term Treasury: 10%

- Future Airdrops: 8%

- Team: 3%

- Initial Airdrop: 2%

- Founders: 2%

- Advisors and Strategic Partners: 2%

Tea-Fi Fundraising

Tea-Fi has secured roughly $35 million in seed and strategic financing across two rounds (as of Oct 31, 2025), led by Rollman Management and Castrum Capital, implying a pre-money valuation of $44.17 million to accelerate platform development and privacy tech.

Tea-Fi Roadmap & Team

Roadmap

Q4 2025

- Launch: TEAccelerator - The official community-driven launchpad & incubator platform

- Introduction & Launch: Under-collateralized loans

- Introduction: Community-Driven Indices

- Launch: Tea.ID (TeaDomains V2.0)

Q1 2026

- Native versions for 32 different languages

- Launch: the TeaDAO

- Launch: Community-Driven Indices

- Deployment on 4 new networks

Team

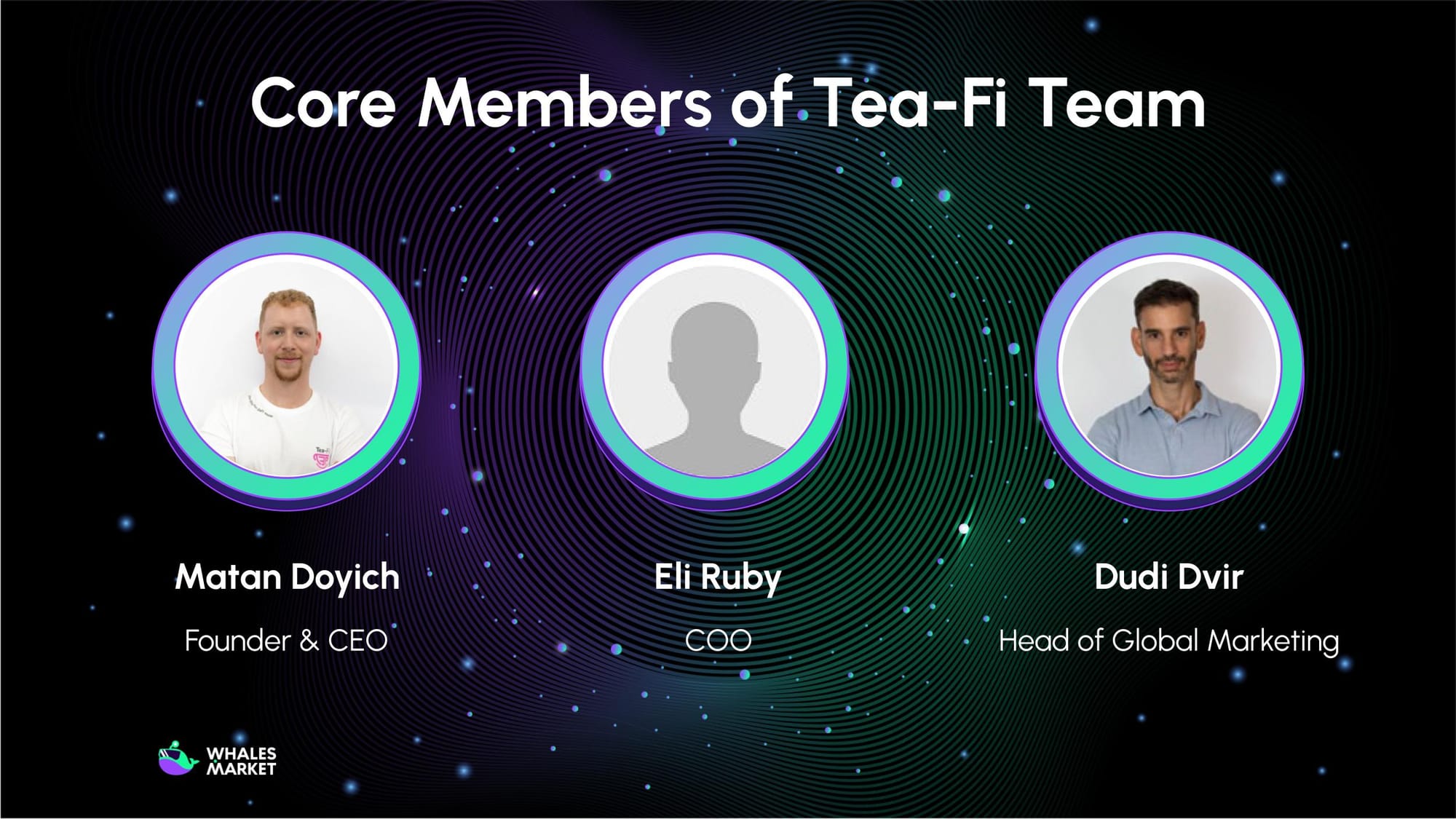

Tea-Fi's team blends DeFi expertise, privacy tech, and marketing pros, though details are somewhat limited publicly (common in early-stage crypto). Key members include:

- Matan Doyich - Founder & CEO: Leads product vision around privacy-enhanced DeFi and cross-chain UX. He has publicly discussed Tea-Fi’s ZK-driven approach and the plan to unify swaps, lending, and synthetic assets in one interface on industry podcasts.

- Eli Ruby - COO: Oversees day-to-day operations, partner execution, and go-to-market coordination.

- Dudi Dvir - Head of Global Marketing: Drives global growth, product marketing, and community programs; responsible for brand and launch strategy.

Conclusion

Tea-Fi looks like a serious build: a coherent incentives flywheel, revenue-funded distributions over pure emissions, and a product surface that ties gas abstraction, cross-chain execution, and guided yield into one flow. It’s still early but the direction and design choices suggest an expert team focused on shipping a practical, user-first DeFi experience.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Tea-Fi?

$TEA is Tea-Fi’s native utility and governance token. It powers staking (to mint veTEA), helps pay platform fees/features, and is used in rewards and governance.

2. Is $TEA a good investment?

There isn’t enough public operating history to judge. $TEA is an early-stage, high-risk asset whose outcome depends on product delivery, security/audits, liquidity at TGE, and real user adoption. Do your own research and never invest more than you can afford to lose.

No financial advice!

3. What is Tea-Fi ($TEA) pre-market price?

Currently, $TEA has been listed on Whales Market, the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

Track and trade $TEA early on Whales Market to capture opportunities and optimize returns!

4. What is the price of Tea-Fi ($TEA) today?

As of Oct 31, 2025, $TEA does not yet have an official market price yet. However, $TEA is tradable on Whales Market, the leading pre-market platform. Then you can track $TEA price and trade it on some centralized exchange when listing, including Kucoin, and Kraken.

5. How much has Tea-Fi ($TEA) raised?

As of October 31, 2025, Tea-Fi reported raising approximately $35 million across two rounds, with an indicated pre-money valuation of $44.17 million.