Symbiotic is a decentralized restaking project backed by some of the most recognized names in crypto investing and has raised over $34.8M. This strong investor confidence signals growing interest in restaking as a core pillar of blockchain security.

What is Symbiotic?

Symbiotic is a restaking platform developed by a founding team with close ties to the leading DeFi ecosystem, Lido. The project aims to unlock more value from staked ERC-20 assets, turning them into a source of security for validators who operate blockchain networks and decentralized protocols.

The main clients of Symbiotic are blockchain projects, developers, and companies that need validators to run their networks or decentralized applications (dApps) without having to spend significant resources building and maintaining their own validator infrastructure.

How Does Symbiotic Work?

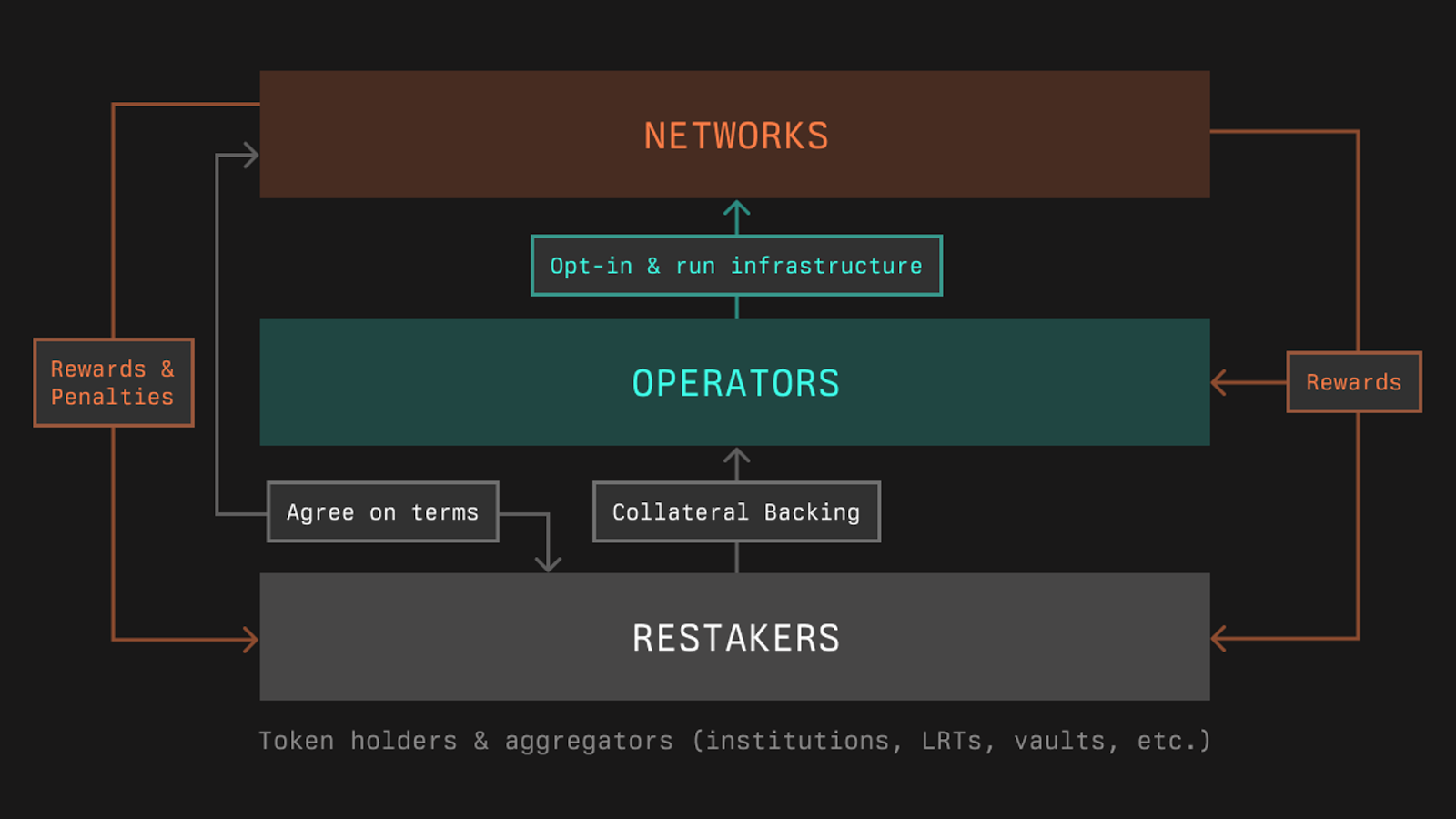

Symbiotic operates through three main layers:

- Stakers: These are entities that earn rewards by depositing their assets into vaults. They can be individual token holders, organizations, or liquid staking/restaking protocols. Stakers deposit funds into specialized smart contracts (vaults), which are managed by curators responsible for deciding how the assets are allocated.

- Networks: These are systems that require economic security to function safely, such as Layer 1 blockchains, Layer 2 solutions, or other decentralized infrastructures that rely on stake-based protection.

- Operators: These are professional entities that maintain the network infrastructure by running validators, nodes, or other essential systems. They receive allocated stake to perform their duties and are responsible for ensuring the network operates smoothly.

$SYMB Token Information

$SYMB Key Metrics

- Token Name: Symbiotic.

- Ticker: $SYMB.

- Type: Utility Token.

- Total Supply: TBA.

- Contract Address: TBA.

$SYMB Use Cases

- Staking in the system to earn real yield from fees, MEV, and multi-chain validation.

- Paying gas fees for staking and trading.

- Receiving community rewards through airdrops and incentive programs.Participating in governance voting.

$SYMB Listing Details

- Listing Date: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

$SYMB Tokenomics & Fundraising

Tokenomics

Total Supply: TBA

Allocation:

- Community: TBA

- Ecosystem Growth: TBA

- Seed Supporters: TBA

- Core Contributors: TBA

- Strategic Supporters: TBA

- Advisors: TBA

Fundraising

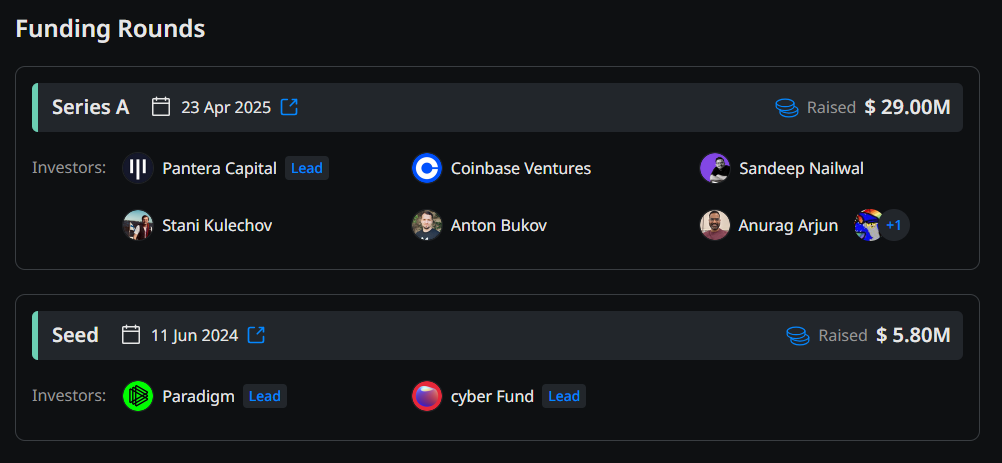

Symbiotic has raised $34.8M from investors such as Pantera Capital (lead of the $29M Series A round), Paradigm, Cyber Fund, Coinbase Ventures, Polygon.

Roadmap & Team

Roadmap

- 2023–2024: Formation, seed funding from Paradigm and Cyber Fund, testnet launch, and initial TVL growth.

- 2025: Mainnet launch on Ethereum (Jan 28), Series A fundraising (Apr), introduction of external rewards and token-based incentives (Aug), partnerships with Chainlink, Lombard, Ethena, and Avail. Achieved over $1.6B TVL and 100,000+ users.

- 2026+: Community governance, integration of more chains, and new products such as universal staking for AI and Bitcoin LSTs to drive broader adoption.

Team

- Misha Putiatin – Co-Founder & CEO

- Algys Ievlev – Co-Founder

Conclusion

Symbiotic is evolving toward a fully decentralized restaking layer, aiming to secure multiple ecosystems and power the next wave of shared blockchain security.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What is the current price of $SYMB?

$SYMB has not been fully launched yet. After launch, it may appear on major CEXs such as Binance, Bybit, or OKX.

Q2. What makes Symbiotic unique?

The protocol combines real yield, decentralized restaking, and smooth onboarding without complicated wallet setup or high gas fees, just straightforward connections and participation.

Q3. What are the use cases of $SYMB?

$SYMB is used for staking, governance, gas payments, and community rewards across the Symbiotic ecosystem.

Q4. How does Symbiotic differ from other restaking platforms like EigenLayer?

Symbiotic takes a more modular and open approach, allowing multiple networks such as appchains and rollups to access shared security through customizable vaults.

Q5. What risks come with using Symbiotic’s restaking system?

Main risks include smart contract issues, market changes, and potential slashing. The team works on audits and gradual rollout to reduce these risks.