Proof of Stake - one of the most widely used consensus mechanisms in the crypto market. It plays an important role in forming major DeFi narratives such as Liquid Staking and Liquid Restaking.

So what is Proof of Stake?

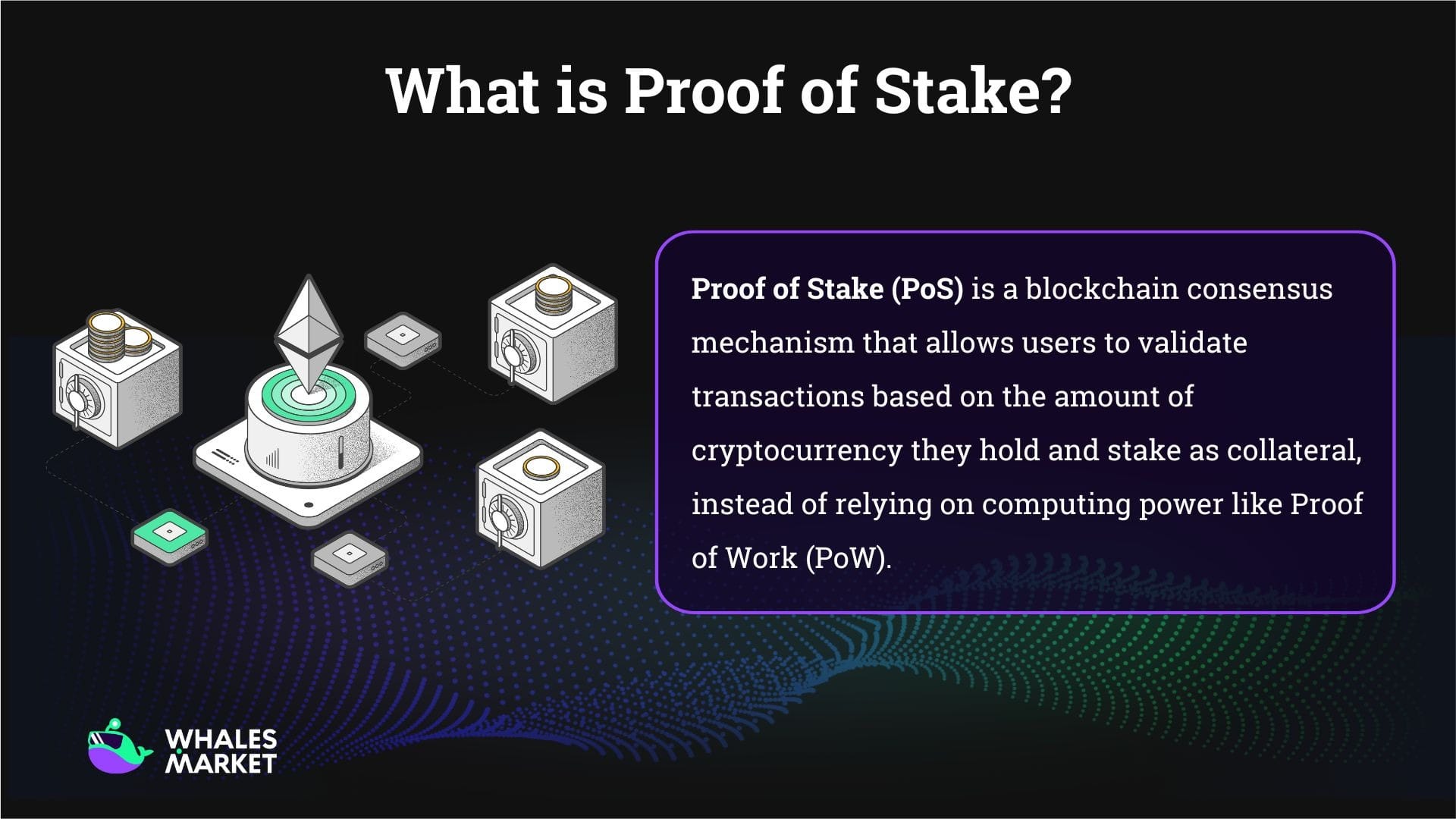

What is Proof of Stake?

Proof of Stake (PoS) is a consensus mechanism used in blockchain technology to validate transactions and maintain the integrity of the network.

Unlike Proof of Work (PoW), which Bitcoin uses and which requires large computational power to solve complex puzzles, PoS relies on the amount of cryptocurrency that participants stake to choose who will validate the next block. This makes PoS more energy efficient and more accessible.

In simple terms, users stake a certain amount of coins or tokens to become a validator, similar to miners in a PoW blockchain.

PoW is often associated with high electricity consumption, environmental impact and concentration of power in the hands of those who own powerful hardware. PoS was created to address these issues, making blockchains more environmentally friendly and more decentralized. It was first proposed by Sunny King and Scott Nadal in 2012 for Peercoin.

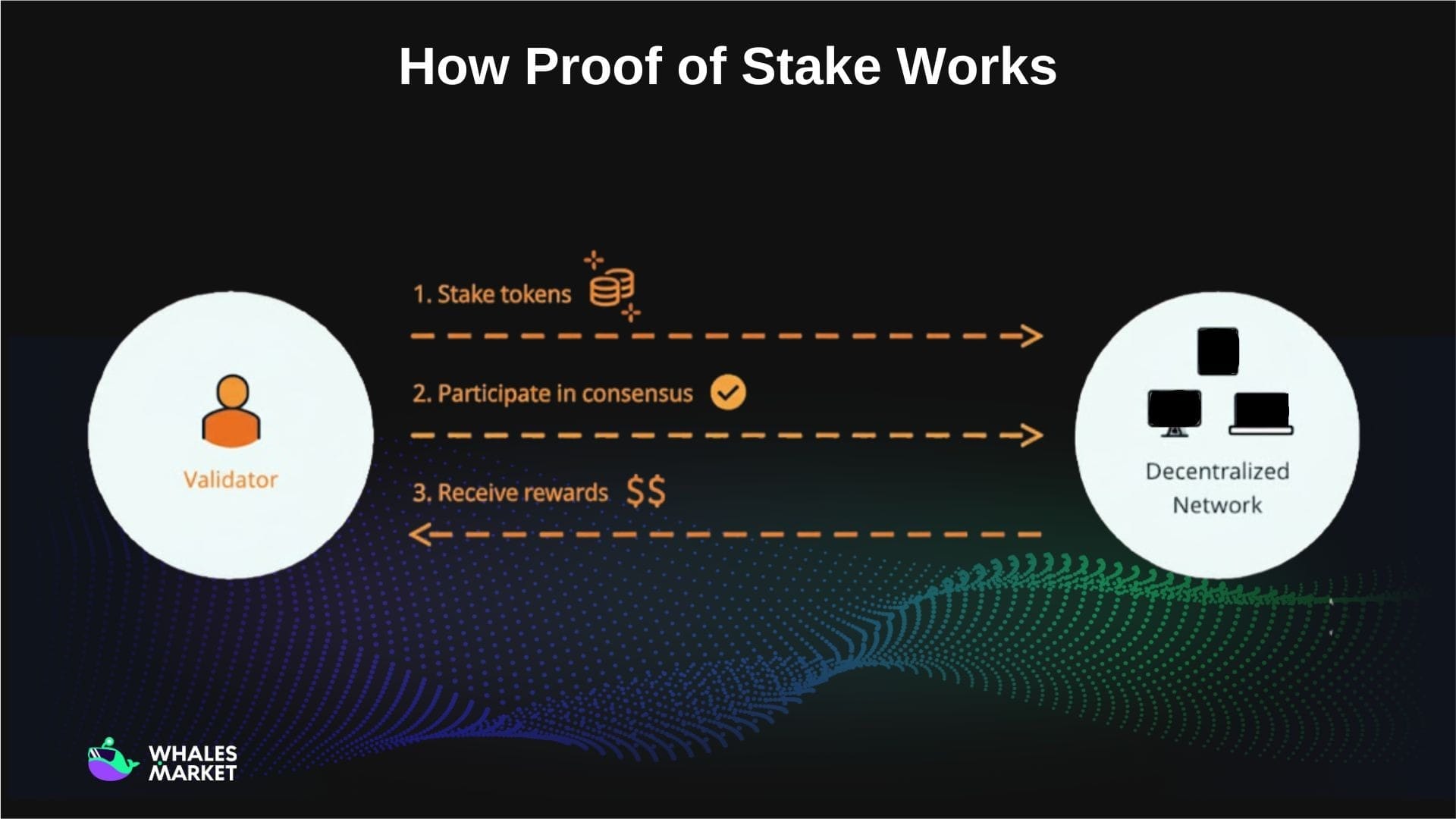

How Proof of Stake Works

In Proof of Stake (PoS), the network replaces miners with validators. Instead of spending electricity to compete for blocks, participants lock (stake) the native coin to help validate transactions and secure the chain. In return, they earn rewards.

The Validation & Consensus process

At a high level, PoS follows a simple flow: Stake from a validator set to validate transactions then reach consensus and finalize blocks.

- Stake to become a validator (or delegate to one): Users lock the native coin to qualify as validators, or delegate their stake to existing validators.

- A validator is selected to propose the next block: The protocol selects a validator (often weighted by stake) to bundle pending transactions into a new block.

- Other validators verify and attest: The rest of the validator set checks the proposed block: transaction validity, signatures, and protocol rules. They then attest/vote on whether the block is valid.

- Consensus is reached and the block is added: Once enough attestations are collected (based on the chain’s rules), the block is accepted. Over time, additional confirmations or finality rules make it increasingly difficult to reverse.

- Finalization strengthens security: Many PoS designs include a finality mechanism so that, after a certain point, reverting blocks becomes extremely costly or practically impossible unless a large share of stake colludes.

Slashing mechanism: To discourage attacks and lazy operation, PoS chains can penalize validators by “slashing” their stake. Slashing can happen for malicious behavior (e.g., double-signing, attempting to finalize conflicting blocks) and sometimes for serious operational faults (e.g., prolonged downtime, depending on the network). This makes PoS security economic: attacking the chain means risking real capital.

Validator Rewards

Validator rewards usually come from two main sources:

- New issuance (inflation): The protocol mints new coins to reward validators for securing the network.

- Transaction fees: Validators also earn fees paid by users when they transfer coins, swap tokens, mint NFTs, or interact with smart contracts.

In early-stage networks, rewards often rely more on issuance to attract validators and bootstrap security. Over time, sustainable chains typically shift toward fees contributing a larger share of rewards, especially if issuance declines or is capped. This is why a high APR does not automatically mean “good” it may simply reflect higher inflation.

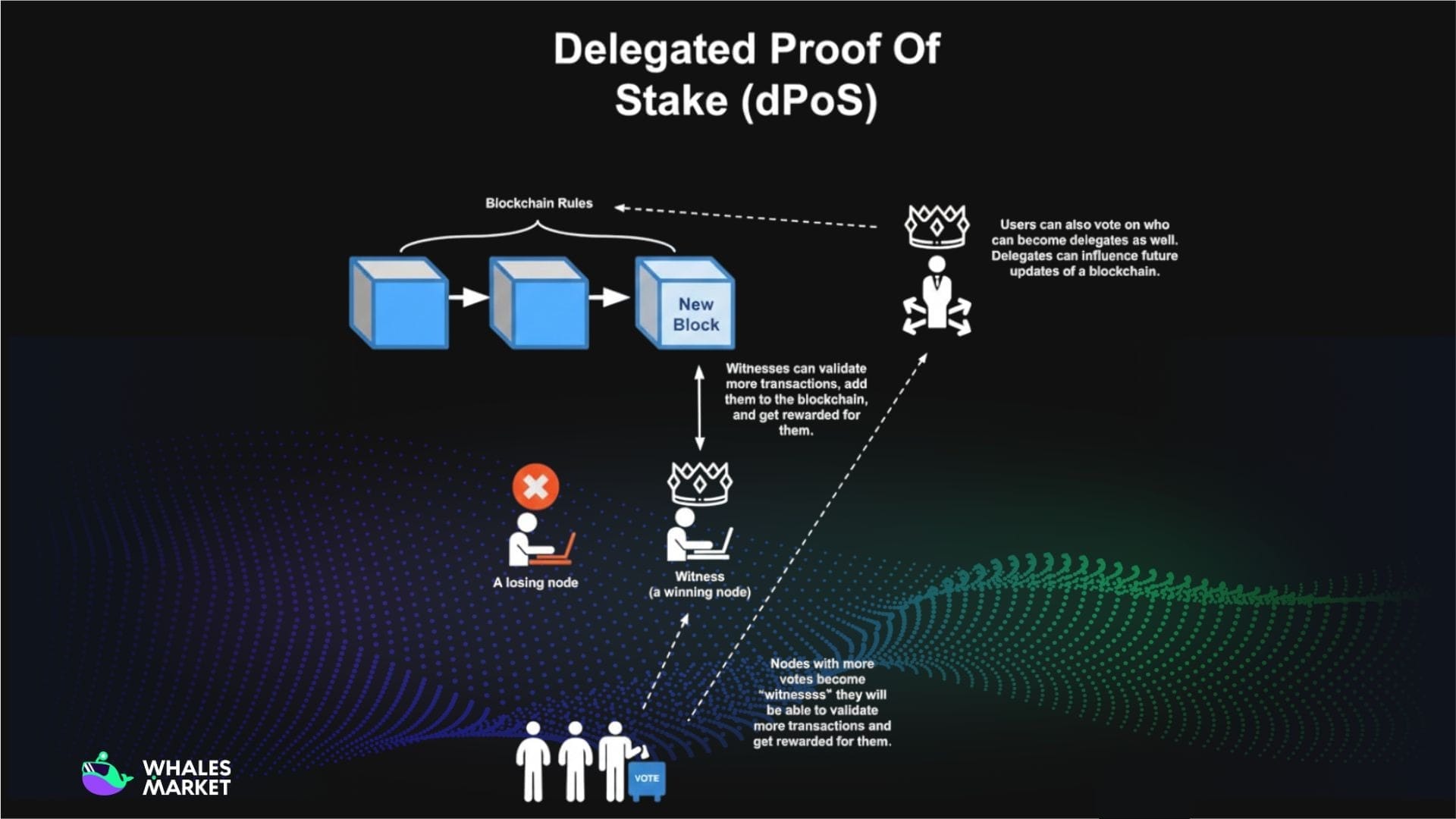

Delegated Proof of Stake (DPoS) – Variation of PoS

There are many ways to implement PoS, but one common variation is Delegated Proof of Stake (DPoS). With DPoS, users vote for validators (or delegates). These validators verify transactions and commit them to the blockchain.

Validators earn rewards (from fees and/or issuance), while token holders can participate by delegating stake or voting power instead of running their own nodes.

Key Characteristics of Proof of Stake

Advantages

- Not dependent on hardware: Anyone can set up a node on a personal computer or a private server without investing in expensive mining rigs.

- Delegation mechanism: Users do not need to act directly as validators. They can delegate their coins to a trusted validator. The validator gains more voting power, while delegators still receive a portion of the rewards without running their own node.

- Faster finality and more efficient consensus: PoS removes the mining race and allows networks to use validator-based consensus with shorter block times and faster finality. This can improve throughput and user experience, although real scalability still depends on the chain’s design (execution, networking, and data availability).

- Energy efficient: PoS does not consume the massive amount of electricity that Proof of Work requires, so it is more environmentally friendly, especially in comparison with Bitcoin.

Disadvantages

- Capital lock and price risk: When acting as a validator or delegator, your coins are locked for a certain period of time. If the price of the coin falls sharply, the rewards you receive may not be enough to offset the loss from price volatility.

- Slow unlock times: Many networks require a waiting period to withdraw coins, such as one week, two weeks or even longer. If the market moves sharply while your coins are unlocked, you may not be able to react in time.

- Concentration and governance capture risk: If stake concentrates in a small number of validators or large delegators, they can gain outsized voting power and influence over upgrades, parameters, and governance outcomes. In extreme cases, majority stake concentration can also increase censorship and reorg risk, weakening the network’s neutrality and security.

- Slashing risk: Validators (and sometimes delegators) can lose part of their staked coins if they break protocol rules either intentionally (malicious behavior) or accidentally (downtime, misconfiguration, or double-signing). This makes staking returns not fully “risk-free,” even when APR looks attractive.

- System design is relatively complex: For PoS to operate safely, coordination is needed between many parties, including developers, validators and the community. Poor design or adjustments can cause disruptions or delays in how the system operates.

Compare Proof of Stake with Proof of Work

Proof of Stake and Proof of Work differ in several important aspects, including costs and the level of control they give to transaction validators.

- PoW can be imagined as a math contest. Miners use powerful rigs to solve a cryptographic puzzle, or hash. Whoever solves it correctly and fastest earns the right to create a block and receive rewards. The disadvantage is high electricity consumption. Before Ethereum moved to PoS, its electricity usage was comparable to that of a small country. PoW is also prone to concentration of power in large mining farms.

- PoS is more like a lottery where tickets are the amount of coins users stake. Users do not need expensive machines. They only need to lock enough tokens to have a chance to be selected to create a block and receive rewards. The advantage is energy efficiency. The disadvantage is that it can create the feeling that the rich get richer because those who hold more coins have a higher chance of being selected and earning rewards.

Conclusion

Proof of Stake is not a completely perfect mechanism, but it is a major step forward that helps blockchains operate with lower energy consumption, opens the door for more participants and lays the foundation for narratives such as Liquid Staking and Restaking.

Understanding how PoS works, its advantages and disadvantages and how rewards are distributed will help investors evaluate projects more accurately. They can judge whether APR is sustainable, whether tokenomics is excessively inflationary and who actually holds power over the network.

FAQs

Q1. How secure is Proof of Stake?

PoS can be very secure, but its security comes from economics rather than electricity. Attacking the network requires acquiring and risking a large amount of the native coin, and malicious validators can be punished through slashing.

In practice, the biggest risks are validator centralization, client bugs, and governance capture not raw “hash power.”

Q2. How are transactions validated in Proof of Stake?

Validators are selected to propose and attest blocks based on how much stake they lock (or how much stake is delegated to them). Other validators verify the block and reach consensus through attestations, and once enough confirmations accumulate, the block becomes finalized. This process replaces PoW mining with stake-weighted validation while keeping an auditable on-chain history.

Q3. Why did blockchains start moving from Proof of Work to Proof of Stake?

They wanted to reduce energy consumption, lower hardware requirements and make it easier for more participants to help secure the network, instead of relying mainly on large mining farms.

Q4. Can small holders earn rewards with PoS or is it only for whales?

Small holders can still earn by delegating their tokens to a validator. They share rewards without having to run their own node, although large holders still have more voting power.

Q5. Is staking completely safe?

No. Besides smart contract and slashing risks, stakers face price risk because their tokens are locked. If the token drops sharply during the lock period, rewards may not cover the loss.

Q6. How does PoS affect tokenomics and inflation?

Many PoS blockchain pay rewards using new token issuance. If inflation is too high and demand is weak, it can dilute holders and make APR look attractive on paper but unsustainable in the long term.