As decentralized finance continues to evolve, the need for a unified, user-centric platform that bridges traditional banking functionality with onchain efficiency has never been greater. Superform emerges as the first user-owned neobank, redefining how individuals interact with their digital assets. So what is Superform? Let’s dive into this article.

What is Superform?

Superform is the onchain wealth app. Users could use SuperVaults to automatically optimize their earnings, or build customized portfolio by directly depositing into over 800 earning opportunities.

In Superform, anyone can save, swap, send, and earn onchain while keeping full control of their assets.

Key Features of Superform

- Single-transaction access: Superform enables users to deposit into multiple vaults, even across different chains within a single transaction. This design streamlines the yield access process, minimizing gas fees and operational friction while offering a truly one-click experience.

- Cross-chain functionality: The platform supports both same-chain and cross-chain deposits and withdrawals. By abstracting away the complexity of bridging, Superform makes cross-chain yield strategies seamless, secure, and natively integrated into its architecture.

- Aggregated protocol access: Superform integrates with multiple DeFi protocols to create a unified yield layer. Instead of navigating across fragmented ecosystems, users can access, compare, and deploy capital into diverse vaults from one interface unlocking efficient and borderless yield aggregation.

Superform Technology

Smart Accounts

Superform routes every user interaction through lightweight ERC-7579 Smart Accounts, which introduce features such as gas abstraction, passkey or social-recovery authentication, and session key management, while maintaining full self-custody. All accounts generated via Superform currently operate on Biconomy Nexus v1.2.0.

Hooks

Hooks are lightweight, permissionless smart contracts designed to execute specific actions such as bridging, swapping, or lending. They are inherently composable, allowing multiple hooks to be chained together to construct complex transaction flows capable of executing any multichain strategy. These hook chains can be executed by any ERC-7579 Smart Account equipped with the SuperValidator and SuperExecutor modules.

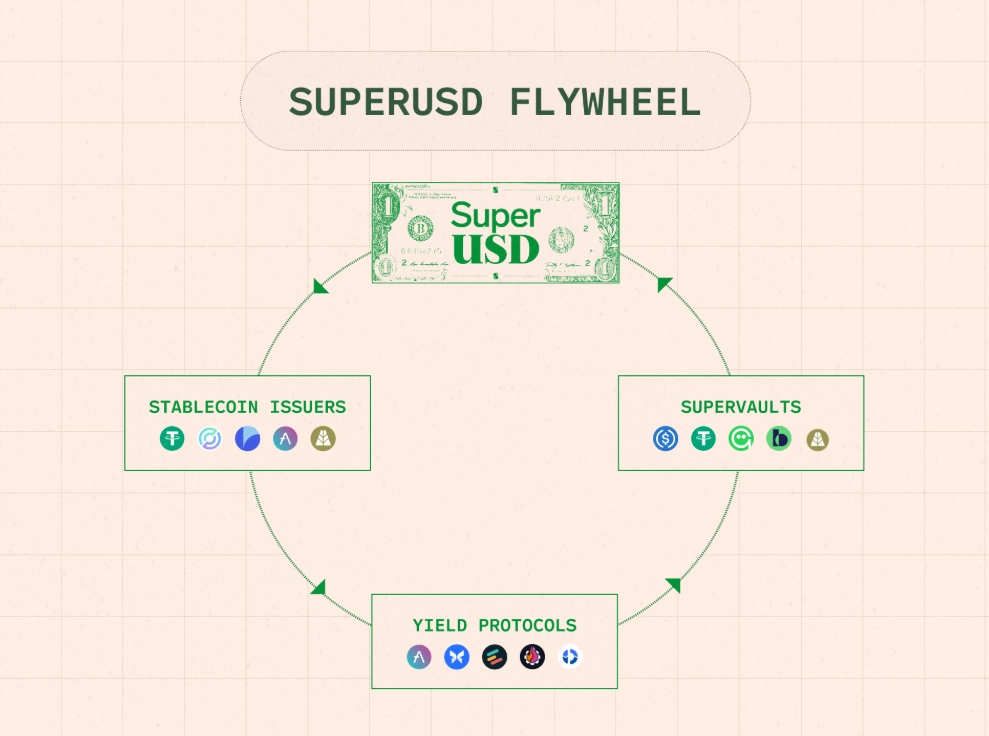

SuperVaults

SuperVaults are flexible and secure vault primitives designed to scale by leveraging the core infrastructure provided by Superform. In addition to standard vault product features—such as simplified access through a unified interface, non-custodial management, and the composability and transparency inherent to onchain systems—SuperVaults introduce several advanced capabilities:

- Permissionless Vault Creation: Any user can deploy a new vault using Hooks, set custom fees, and receive validator support by covering upkeep costs.

- Infinitely Flexible Execution: SuperVaults validate and execute arbitrary Hooks generated within Superform Core using Merkle proofs, enabling actions such as depositing, staking, bridging, looping, and other verified operations.

- Security through Dual Merkle Validation: The protocol employs two distinct Merkle trees for hook validation—a global root, governed for protocol-wide approval, and a strategy root, managed by strategists for vault-specific logic.

- Fee Management: Vaults can implement both management and performance fees, fully configurable by the strategist, with all updates secured through a time-lock mechanism.

- Automated Emergency Controls: Built-in circuit breakers enable emergency withdrawals and pause functionality, providing robust safety mechanisms against unexpected system events.

$UP Token Information

$UP Key Metrics

Here is the information of $UP

- Token Name: Superform

- Ticker: $UP

- Token Type: TBA

- Total Supply: 1B $UP

- Contract address (CA): 0x1d926bbe67425c9f507b9a0e8030eedc7880bf33

$UP Use Case

- Governance: Staking $UP to receive sUP, granting voting rights on SuperVaults parameters, SuperAsset weights, and economic configuration.

- Incentives: Used to reward active user participation and ecosystem expansion campaigns.

- Protocol fees: A portion of SuperVaults fees can be distributed to sUP holders.

$UP Listing

Here are important details revealed to $UP:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

Superform Tokenomics & Fundraising

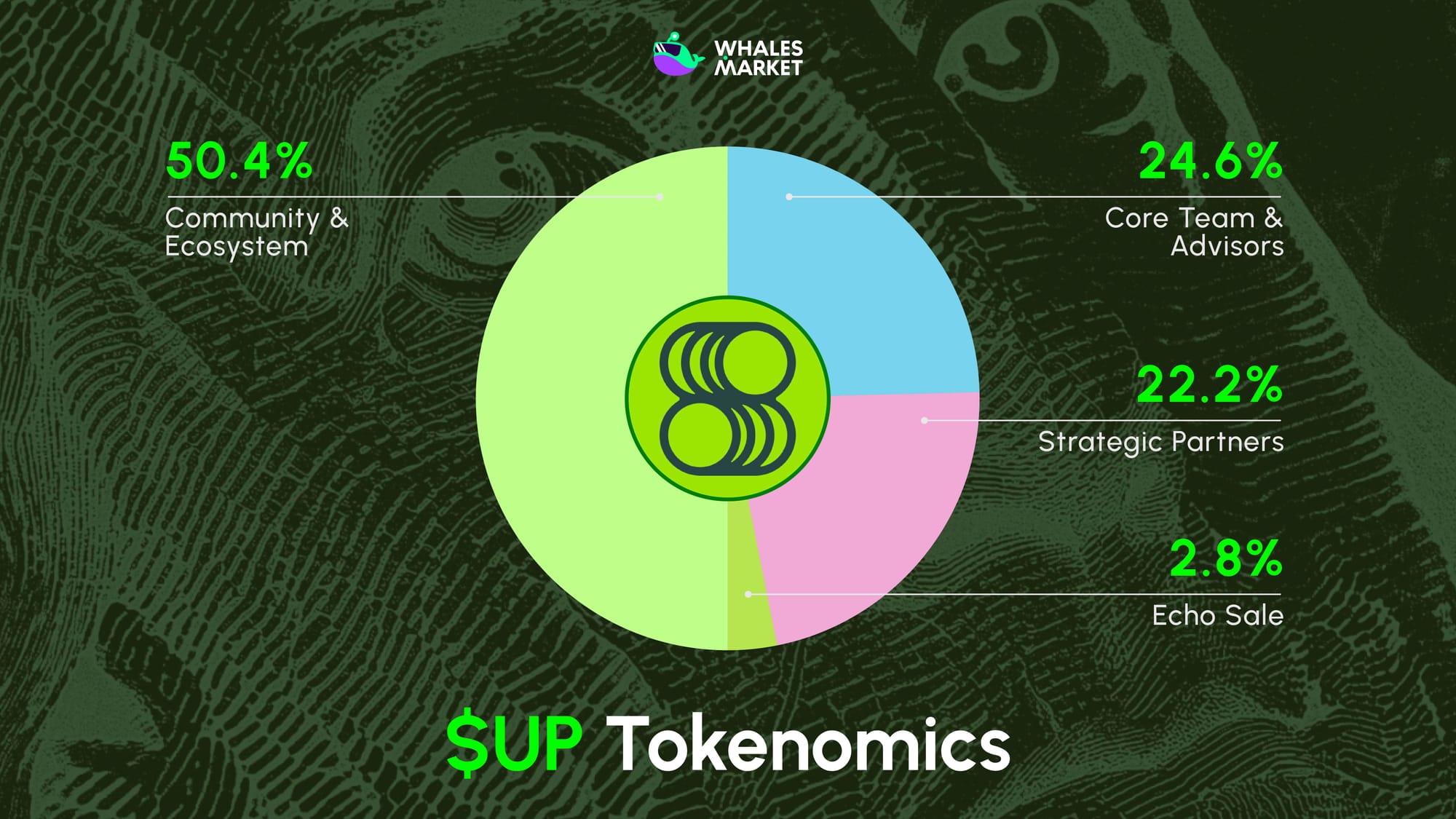

Tokenomics

- Total Supply: 1B $UP

- $UP Allocation:

- Community & Ecosystem: 50.4%

- Core Team & Advisors: 24.6%

- Strategic Partners: 22.2%

- Echo Sale: 2.8%

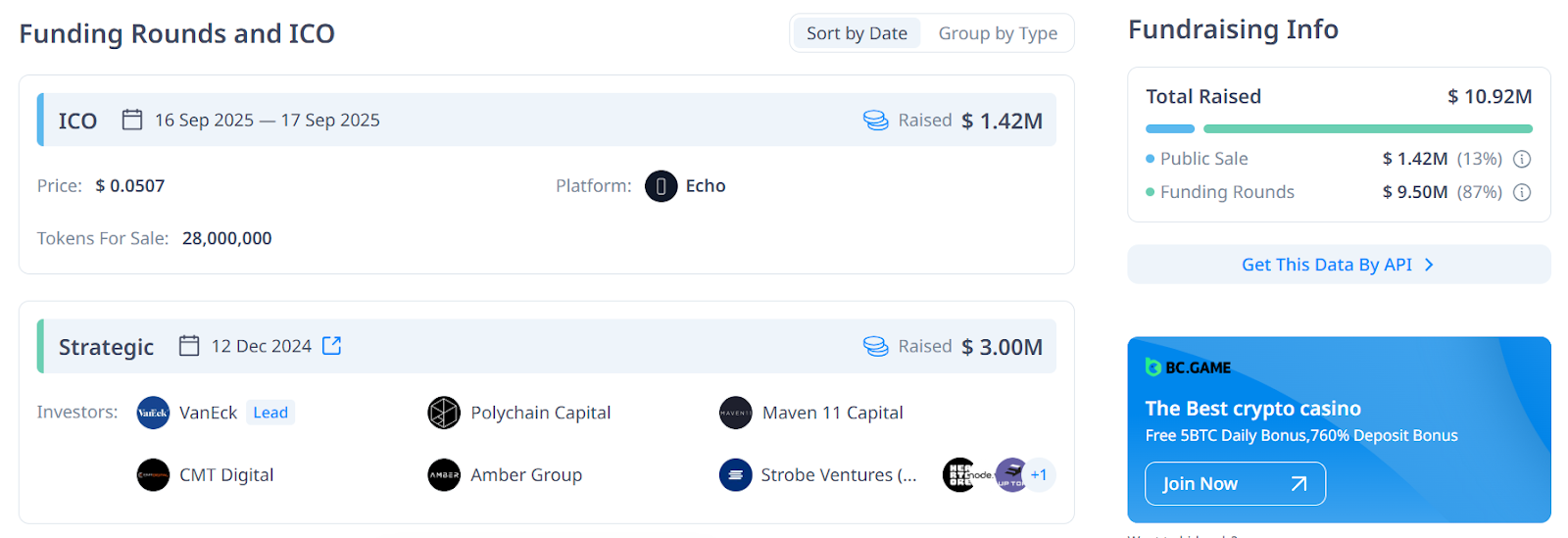

Fundraising

Superform has raised successfully total of $10.92M across the funding rounds, led by VanEck. In addition, Superform launched the Public Sale on Echo with $0.05 per token.

Superform Roadmap & Team

Roadmap

Currently, Superform has not announced any official roadmap for the project. Whales Market will update immediately when the official Superform website announces.

Team

Currently, Superform has not announced any official team for the project. Whales Market will update immediately when the official Superform website announces.

Conclusion

Superform is building the foundation for a next-generation decentralized banking experience, where users retain full control of their assets while accessing advanced DeFi strategies across multiple chains. Through its modular architecture that featuring Smart Accounts, Hooks, and SuperVaults, Superform delivers both flexibility and security without compromising usability.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Superform?

The native token of Superform is $UP, used to facilitate coordination across the ecosystem.

2. What is Superform ($UP) pre-market price?

Currently, $UP is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of Superform ($UP) today?

While Superform ($UP) hasn't been listed yet, users can trade $UP pre-market on Whales Market before the TGE. Here you can trade $UP before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. What is Superform?

Superform is the first user-owned neobank. Anyone can save, swap, send, and earn onchain while keeping full control of their assets.

5. How much has Superform ($UP) raised?

Superform has raised successfully total of $10.92M across the funding rounds, led by Vaneck. In addition, Superform launched the Public Sale on Echo with $0.05 per token.

6. What is $UP allocation?

The $UP token is distributed as follows: 50.4% to the Community and Ecosystem, 24.6% to the Core Team and Advisors, 22.2% to Strategic Partners, and 2.8% to the Echo Sale.