The total market capitalization of stablecoins increased more than 1.5x in 2025, from $206B to approximately $310B by the end of the year. This asset class is also discussed extensively in regulatory drafts related to the crypto market.

So what is stablecoin and what role does it play in the crypto market?

What is Stablecoin?

Stablecoin is a class of crypto assets designed to maintain price stability in the crypto market, which is known for its volatile nature. Instead of allowing prices to be determined purely by supply and demand like traditional cryptocurrencies, stablecoins are typically pegged to stable assets such as fiat currencies, physical commodities like gold and silver, or even other digital assets.

By limiting the impact of volatility, stablecoins create a stable and reliable foundation, playing a key role in expanding real world use cases and accelerating the large-scale adoption of cryptocurrencies.

Why were stablecoins created?

Stablecoins emerged from the inherent limitations of the early crypto market. Most crypto assets such as Bitcoin (BTC) and Ethereum (ETH) exhibit very high volatility, with prices capable of rising or falling sharply within short periods and trading continuously 24/7.

This volatility creates challenges for users in storing value, making payments, and managing risk, while also introducing inconvenience during transactions and daily usage.

In this context, stablecoins were designed to address price instability by maintaining stable value, typically pegged to the USD or other traditional assets. The goal of stablecoins is to create a crypto asset that inherits the advantages of blockchain such as speed, low cost, and transparency, while retaining the stability of fiat currencies.

As a result, stablecoins have become a bridge between traditional finance and the crypto ecosystem, enabling more efficient market operations and broader real world applications.

Purpose of Stablecoins

After more than 10 years of development, the role of stablecoins has become important to the market:

- Becoming a stable store of value: Stablecoins help users preserve asset value during periods of high market volatility. Instead of converting back to fiat, investors can quickly move into stablecoins as a safe haven, avoiding depreciation while keeping assets within the blockchain ecosystem.

- A key bridge between traditional finance and crypto: Stablecoins act as intermediaries connecting two financial systems. Through stablecoins, users can convert flexibly between fiat and digital assets, bringing capital from traditional banking into the crypto market.

- Driving crypto toward mainstream adoption: With stability and ease of use, stablecoins make crypto more accessible to retail users, businesses, and financial institutions. Stablecoins expand real world use cases such as payments, remittances, and e-commerce, pushing crypto closer to broad acceptance in the global economy.

- The backbone of DeFi (decentralized finance): Stablecoins are the base assets in most DeFi protocols including lending, borrowing, trading, and liquidity provision. By reducing volatility risk, stablecoins enable decentralized financial products to operate stably and attract increasing user participation.

- Standard unit of pricing: Most trading pairs on exchanges are denominated in stablecoins, allowing users to compare prices, calculate profits, and manage portfolios easily. Stablecoins are becoming the standard unit of account in the crypto market.

- Payments: With fast settlement, low fees, and no reliance on intermediaries, stablecoins are increasingly used for cross border transfers and international payments, especially in countries with underdeveloped financial systems.

What is Stablecoin’s Key Features?

It is not coincidental that stablecoins have become the backbone asset class of the crypto ecosystem. In a highly volatile market, stablecoins combine essential characteristics that maintain stability and ensure smooth system operations.

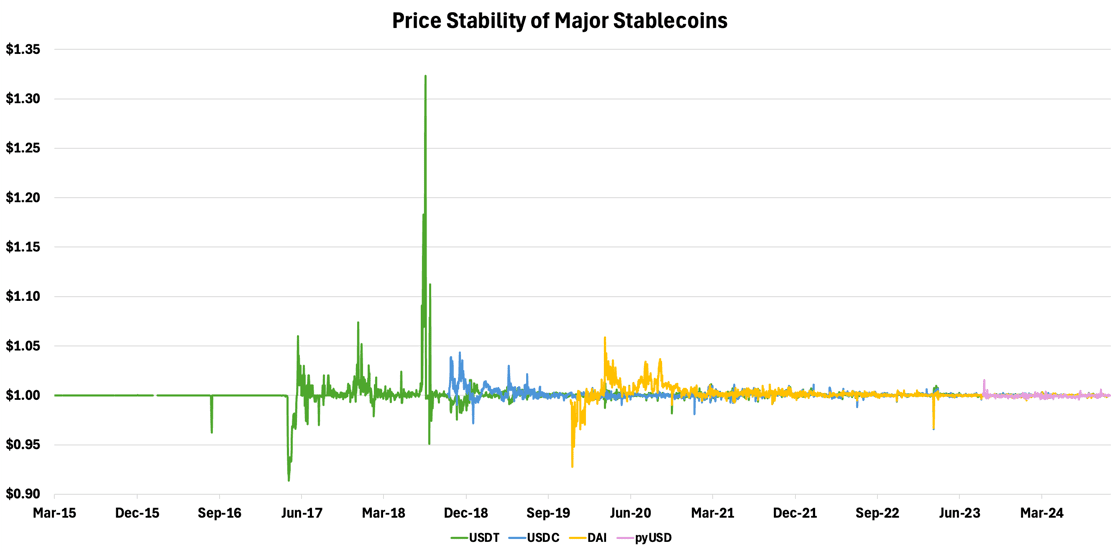

- Price stability: The most important characteristic of stablecoins is their ability to maintain stable value over long periods. Most stablecoins are pegged to the USD or other traditional assets, minimizing price fluctuations.

- Backed by collateral: Stablecoins are typically backed by fiat reserves, reserve assets, or operated through algorithms to maintain fixed exchange rates. This mechanism allows stablecoins to track target value closely and build user confidence.

- High liquidity: Stablecoins are widely traded on most crypto exchanges and serve as intermediary assets in most trading pairs. This enables fast conversions, easy trading, and low transaction costs.

- Ease of use and integration: Stablecoins can be used flexibly across trading, asset storage, payments, remittances, and dApp (decentralized application).

Stablecoin Examples & Classification

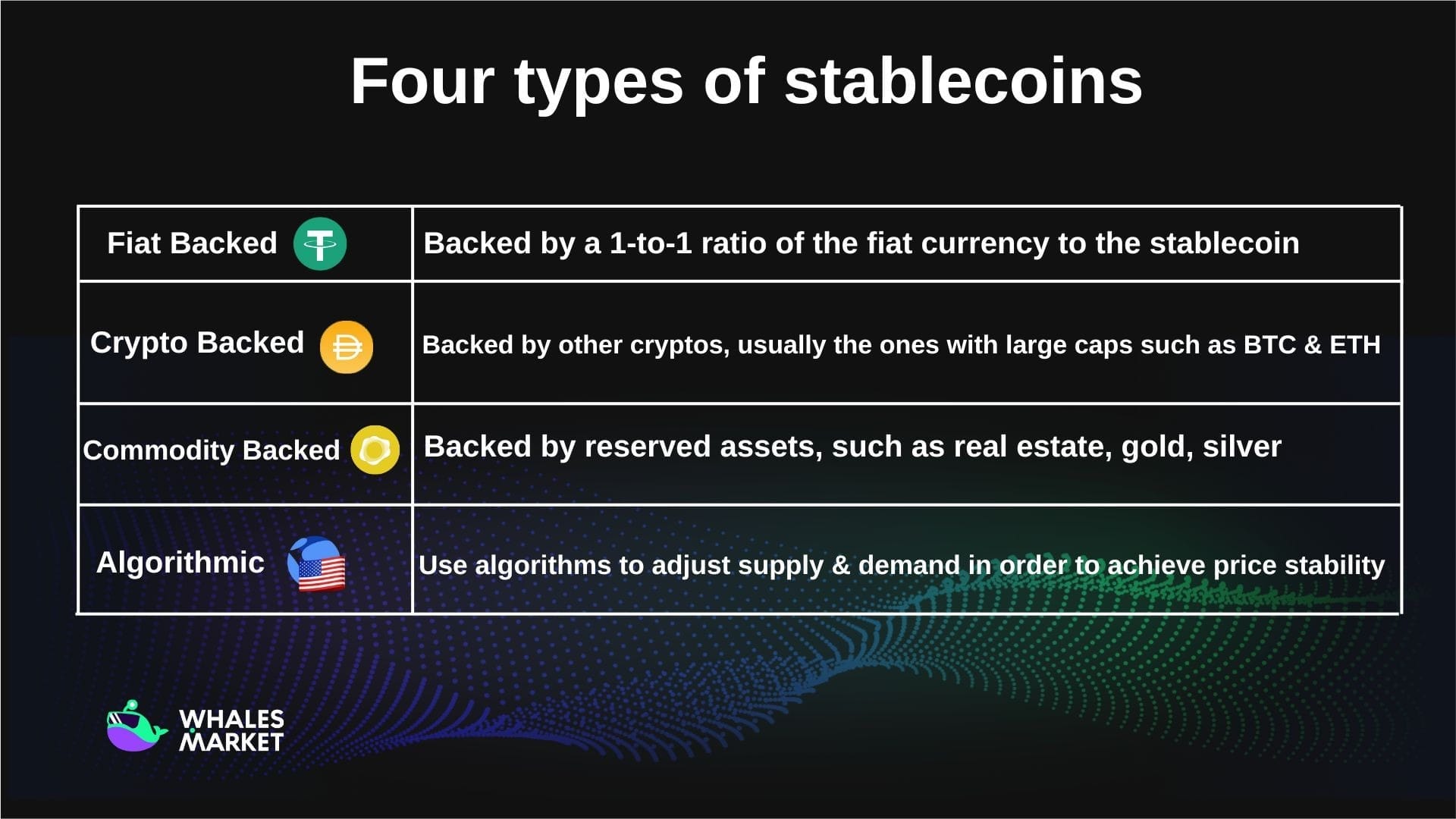

Based on collateral mechanisms and stability models, stablecoins can be divided into four main categories. Each type has distinct characteristics, advantages, and risks suitable for different purposes within the crypto ecosystem.

Fiat-backed Stablecoin

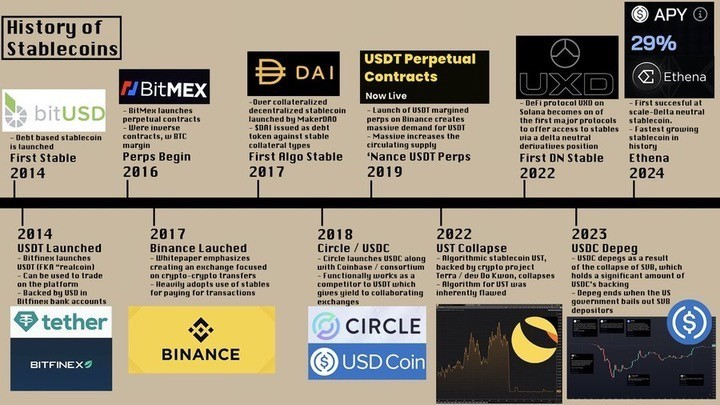

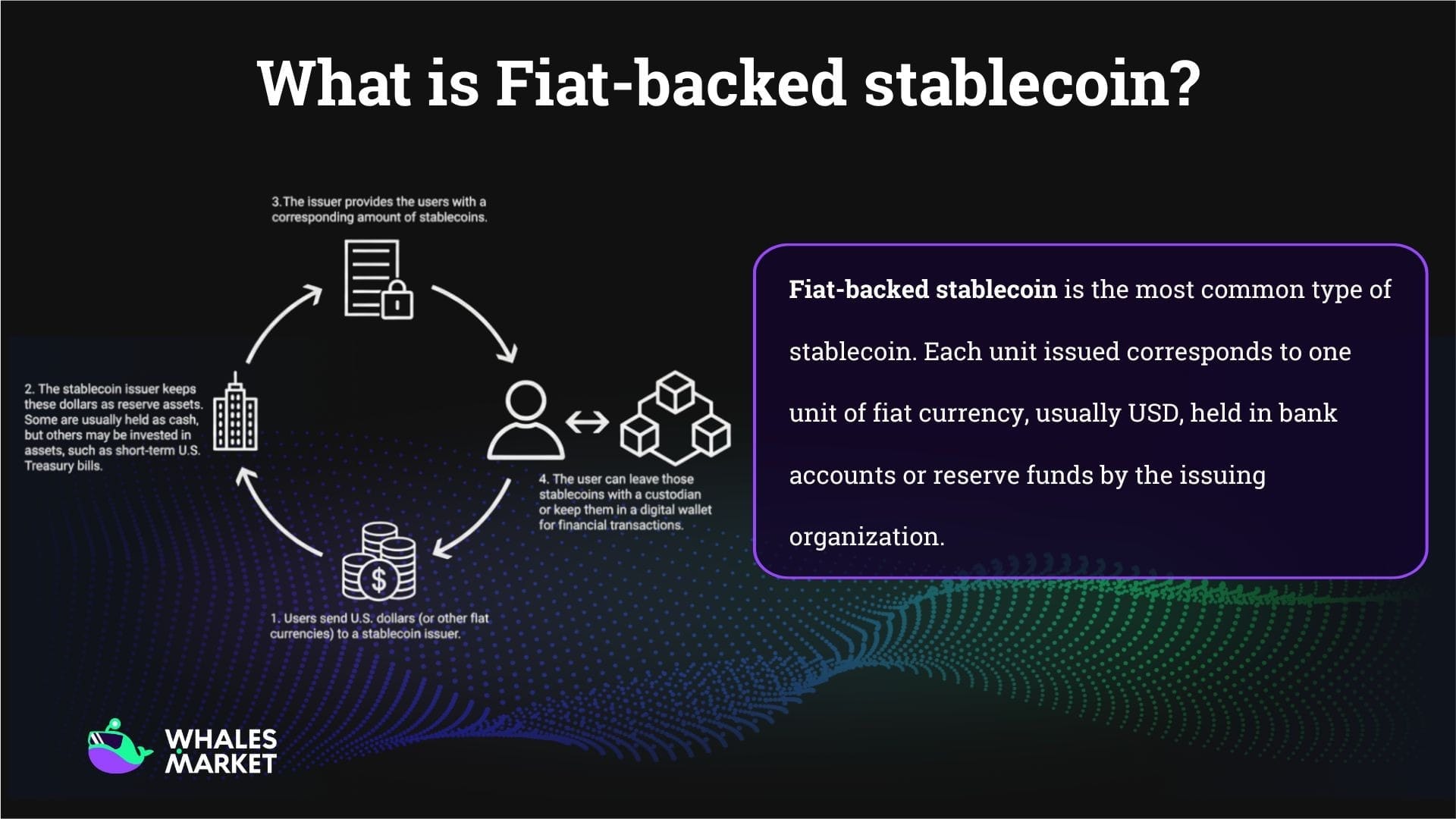

Fiat-backed stablecoin is the most common type of stablecoin. Each unit issued corresponds to one unit of fiat currency, usually USD, held in bank accounts or reserve funds by the issuing organization.

Example: When users exchange $1 for 1 USDT, they mint USDT on-chain and deposit $1 into Tether’s reserve.

Key characteristics:

- Stable value pegged 1:1 to fiat

- Easy to understand and use for beginners, with 1:1 conversion

- High liquidity and broad exchange acceptance

- USDT from Tether and USDC from Circle are the most popular examples.

However, fiat backed stablecoins depend heavily on issuers and the traditional banking system. Users must trust project disclosures and reserve audits.

Example: If USDT market capitalization is $200B, Tether must hold $200B in cash reserves to back all USDT on-chain.

In practice, in 2021, according to Reuters, Tether and Bitfinex were fined $18.5M by the New York Attorney General for concealing reserve shortfalls and using USDT reserves to cover Bitfinex losses. Tether did not admit wrongdoing but was required to publish reserve compositions regularly and exit the New York market.

Crypto-backed Stablecoin

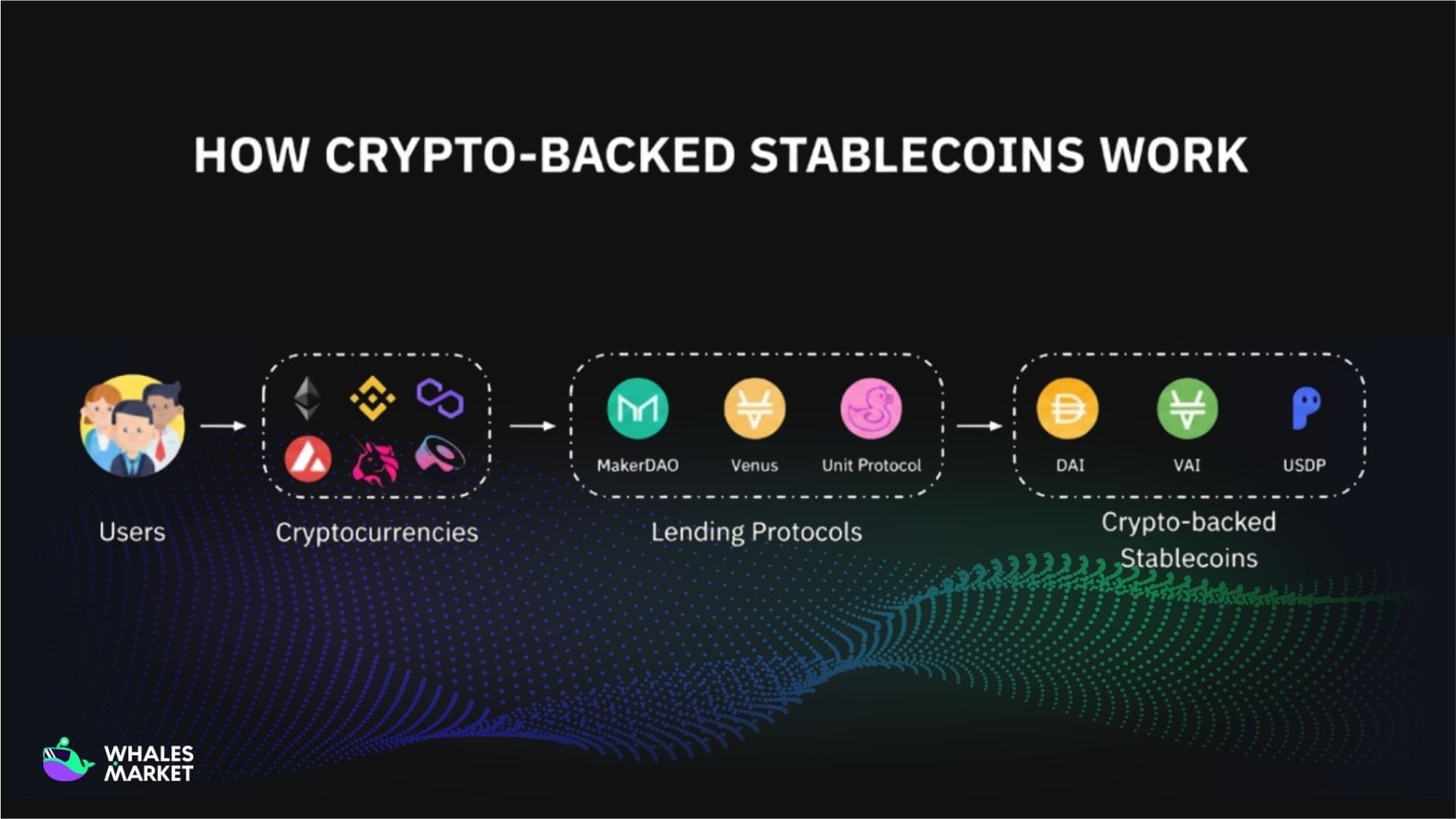

Crypto-backed stablecoins are backed by other crypto assets rather than fiat. Due to crypto volatility, systems require over collateralization, meaning users must lock assets worth more than the stablecoins issued.

Example: DAI from MakerDAO (now Sky, a non-custodial stablecoin protocol built on Ethereum) is backed by ETH, USDC, and other crypto assets. To borrow 100 DAI, users typically lock $150 to $170 worth of crypto. If collateral value falls below safety thresholds, positions are liquidated automatically.

Key characteristics of crypto-backed stablecoins:

- High decentralization: Crypto-backed stablecoins do not rely on banks or traditional custodial institutions. The entire process of issuance, collateralization, and liquidation is executed automatically through smart contracts.

- Fully on-chain operation: Users can directly lock assets, mint stablecoins, repay positions, and withdraw collateral without intermediaries, improving transparency and asset control.

- Transparency and public verifiability: All collateral assets and system states are recorded on the blockchain, allowing anyone to monitor and verify them.

Limitations:

- Liquidation risk: When collateral prices decline rapidly, the system automatically liquidates positions to maintain safety ratios, which may cause users to lose their collateral if they fail to add margin in time.

- High capital requirements: To issue $100 in stablecoins, users typically must lock 150%-200% worth of collateral (i.e., $150–$200 in assets), reducing capital efficiency. For example, to mint $100 DAI, user may need to deposit $150 worth of ETH as collateral.

- Complex mechanisms: Compared to fiat-backed stablecoins, crypto-backed stablecoins are harder for new users to access. It requires users to have knowledge about smart contracts, collateral ratios, interest rates, and liquidation risks.

- DeFi risk: Because all operations are executed through smart contracts, any technical failures, attacks, or bugs in these contracts can directly affect the stablecoin. In the worst case, the stablecoin may lose its ability to maintain price stability, a situation known as depeg.

Commodity-backed Stablecoin

Commodity backed stablecoins operate similarly to fiat backed models but use commodities as reserves.

- Fiat backed stablecoins peg to fiat currencies such as USD.

- Commodity backed stablecoins peg to commodities such as precious metals or real estate, most commonly gold and silver.

Most commodity backed stablecoins are gold pegged. Examples include Tether Gold XAUT, Paxos Gold PAXG, and Digix Gold DGX.

Algorithmic Stablecoin

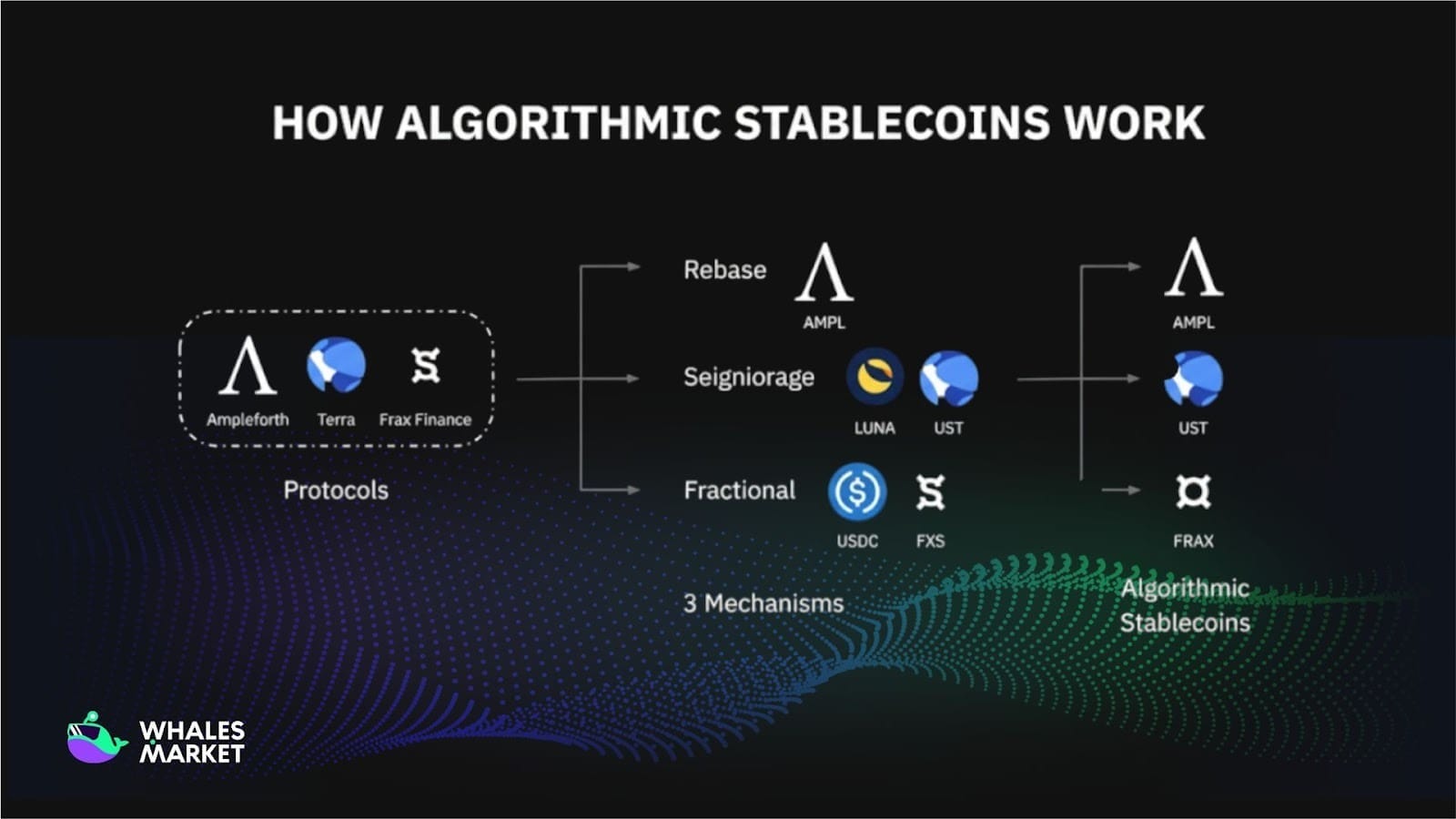

Algorithmic stablecoins are not directly backed by fiat or physical assets. They maintain stability through supply and demand algorithms and internal economic mechanisms.

The system expands or contracts supply based on market prices to maintain a target value, usually $1.

- When the price exceeds $1, supply increases to push the price down.

- When price falls below $1, supply decreases through burning or incentives to push price back up.

There are three main stabilization models.

Rebase mechanism

In this model, the system increases or decreases the number of tokens in users’ wallets without requiring buying or selling transactions.

- When the price is above $1, the system mints additional tokens and distributes them to wallets to increase supply and push the price down.

- When the price is below $1, the system burns tokens from wallets to reduce supply and push the price up.

This approach maintains price stability by adjusting the total supply of the system, but users’ wallet balances change continuously.

Seigniorage mechanism

This model uses two tokens, one stablecoin and one volatile token, to absorb price fluctuations.

- When the stablecoin price is above $1, the system mints stablecoins and simultaneously burns the volatile token to increase stablecoin supply and pull the price back toward $1.

- When the stablecoin price is below $1, the system burns stablecoins and simultaneously mints the volatile token to reduce stablecoin supply and support price recovery.

A typical example is UST and LUNA, where UST is minted by burning LUNA and vice versa.

Fractional mechanism

This model combines collateral assets such as USDC and an algorithmic token such as FXS.

- When minting FRAX, users deposit part USDC and part FXS, with the FXS portion being burned.

- When redeeming FRAX, users receive USDC and newly minted FXS.

The USDC to FXS ratio is adjusted dynamically.

- When FRAX is above $1, the collateral ratio is reduced and minting becomes easier, pushing the price down.

- When FRAX is below $1, the collateral ratio is increased and minting is restricted, supporting the price upward.

How to buy Stablecoin

Stablecoins can be purchased through several channels depending on users’ preferences, location, and access to financial services.

- Centralized exchanges (CEXs): Users can buy stablecoins directly with fiat currencies such as USD, EUR… on major exchanges like Binance, Coinbase, Kraken, and OKX. These platforms typically support bank transfers, credit/debit cards, and offer high liquidity.

- Decentralized exchanges (DEXs): Stablecoins can also be obtained by swapping other cryptocurrencies on decentralized platforms such as Uniswap, Curve, and PancakeSwap. This method does not require intermediaries but requires users to manage their own wallets and transaction fees.

- Peer-to-peer (P2P) marketplaces: Some exchanges provide P2P trading services (e.g., Binance P2P, Bybit P2P), allowing users to buy stablecoins directly from other individuals using various local payment methods.

- Issuing protocols: In certain systems, users can mint stablecoins directly by depositing collateral into DeFi protocols such as MakerDAO (DAI) or Frax Finance (FRAX), subject to collateralization requirements and protocol rules.

Stablecoin Risks

Although designed for stability, stablecoins face significant risks related to operations, markets, and regulation.

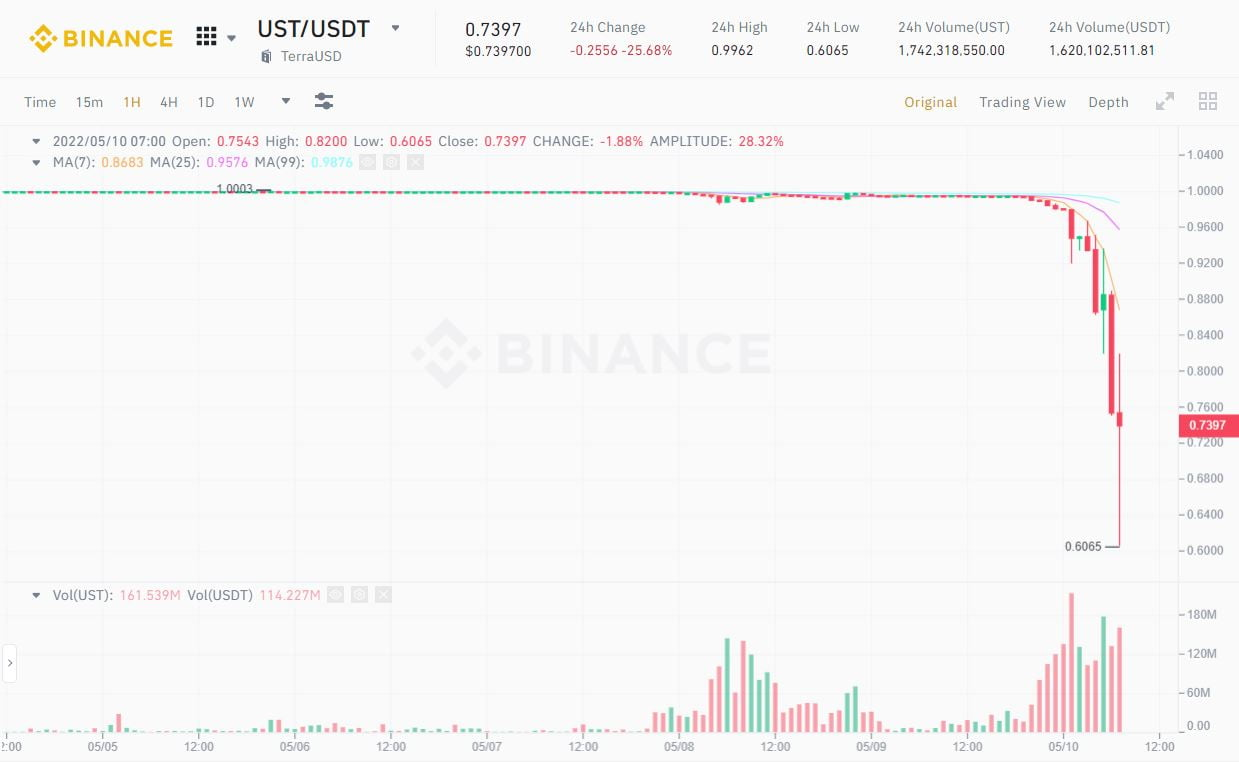

Depeg Risk: Although designed to maintain stable exchange rates, stablecoins can still lose their peg when stabilization mechanisms malfunction or when market confidence declines.

The collapse of UST (Terra) in 2022 is a typical example, when this stablecoin rapidly lost value and fell close to $0, causing massive losses across the entire market.

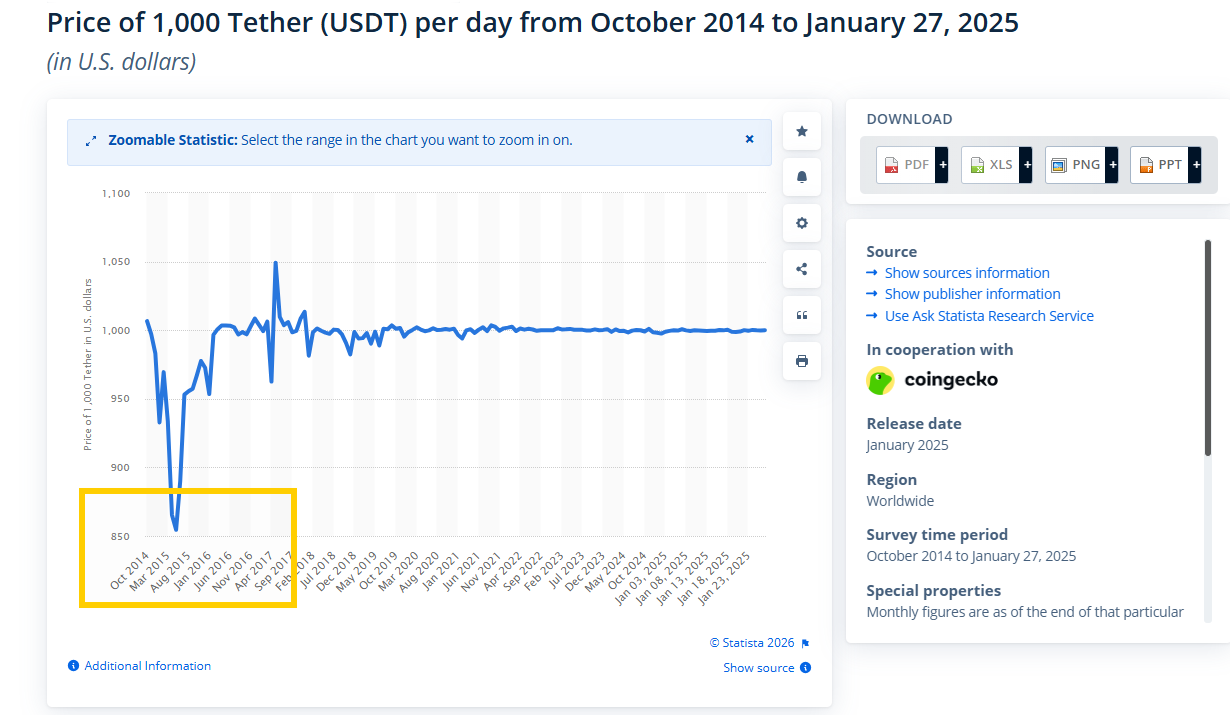

Collateral risk: For stablecoins backed by fiat or real assets, risks arise when reserves are insufficient or lack transparency. In the early stage of Tether’s development (2014-2016), USDT experienced large price deviations due to low market capitalization, limited liquidity, and the absence of regulatory oversight, with the price falling significantly below $1 at times.

A notable later example occurred during 2017–2019, when Tether’s reserves were repeatedly questioned for not being fully backed by USD and instead including illiquid assets. These controversies weakened market confidence and caused USDT to fluctuate around the $1 level, raising serious concerns about the safety and reliability of this stablecoin.

Liquidity risk: Liquidity risk often appears during market crises, when users simultaneously sell or request redemptions of stablecoins.

In March 2023, following the collapse of Silicon Valley Bank, USDC temporarily lost its peg and fell to around $0.88 because part of its reserves was trapped at the bank. This event showed that even major stablecoins can face liquidity crises when market confidence suddenly deteriorates.

2/ Like other customers and depositors who relied on SVB for banking services, Circle joins calls for continuity of this important bank in the U.S. economy and will follow guidance provided by state and Federal regulators.

— Circle (@circle) March 11, 2023

Technical and system risk: Centralized stablecoins rely on the technical infrastructure and administrative controls of their issuers, which may lead to asset restrictions, transaction censorship, or operational failures that directly affect users.

For example, Circle froze dozens of USDC wallets at the request of regulators in cases related to Tornado Cash. This illustrates control risks and the possibility of restricted asset usage for users of centralized stablecoins.

Circle just frozen 75,000 USDC belonging to unsuspecting Tornado users, as well as 149 USDC donated to the project. pic.twitter.com/GBS41FtZvB

— banteg (@banteg) August 8, 2022

Legal risk: The regulatory framework for stablecoins remains fragmented and unclear across jurisdictions, and in many countries stablecoins are not officially recognized as legal tender or fully regulated financial instruments. As a result, regulatory interventions can directly affect their issuance, circulation, and existence.

Legal risk was clearly demonstrated in the case of BUSD, when Binance and Paxos were ordered by US regulators to stop issuing this stablecoin in 2023. The event caused BUSD market capitalization to decline sharply within a short period and forced users to convert to other stablecoins, showing the direct impact of regulatory policy on the existence of stablecoins.

1/ This morning, Paxos announced it will halt minting new #BUSD tokens effective February 21. Read the full press release from Paxos here: https://t.co/jXZY1ak8DR

— Paxos (@Paxos) February 13, 2023

Conclusion

Stablecoins play a central role in the operation of the crypto market, from trading and value storage to DeFi applications and payments. Thanks to price stability, stablecoins reduce the impact of volatility and provide a foundation for more sustainable development of the digital asset ecosystem.

However, stablecoins are not completely risk free. In an environment of increasingly strict regulation, stablecoins are likely to continue evolving and become an important component of future digital financial infrastructure.

FAQs

Q1. What is the purpose of a Stablecoin?

Stablecoins are widely used for trading, value storage, cross-border payments, remittances, and as base assets in DeFi protocols such as lending, borrowing, and liquidity provision.

Q2. How does Stablecoin work?

Stablecoins maintain stability through collateral backing, algorithmic supply adjustments, or hybrid models that combine reserves with algorithmic mechanisms to control supply and demand.

Q3. Which stablecoins are most widely used in the market?

USDT and USDC are the most widely used fiat-backed stablecoins, while DAI is the most prominent crypto-backed stablecoin in decentralized finance.

Q4. Are stablecoins safer than traditional cryptocurrencies?

Stablecoins generally have lower price volatility than traditional cryptocurrencies, but they still carry risks related to depegging, collateral quality, liquidity, technology, and regulation.

Q5. Can stablecoins replace traditional payment systems?

Stablecoins can complement traditional payment systems by enabling faster, cheaper, and borderless transfers, but widespread replacement depends on regulation, adoption, and infrastructure development.

Q6. What does “stablecoin” mean?

A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reference asset such as a fiat currency (e.g., USD), commodities, or a basket of assets. Its main purpose is to reduce price volatility compared to traditional cryptocurrencies.

Q7. What is the difference between a stablecoin and a cryptocurrency?

While both are digital assets built on blockchain technology, stablecoins are designed to maintain a stable price by using collateral or control mechanisms, whereas most cryptocurrencies (such as Bitcoin or Ethereum) have highly volatile prices determined mainly by market supply and demand.

Q8. Where can users buy stablecoins?

Stablecoins can be purchased on centralized exchanges (such as Binance, Coinbase, and Kraken), decentralized exchanges (such as Uniswap and Curve), peer-to-peer marketplaces, or directly minted through certain DeFi protocols by depositing collateral.