Solstice positions itself as a way to package yield access into a stablecoin & vault structure, with reserve visibility supported by tools like Chainlink Proof of Reserves. On Solana, USX is currently the 5th-largest stablecoin by market cap, which gives the protocol a stablecoin base to build around.

What is Solstice?

Solstice is a decentralized finance (DeFi) protocol built natively on the Solana blockchain, designed to provide permissionless access to institutional-grade yield strategies. It reimagines asset management by blending traditional finance (TradFi) execution with DeFi innovation, focusing on speed, transparency, and scalability.

Solstice operates across three integrated verticals:

- USX: A fully collateralized synthetic stablecoin pegged to the US Dollar, backed by stablecoins like USDC and USDT. It enables fast payments and yield generation while maintaining stability.

- YieldVault: A delta-neutral yield platform that offers transparent, real-time returns through institutional strategies, aiming to protect and grow users' purchasing power. As of recent data, it has achieved yields of around 12.5% APY with a total value locked (TVL) of approximately $328M.

- Solstice Staking: A non-custodial staking infrastructure platform, acquired via Solstice Staking AG, which powers over $1B in staked assets across 8,000+ validator nodes.

How does Solstice work?

Solstice's ecosystem revolves around delta-neutral strategies, which minimize directional market risk by balancing long and short positions. Here's a breakdown of its core mechanics:

- USX Minting and Redemption: Users can mint USX by depositing collateral (USDC or USDT) into the protocol. Users also can lock USX into the YieldVault and receive eUSX, which represents a proportional claim on the vault’s net asset value and is intended to appreciate as yield accrues

- YieldVault Operations: This is the yield-generation engine, utilizing battle-tested TradFi strategies adapted for DeFi. Yields are derived from sources like funding rates, basis trades, and other delta-neutral opportunities on Solana. Users deposit assets into YieldVault to earn returns, with real-time transparency via on-chain data.

- Staking Infrastructure: Through the acquired Solstice Staking AG, the protocol provides non-custodial staking for Solana and other networks. It supports institutions and protocols with high-reliability nodes, ensuring minimal downtime and eco-friendly operations.

- Flares System: Users earn "Flares" by achieving milestones, such as holding USX or participating in the ecosystem. These act as reward points, increasing scarcity through burns and qualifying users for future airdrops.

- Overall Flow: The protocol bootstraps liquidity (over $100M initially) to enhance Solana's DeFi ecosystem. Revenue from fees and yields can be routed toward token buybacks, burns, or community incentives, creating a self-sustaining loop where increased usage drives value.

$SLX Token Information

$SLX Key Metrics

- Token Name: Solstice

- Ticker: $SLX

- Token Type: Utility, governance

- Total Supply: 1B $SLX

- Contract Address (CA): TBA

$SLX Token Use Case

- Governance: $SLX holders vote on protocol parameters, such as YieldVault ceilings, new collateral types, and treasury allocations.

- Access: Gates premium features like early strategy access or advanced analytics.

- Incentives: Aligns users through staking rewards, revenue sharing, and ecosystem participation.

- Coordination: Acts as the "glue" for users, builders, and capital, driving protocol evolution.

$SLX Token Listing

- Listing time: TBA

- Confirmed CEX listings: TBA

- Pre-market price (Whales Market): TBA

$SLX Tokenomics & Fundraising

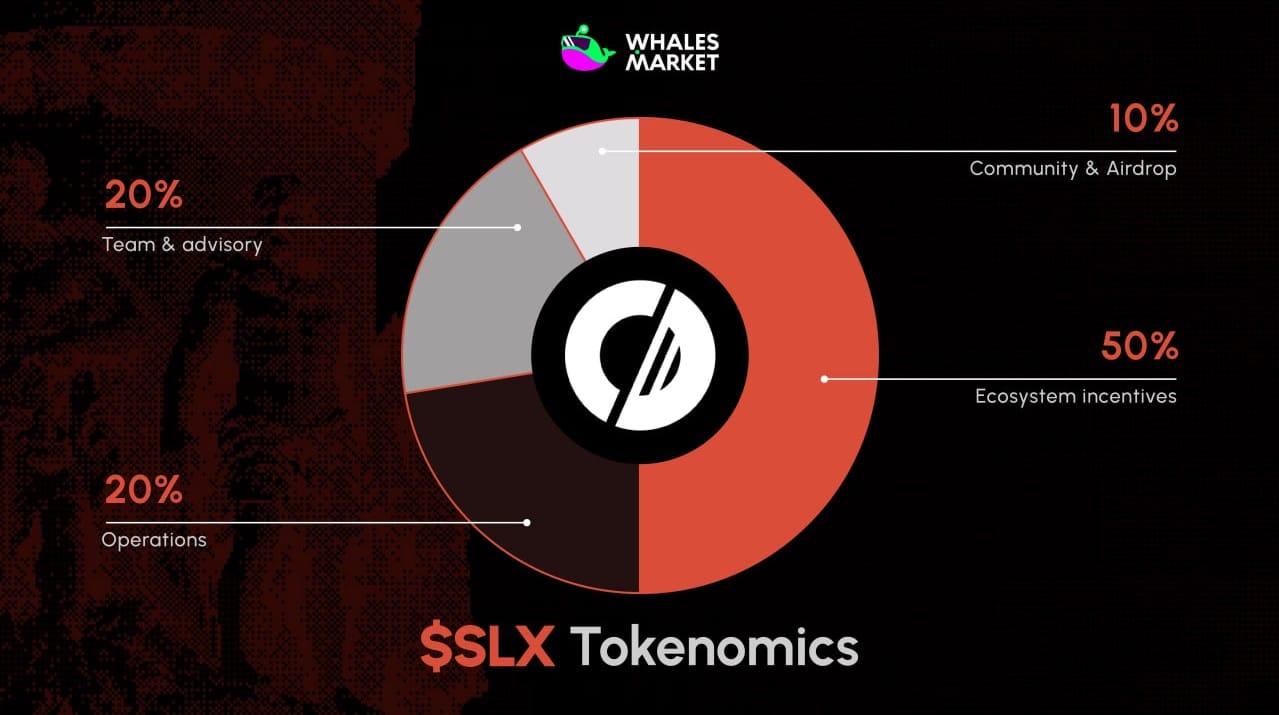

Tokenomics

Total Supply: 1B $SLX

Allocation:

- Ecosystem: 50%

- Operations (Public Sale and TVL incentives): 20%

- Team & Advisory: 20%

- Community Airdrop: 10%

Fundraising

Solstice’s presale is taking place on Legion (KYC required).

- The sale targets $4 million in USDC with a $6.5 million hard cap, at a $130 million FDV valuation.

- 50% unlock at TGE, 50% linear vesting over 3 months.

- Ends on Dec. 25, 1pm UTC.

Allocation is not equal for everyone, it’s based on your Legion score and your activity on Solstice.

Solstice Roadmap & Team

Roadmap

The project has not announced a detailed roadmap yet. Whales Market, the destination for Pre Market crypto trading and Prediction Market crypto will update immediately once the project releases the latest information.

Team

- Ben Nadareski: Co-Founder & CEO

- Tim Grant: Co-Founder & Chairman

Conclusion

Solstice can be summarized as a stablecoin-centered yield stack on Solana:

- USX acts as the stable base asset.

- YieldVault aims to produce yield through a delta-neutral, multi-strategy approach.

- eUSX representing a yield-bearing claim on the vault.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1.What is $SLX pre-market price?

Currently, $SLX is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

Q2. How can I trade $SLX before official listing?

You can buy or sell pre-TGE $SLX on Whales Market, integrating Pre Market crypto trading with advanced Prediction Market crypto features by creating or filling orders with collateral-based settlement.

Q3. What is the price of $SLX today?

While $SLX hasn't been listed yet, users can trade $SLX pre-market on Whales Market, the ultimate crypto Premarket hub and the leading Prediction Market before the TGE. Here you can trade $SLX before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

Q4. What backs USX, and how is backing checked?

USX is designed to be collateralized by major USD stablecoins, with reserve visibility supported by onchain verification tools such as Proof of Reserves.

Q5. What is eUSX?

eUSX is the yield-bearing receipt token minted when USX is deposited into the YieldVault, representing a share of the vault’s net asset value.