The real-world asset (RWA) market continues to expand as institutions look for safer, more compliant ways to bring traditional financial products on-chain. Demand for transparent settlement, programmable assets, and regulated blockchain infrastructure is pushing a new wave of enterprise-grade solutions into the spotlight.

Among the emerging platforms working to bridge this gap is Rayls, a project aiming to unify institutional systems with decentralised finance. So, what exactly is Rayls and what makes it stand out?

What is Rayls?

Rayls is a modular blockchain* infrastructure built for institutions, enabling on-chain transactions, account privacy and regulatory compliance. It aims to connect private institutional networks with public blockchains to provide access to DeFi functions.

*Modular Blockchain is basically a blockchain built like a set of separate pieces of layers that can work independently but also together. Instead of one big system doing everything, a modular blockchain splits these tasks into modules. Each module can be upgraded, replaced, or customized without changing the whole system.

How does Rayls work?

Rayls functions as a multi-layer blockchain architecture that connects regulated financial institutions with DeFi users through both public and private EVM networks. The system is designed to provide compliance, privacy, and interoperability while maintaining the openness of a permissionless chain.

Its core components include:

- Rayls Public Chain: An EVM-compatible Layer 1 that links institutions to open DeFi. It targets deterministic finality and predictable fees, inherits security anchors from Ethereum, and adds MEV protection and on-chain identity services. Assets and positions originating in private domains can bridge here to access public liquidity, applications, and broader distribution.

- Rayls Private Network: Permissioned chain that connects multiple institutions under a shared rule set or jurisdiction. They enable inter-institution settlement, collateral moves, and asset exchange while keeping each party’s client data private.

- Rayls Privacy Node: An institution-run, private EVM chain. Banks or fintechs use them to issue internal tokens, manage client accounts, and process high-throughput transfers without exposing customer data. There is no user-facing gas; institutions pay usage fees. These nodes are the origin point for tokenization and bookkeeping inside each institution.

- Enygma: The privacy protocol used across Privacy Nodes and Private Networks (and slated for the public chain). It validates transfers without revealing sender, recipient, or amount, using zero-knowledge proofs and post-quantum secure key exchange. It supports selective disclosure and auditability, so institutions can prove compliance to regulators without exposing counterparties or balances.

Overall, here’s how these components work together in an end-to-end flow:

- An institution tokenizes and manages assets internally on its Privacy Node, keeping client data isolated.

- It settles with counterparties on a Rayls Private Network under shared compliance rules, with Enygma preserving confidentiality and enabling audit.

- It optionally bridges approved assets to the Rayls Public Chain to access public liquidity and DeFi primitives.

- Fees, validator rewards, and governance flow back to the Rayls ecosystem through the RLS token.

Key Features of Rayls

Designed specifically for banks and financial institutions, Rayls combines a secure private blockchain environment with a KYC-gated public chain, enabling a compliant and scalable path toward digitised financial infrastructure.

At the core of Rayls sits a dual-layer design that allows institutions to operate in a private setting while still connecting to the public chain when needed. Each institution can deploy its own permissioned EVM “subnet”, which is the Value Exchange Network (VEN).

These VENs apply zero-knowledge and homomorphic cryptography to preserve transaction confidentiality and allow institutions to set their own governance and compliance rules. This architecture ensures privacy at the institutional level without disconnecting from broader interoperability.

Other key features of Rayls includes:

- UniFi: This is Rayls’s approach that connects institutional systems with on-chain networks. It provides the framework for integrating private blockchains, enforcing compliance requirements, and enabling controlled interaction with the public chain.

- Institutional foundation: Rayls was developed with a deep understanding of banking operations, compliance, risk management, and due diligence. It is already in use by leading organizations such as Núclea, demonstrating its reliability and industry readiness.

- Various use cases in production: Rayls enables tokenized receivables (backed by real-world assets) and provides infrastructure for Central Bank Digital Currencies (CBDCs), collaborating with central banks to develop better cross-border foreign exchange networks.

$RLS Information

$RLS Key Metrics

- Token Name: Rayls

- Ticker: $RLS

- Token Standard: ERC-20

- Total Supply: 10B

- Initial Circulating: TBA

- Contract Address (CA): 0xB5F7b021a78f470d31D762C1DDA05ea549904fbd

$RLS Use Case

- Gas Fee: On the Private Chain, $RLS is used as transaction fees. However, on the Public Chain, fees are paid in $USDr, Rayls’s native USD-pegged stablecoin.

- Validator Staking: Validators stake $RLS to secure the network, earn rewards, and are slashed for dishonest behavior. Token holders can delegate RLS to validators to share in staking rewards.

- Governance: RLS holders can participate in governance, voting on protocol upgrades, validator rules, ecosystem funding, and other decisions.

$RLS Listing

Here are the key listing details for $RLS:

- Listing Time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): $1 (as of Nov 19, 2025).

Rayls Tokenomics & Fundraising

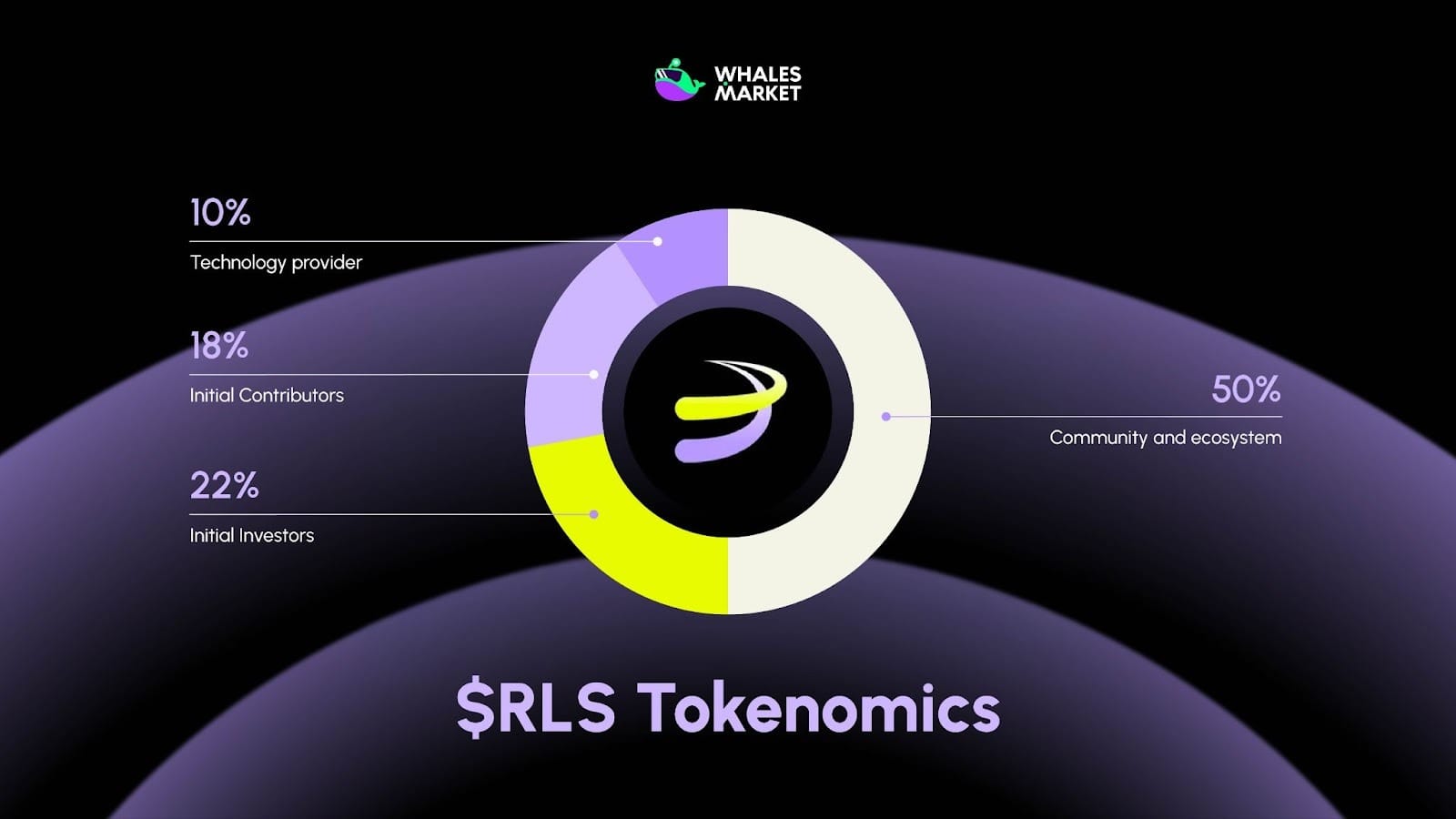

$RLS Tokenomics

- Total Supply: 10B (fixed supply)

- Token Allocation:

- Community & Ecosystem: 50%

- Initial Investors: 22%

- Initial Contributors: 18%

- Technology Provider: 10%

Fundraising

Rayls has raised a total of approximately $32.30M across multiple funding rounds, including:

- Series A: Raised $10M on August 15, 2024. Lead investors include ParaFi Capital, Framework Ventures, L4 Venture Builder, Núclea.

- Strategic: Strategic investment from Mastercard on 15 May, 2024. Amount not disclosed.

- Incubation: Incubation from Accenture on 20 June, 2023. Amount not disclosed.

Rayls Roadmap & Team

Roadmap

- Steam Testnet 1.0: Launched April 2025. Features include basic onboarding dApp with KYC attestation through open-banking providers, MetaMask support, proxy server for whitelisting logic.

- Steam Testnet 2.0: June 2025. Multiple wallet support, mobile support, self-attestation of KYC, user onboarding quizzes/quests.

- MagLev Testnet 1.0: July 2025. Leverages an Arbitrum Orbit fork to customize sequencer for robust KYC validation; introduces privacy-preserving KYC credentials via zkTLS (no open-banking provider).

- MagLev Testnet 2.0: September 2025. Full activation of Rayls Private Bridge, AML logic, suitability logic, Rayls Public Chain custody, sponsored transactions.

- Mainnet: December 2025 (planned). Validator node staking live, active validator services with staking support.

Team

Rayls was initially developed by a multidisciplinary team of engineers, cryptographers, and bankers at Parfin, a British-Brazilian blockchain startup. The project followed more than two years of product research conducted with some of the world’s largest financial institutions.

Core team members of Rayls includes:

- Marcos Viriato: Co-Founder and CEO of Rayls (formerly Parfin), bringing more than 25 years of experience in banking and finance, with deep expertise in how traditional financial systems operate.

- Alex Buelau: Co-Founder and CPTO, an early crypto builder active since 2013, leading the project’s engineering and cryptography initiatives.

- Tom Dickens: CMO, with 17 years of marketing experience spanning global brands, ambitious startups, and innovative tech companies. He specializes in integrating marketing, design/UX, and compliance to drive mainstream blockchain adoption.

Conclusion

Rayls bridges traditional finance and DeFi through a unified ecosystem of public and private chains, with $RLS as the core value driver connecting institutional activity to on-chain growth.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is the native token of Rayls?

$RLS is the native token of Rayls. It powers validator staking, private chain gas fees, and network governance across the Rayls ecosystem.

What is RayIs ($RLS) pre-market price?

Currently, $RLS has been listed on Whales Market, the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300M in volume, no middlemen, trustless and on-chain.

What is the price of RayIs ($RLS) today?

As of Nov 19, 2025, $RLS does not yet have an official market price yet. However, $RLS is tradable on Whales Market at $1, the leading pre-market platform.

How much has RayIs ($RLS) raised?

Rayls has raised approximately $38M in total funding, including a $10M Series A round led by ParaFi Capital, Framework Ventures, L4 Venture Builder, and Núclea.

What is $RLS tokenomics?

Rayls has a fixed total supply of 10B $RLS. The allocation includes community and ecosystem (50%), initial investors (22%), contributors (18%), and technology providers (10%), each with long-term vesting schedules. All transaction fees across public and private chains ultimately create demand for $RLS, reinforcing its value within the ecosystem.