In financial trading, price impact and slippage are two concepts that are frequently mentioned when discussing the hidden costs of order execution. Many investors, especially beginners, often confuse these two terms because both relate to the difference between the expected price and the actual execution price.

What Is Price Impact?

Price impact is the percentage measure of how much a trading order (either a buy or a sell) affects the market price of an asset. When an order is large relative to available liquidity, it can push the price up or down during execution.

The actual execution price is determined by the value of the assets the user receives once the transaction is completed.

Example:

- The order book only has 100 BTC available for sale around the $40K price level.The user places a market buy order for 500 BTC. The user’s order is forced to consume higher and higher price levels, causing the average purchase price to increase. This price difference is the price impact.

- Price impact can occur on both DEX and CEX platforms. However, price impact tends to be higher on DEXs because liquidity on these platforms is generally lower than on CEXs.

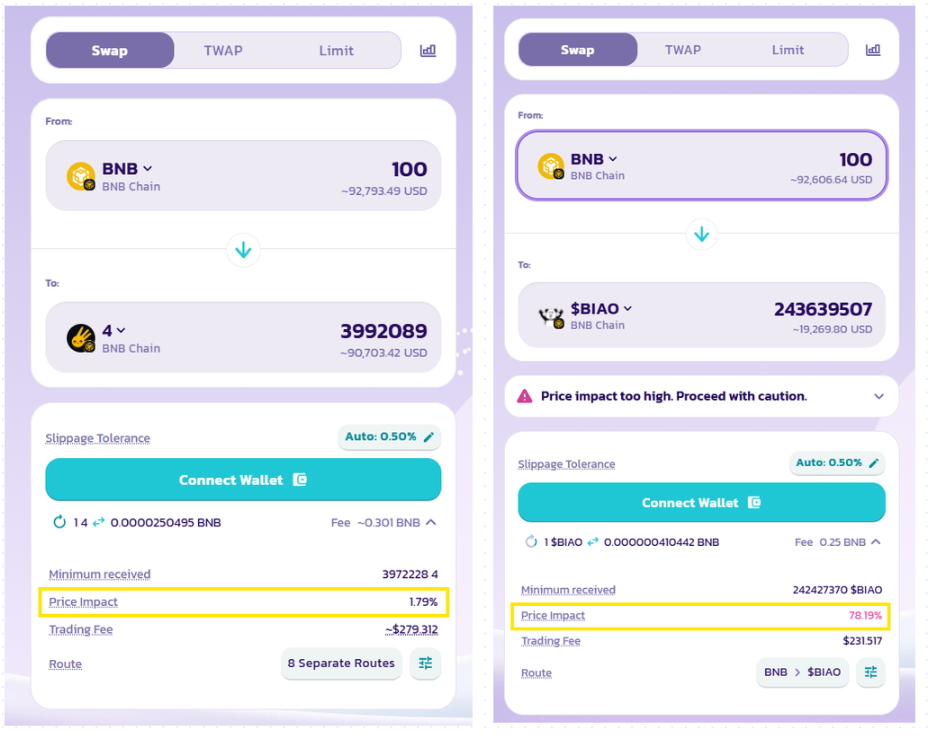

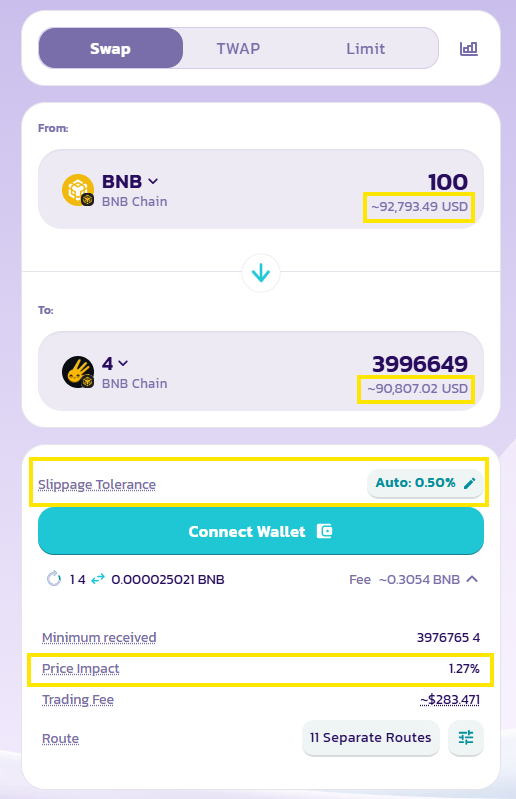

The image below illustrates two different price impact levels, low and high, when trading on the Pancake Swap DEX:

- Low price impact does not significantly affect trade execution for users.

- High price impact at 78.19% directly results in a loss in order value, causing users to incur losses and creating barriers to trading.

The Nature of Price Impact

One important characteristic of price pmpact is that it is unavoidable and structural in nature. Even when the market is completely stable, with no major volatility and no new information, price impact still exists if the order size is large enough. This clearly distinguishes price pmpact from costs that arise due to short-term price fluctuations.

The relationship between order size and market depth is the most critical factor.

- A small buy order in a highly liquid market produces almost no price impact.

- The same order on a low-liquidity asset can push prices significantly.

This shows that price impact is not about absolute order size, but about the relationship between trading volume and available liquidity.

Comparing Price Impact on CEX and DEX

Price Impact on CEX

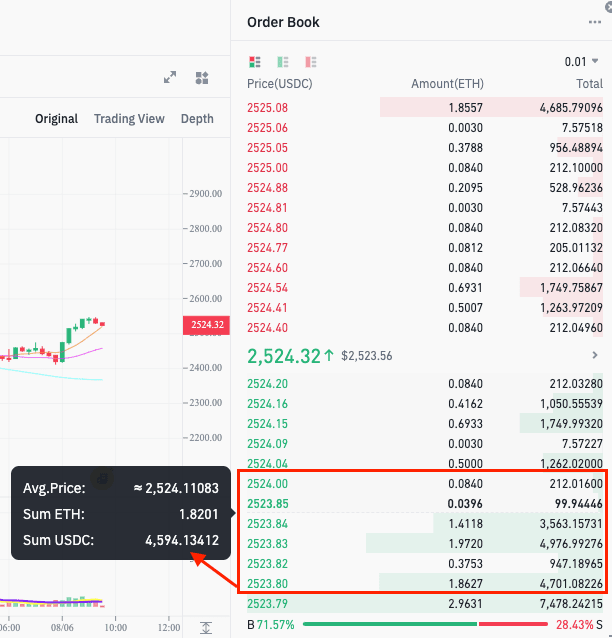

On centralized exchanges (CEX), price impact mainly comes from the order book structure. Market prices are formed through the matching of buy and sell orders at different price levels. Each price level contains a limited amount of liquidity, so when a trader places a large market order, it is filled across multiple price levels in the order book.

In this context, price impact reflects how much existing liquidity is consumed. As an order goes deeper into the order book, the average execution price becomes increasingly unfavorable. Importantly, price impact on CEXs is not continuous, but occurs in steps corresponding to specific price levels in the order book.

Another notable characteristic is that price impact on CEXs can be reduced through execution strategies rather than being purely determined by market liquidity. Professional traders often split large orders, use limit orders, or apply execution algorithms such as TWAP and VWAP to minimize market disruption.

- TWAP (Time-Weighted Average Price): TWAP breaks a large order into multiple smaller orders and executes them evenly over a predefined time window. This allows the trade to blend into normal market activity and reduces sudden liquidity shocks that would otherwise move the price sharply.

- VWAP (Volume-Weighted Average Price): VWAP adjusts execution intensity based on real-time market volume, placing larger portions of the order when liquidity is high and slowing down when it is low. This helps the trade hide within natural trading flows and further reduces observable price impact.

Many major CEXs, such as OKX and Binance, offer built-in TWAP and VWAP bots to automate these strategies. This shows that price impact on CEXs depends both on market liquidity and on how intelligently a trade is executed.

Price Impact on AMM DEX

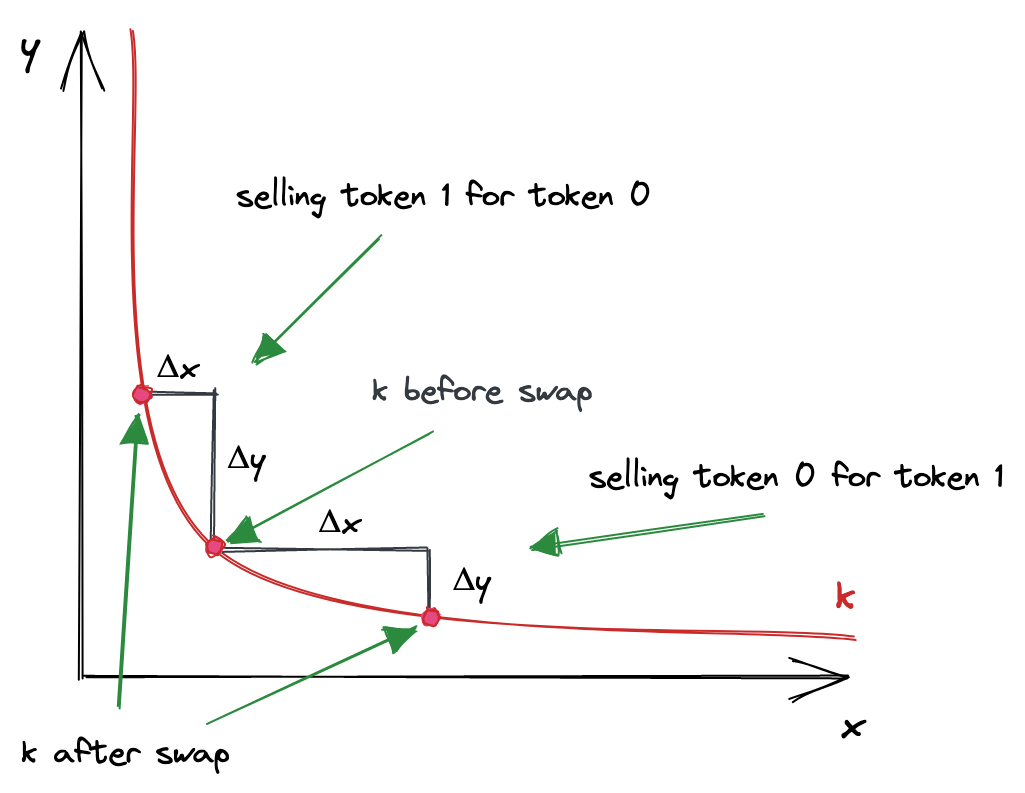

On decentralized exchanges (DEXs) that use automated market makers (AMMs), prices do not come from an order book but are determined by the liquidity curve x*y=k, represented by the red curve in the image.

- The x and y axes represent the quantities of the two tokens in the pool

- While k is a constant.

When a trader performs a swap, for example selling token 0 to buy token 1, the amount of token 0 in the pool increases while the amount of token 1 decreases.

Instead of the pool “moving” to a new point, a swap alters the asset balances within the pool. As these balances shift, the pricing moves continuously along the curve to maintain the invariant kkk, which explains why prices change throughout the swap rather than staying fixed at a single price.

Price impact is the difference between the price at the start of the swap and the average price the trader actually receives while moving along the curve. As the swap size increases, several effects compound:

- Longer movement along the curve: A larger swap pushes the trade further away from the pool’s original balance point, forcing it to traverse a longer segment of the pricing curve.

- Greater curvature effect: Because AMM curves are non-linear, moving further along the curve causes prices to change at an accelerating rate, making each additional unit traded more expensive than the last.

- Higher price impact: The combined effect of deeper curve traversal and stronger curvature results in a larger deviation between the initial quoted price and the average execution price.

An important point is that in traditional AMM designs, every trade creates price impact, even for small swaps.

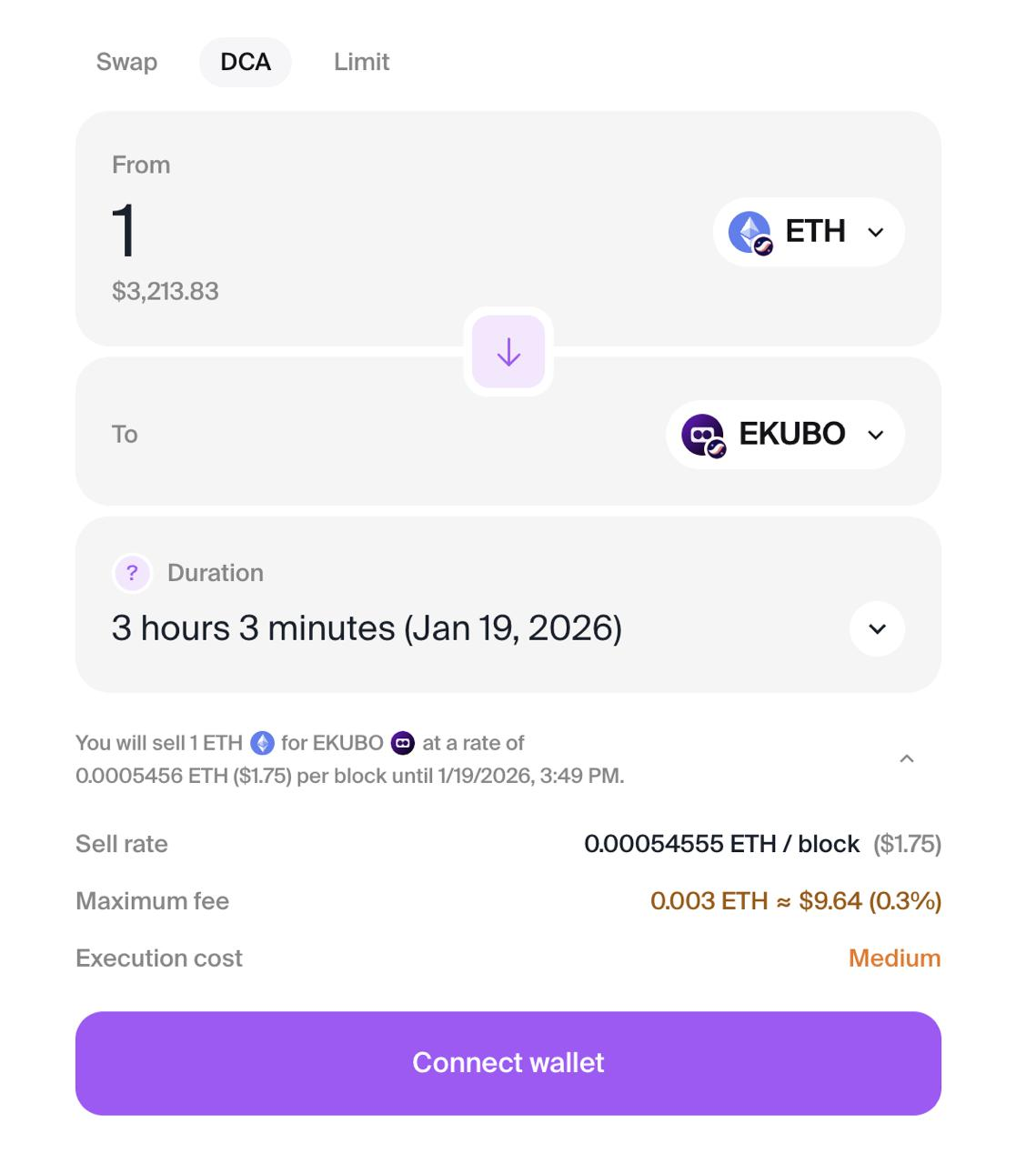

However, this limitation is no longer absolute. With newer architectures such as Uniswap v4’s hook-based design, DEXs are starting to support more advanced execution mechanics, including limit orders and TWAMM (Time-Weighted Automated Market Maker), which split large trades into smaller pieces executed over time to reduce market disruption.

A concrete example is Ekubo on Starknet, which offers DCA-style execution and TWAMM-like functionality, showing that modern AMMs can increasingly replicate CEX-style execution flexibility on-chain.

More broadly, this evolution blurs the traditional distinction between CEX and DEX price impact: while early AMMs produced price impact as a largely mechanical outcome of the pricing model, newer designs make it increasingly dependent on both liquidity depth and the availability of smarter on-chain execution strategies.

The Difference Between Price Impact and Slippage

Price impact comes directly from the trader’s own order. When a user places an order that is large relative to available liquidity, the market must adjust prices to absorb that volume.

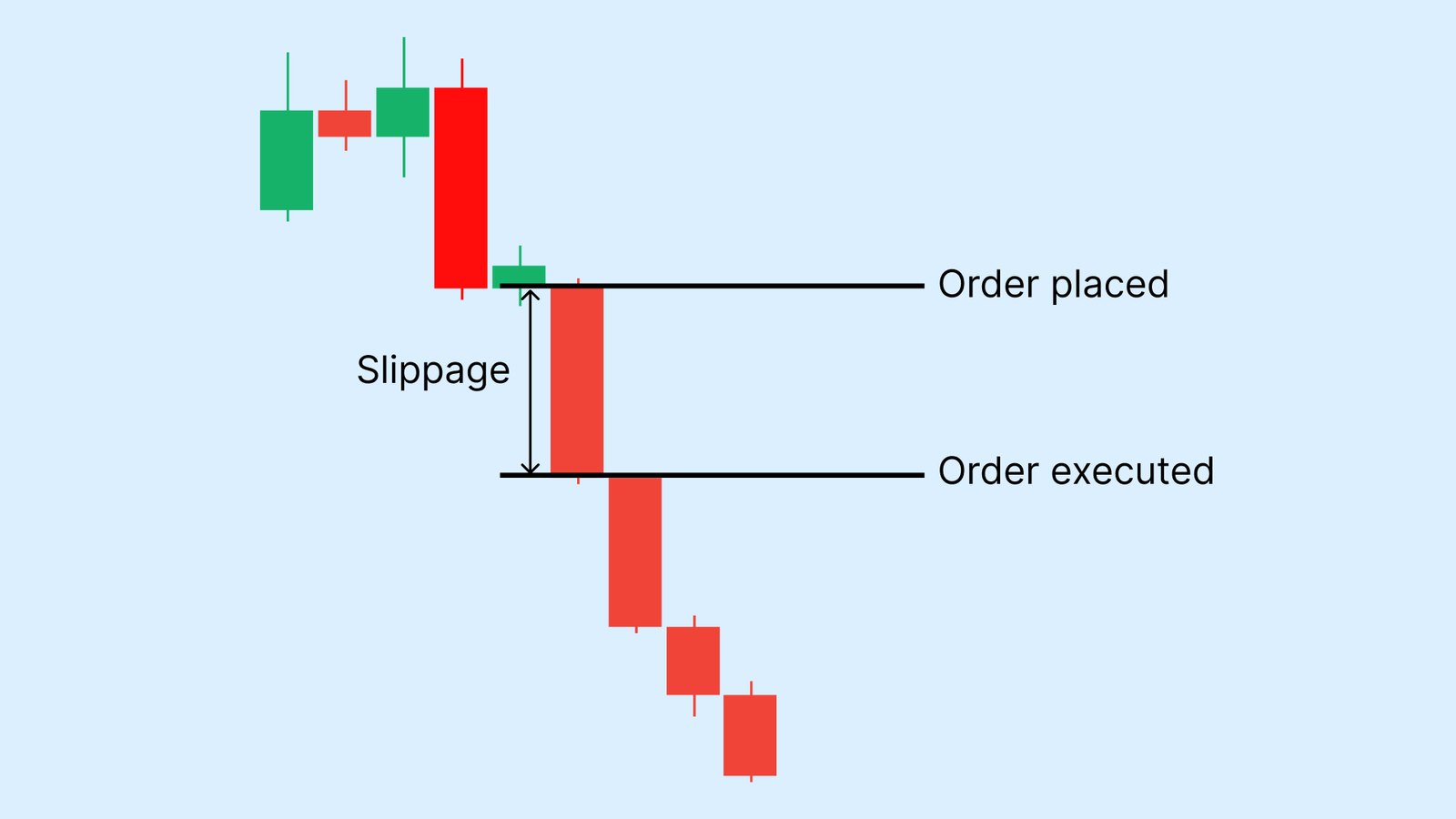

In contrast, Slippage does not result from order size, but from price movement over time. A trader submits an order at an expected price, but while the order is being processed, the market moves to a different price. The order is then filled at a less favorable price, even if the trade size is small. Slippage is therefore more random and strongly dependent on market volatility at the time of execution.

One important practical difference is predictability. Price Impact can be reasonably estimated by examining order book depth, liquidity, or pool size in DEXs. Slippage, however, is nearly impossible to predict precisely because it depends on whether the market moves within the next few milliseconds.

Visually explained:

- With price impact, the trader’s order causes the price to move.

- With Slippage, the market price moves before the trader’s order is fully executed.

This distinction is why price impact is considered a structural market cost, while Slippage is considered timing risk.

How to Reduce Price Impact When Trading

Price impact cannot be completely eliminated, but it can be controlled and significantly reduced if traders understand market mechanics and choose appropriate execution methods. The key issue is not whether price impact exists, but how large it is and whether it remains within acceptable limits.

To reduce the effects of price impact, users should consider the following factors:

- First, split orders instead of entering a full position at once. Smaller orders allow the market to absorb volume gradually, reducing price movement. This is the most effective approach and applies to most markets.

- Second, prioritize limit orders over market orders. Market orders force immediate execution at any available price, while limit orders allow traders to control acceptable price levels and avoid consuming thin liquidity.

- Third, trade during periods of high liquidity. Executing trades during active market hours allows the same volume to produce less price impact than during quiet periods.

For DEX and AMM platforms, pool depth is especially important. Larger pools produce lower price impact. For large trades, executing swaps in parts or using routing tools across multiple pools is more effective than executing a single swap.

In particular, for newly launched tokens, especially memecoins, liquidity is often extremely low. As a result, users are almost guaranteed to experience price impact when trading these assets. The magnitude of this effect depends on both order volume and the liquidity available in the pool.

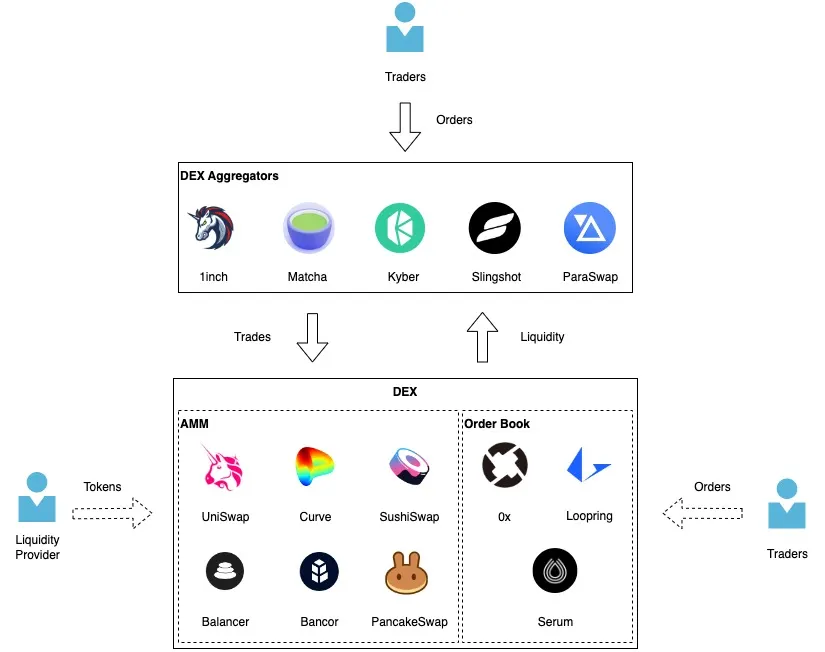

Additionally, using DEX aggregators allows users to aggregate liquidity from multiple sources to find the most suitable venue in terms of price and fees for their trades.

Conclusion

Price impact and Slippage are both unavoidable trading costs, but they come from different sources. Price impact caused by the trader’s own order interacting with available liquidity, while Slippage occurs when the market price moves during order execution.

Understanding this difference helps traders better estimate real execution costs and choose suitable trading methods across both CEX and DEX environments.

FAQs

Q1. Why does price impact increase rapidly when trade size grows?

Price impact increases as trade size grows because available liquidity at each price level is limited, forcing the order to execute across less favorable prices as more liquidity is consumed.

Q2. Is price impact considered a direct trading loss?

Price impact is not a direct fee charged by an exchange, but it represents an execution cost that reduces the effective value of a trade compared to the expected market price.

Q3. Can price impact occur even when the market is not volatile?

Price impact can occur even in calm market conditions because it is driven by liquidity structure and order size rather than short-term price fluctuations.

Q4. How does market liquidity influence price impact?

Higher liquidity allows larger trades to be absorbed with smaller price movements, while lower liquidity causes prices to shift more sharply when executing the same trade size.

Q5. Why is price impact more noticeable on decentralized exchanges?

On decentralized exchanges, prices are determined by liquidity pool balances, so every trade directly alters the pool and changes the execution price.