Solomon emerged as one of stablecoin infrastructures within the Solana ecosystem, bringing a new approach to how on-chain dollars generate and distribute yield. So what is Solomon? Let’s dive into this article.

What is Solomon?

Solomon Labs is a synthetic-dollar protocol built on the Solana blockchain, which issues a stablecoin called USDv pegged to the US dollar. It is designed to provide a non-rebasing, yield-earning dollar asset that can be used across the Solana DeFi ecosystem, aiming to make idle capital more productive.

The project have done ICO phase on MetaDAO.

How does Solomon work?

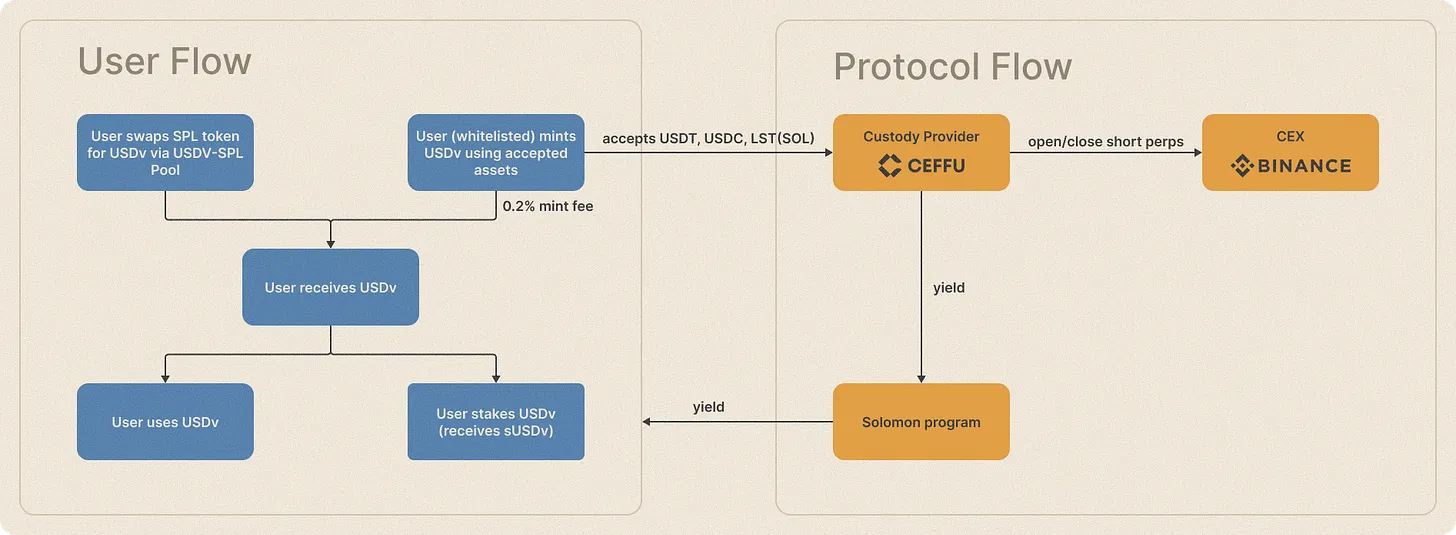

Solomon operates on a two-token model that separates stability from yield generation.

- USDv, is a $1 stablecoin designed to stay close to its peg through two-way arbitrage. Users typically enter or exit through stablecoin pools on Solana, while approved market makers and compliant institutions are able to mint or burn USDv directly.

- sUSDv, represents staked USDv, allowing holders to earn yield generated from Solomon’s basis-trade engine. Rewards are distributed to the staking program several times per week to ensure smooth, predictable payouts and to minimize front-running.

The platform’s yield engine operates by executing a classic basis trade: taking a +1 spot / –1 perpetual position on major assets across centralized exchanges. This offsets price fluctuations while harvesting funding-rate yield, with additional T-Bill backing currently being integrated to further strengthen returns.

Solomon’s architecture connects the user-facing app (dashboards and controls) to on-chain vault programs, which interface with custody provider CeFFU and liquidity venues such as Binance, ensuring secure and efficient execution across the entire system.

Outstanding of Solomon

Stablecoins have moved from no yield (USDC/USDT) to permissionless stake‑to‑earn (e.g., sUSDe). Solomon advances this by giving the yield directly to the dollars that are being used. Either by staking sUSDv or via Yield as a Service (YaaS) for qualified USDv holders, without breaking spendability or composability.

YaaS provides a programmatic yield stream paid directly to eligible USDv wallets, with no staking, no lockups, and no wrapper tokens involved. Eligibility is limited to entities that have completed full KYC/AML and counterparty onboarding, such as teams, DAOs, and liquidity providers. Once qualified, participants gain access to direct 1:1 mint, burn, and redeem functionality for USDv, along with yield streamed automatically to their USDv holdings.

Additionally, the system includes an LP “Yield Hook”, where the USDv side of a DEX liquidity pool receives a programmatic yield stream. This allows LPs to earn both standard pool fees and additional yield on the USDv without requiring any routing modifications or contract changes. Historically, this model has generated around 15% APY.

$SOLO Token Information

$SOLO Key Metrics

Here is the information of $SOLO

- Token Name: Solomon

- Ticker: $SOLO

- Token Type: TBA

- Total Supply: 25.8M $SOLO

- Contract address (CA): SoLo9oxzLDpcq1dpqAgMwgce5WqkRDtNXK7EPnbmeta

$SOLO Use Case

Currently, Solomon has not announced any official use case of $SOLO for the project. Whales Market will update immediately when the official Solomon website announces.

$SOLO Listing

Here are important details revealed to $SOLO:

- Listing time: 19th November, 2025

- Confirmed CEX Listings: TBA

Solomon Tokenomics & Fundraising

Tokenomics

Currently, Solomon has not announced any official tokenomics for the project. Whales Market will update immediately when the official Solomon website announces.

Fundraising

Currently, Solomon has not announced any official fundraising for the project. Whales Market will update immediately when the official Solomon website announces.

Solomon Roadmap & Team

Roadmap

Currently, Solomon has not announced any official roadmap for the project. Whales Market will update immediately when the official Solomon website announces.

Team

Currently, Solomon has not announced any official team for the project. Whales Market will update immediately when the official Solomon website announces.

Conclusion

Solomon represents a significant step forward for yield-bearing stablecoins on Solana, offering a model where users can access on-chain dollars that generate yield without friction, wrappers, or loss of usability. With its dual-token system, basis-trade yield engine, and innovative features like YaaS and the LP Yield Hook, Solomon is shaping a framework that blends stability, composability, and real yield into a single ecosystem.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Solomon?

The native token of Solomon is $SOLO, used to facilitate coordination across the ecosystem.

2. What is the price of Solomon ($SOLO) today?

While Solomon ($SOLO) hasn't been listed yet, users can trade $SOLO pre-market on Whales Market before the TGE. Here you can trade $SOLO before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

3.What is Solomon ($SOLO) pre-market price?

Currently, $SOLO is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

4. How much has Solomon ($SOLO) raised?

Currently, Solomon has not announced any official fundraising for the project. Whales Market will update immediately when the official Solomon website announces.

5. What is $SOLO allocation?

Currently, Solomon has not announced any official tokenomics for the project. Whales Market will update immediately when the official Solomon website announces.

6. How can I trade $SOLO before official listing?

You can buy or sell pre-TGE $SOLO on Whales Market by creating or filling orders with collateral-based settlement.