Stablecoins have become a backbone of the digital economy. They move billions every day but still face problems like slow speed, high costs, and compliance gaps. The demand for a dedicated infrastructure is growing fast. That’s where Stable comes in, a Layer 1 blockchain designed specifically for stablecoins, aiming to make USDT a true payment tool.

What is Stable?

Stable is the first Layer 1 blockchain built exclusively for stablecoins, called Stablechain. Its main focus is optimizing for USDT (Tether). This project wants to solve today’s issues around stablecoins such as fragmentation, high fees, slow settlement, and compliance concerns.

Stable supports over 500M USDT users daily, handling a trading volume of around $27.6 trillion in 2024. The idea is to move stablecoins from being static to fully dynamic, fast, final, and easy to use, becoming the core infrastructure for real-world payments.

Backed by strong partners like Bitfinex and Tether, Stable is pushing stablecoins into everyday transactions and enterprise adoption.

Key Features of Stable

Stablechain

- An EVM-compatible blockchain

- USDT as the native gas for transactions

- Free peer-to-peer transfers

- Sub-1 second finality

- Scales beyond 10,000 TPS

- Strong focus on compliance and enterprise security

This makes it easier for businesses to integrate stablecoin payments globally without the unpredictability of gas costs.

Stable Pay

The first payment wallet on Stablechain. It offers instant, secure, and fee-free transfers. Developers can integrate it easily through modular SDKs. Designed for daily payments and remittances, it also replaces long addresses with simple, memorable aliases.

Stable Token Information

Stable Key Metrics

- Token Name: TBA

- Ticker: $TBA

- Token Type: TBA

- Total Supply: TBA

- Contract Address (CA): TBA

Stable Token Use Case

No official use case has been announced yet. Updates will be shared once Stable publishes details.

Stable Token Listing

- Listing time: TBA

- Confirmed CEX listings: TBA

- Pre-market price (Whales Market): TBA

Stable Tokenomics & Fundraising

Tokenomics

- Total Supply: TBA

- Allocation: Not yet announced

Fundraising

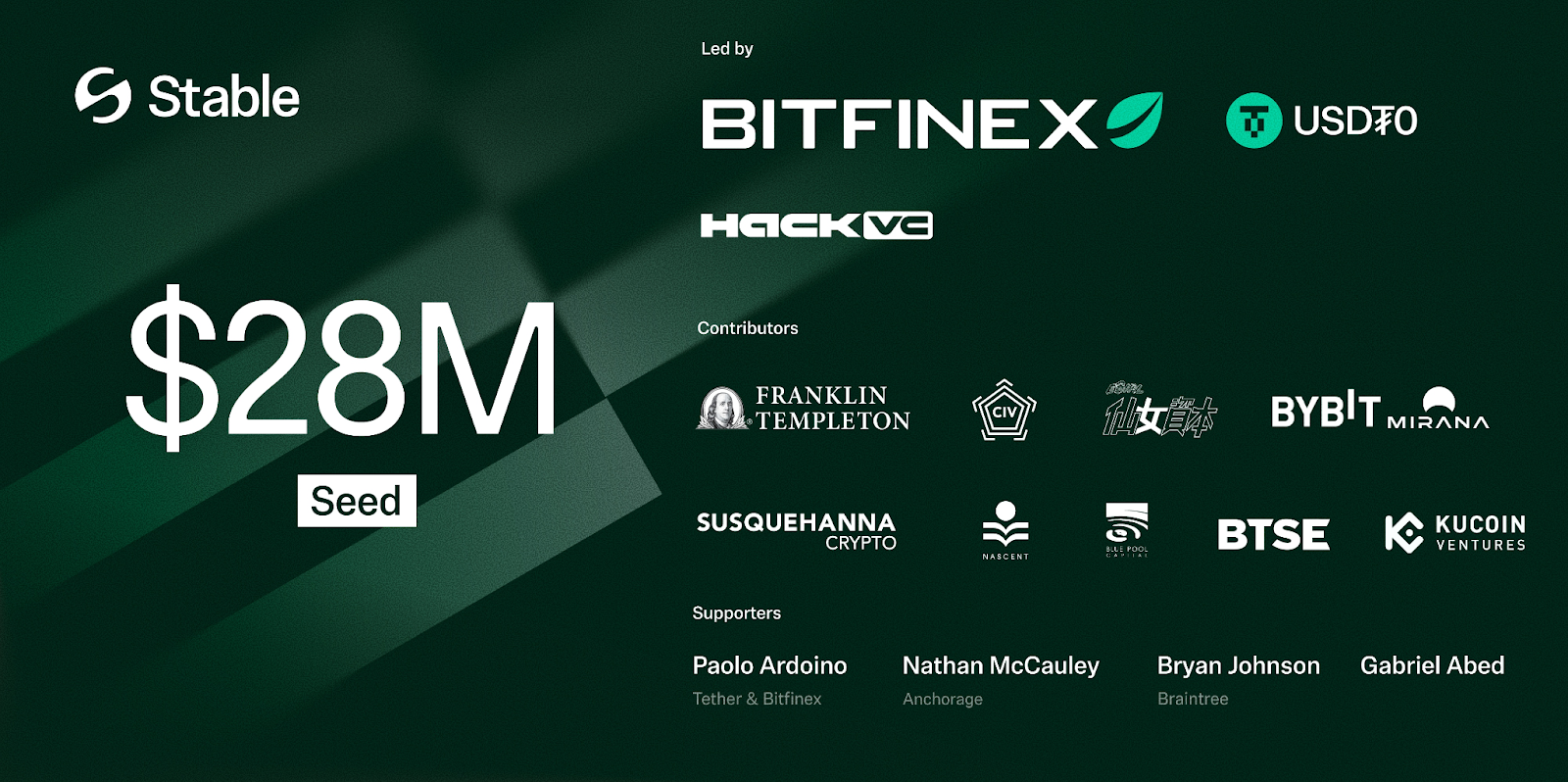

Stable has raised $28M in a Seed round led by Bitfinex and Hack VC. Strategic backing also came from PayPal Ventures to support PYUSD integration. Other investors include Franklin Templeton, eGirl Capital, Castle Island Ventures,...

Stable Roadmap & Team

Roadmap

The project has not announced a detailed roadmap yet. Whales Market will update immediately once the project releases the latest information.

Team

- Brian Mehler – CEO

- Sam Kazemian – CTO

Conclusion

As stablecoins grow rapidly, Stable is positioning itself as a key platform for global digital payments. With compliance in mind and strong partners backing it, Stable has the potential to expand its ecosystem and deliver real value to users and businesses worldwide.

Disclaimer: This article is for informational purposes only, not investment advice. Whales Market is not responsible for investment decisions.

FAQs

What is the native token of Stable?

Stable has not announced any official native token yet.

What is Stable token pre-market price?

Currently, Stable token is trading on Whales Market, a leading pre-market DEX platform for pre-TGE tokens and allocations.

What is the price of Stable token today?

Currently, Stable token is trading on Whales Market with over $300M in pre-market trading volume.

How much has Stableraised?

Stable raised $28M in Seed funding, led by Bitfinex and Hack VC, with support from PayPal Ventures.

What is $TBA allocation?

No allocation details have been announced yet.