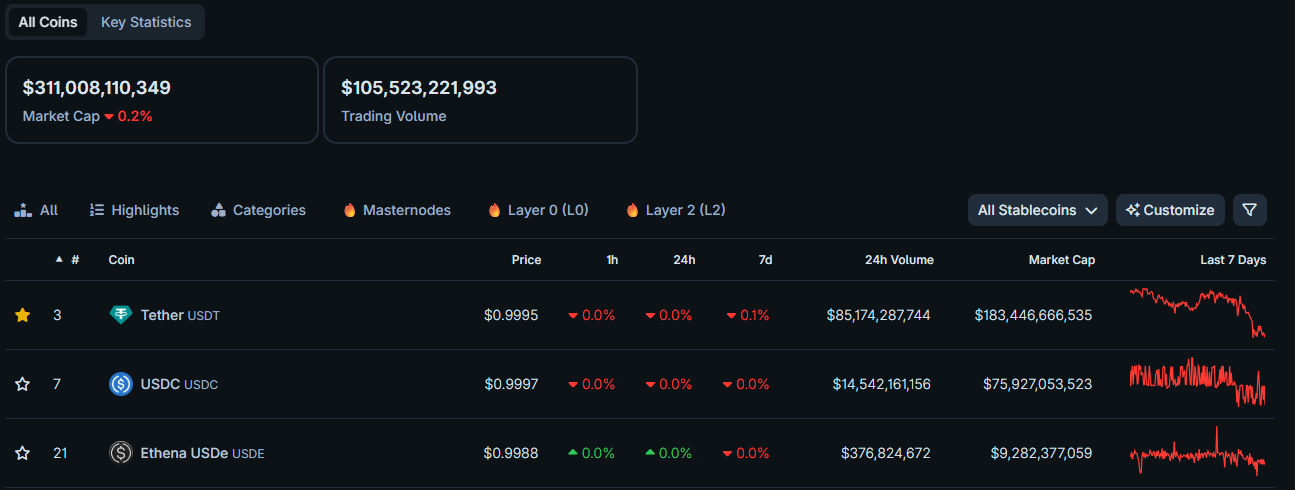

Numbers don’t lie, over $300B now sits in stablecoins, reshaping how money moves across the world. What began as a crypto side tool has quietly evolved into the backbone of digital finance. From instant global payments to AI-driven transactions, stablecoins are rewriting the rules. And now, a new chapter begins: the rise of Stablecoin Chain.

What is Stablecoin Chain?

Stablecoin Chain is Layer 1 blockchains built specifically for stablecoin operations. Unlike general-purpose blockchains, these networks are optimized for fast, cheap, and predictable payment flows. They enable users to pay gas fees directly in stablecoins such as USDT or USDC, simplifying the experience and eliminating the need for volatile native tokens.

Stablecoin Chain focus on:

- Faster settlement

- Lower and more stable fees

- High throughput for payment-heavy activity

- User-friendly design centered around stablecoins

This makes them fundamentally different from chains like Ethereum or Solana, which are multi-purpose and not optimized solely for payment workflows.

Why Stablecoin Chain Are Becoming the Next Big Trend

All these developments reveal a clear opportunity, but traditional blockchains like Ethereum and Solana weren’t built specifically for payments. High gas fees and network congestion limit how far stablecoins can go as a true medium of exchange.

Key drivers behind the trend:

- Changing Money Movement: Cross-border transfers that once took days now settle within seconds, available 24/7 without intermediaries.

- Explosive Growth: Stablecoin capitalization has already exceeded $300B, and experts project it could reach $2T by 2028.

- Business Efficiency: Around 48% of companies now prioritize speed of payment over lower fees, cash flow efficiency is key.

- Friendly Regulations: Policies like the GENIUS Act (U.S.) and MiCA (EU) are making stablecoins legally recognized and ready for mainstream adoption.

- AI Integration: With AI automating stablecoin transactions, digital economies can run nonstop, without human involvement.

With stronger regulations, better infrastructure, and increasing global demand for instant money movement, Stablecoin Chain are poised to become the backbone of the digital financial era.

So, which projects are leading this transformation and setting the new standard for stablecoin payments? Let’s explore the Top Stablecoin Chain below.

Stablecoin Chain Watchlist

Stable

Stable is a Layer 1 blockchain built exclusively for USDT transfers. Users can send USDT without paying any gas fees, whether it’s a small transaction or a large one, transfers remain fast and seamless.

Why it matters:

- Strong Backers: Raised $28M from investors including Tether, Bitfinex, and Hack VC, with support from major funds like Franklin Templeton, Castle Island Ventures, and Mirana Ventures.

- Stable Pay Wallet: The app enables instant, low-cost transfers and links directly to debit and credit cards.

- Massive Pre-Deposit Phase: In Phase 1 alone, over $824M in deposits were made, a clear sign of strong user interest.

Read more: How to get Stable Airdrop?

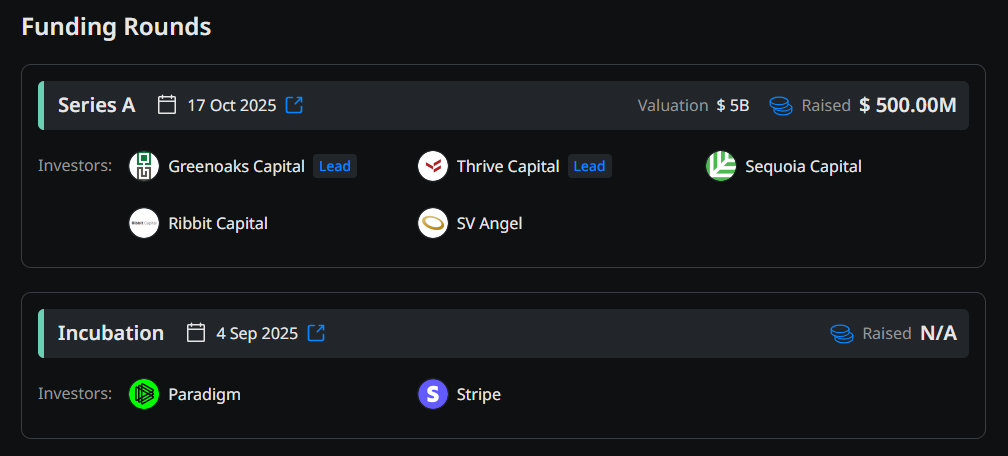

Tempo

Tempo is a Layer 1 blockchain designed for stablecoin payments, developed by Stripe and Paradigm. It can process over 100,000 transactions per second, with sub-second finality and flat transaction fees, making stablecoin transfers fast and predictable.

Why it’s worth attention:

- Powerful Investors: Backed by Stripe and Paradigm, and raised $500M in Series A at a $5B valuation, led by Thrive Capital and Greenoaks, with participation from OpenAI, Visa, Shopify, Deutsche Bank, Revolut, and LayerZero.

- Advanced Technology: Features an AMM-based gas system supporting multiple stablecoins and direct connections to traditional finance systems. Tempo enables global remittances, micro-payments, and even AI-driven automated transactions.

- Exceptional Performance: With 100K TPS and <1 second confirmation, Tempo aims to become the leading infrastructure for global stablecoin payments.

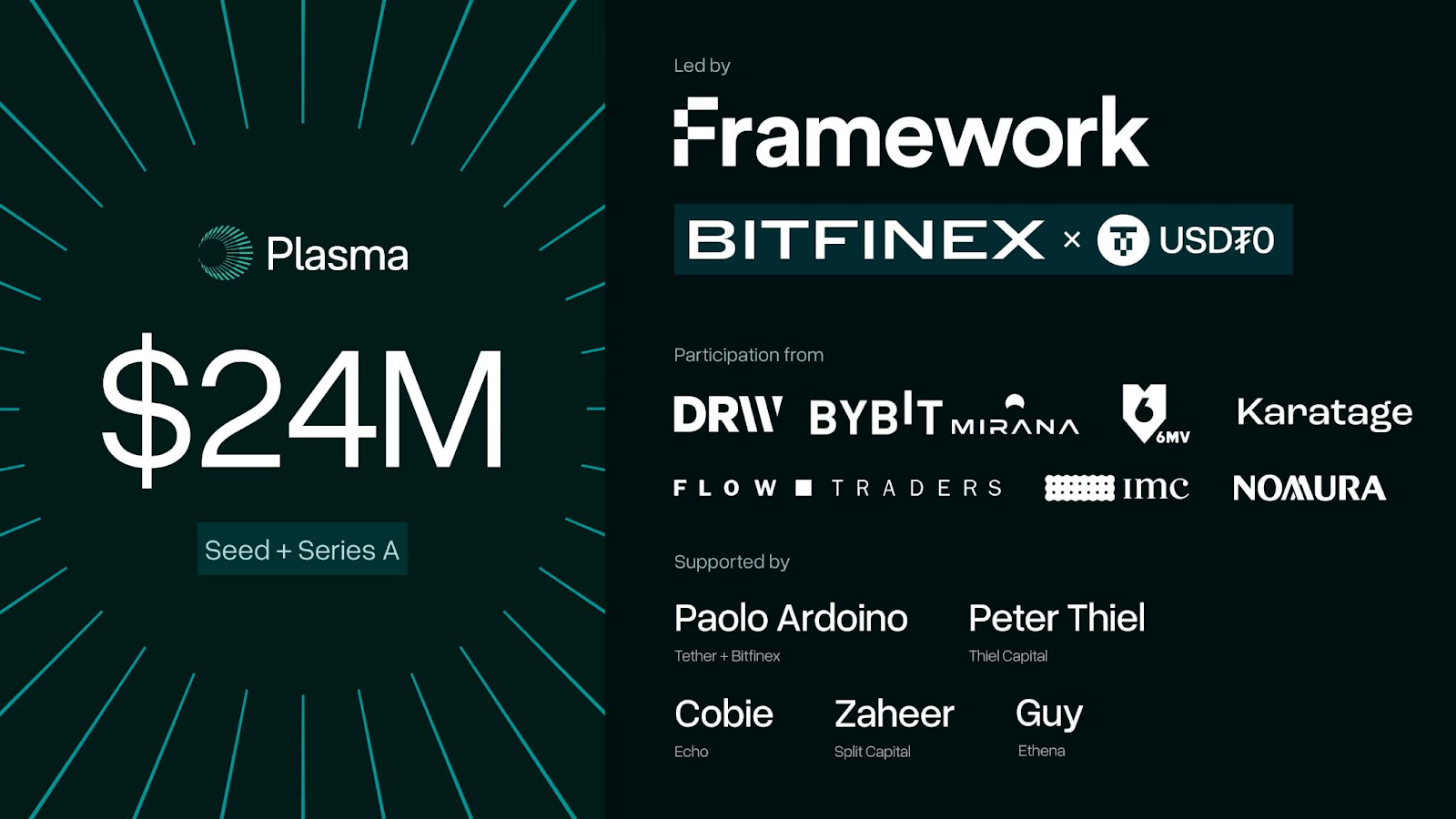

Plasma

Plasma is a Bitcoin-based Layer 1 optimized for stablecoin payments, fully EVM-compatible, and built for speed, low fees, and global payments.

Key highlights:

- Strong Funding: Raised $74M from Framework Ventures, Bitfinex, and Tether. Peter Thiel (PayPal Co-Founder) also invested.

- Massive Community FOMO: Over $50M was raised through an IDO on Echo, with an average ~$10,000 per participant, one of the most talked-about launches of 2025.

- High Performance: After mainnet launch on Sept 25, 2025, over $2B in stablecoins were deposited, boosting liquidity for major DeFi protocols like Aave, Ethena, Fluid, and Euler. The native token XPL quickly entered the top 100 by market cap.

Arc

Arc is a Layer 1 blockchain developed by Circle, the company behind USDC, the world’s second-largest stablecoin. It uses USDC as the native gas token and aims to power the financial internet, enabling payments, FX, lending, and asset issuance directly on-chain.

More than 100 global institutions including BlackRock, HSBC, Visa, Mastercard, Coinbase, AWS, and Anthropic are collaborating on its testing phase. Although Circle hasn’t disclosed Arc’s funding details, it benefits from Circle’s multibillion-dollar financial base and global partner network.

Arc’s native gas is USDC.

— Arc (@arc) August 14, 2025

Arc’s gas fees are low and dollar-denominated. This enables predictable, cost-effective transactions without crypto volatility, whether you’re sending $1 or $1B. pic.twitter.com/EQTS3838cF

Conclusion

Over $100B in stablecoin transactions flow daily through both CEX and DEX platforms, proving real and growing demand. Stablecoins continue to expand rapidly, despite the limitations of traditional blockchains.

To truly compete with legacy payment systems, Stablecoin Chain must stay true to their core promise: fast, cheap, and easy-to-use transactions. The race is still young, but the early results show just how powerful stablecoins can be in everyday finance.

FAQs

Q1. What makes Stablecoin Chain different from regular blockchains?

They are designed specifically for stablecoins, enabling faster payments, lower fees, and the use of stablecoins as gas instead of ETH or SOL.

Q2. Which companies are leading the Stablecoin Chain trend?

Stripe, Circle, Tether, and Bitfinex are key players developing blockchain networks dedicated to stablecoin transactions.

Q3. How can users trade Stablecoin Chain project tokens before official listings?

Users can buy or sell Stablecoin Chain tokens pre-TGE on Whales Market by creating or matching orders with collateral-based mechanisms.

Q4. What’s the future outlook for Stablecoin Chain?

Stablecoin Chain are expected to become core infrastructure for global payments, supporting cross-border capital flow and a 24/7 digital economy.