Perpetual DEXs have always been a promising product category because they can generate very large profits for developers. This also makes the competitive landscape very intense, and the battle between projects has never really cooled down.

Reya, a Layer 2 designed specifically for trading, has recently become one of the names to watch in the broader perpetual DEX landscape

What is Reya?

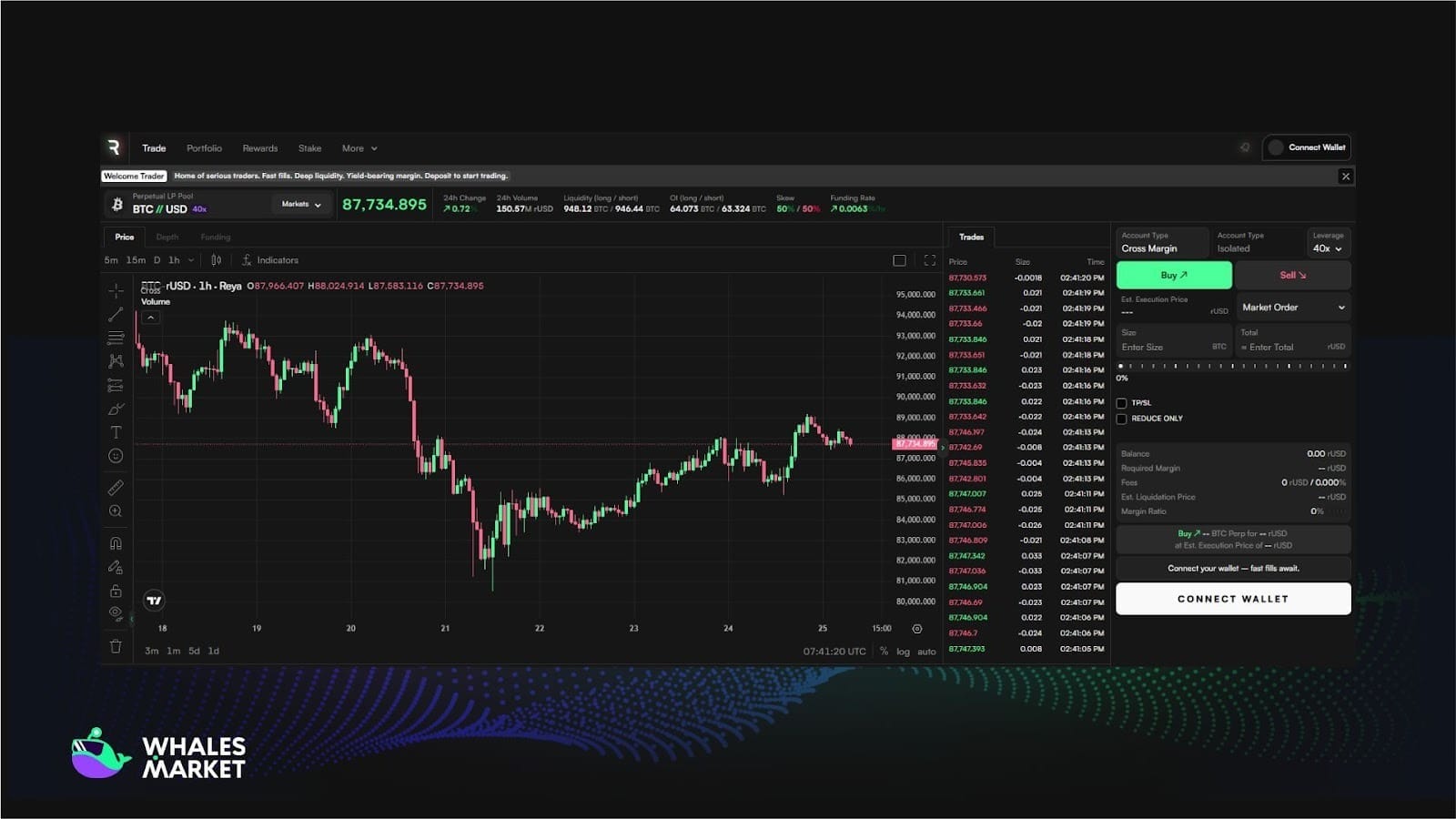

Reya is a Layer 2 optimized for DeFi trading that simultaneously operates as a perpetual DEX on Ethereum. Unlike general purpose Layer 2 networks such as Arbitrum or Base, Reya is built specifically for perpetual DEX trading.

Reya functions as a perpetual DEX supporting more than 70 markets including crypto and RWAs. At the moment, Reya is also expanding into spot trading to serve a wider range of user segments.

Key features of Reya

The core product of Reya is its perpetual DEX, highlighted by the following features.

- Architecture combining L2 and DEX: Reya uses a based rollup architecture on Ethereum with Arbitrum Orbit. Order execution speed is under 1 millisecond, with no gas fees and full EVM compatibility.

- Security and MEV resistance: The system is secured by more than 950.000 Ethereum validators and uses FIFO ordering to prevent front running. In addition, ZK-proofs ensure transparent transaction verification, and self custody enables users to retain full control of their wallets.

- Deep and efficient liquidity: Passive Liquidity Pools (PLP) are shared across DEXs on the network, reducing capital fragmentation. Yield bearing collateral such as srUSD or wstETH allows users to earn passive returns while trading.

- Speed and user experience: There are no maker or taker fees, prices are updated in real time, and multiple sequencers help maintain high performance without bottlenecks.

$REYA Token Information

$REYA Key Metrics

- Token Name: Reya

- Ticker: $REYA

- Token Type: Utility/governance

- Total Supply: 8B $REYA

- Contract Address (CA): TBA

$REYA Token Use Case

The main use cases for Reya include:

- Governance

- Trading fee reduction

- Staking and rewards: Users can stake REYA to earn yield from protocol fees. 80% of these fees are used to buy back REYA, while the remaining 20% goes to buying ETH. By staking, users also help secure the network.

$REYA Token Listing

- Listing time: TBA

- Confirmed CEX listings: TBA

- Pre-market price (Whales Market): TBA

$REYA Tokenomics & Fundraising

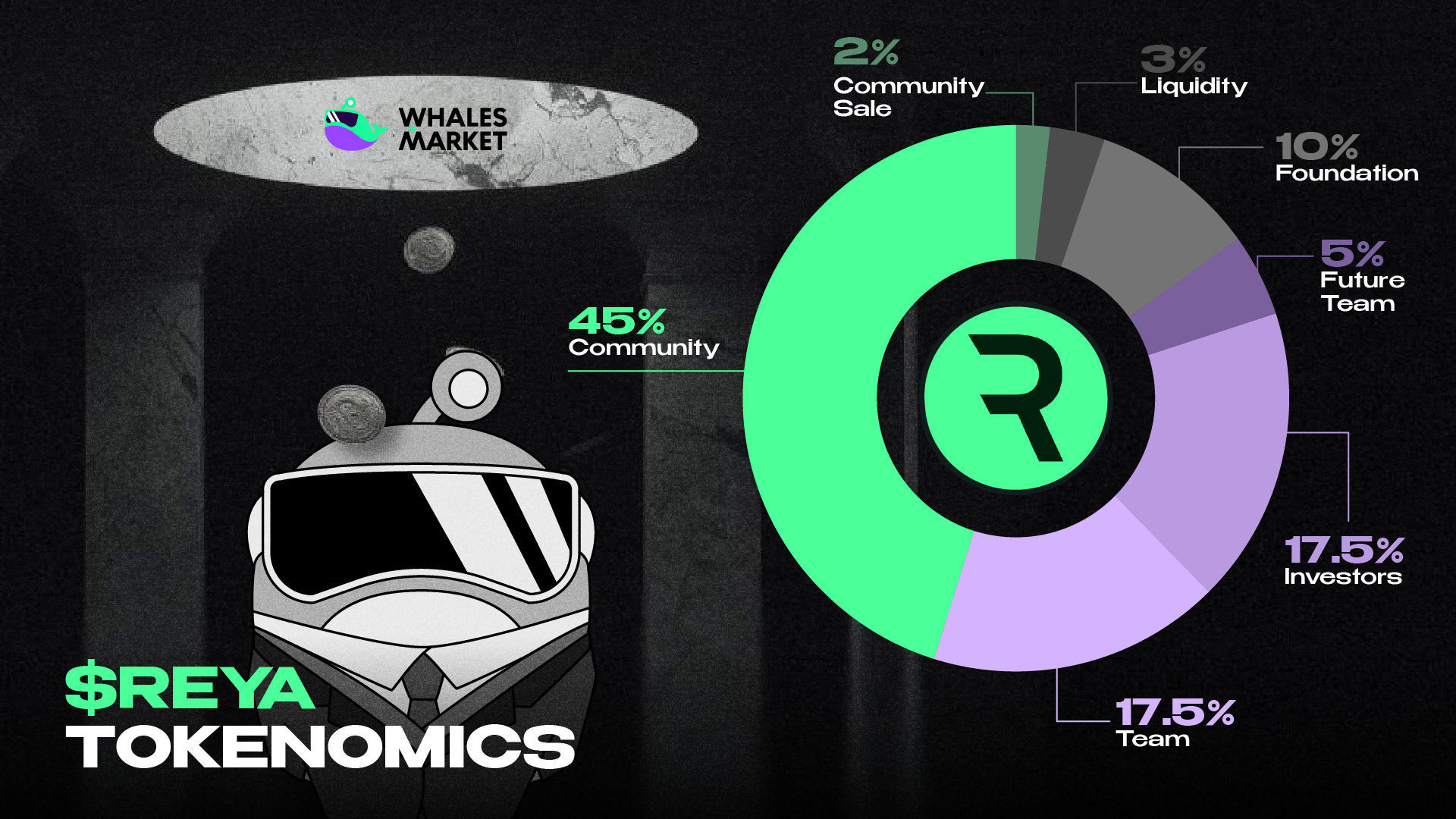

Tokenomics

Total Supply: 8B $REYA

Allocation:

- Community: 45%

- Team: 17.5%

- Investors: 17.5%

- Foundation: 10%

- Future Team: 5%

- Liquidity: 3%

- Community Sale: 2%

Fundraising

According to CryptoRank, Reya has raised 19 million dollars across three funding rounds.

- 1/1/2022: $6M invested in the Seed round by Coinbase Ventures, Framework Ventures, Robot Ventures and others.

- 16/3/2024: Coinbase Ventures, Amber Group, Robot Ventures, Wintermute and others invested $10M into Reya.

- 25/112025: Reya conducted an ICO on Coinlist at a price of $0.0188, with tokens sold accounting for 2% of total supply.

Reya Roadmap & Team

Roadmap

Reya will focus on upgrading the network from an Arbitrum Orbit Layer 2 to a based ZK-rollup directly on Ethereum. The projected timeline is as follows.

- Q1 2026: Orderbook launch

- Q2 2026: Migrate to based design, with single Execution Node

- Q3 2026: Introduce multiple rotating Execution Nodes

Team

- Simon Jones: Co-Founder và CEO.

- Artur Begyan: Co-Founder và CTO.

Conclusion

Reya is building a L2 specialized for perpetual DEX trading with a based rollup architecture and a concentrated liquidity model. The protocol is currently recording about $300M-$400M in daily trading volume with more than 10K active traders, which indicates a certain level of real usage.

However, the project is still in the process of completing its infrastructure transition to a based ZK-rollup and expanding its product scope. Investors should continue to monitor factors such as technical progress, the ability to sustain liquidity, competitive strength against other perpetual DEXs, and the durability of trading volume before making decisions.

FAQs

Q1. How is Reya different from general purpose Layer 2 networks?

Reya is built specifically for trading and perpetual DEX use cases, instead of trying to support every type of dApp. Its architecture and product design focus on low latency execution, deep liquidity and MEV resistance. Networks like Arbitrum or Base are more general purpose, while Reya narrows its scope to trading.

Q2.Who is Reya designed for?

Reya mainly targets traders who want to use perpetual futures on chain, across both crypto and RWA markets. It is also relevant for liquidity providers who want passive exposure through its liquidity pools and for token holders who participate in governance and staking.

Q3.How does Reya address MEV and front running?

Reya uses FIFO ordering to make sure transactions are processed in the order they are received, which helps reduce front running opportunities. It is secured by the Ethereum validator set and uses ZK-proofs to verify transactions transparently. This combination aims to protect users from unfair execution while keeping the system trustless.

Q4.What is the role of Passive Liquidity Pools (PLP) on Reya?

Passive Liquidity Pools on Reya provide shared liquidity across DEXs on the network, which helps reduce capital fragmentation. Liquidity providers deposit assets into these pools and the protocol uses them to support trading activity. Because collateral can be yield bearing, users can trade while still earning passive returns on their deposited assets.

Q5.How do traders benefit from the REYA token?

Traders can use REYA to reduce trading fees on the platform. By staking REYA, they also gain access to yield derived from protocol fees, since a large share of these fees is used to buy back REYA and ETH. Over time, active traders who also stake can combine trading activity with token based rewards.

Q6: What is the price of $REYA today?

$REYA does not yet have an official market price since it has not been listed. However, you will soon be able to trade it on the leading pre-market platform, Whales Market. Here, you can buy more $REYA or sell to take profit before it is officially listed on CEXs like Binance or Bybit.