The decentralized finance (DeFi) ecosystem has recently witnessed a series of depegging events, including the collapse of Stream Finance’s xUSD and the plunge of Stables Labs’ USDX to below $0.60. Elixir’s deUSD also ceased operations due to its critical $68M exposure to Stream.

These failures, triggered by an external fund manager’s $93M loss and opaque solvency issues have exposed a critical systemic fragility: the use of recursive capital loops, and excessive leverage within synthetic stablecoin & yield protocols.

This analysis explores the mechanics of recursive looping, its benefits, and the severe, contagious risks it poses to DeFi's structural integrity.

What is a Recursive Loop in Crypto?

A recursive loop is a leverage strategy that repeatedly cycles borrowed funds back into collateral to expand exposure from an initial deposit. It is also called a recursive loop, or yield loop.

Originally, users looped speculatively, for example: deposit ETH, borrow stablecoins, buy more ETH, add it to collateral, and repeat. The approach later evolved into yield looping, which applies the same mechanism to yield-bearing assets, compounding the return spread between earned yield and borrowing costs.

In stablecoins and yield vaults, recursive loops may operate on the reserve assets themselves, or on the vault token (when accepted by money markets) as collateral, recycling borrow proceeds to acquire additional exposure and repeat the cycle. This creates internal leverage that boosts capital efficiency and reserve carry, while also inflating reported TVL and headline returns relative to fresh capital.

Recursive Yield Loop mechanism: From Capital Efficiency to Systemic Exposure

DeFi composability allows one protocol’s output to become another protocol’s input. In recursive loops, that input is typically a yield-bearing token (e.g. xUSD). The cycle can be executed by individual users or designed and facilitated at the protocol level:

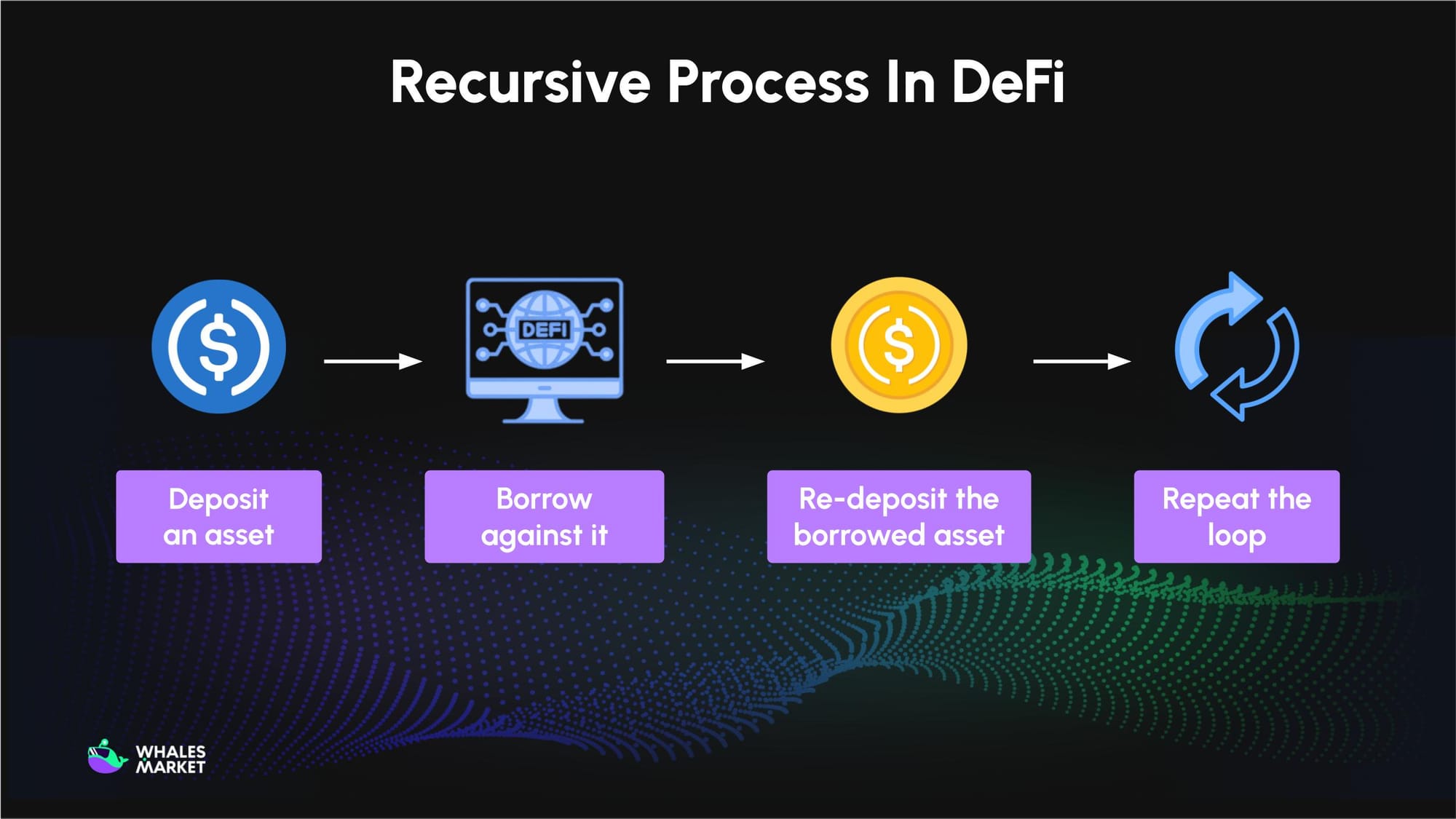

- Initial deposit & tokenization: A user deposits capital (for example USDC) into a vault, receiving a yield-bearing token that can be used in other protocols.

- Collateralization: The user (or protocol manager) takes the token (or reserve tokens) and uses it as collateral on a separate lending market (like Euler or Morpho).

- Borrowing: Funds (stablecoins) are borrowed against this collateral, typically limited by the platform's collateral ratio (for example 75% Loan-to-Value - LTV).

- Recursion: The borrowed capital is immediately recycled to purchase more of the original input token, which is then redeposited as collateral, restarting the cycle.

While individual users perform this process to maximize personal returns, the greatest systemic risk arises when the protocol itself designs its vaults or lending markets to encourage and even execute this process on a large scale, thereby inflating TVL across the entire ecosystem.

Imagine a user deposits $1,000 USDC into a vault on Stream Finance (a yield-optimization focused DeFi protocol with its xUSD stablecoin) and receives $1,000 xUSD. Let's assume perfect pricing and zero fees.

If the lending platform permits platform’s collateral ratio (for example 75% LTV):

- The user uses the $1,000 xUSD to borrow $750 in stablecoins.

- The borrowed $750 is immediately used to purchase and redeposit $750 more xUSD.

- After one loop, the initial $1,000 deposit has resulted in a $1,750 position ($1,000 + $750 borrowed capital) being collateralized, generating amplified yield.

This mechanism enables capital efficiency by turning idle capital into multiplied, working collateral. This resulting internal leverage dramatically impacts the protocol's reported figures.

For example, Stream Finance achieved over $500 million in assets under management from only $160M in user deposits, implying a leverage ratio exceeding 4x through this recursive strategy, according to post-incident analyses. This figure (the difference between TVL and real capital) represents the hidden systemic leverage built into the protocol.

Benefits vs. Risks of Recursive Yield Loop

Benefits

Recursive looping provides distinct financial advantages when managed correctly in theory:

- Yield amplification: By multiplying the core interest spread (yield minus borrowing cost), recursive looping can offer high double-digit APYs (for example 15% in Stream Finance's case), attracting significant institutional and retail liquidity that would otherwise sit idle.

- Expansion of financial tools: The strategy is not limited to crypto; it serves as a valuable tool for integrating stable assets, such as tokenized U.S. Treasury bills. By using RWA as collateral, the loop becomes inherently less volatile and safer, as the underlying asset has predictable returns and lower risk compared to purely crypto-native assets.

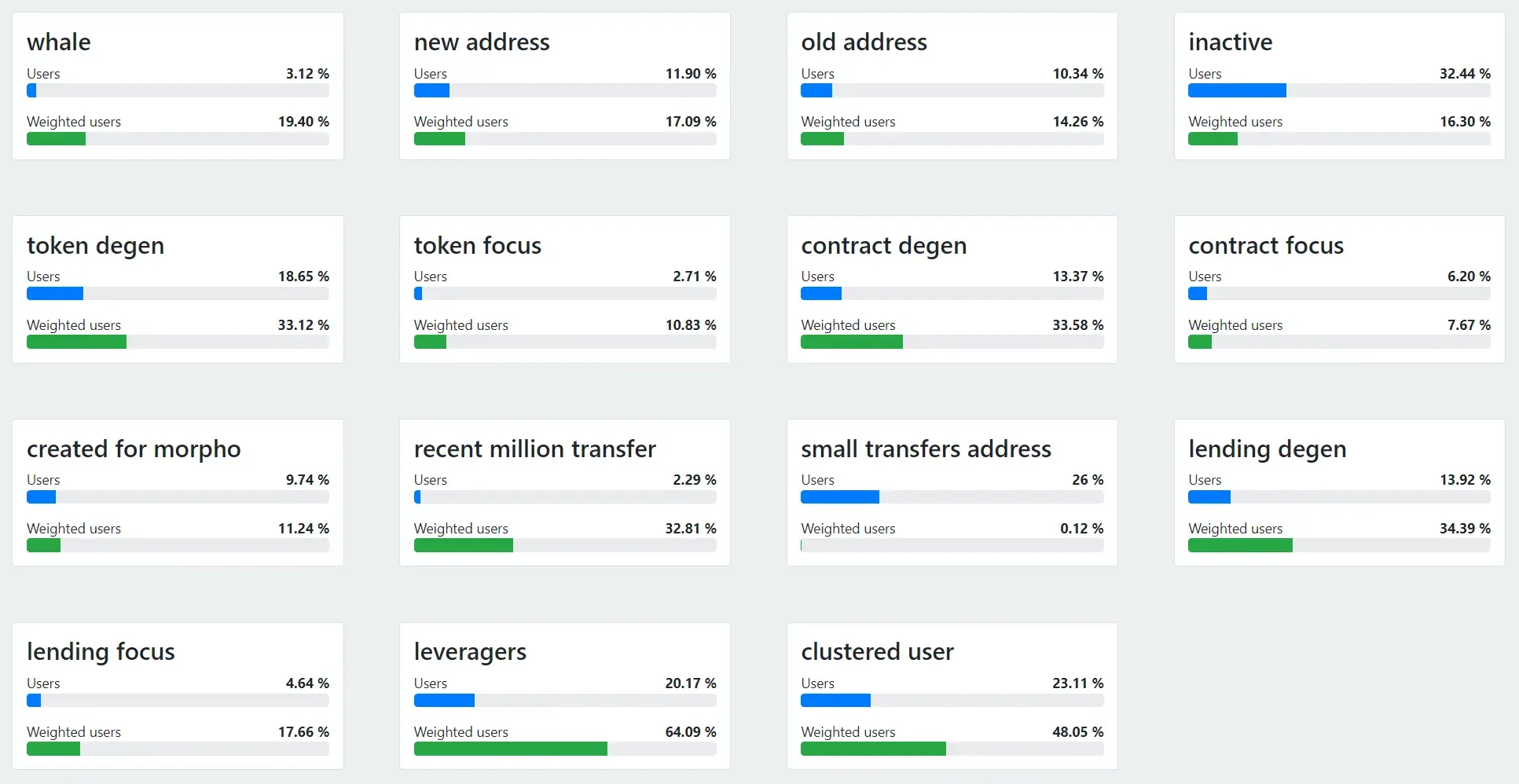

- Capital efficiency: Recursive loops expand effective exposure from the same unit of fresh capital, turning a single dollar of real capital into multiple dollars of working collateral within the ecosystem. Money-market data points show how prevalent this is: Morpho, a yield optimizer protocol, has reported that 64% of its volumes come from loopers, illustrating how users maximize collateral utility across markets.

Risks

While looping looks appealing, the problems lie in its scale and lack of clarity. When many people use this strategy on the same system, the risk turns from personal to system-wide.

First is the TVL illusion.

The most dangerous risk is that Total Value Locked (TVL) stops being real. Because borrowed money is immediately recycled back into the system, the platform's reported TVL starts to balloon.

This creates a massive hidden leverage bubble that gives a false sense of security and depth. You can no longer trust TVL as a sign of a platform's health.

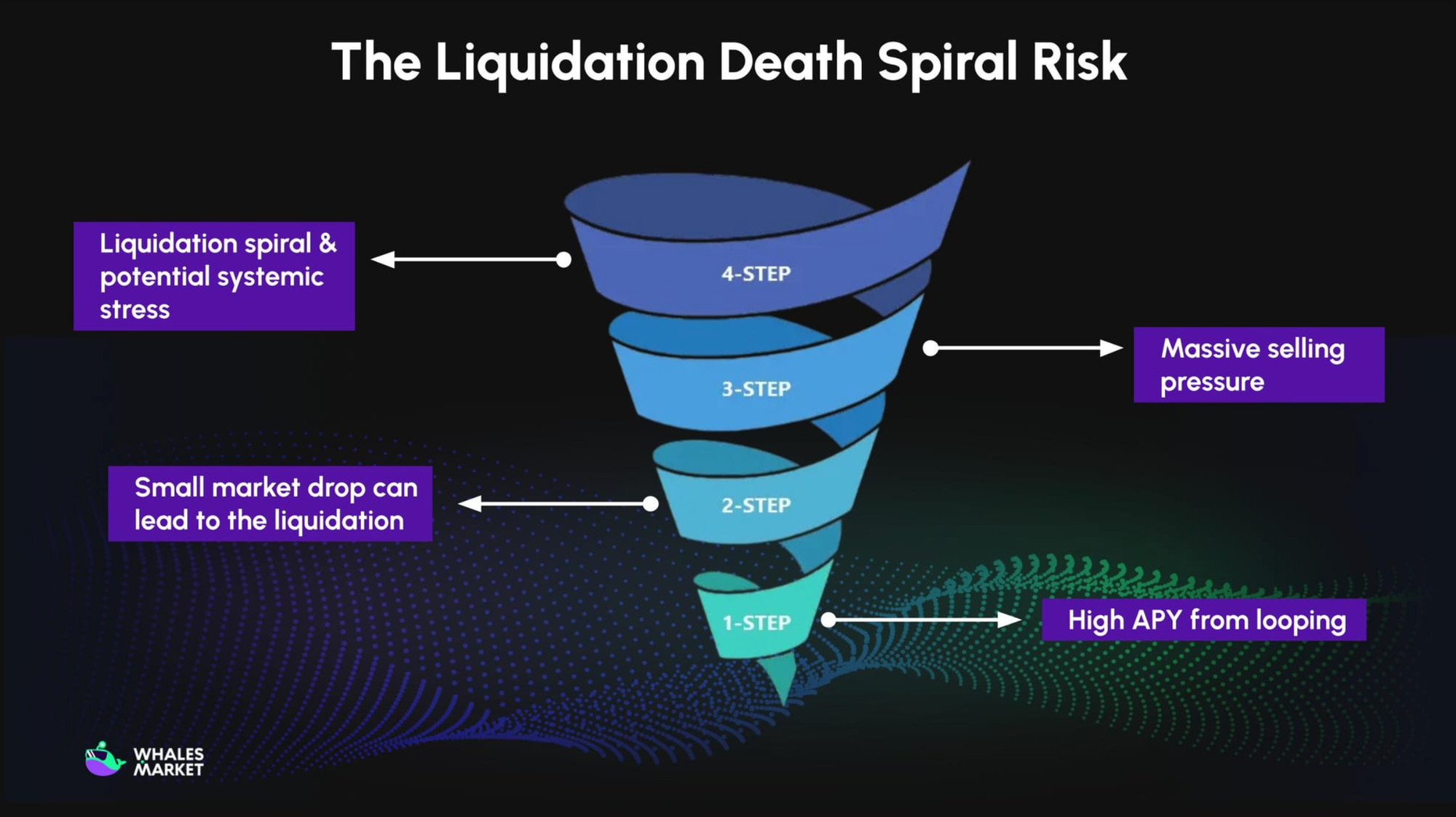

Second is the liquidation death spiral.

Since looping positions are highly leveraged, even a small, sudden market drop (for example -20% in an hour) forces thousands of positions to hit the liquidation point at the exact same time, leading to a massive selling pressure from the system.

This further depresses prices, triggers additional liquidations, and creates a destructive cascading liquidation spiral, where the entire system collapses rapidly due to its own mechanics.

Last is liquidity and contagion risk.

DeFi platforms are interconnected like a tower of cards. When one platform fails, the effect instantly ripples out.

- Liquidity exhaustion: In a sharp market swing, everyone tries to unwind their loops or withdraw their assets, but the liquidity vanishes quickly. Users cannot repay their loans quickly enough, and the system freezes.

- Slow unwinding: To safely reduce leverage, you must repay debt layer by layer, which takes time, gas fees, and multiple transactions. If the market drops 10-20% in hours, you cannot dismantle your leverage fast enough before the system wipes out your entire position.

- Contagion: If one vault with complex leverage fails, the resulting loss spreads instantly across all connected platforms (lending markets, stablecoins….). This is the classic domino effect that threatens the entire DeFi landscape.

Case study: The Stream Finance Collapse and xUSD Depeg

The failure of Stream Finance in early November 2025 serves as a definitive case study in the dangers of opaque recursion, hidden leverage, and systemic fragility in DeFi.

Stream Finance is a yield optimization protocol focused on providing exposure to advanced trading and yield-generating opportunities. Its core product, xUSD, was a yield-bearing stablecoin backed by USDC.

Users could deposit USDC to mint xUSD, which would accrue yield over time. Stream Finance used delta-neutral and hedged market making to make the strategy sound sophisticated and safe.

What happened: The $93M loss and the trigger

Stream Finance announced a sudden $93 million loss tied to an external fund manager's trading strategies on November 3, 2025.

Yesterday, an external fund manager overseeing Stream funds disclosed the loss of approximately $93 million in Stream fund assets.

— Stream Finance (@StreamDefi) November 4, 2025

In response, Stream is in the process of engaging Keith Miller and Joseph Cutler of the law firm Perkins Coie LLP, to lead a comprehensive…

This catastrophic business loss immediately triggered the crisis:

- Stream paused all withdrawals and deposits, effectively halting the redemption mechanism for its yield-bearing stablecoin, xUSD.

- With redemption frozen and thin market liquidity, xUSD immediately broke its $1 peg, crashing 77% to approximately $0.23 intraday.

What went wrong: The recursive flaw and hidden leverage

The collapse was not due to a smart contract exploit but to a flawed, opaque financial structure designed to amplify returns through an extended recursive strategy.

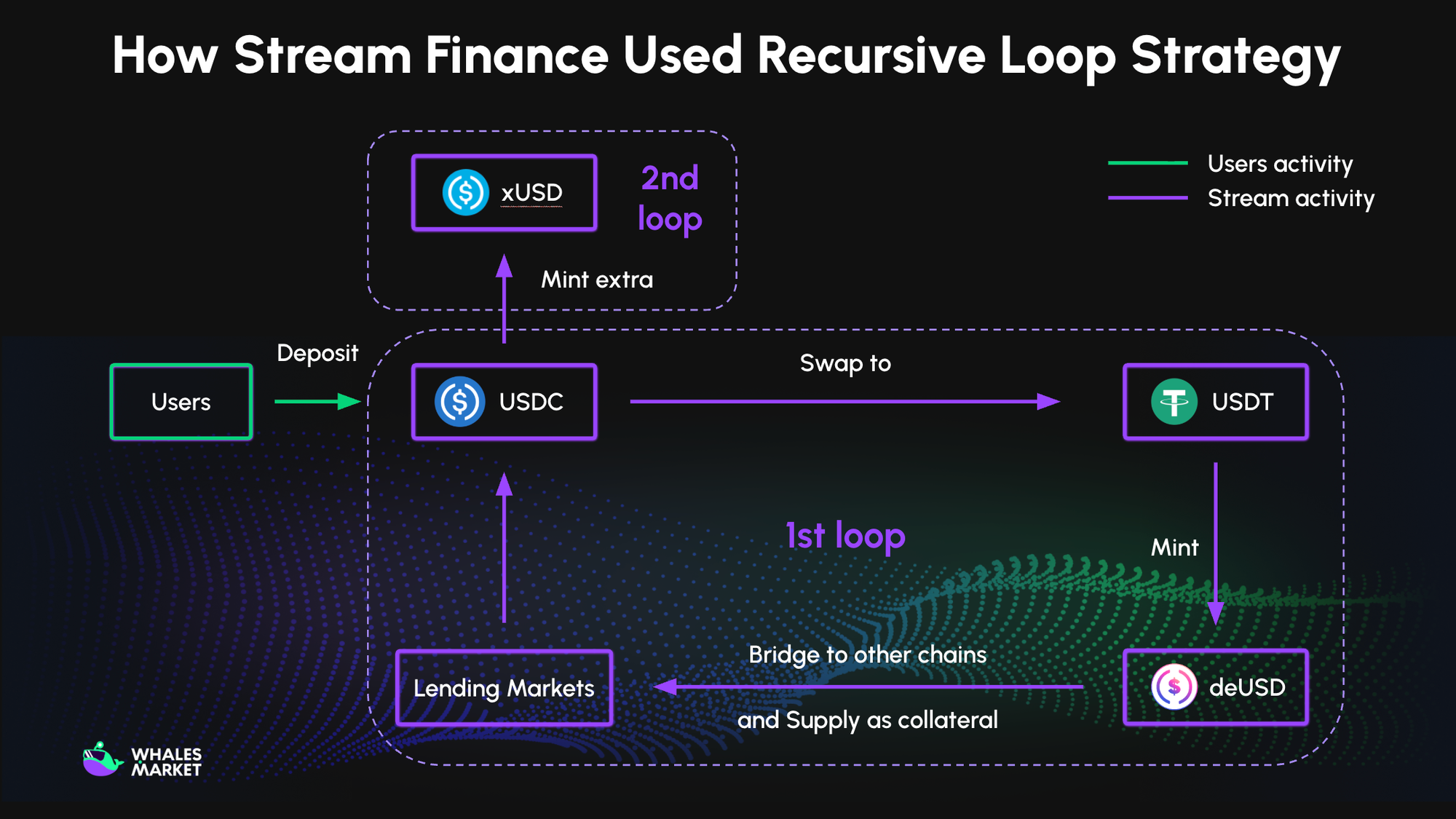

Stream implemented a complex loop that started with user deposits (USDC) and converted them into high-yield collateral on other chains. The standard cycle involved

- Swapping USDC to USDT.

- Minting Elixir's deUSD.

- Bridging deUSD to lending markets to borrow USDC.

- Re-minting more xUSD using the newly borrowed USDC.

This process, which regular users could not replicate, allowed the protocol to redirect received capital and borrowings to continue looping while minting even more unbacked xUSD. According to on-chain data analyzed by Schlagonia, with only 1.9M USDC in real assets, Stream minted 14.5M xUSD, creating a major imbalance between supply and reserves.

Well boys, think I figured out (part of) the scam, and it is a doozy. Strap in.

— Schlag (@Schlagonia) October 28, 2025

TLDR: Stream (xUSD) and Elixir (deUSD), and likely more, are recursively minting each other tokens in order to inflate there own TVL and create a ponzu the likes of which we haven't seen for awhile… https://t.co/oE39IW9PLz pic.twitter.com/ZUPqLdyhfg

This flaw created massive internal leverage. On-chain analysis confirmed a leverage ratio exceeding 4x (about $530M borrowing against $170M in supporting assets). This leverage was sustained by a mutually reinforcing partnership with Elixir, which supplied a $68M USDC loan that Stream borrowed and re-looped, linking the two protocols' solvency.

The impact: Systemic contagion and lost confidence

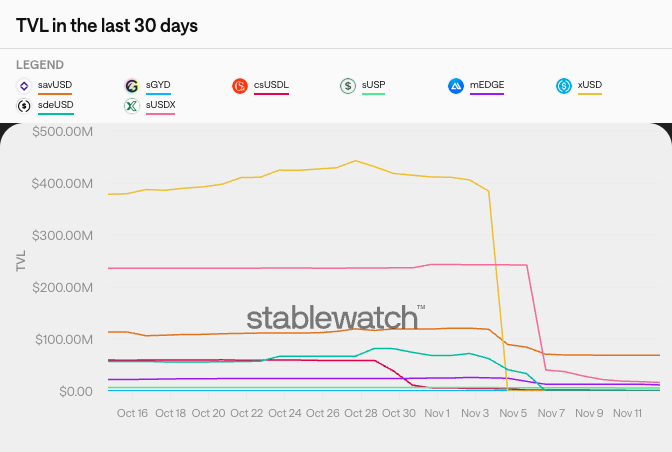

The failure instantly triggered a cascading collapse across the interconnected DeFi ecosystem, proving the severe risk of recycled collateral, a scenario often termed the Domino Effect.

The Stream default directly caused Elixir’s deUSD to cease operations, as Elixir lost 65% of its backing (from the $68 million loan to Stream). This showed how a solvency issue in one vault directly destroys the peg of a dependent stablecoin.

Furthermore, an estimated $285M in cross-protocol bad debt surfaced across multiple lending platforms (Euler, Silo, Morpho, etc.), as collateralized xUSD and xETH positions became worthless, leaving creditors like TelosC ($123.64M) heavily exposed.

The broader market reaction was severe, with yield-bearing stablecoins losing 40–50% of their TVL despite maintaining their dollar pegs.

Investor confidence in new algorithmic and yield-bearing stablecoins dropped sharply, contributing to a $20 billion drop in DeFi's total TVL shortly after the incident.

Lessons learned

The xUSD collapse underscores two hard truths essential for investor due diligence:

- Scrutinize yield source: High yields often hide structural risk. Investors must look beyond marketing and determine if returns come from sustainable sources or from protocol-driven internal leverage.

- Demand absolute transparency: The failure was accelerated by opaque collateral deployment and a lack of Proof of Reserves (PoR). Investors must demand publicly auditable collateral composition and transparency into how stablecoins are managed before allocating capital.

Conclusion

The recursive loop model is a powerful engine for capital efficiency, offering unmatched yield amplification necessary for DeFi’s growth. However, the failures of both xUSD and USDX confirm that this leverage is a systemic vulnerability, where TVL misrepresentation and hidden debt turn localized losses into market-wide cascading contagion.

The future stability of DeFi depends on addressing this duality. Protocols must move toward structural transparency and real-time Proof of Reserves (PoR) to verify solvency. For investors, rigorous due diligence (DYOR) on collateral composition and underlying leverage is no longer optional. It is the minimum requirement for navigating this dynamic and high-risk frontier.

FAQs

What does recursive loop mean?

A recursive loop is a leverage strategy that borrows against posted collateral, converts the borrow into the target exposure, adds it back to collateral, and repeats. The cycle expands exposure from an initial deposit and can be executed across multiple transactions or via a single atomic transaction.

What is the difference between Speculative Looping and Yield Looping?

Speculative looping targets price exposure, for example deposit ETH, borrow stablecoins, buy more ETH, and repeat. Yield looping applies the same mechanics to yield-bearing exposures so the goal shifts to compounding the net carry between earned yield and borrowing costs.

Why can TVL be misleading in recursive models?

TVL becomes misleading because it reflects recycled, borrowed capital rather than real, fresh deposits. This creates a structural deception of solvency where the reported TVL can be 2x to 4x higher than the actual economic value injected, disguising hidden systemic leverage.

What early warning signs should I watch before allocating?

The most critical signs are high, unsustainable APYs (above market norms) and a lack of collateral transparency. Always scrutinize the yield source, and avoid protocols that do not provide a publicly verifiable Proof of Reserves (PoR) or a structured, real-time breakdown of debt dependencies.

How should users evaluate and use these products more safely?

Users should adopt robust due diligence:

- Prioritize transparency: Only use protocols that maintain auditable collateral composition.

- Limit exposure: Only commit disposable income.

- Manage leverage: Do not borrow up to the platform’s maximum Loan-to-Value (LTV) limit, leaving a safe buffer to prevent forced liquidation during sudden market stress.